Академический Документы

Профессиональный Документы

Культура Документы

Demonetisation

Загружено:

riya0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров11 страницdemon

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документdemon

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров11 страницDemonetisation

Загружено:

riyademon

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 11

Demonetisation: A boon or bane for the Indian economy?

First, the sharp drop in the Reserve Bank of

Indias (RBI) dividend payout to the government

primarily on account of the cost of printing currency

and the cost of soaking up excess liquidity from the

financial system; then the publication of central

banks annual report for fiscal year 2016-17 (RBI

follows a July-June fiscal year) which put the

estimated value of the currency that returned to system

at Rs 15.28 trillion or close to 99% of the currency

notes demonetised in November-December 2016.

Prime Minister Narendra Modi on November 8, 2016,

announced that all currency notes of denominations of

Rs 1,000 and Rs 500 would be invalid from the midnight

of that day. In the 50 days between November 10 and

December 30, 2016, Rs 15.44 trillion worth of Rs 500

and Rs 1,000 currency notes were withdrawn to attack

black money, fake currency and terror funding.

These notes constitute 86.9% of the value of total

notes in circulation at that time. Right from Day One,

the move attracted sharp criticism from many quarters.

Particularly, after it had come to light that almost

99% of the currency notes are back into circulation,

many are questioning the efficacy of the move. What

benefit has the demonetisation reaped when 99% of the

currency in circulation has come back to the system?

This clearly shows, no black money was confiscated,

they are saying. Yes, that is true. It is also true

that the small industrial units, which redominantly

operate in cash economy, have suffered and some jobs

have been lost and economic growth is being affected.

But do all these mean that the demonetisation has been

a futile exercise? Should we regret this? As a common

man and someone who has been closely tracking the

people at the so-called bottom of the pyramid first by

virtue of heading a large microfinance institution and

now a bank which serves this segment.

We must remember the demonetisation is one of a

string of steps that the government has been taking t o

attack black money. First, it had given a three month

window for bringing back unaccounted money stashed in

offshore accounts, but the response was not good. The

next target was black money within India. The Income

Disclosure Scheme 2016 has been relatively successful.

It collected Rs 65,250 crore, seven times more than

what one such scheme in 1997 had mopped up. The

government also passed a law to curb benami

transactions and Indias Double Taxation Avoidance

Agreements with Mauritius and Cyprus have been amended.

We cannot see the demonetisation move in isolation

this is part of the larger design to unearth black

money. Yes, it has not confiscated hordes of black

money. However, the banks have reported lakhs of

suspicious transactions where people have deposited

large amount of cash with banks which their financial

background does not justify. In due course, the

investigative agencies will get into action and track

down these people.We also need to take consider the

rise in cashless transactions.

Many say this benefit is an afterthought. Be that

as it may but the fact remains we are seeing a rise in

the use of debit and credit cards, particularly in the

segment which probably never used cards before. Every

such transaction leaves a trail behind and makes sure

that more and more people will come into the tax net.

We cannot ignore the benefits of digitalisation of cash

transactions and a definite move towards a less-cash

economy.

The number of returns filed as on August 5, 2017

have registered a rise of 24.7% compared to a growth

rate of 9.9% in the previous year. The total number of

returns (electronic plus paper) filed during the entire

fiscal year 2016-17 was 5.43 crore which is 17.3% more

than the returns filed during fiscal year 2015-16. For

2016-17, 1.26 crore new taxpayers (return filers plus

non-filers making tax payments) were added to the tax

base (till June 30, 2017).

The effect of demonetisation is also clearly

visible in the 19% growth in direct tax collections.

Collection of advance tax under personal income tax

showed a growth of about 41.79% over the corresponding

period in 2016-2017; collection of self-assessment tax

under personal income tax showed a growth of 34.25%.

According to the income tax department, the number

of e-returns of individual taxpayers filed till August

5 increased to 2.79 crore from 2.22 crore filed during

the corresponding period of last year, registering an

increase of about 57 lakh returns, or 25.3%. Going

forward, tax compliance will rise further.

