Академический Документы

Профессиональный Документы

Культура Документы

Revision Class Handouts 7

Загружено:

Billu SinghАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Revision Class Handouts 7

Загружено:

Billu SinghАвторское право:

Доступные форматы

Page 1 of 9

Handout

Revision

Class #7 dipin@forumias.academy

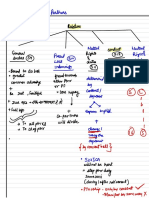

PSU Reforms Disinvestment G Mergers

-

Niti

Aayog has submitted recommendations to the centre for

strategic disinvestment of Bus

cabinet in principle approval to the recommendations

gave

-

Rationale

Poor performance of Psus due to the

following reasons :

Lack of importance toprofit motive

under utilisation of capacity

location

inappropriate

no technical feasibility studies

cost

delay in

project completion and overruns

of professional management

Lack

recruitment and promotion policy

overstaffing defective ,

Lack of rational

pricing policy

political Interference

non competitiveness

Recommendations

Roogta Committee on reforms in Ps E C 2011 )

listing of

Govt should look at 50 CPSES in next 5

years

better corporate

governance

More

autonomy to Boards of BUS

better utilisation of resources and

transparency

-

fix tenure of CMDS

Vijay kelkar Committee Gold recommended monetizing surplus

land

gout .

Economic

Survey 2015-16 also recommended to use PSU lands

India initiatives

'

'

make

for

'

- in -

Steps taken

Disinvestment

Merger

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 2 of 9

dipin@forumias.academy

is investment

it is the process of selling

or

liquidating an asset or

subsidiary

objectives

to reduce fiscal deficit

to fund Social sector schemes

to competition

Introduce

to depoliticise operations

to encourage efficiency and professional management

Approaches

minority disinvestment -

gout retains > 51%

Majority disinvestment -

gout retains a

minority stake

strategic sale

According to Dpt of Disinvestment in the

strategic sale of

a

company

the transaction has two elements

-

transfer of majority shares

-

transfer of management and control

In

order to revive

Strategic sale of Psus the Dpt of Disinvestment

has been renamed as Dpt of Investment and Public Asset

Management

CDIPAM )

72,500

Target

Budget 2017

Govt fixed a

target of collecting crores

through

disinvestment in 2017-18

Govt plans to sell minority Stokes in 51 listed as well as unlisted

approved Ayog 's

Nih proposal for strategic

'

companies .

it also sale

in about 22 PSES ,

and closing certain loss making Psus

centre Is also planning He disinvestment of Air India

Disinvestment policy of present gout

public ownership of CPSES

Promote

retain majority shareholding

strategic disinvestment in identified CPSES

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 3 of 9

dipin@forumias.academy

challenges

labour and

opposition from employees ,

union political parties

CAG report in 2006 found that valuation of the companies

assets done wclhout due

"

"

were seriousness

the

amount realised through disinvestment were not paid to

concerned PSE

Lack of transparency and lack of proper policy on disinvestment

of Crony capitalism

'

'

issues

may affect the social objectives of the

Disinvestment of Air India

gout

Govt Is

planning for disinvestment of Air India .

based on

Nitiaayog

's

report

Facts

Air India has a total debt of Rs 52000 Crore

The Market share

of Air India Is 13 .

3 Y .

C May 2017 )

it has 118 aircraft ,

out of which It owns 77 planes

Rationale

Airline reported losses for 6

straight years ,

its debt Is

growing

unsustainably

bailed out ivcth $ by the

it was 5.8 billion in 2012

, gout

a

overstaffed and inefficient

domestic competition

increasing global

and

de .

link it from political pressures

lack of professionalism

challenges

Huge debt of Rs

52000 crore

its Prime properties has been mortgaged with banks

real estate

three subsidiaries

its are

profit Making MRO Unit CAIESD ,

ground handling unit CAHSL ) and Air India Charters Ltd .

there will be direct and indirect job loss

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 4 of 9

dipin@forumias.academy

Merger of PSBS

SBI merged with Its five associate banks and Bharatiya Manila Bank .

