Академический Документы

Профессиональный Документы

Культура Документы

AFS Math

Загружено:

hasanarif02570 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров1 страницаAFS

Оригинальное название

AFS_Math

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAFS

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров1 страницаAFS Math

Загружено:

hasanarif0257AFS

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

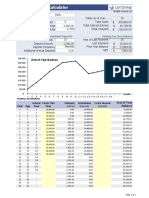

Given that Calculate

Earnings (x) $1,000 i) y = Return to shareholders

Growth rate (g) 0.03 ii) z = Return to shareholders & bondholders

Debt (D) $2,000 $4,000 iii) v = Value of the entire enterprise

Tax rate (T) 0.40 0.20 iv) s = Value of equity

Interst rate (R) 0.10 0.15 v) (d/s) = Debt to equity ratio

Cost of Equity (k) 0.10 vi) (y/s) = Yield on equity

vii) (z/v) = Total return to value of entire enterprise ra

Different Combination

SL NO Tax rate (T) Debt (D) Rate ( r) rd

1 0.40 $2,000 0.10 $200.00

2 0.40 $4,000 0.10 $400.00

3 0.20 $2,000 0.10 $200.00

4 0.20 $4,000 0.10 $400.00

5 0.40 $2,000 0.15 $300.00

6 0.40 $4,000 0.15 $600.00

7 0.20 $2,000 0.15 $300.00

8 0.20 $4,000 0.15 $600.00

SL Y=(x-rd) (1-T) Z=Y+rd V=(1-T) (x/(k-g))+(T*(r/k)*D) S=(V-D) (D/S) (Y/S) (Z/V)

1 $480.00 $680.00 $9,371.43 $7,371.43 0.271 0.065 0.073

2 $360.00 $760.00 $10,171.43 $6,171.43 0.648 0.058 0.075

3 $640.00 $840.00 $11,828.57 $9,828.57 0.203 0.065 0.071

4 $480.00 $880.00 $12,228.57 $8,228.57 0.486 0.058 0.072

5 $420.00 $720.00 $9,771.43 $7,771.43 0.257 0.054 0.074

6 $240.00 $840.00 $10,971.43 $6,971.43 0.574 0.034 0.077

7 $560.00 $860.00 $12,028.57 $10,028.57 0.199 0.056 0.071

8 $320.00 $920.00 $12,628.57 $8,628.57 0.464 0.037 0.073

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- SL No Y (X-RD) (1-T) : Problem Given That CalculateДокумент2 страницыSL No Y (X-RD) (1-T) : Problem Given That Calculatehasanarif0257Оценок пока нет

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTДокумент8 страницLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedОценок пока нет

- Managerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020Документ10 страницManagerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020happiest1Оценок пока нет

- Chapter 7 in Class Practice SolutionДокумент12 страницChapter 7 in Class Practice Solution919282902Оценок пока нет

- Latihan Balance SheetДокумент10 страницLatihan Balance SheetULAN BATAWENОценок пока нет

- ABC AnalysisДокумент2 страницыABC AnalysisNg Zu JieОценок пока нет

- Ejercicio 1: X Y XY XДокумент20 страницEjercicio 1: X Y XY XJoselyn RivasОценок пока нет

- Corporate Finance TDДокумент8 страницCorporate Finance TDThiên AnhОценок пока нет

- Solutions To End-Of-Chapter ProblemsДокумент4 страницыSolutions To End-Of-Chapter ProblemsRab RakhaОценок пока нет

- Economic Order Quantity ExampleДокумент3 страницыEconomic Order Quantity ExampleGolamMostafaОценок пока нет

- Account Debit CreditДокумент4 страницыAccount Debit CreditMcKenzie WОценок пока нет

- Chapter 5Документ13 страницChapter 5Derrick de los ReyesОценок пока нет

- Solutions On Capital Budgeting AssignmentsДокумент3 страницыSolutions On Capital Budgeting AssignmentsjakezzionОценок пока нет

- Exel Calculation (Version 1)Документ10 страницExel Calculation (Version 1)Timotius AnggaraОценок пока нет

- Economic Order Quantity TemplateДокумент5 страницEconomic Order Quantity TemplateM Asim UKОценок пока нет

- Account Excess FV Over BV $ 200,000 Allocations: TotalДокумент6 страницAccount Excess FV Over BV $ 200,000 Allocations: TotalMcKenzie WОценок пока нет

- Aguas Fresh SPLSHДокумент6 страницAguas Fresh SPLSHRafael Guzman MartínezОценок пока нет

- EE - Assignment Chapter 9-10 SolutionДокумент11 страницEE - Assignment Chapter 9-10 SolutionXuân ThànhОценок пока нет

- Present Value Rate-Of-Return (Ror) Examples One Equation, One Unknown Variable 1.61051 FV PV Ror PV FV Ror T M 1 2 3 4 5Документ7 страницPresent Value Rate-Of-Return (Ror) Examples One Equation, One Unknown Variable 1.61051 FV PV Ror PV FV Ror T M 1 2 3 4 5Sagar GogiaОценок пока нет

- Solutions Chapter 8Документ6 страницSolutions Chapter 8Carmella DismayaОценок пока нет

