Академический Документы

Профессиональный Документы

Культура Документы

16 Verizon

Загружено:

Aishwary GuptaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

16 Verizon

Загружено:

Aishwary GuptaАвторское право:

Доступные форматы

Verizon Communications 2011

Forest David

A. Case Abstract

Verizon is a comprehensive strategic management case that includes the companys year-end 2010

financial statements, organizational chart, competitor information and more. The case time setting is the

year 2011. Sufficient internal and external data are provided to enable students to evaluate current

strategies and recommend a three-year strategic plan for the company. Headquartered in New York, New

York, Verizons common stock is publicly traded under the ticker symbol VZ.

Verizon is the #2 US telecom services provider behind AT&T, but Verizon holds the top spot in wireless

services ahead of AT&T Mobility. Verizon's core mobile business is named Verizon Wireless (known

legally as Cellco Partnership), which operates as a joint venture with Vodafone; it serves about 100 million

customers. Meanwhile, with about 30 million landline accounts, Verizon Communications' wireline unit

provides local telephone, long-distance, Internet access, and digital TV services to residential, corporate,

and wholesale customers. The companys Verizon Business division provides a wide range of telecom,

managed network, and IT services to commercial and government clients.

Verizon Wireless' 4G LTE wireless network is the fastest and most advanced 4G network in America and

offers speeds up to 10 times faster than the current 3G network. All total, Verizon has invested more than

$65 billion $6 billion on average every year since its inception to increase the wireless voice and data

coverage of its national network and to add new 3G services like Mobile Broadband and V CAST.

B. Vision Statement (proposed)

Our vision is to enrich the lives of our customers with the benefits of communication, and creating the most

respected brand name worldwide.

C. Mission Statement (proposed)

Our mission is to provide the best wireless and wireline products to the most customers in more places than

our competitors (1, 2, 3). Verizon Communications strives to bring the latest innovative products to its

customers (4) and strives to benefit the communities in which we are located (5) and provide safe and

comfortable work environments (8) while continuing to increase profits (6, 9). Verizon Communications

believes in providing its customers with the best quality products to enable them to communicate with

confidence in our network (7).

1. Customers

2. Products or services

3. Markets

4. Technology

5. Concern for survival, growth, and profitability

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

6. Philosophy

7. Self-concept

8. Concern for public image

9. Concern for employees

D. External Audit

Opportunities

1. 57% of American use more than one phone for business.

2. 76% of kids have a phone by age 12.

3. 50 million iphones sold to date.

4. There are currently 670.6 million mobile connections in India.

5. India is projected to have 1.159 billion mobile subscribers by 2013.

6. Global mobile cellular subscriptions increased 17% per year.

7. Smartphone market in the US is expected to grow by 31%.

8. 500 million people worldwide accessed mobile internet in 2009.

9. There are 277 million mobile web users in China.

10. Revenue of India's telecommunication industry is expected to increase by 230 billion from 2008 to

2012.

Threats

1. Verizon Communications is dependent upon suppliers and vendors to provide equipment.

2. AT&T is a significant competitor owning 25% of the wireless market.

3. 91% of Americans use cell phones.