MOF also to banks to

four five

considering Merge few

15 more create -

global .

sized lenders .

( Canara Bank and Bank of Baroda are top contenders )

Facts

with SBI will have asset base of Rs 37 lakh crore Weth

merger ,

22,500 branches and Over 50 crore customers

Benefits

get economies of scale and reduction in the cost of doing business

address the technical

inefficiencies of Small banks

a improve the professional standards

help will to to International standards with innovative

,

merger gear up

products and services

-

expand geographical coverage

He

huge infrastructure financing

help in needs

funding

the

corporateSupport

sector in overseas acquisitions

end unhealthy and intense competition among PSB ,

volume

of interbank transactions will comedown which results

in

saving

time In clearing and reconciliation of accounts

help in norms under BASEL I '

a Meeting

For the and control will be

regulators , monitoring easier

challenges

India needs

may affect financial inclusion . more banks

- may

reduce competition

end regional focus

merger may

banks collapsed during Global Financial crisis

Even

large global

immediate issues like and

pension liability provisions

harmonisation of accounting policies

labour

opposition by employees and unions

It will result In immediate job losses

weakness of small banks

may get transferred to

bigger bank also

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 5 of 9

dipin@forumias.academy

merger of

oil Bus

Govt Is to India oil Psus

planning merge

Oil HPCL and GAIL

five big Companies are 10C , ONGC , BPCL ,

01L

,

Benefits

will while

A

large entity enjoy more benefits negotiating prices

the market

in

global

may

have

advantages in HE

itbidding process abroad because of

its size

this oil behemoth handle both upstream and downstream

can

process

under one roof

Consolidation will

provide economies of scale and value chain

integration

and trend the oil

Globally mergers acquisitions is the in

industry

challenges

creation of large monopoly affect market and competition

oil reduce risk consortium

Companies try to

forming by a

oil attract World

success In

discovery depends upon its ability to .

class

geologists and latest technology

to buy oil properties abroad it Is important to have gout support ,

.

as In the case of chinese companies

difficulty In blending companies ivcth different cultures

vast potential to impact energy security

as a

giant company will have

Twin balance sheet problem

Economic 2016-17 that of the critical

survey acknowledges one

'

the Problem

'

Indian Is

challenges confronting economy TBS

TBS

the balance sheet of PSB , and some

corporate houses are

weak and Is obstacle to investment and economic

an

reviving

growth

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 6 of 9

dipin@forumias.academy

Facts

Total NPA Is more than 9 lakh crore

RBI identified 12 accounts which account for 251 .

gross

NP As

a Infrastructure ,

Steel and textile sector have contributed most to

stressed loans

The reasons

over

leveraging of corporate during growth years

banks also financed this investment boom

global financial crisis affected growth

increased cost of borrowing

and environmental clearances

difficulty in

getting

land

issues

loan

evergreen ing

affects investment

willful defaulters

diversion of funds

problems from the banks side viz credit appraisal monitoring

,

their BASEL

banks are

struggling to meet lit norms

key elements needed far resolution

loss

recognition

Coordination

incentives

proper

recapitalisation

Steps taken

5125 refinancing infrastructure scheme

private Arcs

a strategic Debt Restructuring

Asset Quality Review

a scheme for sustainable

structuring of stressed Assets

mdradhanush plan

other measures

re capitalization of Ps Bs

-

msdvancy and bankruptcy Code

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 7 of 9

dipin@forumias.academy

bank -

PARA

Economic solo 17 Suggested Public Sector Asset Rehabilitation

survey Agency

-

PARA

PARA is set

up to buy bad loans of PSBS and then revive them or

them

suitably dispose off

Bad

Rationale

the measures to tackle NPA have not delivered

tangible results

limitations to recapitalisation of Ps Bs

fear of action by EDS and others Is

preventing bankers from

into

negotiated settlement with

getting companies

PARA could solve the problem of coordination

Benefits

banks clear their balance sheet

banks could Meet their BASEL II norms

could free up the capital and increased

It

thereby lending

the valuation of banks will increase

challenges

valuation of bad loans

Funding of PARA 1 bad bank

issue of moral hazard .

