Академический Документы

Профессиональный Документы

Культура Документы

Solutions For Practical Problems of Homework Prior To Quiz 3

Загружено:

_vanityk0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров3 страницыwerty

Оригинальное название

Solutions for Practical Problems of Homework Prior to Quiz 3

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документwerty

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров3 страницыSolutions For Practical Problems of Homework Prior To Quiz 3

Загружено:

_vanitykwerty

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

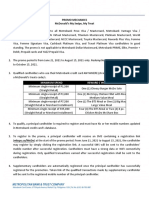

16.

Sales in units 400,000

Multiply by selling price 1.25

Sales in dollars 500,000

Multiply by contribution margin ratio 24%

Contribution margin in dollars 120,000

20. Fixed costs 200,000

Target net income 20,000

Target contribution margin in dollars 220,000

Divide by contribution margin ratio (100%-60%) 40%

Target sales 550,000

22. Sales 512,000

Less variable costs 376,000

Contribution margin 136,000

Divide by sales 512,000

Contribution margin ratio 27%

23. Fixed costs 99,840

Divide by contribution margin per unit 16

Breakeven point in units 6240

24 Month Miles Cost

High April 90,000 130,000

Less Low February 50,000 80,000

Difference 40,000 50,000

Divide by difference in miles 40,000

Unit variable cost 1.25

26 February cost 80000

Less variable cost

February miles 50,000

Multiply by unit variable cost 1.25 62,500

Fixed cost 17,500

27. Sales 600,000

Less Variable expenses 360,000

Contribution margin 240,000

Less Fixed expenses 150,000

Net income 90,000

29. Actual sales (4,000 units x P42) 168,000

Less: Break even sales

Fixed expenses 42,000

Divide by contribution margin ratio

Selling price per unit 42

Less: variable expenses 14

Contribution margin 28

Divide by selling price per unit 42 66.67% 63,000

Difference between actual sales and breakeven sales 105,000

Divide by actual sales 168,000

Margin of safety 62.5%

30. Contribution margin per unit 11.00

Divide by contribution margin ratio 56%

Selling price 19.64

32. Fixed costs 120,000

Divide by contribution margin ratio 20%

Breakeven sales 600,000

33. Machine Power

Month Hours Costs

High November 8,000 13,000

Less low April 2,400 6,400

Difference 5,600 6,600

Divide by difference in machine hours 5,600

Unit variable cost 1.18

34 APR NOV

Costs 6400 13000

Machine hours 2,400 8,000

Multiply by unit variable cost 1.18 1.18

2,832 9,440

Fixed costs 3,568 3,560

38. Variable costs 48,000

Add: Fixed costs 26,000

Breakeven sales 74,000

Divide by number of units 3,500

Breakeven point in unit price 21.14

39. Actual sales 760,000

Less: Breakeven sales 430,000

Difference 330,000

Multiply by actual sales 760,000

Margin of safety ratio 43%

42. Contribution margin 530,000

Divide by contribution margin ratio 34%

Breakeven sales 1,558,824

Less: Contribution margin ration 530,000

Variable costs 1,028,824

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- CSRGOVE Sessions 4 and 5Документ71 страницаCSRGOVE Sessions 4 and 5_vanitykОценок пока нет

- Csrgove Session 3Документ33 страницыCsrgove Session 3_vanitykОценок пока нет

- Stat Tables PDFДокумент11 страницStat Tables PDF_vanitykОценок пока нет

- Csrgove Session 7Документ47 страницCsrgove Session 7_vanitykОценок пока нет

- Csrgove Session 6Документ66 страницCsrgove Session 6_vanitykОценок пока нет

- CSRGOVE Sessions 1 and 2Документ44 страницыCSRGOVE Sessions 1 and 2_vanitykОценок пока нет

- Week 8a - Interval EstimationДокумент43 страницыWeek 8a - Interval Estimation_vanitykОценок пока нет

- Simple Linear Regression Part 1Документ63 страницыSimple Linear Regression Part 1_vanitykОценок пока нет

- Simple Linear Regression3Документ37 страницSimple Linear Regression3_vanitykОценок пока нет

- Week 5b - ProbabilityДокумент49 страницWeek 5b - Probability_vanitykОценок пока нет

- Week 8b - Hypothesis TestingДокумент51 страницаWeek 8b - Hypothesis Testing_vanitykОценок пока нет

- Week 5a - ProbabilityДокумент45 страницWeek 5a - Probability_vanitykОценок пока нет

- SK and KuДокумент23 страницыSK and Ku_vanitykОценок пока нет

- Week 5b - ProbabilityДокумент49 страницWeek 5b - Probability_vanitykОценок пока нет