Demonetisation has also improved transmission in

the banking system and led to the greater

financialisation of savings. Look at the way the banks

have pared their loan rates in past nine months because

they are flush with money. Wont that bring down the

cost of investment when the borrowers decide to lift

the bank money? I am also confident that from now on,

people will shift their focus from real estate to

financial assets such as mutual funds, insurance, among

others, as an investment avenue.

Finally, we must take into account two other great

initiatives of the government and see the big picture.

They are Pradhan Mantri Jan-Dhan Yojana, a national

mission on financial inclusion, launched within months

of the new government assuming power. It has been

trying to expand the banking sectors reach. As on

August 30, it has opened 30.09 crore accounts and the

money kept in these accounts are Rs 65,800 crore. And,

we have seen the launch of goods and services tax, or

GST, in July, the biggest economic reform since 1991 to

created a nationwide market.

All these initiatives form a pattern. Lets not

pick and choose and run down one of them. The design is

for structural changes. We cannot avoid short-term

pains for long-term gains.

It came as a surprise to everybody after our PM

Narendra Modi declared on trashing the 500 and 1000

rupees notes. PMs move on banning the respective notes

certainly may be the ray of hope to sweep out

corruption and a boon to every tax-payer. The attempt

to wipe out black money and corruption might be rigid,

however was it really a well-planned move?

Most of them had this question in mind as they were

unaware of the reason behind such a drastic change.

Usually skeptical to changes is typical among Indians.

However, let me point out few reasons which were the

positive part of this decision was-

1) To stop the funds that were transferred by

terrorists,

2) Put an end to the circulation of fake currency

notes,

3) Wiping off the corruption of black money

4) Bring up the indian economy for a better tomorrow

including real-estate and gold where most black money

were grounded

5) Digitalization being the forte

Digitalizing India to have a cashless policy where

every Indian would either use online transactions or

swipe their card for the smallest of uses. This will

help in maintaining harmony and discipline among people

and the crocodiles out there to fill the country with

filth would step back from corruption. Although the

Constitution has many loopholes, which in turn could

backfire this attempt, as we have other ruling parties

that may unite to stand against the good cause as it

involves the government. The government did not pay

heed to the fact that they may not be in power by the

next elections, still took a step towards a better

tomorrow.

Aiming at combating corruption or black money,

short-term problems and chaos spread among the working

class; especially those that deal with cash on a daily

basis. During this change, most of the working class

people had to stand in queues to withdraw a basic

minimum amount of cash from banks or ATMs, where many

small businesses run on liquid cash. The effect on

urban consumers, small and large businesses will be

prominent as this move will seem to be crippling down

in the sort-term. The semi-urban and rural sections

will take more time than urban areas to cope up with

the change, however the shortage of smaller denominator

notes will create more chaos. People with stationery

shops, daily wagers, auto-drivers, small businesses

that involve services providers like electricians,

plumbers, upholsters, handyman, even online e-commerce

companies that do not have online payment facilities

had to capitulate to the situation. After a point,

other denominations which are less than 2000 and 500

notes will get impacted and there would be requirement

for smaller currencies in the next few weeks. The

incurred loss during these days cannot be mended or

attained by them.

Assuming the attempt to clear out corruption

wasnt a planned process, the brunt that the common

people have been facing since that night was not

justified either. The chaos alerted common man driven

towards a negative thought-process which led them to

fear lack of cash in hand, as this would affect them

while travelling, purchasing necessities and other

emergency requirements. The initial turmoil to any huge

change can be adjusted however, when common man being

effected for an unexplained period of time makes them

anxious and weary about the situation. Infact many

government hospitals and medicine stores refrained from

accepting 500 and 1000 rupees notes which was not as

per the declaration by PM. Most private entities and

organisation neither compromised nor came as a help to

common citizens during this crisis, as they were afraid

of being penalised by the government.

Standing behind long queues in the bank each day to

withdraw nominal amount which is insufficient however,

lately the weekly withdrawal was increased to soothe

the civilians from unrest for the time being. Although

this effect did not hamper the rich as most of their

transactions were online, nonetheless the working class

faced the brunt and are still going through the same.

The controversy of introducing Rs.2000 note coined

several doubts on the government as to what could the

strategy be? Moreover seemed like an unsolved mystery.

