Академический Документы

Профессиональный Документы

Культура Документы

Corporate Finance Report

Загружено:

Parbon Acharjee0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров6 страницThe document summarizes the valuation of 5 Bangladeshi banks using the residual earnings valuation model. It finds that the intrinsic value of the banks is lower than the current market price, indicating the shares are overvalued. A table shows the intrinsic value, current price, and over/undervaluation status for each bank. Assumptions for the valuation include growth rates and constants held over 5 fiscal years.

Исходное описание:

This is a report done on corporate finance.

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document summarizes the valuation of 5 Bangladeshi banks using the residual earnings valuation model. It finds that the intrinsic value of the banks is lower than the current market price, indicating the shares are overvalued. A table shows the intrinsic value, current price, and over/undervaluation status for each bank. Assumptions for the valuation include growth rates and constants held over 5 fiscal years.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров6 страницCorporate Finance Report

Загружено:

Parbon AcharjeeThe document summarizes the valuation of 5 Bangladeshi banks using the residual earnings valuation model. It finds that the intrinsic value of the banks is lower than the current market price, indicating the shares are overvalued. A table shows the intrinsic value, current price, and over/undervaluation status for each bank. Assumptions for the valuation include growth rates and constants held over 5 fiscal years.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

Valuation of 5 Banks:

Residual earnings valuation model has been used to find the intrinsic value of these five banks.

Our valuation shows that the market is imperfect as the current stock prices of those shares are

overvalued.

Name Intrinsic Value Current Price Comment

CITY 40.72 51.3 Overvalued

BRAC 14.46 105.9 Overvalued

DHAKA 9.42 22 Overvalued

MERCANTILE 10.25 27.5 Overvalued

EBL 16.14 54.3 Overvalued

Assumptions:

1) Terminal growth rate 7.2%

2) Interest Growth rate is held constant for the upcoming five fiscal years

3) DPR is held constant for the upcoming five fiscal years

4) NPM is held constant for the upcoming five fiscal years

5) Cost of Equity is held constant for the upcoming five fiscal years

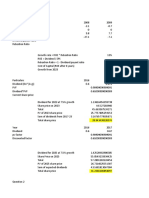

Valuation of City Bank using Residual Earnings (RE) Model

Particulars Time 0 Projected Projected Projected Projected Projected

Year 1 Year 2 Year 3 Year 4 Year 5

Interest income growth rate 6.63% 6.63% 6.63% 6.63% 6.63%

Interest income/profit on investments 16,057,152,921 17122009272 18257483314 19468258173 20759327547 22136016298

NPM 14.23% 14.23% 14.23% 14.23% 14.23%

Earnings 2436663849 2598255196 2770562738 2954297136 3150216181

DPR - dividend payout ratio 43.7% 43.7% 43.7% 43.7% 43.7%

Transfer to the equity 1370802062 1461709043 1558644668 1662008737 1772227565

CSE 22,264,106,438 23,634,908,500 25,096,617,543 26,655,262,211 28,317,270,948 30,089,498,513

Cost of equity 9.11% 9.11% 9.11% 9.11% 9.11%

Benchmark income 2027871328 2152727459 2285863629 2427828942 2579208916

Residual income 408792521 445527737 484699109 526468195 571007265

Year 1 2 3 4 5

PV of discount factor 0.92 0.84 0.77 0.71 0.65

PV of residual income 374666908.11 374248041.47 373163712.69 371485372.58 369278146.42

Summation of PV of residual income 1862842181.27

Terminal growth rate 7.20%

Continuing value 20744943174

PV of terminal value 13,416,036,235.84

Book value of equity - existing value 22264106438

Equity value 37,542,984,855.11

Number of shares outstanding 921,892,664

Value per share 40.72

Valuation of BRAC Bank using Residual Earnings (RE) Model

Projected Year Projected Projected Projected Projected

Particulars Time 0

1 Year 2 Year 3 Year 4 Year 5

Interest income growth rate 2.17% 2.17% 2.17% 2.17% 2.17%

Interest income/profit on investments 18,310,392,086 18708343848 19114944557 19530382186 19954848794 20388540612

NPM 11.74% 11.74% 11.74% 11.74% 11.74%

Earnings 2196812035 2244556792 2293339217 2343181863 2394107771

DPR - dividend payout ratio 27.7% 27.7% 27.7% 27.7% 27.7%

Transfer to the equity 1587273693 1621770954 1657017966 1693031024 1729826778

CSE 22,264,106,438 23,851,380,131 25,473,151,085 27,130,169,050 28,823,200,074 30,553,026,852

Cost of equity 11.43% 11.43% 11.43% 11.43% 11.43%

Benchmark income 2545853480 2727354870 2912800948 3102277448 3295871964

Residual income -349041445 -482798078 -619461731 -759095585 -901764193

Year 1 2 3 4 5

PV of discount factor 0.90 0.81 0.72 0.65 0.58

PV of residual income -313224846.61 -388797931.97 -447663929.53 -492281248.35 -524794193.45

