Академический Документы

Профессиональный Документы

Культура Документы

Pass The 6 Study Sheet

Загружено:

EmmanuelDasiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pass The 6 Study Sheet

Загружено:

EmmanuelDasiАвторское право:

Доступные форматы

This is a Condensed Study Sheet only covering essential exam points.

Series 6 Condensed Study

Sheet

Investment Companies

• Three types of Investment Companies: Face-Amount Certificate Company, Unit

Investment Trust, Management Company

o Face-amount certificate

o Issued at a discount

o Redeemed at higher face amount on some future date

o UIT (unit investment trust) is a portfolio of income producing securities (usually

bonds or preferred stock) that is not managed

o Securities are selected and held (buy and hold)

o No management fees charged

o No board of directors

o When all bonds mature, the trust expires

o Open- and Closed-End funds are management companies

•Open-End mutual funds do NOT trade on secondary market among investors

o Bought from issuer, redeemed by issuer on primary market

o Priced by NAV plus any sales charges

o Redemption or Redeemable = Open-End fund

• Closed-End funds trade among investors, not redeemed

o Fixed number of shares

o Priced by supply & demand for the shares

• If POP is below NAV, it’s a “closed-end fund”

o Closed-End Funds also may trade at a premium to NAV

o Open-End Funds never purchased for less than NAV

Open-End Funds

• A-shares charge front-end load but lower annual operating expenses

o Suitable for long-term investments and larger amounts of money

• B-shares charge back-end load (deducted when investor sells) and higher operating

expenses

o Suitable for smaller investments and long-term

o Convert to A-shares usually after 7 years

• C-shares charge high annual operating expenses

o Suitable for short-term investments only

o Do not convert to A shares

• If POP is the same as NAV, it’s a “no-load fund”

o Still has operating expenses

o All funds have operating expenses

• Sales charges and redemption fees are NOT operating expenses

© Examzone, Inc. http://www.examzone.com/ 1

This is a Condensed Study Sheet only covering essential exam points.

o Deducted from a particular investor’s check, not fund assets

• Operating expenses include management fee, 12b-1fee, custodial and transfer agent,

legal & accounting, board of directors

o Deducted from fund assets on an ongoing basis

• A “diversified fund” follows the 75/5/10 rule.

o 75% of portfolio has no > 5% of assets invested in a particular stock and owns no

> 10% of a company’s outstanding shares

o No requirement to be “diversified fund”

• A “no-load fund” can still charge a 12b-1 fee up to .25% of average net assets

• Conduit treatment means fund distributes 90%+ of net income to shareholders

o Fund pays tax on remainder only

o Investors pay tax on dividends and capital gains received, as indicated in 1099

• Investors reinvest dividends and capital gains without paying a sales charge

o Taxed whether reinvesting or cashing the check

o Raise their cost basis by amount of reinvestment

• Investors have voting rights on:

o Board of Directors

o Approve investment adviser’s contract

o 12b-1 fees

o Changes to investment objective and policies

• The mutual fund prospectus discloses material information

o Does not have all securities in the portfolio or all shareholders

o No other sales literature is required to sell a mutual fund, unless requested by

client

o Deliver prospectus at or before solicitation

• Open-end funds priced by formula

o NAV plus any sales charges

o NAV figured at end of trading day, called “forward pricing”

• Sales charge as a percentage = POP – NAV divided by POP

• To find POP given NAV and sales charge use NAV divided by (100% - sales charge)

• If more investors buy than redeem, or if more redeem than buy, this has NO EFFECT

on the price of the fund

o The fund calculates NAV before executing purchase and redemption orders

o Based on value of securities in the portfolio, not supply and demand for shares

Variable Annuities

• Number of accumulation units and their value vary

o Not tied to AIR, just to positive returns

• Number of annuity units fixed

o Their value varies, separate account versus AIR

o Not this month vs. last month

• Earnings/growth subject to ordinary income

o Subject to 10% early withdrawal penalty

• Random withdrawals use LIFO accounting

o All withdrawals first treated as taxable earnings

© Examzone, Inc. http://www.examzone.com/ 2

This is a Condensed Study Sheet only covering essential exam points.

