Академический Документы

Профессиональный Документы

Культура Документы

ICMAP G1 Financial Accounting Syllabus Overview

Загружено:

Syed Ali HaiderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ICMAP G1 Financial Accounting Syllabus Overview

Загружено:

Syed Ali HaiderАвторское право:

Доступные форматы

ICMAP

SYLLABUS

SYLLABUS2016

2016

Estd. 1951

GRADUATION LEVEL

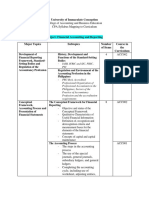

G1 - Financial Accounting

Weightage

Part-A Preparation, Adjustment and Analysis

of Financial Statements 40%

Part-C Part-A

Part-B Accounting Treatment for Specific

Part-B Businesses 30%

Part-C Consolidated Financial Statements

(Single Parent and a Subsidiary) 30%

Syllabus Overview: l Prepare and present the financial statements of

companies

This is the second paper of financial stream and gives

insight to the students about preparation of financial l Understand the types/ nature of errors and its

statements for companies (stand alone and rectification

consolidated) and its analysis. The syllabus also covers

l Analyze the financial statements for decision making

accounting for special businesses. After completion of

and performance measurement

this paper, students will have better understanding for

Financial Reporting paper that will be tested at l Prepare and present the financial statements from

professional level. incomplete records

Learning Outcomes: l Prepare and present the receipts and payments and

On completion of this course, students will be able to: income and expenditure accounts

l Understand the nature and component of l Understand the accounting treatment and process

shareholders' equity and its accounting including for branches

accounting for issuance of shares (at par, discount l Prepare consolidated financial statements for single

and premium) including allocation of dividends and parent and a subsidiary

reserves

Detailed Contents Weightage Level of

in % Study Required

PART - A: PREPARATION, ADJUSTMENT AND ANALYSIS OF FINANCIAL STATEMENTS

1. Company Formation & l Formation of public and private limited companies U

Retained Earnings as per Companies law in Pakistan

l Concept and nature of shares and share capital A

l Types of shares and share capital A

l Recording of issue of shares (at par, premium and A

discount) against cash and for consideration other

than cash

l Concept of partly and fully paid-up shares 25 U

l Share splits, right issue of shares, bonus shares A

(stock dividend)

l Introduction to debentures/ bonds/ PTCs/ TFC/ A

Sukuk etc.

l Retained earnings appropriation to dividends and A

reserves

l Concept and types of dividends and reserves A

l Accounting for dividends, reserves and reserve funds A

l Year-end adjustments A

l Prepare and present the financial statements of A

companies i.e., Statement of Profit or Loss and

Other Comprehensive Income, Statement of

Financial Position, Statement of Cash Flows (Direct

and indirect Method), Statement of changes in equity

Institute of Cost and Management Accountants of Pakistan

74 (Constituted under Cost and Management Accountants Act, 1966)

ICMAP

SYLLABUS 2016

Estd. 1951

2. Rectification of l Types of error A

Errors l Errors not affecting the trial balance A

l Errors affecting the trial balance including suspense A

account, effect of errors on financial statements

3. Financial Statements l Ratios analysis A

Analysis (Ratio l Activity ratios/ operating cycle ratio, liquidity ratios 15 A

Analysis) l Solvency ratios, profitability ratios, investors' ratios A

l Horizontal and Vertical Analysis A

l Interpreting financial information A

l Limitations of ratios analysis A

PART - B: ACCOUNTING TREATMENT FOR SPECIFIC BUSINESSES

4. Accounting for l Features of incomplete records and comparison with A

Incomplete Records double-entry accounting

l Pure and mixed incomplete records accounting A

treatments

l Preparation of financial statements from incomplete A

records

5. Accounting for l Preparation of receipts and payments account A

Non-profit l Preparation of income and expenditure account A

Organizations l Special funds U

l Preparation of financial statements A

6. Accounting for l Operation of a branch A

Branches (Excluding l Types of branch U

Foreign Branches) l Accounting systems for branch (including 30 A

dependent and independent branches) and

head office

l Reciprocal accounts and inter-branch transactions A

l Preparation of combined statements for head office A

and branches

7. Accounting for l Define a partnership and state its essential elements U

Partnership l Formation of a partnership U

Concerns l Accounting for partnerships, preparation of A

partnership accounts

l Preparation of income statement/ profit or loss A

account and statement of comprehensive income

for a partnership concern

l Appropriation/ distribution of profits among partners A

l Prepare capital and current account A

Institute of Cost and Management Accountants of Pakistan

(Constituted under Cost and Management Accountants Act, 1966) 75

ICMAP

SYLLABUS 2016

Estd. 1951

PART-C: CONSOLIDATED FINANCIAL STATEMENTS (SINGLE PARENT AND A SUBSIDIARY)