Ie banks may continue with their reckless

lending

Re .

capitalization of PSBS

Govt of India announced re .

capitalization of PSB , to boost

credit growth in the economy .

C Budget 2016-17 )

Rationale

banks lending capacities are

affected by poor asset quality

and weak capitalization

According to Moody 's Rs 1^2 lakh Crore capital infusion is

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 8 of 9

dipin@forumias.academy

required in 13 PSBS

by 2020

to III which starts from March

according BASEL norms ,

2019 ,

Indian banks need to maintain a minimum CAR of It 5%

wctih weak failed bank one has three options closure

merger

a or ;

, ,

and re .

capitalization .

Re .

capitalization Is

required because the true cost of a

banking

failure is Its effect on the larger economy

Budget 2016-17

govt announced plan to allocate

-

70,000 crore under the

lndradhanush plan introduced in 2015

- way forward

Governance reforms

Empowerment no -

interference from gout

Accountability

Public Debt

PDMA -

Management Authority

said that PDMC be

MOF has will upgraded to a

statutory

PDMA in about two years

PDMA

An independent authority to manage public debt or

gout borrowings

.

Govt has set PDML for interim Period to smoothen

up a an

the transition process

Need

Presently market borrowing Is

Managed by RBI but external

debt by central gout directly .

PDMA will consolidate internal and

external debt in a holistic manner

Management of public debt comes in Conflict with RBI 's

mandate control

to inflation

Being an

independent it puts .

some discipline on the gout debt process

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Page 9 of 9

dipin@forumias.academy

Corporate bond market Is not well developed in India

FSLRC report recommended a specialised agency for PDM

recommended Public debt be the anchor

Nik Singh Committee to new

for deciding fiscal policy

objectives of public debt management strategy

a

to ensure sustainable growth

prevent crowding out

to .

effect

to prevent welfare losses from taxation

Imposes burden on HE future generation

a to maintain stable Macro -

economic indicators

challenges

Govt 's debt management has a wider socio -

economic impact and ,

it broader outlook

requires

PDMA 's focus is only on Central gout

Govt being the

majority shareholder

of PSBS , conflict of interest

would still be present

Current Affairs Classes for Mains 2017 by ForumIAS

ForumIAS Offline, 3rd Floor, Shop No. 6, Near Syndicate Bank, Old Rajinder Nagar, New Delhi 110060 | student@forumias.academy | 9821711605

Вам также может понравиться

- Module 5 ACCTДокумент19 страницModule 5 ACCTFathimath NoohaОценок пока нет

- 22 RailwaysДокумент1 страница22 RailwaysMukesh BugaliyaОценок пока нет

- Module 4 ACCTДокумент11 страницModule 4 ACCTFathimath NoohaОценок пока нет

- Strategic management process and implementationДокумент1 страницаStrategic management process and implementationgina rahmasariОценок пока нет

- Module 3 ACCTДокумент16 страницModule 3 ACCTFathimath NoohaОценок пока нет

- Workstream #3Документ1 страницаWorkstream #3VladОценок пока нет

- Demographic DividendДокумент1 страницаDemographic DividendMukesh BugaliyaОценок пока нет

- AgnipathДокумент1 страницаAgnipathMukesh BugaliyaОценок пока нет

- E WasteДокумент1 страницаE WasteMukesh BugaliyaОценок пока нет

- Case FrameworkДокумент2 страницыCase Frameworkbhanurathi1998Оценок пока нет

- Exercise 2Документ2 страницыExercise 2Fatin NajihahОценок пока нет

- Retail ManagementДокумент52 страницыRetail ManagementSukanta1992Оценок пока нет