• Annuity payments part tax-free return of cost basis and part taxable as ordinary income

o Exclusion ratio determines how much is taxable

• No limits on income or contributions

o Contributions made “after-tax,” no current deduction

• VA’s charge “mortality & expense” risk fees to protect insurance company from

people living longer than expected

• VA’s offer death benefit during accumulation period

o Beneficiary gets greater of contract value or amount contributed

o Any amount received above contributions taxable as ordinary income to

beneficiary

• 1035 contract exchange = tax-free exchange from one annuity to another

o Can’t turn an annuity into a life insurance policy

o Within a VA, individual can move among sub-accounts without tax implications

• VA’s charge more fees than mutual funds

• Deferred annuities have surrender charges in first years of contract

o Long-term investment only

o Investor has no need for liquidity on this $

o Not suitable inside tax-deferred account

Taxation

“Marginal tax rate” is the tax owed on the next dollar of income earned

Only earned income can be used for IRA and other retirement plans

Not portfolio income (interest, dividends, capital gains)

Not passive income (from partnerships, rental income, etc.)

Until tax filing deadline (April 15th) individual can contribute to last year’s IRA

For example, can contribute for 2009 until April 15th, 2010

Indicate on IRA deposit slip for which year a contribution is being made

Bond interest is taxable at ordinary income rates

o Treasuries pay interest subject only to federal income tax

o Municipal bonds pay interest exempt from federal income tax

o Corporate bond interest taxable at federal, state, and local level

Dividends are taxable at dividend tax rates

Capital gains are taxable for the year realized

Capital gains on municipal bonds or municipal bond mutual funds taxable

just like any other capital gain

Only the interest received on a municipal bond is tax-exempt!

Variable Annuities grow tax deferred during accumulation period

Withdrawals on the “excess over cost basis” taxable as ordinary income

Not capital gains rates!

Withdrawals use LIFO (not FIFO) accounting

o Treated as the taxable earnings first, then the return of cost basis

Annuity payments = part taxable income, part return of cost basis

o Called “exclusion ratio”

© Examzone, Inc. http://www.examzone.com/ 3

This is a Condensed Study Sheet only covering essential exam points.

Mutual funds do not offer tax deferral

o Dividends, capital gains taxable for the year received

Mutual funds using “conduit theory” distribute 90% or more of net income to

shareholders

o Shareholders taxed according to 1099 received from fund

o Dividends and capital gains distributions reinvested in a mutual fund are taxable

to the investor

o Raise the investor’s cost basis by the amount reinvested

o Investor avoids sales charges on reinvestments (no effect on taxation)

INSURANCE: Partial surrenders of cash value taxed differently from variable

annuities

Use FIFO (treated as the cost basis first)

Amount up to net premiums paid not taxable

Only excess above that

Death benefit paid on life insurance not taxable to beneficiary

o Included in value of insured’s “estate” at death

Monetary & Fiscal Policy

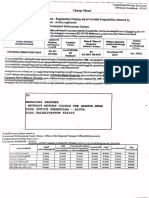

MONETARY RESERVE DISCOUNT OPEN

Federal Reserve Board

REQUIREMENT RATE Market Operations

Fight Inflation Increase Increase Sell Treasuries

Stimulate Decrease Decrease Buy Treasuries

FISCAL TAXATION GOVERNMENT

Congress & President

SPENDING

Fight Inflation Increase Decrease

Stimulate Decrease Increase

© Examzone, Inc. http://www.examzone.com/ 4

This is a Condensed Study Sheet only covering essential exam points.

NASD/FINRA Rules & Regulations

Note: the SRO is called “FINRA,” but there are still NASD Rules

Membership, Registration, and Qualification

Filing incomplete, incorrect, or misleading information is a violation

o i.e. failing to disclose disciplinary or criminal matters on U-4

Branch offices of a member firm must be registered, and an OSJ (Office of

Supervisory Jurisdiction) must be designated to oversee them

Failure to register those subject to registration is a violation

Principals = individuals managing the member's investment banking or securities

business, including supervision, solicitation (selling), conduct of business or the

training of persons for any of these functions

o Principals must be registered

o Firms (except sole proprietorships) must have at least two registered

principals, one a “financial and operations” or “FINOPS” principal

o Principals approve and file sales literature and advertising and monitor

correspondence

o Principals handle customer complaints and maintain files

o Principals approve accounts and all transactions in securities

Registered representatives = individuals engaged in the investment banking or

securities business of a member

o Registered representatives must be registered

o If out of industry 2+ years, or if registration is revoked, must re-qualify by

examinations (Series 7, i.e.)

o Series 7 is “general securities representative” selling stocks, bonds,

municipal bonds, government securities, options, investment company

shares, direct participation programs

o Series 6 is “Investment Company Products/Variable Contracts

Representative” selling investment company products only. Can sell

closed-end funds during primary offering only, not when trading among

investors on secondary market

Form U-4 used to register representatives plus fingerprint card

Form U-5 used to terminate/disassociate with representative

Registration is completed electronically through the Central Registration

Depository “CRD” system maintained by FINRA.

