Академический Документы

Профессиональный Документы

Культура Документы

PARALEL QUIZ - Introduction of Accounting

Загружено:

Cut Farisa Machmud0 оценок0% нашли этот документ полезным (0 голосов)

98 просмотров5 страницquiz

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документquiz

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

98 просмотров5 страницPARALEL QUIZ - Introduction of Accounting

Загружено:

Cut Farisa Machmudquiz

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

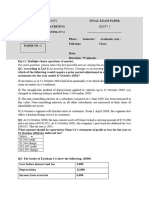

PARALEL QUIZ INTRODUCTION OF ACCOUNTING

Friday, Dec 8th 2017

Faculty of Economics and Business, Universitas Indonesia

Tim Asisten Dosen

Problem 1 Account Receivable (20%)

Suppose PT Gajah uses receivable method in estimating the uncollectible account. PT

Gajah has determined the percentage of uncollectible amount based on aging period,

as shown below.

Age Class % Uncollectible

Not Pass Due 1%

1-30 days past due 4%

31-60 days past due 16%

61-90 days past due 25%

>90 days past due 50%

You are required to:

a) Create the table of aging period based on this list of AR:

Customer Name Due Date Balance AR (in Rp)

Mr. X 17-Aug-16 10,000,000.00

Mr. Y 30-Nov-15 1,400,000.00

PT. Beta 6-Feb-17 500,000,000.00

PT. Adam 6-Nov-16 50,000,000.00

b) Calculate total of estimated uncollectible accounts that will be presented on

balance sheet as of 31 December 2016, if the balance for allowance for

doubtful account (AFDA) at Dec 31, 2015 is Rp 5.000.000!

c) Create the adjustment journal as needed.

Problem 2 Corporation (20%)

On January 1, 2017, Tesla Co. had the following stockholders equity accounts:

Common Stock ($5 par value, 200.000 $1.000.000

shares issued &Outstanding)

Paid-in Capital in Excess of Par Common Stock $200.000

Retained Earnings $ 840.000

During the year, the following transactions occurred.

Jan. 15 Declared a $1 cash dividend per share to stockholders of record on

January 31, payable February 15.

Feb. 15 Paid the dividend declared in January.

Apr. 15 Declared a 10% stock dividend to stockholders of record on April 30,

distributable May 15. On April 15, the market price of the stock was

$15 per share.

May 15 Issued the shares for the stock dividend.

July 1 Announced a 2-for-1 stock split. The market price per share prior to

the announcement was $17. (The new par value is $2.50.)

Dec. 1 Declared a $0.50 per share cash dividend to stockholders of record on

December 15, payable January 10, 2018. (hint : pay attention to

number of share after stock-split)

Dec. 31 Determined that net income for the year was $250,000.

Instructions

(a) Journalize the transactions and the closing entries for net income and

dividends.

(b) Prepare a stockholders equity section at December 31 2017.

Problem 3 Current Liabilities (20%)

Part A - Accounting For Warranty

PT ABC sold 200.000 of equipment during February under a one-year warranty. The

cost to repair defects under the warranty is estimated at 6% of the sales price. On July

2014, a customer required a $60 part replacement, plus $32 of labor under the

warranty. Provide the journal entry for (i) estimated warranty expense on February 28

for February sales and (ii) July 24 warranty work.

Part B - Accounting for Payroll

Pak Alis gross income per month from PT Unilever is Rp 5.000.000. Pak Alis PPH

during March is 450.000. In March, PT Unilever also withheld 3% of each

employees gross income for employees pension. Pak Alis income for March 2014

will be paid on 1 April 2014. Monthly pension contribution& monthl tasxes will be

paid to the pension fund & tax office on 3 April 2014.

i. Calculate the net income received by Pak Ali

ii. Journalize the entry needed to record Pak Alis salary expense

iii. Journalize the entry needed when PT Unilever conducts payment

Problem 4 Plant Asset and Intangible (20%)

Part A Plant Asset

On January 1, 2017, Skyline Limousine Co. purchased a limo at an acquisition cost of

$28,000. The vehicle has been depreciated by the straight-line method using a 4-year

service life and a $4,000 salvage value. The companys scal year ends on December

31.

Prepare the journal entry or entries to record the disposal of the limousine assuming

that it was:

(i) Retired and scrapped with no salvage value on January 1, 2021.

