Академический Документы

Профессиональный Документы

Культура Документы

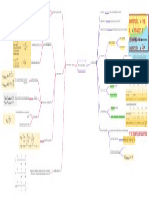

Economics: Summary of Assessing Performance of Different Market Structures

Загружено:

WeimingОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Economics: Summary of Assessing Performance of Different Market Structures

Загружено:

WeimingАвторское право:

Доступные форматы

PC: price taker, DD

perfectly elastic:

P=AR=MR, at prot

maximising level where

MR=MC, P=MC

Society value last unit P>MC at prot

of good produced more maximising level where

than its opportunity Allocative inecient: MR=MC

cost, welfare loss to produces at lower

output and higher Imperfect competition:

society, DWL

price, underallocation downward sloping

Greater price setting

of scarce resources demand (AR) curve,

ability, less price elastic

Better off if additional price setter

demand curve, steeper

units produced AR curve, price greater

Allocative eciency than MC to a greater

Compete in terms of

price cutting and other extent

Incumbent domestic

non pricing strategies,

monopoly can face Globalisation and

advertising and

competition from big removal of protectionist Resources may be put

promotion, highly

foreign conglomerates barriers led to growth into more productive

differentiated products

that vie for a share of in international use

--> affect sales of

lucrative domestic competition

incumbent, need to

market

reduce X-ineciency to

However if provide

survive

better consumer

Productive eciency Advertising to

In spite of information, move

differentiate products

At prot max ineciencies, monopoly market closer to PC

and increase market

Consumers enjoy equilibrium MR=MC, can be desirable in model in terms of

share -- may be seen as

benets of lower prices higher output and industries where perfect information

a form of economic

with huge iEOS in a lower price compared to substantial iEOS can be waste

monopoly perfectly competitive reaped, LRAC falls over

Misallocation of

industry a large range of output,

Monopoly Economic eciency resources, competitive

lower AC, lower MC

oligopoly, resources can

be used to produce

Consumers suffer from more goods and

exploitive pricing services

Exacerbate inequity, supernormal prots Firm in imperfect

concentrated in the hands of a selected few Equity competition settle at LR

monopolies who can block potential entrants equilibrium level that is

iEOS not fully exploited,

Productive eciency not necessarily at the

productive inecient

minimum LRAC, operate

However consumer surplus needs not necessarily at downward sloping

be reduced when enjoy substantial iEOS portion of LRAC curve

Argued that in very LR, Monopolies and

no BTE due to change in Criteria for assessing oligopolies can afford to

level of technology performance/ X-eciency be X-inecient because

Possible LR supernormal prots, able to reinvest

desirability ability to retain LR

into R&D especially with threat of potential

supernormal prots

entrants Dynamic eciency

Strong incentive to

break through market

from entrants

Fairness in distribution

Dynamic eciency of wealth, income and

May not have incentive because dominant position is opportunities

secured, less need (unless theory of contestable markets)

Equity

Idea of equitable

May erode value of monopolist's existing products, distribution is

tend to favour status quo normative

Tend to spread opportunities and wealth widely Consumers able to

and more evenly, prots spread evenly among choose from a wide

many small rms because no BTE variety of products +

Consumer choice

purchase similar goods

from different

Consumer surplus max producers

at equilibrium price Equity

where P=MC

"Excess capacity

theorem": attempts at

PC markets do not rectify pre-existing Not productively productive

Argue if there is merit

inequity, retain old structure of ecient, producing at differentiation incurs

in product

inequitable wealth distribution the falling portion of costs, results in rms

Assessing performance differentiation

the LRAC curve producing at higher

across different market

average cost than

Normal prots, structures

necessary

restricted R&D which

requires high MPC

expenditure Incentive to innovate

Dynamic eciency but easy to copy tech +

LR normal prots

But in reality often

engage in innovation to

Homogeneous products Perfect competition

improve quality and Enhances consumer

makes innovation to Dynamic eciency

earn higher prots in SR choice

improve quality of

product an irrelevant

discussion

Competition key driver Anti-competitive

of innovation behaviour such as

collusion and practice

Equity of price discrimination

Perfect information: innovations quickly replicated by often serve to further

competitor/ new rms, discourage R&D, no benets reduce consumer

surplus

Does not offer

consumer choice in Supernormal prots,

terms of product capable

variety but choice of

many producers Consumer choice

Existing competition

amongst few dominant

There is consumer Reduce fear of rival's

rms induces

sovereignty reactions to their

investment in R&D to

pricing strategies

Oligopoly Dynamic eciency differentiate products

(non pricing strategy)

