Академический Документы

Профессиональный Документы

Культура Документы

Dividend Yield Stocks 300410

Загружено:

kunalprasherОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Dividend Yield Stocks 300410

Загружено:

kunalprasherАвторское право:

Доступные форматы

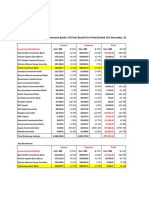

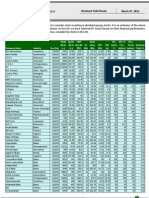

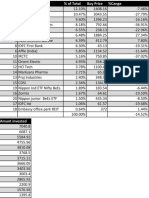

Dividend Yield Stocks April 30, 2010

We present hereunder a table of companies that have announced dividends for FY09, for which dividend yield is 3.5%+.

52 52 BSE- Rise/Fall

Dividend Dividend Week Week Mkt Qrtly PAT for Div

Sr (%) (%) Equity EPS High Low Cap Rs. Avg Vol D/E 9 Yield

No Company Latest Latest-1 Rs Cr Rs Rs Rs Cr. CMP FV (in’000) BV Cons Months % PE

1 Jayshree Chem. 15.0 10.0 5.3 5.2 22.1 9.2 49.9 17.0 10 91.0 15.8 0.2 0.9 8.8% 3.3

2 Indiabulls Sec. 100.0 100.0 46.0 2.7 61.2 26.8 788.2 31.1 2 777.7 8.9 0.4 -37.5 6.4% 11.6

3 Aarti Inds. 60.0 30.0 36.9 11.8 56.8 34.1 379.8 49.5 5 68.2 45.8 1.3 -21.0 6.0% 4.2

4 DIL 150.0 100.0 2.3 25.5 309.0 122.1 66.2 262.6 10 2.6 277.3 0.2 -0.4 5.7% 10.3

5 VST Inds. 300.0 300.0 15.4 40.2 585.0 310.1 844.5 547.0 10 2.8 157.6 0.0 14.9 5.4% 13.6

6 Borax Morarji 35.0 35.0 4.5 8.6 88.4 39.1 30.2 66.9 10 3.8 32.0 1.5 -1.2 5.2% 7.8

7 HCL Infosystems 325.0 400.0 34.2 14.0 188.8 90.1 2860.0 131.1 2 52.9 85.1 0.2 -2.2 4.9% 9.4

8 Dynemic Products 10.0 10.0 11.3 1.9 26.0 13.5 24.3 21.4 10 39.6 24.4 0.5 2.0 4.6% 11.4

9 SRF 100.0 50.0 60.7 22.1 224.6 80.3 1311.0 216.7 10 106.6 151.7 1.1 9.6 4.6% 9.8

10 XPRO India 17.5 10.0 11.0 2.3 41.2 16.6 43.3 39.4 10 32.3 97.9 0.8 3.6 4.4% 17.4

11 Hinduja Global 200.0 150.0 20.6 63.3 603.0 122.0 946.2 459.6 10 4.4 297.2 0.1 22.1 4.3% 7.3

12 Binani Cement 35.0 21.0 203.1 14.4 88.5 36.6 1633.9 80.5 10 111.2 33.2 2.8 176.4 4.3% 5.6

13 Navin Fluo.Intl. 140.0 100.0 10.1 81.6 397.3 116.0 335.6 332.3 10 21.8 288.1 0.2 26.0 4.2% 4.1

14 Kanoria Chem. 30.0 30.0 28.2 2.6 40.8 18.2 200.6 35.7 5 10.7 41.2 1.5 -2.8 4.2% 13.8

15 Cosmo Films 50.0 50.0 19.4 38.1 138.0 70.0 237.2 122.0 10 31.0 132.4 1.1 1.9 4.1% 3.2

16 Blue Star Info. 50.0 25.0 10.0 15.6 155.8 51.1 131.5 122.7 10 10.8 62.8 0.0 1.2 4.0% 7.9

17 Oudh Sugar Mills 15.0 0.0 22.1 9.6 85.8 36.9 96.7 37.3 10 20.6 59.7 4.6 19.0 4.0% 3.9

18 Empee Distill. 50.0 50.0 19.0 5.8 173.8 58.5 240.1 126.4 10 15.2 123.8 0.8 5.4 3.9% 21.7

19 Andhra Bank 50.0 45.0 485.0 21.6 128.3 54.5 6171.6 127.3 10 224.4 90.9 16.6 353.7 3.9% 5.9

20 Satyam Computer 175.0 175.0 134.1 25.2 128.4 43.2 10668.1 90.7 2 2882.0 63.4 0.0 221.6 3.8% 3.6

21 Valiant Commun. 12.0 10.0 7.7 3.1 39.9 22.0 23.5 31.3 10 24.0 40.4 0.0 -0.4 3.8% 10.0

22 Sarla Performanc 35.0 35.0 7.0 12.2 96.0 39.0 64.0 92.1 10 17.6 94.4 0.5 1.1 3.8% 7.6

23 Manugraph India 100.0 200.0 6.1 8.6 68.0 34.4 160.7 52.9 2 70.3 78.3 0.4 -24.6 3.7% 6.2

24 Clariant Chemica 250.0 190.0 26.7 40.4 695.0 171.0 1798.6 674.7 10 20.2 130.5 0.0 25.9 3.7% 16.7

25 Anjani Portland 15.0 15.0 18.4 9.2 43.9 21.5 74.5 40.5 10 19.4 30.3 1.0 -1.4 3.7% 4.4

26 Balrampur Chini 300.0 50.0 25.7 8.2 167.3 65.0 2123.6 82.2 1 850.7 45.5 0.9 101.3 3.6% 10.0

27 Natl. Peroxide 100.0 80.0 5.8 36.5 304.2 162.3 158.1 275.0 10 14.0 120.3 0.2 -6.0 3.6% 7.5

28 Indiabulls Fin. 250.0 100.0 62.0 9.9 224.2 93.1 4328.5 139.7 2 732.2 130.8 2.0 -5.6 3.5% 14.0