4. Bharti Airtel owns 31.18% of the wireless market in India.

5. Nokia leads Smartphone global market with a 39% share.

6. The economy is hurting the wireless industry.

7. European mobile broadband growth is at a record low of 4.7% for 2010.

8. Sprint 4G is available in 53 US markets.

9. AT&T wireless revenue increased 8.8% in 2009.

10. AT&T offers service in over 200 countries.

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

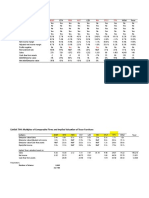

Competitive Profile Matrix

Verizon AT&T Sprint

Critical Success Factors Weight Rating Score Rating Score Rating Score

Advertising 0.12 3 0.36 4 0.48 2 0.24

Market Penetration 0.05 4 0.20 3 0.15 2 0.10

Customer Service 0.08 3 0.24 2 0.16 3 0.24

Store Locations 0.05 2 0.10 2 0.10 1 0.05

R&D 0.12 3 0.36 3 0.36 2 0.24

Global Expansion 0.07 2 0.14 3 0.21 2 0.14

Financial Profit 0.08 2 0.16 3 0.24 1 0.08

Customer Loyalty 0.06 3 0.18 2 0.12 4 0.24

Market Share 0.08 3 0.24 4 0.32 2 0.16

Product Quality 0.12 4 0.48 3 0.36 2 0.24

Top Management 0.06 3 0.18 3 0.18 2 0.12

Price Competitiveness 0.11 3 0.33 2 0.22 4 0.44

Totals 1.00 2.97 2.90 2.29

EFE Matrix

Opportunities Weight Rating Weighted Score

1. 57% of American use more than one phone for business. 0.01 1 0.01

2. 76% of kids have a phone by age 12. 0.04 3 0.12

3. 50 million iphones sold to date. 0.06 2 0.12

4. There are currently 670.6 million mobile connections in India. 0.08 4 0.32

5. India is projected to have 1.159 billion mobile subscribers by 0.09 4 0.36

2013.

6. Global mobile cellular subscriptions increased 17% per year. 0.06 3 0.18

7. Smartphone market in the US is expected to grow by 31%. 0.07 3 0.21

8. 500 million people worldwide accessed mobile internet in 2009. 0.04 2 0.08

9. There are 277 million mobile web users in China. 0.05 2 0.10

10. Revenue of India's telecommunication industry is expected to 0.06 4 0.24

increase by 230 billion from 2008 to 2012.

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

Threats Weight Rating Weighted Score

1. Verizon Communications is dependent upon suppliers and

0.01 1 0.01

vendors to provide equipment.

2. AT&T is a significant competitor owning 25% of the wireless

0.03 2 0.06

market.

3. 91% of Americans use cell phones. 0.02 2 0.04

4. Bharti Airtel owns 31.18% of the wireless market in India. 0.03 4 0.12

5. Nokia leads Smartphone global market with a 39% share. 0.06 2 0.12

6. The economy is hurting the wireless industry. 0.05 2 0.10

7. European mobile broadband growth is at a record low of 4.7% for

0.05 3 0.15

2010.

8. Sprint 4G is available in 53 US markets. 0.04 3 0.12

9. AT&T wireless revenue increased 8.8% in 2009. 0.07 4 0.28

10. AT&T offers service in over 200 countries. 0.08 2 0.16

TOTALS 1.00 2.90

E. Internal Audit

Strengths

1. Verizon acquisition of Alltel which increased total customers by 26.6%.

2. Verizon lowered prices by $30 on unlimited text and talk plans.

3. Worlds largest provider of print and online directory information.

4. Constructed more than 2,300 cell sites in 2009 with fiber Ethernet service.

5. In 2009 Verizon was rated the top performer in overall satisfaction in the Large Enterprise segment by

J.D. Power and Associates.

6. ARPU grew by 17.9% to $15.20.

7. FiOS TV is ranked number one in customer satisfaction in the 2010 American Customer Satisfaction

Index.

8. Verizon Wireless operates the nations most reliable and largest wireless voice and 3G data network,

serving more than 93 million customers.

9. The iPad is available at over 2000 stores nationwide.

10. Diversification of services offered by Verizon.

Weaknesses

1. Dependent upon suppliers and vendors to provide equipment needed to operate business.

2. Unions represent 35% of Verizon employees.

3. 213,000 retirees are participating in the benefits plan significantly impacting profit.

4. ARPU from service revenues decreased by 1.6% to $50.77.

5. Verizon does not carry the Apple iPhone.

6. The company faces considerable amount of litigation.

7. Verizon has a current ratio of 0.8.

8. Long term debt is $45 billion.

9. 12% increase in Verizon's health care costs during the past three years.