- INTRODUCTION TO COST ACCOUNTINGДокумент19 страницINTRODUCTION TO COST ACCOUNTINGCA Manoj Kumar SabatОценок пока нет

- Hana SДокумент1 страницаHana Ssumanbisi100Оценок пока нет

- Production Planning and Control - Operation Planning - 29-09 & 04-10-2022Документ24 страницыProduction Planning and Control - Operation Planning - 29-09 & 04-10-2022Shreya SinghОценок пока нет

- HimanshuSanjayPatil_13509416_-02_00-_1Документ1 страницаHimanshuSanjayPatil_13509416_-02_00-_1Mayur ShindeОценок пока нет

- 22 10 Labour LawsДокумент2 страницы22 10 Labour LawsRk CuОценок пока нет

- As Handwritten Summary CA Avinash SamchetiДокумент24 страницыAs Handwritten Summary CA Avinash Samchetianshuno247Оценок пока нет

- CH 5Документ51 страницаCH 5K60 Phạm Tuấn KiệtОценок пока нет

- BGS Summarised Notes (Kay)Документ60 страницBGS Summarised Notes (Kay)tttkay.2021Оценок пока нет

- Grade 12 Notes 3Документ1 страницаGrade 12 Notes 3RainbowОценок пока нет

- Tips For Nurturing Global Leadership Talent Diversity ManagementДокумент9 страницTips For Nurturing Global Leadership Talent Diversity Managementmohit yadavОценок пока нет

- Matriz QFD - Grupo 2Документ1 страницаMatriz QFD - Grupo 2ALLISON VANESSA DIAZ GUERREROОценок пока нет

- General Organic Chemistry Mind MapДокумент2 страницыGeneral Organic Chemistry Mind MapMohammed Mudassir KhanОценок пока нет

- Definition Size Transition: For Reading: Exemptions From Pfrs For SmesДокумент1 страницаDefinition Size Transition: For Reading: Exemptions From Pfrs For SmesAMОценок пока нет

- Fin PrepДокумент40 страницFin PrepArijit GoraiОценок пока нет

- Resume - MFMДокумент1 страницаResume - MFMFaisal MehmoodОценок пока нет

- ATM Session 2Документ14 страницATM Session 2Saksham AgrawalОценок пока нет

- CHP 4 - Finance in Planning - Decision MakingДокумент16 страницCHP 4 - Finance in Planning - Decision MakingShahpal KhanОценок пока нет

- important pointsДокумент8 страницimportant pointsMeag GhnОценок пока нет

- Advisian Business Process - MAINДокумент10 страницAdvisian Business Process - MAINDavid PrastyanОценок пока нет

- Surat MagangДокумент3 страницыSurat Magangreno bintangОценок пока нет

- Adv Excel Practice 5 PageSetup 04nov2023Документ1 страницаAdv Excel Practice 5 PageSetup 04nov2023Sakshi Marwah ChamolaОценок пока нет

- Stepping Out of The Confines of FinanceДокумент5 страницStepping Out of The Confines of FinanceSanam TОценок пока нет

- WMATA Report by McKinsey & CompanyДокумент89 страницWMATA Report by McKinsey & Companywamu88567% (3)

- Mentor: Mmt÷A#Документ23 страницыMentor: Mmt÷A#Yash AggarwalОценок пока нет

- Exam 1 Cheat SheetДокумент2 страницыExam 1 Cheat SheetRosalindОценок пока нет

- Woodbank RatioДокумент8 страницWoodbank RatioHammadОценок пока нет

- IFRS 5 HELD FOR SALEДокумент10 страницIFRS 5 HELD FOR SALEf9vertexlearningsolutionsОценок пока нет

- Disposal and depreciation of property assetsДокумент4 страницыDisposal and depreciation of property assetsjhell dela cruzОценок пока нет