Pace can be slow in

collusive/ entrenched

oligopolies - lack of

Perfectly contestable competition deter R&D

market when entry into like monopoly

and exit from market by

potential rivals is

costless and can be Also limits consumer choice to existing dominant

done rapidly rms in the market because of advertising

Contestable markets

Consumer choice

Key conditions Tends to engage in multiple branding whereby rm

1. no sunk costs and exit costs, capital equipment is produces same products packaged under different

transferable brand names -- false illusion of consumer choice

2. perfect information and ability of all suppliers to use

the best available production tech in the market

3. low consumer loyalty

Theory of contestable markets: what is

crucial in determining price and output is

Hit and run competition presence of real threat of competition

Economists theorise that this is new way to encourage

rms to act like perfect competitors + shows that

inecient rms cannot survive + why rms act

competitively despite market structure as long as

market is contestable

Вам также может понравиться

- Specific Pricing Strategy: Marketing Mix - 4PsДокумент1 страницаSpecific Pricing Strategy: Marketing Mix - 4PsJordan ChizickОценок пока нет

- ReviewДокумент17 страницReview10622006Оценок пока нет

- Electricity Pricing Model Input Data Range Names UsedДокумент3 страницыElectricity Pricing Model Input Data Range Names UsedJohn WIckОценок пока нет

- Cfa - R1Документ1 страницаCfa - R1Thanh TuyềnОценок пока нет

- Midterm 3 ReviewДокумент34 страницыMidterm 3 ReviewSameer JainОценок пока нет

- Break Even AnalysisДокумент20 страницBreak Even AnalysisSachi DhanandamОценок пока нет

- P-C SurplusesДокумент4 страницыP-C SurplusesWajiha RajaniОценок пока нет

- Yeni Microsoft PowerPoint PresentationДокумент33 страницыYeni Microsoft PowerPoint Presentationdob14Оценок пока нет

- NEC DND 3.5 UltimateCharacterSheet PDFДокумент3 страницыNEC DND 3.5 UltimateCharacterSheet PDFMatteo MorlacchiОценок пока нет

- Economic GrowthДокумент2 страницыEconomic Growthximenaliza6Оценок пока нет

- Mindmap Returns Management XPOДокумент1 страницаMindmap Returns Management XPONgoc PhamОценок пока нет

- Econ201 ReviewДокумент4 страницыEcon201 ReviewChristopher Demmerle-McGregorОценок пока нет

- Micro Economics PDFДокумент54 страницыMicro Economics PDFNguyen Châu AnhОценок пока нет

- Foundation Formulas PDFДокумент12 страницFoundation Formulas PDFsayma saraОценок пока нет

- The White DwarfДокумент4 страницыThe White DwarfBezerkerRageОценок пока нет

- Writing Skill OneДокумент1 страницаWriting Skill OneSylvia CHENОценок пока нет

- Cleric: HP MovementДокумент13 страницCleric: HP MovementRiccardo ForlaniОценок пока нет

- 3 Forces, Work and Materials: Types of Force Turning Effects of ForcesДокумент1 страница3 Forces, Work and Materials: Types of Force Turning Effects of ForcesSyed Wajahat AliОценок пока нет

- 2013 07-20-223905 Jones Family Minicase Analysis ModelДокумент1 страница2013 07-20-223905 Jones Family Minicase Analysis ModelXuân DungОценок пока нет

