Академический Документы

Профессиональный Документы

Культура Документы

Arcadia Agri 18122017

Загружено:

fredtag4393Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Arcadia Agri 18122017

Загружено:

fredtag4393Авторское право:

Доступные форматы

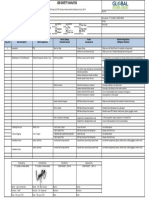

Weekly Market Report Proudly

Sponsored by

Monday, 18th December 2017

Weekly Overview continue to be burdensome. the market focus, till the Wasde

Price changes week on week. report on the 12th, will be on the South-American whether,

Price Change Change% 30 Day Low 30 Day High as there are no new fundamental inputs expected in

Corn 347.50 -5.25 -1.49% 346.50 364.50 between.

Wheat 418.25 -0.75 -0.18% 410.50 450.25

Beans 967.25 -22.50 -2.27% 964.00 1015.00

Meal 320.60 -11.10 -3.35% 311.60 348.20

Beanoil 33.16 -0.46 -1.37% 32.80 35.61

Palmoil 2551 37 1.47% 2458 2852

DCE Beans 3633 4 0.11% 3581 3830

DCE Meal 2806 -56 -1.95% 2734 2927

DCE Beanoil 5836 -80 -1.36% 5790 6358

DCE Palmoil 5300 -82 -1.54% 5208 5812

Cotton 75.92 2.20 2.98% 68.34 76.75

WTI 57.30 -0.06 -0.10% 54.63 59.05

BRENT 63.23 -0.17 -0.27% 61.00 65.83

EUR 1.17 -0.00 -0.20% 1.16 1.20

USD Index 93.93 0.03 0.03% 92.50 95.15

CNY 6.61 -0.01 -0.18% 6.5750 6.6520

As planting weather looks to improve in Argentina, Market

took risk premium off prices. No surprises in the Wasde

report. The market will look towards January weather post

planting competition. The yield-sensitive period would be

Jan/Feb.

As we had anticipated, funds would have added to short

positions on Corn due to improved weather outlook. Funds

added close to 40 k contract short on Corn and Wheat. At

current prices, it is quite possible that funds positions could

go well beyond their record short. Managed money reduced

Soybeans long position by 33 k contracts. We expect the

position in Soybeans to be short by next week’s report.

COT Report Managed Money Positions 12/12/2017

Position Change Max Long Max Short Average

Soybeans 20 (33) 254 (119) 82

SBM 68 4 102 (54) 32

Bean oil 13 (1) 127 (65) 20

Corn (197) (37) 429 (231) 103

Wheat (158) (39) 81 (162) (19)

Oilseed Complex (Soybeans, SBM & SBO)

USDA Wasde report had no surprises on oilseed complex,

the only change in was in Exports numbers, down 25 million

bu, to 2225 mbu. If using USDA export estimate,US still

needs to sell and ship 761 mbu from Dec to Aug next year

with is good 7 million mts higher than what the US had

Fundamentally, we need lower prices to solve the current

shipped last year. Ending stocks reported at 445 mbu.

balance sheet assuming we get benign weather in South

America. Firstly, US beans basis as well flat price need to

Weather forecasts have turned better for Argentina going

trade lower to start attracting demand back into the US.

into the New Year and with outlook where there is no let up

Secondly, with burdensome stocks, ideally, prices should not

of exports from South America, US balance sheet would

Arcadia Agri Pte Ltd Arcadia Agri Ltd

1 Wallich Street 6th Floor

#14-02 Guoco Tower 100 Brompton Road

Singapore 078881 London, UK SW3 1ER

Tel: +65 6411 5080 Welcome@ArcadiaAgri.com Tel: +44 20 7734 2774

Weekly REPORT |18th December 2017

incentivize more planting on beans acres, which would Soybean oil ending stocks were left unchanged as well,

happen at a lower price than current levels. though, with confirmed import duties, USDA has increased

soyoil biodiesel usage by 500 million pounds, and increasing

A couple of issues with a bearish trade view, firstly the SAM overall usage by 200 million pounds. Export was dropped by

farmer selling issues covered in a detail couple of weeks back 200 as well to keep the ending stocks unchanged.

and with trader looking to trade this from the long side, any

short trade would require patience. Argentina introduced a nominal 8% tax on biodiesel vs.