© Examzone, Inc. http://www.examzone.com/ 5

This is a Condensed Study Sheet only covering essential exam points.

Conduct Rules

A member must observe high standards of commercial honor and just and

equitable principles of trade

Examples of violating the above code:

o Filing misleading information concerning membership or registration of

agents, principals

o Failure to register personnel required to be registered

o Front running: placing an order for the firm’s or agent’s account that will

benefit from the placement of a large customer order afterward

For example, buy the stock for agent’s account, then place large

customer order in such a way as to move the price up for a quick

profit

o Charging excessive markups when acting as a principal on a transaction

Excessively marking up the price charged to a customer or

marking down the price paid to a customer in a securities trade

where the firm is on the other side of the transaction

o Breakpoint selling: selling investment company shares just below the next

dollar value that would give the customer a lower sales charge

o Publishing transactions that did not actually occur or publishing fictitious

prices in order to manipulate securities prices

I.e. buy stock for the firm’s account and then fraudulently drive the

price up by reporting a series of bogus transactions that make it

appear the price is rising.

o Failure to pay an arbitration award.

o Refusal to abide by rulings of the disciplinary committee

Communications with the public must not be misleading, must represent fair

dealing with customers. Communications with the public may not predict or

project performance, imply that past performance will recur or make any

exaggerated or unwarranted claim, opinion or forecast.

o For example, “Cash in when the Dow triples next month!” or, “This stock

will rise at least 1,000% by next Friday—don’t miss out!”

Communications must be approved by principal and maintained on file by the

member firm for three years following an item’s last use

o Correspondence must be monitored by compliance principal(s)

Correspondence = any written letter or electronic mail message

distributed by a member to: (A) one or more of its existing retail

customers; and (B) fewer than 25 prospective retail customers

within any 30 calendar-day period

A communication to 25+ prospects = sales literature, subject to

pre-approval.

o Sales literature, advertising, public appearances must be pre-approved by

compliance principal

© Examzone, Inc. http://www.examzone.com/ 6

This is a Condensed Study Sheet only covering essential exam points.

Sales literature = communications sent to a selected audience, i.e.

research report, market letter, cold calling script, seminar

invitations, computer slide shows

o Advertising = mass media, i.e. billboard, newspaper, radio, television,

magazine, kiosk or other electronic display

o Public appearance = participation in a seminar, forum (including an

interactive electronic forum), radio or television interview, or other public

appearance or public speaking activity.

Telemarketing rules: firm must maintain a firm-specific do-not-call list and must

check national do-not-call list to avoid calling anyone on either list.

o Don’t call the residence of any person before 8 AM or after 9 PM in their

time zone

o Exceptions = member has an established business relationship with the

person, has received the person’s prior written permission, the person is a

broker-dealer

Broker-dealers must deliver trade confirmations to customers no later than

settlement of the transaction

o Disclose whether acting as a broker or dealer

o Source and amount of any commission

Broker-dealers must disclose if they are controlled by, or under common control

with, the issuer of the securities involved in a transaction

o If the broker-dealer is owned by GE, they must disclose this when

recommending GE stock to their customers

Broker-dealers must forward proxy voting materials and annual reports to

customers delivered by the issuer

o Issuer bears the cost, i.e. GE or MSFT

Broker-dealers must provide disclosure of their financial condition upon customer

request by providing their most recent balance sheet

Suitability – Recommendations to Customers: must have reasonable grounds to

believe recommendations to customers are suitable based on information

disclosed by customer regarding his other security holdings and as to his financial

situation and needs

o Before recommending anything other than a money market mutual fund to

a non-institutional customer, broker-dealer must make reasonable effort to

obtain the following information:

Customer’s financial status

Customer’s tax status

Customer’s investment objectives

Fair Dealing: sales efforts must be undertaken within the ethical standards of the

Association's Rules, with particular emphasis on the requirement to deal fairly

with the public. Sales efforts must be judged on the basis of whether they can be

reasonably said to represent fair treatment, rather than on the argument that they

result in profits to customers

o Violations of fair dealing requirement include:

Recommending Speculative Low-Priced Securities

© Examzone, Inc. http://www.examzone.com/ 7

This is a Condensed Study Sheet only covering essential exam points.

