Академический Документы

Профессиональный Документы

Культура Документы

Amrut Export LTD.: Particulars YEAR ENDED ON 31/3/2015 Amount (RS) Income

Загружено:

Dipak KashyapИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Amrut Export LTD.: Particulars YEAR ENDED ON 31/3/2015 Amount (RS) Income

Загружено:

Dipak KashyapАвторское право:

Доступные форматы

AMRUT EXPORT LTD.

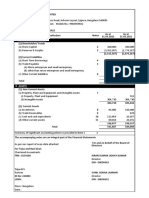

5.9 P&L A/C, BALANCE SHEET & WIC OF YEAR 2014-15, 2015-16:-

PARTICULARS YEAR ENDED ON 31/3/2015

AMOUNT (RS)

INCOME

Revenue from operations(gross) 49,05,19,874.36

Less: excise duty/ custom duty -

Revenue from operation(net) 49,05,19,874.36

Other income 20,12,494.19

Total revenue 49,25,32,368.55

EXPENDITURE

Cost of material consumed 49,82,90,796.05

Purchase of stock-in-trade -

Change in inventories of finish goods & WIP 10,60,92,170.05

Employees benefits expenses 3,25,68000.00

Finance cost 2,06,89,042.37

Depreciation 3,15,56,832.00

Other expenses 2,79,98,075.87

Total expenses 50,50,10,576.24

Profit/loss before exceptional & extraordinary (1,24,78,207.69)

items & tax

Deferred tax (13,77,052.01)

PROFIT/LOSS FOR THE YEAR (1,11,01,155.68)

BALANCESHEET OF YEAR OF 2014-2015:-

PARTICULERS AS ON 31/03/2015 AMOUNT(RS)

I. SOURCE OF FUND

1. Shareholders fund

a) Share capital 3,31,98,200

b) Reserve and surpluses 14,34,92,060.94

2. Share application money pending -

allotment

3. Non-current liabilities

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

a) Long term borrowings 24,72,86,623

b) Deferred tax liabilities (net) 1,09,71,066.94

c) Other long term liabilities -

d) Long term provisions -

4. Current liabilities

a) Short term borrowings 18,41,49,842.75

b) Trade payable 3,89,41,468.00

c) Other current liabilities 76,15,404.00

d) Short term provisions 87,76,437.00

TOTAL 67,44,31,102.63

II. APPLICATION OF FUND

1. Non- current assets

a) Fixed assets

Tangible assets 20,76,13,151,98

Intangible assets 79,836.00

Capital work-in-progress -

Intangible assets under development -

b) Non current investments 2,600.00

c) Long term loans and advances 20,70,930.98

d) Other non-current assets -

2. Current assets

a) Current investment -

b) Inventories 11,76,86,433.00

c) Trade receivables 22,34,39,193,39

d) Cash & cash equivalents 65,46,508.34

e) Short- term loans & advances 11,13,30,865.00

f) Other current assets 56,61,583.94

TOTAL 67,44,31,102.63

PROFIT & LOSS ACCOUNT YEAR OF 2015-2016:-

PARTICULARS YEAR ENDED ON 31/3/2016

Amount(RS)

INCOME

Revenue from operations (GROSS) 11,11,91,004.26

Less: excise duty/ custom duty -

Revenue from operations(NET) 11,11,91,004.26

Other income 5,58,227,74

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

Total revenue 11,17,49,232.00

EXPENDITURE

Cost of material consume 5,78,70,296.00

Purchase of stock-in-trade -

Change in inventories of finish goods & WIP 10,37,43,238.00

Employees benefits expenses 2,53,24,391.00

Finance cost 1,62,97,668.25

Depreciation 1,86,46,658.00

Other expenses 2,52,30,928.73

Total expenses 24,71,13,179.98

Profit/loss before exceptional & extraordinary 13,53,63,947.98

items & tax

Exceptional / extraordinary items 1,95,80,099.00

Profit/loss before tax 15,49,44,046.98

Deferred tax 46,51,248.46

PROFIT/LOSS FOR THE YEAR 15,02,92,798.52

BALANCE SHEET OF THE YEAR 2015-2016:-

PARTICULERS AS ON 31/03/2015 AMOUNT(RS)