(ii) Sold for $5,000 on July 1, 2020. (Hint: dont forget to record current year

depreciation)

Part B - Intangible

The following are selected 2017 transactions of Pedigo Corporation.

Jan. 1 Purchased a small company and recorded goodwill of $150,000. Its useful life

is indefinite.

May 1 Purchased for $90,000 a patent with an estimated useful life of 5 years

(i) Prepare the necessary journal entry on transaction date

(ii) Prepare the necessary adjusting entries at December 31 to record amortization

required by the events above.

PROBLEM 5 Long-Term Liabilities (20%)

Part A Bonds Payable

PT Pengantar Akuntansi sold Rp 10.000.000, 9%, 10-year bonds on January 1, 2015.

The bonds were dated January 1 and pay interest annually on January 1. Prepare

jurnal entries to record :

1) The issuence of bonds on January 1, 2015

2) Adjustment entries on December 31, 2015 ( include interest and amortization

if any)

3) Redeemption on January 1, 2017 at 101

PT Pengantar Akuntansi uses the straight-line method to amortize bond

premium/discount.

Additional information : Company sold bonds at 105

Part B Mortage Note Payable

Matekbis Corp. issues a $800,000, 4%, 20-year mortgage note payable on January 1,

2015. The terms of the note provide for annual installment payments of $ 58.866.

Payments are due January 1

Instructions

a) Prepare an installment payments schedule for the first 4 years.

b) Prepare the entries for issues mortage note payable on Jan 1, 2015 and first

payment on Jan 1, 2016

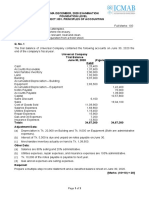

PROBLEM 6 Cash Flow (20%)

The following is a comparative balance of PT Payung Teduh for two years (2014 and

2015) and income statement in 2015.

PT Payung Teduh

Comparative Balance Sheet

(in Rp .000,-)

31 Dec 2015 31 Dec 2014 Changes

Assets

Cash 536,400 568,200 (31,800)

Receivable 508,700 477,200 31,500

Inventory 770,400 734,600 35,800

investment Long-Term - 286,000 (286,000)

Land 361,500 - 361,500

Equipment 701,500 562,000 139,500

Acc. Depre Equipment (190,600) (123,000) (67,600)

2,687,900 2,505,000

Liabilities dan Equity

Account payable 582,700 567,800 14,900

Wages Payable 151,500 156,800 (5,300)

Other Payable 172,500 169,500 3,000

Common Stock 134,500 131,500 3,000

Additional Paid in Capital 306,500 231,500 75,000

Saldo Laba 1,340,200 1,247,900 92,300

2,687,900 2,505,000

PT Payung Teduh

Comparative Balance Sheet

For the year ended December 31, 2015

(in Rp .000,-)

Sales 5,479,200

COGS 3,542,500

Gross Profit 1,936,700

Operating expense

Depreciation 67,600

Other 1,369,400 1,437,000

Other Income and expense

Loss on sale investment 36,000

Earning Before Tax 463,700

Tax 130,000

Net Income 333,700

Instruction :

Make cash Flow statement using direct and indirect (cash flow from operating only) method

Вам также может понравиться

- Correction of ErrorsДокумент6 страницCorrection of ErrorsJanjielyn MoralesОценок пока нет

- Answer: PH P 1,240: SolutionДокумент18 страницAnswer: PH P 1,240: SolutionadssdasdsadОценок пока нет

- Ac6 ProblemsДокумент21 страницаAc6 ProblemsLysss EpssssОценок пока нет

- Corporate Reporting Past Question Papers (ICAB)Документ55 страницCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- CMA Exam Principles of AccountingДокумент4 страницыCMA Exam Principles of AccountingMohammad ShahidОценок пока нет

- 13 Week Cash Flow ModelДокумент16 страниц13 Week Cash Flow ModelASChipLeadОценок пока нет

- Akuntansi Keuangan 1Документ15 страницAkuntansi Keuangan 1Vincenttio le CloudОценок пока нет

- Ak 2Документ12 страницAk 2nikenapОценок пока нет

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekДокумент23 страницыCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BОценок пока нет

- AC4301 FinalExam 2020-21 SemA AnsДокумент9 страницAC4301 FinalExam 2020-21 SemA AnslawlokyiОценок пока нет

- Cap II Group I RTP Dec2023Документ84 страницыCap II Group I RTP Dec2023pratyushmudbhari340Оценок пока нет

