Академический Документы

Профессиональный Документы

Культура Документы

2696221C-F9C9-492B-BFFF-B665B9AF61B5

Загружено:

nishankАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2696221C-F9C9-492B-BFFF-B665B9AF61B5

Загружено:

nishankАвторское право:

Доступные форматы

A Progressive Digital Media business

COMPANY PROFILE

Bata India Limited

REFERENCE CODE: 2696221C-F9C9-492B-BFFF-B665B9AF61B5

PUBLICATION DATE: 06 Sep 2017

www.marketline.com

COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED

Bata India Limited

TABLE OF CONTENTS

TABLE OF CONTENTS

Company Overview ........................................................................................................3

Key Facts ......................................................................................................................... 3

Tickers ............................................................................................................................. 4

Business Description .....................................................................................................5

Corporate Strategy .........................................................................................................6

History ............................................................................................................................. 7

Key Employees .............................................................................................................13

Key Employee Biographies .........................................................................................14

Major Products & Services ..........................................................................................15

SWOT Analysis .............................................................................................................17

Top Competitors ...........................................................................................................22

Company View ..............................................................................................................23

Locations And Subsidaries .........................................................................................25

Financial Overview .......................................................................................................28

Bata India Limited Page 2

MarketLine

Bata India Limited

Company Overview

Company Overview

COMPANY OVERVIEW

Bata India Limited (Bata India) is a producer, wholesaler and retailer of footwear and related accessories.

The companys product portfolio consists of a comprehensive range of footwear products including

slippers, sandals, formal wear shoes, casual wear shoes, infants shoes and sport shoes for men, women

and children, and accessories such as school bags, socks, hand bags, belts, polishes and brushes. Bata

India offers these products under various brands including Bata, Ambassador, Comfit, Moccasino, Marie

Claire, Naturalizer, Pata Pata, Sundrop, Bubblegummer, Disney, Power, North Star, Hush Puppies,

Scholl, Footin and Weinbrenner. The company also provides several services such as repairs, gift cards,

and various discount offers. Bata India is headquartered in Gurgaon, Haryana, India.

The company reported revenues of (Rupee) INR25,043.4 million for the fiscal year ended March 2017

(FY2017), an increase of 2% over FY2016. In FY2017, the companys operating margin was 7.9%,

compared to an operating margin of 7.5% in FY2016. In FY2017, the company recorded a net margin of

6.3%, compared to a net margin of 8.9% in FY2016.

Key Facts

KEY FACTS

Head Office Bata India Limited

Bata House, 418/02

M. G. Road, Sector - 17

Mehrauli Gurgaon Road.

Gurgaon

Haryana

Gurgaon

Haryana

IND

Phone 91 124 3990100

Fax 91 124 3990116

Web Address www.bata.in

Revenue / turnover (INR Mn) 25,043.4

Revenue (USD Mn) 373.3

Financial Year End March

Employees 4,796

National Stock Exchange of India BATAINDIA

Ticker

Bata India Limited Page 3

MarketLine

Bata India Limited

Company Overview

Tickers

TICKERS

10000003

Bata India Limited Page 4

MarketLine

Bata India Limited

Company Overview

Business Description

BUSINESS DESCRIPTION

Bata India Limited (Bata India) is involved in manufacturing, wholesaling and retailing of footwear

products in India. It is a part of Bata Shoe Organization, operating under its strategic business unit Bata

Emerging Markets.

The company offers a wide range of footwear and related accessories under established and company-

owned brands. Its company-owned brand portfolio comprises Bata, Ambassador, Comfit, Moccasino,

Marie Claire, Naturalizer, Pata Pata, Sundrop, Bubblegummer, Disney, Power, North Star, Hush Puppies,

Scholl, Footin and Weinbrenner.

For women, it offers accessories, chappals, closed shoes, sandals and sportswear under various brands

including Bata, Comfit, Disney, Footin, Hush Puppies, Marie Claire, Naturalizer, North Star, Patapata,

Power, Scholl and Sundrops. The company under men category provides accessories, boots, casual

shoes, chappals, formal shoes, outdoor, sandals and sportswear under Bata, Comfit, Footin, Hush

Puppies, North Star, Power, Scholl and Weinbrenner brands. Under kids category, Bata India offers

various shoe and chappal for boys, girls under Bata, Bubblegummers, Disney and Power brands.

It also retails its merchandise through an e-commerce site www.bata.in. The company also offers its

products through third party e-commerce website such as Flipkart, Snapdeal, Jabong, E-bay, Amazon,

HomeShop18, Myntra, Rediff and Indiatimes.

The company classifies its business operations under two reportable segments such as Footwear and

Accessories and Surplus Property Development.

Bata Indias Footwear and Accessories segment is involved in manufacturing and trading of footwear and

accessories through its retail and wholesale network. The company operates this segment under two

divisions namely Retail and Non-Retail. Under Retail division, it operates over 1,293 retail stores in 750

cities covering a retail space of 2.62 million sq. ft which are located mainly in Malls, High Street locations

and in the Tier-2 and Tier-3 cities across India.

Non-Retail division of Bata India comprises of urban wholesale, industrial and institutional business

divisions. The urban wholesale business operates through a network of 400 distributors across India. It

also sells its products through wholesale network of 30,000 shoe dealers across India. The company

through institutional sales customizes shoes to corporate customers according to specific requirements by

various clients and industry bodies. In FY2017, the Footwear and Accessories Retail division accounted

for 87.5% of the companys total revenue followed by Non-Retail division accounted for 12.5% of the

companys total revenue.

The Surplus Property Development segment involved in the development of real estate at Batanagar, a

township situated in Konnagar, near Kolkata, which is managed and operated by the company.

Bata India manages four manufacturing facilities in Batagunj, Bihar; Batanagar, West Bengal; Bangalore,

Karnataka; and Hosur, Tamil Nadu; of which, the Batanagar, West Bengal manufacturing unit was the

first unit in the Indian shoe industry to receive ISO 9001 certification for quality management.

Bata India Limited Page 5

MarketLine

Bata India Limited

Company Overview

Corporate Strategy

CORPORATE STRATEGY

Bata India intends to expand its business operations through two dual strategies which include same

store growth and new store openings in under-served locations and cities. The companys strategy

encompasses maximizing its reach to customers through various channels by understanding the

demands of customers. In view of this, it plans to focus on smaller towns to launch more stores with a

different design and look.

In line, it opened stores in Thodupuzha and Angamaly- Tier 2 towns near Kochi, Kerala. In FY2017, the

company opened 100 new retail stores and 25 franchise stores. In FY2018, it plans to open 100 retail

stores and 50 franchise stores across India.

Bata India to expand its presence it also plans to launch various new products under womens and

childrens category based on consumers needs and insights and lifestyles. To increase childrens

category of products, it built a wide portfolio covering different occasions like school, sports, outdoor,

indoor, etc. under Bubblegummers and Disney brands.