10. Verizon has a high leverage ratio of 5.8 compared to the industry average of 3.4.

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

Financial Ratio Analysis

Growth Rate Percent Verizon Industry S&P 500

Sales (Qtr vs year ago qtr) 5.40 260.20 14.50

Net Income (YTD vs YTD) NA NA NA

Net Income (Qtr vs year ago qtr) 109.30 122.70 47.20

Sales (5-Year Annual Avg.) 8.92 15.33 8.31

Net Income (5-Year Annual Avg.) -15.81 12.13 8.76

Dividends (5-Year Annual Avg.) 3.51 8.72 5.70

Profit Margin Percent

Gross Margin 59.2 53.4 39.8

Pre-Tax Margin 16.8 15.1 18.2

Net Profit Margin 13.8 11.2 13.2

5Yr Gross Margin (5-Year Avg.) 59.4 56.1 39.8

Liquidity Ratios

Debt/Equity Ratio 1.41 1.04 1.00

Current Ratio 0.8 2.8 1.3

Quick Ratio 0.8 0.4 0.9

Profitability Ratios

Return On Equity 18.4 12.4 26.0

Return On Assets 6.7 5.1 8.9

Return On Capital 10.4 6.6 11.8

Return On Equity (5-Year Avg.) 7.3 10.3 23.8

Return On Assets (5-Year Avg.) 4.2 4.5 8.0

Return On Capital (5-Year Avg.) 6.1 5.6 10.8

Efficiency Ratios

Income/Employee 77,459 52,636 126,905

Revenue/Employee 559,846 474,690 1 Mil

Receivable Turnover 9.2 9.0 15.4

Inventory Turnover 41.0 19.7 12.5

Net Worth Analysis (in millions)

Stockholders' Equity $ 38,569

Net Income x 5 $ 12,745

(Share Price/EPS) x Net Income $ 38,184

Number of Shares Outstanding x Share Price $ 105,559

Method Average $ 48,764

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

IFE Matrix

Strengths Weight Rating Weighted Score

1. Verizon acquisition of Alltel which increased total customers by

0.10 4 0.40

26.6%.

2. Verizon lowered prices by $30 on unlimited text and talk plans. 0.10 3 0.30

3. Worlds largest provider of print and online directory

0.08 3 0.24

information.

4. Constructed more than 2,300 cell sites in 2009 with fiber Ethernet

0.04 3 0.12

service.

5. In 2009 Verizon was rated the top performer in overall

satisfaction in the Large Enterprise segment by J.D. Power and 0.04 4 0.16

Associates.

6. ARPU grew by 17.9% to $15.20. 0.05 3 0.15

7. FiOS TV is ranked number one in customer satisfaction in the

0.04 4 0.16

2010 American Customer Satisfaction Index.

8. Verizon Wireless operates the nations most reliable and largest

wireless voice and 3G data network, serving more than 93 million 0.04 4 0.16

customers.

9. The iPad is available at over 2000 stores nationwide. 0.03 3 0.09

10. Diversification of services offered by Verizon. 0.03 4 0.12

Weaknesses Weight Rating Weighted Score

1. Dependent upon suppliers and vendors to provide equipment

0.04 1 0.04

needed to operate business.

2. Unions represent 35% of Verizon employees. 0.09 2 0.18

3. 213,000 retirees are participating in the benefits plan significantly

0.04 1 0.04

impacting profit.

4. ARPU from service revenues decreased by 1.6% to $50.77. 0.03 2 0.06

5. Verizon does not carry the Apple iPhone. 0.04 1 0.04

6. The company faces considerable amount of litigation. 0.03 2 0.06

7. Verizon has a current ratio of 0.8. 0.03 1 0.03

8. Long term debt is $45 billion. 0.04 1 0.04

9. 12% increase in Verizon's health care costs during the past three

0.06 2 0.12

years.

10. Verizon has a high leverage ratio of 5.8 compared to the industry

0.05 2 0.10

average of 3.4.