I. SOURCE OF FUND

1. Shareholders fund

a) Share capital 3,31,98,200.00

b) Reserve and surpluses 68,00,737.58

2. Share application money pending -

allotment

3. Non-current liabilities

a) Long term borrowings 24,96,99,655.25

b) Deferred tax liabilities (net) 63,19,818.48

c) Other long term liabilities -

d) Long term provisions -

4. Current liabilities

a) Short term borrowings 18,59,16,039.45

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

b) Trade payable 3,58,57,382.00

c) Other current liabilities 42,16,553.00

d) Short term provisions 67,74,115.00

TOTAL 51,51,81,025.60

II. APPLICATION OF FUND

1. Non- current assets

a) Fixed assets

Tangible assets 16,95,37,131.98

Intangible assets 76,362.00

Capital work-in-progress -

Intangible assets under development -

b) Non current investments 2,600.00

c) Long term loans and advances 22,32,215.72

d) Other non-current assets -

2. Current assets

a) Current investment -

b) Inventories 75,14,443.00

c) Trade receivables 22,17,93,286.08

d) Cash & cash equivalents 1,55,09,551.04

e) Short- term loans & advances 9,25,56,554.00

f) Other current assets 59,58,881.78

TOTAL 51,51,81,025.60

WORKING CAPITAL OF LAST TWO YEAR:-

PARTICULAR 2014-14 2015-16

I. CURRENT ASSETS

a) Current investment - -

b) Inventories 11,76,86,443.00 75,14,443.00

c) Trade receivables 22,34,39,193.39 22,17,93,286.08

d) Cash & cash equivalents 65,46,508.34 1,55,09,551.04

e) Short term loans & advances 11,13,30,865.00 9,25,56,554.00

f) Other current assets 56,61,558.94 59,58,881.78

TOTAL 46,46,64,583.67 34,33,32,715.90

II. CURRENTLIABILITIES

a) Short term borrowings 18,41,49,842.75 18,59,16,039.45

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

b) Trade payables 3,89,41,468.00 3,58,57,382.00

c) Other current liabilities 76,15,404.00 42,16,553.00

d) Short term provisions 87,76,437.00 67,74,115.00

TOTAL 23,94,83,151.75 23,27,64,089.45

NET WORKING CAPITAL 22,51,81,431.92 11,05,68,626.45

5.10 RATIO ANALYSIS:-

A ratio refers to establishment of relationship between any two inter-related variables. Ratio

analysis stands for the process of determining and presenting the relationship between of items

and groups of items in the financial statements.

Here represent the AMRUT EXPORT LTD. Data analysis.

1. Gross profit ratio:-

This ratio establishes the relationship between gross profit sales and net sales.

Gross profit ratio= Gross profit * 100

Net sales

YEAR GROSS PROFIT SALES RATIO

2014-15 8,79,36,556 59,84,15,434 14.69%

2015-16 4,44,27,294 10,22,97,590 43.43%

Interpretation:- gross profit of the company is increasing day by day. It is increased to 14.69% in

2015 as compare to it increase at 43.43% in 2016.

2. Net profit ratio:-

This ratio establishes the relationship between the amount of net profit and net income

and the amount of sales revenue.

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

Net profit ratio= Net profit * 100

Net sales

YEAR NET PROFIT NET SALES RATIO

2014-15 4,06,95,622 59,84,15,434 6.80%

2015-16 55,42,923 10,22,97,590 5.42%

Interpretation:- the net profit of the increase in 2015-15 and then ratio is decreased as compare

year 2014-15.

3. Operating ratio:-

This ratio establishes profitability from the shareholder point of view here net profit means the

final income that is available to equity shareholders.