Summation of PV of residual income -2166762149.91

Terminal growth rate 7.20%

Continuing value -13284710127

PV of terminal value -7731221519

Book value of equity - existing value 22,264,106,438

Equity value 12,366,122,768.71

Number of shares outstanding 855,209,694

Value per share 14.46

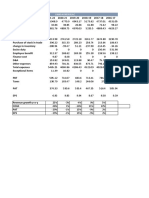

Valuation of Mercantile Bank using Residual Earnings (RE) Model

Projected Year Projected Projected Projected Projected

Particulars Time 0

1 Year 2 Year 3 Year 4 Year 5

Interest income growth rate 2.45% 2.45% 2.45% 2.45% 2.45%

Interest income/profit on investments 13,746,142,871 14082322081 14426722977 14779546630 15140999029 15511291201

NPM 12.01% 12.01% 12.01% 12.01% 12.01%

Earnings 1691979729 1733359221 1775750700 1819178917 1863669225

DPR - dividend payout ratio 31.8% 31.8% 31.8% 31.8% 31.8%

Transfer to the equity 1153214067 1181417367 1210310415 1239910078 1270233638

CSE 16,818,844,936 17,972,059,003 19,153,476,370 20,363,786,785 21,603,696,862 22,873,930,500

Cost of equity 17.78% 17.78% 17.78% 17.78% 17.78%

Benchmark income 2990959016 3196039449 3406135383 3621369476 3841867390

Residual income -1298979287 -1462680228 -1630384682 -1802190559 -1978198165

Year 1 2 3 4 5

PV of discount factor 0.85 0.72 0.61 0.52 0.44

- -

PV of residual income -997787487.22 -936407031.79 -872669383.76

1102854488.28 1054341664.39

Summation of PV of residual income -4964060055.43

Terminal growth rate 7.20%

Continuing value -8839346477

PV of terminal value -3899420785

Book value of equity - existing value 16,818,844,936

Equity value 7,955,364,095.70

Number of shares outstanding 776,114,537

Value per share 10.25

Valuation of EBL using Residual Earnings (RE) Model

Projected Year Projected Year Projected Year Projected Year Projected Year

Particulars Time 0

1 2 3 4 5

Interest income growth rate 0.09% 0.09% 0.09% 0.09% 0.09%

Interest income/profit on investments 13,662,629,884 13674535704 13686451899 13698378478 13710315450 13722262824

NPM 17.29% 17.29% 17.29% 17.29% 17.29%

Earnings 2364394716 2366455085 2368517249 2370581211 2372646970

DPR - dividend payout ratio 40.8% 40.8% 40.8% 40.8% 40.8%

Transfer to the equity 1399980341 1401200305 1402421332 1403643422 1404866578

CSE 20,831,809,735 22,231,790,076 23,632,990,380 25,035,411,712 26,439,055,134 27,843,921,713

Cost of equity 14.55% 14.55% 14.55% 14.55% 14.55%

Benchmark income 3031302829 3235018417 3438911526 3642982310 3847230925

Residual income -666908113 -868563332 -1070394277 -1272401100 -1474583954

Year 1 2 3 4 5

PV of discount factor 0.87 0.76 0.67 0.58 0.51

PV of residual income -582191568.40 -661913611.67 -712104138.57 -738964674.23 -747599592.91

Summation of PV of residual income -3442773585.79

Terminal growth rate 7.20%

Continuing value -10901810940

PV of terminal value -5527111153

Book value of equity - existing value 20,831,809,735

Equity value 11,861,924,996.20

Number of shares outstanding 734,999,590

Value per share 16.14

Valuation of DHAKA Bank using Residual Earnings (RE) Model

Projected Year Projected Projected Projected Projected

Particulars Time 0

1 Year 2 Year 3 Year 4 Year 5

Interest income growth rate 0.23% 0.23% 0.23% 0.23% 0.23%

Interest income/profit on investments 13,173,471,870 13203681099 13233959603 13264307542 13294725074 13325212359