TOTALS 1.00 2.61

F. SWOT

SO Strategies

1. Design plans and easier cell phones for younger kids to operate (S1, S5, S8, O2).

WO Strategies

1. Open 50 stores in China (W8, O9, O7).

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

ST Strategies

1. Start implementing 4G towers in large cities (S8, T9, T2).

WT Strategies

1. Merge with Idea Cellular in India (W1, W8, T5, T4).

2. Cut capital expenditures to reduce long term debt (W8, T7).

G. SPACE Matrix

FP

Conservative Aggressive

7

CP IP

-7 -6 -5 -4 -3 -2 -1 1 2 3 4 5 6 7

-1

-2

-3

-4

-5

-6

-7

Defensive Competitive

SP

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

Internal Analysis: External Analysis:

Financial Position (FP) Stability Position (SP)

Return on Equity (ROE) 6 Rate of Inflation -2

Current Ratio 3 Technological Changes -6

Debt/Equity Ratio 2 Price Elasticity of Demand -3

Gross Margin 5 Competitive Pressure -5

Inventory Turnover 7 Barriers to Entry into Market -4

Financial Position (FP) Average 4.6 Stability Position (SP) Average -4.0

Internal Analysis: External Analysis:

Competitive Position (CP) Industry Position (IP)

Market Share -2 Growth Potential 6

Product Quality -2 Financial Stability 5

Customer Loyalty -2 Ease of Entry into Market 2

Technological know-how -2 Resource Utilization 5

Control over Suppliers and Distributors -6 Profit Potential 6

Competitive Position (CP) Average -2.8 Industry Position (IP) Average 4.8

H. Grand Strategy Matrix

Rapid Market Growth

Quadrant II Quadrant I

Verizon

Weak Strong

Competitive Competitive

Position Position

Quadrant III Quadrant IV

Slow Market Growth

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

I. The Internal-External (IE) Matrix

The Total IFE Weighted Scores

Strong Average Weak

4.0 to 3.0 2.99 to 2.0 1.99 to 1.0

4.0 I II III

High

3.0 IV V VI

The

EFE

Total Medium Verizon

Weighted

Scores

2.0 VII VIII IX

Low

1.0

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

J. QSPM

Open 50 Reduce

stores in longterm

India/China debt

Opportunities Weight AS TAS AS TAS

1. 57% of American use more than one phone for business. 0.01 0 0.00 0 0.00

2. 76% of kids have a phone by age 12. 0.04 0 0.00 0 0.00

3. 50 million iphones sold to date. 0.06 0 0.00 0 0.00

4. There are currently 670.6 million mobile connections in India. 0.08 4 0.32 2 0.16

5. India is projected to have 1.159 billion mobile subscribers by

0.09 4 0.36 1 0.09

2013.

6. Global mobile cellular subscriptions increased 17% per year. 0.06 3 0.18 1 0.06

7. Smartphone market in the US is expected to grow by 31%. 0.07 1 0.07 3 0.21

8. 500 million people worldwide accessed mobile internet in 2009. 0.04 0 0.00 0 0.00

9. There are 277 million mobile web users in China. 0.05 4 0.20 1 0.05

10. Revenue of India's telecommunication industry is expected to

0.06 4 0.24 2 0.12

increase by 230 billion from 2008 to 2012.

Threats Weight AS TAS AS TAS

1. Verizon Communications is dependent upon suppliers and

0.01 0 0.00 0 0.00

vendors to provide equipment.

2. AT&T is a significant competitor owning 25% of the wireless

0.03 0 0.00 0 0.00

market.

3. 91% of Americans use cell phones. 0.02 0 0.00 0 0.00

4. Bharti Airtel owns 31.18% of the wireless market in India. 0.03 4 0.12 2 0.06

5. Nokia leads Smartphone global market with a 39% share. 0.06 0 0.00 0 0.00

6. The economy is hurting the wireless industry. 0.05 1 0.05 4 0.20

7. European mobile broadband growth is at a record low of 4.7% for

0.05 0 0.00 0 0.00

2010.