Although this demonetising step has the potential to

pin down the small rogues, scrape off the illegal

transactions in real estate, gold and other sectors

where circulation of unaccounted money was vigorous.

Mostly the daily wagers, cash related businesses and

services were under a huge loss and had succumbed to

the currency crunch. There wouldnt have been shortage

of cash in banks and ATMs (the new 2000 and 500 notes)

and people who belong to working class would not have

been the victims of the crisis if the idea to

demonetise would have been more planned. Plus, the

primary focus should be on recovering the safeguarded

money of people kept in the overseas.

A lot of corruption came into notice which can be

called as the demonetising effect. Various unaccounted

money in the form of real-estate and gold were

discovered from certain section of people. True though

that the act could be a start of a new economy for

India. The utmost that indian citizens can give away

during this crisis is patience as they work hard, pays

tax and compromises to anything that could be good for

the country. Hoping to see the world of digitalization

strike in India and making the people aware of benefits

of transacting digitally.

On November 8,2016 Prime Minister Narendra Modi

announced demonetisation of Rs500 and 1,000 notes. By

just one stroke, the country changed. Revenue of

municipal corporations of five major cosmopolitan towns

made quantum jump in the month of November 2016,

compared to revenue of 2015.

Hyederabad registered a jump of 2,500 per cent,

North Delhi Municipal Corporation revenue increased by

2,434 percent, Rajkot by 1,275 per cent, Surat by 2,314

per cent and South Delhi by 2,037 per cent. There was a

huge jump in the collection of dues for power, water,

telephone and land revenue. Take it that, it was due to

demonetisation of high value currency notes. This is

just the beginning. Wait for some time to see how the

country is making move towards a cashless society,

which is a big assault on black money.

Now, let us look at its political fallout. After

Bihar Chief Minister Nitish Kumar supporting Modi in

the fight against corruption, and black money, it is

now the turn of RJD chief Lalu Prasad, who too has come

out in support of demonetisation. With some ange,r Lalu

said, I am also in favour of notebandi , but my

objection is to its implementation. Lalu was compelled

to come out in support of demonetisation, because

opposing it, would have threatened the ruling alliance

in Bihar. The Congress now is isolated in Bihar on this

issue.

Chandrababu Naidu of Andhra Pradesh, and Chandra

Shekhar Rao of Telangana, both Chief Ministers of their

respective States, have supported the Government

decision. Naveen Patnaik, Chief Minister of Odisha, has

come out in favour of the move. In Kerala, the CPI(M)

Government is opposed to the move, but not as

aggressively as its central leadership of the party.

The outcome of 12 by-elections held last month,

after demonetisation, is also a signal of peoples

support to the move. The Congress had to contend with a

win of only one seat. The BJP won five seats, while

regional parties got six seats taken together, the

Assembly , and Lok Sabha constituencies. This decision

of Prime Minister Modi has placed the nation on the

fast track of cashless transactions. After the

demonetisation, according to one estimate, online

transactions have risen by 300 per cent.

No doubt, the move has resulted in long queues of

people, that can be seen outside ATMs and banks. There

is anxiety, and some anguish on the face of people, who

have to wait for long hours to get cash, but there is

also a faint smile on their face indicating that common

man, and majority of the people want era of corruption,

and generation of black money to end.

Even Mayawati is not mustering enough courage to

oppose the move. She and many other opposition leaders

find fault with the lack of preparedness, that is

causing hardships to people in getting cash from banks

and ATMs. But, how could the Government make advance

preparation for implementing the decision? It would

have defeated the purpose of the demonetisation.By each

passing day, the queues are getting shorter. Beside the

point, the process of digitisation in cash transaction

is on fast track. The online, and cashless,

transactions would increase in three months that the

country would have achieved in three years, had this

decision not been taken.

The total number of debit cards in November 2015

was Rs62.36 crore. This figure has now gone up to Rs90

crore. Even Nandan Nilekani, the man behind Aadhar card

identification, has openly come out in support of the

Government move towards cashless transactions.We have

already created a base for this types of

transformation, by having large base of smart, and

android mobile phones sets with the people. There is

also feature phone users for online payment by using

the unified payment interface application.