Member has responsibility to know that speculative trading is

appropriate for investor and that it is not appropriate for most

investors

Excessive Trading Activity

Called “churning” or “overtrading”

Trading more frequently than character of the account justifies to

benefit the member at the expense of the customer

Trading (frequent selling of) Mutual Fund Shares

Mutual funds not appropriate for frequent trading

Front- and back-end sales charges, redemption fees make frequent

trades cost prohibitive for the customer

Fraudulent Activity including:

Fictitious Accounts

o Trading like crazy in an account opened in the name of a

dead person

Discretionary Accounts

o Using discretion when it’s not granted by the customer

Unauthorized Transactions

o Executing purchases and sales in customer accounts

without customer’s knowledge or consent

Misuse of Customers' Funds or Securities

o Unauthorized borrowing of customer funds and securities

Recommending Purchases Beyond Customer Capability

Pressuring customers to purchase securities beyond their

financial means, risk tolerance, objectives, etc.

Derivative Products or New Financial Products

When recommending new and/or sophisticated financial products,

member must be sure customer understands risks and

characteristics of the investment and that the investment is

suitable

CMO’s, options, limited partnerships, and other complex

investments not suitable for many investors

No member or person associated with a member shall make improper use of a

customer's securities or funds

o Violation to lend customer’s securities to the firm or other party unless the

firm has obtained from the customer a written authorization permitting the

lending of securities, i.e. “properly executed lien.”

o Firm must segregate the customer’s fully paid securities from the

securities pledged as collateral for margin loans and from the firm’s own

securities. Segregation and identification of who owns which securities.

o No member or person associated with a member shall guarantee a

customer against loss

o No sharing in profits and losses with customer account unless the

customer gives written consent, the firm gives written consent, and the

associated person shares in proportion to his investment in the account

(except for immediate family members and persons associated with the

member firm).

Must provide customers with information on SIPC and how to contact SIPC for

more information by phone and through the website www.sipc.org.

© Examzone, Inc. http://www.examzone.com/ 8

This is a Condensed Study Sheet only covering essential exam points.

Member firms operating on the premises of a bank must take precautions to make

clear the difference between the broker-dealer and banking operations.

o To the extent practical, conduct the securities business in a separate

physical space from where retail deposits are taken

o Identify the broker-dealer services as being separate from the banking

services

o Disclose orally and in writing that securities investments are:

Not FDIC insured

Not deposits of or insured by the bank

Subject to investment risks including loss of principal

Borrowing from or lending to customers is a violation unless certain procedures

are followed.

o Member must have written procedures governing the practice of

borrowing and lending with customers

o If customer is a bank or other lending institution, associated persons and

the firm may borrow money. If the customer is a broker-dealer, securities

may be borrowed

o If customer is an immediate family member or business partner, member

firm may allow (or disallow) borrowing/lending activities

No member shall deal with any non-member broker or dealer except at the same

prices, for the same commissions or fees, and on the same terms and conditions as

are accorded to the general public. Broker-dealers whose registrations are

suspended, expelled, or revoked must be treated as non-members.

o Payment of continuing commissions in connection with the sale of

securities is okay as long as the person receiving the commissions remains

a registered representative of a member of the Association.

o However, payment of compensation to registered representatives after

they cease to be employed by a member of the Association — or payment

to their widows or other beneficiaries — will not be deemed in violation

of Association Rules, provided bona fide contracts call for such payment.

o Also, a dealer-member may enter into a bona fide contract with another

dealer-member to take over and service his accounts and, after he ceases

to be a member, to pay to him or to his widow or other beneficiary

continuing commissions generated on such accounts

o Can’t pay someone who is ineligible for membership due to

disqualification such as revocation, suspension, expulsion.

Charges for services performed must be reasonable and not unfairly

discriminatory between customers (just and equitable)

o Violation to enter into securities transactions with customers at prices not

reasonably related to current market price for the security

Unusual commissions and markups must be disclosed to customer before

transaction.

Discretion = choosing which securities are bought or sold or how many

shares/units are purchased or sold without consulting the customer

© Examzone, Inc. http://www.examzone.com/ 9

This is a Condensed Study Sheet only covering essential exam points.

o Must have discretionary authorization granted by customer in writing prior

to executing first trade and account must be accepted by member in

writing.

o Discretionary orders and accounts must be reviewed frequently

o Discretion as to time and price to enter the order does not require written

authorization

Members may not sell a new issue to an account in which a “restricted person”

has a beneficial interest. Restricted persons include:

o Any officer, director, general partner, associated person, or employee of a

member or any other broker/dealer

o Any agent of a member or any other broker/dealer that is engaged in the

investment banking or securities business

o An immediate family member of a person above if the person specified in

subparagraph:

materially supports, or receives material support from, the

immediate family member;

is employed by or associated with the member, or an affiliate of

the member, selling the new issue to the immediate family

member; or

has an ability to control the allocation of the new issue.

o A finder or any person acting in a fiduciary capacity to the managing

underwriter, including attorneys, accountants and financial consultants

And their immediate family

o Any person who has authority to buy or sell securities for a bank, savings

and loan institution, insurance company, investment company, investment

advisor, or collective investment account.