Soybean oil export tax at 27%. The logic behind this is

Over in South America, Rosario grain exchange increased the baffling, as this would not help the economics of shipping

Argentine crop estimate marginally.The fact that it was an Argentine SME unless this was part of some backroom deal

increase, even though small, has reduced the market’s negotiation deal with the US. This is just a guess at the

concern on the issues with the current crop. Argentina crop moment. Brazil Senate passed legislation to increase biofuel

is 64% planted, and expect it complete by the end of the use mandates. In the US, there is a rumor that Senate

year. Brazil crop estimate at > 112 million. finance committee has agreed on the tax extenders package,

including a continuation of the $1/gallon blending credit

retroactively for 2017 and also for 2018.

Meal dropped sharply as well, as the main reason for its

recent rally, the SAM weather concerns are no longer there

in current forecasts.

Arcadia Agri Pte Ltd Arcadia Agri Ltd

1 Wallich Street 6th Floor

#14-02 Guoco Tower 100 Brompton Road

Singapore 078881 London, UK SW3 1ER

Tel: +65 6411 5080 Welcome@ArcadiaAgri.com Tel: +44 20 7734 2774

Weekly REPORT |18th December 2017

With vol. trading at its very lows, we think it would be a good

opportunity to express trade view via long options, as there

is still time for yields to get impacted in South America.

Grains (Corn and Wheat)

Corn continued to trade lower this week due to improved

weather extended forecast for Argentina.

Corn vol., like most of options complex, continues to trade

very low levels. With most of the global Corn balance sheets

looking comfortable, there is hardly anyone ready to pay for

the price of optionality.

WASDE report changed little for Corn balance sheet, leaving BA grain exchange estimated Corn to be 45% planted vs. a

the ending stocks burdensome at 2.437 billion bu. Current year ago. Argentine Corn is due for pollination next week

burdensome stocks would prevent a significant rally. Similar until early next year, adding significance realized weather.

to Soybeans, there are no new fundamental inputs there till

12th Jan. report, so price moves would mainly be dependent

on how the much publicized improvement in South

American forecast get materialized.

Arcadia Agri Pte Ltd Arcadia Agri Ltd

1 Wallich Street 6th Floor

#14-02 Guoco Tower 100 Brompton Road

Singapore 078881 London, UK SW3 1ER

Tel: +65 6411 5080 Welcome@ArcadiaAgri.com Tel: +44 20 7734 2774

Weekly REPORT |18th December 2017

between 6 -8 cents spread, depending on the size of any

potential issues.

CBOT Soybeans Put Spread Feb -18 (expiry 26-01-2018)

reference March -18 future @ 979.50. Buy 960 Put and Sell

940 Put for cost of 3.80 cents. Maximum payoff from trade

is 16.20 cents or 4X inintial outlay. Maximum loss limited to

upfront premium payment. Bearish market strategy while

taking advantage of low vol. environment.

Wheat carryout was at 960 mbu vs. a market avg. estimate

at 930 mbu. Only change was the 25 mbu drop in exports.

Managed money continued to add shorts, but by the end of

the week, price action suggests that there would have been

some short unwinding.

US Wheat found support due to some interest cropping up

in US origin Wheat in export market at current prices.

However,export competition continues to strengthen. The

initial dismissal of large Russian crop, due to estimated that

they can possibly only export only 30 million mts were

wrong, currently the same number is close to 37 million mts.

Earlier, the risk premium on Wheat has been due to

forecasted colder winter, which would have created

winterkill issues, however current weather forecast does not

show any signs of threat.