Bata India Limited Page 6

MarketLine

Bata India Limited

Company Overview

History

HISTORY

Plans/Strategy

Year: 2017

The company plans to open 100 new retail stores and 50 franchise stores.

Plans/Strategy

Year: 2016

The company plans to close its remaining 29 stores in Switzerland as part of its ongoing restructuring

strategy.

Corporate Changes/Expansions

Year: 2016

The company opened 100 new retail stores and 25 franchise stores across India.

Corporate Changes/Expansions

Year: 2015

The company opened 159 new stores.

Plans/Strategy

Year: 2015

The company plans to open 100 new stores in FY2016.

Corporate Changes/Expansions

Year: 2014

The company opened its First Global Concept Store at The DLF Place, Saket in India.

Corporate Awards

Year: 2014

Bata India Limited Page 7

MarketLine

Bata India Limited

Company Overview

The company received the Most Trusted Brand and Udyog Rattan awards.

Others

Year: 2013

The company ranked 11 in the Most Attractive Brand of 2013.

Corporate Changes/Expansions

Year: 2013

The company opened 95 new stores including eight FOOTIN stores.

Corporate Changes/Expansions

Year: 2012

The company opened 189 new stores including 10 FOOTIN and 15 Hush Puppies branded stores.

Corporate Changes/Expansions

Year: 2012

The company launched online shopping website.

New Products/Services

Year: 2012

The company launched new brands such as Sundrops and Angry Birds.

Business / Operations Closure

Year: 2012

The company closed/relocated 60 existing stores.

Corporate Awards

Year: 2011

The company received the Most Admired Footwear Brand of the year from Images Fashion Forum.

Bata India Limited Page 8

MarketLine

Bata India Limited

Company Overview

Corporate Changes/Expansions

Year: 2011

The company opened a new large format store in Ludhiana, India.

Corporate Awards

Year: 2010

The company won the Consumer Awards 2010 as India's Most Preferred Retailer given by CNBC

Awaaz.

Corporate Awards

Year: 2009

The company won the prestigious Images award for the Most Admired Retailer of the Year Fashion &

Lifestyle.

Corporate Awards

Year: 2008

The company received The Amity Corporate Excellence award and Images Retail award.

Corporate Awards

Year: 2007

The company won the FMCG Consumer Reaction Award in Fashion & Specialties (Shoes), presented by

Bharati Vidyapeeth's Institute of Management Studies & Research.

Corporate Awards

Year: 2007

The company was named as the years Most Admired Brand in the footwear category by the Lycra

Images Fashion Awards, for the third consecutive year.

Corporate Changes/Expansions

Year: 2007

Bata India established a new flagship store in Thiruvananthapuram, Kerala, India.

Bata India Limited Page 9

MarketLine

Bata India Limited

Company Overview

Corporate Awards

Year: 2006

The company received the Retailer of the Year award in the footwear category, as part of the Reid &

Taylor Awards for Retail Excellence during the 2006 India Retail Summit.

Corporate Awards

Year: 2005

The company won the Top Retailer 2006 India Bronze award at the Retail Asia-Pacific Top 500 awards

ceremony.

Others

Year: 2005

The company was named as one of the first top 10 Super Brands of India.

Corporate Changes/Expansions

Year: 2004

The company established its new flagship store in Mumbai, Maharashtra, India.

Contracts/Agreements

Year: 2003

The company formed a partnership with Lee Cooper to retail the brands shoes.

New Products/Services

Year: 1999

The company launched the Sundrops line at New Delhi, India.

Contracts/Agreements

Year: 1997

The company signed an agreement to retail Nike products at selected Bata outlets.

Bata India Limited Page 10

MarketLine

Bata India Limited

Company Overview

Corporate Changes/Expansions

Year: 1992

The company established an export-oriented unit at Hosur, Tamil Nadu, India.

New Products/Services

Year: 1989

The company launched the Adidas collection of sports footwear.

Contracts/Agreements

Year: 1988

The company entered into an agreement with Adidas of West Germany to manufacture and market sports

and special-application footwear, sports goods and sportswear in India.

New Products/Services

Year: 1988

The company launched the Star clothing range, designed by Murjani International and sourced through

Inmark Brands Pvt Ltd.

Corporate Changes/Expansions

Year: 1973

The Bata Shoe Company Private Limited was renamed as Bata India Limited.

Stock Listings/IPO

Year: 1973

The companys shares were listed on the Bombay Stock Exchange.

Corporate Changes/Expansions

Year: 1952

The company established a factory in Faridabad, Haryana, India.

Corporate Changes/Expansions

Bata India Limited Page 11

MarketLine

Bata India Limited

Company Overview

Year: 1942

The company established a leather footwear factory at Patna, Bihar, India.

New Products/Services

Year: 1937

The company launched leather products.

Incorporation/Establishment

Year: 1931

Bata India Limited was established as Bata Shoe Company Private Limited.

Bata India Limited Page 12

MarketLine

Bata India Limited

Company Overview

Key Employees

KEY EMPLOYEES

Name Job Title Board

Vinod Kumar Mangla Assistant Vice President - Internal Senior Management

Audit

Uday Khanna Chairman Executive Board

Juan Pablo Malaver Chief Collection Manager Senior Management

Rajeev Gopalakrishnan Chief Executive Officer, Managing Executive Board

Director

Ram Kumar Gupta Chief Financial Officer, Director- Senior Management

Finance

Uttam Kumar Chief Merchandising Manager Senior Management

Maloy Kumar Gupta Compliance Officer , Secretary Senior Management

Akshay Chudasama Director Non Executive Board

Anjali Bansal Director Non Executive Board

Ravindra Dhariwal Director Non Executive Board

Shaibal Sinha Director Non Executive Board

Christopher MacDonald Kirk Director Non Executive Board

Inderpreet Singh Head-Retail Senior Management

Vikas Baijal Senior Vice President-Human Senior Management

Resource

Sanjay Kanth Senior Vice President-Manufacturing Senior Management

Kumar Sambhav Vice President-eCommerce Senior Management

Vijay Gogate Vice President-Famous Brands & Senior Management

Retail Operations (FSC)

Rupesh Bhagchandani Vice President-Franchisee Senior Management

Operations

Raman Krishnamoorthy Vice President-Information Senior Management

Technology

Manoj Goswani Vice President-Legal Senior Management

Anand Narang Vice President-Marketing and Senior Management

Consumer Services

Amitabh Coomar Vice President-Non-Retail Senior Management

Joshi Kiran Vice President-Procurement Senior Management

Matteo Lambert Vice President-Product Senior Management

Development and Research

Ankur Kohli Vice President-Real Estate Senior Management

Ankur Rastogi Vice President-Sourcing Senior Management

Bata India Limited Page 13

MarketLine

Bata India Limited

Company Overview

Key Employee Biographies

KEY EMPLOYEE BIOGRAPHIES

Uday Khanna

Board:Executive Board

Job Title:Chairman

Mr. Uday Khanna is the Chairman of the company. Prior to this, he served as the Non-Executive

Chairman from 2011 to 2014 and as Managing Director and Chief Executive Officer of Lafarge India from

2005 to 2011. Earlier, he served as the Senior Vice President for Group Strategy of Lafarge Group. Mr.