- Ac208 2019 11Документ6 страницAc208 2019 11brian mgabi100% (1)

- Auditing Problem Assignment Lyeca JoieДокумент12 страницAuditing Problem Assignment Lyeca JoieEsse ValdezОценок пока нет

- Saint Louis College Prelim Quiz Net Cash Flow ProblemsДокумент2 страницыSaint Louis College Prelim Quiz Net Cash Flow ProblemsPrince Anton DomondonОценок пока нет

- Intermediate Accounting ExamДокумент6 страницIntermediate Accounting ExamPISONANTA KRISETIAОценок пока нет

- Assessing Financial Strength and Viability of a New VentureДокумент38 страницAssessing Financial Strength and Viability of a New VentureAd Nan DaNiОценок пока нет

- Statement of Cash Flow Set-2Документ9 страницStatement of Cash Flow Set-2vdj kumarОценок пока нет

- Acct1101 Final Examination SEMESTER 2, 2020Документ13 страницAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarОценок пока нет

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Документ3 страницы2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidОценок пока нет

- Joint Venture Accounting EntriesДокумент8 страницJoint Venture Accounting EntriesMonica DespiОценок пока нет

- AP 1st Monthly AssessmentДокумент6 страницAP 1st Monthly AssessmentCiena Mae Asas100% (1)

- Bus. Finance W3-4 - C5 (Answer)Документ5 страницBus. Finance W3-4 - C5 (Answer)Rory GdLОценок пока нет

- Accounting For Single Entry and Incomplete RecordsДокумент18 страницAccounting For Single Entry and Incomplete RecordsCA Deepak Ehn77% (13)

- Accounting For Single Entry and Incomplete Records PDFДокумент18 страницAccounting For Single Entry and Incomplete Records PDFCj BarrettoОценок пока нет

- MSU College of Business Administration and Accountancy Audit ProblemsДокумент7 страницMSU College of Business Administration and Accountancy Audit ProblemsHasmin Saripada Ampatua100% (1)

- Business Accounting (LO 03,4,5) - Alternative AssessmentДокумент7 страницBusiness Accounting (LO 03,4,5) - Alternative Assessmentpiumi100% (1)

- Short Answer Questions SolutionsДокумент11 страницShort Answer Questions SolutionsAamir SaeedОценок пока нет

- Cash FlowДокумент6 страницCash FlowKailaОценок пока нет

- Bahasan Soal AK 2Документ9 страницBahasan Soal AK 2nikenapОценок пока нет

- Comparative Financial StatementsДокумент2 страницыComparative Financial StatementsomairОценок пока нет

- Practice Questions For Final W Brick FinancialsДокумент7 страницPractice Questions For Final W Brick FinancialsJoana SilvaОценок пока нет

- IFRS Adjustments for Sangana CompanyДокумент13 страницIFRS Adjustments for Sangana CompanyShakhawatОценок пока нет

- F2 Sept 2014 QP Final Version For PrintДокумент20 страницF2 Sept 2014 QP Final Version For PrintFahadОценок пока нет

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Документ2 страницыFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCOОценок пока нет

- FAR - Final Preboard CPAR 92Документ14 страницFAR - Final Preboard CPAR 92joyhhazelОценок пока нет

- ACT1101, PRB, Midterm, Wit Ans KeyДокумент5 страницACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Unit 1 - Essay QuestionsДокумент7 страницUnit 1 - Essay QuestionsJaijuОценок пока нет

- Acp - Acc417 Case Study 1Документ6 страницAcp - Acc417 Case Study 1Faker MejiaОценок пока нет

- Financial Accounting and Reporting: IFRS - 2016 June QPДокумент11 страницFinancial Accounting and Reporting: IFRS - 2016 June QPMarchella LukitoОценок пока нет

- Tugas 1 Lab Auditing OkДокумент9 страницTugas 1 Lab Auditing OkIrmalia Anastasia SiagianОценок пока нет

- Project Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofДокумент11 страницProject Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofGetahunОценок пока нет

- Auditing BS 2Документ4 страницыAuditing BS 2Gletzmar IgcasamaОценок пока нет

- Balance Sheet Errors: Problem 1Документ2 страницыBalance Sheet Errors: Problem 1Alyana SandiegoОценок пока нет

- PC 2 QuestionnaireДокумент3 страницыPC 2 QuestionnaireLuWiz DiazОценок пока нет