Wheat prices last week were pushed lower due to higher

than expected Canadian Wheat crop estimated by StatsCan

at 30 MMT vs. market at 28 MMT. Trader are having a hard

time digesting this, due StatsCan using satellite images to

predict the numbers. this method has not been proven

robust in the past, hence the skepticism.

Fundamentally, not much has changed for Wheat, and we

expect to continue to trade in a range.

Trade-Ideas:

CBOT Corn Calendar Spread March 18 – July 18.

Buy Mar 18 and Sell July 18 for 16.50 cents spread. It is

currently trading at 71% of full carry of 22 cents. Target level

Arcadia Agri Pte Ltd Arcadia Agri Ltd

1 Wallich Street 6th Floor

#14-02 Guoco Tower 100 Brompton Road

Singapore 078881 London, UK SW3 1ER

Tel: +65 6411 5080 Welcome@ArcadiaAgri.com Tel: +44 20 7734 2774

Weekly REPORT |18th December 2017

Disclaimer and Important Disclosures

The information in this report is provided solely for informational purposes and should not be regarded as a recommendation to buy, sell or

otherwise deal in any particular investment. Please be aware that, where any views have been expressed in this report, the author of this report

may have had many, varied views over the past 12 months, including contrary views. A large number of views are being generated at all times,

and these may change quickly. Any valuations or underlying assumptions made are solely based on the author’s market knowledge and

experience. Furthermore, the information in this report has not been prepared in accordance with legal requirements designed to promote the

independence of investment research. The given material is subject to change and although based upon information which we consider reliable,

it is not guaranteed as to accuracy or completeness. Arcadia Agri believes that the information contained within this report is already in the

public domain. The material is not intended to be used as a general guide to investing or as a source of any specific investment recommendations.

Investors with any questions regarding the suitability of the products referred to in this presentation should consult their financial and tax

advisors.

This material does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or

to any person to whom it is unlawful to make such offer or solicitation. Persons into whose possession this document may come are required to

inform themselves of and to observe such restrictions.

This document is confidential. It may not be reproduced, distributed or transmitted without the express written consent of Acadia Agri Limited

which reserves all rights.

Arcadia Agri Pte Ltd Arcadia Agri Ltd

1 Wallich Street 6th Floor

#14-02 Guoco Tower 100 Brompton Road

Singapore 078881 London, UK SW3 1ER

Tel: +65 6411 5080 Welcome@ArcadiaAgri.com Tel: +44 20 7734 2774

Вам также может понравиться

- AQR-Introducing The New AQR SMOOTH FundДокумент2 страницыAQR-Introducing The New AQR SMOOTH Fundfredtag4393Оценок пока нет

- Active TRader-Marco Dion Interview Sep 2009Документ5 страницActive TRader-Marco Dion Interview Sep 2009fredtag4393Оценок пока нет

- Arthur MerrillДокумент20 страницArthur Merrillfredtag4393Оценок пока нет

- Arthur MerrillДокумент20 страницArthur Merrillfredtag4393Оценок пока нет

- Active TRader-Marco Dion Interview Sep 2009Документ5 страницActive TRader-Marco Dion Interview Sep 2009fredtag4393Оценок пока нет

- Arcadia Agri 01032021Документ7 страницArcadia Agri 01032021fredtag4393Оценок пока нет

- Arcadia Agri 15032021Документ7 страницArcadia Agri 15032021fredtag4393Оценок пока нет

- Arcadia Agri 29032021Документ8 страницArcadia Agri 29032021fredtag4393Оценок пока нет

- Futures Magazine Archives 02Документ23 страницыFutures Magazine Archives 02fredtag4393Оценок пока нет

- Mulitime Frame TrendДокумент7 страницMulitime Frame Trendfredtag4393Оценок пока нет

- GannSquare FrontEndDocДокумент3 страницыGannSquare FrontEndDocfredtag4393Оценок пока нет