Khanna also serves on the Board of Castrol India Ltd., Pfizer Ltd., DSP BlackRock Investment Managers

Pvt. Ltd., Pidilite Industries Ltd. and Kotak Mahindra Bank Ltd.

Rajeev Gopalakrishnan

Board:Executive Board

Job Title:Chief Executive Officer, Managing Director

Age:52

Mr. Rajeev Gopalakrishnan is the Chief Executive Officer and the Managing Director of the company.

Prior to this, he served as the Managing Director of Bata Bangladesh, Managing Director - Bata Retail

Stores and also the Managing Director for Bata Thailand. Earlier, he held various positions including

Director of Wholesale Channels, Sales and Marketing of Bata International in Canada and the Vice

President of Bata India Limited for Retail Operations and Wholesale Division. Mr. Gopalakrishnan joined

Bata in 1990.

Ram Kumar Gupta

Board:Senior Management

Job Title:Chief Financial Officer, Director-Finance

Since:2015

Age:58

Mr. Ram Kumar Gupta has been the Chief Financial Officer and the Director of Finance of the company

since 2015. Prior to this, he served as the Director - Finance of Bata Shoe Company Kenya Ltd. from

2013 to 2015. Previously, he served as the Senior Vice President - Finance of the company from 2011 to

2013. Mr. Gupta joined the company in 1986.

Bata India Limited Page 14

MarketLine

Bata India Limited

Company Overview

Major Products & Services

MAJOR PRODUCTS & SERVICES

Bata India is a manufacturer, wholesaler and retailer of footwear and related accessories. The major

products and services offered by the company include the following:

Products:

Footwear:

Slippers

Sandals

Formal Shoes

Casual Shoes

Infants Shoes

Sports Shoes

Accessories:

Bags

Socks

Belts

Show Polishes

Brushes

Hand Bags

Services:

Repairs

Gifts Cards

Discounts

E-retail

Home Delivery

Brands:

Bata

Comfit

Naturalizer

Pata Pata

Disney

Hush Puppies

Sundrop

Footin

Bubblegummer

Ambassador

Moccasino

Marie Claire

Bata India Limited Page 15

MarketLine

Bata India Limited

Company Overview

Power

North Star

Scholl

Weinbrenner

Bata India Limited Page 16

MarketLine

Bata India Limited

Company Overview

SWOT Analysis

SWOT ANALYSIS

Bata India Limited (Bata India) manufactures and trades footwear and accessories through its retail and

wholesale network. Industry recognition, revenue, offerings and multiple channels selling are the main

strengths of the company, whereas low inventory turnover ratio and lack of focus on overseas operations

remains an area of concern. In the future, risks associated with changes in fashion trends, increasing

wage rate and stringent regulation could affect its growth prospects. However, growing global footwear

market, expanding retail market in India, expanding e-retail market in India and rising demand for private

labels are likely to offer ample growth opportunities to the company.

Strength Weakness

Revenue Growth Inventory Turnover Ratio

Offerings Lack of Focus on Overseas Operations

Multiple Channels Selling

Industry Recognition

Opportunity Threat

Expanding E-Retail Market in India Changes in Fashion Trends

Private Label Gaining Momentum Stringent Regulation

Expanding Retail Market in India Intense Competition

Growing Global Footwear Market

Strength

Revenue Growth

Bata India exhibited a steady revenue growth during the review year. Strong revenue performance

enables the companys ability to provide higher returns to its shareholders and also increases its ability to

allocate adequate funds for future growth initiatives. In FY2017, the company generated revenues of

INR25,043.4 million as compared to INR24,559.1 million in FY2016, with an annual growth of 2% over

FY2016. This growth in annual revenue was driven by increase in the store count by 100 and also due to

the opening of 23 franchise stores across India.

Offerings

The companys product and service offerings help it to serve diverse needs and preferences of customers

enhancing its top line performance. Bata Indias product portfolio includes a wide choice among slippers,

sandals, formal shoes, casual shoes, infants shoes and sports shoes. The company offers these

products under three categories including Mens, Womens and Kids. Under womens category, it offers

accessories, chappals, closed shoes, sandals and sportswear under several brands including Bata,

Comfit, Disney, Footin, Hush Puppies, Marie Claire, Naturalizer, North Star, Patapata, Power, Scholl and

Bata India Limited Page 17

MarketLine

Bata India Limited

Company Overview

Sundrops. Bata India under mens category provides accessories, boots, casual shoes, chappals, formal

shoes, outdoor, sandals and sportswear under Bata, Comfit, Footin, Hush Puppies, North Star, Power,

Scholl and Weinbrenner brands. The companys kids category offers various shoe and chappal for boys

and girls under Bata, Bubblegummers, Disney and Power brands. The company also offers repairs, gifts

cards, discounts, e-retail and home delivery services.

Multiple Channels Selling

The sale of merchandise through multiple channels increases the companys direct-to-consumer

business. Bata India enjoys a dominant market position, which provides it an edge over competitors while

attracting and retaining a loyal customer base. As of March 2017, the company operates over 1,293 retail

outlets across India in 750 cities covering a retail space of 2.62 million sq. ft. It also operates four

manufacturing facilities across India. These facilities holds a production capacity of 21 million footwear

pairs per annum and through its stores, Bata India sold more than 47 million footwear pairs. It also sells

its products through wholesale network of 30,000 shoe dealers across India. The company also

merchandises its products online through an ecommerce website www.bata.in. This dominant presence

in footwear retailing allows the company to enjoy an advantageous position over its competitors in terms

of long business relations with a wide network of suppliers and a strong brand image.

Industry Recognition

Bata India is one of the prominent footwear and related accessories retailer in India. The leading position

offers it a competitive edge over other players in the industry while attracting and retaining a loyal

customer base. The company's retail business has strong market positions in the India. The company

received a number of high-profile industry and consumer awards for its service quality. The company

offers a vast portfolio of footwear products, chappals, closed shoes, sandals and sportswear products. In

FY2017, it was awarded as the Top Indian Footwear Brand for 2017 in the footwear division by Dun &

Bradstreet. It also received Most Admired Retailer of the Year for 2016-17 in the footwear division by

Images Retail, India. Industry recognition enhances the companys brand image improving its revenues.