Operating ratio= Cost of Goods Sold + Operating Ratio

Sales

YEAR COST OF OPERATING SALES RATIO

GOOD SOLD EXPENSES

2014-15 41,03,58,294 7,03,70,707 59,84,15,434 9.05%

2015-16 1,36,07,737 8,86,89,853 10,22,97,590 20.32%

Interpretation:- the operating ratio is increased continuously.

4. Stock turnover ratio:-

This is also known as stock velocity. This ratio is helpful to determine policies related to

inventory and its management.

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

Stock turnover ratio= Cost of goods sold

Average stock

YEAR COST OF GOOD AVERAGE STOCK RATIO

SOLD

2014-14 41,03,58,294 6,80,75,314.50 6.02%

2015-16 - - -

Interpretation:- the stock turnover ratio year 2015-16 is zero.

5. Current ratio:-

Current ratio express relationship between current assets and current liabilities. It measure the

short term solvency of the firm.

Current ratio= Current assets

Current liabilities

YEAR CURENT ASSETS CURRENT RATIO

LIABILITIES

2014-14 46,46,64,583.67 23,94,83,151.75 1.94%

2015-16 34,33,32,715.90 23,27,64,089.45 1.47%

Interpretation:- in a current ratio nothing much difference between current ratio and current

liabilities.

6. Proprietary ratio:-

It related shareholders fund to total assets, it show the term solvency of the firm. It is test of long

term credit strength. It is variant of debt equity ratio.

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

Proprietary ratio= Shareholders fund

Total assets

YEAR SHAREHOLDERS TOTAL ASSETS RATIO

FUND

2014-15 3,31,98,200 17,44,94,787 19.02%

2015-16 3,31,98,200 16,96,41,393 24.33%

Interpretation:- in a proprietary ratio 2014-16 s 19.02% then it increase in 2015-16 24.33%.

7. Liquidity ratio:-

It is ratio between liquid assets and liquid liabilities. It is crude measure of liquidity position.

Liquidity ratio= Current assets

Current liabilities

YEAR CURENT ASSETS CURRENT RATIO

LIABILITIES

2014-15 34,69,78,150.67 23,94,83,151.75 1.45%

2015-16 33,58,18,272.90 23,27,64,089.45 1.44%

8. Return on assets ratio:-

It measures the profitability of the business investment. Higher the ratio better it is.

Return on assets ratio= Net profit

Total assets

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

AMRUT EXPORT LTD.

YEAR NET PROFIT TOTAL ASSETS RATIO

2014-15 4,06,95,622 17,44,92,487 23.32%

1016-16 55,42,923 16,96,41,393 3.27%

Interpretation:- Return on assets ratio in 2014-15 23.32% then 2015-16 ratio is fall business

investment profitability is very low.

5.11 COMMON SIZE FINANCIAL STATEMENTS:-

COMMON SIZE INCOME STATEMENT

Particular 2014-15 percentage 2015-16 Percentage

ASSETS

Fixed assets 20,97,66,518.96 31.24% 17,18,48,309.7 83.35%

Current assets 46,16,64,583.67 68.76% 3,43,32,715.90 16.65%

Total assets 67,14,31,102.63 100% 20,61,81,025.60 100%

LIALIBLITIES

& CAPITAL

Equity capital 3,31,98,200.00 4.992% 3,31,98,200.00 6.44%

Preference - - - -

capital

Reserves 14,34,92,060.94 21.27% (68,00,73,758) (-1.32%)

Total 17,66,90,260.94 26.19% 2,63,97,462.42 5.12%

shareholders

fund

Long term 25,82,57,689.94 38.29% 25,60,19,473.73 29.69%

liabilities

Debentures - - - -

Current liabilities 23,94,83,151.75 35.51% 23,27,64,089.45 45.18%

Total liabilities 49,77,40,841.69 73.80% 48,87,83,563,18 94.88%

TOTAL 67,44,31,102.63 100% 51,51,81,025.60 100%

LIABILITIES

& CAPITAL

SHRI S.V PATEL COLLEGE OF C.S & B.M Page 56

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Schaum's Outline of Principles of Accounting I, Fifth EditionОт EverandSchaum's Outline of Principles of Accounting I, Fifth EditionРейтинг: 5 из 5 звезд5/5 (3)