- 6 - Portfolio TheoryДокумент5 страниц6 - Portfolio TheoryAmit GuptaОценок пока нет

- Alchemi T: HP MovementДокумент16 страницAlchemi T: HP MovementRiccardo ForlaniОценок пока нет

- Oxford IB Diploma Programme IB Economics Course Book (JOCELYN. DORTON BLINK (IAN.), Ian Dorton)Документ601 страницаOxford IB Diploma Programme IB Economics Course Book (JOCELYN. DORTON BLINK (IAN.), Ian Dorton)sophieperervinОценок пока нет

- Ghost in The Shell RPG d20 Sheet PDFДокумент2 страницыGhost in The Shell RPG d20 Sheet PDFice79Оценок пока нет

- Demand and SupplyДокумент25 страницDemand and SupplyArjit Verma 1035Оценок пока нет

- Ficha Personagem 5e Editavel InglesДокумент3 страницыFicha Personagem 5e Editavel Inglesgregorywallace1221Оценок пока нет

- 25 MaretДокумент8 страниц25 MaretIndri Br SitumorangОценок пока нет

- MI DnDCharSheet23Документ4 страницыMI DnDCharSheet23Sgt. MushroomОценок пока нет

- 4 PDFДокумент1 страница4 PDFSim Pei YingОценок пока нет

- Macroeconomic Analysis I Topic 10: Keynesianism and Wage-Price Rigidity (Abel, Bernanke & Croushore: Chapter 11)Документ50 страницMacroeconomic Analysis I Topic 10: Keynesianism and Wage-Price Rigidity (Abel, Bernanke & Croushore: Chapter 11)Enigmatic ElstonОценок пока нет

- CH 17Документ11 страницCH 17jamalyyy111Оценок пока нет

- Take PhotoДокумент3 страницыTake PhotopunthadewaОценок пока нет

- Competitor Price Location Facility Strength Weakness StrategyДокумент2 страницыCompetitor Price Location Facility Strength Weakness StrategyRoeder IgnacioОценок пока нет

- KinematicsДокумент12 страницKinematicssaifaly shaheenОценок пока нет

- D&D 4e Character SheetДокумент3 страницыD&D 4e Character SheetcynaragriloОценок пока нет

- Quality at an affordable priceДокумент27 страницQuality at an affordable priceAbhishekh GuptaОценок пока нет

- PZO1110 CharacterSheetДокумент2 страницыPZO1110 CharacterSheetLuis MartínezОценок пока нет

- PZO1110 CharacterSheetДокумент2 страницыPZO1110 CharacterSheetTakumiОценок пока нет

- Character Sheet: STR DEX CON INT WIS CHA HP SpeedДокумент2 страницыCharacter Sheet: STR DEX CON INT WIS CHA HP SpeedFОценок пока нет

- Pathfinder 2e Kitsune SorcererДокумент4 страницыPathfinder 2e Kitsune SorcererLuiz GustavoОценок пока нет

- HGA Data Model DiagramsДокумент1 страницаHGA Data Model DiagramsIna-Lu MuresanОценок пока нет

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Документ1 страницаSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxОценок пока нет

- 5e Character Sheet (Out of The Abyss Format)Документ3 страницы5e Character Sheet (Out of The Abyss Format)Migz CasasОценок пока нет

- Business Standard - 13 Jan 2011 - Should The Rural Job Guarantee Scheme Be Linked To Minimum WagesДокумент1 страницаBusiness Standard - 13 Jan 2011 - Should The Rural Job Guarantee Scheme Be Linked To Minimum WagesSuchna evum Rozgar ka adhikar AbhiyanОценок пока нет

- Chapter 9 - Inflation and Philips CurveДокумент3 страницыChapter 9 - Inflation and Philips CurveGiang PhạmОценок пока нет

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Документ1 страницаSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxОценок пока нет

- Ae687 Assignment1Документ4 страницыAe687 Assignment1Shrutikirti SinghОценок пока нет