Weakness

Inventory Turnover Ratio

Bata India reported weak inventory turnover ratio during the review year. The decline in the turnover ratio

and higher inventory turnover days signify that the company incurs high inventory carrying costs, which

affect its operating performance. In FY2017, the company reported inventory turnover ratio of 1.7, lower

than one of its major competitor, Relaxo Footwears Limited (Relaxo) which reported a value of 3.2 during

the same period. Lower inventory turnover than competitors indicates that the company takes more days

to clear its inventory than its competitors. Bata India takes 210 days to sell its inventory compared to 116

days by Relaxo.

Lack of Focus on Overseas Operations

The companys operations are primarily focused in India and this could limit its revenue generation. In

Bata India Limited Page 18

MarketLine

Bata India Limited

Company Overview

FY2017, Bata India generates most of the companys total revenue from India. Dependence on the Indian

market makes the company vulnerable to economic, social, political and climatic instability in this region

and reduces demand for its products or prevents customers from coming to its stores. Any loss of sales

as a result of these factors may reduce the companys revenue generation. This also puts the company at

a disadvantage compared to geographically diversified companies such as Adidas Group, which operates

through 12,800 own-retail and franchised stores across 160 countries at the end of FY2017, and able to

offset revenue losses from one region with profits from another, and benefits from economies of scale

through centralized and bulk sourcing.

Opportunity

Expanding E-Retail Market in India

The company stands to benefit from growing online retail market in India. In FY2017, the company sold

more than 0.63 million pair of footwear products through online channels which generated revenues of

INR692 million accounting for 2.8% of the companys total revenue. Bata India also sells its merchandise

online through its website www.bata.in. The company also sells its products through third party websites

such as e-bay, jabong, flipkart, jungle and snapdeal. These initiatives are expected to strength its

presence across the country and enhance the companys capabilities to explore expanding Indian retail

market. According to the in-house research report, the online retail sales in India reached INR219 billion

in 2014 and are expected to grow at CAGR of 53.9% during 2014-19 which is expected to drive the

market to a value of INR1,282 billion by the end of 2019. Changing consumer trends, higher income

levels and an increasing desire for aspiration and luxury goods are responsible for the changing retail

sector, along with improving economic conditions creating a higher level of consumption among

consumers.

Private Label Gaining Momentum

The company stands to benefit from the increasing demand for private label products. Following a period

of slow and negative economic growth, private label sales are rising as consumers increasingly shop to a

budget. While price is a prime factor driving private label sales, improvements in packaging and quality

have helped to remove the stigma attached to buying store brands. As the company recently expanded

its private label brands such as Bata, Sundrop, Footin, Bubblegummer, Ambassador, Moccasino, Marie

Claire, Power, North Star, Scholl and Weinbrenner, it has a strong opportunity to increase its profit

margins in the future.

Expanding Retail Market in India

Bata India offers a wide range of footwear products through its retail stores which are spread across

India. In FY2017, the company invested INR512.3 million to enhance its foot wear and accessories

business of which it opened 100 new retail stores and 25 franchise stores across India. In FY2018, it

planned to open 100 new retail stores and 50 franchise stores in the Malls, High Street Markets and in the

Tier-2 and Tier-3 cities in India. These initiatives are expected to strengthen its presence across the

country and enhance the companys capabilities to explore expanding Indian retail market. Bata India

would get benefit from growth of retail spending and economic condition in India. According to in-house

Bata India Limited Page 19

MarketLine

Bata India Limited

Company Overview

research, retail market in India reached INR34,896 billion in 2014 and is expected to reach INR62,721

billion by 2019 growing at a CAGR of 12.4% during 2014-19. Food and grocery is expected to lead the

share with 62.7% of the total retail sales followed by electrical and electronics (9.3%), and clothing (7.2%)

will continue to be major product categories contributing to retail sales. Change in lifestyle, greater

employment opportunities in service sectors and increased industrial output have resulted in a new era of

consumerism with an increased per capita spending level.

Growing Global Footwear Market

Bata India offers different types of footwear through its portfolio of strong brands across various

geographies. The global footwear market has been growing at a moderate pace in the recent years and

the trend is expected to continue in the future. According to in-house research report, the global footwear

market had total revenues of US$1,493.1 billion in 2015, representing a compound annual growth rate

(CAGR) of 1.6% between 2010 and 2015. As per estimations, the global footwear market will grow at an

anticipated CAGR of 5% for the five-year period 201520, which is expected to drive the market to a

value of US$1,904.5 billion by the end of 2020. The US sales are expected to account for 41% of the

global total sales, followed by Asia-Pacific with 30%, Europe with 26% and remaining 3% from Middle

East and Africa. The growth will be primarily driven by growing world population, expanding base of

middle class consumers, rising standards of living, increasing household income and per capita spends.

Asia-Pacific represents the largest market in terms of volume sales and the third largest in terms of dollar

sales. The growing market also offers opportunity to increase market share beside sales.

Threat

Changes in Fashion Trends

The companys performance could be impacted by the frequent evolution in the fashion trends. The rate

of change in fashion trends has been increasing over the years, thereby forcing companies such as Bata

India to constantly update its product offerings with the latest market trends. To adopt the latest fashion

trends, customers often shift their loyalties to those brands that offer these trendy merchandises. Inability

of the company to change or update its collection, according to the fashion trends and varying customer

preferences, may negatively affect its brand image.

Stringent Regulation

Stringent regulations pose a challenge to retailers which might impede their growth. In India, the country

does not have heterogeneous rules and regulations, it keeps on changing state by state which result in

company has to adopt different pricing for each state that increase in cost to the company. In most of the

states in India, the companys registration is compulsory for all business whose annual turnovers is over

INR500,000, whereas in some states monetary limits of sales and purchases are also specified by state

VAT laws. The companies whose business lines are not involved in manufacturing of excisable goods

and also not engaged in providing taxable services are not eligible to offset any input service tax.

Imposition of new acts and policies by the government might escalate the operational cost of Bata India

and may affect its growth strategies.

Bata India Limited Page 20

MarketLine

Bata India Limited

Company Overview

Intense Competition

Bata India faces intense competition from both domestic and international companies in the Indian shoe

market. High competition in the market could force the company to increase its product differentiation by

offering merchandise at low prices and/or increase its promotional expenses, which might escalate its

operating costs. The companys major competitors include Liberty Shoes Limited, Metro Shoes Ltd, Mirza

International Limited, Relaxo Footwears Ltd and Adidas India Marketing Pvt. Ltd. The company also faces

competition from local malls and brand outlets. Furthermore, with India becoming an attractive retail

market, there is a gradual increase in the number of global giants such as Wal-Mart, showing interest in

the countrys retail market. Thus, there is rivalry among leading retailers for new locations and quality real

estate space, which is limited. These conditions may force the company to spend more to retain its

customers and acquire new locations, which may affects its profits.

Bata India Limited Page 21

MarketLine

Bata India Limited

Company Overview

Top Competitors

TOP COMPETITORS

The following companies are the major competitors of Bata India Limited

Action Footwear Pvt Ltd

Adidas India Marketing Pvt. Ltd.

