Академический Документы

Профессиональный Документы

Культура Документы

Drfat For Review PDF

Загружено:

Anonymous gKfTqXObkDИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Drfat For Review PDF

Загружено:

Anonymous gKfTqXObkDАвторское право:

Доступные форматы

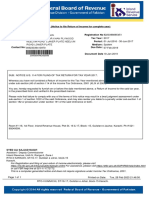

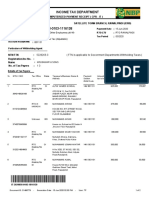

114(6)(b) (Application for revision of Return of Income for complete year)

Name: MUNAWAR JANNAT RANA Registration No 3740503258676

Address: KAROR POST OFFICE BAHADUR TEHSIL Tax Year : 2015

KOTLISATTIAN DISTT. Period : 01-Jul-2014 - 30-Jun-2015

Medium : Online

Due Date : 29-Oct-2017

Subject: 114(6)(b) application for revision of Return of income for Complete Year) Tax year 2015.

References: (a). 121( Order to Make Best judgement assessment) Dated 26 Oct 2017 (Copy Attached)

(b) 122(9) (Notice to Amend Assessment) Dated 23 Oct 2017.

1. I've received your intimation. Gilgit being a far-flung area with poor communication and access and

due to my commitment as the single senior gynaecologist in whole of gilgit baltistan and poor Internet,

due to non availability of tax experts I couldn't respond to your intimation even though that

I am a conscientious tax payer. Now I have arranged almost all required documents pertains to Income

under-head Salary and Business(Private Practice). It is humbly requested to please allow me revised returns

for said tax year as per 121(order to Make best judgement assessment dated

26 Oct 2017. In addition it is also submitted That the NOU Signed is not an act or rule and the source end

not excepting the rate which is described/agreed in NOU. (Detection Certificates under-head Salary and

Private Practice/Business as evidence are also attached ).

2. In view of above it is again requested the slab rate of income Tax should be applied as implemented

by the Government of Pakistan for Tax year 2015.

3. Positive Response is solicited, please.

Javaid Iqbal, Commissioner

Zone-Cantt, Inland Revenue

RTO RAWALPINDI, TAX HOUSE 12-MAYO ROAD RAWALPINDI

Page 1 of 1 Printed on Date: Sun, 29 Oct 2017 13:12:19

RTO RAWALPINDI, TAX HOUSE 12-MAYO ROAD RAWALPINDI

Вам также может понравиться

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanДокумент1 страницаAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanОценок пока нет

- Plot 5-C, Street N-2, Rawat Industrial Estate, Islamabad Rawat Oil and Ghee Mills Private LimitedДокумент1 страницаPlot 5-C, Street N-2, Rawat Industrial Estate, Islamabad Rawat Oil and Ghee Mills Private LimitedMadiah abcОценок пока нет

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanДокумент1 страницаAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanОценок пока нет

- Internal Corresponence2644435Документ1 страницаInternal Corresponence2644435Bm ShopОценок пока нет

- MobileBill 1140609044Документ10 страницMobileBill 1140609044Nirbhay SinghОценок пока нет

- Vishal Income Tax NoticeДокумент4 страницыVishal Income Tax NoticePriyank SisodiaОценок пока нет

- Tax Collector Correspondence3362544Документ5 страницTax Collector Correspondence3362544hamza awanОценок пока нет

- TemplateДокумент1 страницаTemplateEyasin ArifОценок пока нет

- Tax Collector Correspondence3650252089558Документ1 страницаTax Collector Correspondence3650252089558MustansarWattoo0% (1)

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanДокумент1 страницаAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanОценок пока нет

- 2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioДокумент7 страниц2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioThe Chartered Professional NewsletterОценок пока нет

- 0bba0 GSTR 9 Booklet HiregangeДокумент113 страниц0bba0 GSTR 9 Booklet HiregangeAMIT SHARMAОценок пока нет

- In The High Court of Delhi at New DelhiДокумент18 страницIn The High Court of Delhi at New DelhiSambasivam GanesanОценок пока нет

- ReportДокумент1 страницаReportdeclerckclever5Оценок пока нет

- Cta Eb CV 01608 M 2019apr15 AssДокумент5 страницCta Eb CV 01608 M 2019apr15 AssMarishiОценок пока нет

- For Billing Enquiry Visit Https://selfcare - Tikona.inДокумент1 страницаFor Billing Enquiry Visit Https://selfcare - Tikona.incyberabadОценок пока нет