- Ben Stein - Can Your Retirement SurviveДокумент8 страницBen Stein - Can Your Retirement SurviveJulietaОценок пока нет

- This Study Resource Was: Logo HereДокумент5 страницThis Study Resource Was: Logo HereMarcus MonocayОценок пока нет

- Assessment of Working Capital Requirements Form Ii-Operating StatementДокумент9 страницAssessment of Working Capital Requirements Form Ii-Operating Statementdeshrajji75% (4)

- Balance Sheet of Tata Communications: - in Rs. Cr.Документ24 страницыBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaОценок пока нет

- Comparative Study NSE - BSEДокумент119 страницComparative Study NSE - BSEPradeep Rajput76% (34)

- DSP Mutual Fund OverviewДокумент5 страницDSP Mutual Fund OverviewSarika AroteОценок пока нет

- JM Financial: L Indi N L 1 LДокумент9 страницJM Financial: L Indi N L 1 LPiyush LuthraОценок пока нет

- P3.5 Different Forms of Business CombinationДокумент8 страницP3.5 Different Forms of Business CombinationAgnes CahyaОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- DGKC Research ReportДокумент34 страницыDGKC Research Reportgbqzsa100% (1)

- Equity Mutual Funds ProjectДокумент65 страницEquity Mutual Funds Projectmanoranjanpatra100% (5)

- Var, CaR, CAR, Basel 1 and 2Документ7 страницVar, CaR, CAR, Basel 1 and 2ChartSniperОценок пока нет

- Profitability AnalysisДокумент43 страницыProfitability AnalysisAvinash Iyer100% (1)

- IFRS 9 Part IV Hedging November 2015Документ28 страницIFRS 9 Part IV Hedging November 2015Nicolaus CopernicusОценок пока нет

- Final Balance Sheet As On 31.03.2021... 06.12.2021Документ101 страницаFinal Balance Sheet As On 31.03.2021... 06.12.2021Naman JainОценок пока нет

- Clavax Power - TAR - 2023 - Provisional - 10.09Документ7 страницClavax Power - TAR - 2023 - Provisional - 10.09Naresh nath MallickОценок пока нет

- Elgi Gulf (Fze) Balance Sheet As at 31St March 2015Документ7 страницElgi Gulf (Fze) Balance Sheet As at 31St March 2015SnehaОценок пока нет

- Copy of IndiaMart P&L and BS 2022-23 - Updated(1)Документ22 страницыCopy of IndiaMart P&L and BS 2022-23 - Updated(1)Aman LambaОценок пока нет

- 3.nuventures CFS FINALoldДокумент32 страницы3.nuventures CFS FINALoldNagendra KoreОценок пока нет

- Stemhouse Education Joint Stock CompanyДокумент3 страницыStemhouse Education Joint Stock CompanyHung NguyenОценок пока нет

- Consolidated Balance Sheet As at 31 MARCH 2016Документ8 страницConsolidated Balance Sheet As at 31 MARCH 2016balvinderОценок пока нет

- Balance Sheet: Working Capital ManagementДокумент11 страницBalance Sheet: Working Capital ManagementAnu GraphicsОценок пока нет

- Shriram Life 2016-17Документ2 страницыShriram Life 2016-17Javeed GurramkondaОценок пока нет

- Common Size Statement ITCДокумент16 страницCommon Size Statement ITCManjusha JuluriОценок пока нет

- Govati Financials FY 2021-22Документ19 страницGovati Financials FY 2021-22Anjali JainОценок пока нет

- FA Analysis - HUL RatiosДокумент29 страницFA Analysis - HUL RatiosharjinderОценок пока нет

- Financial Analysis of Cadila Healthcare: Presented By: Snehal Nemane Rahul GautamДокумент15 страницFinancial Analysis of Cadila Healthcare: Presented By: Snehal Nemane Rahul GautamUBAIDОценок пока нет