Liberty Shoes Limited

Metro Shoes Ltd.

Mirza International Limited

Relaxo Footwears Ltd

Bata India Limited Page 22

MarketLine

Bata India Limited

Company Overview

Company View

COMPANY VIEW

A statement by Mr. Rajeev Gopalakrishnan, Chief Executive Officer and Managing Director of Bata India

Limited is given below. The statement has been taken from the companys 2016 annual report.

Dear Shareholders, It gives me immense pleasure to share with you an update on the overall

performance of your Company during 2016-17. Bata India Limited continues to be the market leader in

the organized footwear segment with a wide portfolio of products across different categories like Women,

Children, Youth, Sports and Men. In India, the demand of our shoes and accessories has been consistent

throughout the year but faced a temporary slow-down due to certain external factors beyond our control.

Despite the unknown setbacks, we have closed the Financial Year 2016-17 with a turnover of Rs. 24,972

Million.

As our customers become more and more demanding and the marketplace gets increasingly crowded,

we have realized that our best bet for winning is by offering a great product. And so for the past year we

have singularly focused on the strategy of Product is king! Here we have explored and identified for

ourselves a unique space, which is owning comfort with style as a brand. That has enabled us to not

only create comfort related innovations on large scale, but also add contemporary, sleek and quality

styling to our products.

After getting the product right, the other key milestone that we accomplished was to be commercially

aggressive. We have actively mapped the consumer preferences, fashion trends and demands to the

right target audiences through our over 1290 retail stores across 500 cities in India. Our offerings are

becoming more contemporary with comfort and wow pricing as strong differentiators. We have evolved

from building a wide range across multiple categories to now launching more flagship products and hero

collections across categories.

We have been following a dual strategy of driving same store growth and opening new stores in under-

served locations and cities. Geographically, the consumption story and the need for great shopping

experience are not limited to only the urban centres. In fact, non-urban markets are growing equally fast,

with consumers from Tier 2 and Tier 3 cities aspiring for better designs. Bata India has increased its focus

on smaller towns with internationally-designed stores being launched in these areas. The latest ones are

at Thodupuzha and Angamaly- Tier 2 towns near Kochi, Kerala. These large sized, modern concept

stores are unique with their clutter free aesthetics and visual impact which creates a truly international

shopping experience for our customers.

Now we are at the stage, even globally, where we are focusing on evolving Bata the Brand and to

encompass style and fashion very intrinsically as well. At present, we are developing the communication

across all touch points to convey Batas point of view on these attributes. We are also substantially

increasing our advertising budget for 2017. In recent past, there have been a range of stylish collections

launched, like the hand-crafted premium European Collection in Mens Dress space, The Buckline

collection giving a fashion fillip to Mens Business Casual range and the Festive range for party/marriage

wear for women. All these new initiatives were well received by our patrons and so it has made us

confident about our new focus.

Attracting and nurturing talent to build a robust pipeline of leadership has been an ongoing focus for the

Company. Our diversified workforce ranges from those at the forefront in our retail stores to those who

translate innovative ideas into products. Retaining and motivating the best people with the right skills at all

levels is the key focus to ensure that the organizations objective is accomplished.

This year, young women are the new focus market for Bata India. The first step was to sharply define our

audience and understand her aspirations so as to tailor-make our offering to excite and entice her. This

Bata India Limited Page 23

MarketLine

Bata India Limited

Company Overview

has helped shape our new brand manifesto to celebrate the modern woman. Our new television

campaign of Bata Me. And comfortable with it has been launched, highlighting the brands admiration

for women in a very special way and presenting a glimpse of the transformation in Batas image and

product line. At the product level our women focus is supported through our latest Bata Insolia range of

heels, with technology that enables women to walk taller, walk further. Leveraging on the patented

technology of Insolia owned by American company HBN Batas new line of heels can be worn three

times longer than regular heels and reduce the pressure on the front of the foot by almost 30%. This is a

benefit that no other brand can claim and our women customers are loving it.

But its not just the womens category which has kept our attention, the childrens category is also growing

at a very fast rate and offers a big opportunity for growth. We have made concrete plans to corner a major

share of this market and have built a wide portfolio covering different occasions like school, sports,

outdoor, indoor, etc. under Bubblegummers and Disney brands. The childrens category, which has been

the legacy of Bata, will be seeing further expansion in the coming times.

With majority of the population in India becoming younger, new ways to connect with the new customers

and launching new collections of footwear at a faster pace become imperative. The needs for footwear

are becoming increasingly specific, especially in sports and athleisure. We have always introduced our

products based on consumers needs and insights. Also with more and more people living healthier

lifestyles, we have launched the Power XoRise Collection with 4D mesh, memory foam, and Tunnel

technology for a run more, tire less proposition.

In another first, Bata India has partnered with fbb Colors Femina Miss India 2017 as their official

Footwear/Ramp walk partner, bringing Bata firmly in all style conversations throughout the pageant

season and beyond. Their 29 state winners also graced our key Bata stores all over the Country and

brought alive the conversation of styling, wardrobe and the need for great shoes in life!

Our achievements have further been encouraged and recognized by Dun & Bradstreet Corporate Award

as Top Indian Footwear Brand for 2017 and Images Retail Most Admired Retailer of the Year

Footwear for 2016-17. Last one year saw all of us at Bata constantly evolving with the changing times.

The consumers, going forward, will be more digitally savvy, craving for newer levels of experiences and

latest footwear solutions which are more customized and individualistic in approach and Bata India will

mirror these needs in all its offerings.

As always, I would like to take this opportunity to thank you for reposing your immense trust in us and

growing with us. We will continue to try and keep this journey as successful as it has been in the legacy

spanning more than eight decades.

Bata India Limited Page 24

MarketLine

Bata India Limited

Company Overview

Locations And Subsidaries

LOCATIONS AND SUBSIDARIES

Head Office

Bata India Limited

Bata House, 418/02

M. G. Road, Sector - 17

Mehrauli Gurgaon Road.

Gurgaon

Haryana

Gurgaon

Haryana

IND

Phone:91 124 3990100

Fax:91 124 3990116

www.bata.in

Other Locations and Subsidiaries

Bata Brands S.a.r.l. Bata India Limited

Avenue De Rhodanie 70 27B, Camac Street

Succursale De 1st Floor

Lausanne Kolkata

Lausanne West Bengal

CHE Kolkata

West Bengal

IND

Phone:91 33 22895796

Fax:91 33 22895748

Bata India Limited Bata Industrials Europe

7A, Beltala Road, 1st Floor Europaplein 1

Kolkata Noord-Brabant

West Bengal Noord-Brabant

Kolkata NLD

West Bengal

IND

Phone:91 33 24192641

Fax:91 33 24192642

Bata Malaysia Sdn Bhd Bata Properties Limited

3 1/4 Mile 6A, S.N. Banerjee Road

Jalan Kapar Kolkata

Klang West Bengal

Selangor Kolkata

Bata India Limited Page 25

MarketLine

Bata India Limited

Company Overview

Klang West Bengal

Selangor IND

MYS

Phone:60 3 33425411

Fax:60 3 33426034

bata.com.my

Bata Shoe (Singapore) Pte. Ltd. Bata Shoe Co. (Bangladesh) Ltd.