- 7 PartnershipДокумент18 страниц7 Partnership_vanitykОценок пока нет

- 4 Appg - g01-g20 PDFДокумент20 страниц4 Appg - g01-g20 PDF_vanitykОценок пока нет

- Actpaco Download Lecture NotesДокумент59 страницActpaco Download Lecture NotesCharles Reginald K. Hwang100% (1)

- 7 PartnershipДокумент18 страниц7 Partnership_vanitykОценок пока нет

- 6 PartnershipДокумент12 страниц6 Partnership_vanitykОценок пока нет

- 8 Partnership2Документ7 страниц8 Partnership2_vanitykОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- PARCOR DiscussionДокумент6 страницPARCOR DiscussionSittiОценок пока нет

- 15-Minute Retirement Plan FINALДокумент23 страницы15-Minute Retirement Plan FINALUmar FarooqОценок пока нет

- Top 50 RulesДокумент53 страницыTop 50 RulesShaji HakeemОценок пока нет

- Reviewer Chapter 1 - Book 1 - Comprehensive ExamДокумент5 страницReviewer Chapter 1 - Book 1 - Comprehensive ExamKrizel Dixie ParraОценок пока нет

- Simple Deed of Mortgage - Cenotaph Road Land-ITSL ENear Final VersionДокумент37 страницSimple Deed of Mortgage - Cenotaph Road Land-ITSL ENear Final VersionSELMA G.SОценок пока нет

- Acctg1205 - Chapter 4 PROBLEMSДокумент6 страницAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronОценок пока нет

- Business and Corporate LawДокумент3 страницыBusiness and Corporate LawRuhaan TanvirОценок пока нет

- DeliveryHeroSE Annual Financial Statement FinalДокумент108 страницDeliveryHeroSE Annual Financial Statement FinalimranОценок пока нет

- P5-1A Dan P5-2AДокумент6 страницP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- Annual Report 2022 en Final WebsiteДокумент76 страницAnnual Report 2022 en Final WebsiteSin SeutОценок пока нет

- Muntiariani - NTUC Income-Security BondДокумент2 страницыMuntiariani - NTUC Income-Security BondSyscom PrintingОценок пока нет

- 2021 - MSMT (McDonald's) - Promo Mechanics - 0620Документ4 страницы2021 - MSMT (McDonald's) - Promo Mechanics - 0620kheriane veeОценок пока нет

- Jwalamala JewellersДокумент9 страницJwalamala Jewellersbharath289Оценок пока нет

- Illustration On AFN (FE 12)Документ39 страницIllustration On AFN (FE 12)Jessica Adharana KurniaОценок пока нет

- Monetary Policy and Commercial Banks in Ethiopia: Credit Creation RolePDFДокумент81 страницаMonetary Policy and Commercial Banks in Ethiopia: Credit Creation RolePDFbereket nigussieОценок пока нет

- JSW Steel LTD PDFДокумент4 страницыJSW Steel LTD PDFTanveer NОценок пока нет

- Tata Steel 2015 16 PDFДокумент300 страницTata Steel 2015 16 PDFAman PrasasdОценок пока нет

- Receivable Financing: Pledge, Assignment and FactoringДокумент35 страницReceivable Financing: Pledge, Assignment and FactoringMARY GRACE VARGASОценок пока нет

- Personal Finance SyllabusДокумент5 страницPersonal Finance SyllabusRaymond DiazОценок пока нет

- Ringkasan Kinerja Perusahaan TercatatДокумент3 страницыRingkasan Kinerja Perusahaan TercatatDian PrasetyoОценок пока нет

- Differences Between A Partnership and CorporationДокумент4 страницыDifferences Between A Partnership and CorporationIvan BendiolaОценок пока нет

- ArundelДокумент6 страницArundelArnab Pramanik100% (1)

- What Is Collateral?Документ2 страницыWhat Is Collateral?Debasish DeyОценок пока нет

- Random Walk TheoryДокумент2 страницыRandom Walk TheorySuraj TheruvathОценок пока нет

- Book Economics Organization and ManagementДокумент635 страницBook Economics Organization and ManagementHoBadalaОценок пока нет

- Internship ReportДокумент22 страницыInternship ReportBadari Nadh100% (1)

- Marriott Corporation Cost of Capital Case AnalysisДокумент11 страницMarriott Corporation Cost of Capital Case Analysisjen1861269% (13)

- Pedrosa Excel1Документ11 страницPedrosa Excel1Madaum Elementary100% (1)

- Wolfx Signals ®Документ9 страницWolfx Signals ®Fale MensОценок пока нет

- β β X, X σ X X X: Simposium Nasional Akuntansi ViДокумент12 страницβ β X, X σ X X X: Simposium Nasional Akuntansi ViNicholas AlexanderОценок пока нет