- IcДокумент12 страницIcaplicacionestecnologicaucvОценок пока нет

- Solutions To IFM 2020 JanДокумент4 страницыSolutions To IFM 2020 Janrahul krishnaОценок пока нет

- Truman Company Acquired A 70 Percent Interest in Atlanta CompanyДокумент4 страницыTruman Company Acquired A 70 Percent Interest in Atlanta CompanyKailash KumarОценок пока нет

- AKDAS Tugas 2Документ5 страницAKDAS Tugas 2Reza PahleviОценок пока нет

- Value Drivers (Assumptions)Документ6 страницValue Drivers (Assumptions)Phuong ThaoОценок пока нет

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Документ7 страницPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanОценок пока нет

- Evaluación Financiera Real BessДокумент21 страницаEvaluación Financiera Real BessrolandogaraysalazarОценок пока нет

- Julia - Anand - Tugas - AsdosДокумент4 страницыJulia - Anand - Tugas - AsdosJulia AnandaОценок пока нет

- Financial BP OriДокумент32 страницыFinancial BP OriKhairul AnuarОценок пока нет

- Pacilio Securtiy Service Accounting EquationДокумент11 страницPacilio Securtiy Service Accounting EquationKailash KumarОценок пока нет

- Live Policy V2 (AR) .Документ2 страницыLive Policy V2 (AR) .lola omarОценок пока нет

- Managerial Investment Decisions: Tools and AnalysisДокумент40 страницManagerial Investment Decisions: Tools and AnalysisRОценок пока нет

- Sample Data For RegressionДокумент2 страницыSample Data For RegressionAravindVenkatramanОценок пока нет

- Case Nifty CoДокумент6 страницCase Nifty Conguyencutephomaique1511Оценок пока нет

- Cost AssignmentДокумент4 страницыCost AssignmentAtka chОценок пока нет

- BTДокумент4 страницыBTNam HảiОценок пока нет

- CityofSouthMia CitywideDrainImprovPhaseIV C107 1214 Nov 07Документ10 страницCityofSouthMia CitywideDrainImprovPhaseIV C107 1214 Nov 07graneros1944Оценок пока нет

- 08 ENMA302 InflationExamplesДокумент8 страниц08 ENMA302 InflationExamplesMotazОценок пока нет

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnДокумент3 страницыSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnTatiana SanchezОценок пока нет

- Case Study 1 StudДокумент11 страницCase Study 1 StudLucОценок пока нет

- DEPRESIASIДокумент7 страницDEPRESIASISaffira Annisa BeningОценок пока нет

- Book 1Документ4 страницыBook 1Harrison DwyerОценок пока нет

- Excel Solution To 10.1-10.4Документ14 страницExcel Solution To 10.1-10.4mansiОценок пока нет

- Vrachier M/V Manchester Date Referitoare La Voiaj Date Despre Nava Descriere VoiajДокумент47 страницVrachier M/V Manchester Date Referitoare La Voiaj Date Despre Nava Descriere VoiajAdi SPОценок пока нет

- H.W ch4q7 Acc418Документ4 страницыH.W ch4q7 Acc418SARA ALKHODAIRОценок пока нет

- Oferta y DemandaДокумент5 страницOferta y DemandaCristal Campos cheОценок пока нет

- Exercise 2-3Документ2 страницыExercise 2-3Nick AltmanОценок пока нет

- 1 $20,000 2 56000 3 - 2500 4 48000 - 48000 5 10000 6 - 2000 7 8 9 10 11 12 13 14 15 Totals $63,500 $8,000 $0 $0 $0 $0 $0 $10,000 $0Документ2 страницы1 $20,000 2 56000 3 - 2500 4 48000 - 48000 5 10000 6 - 2000 7 8 9 10 11 12 13 14 15 Totals $63,500 $8,000 $0 $0 $0 $0 $0 $10,000 $0Nick AltmanОценок пока нет

- 552748Документ3 страницы552748mohitgaba19Оценок пока нет

- Deber 1Документ5 страницDeber 1Carlos Javier Vergara GuanangaОценок пока нет

- Advance2 HW - P6-9Документ4 страницыAdvance2 HW - P6-9Fernando HermawanОценок пока нет

- Assumptions/Data: Unit Price Unit Variable CostДокумент7 страницAssumptions/Data: Unit Price Unit Variable CostHannan yusuf KhanОценок пока нет

- Mortgage Interest Rates and Home Prices Median Home PriceДокумент11 страницMortgage Interest Rates and Home Prices Median Home PriceI'm a red antОценок пока нет

- Projected Cash BudgetДокумент2 страницыProjected Cash Budgetapi-464285260Оценок пока нет

- Perhitungan LODДокумент4 страницыPerhitungan LODFranciskus Febry AnggoroОценок пока нет

- Master Excel ResourcesДокумент123 страницыMaster Excel ResourcesGregory GoodОценок пока нет

- College Savings CalculatorДокумент1 страницаCollege Savings CalculatorsrinaldyОценок пока нет

- Book 1Документ8 страницBook 1Alejandra LamasОценок пока нет

- SCM Topic 1 Blades Solution 2022Документ3 страницыSCM Topic 1 Blades Solution 2022Adi KurniawanОценок пока нет