8. Sprint 4G is available in 53 US markets. 0.04 0 0.00 0 0.00

9. AT&T wireless revenue increased 8.8% in 2009. 0.07 0 0.00 0 0.00

10. AT&T offers service in over 200 countries. 0.08 4 0.32 2 0.16

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

Open 50 Reduce

stores in longterm

India/China debt

Strengths Weight AS TAS AS TAS

1. Verizon acquisition of Alltel which increased total customers by

0.10 1 0.10 3 0.30

26.6%.

2. Verizon lowered prices by $30 on unlimited text and talk plans. 0.10 1 0.10 3 0.30

3. Worlds largest provider of print and online directory

0.08 3 0.24 2 0.16

information.

4. Constructed more than 2,300 cell sites in 2009 with fiber Ethernet

0.04 0 0.00 0 0.00

service.

5. In 2009 Verizon was rated the top performer in overall

satisfaction in the Large Enterprise segment by J.D. Power and 0.04 0 0.00 0 0.00

Associates.

6. ARPU grew by 17.9% to $15.20. 0.05 0 0.00 0 0.00

7. FiOS TV is ranked number one in customer satisfaction in the

0.04 0 0.00 0 0.00

2010 American Customer Satisfaction Index.

8. Verizon Wireless operates the nations most reliable and largest

wireless voice and 3G data network, serving more than 93 million 0.04 0 0.00 0 0.00

customers.

9. The iPad is available at over 2000 stores nationwide. 0.03 0 0.00 0 0.00

10. Diversification of services offered by Verizon. 0.03 0 0.00 0 0.00

Weaknesses Weight AS TAS AS TAS

1. Dependent upon suppliers and vendors to provide equipment

0.04 0 0.00 0 0.00

needed to operate business.

2. Unions represent 35% of Verizon employees. 0.09 1 0.09 3 0.27

3. 213,000 retirees are participating in the benefits plan significantly

0.04 1 0.04 3 0.12

impacting profit.

4. ARPU from service revenues decreased by 1.6% to $50.77. 0.03 0 0.00 0 0.00

5. Verizon does not carry the Apple iPhone. 0.04 0 0.00 0 0.00

6. The company faces considerable amount of litigation. 0.03 1 0.03 3 0.09

7. Verizon has a current ratio of 0.8. 0.03 1 0.03 3 0.09

8. Long term debt is $45 billion. 0.04 1 0.04 4 0.16

9. 12% increase in Verizon's health care costs during the past three

0.06 1 0.06 3 0.18

years.

10. Verizon has a high leverage ratio of 5.8 compared to the industry

0.05 1 0.05 3 0.15

average of 3.4.