111 North Bridge Road #19-02 Peninsula Plaza Tongi

Singapore Gazipur

Singapore Gazipur

SGP BGD

Phone:65 6339 7000

Fax:65 6337 3000

www.bataintergroup.com

Bata Shoe Co. (Kenya) Ltd. Bata Shoe Co. Of Ceylon Ltd.

KEN 100, General Sir John Kotalawala Road,

Ratmalana

Ratmalana

LKA

Bata Shoe Company of Thailand PCL China Footwear Services Limited

35th floor CHN

1858-2, 1858-134-136 Bangna-Trad Road

Bangna

Bangkok

Bangkok

THA

Phone:66 2 3120341

www.bata.co.th

Coastal Commercial & Exim Limited Euro Footwear Holdings S.a.r.l

16A, Shakespeare Sarani LUX

Kolkata

West Bengal

Kolkata

West Bengal

IND

Futura Footwear Ltd. Global Footwear Services Pte Ltd.

1 Manchester Park 111 North Bridge Road

Manchester Road #19-04 Peninsula Plaza

Pinetown Singapore

Pinetown Singapore

ZAF SGP

International Footwear Investment B.V. Manufactura Boliviana S.A.

NLD BOL

Way Finders Brands Limited

204 Rashbehari Avenue

Bata India Limited Page 26

MarketLine

Bata India Limited

Company Overview

Kolkata

IND

Bata India Limited Page 27

MarketLine

Bata India Limited

Company Overview

Financial Overview

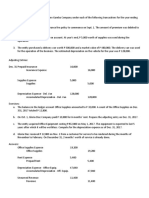

FINANCIAL OVERVIEW

Summarized Statement

*Note: Eliminations not included, all figures in Million except per share data.

Parameters Currency 2013 2014 2015 2016 2017

Income Statements

Total Revenue INR 20,651.74 0.00 26,939.95 24,559.12 25,043.36

Gross Profit INR 10,618.37 0.00 13,872.73 12,126.99 12,590.20

Operating Income INR 2,565.46 0.00 2,646.59 1,850.23 1,981.43

Net Income INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

Diluted Normalized EPS INR 15.59 0.00 16.28 12.92 13.84

Balance Sheet

Total Current Assets INR 9,231.61 0.00 10,252.09 11,576.22 13,619.11

Total Assets INR 13,820.22 0.00 16,208.10 17,330.57 19,231.38

Total Current Liabilities INR 4,628.73 0.00 4,680.85 4,092.60 4,948.44

Total Liabilities INR 5,421.48 0.00 5,658.45 5,121.33 5,988.15

Total Equity INR 8,398.74 0.00 10,549.65 12,209.24 13,243.23

Total Common Shares INR 128.53 0.00 128.53 128.53 128.53

Outstanding

Cash Flow

Cash from Operating Activities INR 1,825.04 0.00 1,187.62 2,036.42 2,565.05

Cash from Investing Activities INR -1,181.52 0.00 -660.37 -1,143.08 -2,288.18

Cash from Financing Activities INR -462.23 0.00 -504.27 -518.80 -556.97

Net Change in Cash INR 181.29 0.00 22.98 374.54 -280.10

Detailed Statement

*Note: Eliminations not included, all figures in Million except per share data.

Parameters Currency 2013 2014 2015 2016 2017

Income Statements

Revenue INR 20,651.74 0.00 26,939.95 24,559.12 25,043.36

Total Revenue INR 20,651.74 0.00 26,939.95 24,559.12 25,043.36

Cost of Revenue, Total INR 10,033.37 0.00 13,067.22 12,432.13 12,453.16

Gross Profit INR 10,618.37 0.00 13,872.73 12,126.99 12,590.20

Selling/ General/ Admin. INR 6,730.67 0.00 9,554.77 8,515.36 8,729.58

Expenses, Total

Research & Development INR 20.96 0.00 21.18 59.74 57.97

Bata India Limited Page 28

MarketLine

Bata India Limited

Company Overview

Depreciation/ Amortization INR 592.19 0.00 792.84 788.22 650.36

Unusual Expense (Income) INR 100.77 0.00 -76.06 167.31 216.69

Other Operating Expenses, Total INR 608.32 0.00 933.41 746.13 954.17

Total Operating Expense INR 18,086.28 0.00 24,293.36 22,708.89 23,061.93

Operating Income INR 2,565.46 0.00 2,646.59 1,850.23 1,981.43

Gain (Loss) on Sale of Assets INR -38.78 0.00 237.80 867.22 -62.65

Other, Net INR 123.08 0.00 184.53 1.91 20.36

Net Income Before Taxes INR 2,828.61 0.00 3,289.36 2,965.48 2,338.64

Provision for Income Taxes INR 919.57 0.00 975.95 791.58 749.13

Net Income After Taxes INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

Net Income Before Extra. Items INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

Net Income INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

Income Available to Com Excl INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

ExtraOrd

Income Available to Com Incl INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