8. Consolidated l Concept of a group as single economic unit U

Statement of l Concept of subsidiary and holding company U

Financial Position l Objectives of preparation of consolidated financial U

statements

l Pre and post-acquisition profits U

l Non-controlling interest U

l Need for valuing investment and net assets U

acquired in a subsidiary on fair values

l Accounting treatment of unrealized profit U

l Accounting for mid-year acquisitions 30 U

l Accounting treatment of goodwill U

l Preparation of consolidated statement of financial A

Position

9. Consolidated l Principles and elements of the consolidated U

Statement of statement of comprehensive income

Comprehensive l Inter-company transactions and why they need U

Income to be eliminated

l Other consolidated income statement adjustments U

l Preparation of consolidated statement of profit or A

loss and other comprehensive income

TOTAL WEIGHTAGE 100

NOTE:-

U = Understanding

A = Application

D = Decision

Institute of Cost and Management Accountants of Pakistan

76 (Constituted under Cost and Management Accountants Act, 1966)

Вам также может понравиться

- G1 PDFДокумент3 страницыG1 PDFfawad aslamОценок пока нет

- ICMAP C3 Strategic Financial Management SyllabusДокумент5 страницICMAP C3 Strategic Financial Management SyllabustehmeenaОценок пока нет

- Corporate Financial ReportingДокумент2 страницыCorporate Financial ReportingAizaButtОценок пока нет

- Course Title: Financial Reporting Course Code: FIBA204 Credit Units: 3 Course Level: UGДокумент3 страницыCourse Title: Financial Reporting Course Code: FIBA204 Credit Units: 3 Course Level: UGKajol SethiОценок пока нет

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksДокумент240 страницAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY71% (7)

- Accounting Resource 2019Документ20 страницAccounting Resource 2019simphiwemotaung671Оценок пока нет

- DLL Cot2 .Buss Fin. Nov.42020Документ3 страницыDLL Cot2 .Buss Fin. Nov.42020florabel hilarioОценок пока нет

- 1.150 ATP 2023-24 GR 12 Acc FinalДокумент4 страницы1.150 ATP 2023-24 GR 12 Acc FinalsiyabongaОценок пока нет

- M4 FacrДокумент2 страницыM4 FacrMaher MubeenОценок пока нет

- Chapter 17Документ37 страницChapter 17Josh Yanez50% (2)

- Accountancy (Code No. 055) : Class-XII (2019-20)Документ6 страницAccountancy (Code No. 055) : Class-XII (2019-20)naveenaОценок пока нет

- 67178bos54090 Cp7u1Документ59 страниц67178bos54090 Cp7u1Hansika ChawlaОценок пока нет

- 67178bos54090 Cp7u1Документ59 страниц67178bos54090 Cp7u1ashifОценок пока нет

- Must Do Content Accountancy Class XiiДокумент46 страницMust Do Content Accountancy Class XiiHigi SОценок пока нет

- On CFS FFSДокумент31 страницаOn CFS FFSShirsendu MondolОценок пока нет

- CHP 1 FsaДокумент15 страницCHP 1 Fsaabhaymac22Оценок пока нет

- Assignment Financial Accounting & Analysis: Answer 1. Sr. No Point of Differentiation Indian GAAP Ifrs Ind ASДокумент3 страницыAssignment Financial Accounting & Analysis: Answer 1. Sr. No Point of Differentiation Indian GAAP Ifrs Ind ASRASHMIОценок пока нет

- Lecture ONE Accounting For ManagerДокумент30 страницLecture ONE Accounting For Managermohamed elsabahiОценок пока нет

- Accounting II BBA 3rdДокумент9 страницAccounting II BBA 3rdTalha GillОценок пока нет

- 55008bosfndnov19 p1 Cp7u1Документ62 страницы55008bosfndnov19 p1 Cp7u1Jammigumpula Priyanka100% (1)

- DELHI PUBLIC SCHOOL ASSIGNMENT BOOKLETДокумент140 страницDELHI PUBLIC SCHOOL ASSIGNMENT BOOKLETsainimanish170gmailc0% (2)