- Average Volume&Current Volume Tim Phila TSFДокумент3 страницыAverage Volume&Current Volume Tim Phila TSFfredtag4393Оценок пока нет

- BRSI Howard WangДокумент8 страницBRSI Howard Wangfredtag4393100% (1)

- How To Pick StocksДокумент6 страницHow To Pick Stocksfredtag4393Оценок пока нет

- BRSI Howard WangДокумент8 страницBRSI Howard Wangfredtag4393100% (1)

- Bill Eckhardt The Man Who Launched 1000 SystemsДокумент17 страницBill Eckhardt The Man Who Launched 1000 Systemsfredtag4393Оценок пока нет

- Nicole Elliott Interview Series - Anne Whitby FSTA - Society of Technical AnalystsДокумент1 страницаNicole Elliott Interview Series - Anne Whitby FSTA - Society of Technical Analystsfredtag4393Оценок пока нет

- Corn Jay Kaeppel 28022019Документ4 страницыCorn Jay Kaeppel 28022019fredtag4393Оценок пока нет

- Larry Williams (Seminar Notes)Документ6 страницLarry Williams (Seminar Notes)fredtag4393100% (2)

- Eckhardt TradingДокумент30 страницEckhardt Tradingfredtag4393Оценок пока нет

- COT Commercials IndicatorДокумент4 страницыCOT Commercials Indicatorfredtag4393Оценок пока нет

- BRSI Howard WangДокумент8 страницBRSI Howard Wangfredtag4393100% (1)

- Vertical Line TSFДокумент2 страницыVertical Line TSFfredtag4393Оценок пока нет

- Open High Low Close Cart in ExcelДокумент6 страницOpen High Low Close Cart in Excelfredtag4393Оценок пока нет

- Greg Morris Core Rotation StrategyДокумент7 страницGreg Morris Core Rotation Strategyfredtag4393Оценок пока нет

- Fibonacci Time LinesДокумент3 страницыFibonacci Time Linesfredtag4393Оценок пока нет

- Greg Morris Pair Analysis 1&2Документ7 страницGreg Morris Pair Analysis 1&2fredtag4393Оценок пока нет

- Heikin Ashi Newsletter 03032019Документ34 страницыHeikin Ashi Newsletter 03032019fredtag4393Оценок пока нет

- Balance of Power Igor LivshinДокумент11 страницBalance of Power Igor Livshinfredtag4393100% (1)

- Our Technical Analysis: A Brief IntroductionДокумент8 страницOur Technical Analysis: A Brief Introductionfredtag4393Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Question: Ledger, TB: Dr cash 变多5000Документ2 страницыQuestion: Ledger, TB: Dr cash 变多5000S1X 32 許詠棋 KohYongKeeОценок пока нет

- 6american Bible Society V City of Manila - Freedom of Religion, Free Exercise of ReligionДокумент1 страница6american Bible Society V City of Manila - Freedom of Religion, Free Exercise of ReligionIanОценок пока нет

- A Synopsis Report ON A Study On Investment Analysis AT Icici Bank LTDДокумент9 страницA Synopsis Report ON A Study On Investment Analysis AT Icici Bank LTDMOHAMMED KHAYYUMОценок пока нет

- OPSS - MUNI 1440 Nov2014Документ6 страницOPSS - MUNI 1440 Nov2014P ScribedОценок пока нет

- Punching MediumДокумент42 страницыPunching Mediumnagarjuna_upscОценок пока нет

- Features of EntrepreneurshipДокумент33 страницыFeatures of EntrepreneurshipRamesh PaladuguОценок пока нет

- ICM-SU-5102-C.3 CV Selection & FabricationДокумент67 страницICM-SU-5102-C.3 CV Selection & FabricationShivani DubeyОценок пока нет

- MB20202 Corporate Finance Unit V Study MaterialsДокумент33 страницыMB20202 Corporate Finance Unit V Study MaterialsSarath kumar CОценок пока нет