TOTALS 2.64 2.93

K. Recommendations

1. Open 50 stores in China at $10 million each.

2. Invest $200 million to design plans and easier cell phones for younger kids to operate.

3. Cut capital expenditures to reduce long term debt.

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

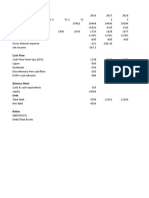

L. EPS/EBIT Analysis (in millions)

Amount Needed: $700M

Stock Price: $36.72

Shares Outstanding: 2,380

Interest Rate: 5%

Tax Rate: 19%

Common Stock Financing Debt Financing

Recession Normal Boom Recession Normal Boom

EBIT $10,000 $15,000 $20,000 $10,000 $15,000 $20,000

Interest 0 0 0 35 35 35

EBT 10,000 15,000 20,000 9,965 14,965 19,965

Taxes 1,900 2,850 3,800 1,893 2,843 3,793

EAT 8,100 12,150 16,200 8,072 12,122 16,172

# Shares 2,849 2,849 2,849 2,830 2,830 2,830

EPS 2.84 4.26 5.69 2.85 4.28 5.71

20 Percent Stock 80 Percent Stock

Recession Normal Boom Recession Normal Boom

EBIT $10,000 $15,000 $20,000 $10,000 $15,000 $20,000

Interest 28 28 28 7 7 7

EBT 9,972 14,972 19,972 9,993 14,993 19,993

Taxes 1,895 2,845 3,795 1,899 2,849 3,799

EAT 8,077 12,127 16,177 8,094 12,144 16,194

# Shares 2,834 2,834 2,834 2,845 2,845 2,845

EPS 2.85 4.28 5.71 2.84 4.27 5.69

M. Epilogue

Verizons Q3 2011 earnings benefited from higher-than-expected postpaid wireless subscriber additions.

While rival AT&T added more new wireless customers in total (2.1 million versus Verizons 1.3 million),

Verizon landed almost triple the number of more lucrative postpaid customers. However, Verizon was only

able to activate 2 million units versus 2.7 million for AT&T in Q3 2011. That's a narrower gap than the

two rivals in Q2 of 2011, when AT&T outsold Verizon by 1.3 million iPhones. Thus, AT&T remains the

most popular iPhone carrier in the United States, but Verizon is catching up.

The number of wireless subscriber connections (327.6 million) in the United States has recently surpassed

the population (315.5 million) of America. Consequently, Verizon and other carriers are fighting it out for

new subscribers, especially those that pay for lucrative data plans on smartphones. The iPhone 4S sold 4

million units in its very first weekend, and it will likely bring in more customers for Verizon in Q4 2011.

Verizon is negotiating with about 45,000 wireline union workers who recently walked off the job for two

weeks to protest deep concessions the company is seeking in a new multi-year contract.

In Q3 2011, Verizons Consumer revenue grew 1.1 percent year-over-year with FiOS revenue up 18.5

percent. In Global Enterprise, revenue growth was 2.1 percent year-over-year, driven by Strategic Services

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

growth of 15.6 percent.

Verizon recently expanded its 3G wireless networks in Ohio. "People across Ohio are increasingly relying

on smartphones and 3G applications to manage their busy lives and stay connected at home or on-the-go,"

said Mark Frazier, presidentOhio/Pennsylvania/West Virginia Region, Verizon Wireless. "The nearly $2

billion we've invested into our Ohio network has kept us ahead of consumer trends, provided our customers

a 3G advantage and underscored our belief that any mobile device is only as good as the network it runs on.

Proactive and sustained investment has made Verizon Wireless the 3G leader in Ohio and nationwide."

Verizon Wireless' 3G network powers many leading mobile multimedia services, including. For example,

notebook computer users can access e-mail, download files and browse the Internet at broadband speed,

downloading a one megabyte e-mail attachment the equivalent of a small PowerPoint presentation or a

large PDF file in about eight seconds and uploading it in less than 13 seconds.

In addition to recently enhancing its 3G network, Verizon Wireless has deployed its 4G LTE Network in

165 metropolitan areas across the country, covering more than 186 million Americans from coast to coast

and surpassing the company's goal of 185 million Americans by year-end.

Copyright 2013 Pearson Education, Inc. publishing as Prentice Hall.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Call Center TrainingДокумент14 страницCall Center TrainingJaveria Maqbool100% (6)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Supply Chain For Dummies JDAДокумент76 страницSupply Chain For Dummies JDAAgustin Scoponi100% (5)

- Case Analysis Assignment Google CaseДокумент8 страницCase Analysis Assignment Google CaseSaurabh Sharma100% (1)

- RFIDДокумент19 страницRFIDNikitaSomaiyaОценок пока нет

- AF - PD 2010-08 Real Estate Department - FinalДокумент32 страницыAF - PD 2010-08 Real Estate Department - FinalAishwary GuptaОценок пока нет

- Workbook 1Документ3 страницыWorkbook 1Aishwary GuptaОценок пока нет

- Play GamesДокумент1 страницаPlay GamesAishwary GuptaОценок пока нет

- Windows BuildДокумент7 страницWindows BuildAishwary GuptaОценок пока нет

- 03 Measure Step 7 Ver1Документ20 страниц03 Measure Step 7 Ver1Aishwary GuptaОценок пока нет