- Balance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20Документ8 страницBalance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20javoleОценок пока нет

- Financial Statements Guts Electro Mech 19 20Документ39 страницFinancial Statements Guts Electro Mech 19 20Manjusha JuluriОценок пока нет

- Doc-4 Budget at A GlanceДокумент3 страницыDoc-4 Budget at A GlanceImran KhanОценок пока нет

- Provisional Profit and Loss Accounts For The Period Un-Audited AuditedДокумент4 страницыProvisional Profit and Loss Accounts For The Period Un-Audited AuditedAnonymous btsj64wRОценок пока нет

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountДокумент8 страницChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVОценок пока нет

- Tata Consultancy Services Limited: Balance Sheet As at March 31, 2015Документ61 страницаTata Consultancy Services Limited: Balance Sheet As at March 31, 2015Mansoor AliОценок пока нет

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountДокумент7 страницChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVОценок пока нет

- 17106A1013 - Ratio Analysis of Apollo TyresДокумент14 страниц17106A1013 - Ratio Analysis of Apollo TyresNitin PolОценок пока нет

- Managing Financial PrinciplesДокумент37 страницManaging Financial PrinciplesNinu MolОценок пока нет

- HKEX Interim ResultsДокумент39 страницHKEX Interim Resultsin resОценок пока нет

- Project+solutionДокумент13 страницProject+solutionpre.meh21Оценок пока нет

- Finance Department Analysis of Dabur LimitedДокумент15 страницFinance Department Analysis of Dabur LimitedradhikaОценок пока нет

- CEAT TyreДокумент3 страницыCEAT TyreMr. Harsh Kumar Student, Jaipuria LucknowОценок пока нет

- Sriki Financial Report-62-65Документ4 страницыSriki Financial Report-62-65gaganaОценок пока нет

- Abridged StatementДокумент7 страницAbridged StatementAnkit BankaОценок пока нет

- Financial White Lotus Motors PVT - LTD - For The FY 2078-79Документ117 страницFinancial White Lotus Motors PVT - LTD - For The FY 2078-79Roshan PoudelОценок пока нет

- Financials Fy 2022-23Документ39 страницFinancials Fy 2022-23syedfareed596Оценок пока нет

- Airbus Group Financial AnalysisДокумент8 страницAirbus Group Financial AnalysisApply Ako Work EhОценок пока нет

- ANNUAL REPORT 2020 - 2021 of LA: Balance Sheet As at 31St MarchДокумент5 страницANNUAL REPORT 2020 - 2021 of LA: Balance Sheet As at 31St MarchYatinSharmaОценок пока нет

- Habib Motors 2022Документ6 страницHabib Motors 2022usmansss_606776863Оценок пока нет

- Nagarro SE standalone financial statementsДокумент20 страницNagarro SE standalone financial statementsPolloFlautaОценок пока нет

- Spring 2023 - ACC501 - 1Документ3 страницыSpring 2023 - ACC501 - 1Ghazanfar AliОценок пока нет

- GDT Fsa 1Документ17 страницGDT Fsa 1Đào Huyền Trang 4KT-20ACNОценок пока нет

- Indigo FINALДокумент33 страницыIndigo FINALankurОценок пока нет

- Beng Kuang Marine Limited: Page 1 of 10Документ10 страницBeng Kuang Marine Limited: Page 1 of 10pathanfor786Оценок пока нет

- FRA Endterm QP-Term 1 - PGDM 2023-25Документ4 страницыFRA Endterm QP-Term 1 - PGDM 2023-25elitesquad9432Оценок пока нет

- Indigo FINALДокумент35 страницIndigo FINALankurОценок пока нет

- So Lieu Tai Chinh HAGL - Copy3.Документ6 страницSo Lieu Tai Chinh HAGL - Copy3.Dao HuynhОценок пока нет

- Andi Woodworks Pvt. Ltd. - 14-15Документ17 страницAndi Woodworks Pvt. Ltd. - 14-15Aayush agarwalОценок пока нет