29 Deepak Fert 40.0 35.0 88.2 15.5 126.2 67.2 1004.6 113.9 10 92.9 91.1 0.8 -1.5 3.5% 7.3

DataSource: Capitaline

Note:

1. EPS (FY09), BV and D/E are consolidated wherever applicable. Dividends for FY09 have been declared and distributed in most cases and dividends

for FY10 has been declared in some cases. Hence fresh investors will be eligible to receive FY10 dividends only (except for interim dividends

wherever announced and distributed). P/E is based on FY09 EPS.

2. Unforeseen deterioration in performance could affect dividend payouts and consequently the dividend yields. While in some cases, the 9MFY10

results show a fall in PAT that could result in a cutback in dividends, even at reduced levels, they could still work out to be attractive.

HDFC Securities Limited, I Think Techno Campus, Building –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station,

Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435

Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to

be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information

contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from

time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other

services for, any company mentioned in this document. This report is intended for Retail Clients only and not for any other category of clients, including, but not limited

to, Institutional Clients

Retail Research 1

Вам также может понравиться

- Dividend Yield Stocks - HDFC Sec - 26 09 09Документ1 страницаDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxОценок пока нет

- Dividend Yield StocksДокумент2 страницыDividend Yield Stocksunu_uncОценок пока нет

- Dividend Yield Stocks 200619-201906201641102022239Документ2 страницыDividend Yield Stocks 200619-201906201641102022239Pushkaraj SherkarОценок пока нет

- Dividend Yield Stocks: Retail ResearchДокумент3 страницыDividend Yield Stocks: Retail ResearchAmeerHamsaОценок пока нет

- Dividend Yield Stocks: Retail ResearchДокумент2 страницыDividend Yield Stocks: Retail ResearchrajivОценок пока нет

- Dividend Yield StocksДокумент3 страницыDividend Yield StocksSushilОценок пока нет

- Dividend Yield Stocks 210922Документ3 страницыDividend Yield Stocks 210922Aaron KaleesОценок пока нет

- Dividend Yield StocksДокумент3 страницыDividend Yield StocksDilip KumarОценок пока нет

- ICICIdirect ExpectedHighDividendYieldStocksДокумент2 страницыICICIdirect ExpectedHighDividendYieldStocksRamesh RajagopalanОценок пока нет

- High Dividend Yield Stocks 2013Документ2 страницыHigh Dividend Yield Stocks 2013Karthik ChockkalingamОценок пока нет

- Portflio 2Документ51 страницаPortflio 2gurudev21Оценок пока нет

- Top 17 Stocks BuyДокумент13 страницTop 17 Stocks BuySushilОценок пока нет

- Dividend Yield Stocks 6 JanДокумент2 страницыDividend Yield Stocks 6 JanIndrayani NimbalkarОценок пока нет

- Div Yield 10Документ2 страницыDiv Yield 10Hardik SompuraОценок пока нет

- Matriks Valuasi Saham Sharia 18 May 2020Документ1 страницаMatriks Valuasi Saham Sharia 18 May 2020hendarwinОценок пока нет

- Long Term SIP Picks Jan 23Документ15 страницLong Term SIP Picks Jan 23sbvaОценок пока нет

- Dividend Yield Stocks 220811Документ2 страницыDividend Yield Stocks 220811Atul KapoorОценок пока нет