- Tax Invoice: Billing Address Installation Address Invoice DetailsДокумент1 страницаTax Invoice: Billing Address Installation Address Invoice DetailsJS TradersОценок пока нет

- AUCSC Advanced Text 041211 1 PDFДокумент186 страницAUCSC Advanced Text 041211 1 PDFravi00098Оценок пока нет

- Cold Email Personalization at Scale - Becc HollandДокумент34 страницыCold Email Personalization at Scale - Becc HollandGeorge GuerraОценок пока нет

- E.O. #10 Kasambahay Desk OfficerДокумент2 страницыE.O. #10 Kasambahay Desk OfficerMarj Apolinar100% (1)

- CA Ravi Taori: List of SasДокумент3 страницыCA Ravi Taori: List of SasVikram KumarОценок пока нет

- Meet Yogesh Patel First Report SipДокумент11 страницMeet Yogesh Patel First Report SipMeet PatelОценок пока нет

- Exercise 5 VATДокумент3 страницыExercise 5 VATQuenie De la CruzОценок пока нет

- Session 3: Creating Accounting Masters in Tally - ERP 9: Go To Gateway of Tally Press F11: FeaturesДокумент12 страницSession 3: Creating Accounting Masters in Tally - ERP 9: Go To Gateway of Tally Press F11: FeaturesAfritam UgandaОценок пока нет

- JSA LandFill KHPT-BBB JOДокумент1 страницаJSA LandFill KHPT-BBB JOICEDA HumОценок пока нет

- Ent300 - Business Plan Format June2020Документ8 страницEnt300 - Business Plan Format June2020NURFAQIHAH AFIQAHОценок пока нет

- EM Nigeria Affiliates Contractor Registration FormДокумент7 страницEM Nigeria Affiliates Contractor Registration FormEmamor-Oghene.George.jr OnokpiteОценок пока нет

- openSAP dmc1 Unit 1 Introduction Presentation PDFДокумент11 страницopenSAP dmc1 Unit 1 Introduction Presentation PDFKenny RalphОценок пока нет

- Handling Unit (HU) Is The Combination of Material and Packaging MaterialДокумент22 страницыHandling Unit (HU) Is The Combination of Material and Packaging MaterialDeepakОценок пока нет

- Atul Kumar 2110139Документ8 страницAtul Kumar 2110139Atul VermaОценок пока нет

- Matemáticas y Música (Síndrome de Williams)Документ24 страницыMatemáticas y Música (Síndrome de Williams)Raquel Fraile RodríguezОценок пока нет

- Plant Human Resources Manager-DUBAIДокумент2 страницыPlant Human Resources Manager-DUBAIJc Duke M EliyasarОценок пока нет

- Sheet1: WUSERINFO-login 2000077 - Password abc123/nQUIT/n Account NumberДокумент3 страницыSheet1: WUSERINFO-login 2000077 - Password abc123/nQUIT/n Account NumberPham VietОценок пока нет

- CorFin BPCL Assignment.Документ21 страницаCorFin BPCL Assignment.Mounisha g bОценок пока нет

- Factbook 2019 Indesign Halaman 2 PDFДокумент180 страницFactbook 2019 Indesign Halaman 2 PDFerlangga suryarahmanОценок пока нет

- 1788 - Uy vs. Puzon, 79 SCRA 598 - DIGESTДокумент2 страницы1788 - Uy vs. Puzon, 79 SCRA 598 - DIGESTI took her to my penthouse and i freaked it100% (1)

- SOLON, Donnie Ray O. - Legal OpinionДокумент3 страницыSOLON, Donnie Ray O. - Legal OpinionDONNIE RAY SOLONОценок пока нет

- Globalization, Slobalization and LocalizationДокумент2 страницыGlobalization, Slobalization and LocalizationSadiq NaseerОценок пока нет