- Company Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMДокумент11 страницCompany Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMAryan RajОценок пока нет

- AIS Final ReqДокумент10 страницAIS Final ReqSucreОценок пока нет

- CIPLAДокумент10 страницCIPLAMAGOMU DAN DAVIDОценок пока нет

- Consolidated balance sheet as of June 2020Документ7 страницConsolidated balance sheet as of June 2020Muzammil ImranОценок пока нет

- Mahindra and MahindraДокумент18 страницMahindra and Mahindravenkataswamynath channa100% (1)

- CA2 (1)Документ22 страницыCA2 (1)aryanvaish64Оценок пока нет

- Research Methodology AssignmentДокумент11 страницResearch Methodology AssignmentShakshi YadavОценок пока нет

- Long Hau LGH - Sonadezi Chau Duc SZC - Case Study Group17Документ75 страницLong Hau LGH - Sonadezi Chau Duc SZC - Case Study Group17Trung Hung HoОценок пока нет

- Financials Finstream AY 2022-23Документ22 страницыFinancials Finstream AY 2022-23yogiprathmeshОценок пока нет

- STC FS 2016Документ3 страницыSTC FS 2016ehackwhiteОценок пока нет

- Financial Accounting - Vi: Project TopicДокумент10 страницFinancial Accounting - Vi: Project TopicSaba MullaОценок пока нет

- Balance Sheet: As at March 31, 2017Документ2 страницыBalance Sheet: As at March 31, 2017Ranjan DasguptaОценок пока нет

- I. Assets Non-Current AssetsДокумент10 страницI. Assets Non-Current AssetsdeepzОценок пока нет

- Welcome To Aicte-CmatДокумент2 страницыWelcome To Aicte-CmatDipak KashyapОценок пока нет

- Undrawn Commitment (Please Edit Before Print)Документ1 страницаUndrawn Commitment (Please Edit Before Print)Dipak KashyapОценок пока нет

- Special Power of Attorney To Receive Mortgage DocumentsДокумент2 страницыSpecial Power of Attorney To Receive Mortgage DocumentsDipak KashyapОценок пока нет

- Home Loan T/o: Post Disbursment Inspection ReportДокумент3 страницыHome Loan T/o: Post Disbursment Inspection ReportDipak KashyapОценок пока нет

- FI SheetДокумент1 страницаFI SheetDipak KashyapОценок пока нет

- Form No. 49A: See Rule 114Документ8 страницForm No. 49A: See Rule 114deepdxtОценок пока нет

- Welcome To Aicte-CmatДокумент2 страницыWelcome To Aicte-CmatDipak KashyapОценок пока нет

- ChinaДокумент1 страницаChinaDipak KashyapОценок пока нет

- Songs NameДокумент1 страницаSongs NameDipak KashyapОценок пока нет

- A Summer Training Report at Amrut Export Ltd. (Vraj Shila Diamond Merchant)Документ3 страницыA Summer Training Report at Amrut Export Ltd. (Vraj Shila Diamond Merchant)Dipak KashyapОценок пока нет

- Learners LicenceДокумент2 страницыLearners LicenceN Rakesh83% (6)

- Learners LicenceДокумент2 страницыLearners LicenceN Rakesh83% (6)

- Summer ProjectДокумент69 страницSummer ProjectDipak KashyapОценок пока нет

- Certificate: Shri Shambhubhai V. Patel College of Computer Science & Business ManagementДокумент1 страницаCertificate: Shri Shambhubhai V. Patel College of Computer Science & Business ManagementDipak KashyapОценок пока нет

- Certificate: Shri Shambhubhai V. Patel College of Computer Science & Business ManagementДокумент1 страницаCertificate: Shri Shambhubhai V. Patel College of Computer Science & Business ManagementDipak KashyapОценок пока нет

- Analysis of GST Impact on Economic GrowthДокумент36 страницAnalysis of GST Impact on Economic Growthhaz008100% (1)