ExtraOrd

Diluted Net Income INR 1,909.04 0.00 2,313.41 2,173.90 1,589.51

Diluted Weighted Average INR 128.53 0.00 128.53 128.53 128.53

Shares

Diluted EPS Excluding ExtraOrd INR 14.85 0.00 18.00 16.91 12.37

Items

Diluted Normalized EPS INR 15.59 0.00 16.28 12.92 13.84

DPS - Common Stock Primary INR 3.25 0.00 3.25 3.50 3.50

Issue

Balance Sheet

Cash INR 486.34 0.00 521.71 598.58 617.80

Cash & Equivalents INR 0.00 0.00 0.00 300.41 0.00

Short Term Investments INR 2,060.50 0.00 1,582.28 2,513.93 4,589.70

Cash and Short Term INR 2,546.84 0.00 2,103.99 3,412.92 5,207.50

Investments

Accounts Receivable - Trade, INR 509.20 0.00 583.99 709.96 694.08

Net

Total Receivables, Net INR 765.46 0.00 904.89 1,068.62 1,090.76

Total Inventory INR 5,826.94 0.00 7,070.04 6,902.82 7,164.73

Prepaid Expenses INR 66.44 0.00 158.65 180.08 143.25

Other Current Assets, Total INR 25.93 0.00 14.52 11.78 12.87

Total Current Assets INR 9,231.61 0.00 10,252.09 11,576.22 13,619.11

Property/ Plant/ Equipment, Total INR 6,182.85 0.00 3,243.44 3,942.30 4,281.26

- Gross

Accumulated Depreciation, Total INR -3,552.39 0.00 0.00 -773.08 -1,373.33

Property/ Plant/ Equipment, Total INR 2,630.46 0.00 3,243.44 3,169.22 2,907.93

Bata India Limited Page 29

MarketLine

Bata India Limited

Company Overview

- Net

Intangibles, Net INR 89.65 0.00 325.33 62.18 69.94

Long Term Investments INR 0.00 0.00 0.00 5.00 5.00

Note Receivable - Long Term INR 1,019.79 0.00 937.34 852.93 985.74

Other Long Term Assets, Total INR 848.71 0.00 1,449.90 1,665.02 1,643.66

Total Assets INR 13,820.22 0.00 16,208.10 17,330.57 19,231.38

Accounts Payable INR 2,861.42 0.00 3,567.50 3,286.22 4,084.47

Accrued Expenses INR 0.00 0.00 0.00 0.00 0.00

Notes Payable/ Short Term Debt INR 0.00 0.00 0.00 0.00 0.00

Other Current liabilities, Total INR 1,767.31 0.00 1,113.35 806.38 863.97

Total Current Liabilities INR 4,628.73 0.00 4,680.85 4,092.60 4,948.44

Total Long Term Debt INR 0.00 0.00 0.00 0.00 0.00

Total Debt INR 0.00 0.00 0.00 0.00 0.00

Other Liabilities, Total INR 792.75 0.00 977.60 1,028.73 1,039.71

Total Liabilities INR 5,421.48 0.00 5,658.45 5,121.33 5,988.15

Common Stock, Total INR 642.64 0.00 642.64 642.64 642.64

Additional Paid-In Capital INR 501.36 0.00 501.36 501.36 501.36

Retained Earnings (Accumulated INR 6,975.23 0.00 9,405.65 11,065.24 12,099.23

Deficit)

Unrealized Gain (Loss) INR 279.51 0.00 0.00 0.00 0.00

Total Equity INR 8,398.74 0.00 10,549.65 12,209.24 13,243.23

Total Liabilities & Shareholders' INR 13,820.22 0.00 16,208.10 17,330.57 19,231.38

Equity

Total Common Shares INR 128.53 0.00 128.53 128.53 128.53

Outstanding

Cash Flow

Net Income/ Starting Line INR 2,828.61 0.00 3,289.36 2,965.48 2,338.64

Depreciation/ Depletion INR 592.19 0.00 792.84 784.73 646.30

Amortization INR 0.00 0.00 0.00 3.49 4.06

Non-Cash Items INR 119.91 0.00 -244.11 -231.57 -300.48

Changes in Working Capital INR -1,715.67 0.00 -2,650.47 -1,485.71 -123.47

Cash from Operating Activities INR 1,825.04 0.00 1,187.62 2,036.42 2,565.05

Capital Expenditures INR -817.23 0.00 -1,464.90 -404.14 -512.74

Other Investing Cash Flow Items, INR -364.29 0.00 804.53 -738.94 -1,775.44

Total

Cash from Investing Activities INR -1,181.52 0.00 -660.37 -1,143.08 -2,288.18

Financing Cash Flow Items INR -78.52 0.00 -88.55 -102.27 -108.22

Total Cash Dividends Paid INR -383.71 0.00 -415.72 -416.53 -448.75

Issuance (Retirement) of Debt, INR 0.00 0.00 0.00 0.00 0.00

Net

Bata India Limited Page 30

MarketLine

Bata India Limited

Company Overview

Cash from Financing Activities INR -462.23 0.00 -504.27 -518.80 -556.97

Net Change in Cash INR 181.29 0.00 22.98 374.54 -280.10

Cash Interest Paid INR 12.99 0.00 17.56 17.23 16.65

Cash Taxes Paid INR 1,106.46 0.00 1,435.44 1,076.81 651.37

Capital Market Ratios

Key Ratios November 10,2017

P/E (Price/Earnings) Ratio 32.34

EV/EBITDA (Enterprise Value/Earnings Before Interest, Taxes, 0.00

Depreciation and Amortization)