- DM22118 - Dinakaran SДокумент11 страницDM22118 - Dinakaran SDinakaranОценок пока нет

- Kenyan Brokerage & Investment Banking Financial Results 2009Документ83 страницыKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaОценок пока нет

- Matriks Valuasi Saham Syariah 23112020Документ2 страницыMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aОценок пока нет

- Portfolio SnapshotДокумент63 страницыPortfolio Snapshotgurudev21Оценок пока нет

- Matrix Valuasi Saham Syariah 1 Mar 21Документ1 страницаMatrix Valuasi Saham Syariah 1 Mar 21haji atinОценок пока нет

- DIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564Документ5 страницDIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564uma AgrawalОценок пока нет

- Nov PMS PerformanceДокумент3 страницыNov PMS PerformanceYASHОценок пока нет

- Trending Value Portfolio Implementation-GoodДокумент260 страницTrending Value Portfolio Implementation-Gooddheeraj nautiyalОценок пока нет

- Market Statistics - Friday, October 30 2009: Japan - Nikkei 225Документ7 страницMarket Statistics - Friday, October 30 2009: Japan - Nikkei 225Andre SetiawanОценок пока нет

- FIB Research - NSE Financial StatsДокумент16 страницFIB Research - NSE Financial StatslexmuiruriОценок пока нет

- Matriks Valuasi Saham Sharia 11 May 2020Документ4 страницыMatriks Valuasi Saham Sharia 11 May 2020hendarwinОценок пока нет

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςДокумент43 страницыΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςagis.condtОценок пока нет

- MarketInsightUploads DividendYieldStocks8MarДокумент2 страницыMarketInsightUploads DividendYieldStocks8MarsanakdasОценок пока нет

- Dividend Yielding StocksДокумент2 страницыDividend Yielding StocksleninbapujiОценок пока нет

- Quality Dividend Yield Stocks - 301216Документ5 страницQuality Dividend Yield Stocks - 301216sumit guptaОценок пока нет

- CFD - November 2nd 2009Документ4 страницыCFD - November 2nd 2009Andre SetiawanОценок пока нет

- KSL StockmeterДокумент5 страницKSL StockmeterAn AntonyОценок пока нет

- Arcadia - Syndicate 9Документ6 страницArcadia - Syndicate 9Uus FirdausОценок пока нет

- L Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CДокумент5 страницL Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CdineshОценок пока нет

- 2012 2013 2014 2015 Assumptions: INR MN %p.a. Years #Документ6 страниц2012 2013 2014 2015 Assumptions: INR MN %p.a. Years #Shirish BaisaneОценок пока нет

- Depriciation Function AДокумент6 страницDepriciation Function ADeep BusaОценок пока нет

- Companies (CNX 500 Stocks) That Offer Good Dividend Yield.: MSFL ResearchДокумент2 страницыCompanies (CNX 500 Stocks) That Offer Good Dividend Yield.: MSFL ResearchJay SagarОценок пока нет

- PDF CropДокумент2 страницыPDF CropDevesh BalkoteОценок пока нет

- Portflio 3Документ33 страницыPortflio 3gurudev21Оценок пока нет

- GAWARVALAДокумент31 страницаGAWARVALAgurudev21Оценок пока нет

- Case Study On: Gainesboro Machine ToolsДокумент31 страницаCase Study On: Gainesboro Machine Toolsshaiqua TashbihОценок пока нет

- 07 Findings and ConclusionДокумент7 страниц07 Findings and ConclusionAmish SoniОценок пока нет

- Impact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajДокумент11 страницImpact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajSavy DhillonОценок пока нет

- Harga Wajar DBIДокумент40 страницHarga Wajar DBISeptiawanОценок пока нет

- Case RockboromachinetoolscorporationДокумент10 страницCase RockboromachinetoolscorporationPatcharanan SattayapongОценок пока нет

- AmcДокумент19 страницAmcTimothy RenardusОценок пока нет

- Monthly Performance Report: MonthДокумент16 страницMonthly Performance Report: Monthkumarprasoon99Оценок пока нет

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Документ5 страницCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaОценок пока нет

- ST BK of IndiaДокумент42 страницыST BK of IndiaSuyaesh SinghaniyaОценок пока нет

- India Cements FAДокумент154 страницыIndia Cements FARohit KumarОценок пока нет

- SubrosДокумент31 страницаSubrossumit3902Оценок пока нет

- Submission v2Документ32 страницыSubmission v2MUKESH KUMARОценок пока нет

- Daily FNO Overview: Retail ResearchДокумент5 страницDaily FNO Overview: Retail ResearchjaimaaganОценок пока нет

- Portflio 4Документ32 страницыPortflio 4gurudev21Оценок пока нет

- And Investment Holdings 32015Документ10 страницAnd Investment Holdings 32015Milan PetrikОценок пока нет