Those who dont have mobile phones, can use their

Aadhar cards in micro-ATMs for making payments. Milk

and vegetable vendors, and even small grocers, have

started accepting online payments.The day is not far

off, when our country would go cashless transaction,

and paperless work. What is needed is to implement this

policy. A determined leadership with firm conviction

which our Prime Minister has is taking the nation

forward.

By the year 2024-2025, all citizens of the country

would have smart phones. Those opposed to cashless

transactions say that countries like Sweden, Canada and

Britain have a small population base with cent per cent

literacy, hence cashless transactions are possible.

Some people are hell-bent upon criticising, and

opposing the Government decision on social media. But

it is not going to impact the nation.

Вам также может понравиться

- Simple DistillationДокумент4 страницыSimple DistillationriyaОценок пока нет

- N. Ganesan - Attain Success & Retain PeaceДокумент84 страницыN. Ganesan - Attain Success & Retain PeaceriyaОценок пока нет

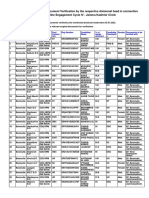

- JammuKashmir DV List1Документ8 страницJammuKashmir DV List1riyaОценок пока нет

- Sri Shakthi: Question BankДокумент3 страницыSri Shakthi: Question BankriyaОценок пока нет

- Bio ProcessДокумент17 страницBio ProcessriyaОценок пока нет

- Enzyme ImmobilizationДокумент2 страницыEnzyme ImmobilizationriyaОценок пока нет

- Solar Air HeaterДокумент2 страницыSolar Air HeaterriyaОценок пока нет

- NMR 1Документ60 страницNMR 1riyaОценок пока нет

- 2019 21 Notyfn SOCIOLOGY ECONOMIST PDFДокумент24 страницы2019 21 Notyfn SOCIOLOGY ECONOMIST PDFriyaОценок пока нет

- UNIT-V Chromatographic MethodsДокумент22 страницыUNIT-V Chromatographic MethodsriyaОценок пока нет

- Lecture 24-Anaerobic and Aerobic Digestion (Many Slides) PDFДокумент124 страницыLecture 24-Anaerobic and Aerobic Digestion (Many Slides) PDFriyaОценок пока нет

- Basic Chromatography - 1 PDFДокумент22 страницыBasic Chromatography - 1 PDFriyaОценок пока нет

- 4 2Документ24 страницы4 2riyaОценок пока нет

- Module-9 (Theory) Media FormulationДокумент4 страницыModule-9 (Theory) Media FormulationriyaОценок пока нет

- Pdfbio El4Документ2 страницыPdfbio El4riyaОценок пока нет

- 27.21 COENZYMES: 1088 Chapter Twenty-SevenДокумент2 страницы27.21 COENZYMES: 1088 Chapter Twenty-SevenriyaОценок пока нет

- BT6504Документ2 страницыBT6504riyaОценок пока нет

- 214 Basic Fluids Mechanics and Hydraulic Machines: 9.4.5 Gear PumpДокумент1 страница214 Basic Fluids Mechanics and Hydraulic Machines: 9.4.5 Gear PumpriyaОценок пока нет

- Central Universities Common Entrance Test CUCET 2018: B.A. Programme (3 Years-6 Semesters)Документ7 страницCentral Universities Common Entrance Test CUCET 2018: B.A. Programme (3 Years-6 Semesters)riyaОценок пока нет

- SyllabusДокумент1 страницаSyllabusriyaОценок пока нет

- Partial Differential Equations: T. Muthukumar Tmk@iitk - Ac.in April 18, 2014Документ199 страницPartial Differential Equations: T. Muthukumar Tmk@iitk - Ac.in April 18, 2014riyaОценок пока нет

- Eligibility Criteria CUKASДокумент11 страницEligibility Criteria CUKASriyaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 129-Atienza vs. Philimare Shipping & Eqpt. SupplyДокумент3 страницы129-Atienza vs. Philimare Shipping & Eqpt. SupplyNimpa PichayОценок пока нет

- Problem StatementДокумент2 страницыProblem StatementShahid Javaid67% (3)