- IJP AllowanceДокумент3 страницыIJP AllowanceAbu Bakar SiddiqueОценок пока нет

- Income Tax - Computation - 2021Документ26 страницIncome Tax - Computation - 2021umasankarОценок пока нет

- Acc No: 906484771 Bsno: 2: MR Ravinder Verma .Документ2 страницыAcc No: 906484771 Bsno: 2: MR Ravinder Verma .verma_ravinderОценок пока нет

- PDR Tax Forum 2016 Recent Court Decisions On Tax - FinalДокумент144 страницыPDR Tax Forum 2016 Recent Court Decisions On Tax - FinalFender Boyang100% (1)

- 4 Service Tax Vat Ay 2011 12 NewДокумент20 страниц4 Service Tax Vat Ay 2011 12 NewJitendra VernekarОценок пока нет

- PDF DocumentДокумент1 страницаPDF Documentmoizsan76Оценок пока нет

- Pak Telecom Mobile Limited: 967.22 Nine Hundred Sixty-Seven Rupees Twenty-Two PaisasДокумент1 страницаPak Telecom Mobile Limited: 967.22 Nine Hundred Sixty-Seven Rupees Twenty-Two PaisasMahar Tahir Sattar MtsОценок пока нет

- Core Competencies Profile Summary: Ca Akash MaheshwariДокумент2 страницыCore Competencies Profile Summary: Ca Akash MaheshwariDivya NinaweОценок пока нет

- 27 Useful Charts of Service Tax 2016 17 PDFДокумент24 страницы27 Useful Charts of Service Tax 2016 17 PDFJosef AnthonyОценок пока нет

- Union GST Audit ReplyДокумент2 страницыUnion GST Audit ReplybirmaniОценок пока нет

- Ca Audit Report 2324Документ6 страницCa Audit Report 2324UmasankarОценок пока нет

- SSCДокумент4 страницыSSCAnonymous gvw9aCjОценок пока нет

- Cover Letter For Tax ClearanceДокумент1 страницаCover Letter For Tax ClearanceWelbert CornejoОценок пока нет

- Abound Routes - Fee QuoteДокумент2 страницыAbound Routes - Fee Quotefinserv2998Оценок пока нет

- GST Update 18.11.2017Документ39 страницGST Update 18.11.2017sridharanОценок пока нет

- ACK612420510050124Документ1 страницаACK612420510050124knowthebest787Оценок пока нет

- Hawwa NaseeraДокумент2 страницыHawwa Naseerahawwa naseeraОценок пока нет

- CIR VДокумент9 страницCIR VKristiana LeañoОценок пока нет

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Документ6 страницSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377meedinesh123Оценок пока нет

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanДокумент1 страницаAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanОценок пока нет

- Tax Certificate 03326459660 2016Документ1 страницаTax Certificate 03326459660 2016ChoudheryShahzadОценок пока нет

- Your Reliance Communications Bill: Summary of Current Charges Amount (RS)Документ3 страницыYour Reliance Communications Bill: Summary of Current Charges Amount (RS)Dhamotharan ChinnaduraiОценок пока нет

- 380Документ6 страниц380Gokul PrabuОценок пока нет

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityДокумент17 страницSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityGeorge Mitchell S. GuerreroОценок пока нет

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Документ4 страницыSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377BHAWANATH JHAОценок пока нет

- Tax Collector Correspondence3740587933521Документ1 страницаTax Collector Correspondence3740587933521shahid kamalОценок пока нет

- Balasubramaniam AppealДокумент23 страницыBalasubramaniam AppealSambasivam GanesanОценок пока нет

- Type:: Taxdivision: ReturndateДокумент1 страницаType:: Taxdivision: ReturndatekamalakarvreddyОценок пока нет

- Cta Eb CV 02466 D 2023mar08 Ass PDFДокумент37 страницCta Eb CV 02466 D 2023mar08 Ass PDFHershey GabiОценок пока нет

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsДокумент1 страницаBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsRajeev SinghОценок пока нет

- Tax Collector Correspondence4005106Документ1 страницаTax Collector Correspondence4005106Muhammad AbdullahОценок пока нет

- Income Tax ReturnДокумент6 страницIncome Tax ReturnMilan ChakmaОценок пока нет

- Telephone: 18001034455 (Toll Free) or 080-46605200: Bengaluru-560500Документ2 страницыTelephone: 18001034455 (Toll Free) or 080-46605200: Bengaluru-560500Siddharth SoporiОценок пока нет

- As2011julm05 1068707857 935958945Документ2 страницыAs2011julm05 1068707857 935958945nirmalОценок пока нет