And immediate family

o “Immediate family member" means a person's parents, mother-in-law or

father-in-law, spouse, brother or sister, brother-in-law or sister-in-law,

son-in-law or daughter-in-law, and children, and any other individual to

whom the person provides material support.

o "Material support" means directly or indirectly providing more than 25%

of a person's income in the prior calendar year. Members of the immediate

family living in the same household are deemed to be providing each other

with material support.

To sell variable contracts of an insurance company member must have written

sales agreement and must sell only through member firms; must forward payment

by customers promptly to the insurance company

o Can not accept payment from “offeror” in form of securities

o Member must keep records on any cash or non-cash compensation paid to

member or associated person by offeror of the variable contracts

o Gifts from offeror may not exceed current annual limit

Occasional meals, entertainment ticks ok as long as not pre-

conditioned on meeting a sales target

o Seminar/meeting attendance of member or associated person can’t be

preconditioned on meeting sales targets

© Examzone, Inc. http://www.examzone.com/ 10

This is a Condensed Study Sheet only covering essential exam points.

o Attendees must get prior approval from member, who must keep records

o Location of meeting must be appropriate (Maui looks suspicious)

o Expenses of guest can not be covered

Must make special efforts to determine suitability when selling deferred variable

annuities (deferred = surrender period, charges in early years of contract)

o customer must be informed, in general terms, of various features of

deferred variable annuities, such as the potential surrender period and

surrender charge; potential tax penalty if customers sell or redeem

deferred variable annuities before reaching the age of 59½; mortality and

expense fees; investment advisory fees; potential charges for and features

of riders; the insurance and investment components of deferred variable

annuities; and market risk

o the customer would benefit from certain features of deferred variable

annuities, such as tax-deferred growth, annuitization, or a death or living

benefit

o in general, the recommendation is suitable taking all relevant facts into

consideration

When completing a surrender/exchange of a deferred variable annuity, member

must take into consideration whether:

o the customer would incur a surrender charge, be subject to a new

surrender period, lose existing benefits (such as death, living, or other

contractual benefits), or be subject to increased fees or charges (such as

mortality and expense fees, investment advisory fees, or charges for riders

and similar product enhancements);

o the customer would benefit from product enhancements and

improvements; and

o the customer's account has had another deferred variable annuity exchange

within the preceding 36 months

Member firms may not sell investment company securities (mutual funds) if sales

charges are excessive and may only sell through member firms. Member firms

only buy shares to fill customer orders or orders for firm’s account—not in

anticipation of future orders. 8.5% is maximum sales charge and only if no 12b-1

or “asset-based sales charge.

o Breakpoint selling a violation: not giving customer appropriate sales

charge or failing to inform of breakpoints, LOI, rights of accumulation

o Selling dividends is a violation: implying that customer should buy shares

in order to receive the next dividend

o If the shares have a CDSC or “back-end sales charge,” firm must disclose

on confirmation, “On selling your shares, you may pay a sales charge. For

the charge and other fees, see the prospectus." The legend shall appear on

the front of a confirmation and in, at least, 8-point type.

o Member firms may not enter agreements to push a fund to customers

based on trading business the fund does through the firm.

o Members and associated persons may not accept gifts from mutual fund

sponsor that exceeds annual limit or suggest impropriety. Meeting and

© Examzone, Inc. http://www.examzone.com/ 11

This is a Condensed Study Sheet only covering essential exam points.

seminar attendance may not be preconditioned on meeting sales targets

and only the attendee’s (not guest’s) expenses may be reimbursed.

Each member shall establish and maintain a system to supervise the activities of

each registered representative, registered principal, and other associated person

that is reasonably designed to achieve compliance with applicable securities laws

and regulations, and with applicable NASD Rules. Firms must designate

principals and Offices of Supervisory Jurisdiction (OSJ) responsible for

supervision.