NPM 11.69% 11.69% 11.69% 11.69% 11.69%

Earnings 1544017390 1547558110 1551106949 1554663927 1558229061

DPR - dividend payout ratio 28.7% 28.7% 28.7% 28.7% 28.7%

Transfer to the equity 1101162591 1103687762 1106218724 1108755490 1111298073

CSE 14,914,932,104 16,016,094,695 17,119,782,457 18,226,001,181 19,334,756,672 20,446,054,745

Cost of equity 17.08% 17.08% 17.08% 17.08% 17.08%

Benchmark income 2548203729 2736336441 2924900576 3113897124 3303327076

Residual income -1004186340 -1188778331 -1373793627 -1559233197 -1745098015

Year 1 2 3 4 5

PV of discount factor

0.85 0.73 0.62 0.53 0.45

PV of residual income -857656449.38 -867159482.45 -855891361.65 -829673592.12 -793076474.84

Summation of PV of residual income -4203457360.43

Terminal growth rate 7.20%

Continuing value -8600760178

PV of terminal value -3908697681

Book value of equity - existing value 14,914,932,104

Equity value

6,802,777,062.68

Number of shares outstanding 722,295,720

Value per share

9.42

Вам также может понравиться

- Public Sector Banks Comparative Analysis 3QFY24Документ10 страницPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaОценок пока нет

- SBI Press Release Q2FY22Документ2 страницыSBI Press Release Q2FY22Arjun KumarОценок пока нет

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloДокумент1 страницаDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLОценок пока нет

- Key Ratio Analysis: Profitability RatiosДокумент27 страницKey Ratio Analysis: Profitability RatioskritikaОценок пока нет

- Private Banks Fundamentals: Siddesh Naik Abhishek RanjanДокумент19 страницPrivate Banks Fundamentals: Siddesh Naik Abhishek RanjanAbhishekОценок пока нет

- Valuation Task 20 - SUPRITHA.KДокумент14 страницValuation Task 20 - SUPRITHA.KSupritha HegdeОценок пока нет

- DCF Analysis Coba2Документ6 страницDCF Analysis Coba2Main SahamОценок пока нет

- Ashok Leyland Limited: RatiosДокумент6 страницAshok Leyland Limited: RatiosAbhishek BhattacharjeeОценок пока нет

- SBI Press Release - SBI Q4 FY22 & Annual ResultsДокумент2 страницыSBI Press Release - SBI Q4 FY22 & Annual ResultsSudarshan VaradhanОценок пока нет

- PSU Banks Comparative Analysis FY21Документ10 страницPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Financial Modelling ExcelДокумент6 страницFinancial Modelling ExcelAanchal MahajanОценок пока нет

- GR I Crew XV 2018 TcsДокумент79 страницGR I Crew XV 2018 TcsMUKESH KUMARОценок пока нет

- Radico KhaitanДокумент38 страницRadico Khaitantapasya khanijouОценок пока нет

- Stock Valuation Spreadsheet TemplateДокумент5 страницStock Valuation Spreadsheet TemplatebgmanОценок пока нет

- AkzoNobel Last Five YearsДокумент2 страницыAkzoNobel Last Five YearsNawair IshfaqОценок пока нет

- 15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BankДокумент2 страницы15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BanksantuОценок пока нет

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualДокумент7 страницFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramОценок пока нет

- Sapm AssignmentДокумент4 страницыSapm Assignment401-030 B. Harika bcom regОценок пока нет

- 040821-SBI Press Release Q1FY22Документ2 страницы040821-SBI Press Release Q1FY22Prateek WadhwaniОценок пока нет

- Delta Corp Limited: Consolidated Summary Standalone SummaryДокумент5 страницDelta Corp Limited: Consolidated Summary Standalone SummaryShiva MehtaОценок пока нет

- 3 Statement Model - Blank TemplateДокумент3 страницы3 Statement Model - Blank Templated11210175Оценок пока нет

- Cigniti - Group 3 - BFBVДокумент24 страницыCigniti - Group 3 - BFBVpgdm22srijanbОценок пока нет

- FM Assigment 14 FebДокумент6 страницFM Assigment 14 FebSubhajit HazraОценок пока нет

- FIN254 ExcelTeam DynamicДокумент20 страницFIN254 ExcelTeam Dynamicfarah zarinОценок пока нет

- Private Sector Banks Comparative Analysis 1HFY22Документ12 страницPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- At Tahur LimitedДокумент24 страницыAt Tahur Limitedcristiano ronaldooОценок пока нет

- SBI Press Release Q3FY22Документ2 страницыSBI Press Release Q3FY22Virat PatelОценок пока нет

- Vertical & Horizontal AnalysisДокумент11 страницVertical & Horizontal Analysisstd25732Оценок пока нет