- Savvy StudiozДокумент4 страницыSavvy Studioza1amarpatelОценок пока нет

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanДокумент1 страницаAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanОценок пока нет

- Journal Entries Receipt On Advance in GST - Accounting Entries in GSTДокумент8 страницJournal Entries Receipt On Advance in GST - Accounting Entries in GSTCAMSBABJI MAHОценок пока нет

- Spectra Net 2Документ4 страницыSpectra Net 2nitinОценок пока нет

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2021Документ2 страницыTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2021krisivaОценок пока нет

- G S T One Tax One NationДокумент61 страницаG S T One Tax One NationTripati PatraОценок пока нет

- Government of The People's Republic of Bangladesh National Board of RevenueДокумент1 страницаGovernment of The People's Republic of Bangladesh National Board of Revenuerokibulhasan463Оценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОценок пока нет

- CPR May 2020Документ2 страницыCPR May 2020Anonymous gKfTqXObkDОценок пока нет

- Cir Exam 02042k20Документ1 страницаCir Exam 02042k20Anonymous gKfTqXObkDОценок пока нет

- Working On Sales TaxДокумент1 страницаWorking On Sales TaxAnonymous gKfTqXObkDОценок пока нет

- FBR Tax Profiling SystemДокумент1 страницаFBR Tax Profiling SystemAnonymous gKfTqXObkDОценок пока нет

- JKJKJДокумент1 страницаJKJKJAnonymous gKfTqXObkDОценок пока нет

- Active Taxpayers List (Atl) : Sales TaxДокумент1 страницаActive Taxpayers List (Atl) : Sales TaxAnonymous gKfTqXObkDОценок пока нет

- Mail - Nosheen Butt - OutlookДокумент2 страницыMail - Nosheen Butt - OutlookAnonymous gKfTqXObkDОценок пока нет

- Sales Tax Payment Challan: Input FormДокумент1 страницаSales Tax Payment Challan: Input FormAnonymous gKfTqXObkDОценок пока нет

- Accounting Basics 3Документ74 страницыAccounting Basics 3Mukund kelaОценок пока нет

- Form I OrignalДокумент1 страницаForm I OrignalAnonymous gKfTqXObkDОценок пока нет

- NTN ShabanДокумент1 страницаNTN ShabanAnonymous gKfTqXObkDОценок пока нет

- Check ListДокумент1 страницаCheck ListAnonymous gKfTqXObkDОценок пока нет

- Aoa-Act 2017 - (Table A Part II) SMCДокумент5 страницAoa-Act 2017 - (Table A Part II) SMCAnonymous gKfTqXObkDОценок пока нет

- SecpДокумент1 страницаSecpAnonymous gKfTqXObkDОценок пока нет

- Advantages of Being Active Tax Payer/FilerДокумент3 страницыAdvantages of Being Active Tax Payer/FilerAnonymous gKfTqXObkDОценок пока нет

- Form 1Документ2 страницыForm 1Muhammad Irfan Riaz100% (1)

- Apartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirДокумент3 страницыApartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirAnonymous gKfTqXObkDОценок пока нет

- Electricity ActДокумент61 страницаElectricity ActAnonymous gKfTqXObkDОценок пока нет

- PTCL Charji Evo TabДокумент1 страницаPTCL Charji Evo TabAnonymous gKfTqXObkDОценок пока нет

- QureshiДокумент5 страницQureshiAnonymous gKfTqXObkDОценок пока нет

- Undertaking For C-6 To C-5Документ1 страницаUndertaking For C-6 To C-5Anonymous gKfTqXObkDОценок пока нет

- Contact F BRДокумент14 страницContact F BRAnonymous gKfTqXObkDОценок пока нет

- 1Документ1 страница1Anonymous gKfTqXObkDОценок пока нет

- CheezMall FlyerДокумент2 страницыCheezMall FlyerAnonymous gKfTqXObkDОценок пока нет

- Azcorp Engineering PL 02 2013 Te AzcorpДокумент5 страницAzcorp Engineering PL 02 2013 Te AzcorpAnonymous gKfTqXObkDОценок пока нет

- Q Mobile SBS FlyerДокумент2 страницыQ Mobile SBS FlyerAnonymous gKfTqXObkDОценок пока нет

- LLB Form Combined NewДокумент2 страницыLLB Form Combined NewAnonymous gKfTqXObkDОценок пока нет

- BA Form PrivateДокумент4 страницыBA Form PrivateMuhammad JamshaidОценок пока нет

- HondaДокумент2 страницыHondaAnonymous gKfTqXObkDОценок пока нет