- Group 1Документ53 страницыGroup 1Nishma BaniyaОценок пока нет

- Advanced Financial Accounting Final Exam SolutionsДокумент13 страницAdvanced Financial Accounting Final Exam SolutionsHayyin Nur AdisaОценок пока нет

- Finals - IAДокумент6 страницFinals - IAShariine BestreОценок пока нет

- Final Exam QuestionДокумент4 страницыFinal Exam QuestionHồng XuânОценок пока нет

- BBA Program Spring 2022 ACT301: Intermediate Accounting Assignment 2Документ2 страницыBBA Program Spring 2022 ACT301: Intermediate Accounting Assignment 2মাহিদ হাসানОценок пока нет

- F7.2 - Mock Test 1Документ5 страницF7.2 - Mock Test 1huusinh2402Оценок пока нет

- Nov 2018 Pathfinder SkillsДокумент162 страницыNov 2018 Pathfinder SkillsWaidi AdebayoОценок пока нет

- Nov 19 Q PDFДокумент9 страницNov 19 Q PDFTenywa SalimОценок пока нет

- ACCT 10001: Accounting Reports & Analysis – Lecture 9 Budgeting & Variance ReportДокумент4 страницыACCT 10001: Accounting Reports & Analysis – Lecture 9 Budgeting & Variance ReportBáchHợpОценок пока нет

- Final Exam - ACCT 5001P - Fall 2022Документ23 страницыFinal Exam - ACCT 5001P - Fall 2022shuvorajbhattaОценок пока нет

- Statement of Cash FlowsДокумент6 страницStatement of Cash FlowsLuiОценок пока нет

- Compre Problems REДокумент3 страницыCompre Problems REGegante Shayne SarahОценок пока нет

- pdf-topic-no-2-statement-of-cash-flows-pdf_compressДокумент3 страницыpdf-topic-no-2-statement-of-cash-flows-pdf_compressMillicent AlmueteОценок пока нет

- CA Inter Adv. Accounting Top 50 Question May 2021Документ117 страницCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavОценок пока нет

- Intermediate Accounting 3 - Statement of Cash Flows ProblemsДокумент3 страницыIntermediate Accounting 3 - Statement of Cash Flows ProblemsSARAH ANDREA TORRESОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- AIMAДокумент43 страницыAIMACut Farisa MachmudОценок пока нет

- AIMAДокумент43 страницыAIMACut Farisa MachmudОценок пока нет

- Insight Disruption For FIДокумент48 страницInsight Disruption For FIfandieconomistОценок пока нет

- Quiz CL & Ppe & IntangiblesДокумент2 страницыQuiz CL & Ppe & IntangiblesCut Farisa MachmudОценок пока нет

- Our Potential Healthy Catering Partners (Jakarta)Документ7 страницOur Potential Healthy Catering Partners (Jakarta)Cut Farisa MachmudОценок пока нет

- December 2018 International Private Equity and Venture Capital Valuation GuidelinesДокумент70 страницDecember 2018 International Private Equity and Venture Capital Valuation Guidelinestruyn cuoiОценок пока нет

- Ifsa Chapter4Документ62 страницыIfsa Chapter4Anonymous 45z6m4eE7pОценок пока нет

- Oler Et Al - Characterizng Acctg ResearchДокумент37 страницOler Et Al - Characterizng Acctg ResearchCut Farisa MachmudОценок пока нет

- Preacher, Lawyer, Salesman SpeechДокумент4 страницыPreacher, Lawyer, Salesman SpeechCut Farisa MachmudОценок пока нет

- CH 05Документ81 страницаCH 05Cut Farisa MachmudОценок пока нет

- Soal Asistensi Pertemuan 12Документ2 страницыSoal Asistensi Pertemuan 12Cut Farisa MachmudОценок пока нет

- Analisa INDF TrsДокумент3 страницыAnalisa INDF TrsCut Farisa MachmudОценок пока нет

- UNTR - Strong 1Q17 But in LineДокумент3 страницыUNTR - Strong 1Q17 But in LineCut Farisa MachmudОценок пока нет

- Ifrs Acctg For Intangible AssetsДокумент24 страницыIfrs Acctg For Intangible AssetsCut Farisa MachmudОценок пока нет

- Implementing Good Corporate GovernanceДокумент5 страницImplementing Good Corporate GovernanceCut Farisa MachmudОценок пока нет