- 030224-SBI Press Release Q3FY24 SДокумент2 страницы030224-SBI Press Release Q3FY24 Sbhanjasomanath4Оценок пока нет

- Tata SteelДокумент66 страницTata SteelSuraj DasОценок пока нет

- Al Shaheer CompsДокумент4 страницыAl Shaheer CompsAbdullah YousufОценок пока нет

- Fin3320 Excelproject sp16 TravuobrileДокумент9 страницFin3320 Excelproject sp16 Travuobrileapi-363907405Оценок пока нет

- 6 Years at A Glance: 2015 Operating ResultsДокумент2 страницы6 Years at A Glance: 2015 Operating ResultsHassanОценок пока нет

- 180523-SBI Press Release FY23Документ2 страницы180523-SBI Press Release FY23jyottsnaОценок пока нет

- 04 02 BeginДокумент2 страницы04 02 BeginnehaОценок пока нет

- 210521-SBI Press Release Q4FY21 FinalДокумент2 страницы210521-SBI Press Release Q4FY21 Finalprivate penguinОценок пока нет

- Dupont Analysis 3 FactorДокумент7 страницDupont Analysis 3 FactorVasavi MendaОценок пока нет

- Valuation ModelsДокумент11 страницValuation ModelsPIYA THAKURОценок пока нет

- TCS Financial AnalysisДокумент5 страницTCS Financial AnalysisREVATHI NAIRОценок пока нет

- Excel Bav Vinamilk C A 3 Chúng TaДокумент47 страницExcel Bav Vinamilk C A 3 Chúng TaThu ThuОценок пока нет

- Financial Results For The Quarter Ended December 31, 2022: by Bps BpsДокумент3 страницыFinancial Results For The Quarter Ended December 31, 2022: by Bps BpsSurekha ShettyОценок пока нет

- HanssonДокумент11 страницHanssonJust Some EditsОценок пока нет

- CH 32Документ2 страницыCH 32Mukul KadyanОценок пока нет

- Abbott Laboratories (Pakistan) Limited-1Документ9 страницAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007Оценок пока нет

- FSB - 01 - Reeby SportsДокумент3 страницыFSB - 01 - Reeby SportsDhagash SanghaviОценок пока нет

- Ten Years 2006Документ2 страницыTen Years 2006Zeeshan SiddiqueОценок пока нет

- SUNDARAM CLAYTONДокумент19 страницSUNDARAM CLAYTONELIF KOTADIYAОценок пока нет

- ACC Cement: Reference ModelДокумент21 страницаACC Cement: Reference Modelsparsh jainОценок пока нет

- Marico Financial Model (Final) (Final-1Документ22 страницыMarico Financial Model (Final) (Final-1Jayant JainОценок пока нет

- ACC DCF ValuationДокумент7 страницACC DCF ValuationJitesh ThakurОценок пока нет

- FM 2 AssignmentДокумент337 страницFM 2 AssignmentAvradeep DasОценок пока нет

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Документ2 страницыKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenОценок пока нет

- ValuationДокумент10 страницValuationismat arteeОценок пока нет

- Key Performance Indicators (Kpis) : FormulaeДокумент4 страницыKey Performance Indicators (Kpis) : FormulaeAfshan AhmedОценок пока нет

- KPI BRI DIVISI PBI2 2022 UpdateДокумент146 страницKPI BRI DIVISI PBI2 2022 UpdateDessy WulandariОценок пока нет

- thu-BAV VNMДокумент45 страницthu-BAV VNMLan YenОценок пока нет

- 030223-SBI Press Release Q3FY23Документ2 страницы030223-SBI Press Release Q3FY23arun13091987Оценок пока нет

- Business Finance PeTa Shell Vs Petron FinalДокумент5 страницBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGОценок пока нет

- IndusInd BankДокумент9 страницIndusInd BankSrinivas NandikantiОценок пока нет

- Carriage of GoodsДокумент99 страницCarriage of GoodsParbon AcharjeeОценок пока нет

- Accounting Problem 5 5AДокумент8 страницAccounting Problem 5 5AParbon Acharjee100% (1)

- Financial Statements and Business Transactions: Mcgraw-Hill/IrwinДокумент33 страницыFinancial Statements and Business Transactions: Mcgraw-Hill/IrwinParbon AcharjeeОценок пока нет

- Analyzing and Recording Transactions: Mcgraw-Hill/IrwinДокумент38 страницAnalyzing and Recording Transactions: Mcgraw-Hill/IrwinParbon AcharjeeОценок пока нет