- ch1 HandoutДокумент6 страницch1 HandoutPaolo TipoОценок пока нет

- Grade 12 AccountancyДокумент8 страницGrade 12 AccountancyPeeyush VarshneyОценок пока нет

- CBSE Class 12 Accountancy Syllabus 2023 24Документ8 страницCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424Оценок пока нет

- O1 FfaДокумент3 страницыO1 Ffamuhammmad irfanОценок пока нет

- NTT University Offers Edexcel HND in Business AccountingДокумент6 страницNTT University Offers Edexcel HND in Business Accountingpck1004Оценок пока нет

- 61809bos50279 cp7 U1Документ61 страница61809bos50279 cp7 U1Sukhmeet Singh100% (1)

- Accounts Complier (QB) @mission - CA - InterДокумент350 страницAccounts Complier (QB) @mission - CA - Intershivangi sharma0907100% (1)

- T0 2022-2023 MS FA - NotesДокумент154 страницыT0 2022-2023 MS FA - NotesPAURUSH GUPTAОценок пока нет

- ACCOUNTANCY (Code No. 055) : RationaleДокумент10 страницACCOUNTANCY (Code No. 055) : RationaleAshish GangwalОценок пока нет

- CFA Level 1 FRAДокумент17 страницCFA Level 1 FRAAkash KaleОценок пока нет

- Financial AccountingДокумент4 страницыFinancial AccountingprachiОценок пока нет

- S1 AfacrДокумент3 страницыS1 Afacrmudassar saeedОценок пока нет

- @cbse - Xyz Accountancy Term 2 Class 11Документ244 страницы@cbse - Xyz Accountancy Term 2 Class 11happy100% (2)

- Screenshot 2022-02-16 at 5.18.38 PMДокумент244 страницыScreenshot 2022-02-16 at 5.18.38 PMSoumya Bhasin100% (1)

- Part B: Computerised AccountingДокумент6 страницPart B: Computerised AccountingSonakshi JainОценок пока нет

- CBSE Class 12 Accountancy Syllabus 2022 23Документ8 страницCBSE Class 12 Accountancy Syllabus 2022 23SanakhanОценок пока нет

- 2022 23 Accountancy 12-MinДокумент8 страниц2022 23 Accountancy 12-MinShajila AnvarОценок пока нет

- CAF SyllabusДокумент88 страницCAF SyllabusTeen CharaghОценок пока нет

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Документ5 страницTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargОценок пока нет

- Trial Balance, Financial Reports and Statements GuideДокумент22 страницыTrial Balance, Financial Reports and Statements GuideJayvee BernalОценок пока нет

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesДокумент4 страницыPost Graduate Diploma in Management: Narsee Monjee Institute of Management Studiesharendra choudharyОценок пока нет

- Chapter 6 Preparation of Final Accounts of Sole Proprietors PDFДокумент56 страницChapter 6 Preparation of Final Accounts of Sole Proprietors PDFBabalss MishraОценок пока нет

- Financial Statements ExplainedДокумент17 страницFinancial Statements Explainedshubham kumarОценок пока нет

- Accounting Knowledge Level LecturesДокумент12 страницAccounting Knowledge Level LecturesMainul HasanОценок пока нет

- SLIDES UNIT 6 Part 2Документ22 страницыSLIDES UNIT 6 Part 2joseguticast99Оценок пока нет

- CAF Syllabus PDFДокумент88 страницCAF Syllabus PDFAbdullah AbidОценок пока нет

- Accounting - Fundamentals - India Version 15th March 2024Документ43 страницыAccounting - Fundamentals - India Version 15th March 2024akshat.gargug25Оценок пока нет

- StudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Документ58 страницStudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Amir Ali LiaqatОценок пока нет

- Comparative FSs 6Документ21 страницаComparative FSs 6Shierwin Ebcas JavierОценок пока нет

- Chapter - 6: © The Institute of Chartered Accountants of IndiaДокумент56 страницChapter - 6: © The Institute of Chartered Accountants of IndiaArvind RamanujanОценок пока нет

- Lesson 3: Accounting EquationДокумент3 страницыLesson 3: Accounting EquationDante SausaОценок пока нет

- Course Outline - Financial Accounting - FMG 27, IMG 12 & FM 1 - Prof. Vandana Gupta, Prof. Ambrish Gupta and Prof. HarshitaДокумент3 страницыCourse Outline - Financial Accounting - FMG 27, IMG 12 & FM 1 - Prof. Vandana Gupta, Prof. Ambrish Gupta and Prof. HarshitaVineetОценок пока нет