- QHQ5XN EThzrlpRFD4Emc6iДокумент1 страницаQHQ5XN EThzrlpRFD4Emc6iAishwary GuptaОценок пока нет

- Aits Schedule 2016 17 XII Jee For Kota DLP StudentsДокумент2 страницыAits Schedule 2016 17 XII Jee For Kota DLP StudentsAishwary GuptaОценок пока нет

- Student Feedback FormДокумент1 страницаStudent Feedback FormAishwary GuptaОценок пока нет

- Teuer B DataДокумент41 страницаTeuer B DataAishwary Gupta100% (1)

- Chapter 17 - Fundamental Principles of Relative ValuationДокумент3 страницыChapter 17 - Fundamental Principles of Relative ValuationAishwary GuptaОценок пока нет

- Medical CertificateДокумент1 страницаMedical CertificateAishwary GuptaОценок пока нет

- Maurice Nicoll The Mark PDFДокумент4 страницыMaurice Nicoll The Mark PDFErwin KroonОценок пока нет

- Rt-1 (24!05!15) (Solution) (Jee Mains) Code-AДокумент13 страницRt-1 (24!05!15) (Solution) (Jee Mains) Code-AAishwary GuptaОценок пока нет

- Paper - Disney PixarДокумент13 страницPaper - Disney PixarNguyen Duy LongОценок пока нет

- Students-Expenses Statement Check ListДокумент2 страницыStudents-Expenses Statement Check ListAishwary GuptaОценок пока нет

- Illustration of Analogs & AntilogsДокумент3 страницыIllustration of Analogs & AntilogsAishwary GuptaОценок пока нет

- Rt-1 (24!05!15) (Solution) (Jee Mains) Code-AДокумент13 страницRt-1 (24!05!15) (Solution) (Jee Mains) Code-AAishwary GuptaОценок пока нет

- S.No. Expense Name Bill ReferenceДокумент7 страницS.No. Expense Name Bill ReferenceAishwary GuptaОценок пока нет

- 1st Round TT ScheduleДокумент2 страницы1st Round TT ScheduleAishwary GuptaОценок пока нет

- Students-Expenses Statement Check ListДокумент2 страницыStudents-Expenses Statement Check ListAishwary GuptaОценок пока нет

- Viteee Physics 2014Документ6 страницViteee Physics 2014Aishwary GuptaОценок пока нет

- IDirect KotakBank Q1FY16Документ15 страницIDirect KotakBank Q1FY16Aishwary GuptaОценок пока нет

- 78359600Документ9 страниц78359600Aishwary GuptaОценок пока нет

- 10.22.16 ATT To Buy Time Warner For 85.4BДокумент1 страница10.22.16 ATT To Buy Time Warner For 85.4BAishwary GuptaОценок пока нет

- ApostilleДокумент1 страницаApostilleAishwary GuptaОценок пока нет

- Mangr Fores Res Est Estoration Mang R o V eДокумент32 страницыMangr Fores Res Est Estoration Mang R o V esaibaba_123Оценок пока нет

- Formulaire Ls Anglais PDFДокумент2 страницыFormulaire Ls Anglais PDFgp_ph86Оценок пока нет

- Logic 1 and Is Historically Referred To As "Marking." Similarly, A High Level (+3V To +15V) Is Defined As Logic 0 and Is Referred To As "Spacing."Документ4 страницыLogic 1 and Is Historically Referred To As "Marking." Similarly, A High Level (+3V To +15V) Is Defined As Logic 0 and Is Referred To As "Spacing."Mohammad NadimОценок пока нет

- DM9051 Product Brief Ver 0.2 - 021814Документ4 страницыDM9051 Product Brief Ver 0.2 - 021814wwОценок пока нет