- Future Perfect Character SheetДокумент2 страницыFuture Perfect Character Sheet13thBlackAngelОценок пока нет

- Crack Width Short NoteДокумент1 страницаCrack Width Short NotePhanathon OunonОценок пока нет

- Semiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007Документ1 страницаSemiemperical Estimate of Pile Capacity Conforming Aashto Lrfd-2007civixxОценок пока нет

- The Economics Way To Thinking About Business: Chapter 1: Dr. Rudi PurwonoДокумент25 страницThe Economics Way To Thinking About Business: Chapter 1: Dr. Rudi PurwonohanaОценок пока нет

- Character Sheet 14Документ2 страницыCharacter Sheet 14romain.delattre81Оценок пока нет

- Samsaran PathfinderДокумент2 страницыSamsaran PathfinderDa GeißerОценок пока нет

- Future Perfect Character SheetДокумент2 страницыFuture Perfect Character Sheet13thBlackAngelОценок пока нет

- CPT TK03 001Документ46 страницCPT TK03 001Şəhriyar ƏliyevОценок пока нет

- Résume MicroДокумент77 страницRésume MicroKerrian MathezОценок пока нет

- DnD5e en - Feuille de Personnage Interactive 13.1Документ4 страницыDnD5e en - Feuille de Personnage Interactive 13.1NicolasОценок пока нет

- Monopoly price ceilings effectДокумент4 страницыMonopoly price ceilings effectrandom122Оценок пока нет

- Acc 406Документ1 страницаAcc 406hanhvy04Оценок пока нет

- BSP1703 NotesДокумент33 страницыBSP1703 NotesChloe TewОценок пока нет

- Applying To Oxbridge 2019Документ10 страницApplying To Oxbridge 2019WeimingОценок пока нет

- KEY REVIEW Engineered Liver Platforms For Different Phases of Drug DevelopmentДокумент12 страницKEY REVIEW Engineered Liver Platforms For Different Phases of Drug DevelopmentWeimingОценок пока нет

- Superintelligence Book ReviewДокумент7 страницSuperintelligence Book ReviewMateo AcostaОценок пока нет

- Crypto-Assets UnencryptedДокумент49 страницCrypto-Assets UnencryptedWeimingОценок пока нет

- Magnetism Post Flip QuizДокумент3 страницыMagnetism Post Flip QuizWeimingОценок пока нет

- Social Studies GuideДокумент2 страницыSocial Studies GuideWeimingОценок пока нет

- Brightsparks Extract Report 2017Документ22 страницыBrightsparks Extract Report 2017WeimingОценок пока нет

- 2018 Year 6 Common Test 1 InfoДокумент2 страницы2018 Year 6 Common Test 1 InfoWeimingОценок пока нет

- Engineers Australia - 2010 Salary Survey - Answer To QONsДокумент73 страницыEngineers Australia - 2010 Salary Survey - Answer To QONsDaniel DinhОценок пока нет

- Personal Essay About The 21st CenturyДокумент2 страницыPersonal Essay About The 21st CenturyWeimingОценок пока нет

- Lian He Zao Bao NewspaperДокумент2 страницыLian He Zao Bao NewspaperWeimingОценок пока нет

- How To Win Every Argument PDFДокумент185 страницHow To Win Every Argument PDFWeiming100% (2)

- Habits: How They Form and How To Break ThemДокумент4 страницыHabits: How They Form and How To Break ThemWeimingОценок пока нет

- The Size of Countries: Does It Matter?Документ18 страницThe Size of Countries: Does It Matter?WeimingОценок пока нет

- Finnish Learning BookДокумент12 страницFinnish Learning BookMihai Voinea100% (7)

- Math SymbolsДокумент1 страницаMath SymbolsWeimingОценок пока нет

- Physician Labor Market ExplainedДокумент29 страницPhysician Labor Market ExplainedZineb LabiadОценок пока нет

- ICT 2022 Mentorship - Free DownloadableДокумент297 страницICT 2022 Mentorship - Free DownloadableSlw habbosОценок пока нет

