Академический Документы

Профессиональный Документы

Культура Документы

Turnover Ratios

Загружено:

Ashish3339Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Turnover Ratios

Загружено:

Ashish3339Авторское право:

Доступные форматы

The financial ratio accounts receivable turnover is a company's annual sales divided by the

company's average balance in its Accounts Receivable account during the same period of time.

For example, if a company’s sales for the most recent year were $6,000,000 and its average

balance in Accounts Receivable for the same twelve months was $600,000, its accounts receivable

turnover ratio is 10. This indicates that on average the company’s accounts receivables turned over

10 times during the year, or approximately every 36 days (360 or 365 days per year divided by the

turnover of 10).

What is the inventory turnover ratio?

The calculation for the inventory turnover ratio is: Cost of Goods Sold for a Year divided

by Average Inventory during the same 12 months.

To illustrate the inventory turnover ratio, let’s assume 1) that during the most recent year a

company’s Cost of Goods Sold was $3,600,000, and 2) the company’s average cost in its

Inventory account during the same 12 months was calculated to be $400,000. The company’s

inventory turnover ratio is 9 ($3,600,000 divided by $400,000) or 9 times.

The higher the inventory turnover ratio, the better, provided you are able to fill customers' orders

on time. It would be foolish to lose customers because you didn't carry sufficient inventory

quantities.

What is the total asset turnover ratio?

The total asset turnover ratio indicates the relationship of net sales for a specified year to the

average amount of total assets during the same 12 months.

Let's assume that during a recent year a corporation had net sales of $2,100,000 and its total

assets during the same 12 month period averaged $1,400,000. The company's total asset turnover

for the year was 1.5 (net sales of $2,100,000 divided by $1,400,000 of average total assets).

This ratio will vary by industry, as some industries are more capital intensive than others.

Always compare your company's financial ratios to the ratios of other companies in the same

industry.

What is the fixed asset turnover ratio?

The fixed asset turnover ratio shows the relationship between the annual net sales and the net

amount of fixed assets.

The net amount of fixed assets is the amount of property, plant and equipment reported on

the balance sheet after deducting the accumulated depreciation. Ideally, you should use

the average amount of net fixed assets during the year of the net sales.

A corporation having property, plant and equipment with an average gross amount of $10

million and an average accumulated depreciation of $4 million would have average net fixed

assets of $6 million. If its net sales were $18 million, its fixed asset turnover would be 3 ($18

million of net sales divided by $6 million of average net fixed assets).

What is the working capital turnover ratio?

The working capital turnover ratio is also referred to as net sales to working capital. It indicates

a company's effectiveness in using its working capital.

The working capital turnover ratio is calculated as follows: net annual sales divided by the

average amount of working capital during the same 12 month period.

For example, if a company's net sales for a recent year were $2,400,000 and its average amount

of working capital during the year was $400,000, its working capital turnover ratio was 6

($2,400,000 divided by $400,000).

Working capital is defined as the total amount of current assets minus the total amount

of current liabilities. As indicated above, you should use the average amount of working

capital for the year of the net sales.

As with most financial ratios, you should compare the working capital turnover ratio to other

companies in the same industry and to the same company's past and planned working capital

turnover ratio.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Trenching Shoring SafetyДокумент29 страницTrenching Shoring SafetyMullapudi Satish KumarОценок пока нет

- CGP Module 1 FinalДокумент19 страницCGP Module 1 Finaljohn lexter emberadorОценок пока нет

- Final Module in Human BehaviorДокумент60 страницFinal Module in Human BehaviorNarag Krizza50% (2)

- SET UP Computer ServerДокумент3 страницыSET UP Computer ServerRicHArdОценок пока нет

- List of Vocabulary C2Документ43 страницыList of Vocabulary C2Lina LilyОценок пока нет

- Coordination Compounds 1Документ30 страницCoordination Compounds 1elamathiОценок пока нет

- FIREXДокумент2 страницыFIREXPausОценок пока нет

- (Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)Документ233 страницы(Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)monomonkisidaОценок пока нет

- Impact Grammar Book Foundation Unit 1Документ3 страницыImpact Grammar Book Foundation Unit 1Domingo Juan de LeónОценок пока нет

- De Luyen Thi Vao Lop 10 Mon Tieng Anh Nam Hoc 2019Документ106 страницDe Luyen Thi Vao Lop 10 Mon Tieng Anh Nam Hoc 2019Mai PhanОценок пока нет

- Vce Smart Task 1 (Project Finance)Документ7 страницVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Oral Communication in ContextДокумент31 страницаOral Communication in ContextPrecious Anne Prudenciano100% (1)

- Transfer Pricing 8Документ34 страницыTransfer Pricing 8nigam_miniОценок пока нет

- China Daily 20181031Документ24 страницыChina Daily 20181031JackZhangОценок пока нет

- Skype OptionsДокумент2 страницыSkype OptionsacidwillОценок пока нет

- Flabbergasted! - Core RulebookДокумент160 страницFlabbergasted! - Core RulebookRobert RichesonОценок пока нет

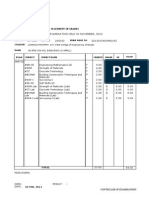

- 2024 01 31 StatementДокумент4 страницы2024 01 31 StatementAlex NeziОценок пока нет

- Nandurbar District S.E. (CGPA) Nov 2013Документ336 страницNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaОценок пока нет

- Conrad John's ResumeДокумент1 страницаConrad John's ResumeTraining & OD HRODОценок пока нет

- Psychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFДокумент56 страницPsychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFdiemdac39kgkw100% (9)

- Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Документ1 страницаCambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013RedrioxОценок пока нет

- Europe Landmarks Reading Comprehension Activity - Ver - 1Документ12 страницEurope Landmarks Reading Comprehension Activity - Ver - 1Plamenna Pavlova100% (1)

- CrisisДокумент13 страницCrisisAngel Gaddi LarenaОценок пока нет

- On The Linguistic Turn in Philosophy - Stenlund2002 PDFДокумент40 страницOn The Linguistic Turn in Philosophy - Stenlund2002 PDFPablo BarbosaОценок пока нет

- Introduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTДокумент27 страницIntroduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTMelvin J. Reyes100% (2)

- HTTP Parameter PollutionДокумент45 страницHTTP Parameter PollutionSpyDr ByTeОценок пока нет

- Engineering Graphics and Desing P1 Memo 2021Документ5 страницEngineering Graphics and Desing P1 Memo 2021dubethemba488Оценок пока нет

- EDCA PresentationДокумент31 страницаEDCA PresentationToche DoceОценок пока нет

- GemДокумент135 страницGemZelia GregoriouОценок пока нет

- IndianJPsychiatry632179-396519 110051Документ5 страницIndianJPsychiatry632179-396519 110051gion.nandОценок пока нет