- Ease of Doing Business LawДокумент3 страницыEase of Doing Business LawDanica ZamoraОценок пока нет

- Best Practices Local Gov Budgeting WPДокумент8 страницBest Practices Local Gov Budgeting WPPejantan SuperОценок пока нет

- CHP 3 - Innovation, Performance - Change MGTДокумент20 страницCHP 3 - Innovation, Performance - Change MGTShahpal KhanОценок пока нет

- MARATHAN MOTOR (I) PVT LTD. 5S COMMITTEE- PLANT ORGANIZATION CHARTДокумент4 страницыMARATHAN MOTOR (I) PVT LTD. 5S COMMITTEE- PLANT ORGANIZATION CHARTRishi GautamОценок пока нет

- Important Questions For May 22 - Compressed - Watermark - Ac43aff8 Ccb7 4278 Bf94 Fa8e7c7f105bДокумент22 страницыImportant Questions For May 22 - Compressed - Watermark - Ac43aff8 Ccb7 4278 Bf94 Fa8e7c7f105bannabsn0Оценок пока нет

- Mumbai-based CA Article Trainee and FounderДокумент1 страницаMumbai-based CA Article Trainee and FounderAditya PatadiaОценок пока нет

- 2021-08-18 Is LM FrameworkДокумент9 страниц2021-08-18 Is LM FrameworkMansi ParmarОценок пока нет

- .Sn?I.Ybgapnika-Ksha: Sohit PrajapatiДокумент14 страниц.Sn?I.Ybgapnika-Ksha: Sohit PrajapatiMalathy VijayОценок пока нет

- Unicorns PapermockДокумент1 страницаUnicorns PapermockSargamОценок пока нет

- Kuliah - Week 1 (Pengantar Analbi)Документ1 страницаKuliah - Week 1 (Pengantar Analbi)Falisha RivienaОценок пока нет

- Construction - Site Manager - Zimplats, Zimbabwe - Job at Ashton Personnel in ZimbabweДокумент4 страницыConstruction - Site Manager - Zimplats, Zimbabwe - Job at Ashton Personnel in ZimbabweAwes SewsaОценок пока нет

- Digital transformation starts with peopleДокумент2 страницыDigital transformation starts with peopleNguyễn Minh NghiêmОценок пока нет

- Capital Budgeting Techniques Using The Excel Spreadsheets: February 2021Документ44 страницыCapital Budgeting Techniques Using The Excel Spreadsheets: February 2021Vinay ChhedaОценок пока нет

- Abdul Basit Ansari CVДокумент2 страницыAbdul Basit Ansari CVmshaheer01Оценок пока нет

- Grant: SubsidyДокумент10 страницGrant: SubsidyFatima MianoorОценок пока нет

- Bobby Kumar: Chitransh Enterprises, Mohan Nagar, Ghaziabad - Marketing InternДокумент2 страницыBobby Kumar: Chitransh Enterprises, Mohan Nagar, Ghaziabad - Marketing InternBobby KumarОценок пока нет

- 18 Facility Layout 1 - Qualitative and Quantitative - AnnotatedДокумент42 страницы18 Facility Layout 1 - Qualitative and Quantitative - Annotatedmates4workОценок пока нет

- 03.09.2023 Publication Parole and Probation Administration Central OfficeДокумент5 страниц03.09.2023 Publication Parole and Probation Administration Central OfficeEmmanuel De OcampoОценок пока нет

- How To Identify Winning Mutual Funds Safal Niveshak 2013Документ23 страницыHow To Identify Winning Mutual Funds Safal Niveshak 2013easytrainticketsОценок пока нет

- Corporate Finance: Cash ManagementДокумент29 страницCorporate Finance: Cash ManagementrubalОценок пока нет

- Kotak Multi Asset Allocator Fund of Fund Dynamic Leaflet (English)Документ4 страницыKotak Multi Asset Allocator Fund of Fund Dynamic Leaflet (English)Sidhartha Marketing CompanyОценок пока нет