- KeyboardДокумент1 страницаKeyboardDipak KashyapОценок пока нет

- An Introduction: Fibers, Yarns & Threads Industry OverviewДокумент41 страницаAn Introduction: Fibers, Yarns & Threads Industry OverviewDipak KashyapОценок пока нет

- Submitted ByДокумент5 страницSubmitted ByDipak KashyapОценок пока нет

- FINAL2Документ86 страницFINAL2Dipak KashyapОценок пока нет

- Submitted ByДокумент5 страницSubmitted ByDipak KashyapОценок пока нет

- FINAL1Документ7 страницFINAL1Dipak KashyapОценок пока нет

- Learners LicenceДокумент2 страницыLearners LicenceN Rakesh83% (6)

- Project Garden SilkДокумент32 страницыProject Garden SilkDipak KashyapОценок пока нет

- Form No. 49A: See Rule 114Документ8 страницForm No. 49A: See Rule 114deepdxtОценок пока нет

- Certificate: Shri Shambhubhai V. Patel College of Computer Science & Business ManagementДокумент1 страницаCertificate: Shri Shambhubhai V. Patel College of Computer Science & Business ManagementDipak KashyapОценок пока нет

- Learners LicenceДокумент2 страницыLearners LicenceN Rakesh83% (6)

- Chapter 9: FOREX MARKET Key PointsДокумент6 страницChapter 9: FOREX MARKET Key PointsDanica AbelardoОценок пока нет

- Financial Modeling and Company Valuation Excel MacroДокумент2 страницыFinancial Modeling and Company Valuation Excel MacroSuresh Kumar SainiОценок пока нет

- Lesson 5Документ21 страницаLesson 5Carlos miguel GonzagaОценок пока нет

- Cash Chapter-DefinitionsДокумент44 страницыCash Chapter-DefinitionsJhonielyn Regalado RugaОценок пока нет

- Revenue StreamДокумент11 страницRevenue Stream1B053Faura Finda FantasticОценок пока нет

- UOB Business BankingДокумент10 страницUOB Business BankingJasmine SoniОценок пока нет

- Monthly Fund Performance Update Aia International Small Cap FundДокумент1 страницаMonthly Fund Performance Update Aia International Small Cap FundLam Kah MengОценок пока нет

- Evaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXДокумент30 страницEvaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXRhizhail MortallaОценок пока нет

- Project Viability FinalДокумент79 страницProject Viability FinalkapilОценок пока нет

- A Case Study Entitled: The Collapse of Lehman BrothersДокумент10 страницA Case Study Entitled: The Collapse of Lehman BrothersRoby IbeОценок пока нет

- Novus OverlapДокумент8 страницNovus OverlaptabbforumОценок пока нет

- Overview of SEBI Takeover Regulations, 2011 PDFДокумент54 страницыOverview of SEBI Takeover Regulations, 2011 PDFSumit AroraОценок пока нет

- Attica Gold Company 8880 300 300Документ1 страницаAttica Gold Company 8880 300 300Gopi NarahariОценок пока нет

- Price B1 S2 2024 - DFДокумент30 страницPrice B1 S2 2024 - DFYara AzizОценок пока нет

- Bank Ganesha TBKДокумент3 страницыBank Ganesha TBKTam sneakersОценок пока нет

- Tax Reform For Acceleration and Inclusion ActДокумент6 страницTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadОценок пока нет

- Volatility Indices Trading StrategiesДокумент4 страницыVolatility Indices Trading Strategiesherrlich adefoulouОценок пока нет

- Literature ReviewДокумент50 страницLiterature ReviewMohmmedKhayyumОценок пока нет

- Raising Capital in The Financial MarketsДокумент18 страницRaising Capital in The Financial Markets22GayeonОценок пока нет

- Roostoo User ManualДокумент6 страницRoostoo User ManualbhagyashreeОценок пока нет

- Acc564 HW 3Документ4 страницыAcc564 HW 3Aaryan PatelОценок пока нет

- Mechanics of Futures Markets ExplainedДокумент23 страницыMechanics of Futures Markets ExplainedaliОценок пока нет