- Determinants of Sustainability Reporting and Its Impact 2017 Journal of CleДокумент13 страницDeterminants of Sustainability Reporting and Its Impact 2017 Journal of CleCut Farisa MachmudОценок пока нет

- New Dgt-1 Form - Per 10-0817Документ14 страницNew Dgt-1 Form - Per 10-0817Jesslyn PermatasariОценок пока нет

- Im CH 08Документ16 страницIm CH 08Tanpo NomoОценок пока нет

- Corporate Accounting Multiple Choice QuestionsДокумент23 страницыCorporate Accounting Multiple Choice QuestionsحسينبيسواسОценок пока нет

- Long-term Finance Options for Delite FurnitureДокумент4 страницыLong-term Finance Options for Delite FurnitureNaveen RaiОценок пока нет

- Chapter 5Документ26 страницChapter 5sdfklmjsdlklskfjdОценок пока нет

- Case StudiesДокумент6 страницCase StudiesFrancesnova B. Dela PeñaОценок пока нет

- Taxation ExamsДокумент105 страницTaxation ExamsJoyce LunaОценок пока нет

- Ian Ferrao Concludes Term As Vodacom Tanzania Managing DirectorДокумент3 страницыIan Ferrao Concludes Term As Vodacom Tanzania Managing DirectorMuhidin Issa MichuziОценок пока нет

- Auditing Shareholders' Equity ProblemsДокумент1 132 страницыAuditing Shareholders' Equity ProblemsUNKNOWNNОценок пока нет

- Solving - Business Finance 1-6Документ28 страницSolving - Business Finance 1-6Samson, Ma. Louise Ren A.Оценок пока нет

- Some Lessons From Capital Market History: Answers To Concepts Review and Critical Thinking Questions 1Документ13 страницSome Lessons From Capital Market History: Answers To Concepts Review and Critical Thinking Questions 1Sindhu JattОценок пока нет

- Sunley CaseДокумент5 страницSunley CasePeterОценок пока нет

- Vanguard S&P 500 UCITS ETF: (USD) DistributingДокумент4 страницыVanguard S&P 500 UCITS ETF: (USD) DistributingMateuszGóreckiОценок пока нет

- Ratio AnalysisДокумент33 страницыRatio AnalysisTuan Nguyen MinhОценок пока нет

- Chapter 9 PracticeДокумент4 страницыChapter 9 Practicexabir54952Оценок пока нет

- HONDA THE POWER OF DREAMS HISTORYДокумент43 страницыHONDA THE POWER OF DREAMS HISTORYzee412Оценок пока нет

- Cost of Project and Means of FinancingДокумент7 страницCost of Project and Means of FinancingEhsaan Illahi0% (1)

- Assignment 1 - Fin242 Set 2Документ4 страницыAssignment 1 - Fin242 Set 22022328009Оценок пока нет

- CFMAДокумент36 страницCFMAArlan Joseph LopezОценок пока нет

- China Banking Corp. v. CTAДокумент9 страницChina Banking Corp. v. CTAChino SisonОценок пока нет

- ACCA F6UK December 2015 Notes PDFДокумент264 страницыACCA F6UK December 2015 Notes PDFopentuitionID100% (2)

- Walter's Dividend ModelДокумент13 страницWalter's Dividend ModelVaidyanathan RavichandranОценок пока нет

- Chapter 9 Long Term Financing CalculationДокумент13 страницChapter 9 Long Term Financing Calculationsofea yusoffОценок пока нет

- A Summer Training Report On Ratio Analysis: Completed atДокумент30 страницA Summer Training Report On Ratio Analysis: Completed atFarhan khanОценок пока нет

- 2 RR 13-2004 PDFДокумент14 страниц2 RR 13-2004 PDFJoyceОценок пока нет

- The Role of The Financial MarketsДокумент6 страницThe Role of The Financial Marketsrosalyn mauricioОценок пока нет

- Book Value per Share CalculationsДокумент3 страницыBook Value per Share CalculationsNor-hayne LucmanОценок пока нет

- Eliminating Unrealized Profit on Intercompany SalesДокумент6 страницEliminating Unrealized Profit on Intercompany SalesYuitaОценок пока нет

- Bharat Parenterals 2019Документ110 страницBharat Parenterals 2019Puneet367Оценок пока нет

- Income Tax ActДокумент711 страницIncome Tax ActPikinisoОценок пока нет