Академический Документы

Профессиональный Документы

Культура Документы

Problem Set No. 2 ES 321: Solving

Загружено:

Joselito Daroy0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров1 страницаОригинальное название

number 9.doc

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров1 страницаProblem Set No. 2 ES 321: Solving

Загружено:

Joselito DaroyАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

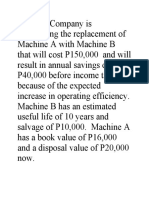

PROBLEM SET NO.

2

ES 321

9. Alpha company is planning to invest in a machine the use of which will result in

the following:

Annual revenues of $10,000 in the first year and increases of $5,000 each

year, up to year 9. From year 10, the revenues will remain constant

(%52,000 for an indefinite period.

The machine is to be overhauled every 10 years. The expense for each

overhaul is $40,000.

If Alpha expects a present worth of at least $100,000 at a MARR of 10% for this

project, what is the maximum investment that Alpha should be prepared to

make?

CF diagram

Present worth total cash inflow: Pg PA P

5 ,000 ( 1 0.10 )9 1 1

Pg n 9

0.10 0.10 ( 1 0.10 )

Pg $97 ,107.35

1 ( 1 0.10 )9

PA 10 ,000

0.10

PA P 57 ,590.24

52 ,000

1 0.10

9

P Pg PA P P 375 ,228.35

0.10

P 220 ,530.76

Present worth total cash outflow: X InitialInvestment

40 ,000

X

1 01.0 10 1

X 25 ,098.16 X InitialInvestment 25 ,098.16 I

If Pg PA P X I $100 ,000 ; Solving I

I $375 ,228.35 $25 ,098.16 $100 ,000

I P 250 ,130.19

Вам также может понравиться

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)От EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeОт EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeОценок пока нет

- Time Value of Money Solutions PDFДокумент12 страницTime Value of Money Solutions PDFIoana DragneОценок пока нет

- Tugas GSLC Corp Finance Session 16Документ6 страницTugas GSLC Corp Finance Session 16Javier Noel ClaudioОценок пока нет

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Документ6 страницGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpОценок пока нет

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Документ6 страницGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioОценок пока нет

- TVM Review LectureДокумент20 страницTVM Review LectureKalle AhiОценок пока нет

- TVM Review LectureДокумент19 страницTVM Review LectureAnu KulОценок пока нет

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIДокумент6 страницIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezОценок пока нет

- TVM Review LectureДокумент19 страницTVM Review Lectureruvina monteiroОценок пока нет

- Lecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingДокумент38 страницLecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingHồng KhánhОценок пока нет

- Addtl Exercises 10 12Документ5 страницAddtl Exercises 10 12John Lester C AlagОценок пока нет

- ASSIGNMENT 3 - Evaluating A Single ProjectДокумент9 страницASSIGNMENT 3 - Evaluating A Single ProjectKhánh Đoan Lê ĐìnhОценок пока нет

- Chapter 2Документ14 страницChapter 2Kumar ShivamОценок пока нет

- 202E13Документ24 страницы202E13Sammy Ben MenahemОценок пока нет

- Villar, Valeriano Jr. D. - EconДокумент13 страницVillar, Valeriano Jr. D. - Econjung biОценок пока нет

- Week 7&8: AssignmentДокумент11 страницWeek 7&8: AssignmentkmarisseeОценок пока нет

- Final RevisionДокумент13 страницFinal Revisionaabdelnasser014Оценок пока нет

- 5 - Capital Investment Appraisal (Part-2)Документ10 страниц5 - Capital Investment Appraisal (Part-2)Fahim HussainОценок пока нет

- Book 1Документ6 страницBook 1ROSELLE OKYOОценок пока нет

- P10-7 Net Present Value - Independent Projects Project AДокумент2 страницыP10-7 Net Present Value - Independent Projects Project AIntan N TОценок пока нет

- M03 Broo6637 1e Im C03Документ21 страницаM03 Broo6637 1e Im C03Inzhu SarinzhipОценок пока нет

- Chapter 12Документ14 страницChapter 12Naimmul FahimОценок пока нет

- Chapter 18 Answer KeyДокумент9 страницChapter 18 Answer KeyNCT100% (1)

- Tutorial-1 2012 Mba 680 Solutions1Документ5 страницTutorial-1 2012 Mba 680 Solutions1Pratheek MedipallyОценок пока нет

- Capital Budgeting Template-Jumawid, Joyce S.Документ8 страницCapital Budgeting Template-Jumawid, Joyce S.Aian Kit Jasper SanchezОценок пока нет

- Ast Answer Shere Partnership FormationДокумент13 страницAst Answer Shere Partnership FormationNicole AgostoОценок пока нет

- Acc 223 CB PS3 AkДокумент19 страницAcc 223 CB PS3 AkAeyjay ManangaranОценок пока нет

- Engineering Econ Lab - Week 1Документ2 страницыEngineering Econ Lab - Week 1Zac QuezonОценок пока нет

- May 2014 Q3Документ1 страницаMay 2014 Q3Chahak BhallaОценок пока нет

- CourseheroДокумент2 страницыCourseheroSharjaaah50% (2)

- ValuationДокумент3 страницыValuationPratik ChourasiaОценок пока нет

- Capital Budgeting Techniques: ProblemsДокумент3 страницыCapital Budgeting Techniques: ProblemsripplerageОценок пока нет

- Ch6è Ç Ä È È È É¡ Ç ®Документ7 страницCh6è Ç Ä È È È É¡ Ç ®fgknpqvfzcОценок пока нет