- Free Beacon10Документ3 страницыFree Beacon10Kaveh L. AfrasiabiОценок пока нет

- Revolution of 1806 - GR2Документ3 страницыRevolution of 1806 - GR2Remenade WBОценок пока нет

- United Nations High Commissioner For RefugeesДокумент2 страницыUnited Nations High Commissioner For RefugeesNataliaОценок пока нет

- Cultural Self Awareness EssayДокумент4 страницыCultural Self Awareness EssayRayvonne Brown100% (1)

- TICKNER, Ann. Gendering World Politics. 2001Документ214 страницTICKNER, Ann. Gendering World Politics. 2001Cristian D. ValdiviesoОценок пока нет

- San Miguel Corp. v. LaguesmaДокумент2 страницыSan Miguel Corp. v. LaguesmaAnonymous 5MiN6I78I0Оценок пока нет

- Active With South East AsiaДокумент64 страницыActive With South East AsiaOECD Global RelationsОценок пока нет

- Villegas Vs LegaspiДокумент1 страницаVillegas Vs LegaspiVanessa Evans CruzОценок пока нет

- UN Core Values and CompetenciesДокумент52 страницыUN Core Values and CompetenciesMahmoud FayyazОценок пока нет

- Philippine HistoryДокумент34 страницыPhilippine Historyjamineriorecierdo07Оценок пока нет

- 13Документ291 страница13Maria MoraisОценок пока нет

- 2hours Training ModuleДокумент24 страницы2hours Training ModuleMacky Paul Masong AmoresОценок пока нет

- The Guardian - 26 04 2019 PDFДокумент56 страницThe Guardian - 26 04 2019 PDFmunawarnuml2913100% (1)

- Does Greek Historical Memory Shape NostalgiaДокумент9 страницDoes Greek Historical Memory Shape NostalgiaAisha KhanОценок пока нет

- GENERAL MILLING CORP DigestДокумент1 страницаGENERAL MILLING CORP DigestRobertОценок пока нет

- 18 - Chapter 6 (Launching The Nation)Документ30 страниц18 - Chapter 6 (Launching The Nation)Maryory Suset CastroОценок пока нет

- United States v. Bailey, 4th Cir. (2000)Документ15 страницUnited States v. Bailey, 4th Cir. (2000)Scribd Government DocsОценок пока нет

- Baita Ba1ma RPH Written Work MD 10.1.1 PDFДокумент4 страницыBaita Ba1ma RPH Written Work MD 10.1.1 PDFDeserie Aguilar DugangОценок пока нет

- M HVB WRNB QДокумент109 страницM HVB WRNB QMiguel ChavezОценок пока нет

- Mills - Michel FoucaultДокумент9 страницMills - Michel FoucaultKalyar Ei Ei LwinОценок пока нет

- Reflexive Embodiment in Contemporary Society-LДокумент86 страницReflexive Embodiment in Contemporary Society-LAlejandro Martinez EspinosaОценок пока нет

- Malamud's Essay On The First Seven YearsДокумент3 страницыMalamud's Essay On The First Seven YearsTatiana BecerraОценок пока нет

- Madras Hindu Religious and Charitable Endowments Act, 1951Документ38 страницMadras Hindu Religious and Charitable Endowments Act, 1951Latest Laws TeamОценок пока нет

- Council For National PolicДокумент63 страницыCouncil For National PolicGregory HooОценок пока нет

- Meet The BRICs (Case Study 4)Документ5 страницMeet The BRICs (Case Study 4)lekhanh_y2k50% (2)

- Cir V AcostaДокумент2 страницыCir V AcostaJennilyn TugelidaОценок пока нет

- Indian Chamber of Commerce Phils., Inc Vs Filipino Indian Chamber of Commerce in The Philippines, Inc. GR No. 184008, August 3, 2016Документ3 страницыIndian Chamber of Commerce Phils., Inc Vs Filipino Indian Chamber of Commerce in The Philippines, Inc. GR No. 184008, August 3, 2016Ces DavidОценок пока нет

- Students' Research 4 Chitrangada DebДокумент9 страницStudents' Research 4 Chitrangada DebUbaidОценок пока нет