Each member must establish and implement a written anti-money laundering

program to comply with the Bank Secrecy Act

o Currency Transaction Reports filed for cash transactions > $10,000

o Suspicious Activity Reports filed for any suspicious activity

Associated persons must notify member firm of all outside activities for

compensation

o Member can refuse to allow registered person to engage in outside activity

o Passive investments not considered “outside employment”

o Investing in a limited partnership = passive investment

No person associated with a member may participate in a private securities

transaction unless the firm is notified and approves

o Rep can’t sell securities outside the firm or sell securities his firm doesn’t

want him to sell

o Otherwise, a violation called “selling away”

o If firm approves, must supervise and record transactions on regular books

and records

Before executing any transaction for an associated person or his immediate

family, a member firm must notify the employing member of their intention of

opening the account, notify the associated person of their intent to notify the

employer, and, upon request, provide the employing member with duplicate trade

confirmations or other information requested

o Associated person must notify employer of intention to open account and

notify the executing member firm that he is associated with a member firm

o If account established before employment, associated person must notify

employer of its existence and notify the firm holding the account that he is

now associated with a member firm

o Investment company shares (variables, UIT’s, open-end funds) exempt

from this requirement

Violation to give or permit to be given anything of value, in excess of $100 per

individual per year to any person, principal, proprietor, employee, agent or

representative of another person where the payment is related to the business of

the employer of the recipient. A gift of any kind is considered a gratuity.

o Occasional meals or tickets to entertainment/sporting events okay

o Reminder advertising okay (as long as it isn’t worth a lot of $)

Each member shall make and preserve books, accounts, records, memoranda, and

correspondence in conformity with all applicable laws, rules, regulations and

statements of policy

© Examzone, Inc. http://www.examzone.com/ 12

This is a Condensed Study Sheet only covering essential exam points.

o Customer Account Information: for each account, each member shall

maintain the following information:

customer's name and residence

whether customer is of legal age

signature of the registered representative introducing the account

and signature of the member or partner, officer, or manager who

accepts the account

if the customer is a corporation, partnership, or other legal entity,

the names of any persons authorized to transact business on behalf

of the entity

o For non-institutional accounts in which securities will be recommended

(most accounts), the member must obtain:

customer's tax identification or Social Security number

occupation of customer and name and address of employer

whether customer is an associated person of another member

o Record of Written Complaints: each member shall keep and preserve in

each office of supervisory jurisdiction records of customer written

complaints

Complaint means “any written statement of a customer alleging a

grievance involving the activities of those persons under the

control of the member in connection with the solicitation or

execution of any transaction or funds of that customer.”

o Requirements When Using Pre-dispute Arbitration Agreements for

Customers Accounts: any pre-dispute arbitration clause shall be

highlighted and make clear what arbitration involves

Arbitrators don’t have to explain decisions

Generally no appeals (all decisions final)

Some arbitration panelists come from securities industry

o Holding Customer Mail: a member may hold mail for a customer who will

not be at the usual address for the period of his absence, but not to exceed

2 months if the member is advised the customer will be on vacation or

traveling or not to exceed 3 months if the customer is going abroad.

Violations of Member Conduct Rules handled under Code of Procedure

o Sanctions include monetary fines, suspension, expulsion, bar

o No maximum penalty

o Failure to provide written response or cooperate taken as admission

o Respondents may appeal to National Adjudicatory Council, SEC, federal

courts

Disputes handled under Code of Arbitration

o Members, associated persons, transfer agent, others in the industry must

use arbitration (not civil court) for disputes

o Customer must use arbitration after signing pre-dispute arbitration

agreement

o Arbitration decisions are binding on all parties

o Failure to abide by decision is a violation of conduct rules

© Examzone, Inc. http://www.examzone.com/ 13

This is a Condensed Study Sheet only covering essential exam points.

Federal Securities Acts

Securities Act of 1933

Investors provided with full and fair disclosure on primary market (new issues of

securities)

Securities registered unless exemption can be claimed

SEC and other regulators neither approve nor disapprove

o No judgment passed on merits

o Issuers, underwriters unconditionally liable

Securities Act of 1934

Creates Securities and Exchange Commission (SEC)

Requires broker-dealers, associated persons to register

Requires exchanges, SRO’s to register

Gives FRB power to regulate margin

Anti-fraud, manipulation rules

Public company reports to SEC

Insider/Control Person regulation

o Officers, directors, 10% owners register

o Can’t sell short

o No “short swing” profits

o Anyone with material, non-public information = insider

o Can not share or use inside information

o Civil penalties, Criminal prosecution

Investment Company Act of 1940

Requires investment companies to register

Classifies investment companies

o Face-Amount Certificate

o Unit Investment Trust (UIT)

o Management Company

o Managed by advisor for a fee

o Usually % of assets

o Open-End - redeemable

o Closed-End – traded on secondary market

© Examzone, Inc. http://www.examzone.com/ 14

Вам также может понравиться

- Series 6 Study SheetДокумент14 страницSeries 6 Study SheetJoseph BarozОценок пока нет