- Afm New Topic CompiledДокумент59 страницAfm New Topic Compiledganesh bhaiОценок пока нет

- Chapter 13 SolutionsДокумент5 страницChapter 13 SolutionsStephen Ayala100% (1)

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsДокумент16 страницSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamОценок пока нет

- Dewa Satria Rachman LubisДокумент13 страницDewa Satria Rachman LubisDewaSatriaОценок пока нет

- Time Value of Money Practice Problems - SolutionsДокумент12 страницTime Value of Money Practice Problems - Solutionslex_jung100% (1)

- Corporate Finance: Capital BudgetingДокумент29 страницCorporate Finance: Capital BudgetingPigeons LoftОценок пока нет

- Benito Juhantyo Wibbowo 1714422056 NPVДокумент6 страницBenito Juhantyo Wibbowo 1714422056 NPVBenito JuhantyoОценок пока нет

- Jordan Pippen Total: Multiple Choice Answers and SolutionsДокумент25 страницJordan Pippen Total: Multiple Choice Answers and SolutionsNelia Mae S. VillenaОценок пока нет

- Equity Analysis of A Project: Capital Budgeting WorksheetДокумент8 страницEquity Analysis of A Project: Capital Budgeting WorksheetanuradhaОценок пока нет

- ANSWER KEY ON PARTNERSHIP MOCK TESTxДокумент6 страницANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilОценок пока нет

- Lahore School of Economics Financial Management II Review of FM I - 1Документ3 страницыLahore School of Economics Financial Management II Review of FM I - 1Daniyal AliОценок пока нет

- 202E13Документ28 страниц202E13Ashish BhallaОценок пока нет

- Gitman IM Ch09Документ24 страницыGitman IM Ch09Imran FarmanОценок пока нет

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part B)Документ2 страницы(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part B)John Carlos DoringoОценок пока нет

- Business Finance - CH 6 SolutionДокумент6 страницBusiness Finance - CH 6 SolutionRita100% (1)

- Financial Analysis of ProjectsДокумент61 страницаFinancial Analysis of ProjectsMohamed MustefaОценок пока нет

- Chapter 2 Partnership Operationsdoc PDF FreeДокумент25 страницChapter 2 Partnership Operationsdoc PDF Freemaria evangelistaОценок пока нет

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFДокумент38 страницFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (10)

- Chapter 6 Invetsment ExercisesДокумент14 страницChapter 6 Invetsment ExercisesAntonio Jose DuarteОценок пока нет

- ECON - MODULE - 2. For PrintingДокумент15 страницECON - MODULE - 2. For PrintingMarcial Jr. Militante67% (3)

- Tutorial Qs 1AДокумент11 страницTutorial Qs 1Ashajea aliОценок пока нет

- MMM041 MCQ Test Feedback To Students 202021Документ3 страницыMMM041 MCQ Test Feedback To Students 202021ArisaОценок пока нет

- Ans 1 Future Value of Annuity ProblemДокумент4 страницыAns 1 Future Value of Annuity ProblemParth Hemant PurandareОценок пока нет

- 015 June 10, 2023 Problem Solving PRCДокумент20 страниц015 June 10, 2023 Problem Solving PRCPrince EG DltgОценок пока нет

- TQM-Module 1Документ23 страницыTQM-Module 1Joselito DaroyОценок пока нет

- DC Generator Sample ProblemДокумент20 страницDC Generator Sample ProblemJoselito DaroyОценок пока нет

- HWPL Peace Education Lesson 6Документ52 страницыHWPL Peace Education Lesson 6Joselito DaroyОценок пока нет

- Charge, Current, Voltage and PowerДокумент8 страницCharge, Current, Voltage and PowerJoselito DaroyОценок пока нет

- Ohm's LawДокумент3 страницыOhm's LawJoselito DaroyОценок пока нет

- Laplace Transform Sample ProblemsДокумент5 страницLaplace Transform Sample ProblemsJoselito DaroyОценок пока нет

- Application of Laplace TransformДокумент25 страницApplication of Laplace TransformJoselito DaroyОценок пока нет

- Assgn 1Документ7 страницAssgn 1Joselito DaroyОценок пока нет

- DC and Ac SourcesДокумент3 страницыDC and Ac SourcesJoselito DaroyОценок пока нет

- Assgn 1Документ9 страницAssgn 1Joselito DaroyОценок пока нет

- Cost in Using The Present MethodДокумент1 страницаCost in Using The Present MethodJoselito DaroyОценок пока нет

- ExamДокумент6 страницExamJoselito DaroyОценок пока нет

- Hje ExampleДокумент4 страницыHje ExampleJoselito DaroyОценок пока нет

- Economy Prob Set 2Документ9 страницEconomy Prob Set 2Joselito DaroyОценок пока нет

- Number 1Документ1 страницаNumber 1Joselito DaroyОценок пока нет

- Examples For Cost Estimation TechniquesДокумент8 страницExamples For Cost Estimation TechniquesJoselito DaroyОценок пока нет

- Number 4Документ2 страницыNumber 4Joselito DaroyОценок пока нет

- Economy Prob Set 1Документ12 страницEconomy Prob Set 1Joselito DaroyОценок пока нет

- Economic Analysis of Industrial Projects: Allied Technical CorporationДокумент4 страницыEconomic Analysis of Industrial Projects: Allied Technical CorporationJoselito DaroyОценок пока нет

- ExamДокумент6 страницExamJoselito DaroyОценок пока нет

- B-C RatioДокумент3 страницыB-C RatioJoselito DaroyОценок пока нет