- If A Diploma Syl Lab I Sept 0911Документ26 страницIf A Diploma Syl Lab I Sept 0911Muluuka Geoffrey WamangaОценок пока нет

- Final Accouts SPДокумент74 страницыFinal Accouts SPASHIR GANDHI100% (1)

- Accounting for Not-for-Profit OrganizationsДокумент333 страницыAccounting for Not-for-Profit OrganizationsRaj Rajeshwer Gupta100% (1)

- BoA CPA Board Syllabus MappingДокумент27 страницBoA CPA Board Syllabus MappingTrisha Monique VillaОценок пока нет

- CPA (USA) Financial Accounting: Examination Preparation GuideОт EverandCPA (USA) Financial Accounting: Examination Preparation GuideОценок пока нет

- Arif CVДокумент4 страницыArif CVSyed Ali HaiderОценок пока нет

- GeographyДокумент7 страницGeographySyed Ali HaiderОценок пока нет

- UNIT7 Literature From Around The WorldДокумент21 страницаUNIT7 Literature From Around The WorldSyed Ali HaiderОценок пока нет

- Syed Ali HaiderДокумент5 страницSyed Ali HaiderSyed Ali HaiderОценок пока нет

- Ch3 Application SoftwareДокумент1 страницаCh3 Application SoftwareSyed Ali HaiderОценок пока нет

- Pre Historic Man and The Start of CivilizationДокумент3 страницыPre Historic Man and The Start of CivilizationSyed Ali HaiderОценок пока нет

- Short Response Questions Ch3 ComputerДокумент2 страницыShort Response Questions Ch3 ComputerSyed Ali HaiderОценок пока нет

- Historical PersonalitiesДокумент2 страницыHistorical PersonalitiesSyed Ali HaiderОценок пока нет

- Computer Ch2Документ1 страницаComputer Ch2Syed Ali HaiderОценок пока нет

- GovernmentДокумент4 страницыGovernmentSyed Ali HaiderОценок пока нет

- English BДокумент2 страницыEnglish BSyed Ali HaiderОценок пока нет

- Pakistan MovementДокумент2 страницыPakistan MovementSyed Ali HaiderОценок пока нет

- Short Response Questions Ch3 ComputerДокумент2 страницыShort Response Questions Ch3 ComputerSyed Ali HaiderОценок пока нет

- Idioms 1Документ1 страницаIdioms 1Syed Ali HaiderОценок пока нет

- IdiomsДокумент5 страницIdiomsSyed Ali HaiderОценок пока нет

- Words Meanings SentencesДокумент6 страницWords Meanings SentencesSyed Ali HaiderОценок пока нет

- CultureДокумент3 страницыCultureSyed Ali HaiderОценок пока нет

- AbbreviationsДокумент1 страницаAbbreviationsSyed Ali HaiderОценок пока нет

- ICT Ethics and SecurityДокумент4 страницыICT Ethics and SecuritySyed Ali HaiderОценок пока нет

- Short Response QuestionsДокумент1 страницаShort Response QuestionsSyed Ali HaiderОценок пока нет

- Social Studies Paper 4thДокумент1 страницаSocial Studies Paper 4thSyed Ali HaiderОценок пока нет

- Such Aur Us K AhmiatДокумент4 страницыSuch Aur Us K AhmiatSyed Ali HaiderОценок пока нет

- MCQs Ch1 ComputerДокумент1 страницаMCQs Ch1 ComputerSyed Ali HaiderОценок пока нет

- Pre Historic Man and The Start of CivilizationДокумент3 страницыPre Historic Man and The Start of CivilizationSyed Ali HaiderОценок пока нет

- Short Response Questions Ch3 ComputerДокумент2 страницыShort Response Questions Ch3 ComputerSyed Ali HaiderОценок пока нет

- Computer Paper Class 6thДокумент1 страницаComputer Paper Class 6thSyed Ali HaiderОценок пока нет

- CultureДокумент3 страницыCultureSyed Ali HaiderОценок пока нет

- Short Response QuestionsДокумент1 страницаShort Response QuestionsSyed Ali HaiderОценок пока нет

- Pakistan MovementДокумент2 страницыPakistan MovementSyed Ali HaiderОценок пока нет

- Components of A ComputerДокумент1 страницаComponents of A ComputerSyed Ali HaiderОценок пока нет