- Management Summary: 6.1 Personnel PlanДокумент24 страницыManagement Summary: 6.1 Personnel Planrichelle andayaОценок пока нет

- Corporate Social ResponsibilityДокумент5 страницCorporate Social ResponsibilityanishabatajuОценок пока нет

- Time Value of Money ExamplesДокумент4 страницыTime Value of Money ExamplessmsmbaОценок пока нет

- Fortress Investment Group 2008 Annual ReportДокумент165 страницFortress Investment Group 2008 Annual ReportAsiaBuyoutsОценок пока нет

- Business Valuation Model ExcelДокумент20 страницBusiness Valuation Model ExcelWagane DioufОценок пока нет

- Account PaperДокумент8 страницAccount PaperAhmad SiddiquiОценок пока нет

- Metro: Agenda - FinalДокумент16 страницMetro: Agenda - FinalMetro Los AngelesОценок пока нет

- Steven Guerra ResumeДокумент1 страницаSteven Guerra Resumeapi-281084241Оценок пока нет

- Growth, Corporate Profitability, and Value Creation: Cyrus A. Ramezani, Luc Soenen, and Alan JungДокумент12 страницGrowth, Corporate Profitability, and Value Creation: Cyrus A. Ramezani, Luc Soenen, and Alan JungAbhishek DoshiОценок пока нет

- To Invest in The Multibagger Parag Milk PDFДокумент3 страницыTo Invest in The Multibagger Parag Milk PDFChetan PanchamiaОценок пока нет

- Marketing Strategies of HDFC BankДокумент72 страницыMarketing Strategies of HDFC Banksunit2658Оценок пока нет

- Public Private Partnership (PPP) - Group DДокумент31 страницаPublic Private Partnership (PPP) - Group Ddevdattam100% (1)

- Suitability of analytical procedures for audit evidenceДокумент7 страницSuitability of analytical procedures for audit evidencebaabasaamОценок пока нет

- Economy of MauritiusДокумент6 страницEconomy of MauritiusKristen NallanОценок пока нет

- Nutrien 2019 Investor Day PresentationДокумент109 страницNutrien 2019 Investor Day PresentationPPMazziniОценок пока нет

- Invast Securities Q3 FinancialsДокумент9 страницInvast Securities Q3 FinancialsRon FinbergОценок пока нет

- Roll No.50, A Study On Working Capital ManagementДокумент10 страницRoll No.50, A Study On Working Capital ManagementBala NadarОценок пока нет

- Multifamily EbookДокумент15 страницMultifamily EbookLloydMandrellОценок пока нет

- Russell US Indexes 1Документ2 страницыRussell US Indexes 1Jaihind PatilОценок пока нет

- Long Hain CelestialДокумент4 страницыLong Hain CelestialAnonymous Ht0MIJОценок пока нет

- Case Study CostcoДокумент3 страницыCase Study CostcoAndi FirmanataОценок пока нет

- The Bank and The Mundhra AffairДокумент14 страницThe Bank and The Mundhra AffairAmbika MehrotraОценок пока нет

- Cybercash - The Coming Era of Electronic Money (Preview)Документ22 страницыCybercash - The Coming Era of Electronic Money (Preview)Bayu HerkuncahyoОценок пока нет

- Beach Course Renovation FinalДокумент11 страницBeach Course Renovation Finalapi-387651574Оценок пока нет

- JengaCashFlowExercise 1546983290168Документ2 страницыJengaCashFlowExercise 1546983290168Vibhuti BatraОценок пока нет

- THE 10% Entrepreneur: TranscriptsДокумент14 страницTHE 10% Entrepreneur: TranscriptsyoachallengeОценок пока нет

- Vendor Data Bank Form CSG-003 Rev 2Документ5 страницVendor Data Bank Form CSG-003 Rev 2Deepak JainОценок пока нет