- Examiners' commentary on Industrial economics examДокумент23 страницыExaminers' commentary on Industrial economics examShawn MorganОценок пока нет

- Amartya Sen CVДокумент28 страницAmartya Sen CVPrasad SawantОценок пока нет

- Cost Problem SetДокумент2 страницыCost Problem SetRayОценок пока нет

- Consumers, Producers, & Market EfficiencyДокумент40 страницConsumers, Producers, & Market EfficiencymanikОценок пока нет

- Econ Ch01 Chapter Test AДокумент3 страницыEcon Ch01 Chapter Test ATony DeCotisОценок пока нет

- Evaluation of TrainingДокумент2 страницыEvaluation of TrainingKav99Оценок пока нет

- Intermediate Microeconomics and Its Application 12th Edition Nicholson Test BankДокумент7 страницIntermediate Microeconomics and Its Application 12th Edition Nicholson Test Bankchiliasmevenhandtzjz8j100% (31)

- This Paper Is Not To Be Removed From The Examination HallsДокумент55 страницThis Paper Is Not To Be Removed From The Examination Halls陈红玉Оценок пока нет

- Measuring Economic Growth with GDP & GNPДокумент10 страницMeasuring Economic Growth with GDP & GNPLeigh CabritoОценок пока нет

- The Basic Tenets of Marxism Power PointДокумент29 страницThe Basic Tenets of Marxism Power PointShiela Fherl S. Budiongan100% (2)

- Cabanyss Et Al. (2014) - Preliminary Market Analysis and Plant CapacityДокумент5 страницCabanyss Et Al. (2014) - Preliminary Market Analysis and Plant Capacityvazzoleralex6884Оценок пока нет

- The Democratic SocietyДокумент11 страницThe Democratic SocietyBernardo Cielo IIОценок пока нет

- Ecs ShoesДокумент24 страницыEcs ShoesBilal Yasir100% (3)

- Michael Ceasar B. Abarca: BS Business Economics IIДокумент14 страницMichael Ceasar B. Abarca: BS Business Economics IIapi-26604549Оценок пока нет

- Basic Microeconomics (Reviewer)Документ3 страницыBasic Microeconomics (Reviewer)Patricia QuiloОценок пока нет

- Annual Review of Social Development in PakistanДокумент197 страницAnnual Review of Social Development in PakistanAsif IqbalОценок пока нет

- General Mills Marketing Research for New Yogurt ProductДокумент3 страницыGeneral Mills Marketing Research for New Yogurt ProductVivek Kumar BhagboleОценок пока нет

- Eco 2009 Het Final Exam QuestionsДокумент4 страницыEco 2009 Het Final Exam QuestionsAslı Yaren K.Оценок пока нет

- Market Structure ConfluenceДокумент7 страницMarket Structure ConfluenceSagar BhandariОценок пока нет

- Econ 4413 Poverty and Income DistributionДокумент509 страницEcon 4413 Poverty and Income DistributionAli Haider YaseenОценок пока нет

- Elasticity of Demand AДокумент4 страницыElasticity of Demand AAzlan Psp50% (2)

- Zara Project Report Part 01Документ15 страницZara Project Report Part 01adeel0523261Оценок пока нет

- Improving Sugarcane Farming in Rural PhilippinesДокумент2 страницыImproving Sugarcane Farming in Rural PhilippinesKim BalotОценок пока нет

- LibroДокумент212 страницLibromiguelchp02Оценок пока нет

- Commanding Heights Episode 1 Movie WorksheetДокумент3 страницыCommanding Heights Episode 1 Movie WorksheetBanana QОценок пока нет

- Managerial EconomicsДокумент15 страницManagerial Economicslovey50% (2)

- Executive Summary SCIENCEДокумент68 страницExecutive Summary SCIENCEJyotishmoi BoraОценок пока нет

- D0683ECO BQP QR (2021) .pdf-1-21Документ21 страницаD0683ECO BQP QR (2021) .pdf-1-21Tanya SinghОценок пока нет