- Account for Inventories at Lower of Cost and NRVДокумент26 страницAccount for Inventories at Lower of Cost and NRVAnn Margarette LopezОценок пока нет

- Chapter9Solutions (Questions)Документ14 страницChapter9Solutions (Questions)ayaОценок пока нет

- Net Present Value - NPV: Capital BudgetingДокумент4 страницыNet Present Value - NPV: Capital BudgetingCris Marquez100% (1)

- 07 Objective Type IAS 7 Statement of Cash Flows A35Документ9 страниц07 Objective Type IAS 7 Statement of Cash Flows A35Haris IshaqОценок пока нет

- Payback and Related FormulasДокумент3 страницыPayback and Related FormulasJowelYabotОценок пока нет

- Liquidity, Tax Rates, and Financial Statement AnalysisДокумент7 страницLiquidity, Tax Rates, and Financial Statement AnalysisAndresОценок пока нет

- Journal Entries For The Issue of Bonus SharesДокумент2 страницыJournal Entries For The Issue of Bonus Sharesananthu p santhoshОценок пока нет

- Ledger PDFДокумент23 страницыLedger PDFStatusОценок пока нет

- Ekuitas (Preferen Share Dan Dividen)Документ29 страницEkuitas (Preferen Share Dan Dividen)Reza ElvaniaОценок пока нет

- Auditing Canadian 7th Edition Smieliauskas Solutions Manual DownloadДокумент35 страницAuditing Canadian 7th Edition Smieliauskas Solutions Manual DownloadMargaret Narcisse100% (25)

- Economics HL Formula BookletДокумент7 страницEconomics HL Formula BookletNeha MathewОценок пока нет

- Bba Training ReportДокумент64 страницыBba Training ReportNourin KhanОценок пока нет

- Study of ICICI Direc - Com - Demeterilisaton in ICICI CapitalДокумент61 страницаStudy of ICICI Direc - Com - Demeterilisaton in ICICI Capitalredhat11Оценок пока нет

- eLearnMarkets OptionsBuying HindiДокумент17 страницeLearnMarkets OptionsBuying Hindisrinivas20% (1)

- Bankruptcy Problems MirzaДокумент3 страницыBankruptcy Problems MirzaKesarapu Venkata ApparaoОценок пока нет

- 013 - Forex & NPO-1-39Документ153 страницы013 - Forex & NPO-1-39Mae Flor Cuya GabasОценок пока нет

- Nyse WPT 2016-1Документ88 страницNyse WPT 2016-1Siddharth Adithya RaveendranОценок пока нет

- Problemset5 AnswersДокумент11 страницProblemset5 AnswersHowo4DieОценок пока нет

- Pension Fund Management Without Solution For StudentsДокумент2 страницыPension Fund Management Without Solution For StudentsHarshil MehtaОценок пока нет

- Feasibility Study For Caustic Soda Production PlantДокумент3 страницыFeasibility Study For Caustic Soda Production PlantMosaddek100% (3)

- HW 15-2 Task Budget Prep MCQ StudДокумент9 страницHW 15-2 Task Budget Prep MCQ StudКсения НиколоваОценок пока нет

- Chapter 3 ValuationДокумент8 страницChapter 3 ValuationSwee Yi LeeОценок пока нет

- Quote Vendor File ExcelДокумент254 страницыQuote Vendor File ExcelsefiplanОценок пока нет

- CAF For Reliance SIP Insure - 24 10 2017 Full PDFДокумент51 страницаCAF For Reliance SIP Insure - 24 10 2017 Full PDFARVINDОценок пока нет

- Money To Be Paid by Reliance Infra-: Reliance Can Go ForДокумент5 страницMoney To Be Paid by Reliance Infra-: Reliance Can Go ForAbhishekKumarОценок пока нет

- Application of Tax Treaties To Investment FundsfundsДокумент69 страницApplication of Tax Treaties To Investment FundsfundsEvelinaОценок пока нет

- Equity Asset Valuation Mughal SteelsДокумент11 страницEquity Asset Valuation Mughal SteelsHabiba PashaОценок пока нет

- Partnership & ClubsДокумент8 страницPartnership & ClubsGary ChingОценок пока нет

- Jurnal Kombinasi BisnisДокумент12 страницJurnal Kombinasi Bisnisadi mulyonoОценок пока нет

- Asialink Finance CorporationДокумент52 страницыAsialink Finance CorporationJay BagsОценок пока нет