Enterprise Value/Sales 0.00

Enterprise Value/Operating Profit 0.00

Enterprise Value/Total Assets 0.00

Dividend Yield 0.01

Market Cap 70,304.56

Enterprise Value 0.00

Note: The above ratios are based on

the share price as of November

10,2017, they are absolute numbers

Annual Ratios

Key Ratios Unit Currency 2013 2014 2015 2016 2017

Growth Ratios

Sales Growth % 18.94 12.09 0.00 0.00 -8.84

Operating Income Growth % 0.00 0.00 0.00 18.70 14.31

EBITDA Growth % -22.78 12.26 0.00 0.00 -8.05

Net Income Growth % 0.00 0.00 0.00 -33.52 10.94

EPS Growth % -34.14 17.80 0.00 0.00 -20.64

Working Capital Growth % 0.00 0.00 0.00 21.81 32.14

Equity Ratios

EPS (Earnings per Share) USD 0.00 0.00 20.14 13.39 14.85

Bata India Limited Page 31

MarketLine

Bata India Limited

Company Overview

Dividend per Share USD 3.00 3.25 0.00 3.25 3.50

Dividend Cover Absolute 0.00 0.00 8.06 4.46 4.57

Book Value per Share USD 54.39 65.35 0.00 82.08 94.99

Cash Value per Share USD 0.00 0.00 0.00 0.00 0.00

Profitability Ratios

Gross Margin % 0.00 0.00 50.42 50.29 51.42

Operating Margin % 12.18 12.42 0.00 9.82 7.53

Net Profit Margin % 0.00 0.00 16.71 9.34 9.24

Profit Markup % 101.18 105.83 0.00 106.16 97.55

PBT Margin (Profit Before Tax) % 0.00 0.00 22.75 13.71 13.70

Return on Equity % 24.62 22.73 0.00 21.93 17.81

Return on Capital Employed % 0.00 0.00 29.77 29.72 27.91

Return on Assets % 15.24 13.81 0.00 14.27 12.54

Return on Fixed Assets % 55.17 55.91 0.00 44.44 32.15

Return on Working Capital % 0.00 0.00 66.12 64.43 55.74

Cost Ratios

Operating Costs (% of Sales) % 87.82 87.58 0.00 90.18 92.47

Administration Costs (% of Sales) % 0.00 0.00 32.16 32.44 32.59

Liquidity Ratios

Current Ratio Absolute 1.93 1.99 0.00 2.19 2.83

Quick Ratio Absolute 0.00 0.00 0.63 0.70 0.74

Cash Ratio Absolute 0.50 0.55 0.00 0.45 0.83

Leverage Ratios

Debt to Equity Ratio Absolute 0.00 0.00 0.00 0.00 0.00

Net Debt to Equity Absolute 0.05 0.06 0.00 0.05 0.02

Debt to Capital Ratio Absolute 0.00 0.00 0.00 0.00 0.00

Efficiency Ratios

Asset Turnover Absolute 0.00 0.00 1.68 1.63 1.49

Fixed Asset Turnover Absolute 7.06 7.85 0.00 8.31 7.75

Inventory Turnover Absolute 1.98 1.72 0.00 1.85 1.80

Current Asset Turnover Absolute 2.55 2.24 0.00 2.63 2.12

Capital Employed Turnover Absolute 0.00 0.00 2.71 2.64 2.46

Working Capital Turnover Absolute 5.29 4.49 0.00 4.84 3.28

Revenue per Employee USD 0.00 0.00 0.00 0.00 0.00

Net Income per Employee USD 0.00 0.00 0.00 0.00 0.00

Capex to Sales % 4.65 3.96 0.00 5.44 1.65

R&D to Sales % 0.00 0.00 0.00 0.00 0.10

Bata India Limited Page 32

MarketLine

A Progressive Digital Media business

John Carpenter House, John Carpenter Street, London, United Kingdom, EC4Y 0AN

T: +44 (0) 203 377 3042 | F: +44 (0) 870 134 4371 | E: reachus@marketline.com | W: www.marketline.com

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Market Overview - Five Forces Analysis - PESTEL Analysis - SWOT Analysis - ConclusionДокумент8 страницMarket Overview - Five Forces Analysis - PESTEL Analysis - SWOT Analysis - ConclusionnishankОценок пока нет

- Sam 1Документ35 страницSam 1nishankОценок пока нет

- Assignment3 Group4Документ56 страницAssignment3 Group4nishankОценок пока нет

- Industry AnalysisДокумент7 страницIndustry AnalysisnishankОценок пока нет

- Indian Footwear Industry AnalysisДокумент14 страницIndian Footwear Industry AnalysisnishankОценок пока нет

- Indian Footwear Industry AnalysisДокумент14 страницIndian Footwear Industry AnalysisnishankОценок пока нет

- Principles of Macroeconomics 10th Edition Solution Manual PDFДокумент44 страницыPrinciples of Macroeconomics 10th Edition Solution Manual PDFnishankОценок пока нет

- Mycure HospitalДокумент2 страницыMycure HospitalnishankОценок пока нет

- Group 10 - Southwest AirlinesДокумент3 страницыGroup 10 - Southwest AirlinesnishankОценок пока нет

- Mycure HospitalДокумент2 страницыMycure HospitalnishankОценок пока нет

- Group 10 - Moa & AoaДокумент6 страницGroup 10 - Moa & AoanishankОценок пока нет

- In Tell EcapДокумент6 страницIn Tell EcapNirmal KumarОценок пока нет

- Group 10 Raffles Case AssignmentДокумент11 страницGroup 10 Raffles Case AssignmentnishankОценок пока нет

- Group 10 - Southwest AirlinesДокумент3 страницыGroup 10 - Southwest AirlinesnishankОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Doctora (DR - Nickmarasigan) WorksheetДокумент2 страницыDoctora (DR - Nickmarasigan) Worksheetkianna doctoraОценок пока нет

- Drilling and Development Cost-SEДокумент16 страницDrilling and Development Cost-SESyifasalwa SalsabilaОценок пока нет

- PQE 2009 AM QuestionnaireДокумент7 страницPQE 2009 AM QuestionnaireJade MarkОценок пока нет

- 16 - Property, Plant and EquipmentДокумент2 страницы16 - Property, Plant and EquipmentralphalonzoОценок пока нет

- ABM ReviewerДокумент2 страницыABM Reviewermary christy mantalabaОценок пока нет

- PPSAS 5 - Borrowing Cost NitsДокумент48 страницPPSAS 5 - Borrowing Cost NitsDianne Morada-AmigoОценок пока нет

- Exercises II - Adjusting TransactionsДокумент2 страницыExercises II - Adjusting TransactionsJowjie TV80% (5)

- Chapter 8Документ84 страницыChapter 8Ian NgaaraОценок пока нет

- Chapter 03 Im 10th EdДокумент32 страницыChapter 03 Im 10th EdAzman MendaleОценок пока нет

- UntitledДокумент5 страницUntitledCristel TannaganОценок пока нет

- Waterways Continuous ProblemДокумент18 страницWaterways Continuous ProblemAboi Boboi60% (5)

- Financial Delegated Authorities Policy: 1 PurposeДокумент10 страницFinancial Delegated Authorities Policy: 1 PurposetinmaungtheinОценок пока нет

- Shezan Annual ReportДокумент41 страницаShezan Annual Reportmudi201100% (2)

- 10 Principles - Basics of Financial ManagementДокумент13 страниц10 Principles - Basics of Financial ManagementJessa De Guzman100% (1)

- Quiz 1 Financial StatementДокумент8 страницQuiz 1 Financial StatementErvAnTjAhJaCkОценок пока нет

- Irc Gov in SP 055 2014Документ14 страницIrc Gov in SP 055 2014Karthik Reddy ArekutiОценок пока нет

- Chapter 2Документ16 страницChapter 2Rynette FloresОценок пока нет

- Accounting Final ExaminationДокумент4 страницыAccounting Final ExaminationNow OnwooОценок пока нет

- Ampalaya Ice CreamДокумент12 страницAmpalaya Ice CreamEdhel Bryan Corsiga SuicoОценок пока нет

- FIN600 Module 3 Notes - Financial Management Accounting ConceptsДокумент20 страницFIN600 Module 3 Notes - Financial Management Accounting ConceptsInés Tetuá TralleroОценок пока нет

- Henderson vs. CollectorДокумент8 страницHenderson vs. CollectorMutyaAlmodienteCocjinОценок пока нет

- LQ 1 - Set A SolutionДокумент14 страницLQ 1 - Set A SolutionChristina Jazareno64% (11)

- 2007 MFI BenchmarksДокумент42 страницы2007 MFI BenchmarksVũ TrangОценок пока нет

- Credit Evaluation ProcessДокумент73 страницыCredit Evaluation ProcessNeeRaz Kunwar100% (2)

- Busfin 6 Budget-PlanДокумент16 страницBusfin 6 Budget-PlanHazel CabreraОценок пока нет

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I ACCOUNTING CYCLE: Adjusting Journal EntriesДокумент12 страницACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I ACCOUNTING CYCLE: Adjusting Journal EntriesJerric CristobalОценок пока нет

- Chapter 14: Cash and Accrual BasisДокумент60 страницChapter 14: Cash and Accrual BasissofiaОценок пока нет

- Accs Qns VarietyДокумент55 страницAccs Qns VarietyBharatonОценок пока нет

- Tutorial 4 - Consolidated Statement of Cash FlowsДокумент6 страницTutorial 4 - Consolidated Statement of Cash FlowsFatinОценок пока нет

- Cma End NotesДокумент66 страницCma End NotesP LalithaОценок пока нет