- Series 22 Exam Study Guide 2022 + Test BankОт EverandSeries 22 Exam Study Guide 2022 + Test BankОценок пока нет

- SERIES 63 EXAM STUDY GUIDE 2022 + TEST BANKОт EverandSERIES 63 EXAM STUDY GUIDE 2022 + TEST BANKОценок пока нет

- Series 6 Exam Study Guide 2022 + Test BankОт EverandSeries 6 Exam Study Guide 2022 + Test BankОценок пока нет

- Complete Series 6 License Exam Training and DocumentationДокумент449 страницComplete Series 6 License Exam Training and DocumentationChad Artiaga100% (1)

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKОт EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKОценок пока нет

- Series 4 Exam Study Guide 2022 + Test BankОт EverandSeries 4 Exam Study Guide 2022 + Test BankОценок пока нет

- Series 7 Exam 2022-2023 For Dummies with Online Practice TestsОт EverandSeries 7 Exam 2022-2023 For Dummies with Online Practice TestsОценок пока нет

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKОт EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKРейтинг: 5 из 5 звезд5/5 (4)

- SERIES 66 EXAM STUDY GUIDE 2022 + TEST BANKОт EverandSERIES 66 EXAM STUDY GUIDE 2022 + TEST BANKОценок пока нет

- Securities Industry Essentials Exam 2023-2024 For Dummies with Online PracticeОт EverandSecurities Industry Essentials Exam 2023-2024 For Dummies with Online PracticeОценок пока нет

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKОт EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKОценок пока нет

- Series 7 Study Guide 2022 + Test BankОт EverandSeries 7 Study Guide 2022 + Test BankРейтинг: 5 из 5 звезд5/5 (1)

- 2023 Series 7 No-Fluff Study Guide with Practice Test Questions and AnswersОт Everand2023 Series 7 No-Fluff Study Guide with Practice Test Questions and AnswersОценок пока нет

- Series 7 Exam For Dummies: 1,001 Practice QuestionsОт EverandSeries 7 Exam For Dummies: 1,001 Practice QuestionsРейтинг: 4 из 5 звезд4/5 (4)

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKОт EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKРейтинг: 5 из 5 звезд5/5 (1)

- Series 6 ReviewДокумент202 страницыSeries 6 ReviewAnthony McnicholsОценок пока нет

- Series 7 Exam 2024-2025 For Dummies (+ 6 Practice Tests Online)От EverandSeries 7 Exam 2024-2025 For Dummies (+ 6 Practice Tests Online)Оценок пока нет

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)От EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Securities Industry Essentials Exam For Dummies with Online PracticeОт EverandSecurities Industry Essentials Exam For Dummies with Online PracticeОценок пока нет

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)От EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Оценок пока нет

- Series 26 Exam Study Guide 2022 + Test BankОт EverandSeries 26 Exam Study Guide 2022 + Test BankОценок пока нет

- SERIES 66 EXAM STUDY GUIDE 2023+ TEST BANKОт EverandSERIES 66 EXAM STUDY GUIDE 2023+ TEST BANKОценок пока нет

- 101 Ways to Score Higher on Your Series 7 Exam: What You Need to Know Explained SimplyОт Everand101 Ways to Score Higher on Your Series 7 Exam: What You Need to Know Explained SimplyОценок пока нет

- SERIES 63 EXAM STUDY GUIDE 2023+ TEST BANKОт EverandSERIES 63 EXAM STUDY GUIDE 2023+ TEST BANKРейтинг: 5 из 5 звезд5/5 (1)

- Grow Your Investments with the Best Mutual Funds and ETF’s: Making Long-Term Investment Decisions with the Best Funds TodayОт EverandGrow Your Investments with the Best Mutual Funds and ETF’s: Making Long-Term Investment Decisions with the Best Funds TodayОценок пока нет

- Series 99 Exam Study Guide 2022 + Test BankОт EverandSeries 99 Exam Study Guide 2022 + Test BankОценок пока нет

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachОт EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachОценок пока нет

- Asset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectОт EverandAsset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectОценок пока нет

- Series 57 Exam Study Guide 2022 and Test BankОт EverandSeries 57 Exam Study Guide 2022 and Test BankОценок пока нет

- Your First Government Contract: Capture and Proposal WritingОт EverandYour First Government Contract: Capture and Proposal WritingОценок пока нет

- SERIES 66 EXAM STUDY GUIDE 2021 + TEST BANKОт EverandSERIES 66 EXAM STUDY GUIDE 2021 + TEST BANKОценок пока нет