- 5G From Space - An Overview of 3GPP Non-Terrestrial NetworksДокумент7 страниц5G From Space - An Overview of 3GPP Non-Terrestrial NetworkslucasolveigaОценок пока нет

- VRBT OverviewДокумент7 страницVRBT OverviewsonataeestudioОценок пока нет

- Confidential: IT8783E/FДокумент204 страницыConfidential: IT8783E/FSomendra SinghОценок пока нет

- Overview of GSM Cellular Network and Operations: Ganesh Srinivasan NTLGSPTNДокумент90 страницOverview of GSM Cellular Network and Operations: Ganesh Srinivasan NTLGSPTNsudib1986Оценок пока нет

- Quezon City Polytechnic UniversityДокумент48 страницQuezon City Polytechnic UniversityWarriormikeОценок пока нет

- 03 - Lte - Ca & Sinr To THPДокумент12 страниц03 - Lte - Ca & Sinr To THPmohammad marwanОценок пока нет

- RF Syncing To Stratasync Using An Onx-620/630Документ2 страницыRF Syncing To Stratasync Using An Onx-620/630omar cribas pinedaОценок пока нет

- 1805 - GHIELMETTI - GCS 3x4x1 422 MP Product Info (En) - PublicДокумент8 страниц1805 - GHIELMETTI - GCS 3x4x1 422 MP Product Info (En) - PublicrbalatceОценок пока нет

- RF Engineer With 9 Year ExpДокумент3 страницыRF Engineer With 9 Year ExpMaheswari TОценок пока нет

- Lesson Exemplar Cot1 - css10Документ3 страницыLesson Exemplar Cot1 - css10Nanette M. Sansano100% (1)

- Course Overview: Waleed EjazДокумент44 страницыCourse Overview: Waleed EjazMuskaan KalraОценок пока нет

- Introduction To Digital CommunicationsДокумент10 страницIntroduction To Digital CommunicationsJanine NaluzОценок пока нет

- FT 101ZDSurvivalGuide3Документ28 страницFT 101ZDSurvivalGuide3Jamesson FrancoОценок пока нет

- ESpace EMS Product Description (V200R001C02SPC200 - 04)Документ53 страницыESpace EMS Product Description (V200R001C02SPC200 - 04)Beatriz RomanОценок пока нет

- Wi-Fi (Or Wifi) Is AДокумент1 страницаWi-Fi (Or Wifi) Is AJashОценок пока нет

- DWDM / DCI - Discovery: SP OpticalДокумент21 страницаDWDM / DCI - Discovery: SP OpticalMakusОценок пока нет

- 5G TowersДокумент2 страницы5G Towersshahzaib sajjadОценок пока нет

- ITGS GlossaryДокумент108 страницITGS GlossaryAbdullah NajiОценок пока нет

- Ddos AttackДокумент18 страницDdos AttackGodaveri VasОценок пока нет

- Nanocell Technologies: Your Perfect Partner For Learning SolutionsДокумент11 страницNanocell Technologies: Your Perfect Partner For Learning SolutionsKuldeep KumarОценок пока нет

- Local Area Network: Computer Networks LabДокумент7 страницLocal Area Network: Computer Networks LabljjbОценок пока нет

- Investigation of Wi-Fi (Esp8266) Module and Application To An Audio Signal Transmission by Tatap PeretsДокумент59 страницInvestigation of Wi-Fi (Esp8266) Module and Application To An Audio Signal Transmission by Tatap Peretsnestor martourezОценок пока нет

- Marantz Hifi Av-Receivers SR6003 OverviewДокумент31 страницаMarantz Hifi Av-Receivers SR6003 OverviewDumitru DamianОценок пока нет

- Lutron Myroom Presentation PlusДокумент18 страницLutron Myroom Presentation PlusIrvingОценок пока нет

- Product Specifications: 854DG65T6ESXДокумент3 страницыProduct Specifications: 854DG65T6ESXfaapctbaОценок пока нет