- Partners Healthcare (Tables and Exhibits)Документ9 страницPartners Healthcare (Tables and Exhibits)sahilkuОценок пока нет

- Portfolio Data For TableauДокумент4 страницыPortfolio Data For TableauSai PavanОценок пока нет

- BOB DiemДокумент2 страницыBOB DiemkunalprasherОценок пока нет

- NPS FormДокумент9 страницNPS FormkunalprasherОценок пока нет

- News Flash 07.09Документ1 страницаNews Flash 07.09kunalprasherОценок пока нет

- Campus FormДокумент1 страницаCampus FormkunalprasherОценок пока нет

- Elective Option Form Estbcampus Class 2011Документ2 страницыElective Option Form Estbcampus Class 2011kunalprasherОценок пока нет

- Final PharmaДокумент40 страницFinal PharmakunalprasherОценок пока нет

- KunalДокумент15 страницKunalkunalprasherОценок пока нет

- SIM Game Theory To FinanceДокумент47 страницSIM Game Theory To FinancekunalprasherОценок пока нет

- Body Shop ClaseДокумент29 страницBody Shop ClaseChristian CabariqueОценок пока нет

- Lion Global Vietnam FundДокумент1 страницаLion Global Vietnam FundcharmendarОценок пока нет

- Answer Key Module 2 Financial Statement Analysis 1Документ6 страницAnswer Key Module 2 Financial Statement Analysis 1Mc Bryan Barlizo0% (1)

- JJJДокумент12 страницJJJCamille ManalastasОценок пока нет

- CH 05Документ46 страницCH 05Waseem Ahmad QurashiОценок пока нет

- Valuation of StocksДокумент20 страницValuation of StocksRadhakrishna MishraОценок пока нет

- Jesse Livermore MethodsДокумент64 страницыJesse Livermore MethodsIrene Lye100% (3)

- Lecture SixДокумент10 страницLecture SixSaviusОценок пока нет

- Chapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)Документ18 страницChapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)XОценок пока нет

- New Microsoft Word DocumentДокумент3 страницыNew Microsoft Word DocumentRajat PawanОценок пока нет

- Askari Bank LTDДокумент136 страницAskari Bank LTDnadshmsОценок пока нет

- Chapter 7 Test Bank PDFДокумент22 страницыChapter 7 Test Bank PDFCharmaine CruzОценок пока нет

- Security Analysis PDFДокумент254 страницыSecurity Analysis PDFTakangNixonEbot0% (1)

- Savings BondsДокумент2 страницыSavings BondsffsdfsfdftrertОценок пока нет

- Techical Analysis-SAPMДокумент34 страницыTechical Analysis-SAPMHeavy GunnerОценок пока нет

- Ch09 P18 Build A ModelBAMДокумент2 страницыCh09 P18 Build A ModelBAMsadoleh83% (6)

- The Crown Prince of BuyoutsДокумент10 страницThe Crown Prince of BuyoutsdondeosОценок пока нет

- Dividend DecisionsДокумент3 страницыDividend DecisionsRatnadeep MitraОценок пока нет

- Gold ETFДокумент11 страницGold ETFPravin ChoughuleОценок пока нет

- Acca f9 2012 NotesДокумент19 страницAcca f9 2012 NotesThe ExP GroupОценок пока нет

- Working Capital ManagementДокумент47 страницWorking Capital Managementayush mohta100% (1)

- Final Company ProfileДокумент28 страницFinal Company ProfileVinod Manoj SaldanhaОценок пока нет

- Satish PPT 1st ChapterДокумент14 страницSatish PPT 1st ChaptersatishОценок пока нет

- EdTech Funding CompaniesДокумент3 страницыEdTech Funding Companiesrajat100% (1)

- Persianas Group Profile Sep2011Документ21 страницаPersianas Group Profile Sep2011paulyaacoubОценок пока нет

- Strategy Reading ListДокумент2 страницыStrategy Reading ListyyyОценок пока нет

- Portfolio Management and Mutual Fund Analysis: Sweti KejariwalДокумент41 страницаPortfolio Management and Mutual Fund Analysis: Sweti KejariwalArun AhirwarОценок пока нет

- Resurgent India Limited Weekly Newsletter Aug 13 2010Документ5 страницResurgent India Limited Weekly Newsletter Aug 13 2010Udrrek Vikram DharnidharkaОценок пока нет

- Trading System in Stock ExchangeДокумент19 страницTrading System in Stock ExchangeMohan KumarОценок пока нет

- A Case Study in Transforming of Retail Stock TradeДокумент24 страницыA Case Study in Transforming of Retail Stock Tradeapi-3835230Оценок пока нет