- Chap 1Документ31 страницаChap 1Parbon AcharjeeОценок пока нет

- HRM Assignment TopicДокумент5 страницHRM Assignment TopicParbon AcharjeeОценок пока нет

- Questionnaire For A Job InterviewДокумент2 страницыQuestionnaire For A Job InterviewParbon AcharjeeОценок пока нет

- UST Debt Policy Spreadsheet (Reduced)Документ9 страницUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonОценок пока нет

- Economics-: Stock Investing 101Документ2 страницыEconomics-: Stock Investing 101Tanishka Saluja0% (1)

- FIN 4610 HW 3Документ19 страницFIN 4610 HW 3Michelle Lam50% (2)

- Synopsis - Stock Market Book - FДокумент1 страницаSynopsis - Stock Market Book - Fkhantil ShahОценок пока нет

- BCE Inc. in PlayДокумент8 страницBCE Inc. in PlayunveiledtopicsОценок пока нет

- How To Be An Angel InvestorДокумент9 страницHow To Be An Angel Investorcarlyblack2006Оценок пока нет

- Ps Capital Structure Solutions PDFДокумент12 страницPs Capital Structure Solutions PDFmohan ksОценок пока нет

- Rice Company Was Incorporated On January 1Документ6 страницRice Company Was Incorporated On January 1Marjorie PalmaОценок пока нет

- 8 - Stock MarketsДокумент78 страниц8 - Stock MarketsDineAbs01Оценок пока нет

- A3 Long ProblemДокумент1 страницаA3 Long ProblemJohn Rey Bantay RodriguezОценок пока нет

- Lecture 8 - 8 Point and EV To EBITDA by CA Rachana RanadeДокумент8 страницLecture 8 - 8 Point and EV To EBITDA by CA Rachana RanadeMufaddal DaginawalaОценок пока нет

- 3 Mutual Funds Correction - 175 - 230 PDFДокумент56 страниц3 Mutual Funds Correction - 175 - 230 PDFDarsini KumarОценок пока нет

- Dividend Yield MohsinДокумент122 страницыDividend Yield MohsinSuhail MominОценок пока нет

- APO Investor Presentation February 2014Документ32 страницыAPO Investor Presentation February 2014Ram KumarОценок пока нет

- Credit Suisse Securities (Philippines) Inc.: List of OfficersДокумент5 страницCredit Suisse Securities (Philippines) Inc.: List of OfficersBroochi DealsОценок пока нет

- Reno ChartДокумент8 страницReno ChartabhishekОценок пока нет

- Ias 33 Earnings Per Share ScopeДокумент3 страницыIas 33 Earnings Per Share ScopeFurqan ButtОценок пока нет

- Ch09 Tool KitДокумент45 страницCh09 Tool KitNino NatradzeОценок пока нет

- Wisdom of Great InvestorsДокумент16 страницWisdom of Great Investorsdmoo10Оценок пока нет

- AIB Prospectus Final 12062017Документ696 страницAIB Prospectus Final 12062017grumpyfeckerОценок пока нет

- 79 TH AGMNotice-Bajaj Hindusthan LTDДокумент8 страниц79 TH AGMNotice-Bajaj Hindusthan LTDBadrinath ChavanОценок пока нет

- Advanced Corporate Finance Chapter 19Документ35 страницAdvanced Corporate Finance Chapter 19laurenОценок пока нет

- 1 Financial Statements AnalysisДокумент6 страниц1 Financial Statements AnalysisJamaica DavidОценок пока нет

- 19Документ50 страниц19Ahmed El KhateebОценок пока нет

- Trading Volume On Stock PriceДокумент11 страницTrading Volume On Stock PriceShinta KarinaОценок пока нет

- F G GSFG G Agf SFDGSGH KGJ.J: The Corporate Form of Organization Characteristics of CorporationsДокумент2 страницыF G GSFG G Agf SFDGSGH KGJ.J: The Corporate Form of Organization Characteristics of CorporationsbeachsnowОценок пока нет

- Does Stock Split Influence To Liquidity and Stock ReturnДокумент9 страницDoes Stock Split Influence To Liquidity and Stock ReturnBhavdeepsinh JadejaОценок пока нет

- Working of Stock Market and Depository ServicesДокумент59 страницWorking of Stock Market and Depository ServicesSweta Singh0% (1)

- Vaibhav Bhansali Corporate Analysis and Valuation Project NMDC PDFДокумент11 страницVaibhav Bhansali Corporate Analysis and Valuation Project NMDC PDFmk singhОценок пока нет

- Carlyle Investor Presentation - Nov13Документ256 страницCarlyle Investor Presentation - Nov13silmoonver50% (2)