- Securities Industry Essentials Exam For Dummies with Online Practice TestsОт EverandSecurities Industry Essentials Exam For Dummies with Online Practice TestsРейтинг: 5 из 5 звезд5/5 (1)

- Series 7 Key FactsДокумент2 страницыSeries 7 Key FactsMohit VermaОценок пока нет

- Series 65 Exam Study Guide 2022 + Test BankОт EverandSeries 65 Exam Study Guide 2022 + Test BankРейтинг: 5 из 5 звезд5/5 (1)

- Technical English Exam Read The Following Text Carefully and Repeatedly Then Answer The Ensuing ExercisesДокумент3 страницыTechnical English Exam Read The Following Text Carefully and Repeatedly Then Answer The Ensuing ExercisessabriОценок пока нет

- SERIES 63 FUTURES LICENSING EXAM REVIEW 2021+ TEST BANKОт EverandSERIES 63 FUTURES LICENSING EXAM REVIEW 2021+ TEST BANKОценок пока нет

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKОт EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKОценок пока нет

- Series 6 Study GuideДокумент8 страницSeries 6 Study GuideelОценок пока нет

- SERIES 7 EXAM STUDY GUIDE + TEST BANKОт EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKРейтинг: 2.5 из 5 звезд2.5/5 (3)

- Morningstar Guide to Mutual Funds: Five-Star Strategies for SuccessОт EverandMorningstar Guide to Mutual Funds: Five-Star Strategies for SuccessОценок пока нет

- SIE Exam Prep 2021-2022: SIE Study Guide with 300 Questions and Detailed Answer Explanations for the FINRA Securities Industry Essentials Exam (Includes 4 Full-Length Practice Tests)От EverandSIE Exam Prep 2021-2022: SIE Study Guide with 300 Questions and Detailed Answer Explanations for the FINRA Securities Industry Essentials Exam (Includes 4 Full-Length Practice Tests)Рейтинг: 5 из 5 звезд5/5 (1)

- Stocks, Bonds & Taxes: A Comprehensive Handbook and Investment Guide for EverybodyОт EverandStocks, Bonds & Taxes: A Comprehensive Handbook and Investment Guide for EverybodyОценок пока нет

- The Mortgage Encyclopedia: The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second EditionОт EverandThe Mortgage Encyclopedia: The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second EditionОценок пока нет

- Fund Accounting A Complete Guide - 2020 EditionОт EverandFund Accounting A Complete Guide - 2020 EditionРейтинг: 2 из 5 звезд2/5 (1)

- Biblical Mathematics X X 1 and 70 72Документ3 страницыBiblical Mathematics X X 1 and 70 72EmmanuelDasiОценок пока нет

- BrainBoosting 1 and 2Документ2 страницыBrainBoosting 1 and 2EmmanuelDasiОценок пока нет

- Quantitative Strategy With RДокумент25 страницQuantitative Strategy With REmmanuelDasiОценок пока нет

- 10 FREE FINRA Series 6 Top Off Exam Practice Questions in PDF FormatДокумент3 страницы10 FREE FINRA Series 6 Top Off Exam Practice Questions in PDF FormatEmmanuelDasiОценок пока нет

- Cash Flow WaterfallДокумент8 страницCash Flow WaterfallEmmanuelDasiОценок пока нет

- Analyzing Real-Time Data With SparkДокумент7 страницAnalyzing Real-Time Data With SparkEmmanuelDasiОценок пока нет

- Risk Measures and Capital AllocationДокумент156 страницRisk Measures and Capital AllocationEmmanuelDasiОценок пока нет

- STA Election YearДокумент44 страницыSTA Election YearEmmanuelDasiОценок пока нет

- AlgoTrading101 Full SyllabusДокумент6 страницAlgoTrading101 Full SyllabusEmmanuelDasiОценок пока нет

- Pass The 66 Study SheetДокумент4 страницыPass The 66 Study SheetEmmanuelDasiОценок пока нет

- FRM Questions and Answers On VaRДокумент4 страницыFRM Questions and Answers On VaREmmanuelDasiОценок пока нет

- Pass The 66 Study SheetДокумент4 страницыPass The 66 Study SheetEmmanuelDasiОценок пока нет

- Volat Trad 690GДокумент38 страницVolat Trad 690GEmmanuelDasiОценок пока нет

- CPP For Financial Mathematics Cpp-Book-SolutionsДокумент11 страницCPP For Financial Mathematics Cpp-Book-SolutionsEmmanuelDasiОценок пока нет

- CPP Chapter0 SlidesДокумент13 страницCPP Chapter0 SlidesEmmanuelDasiОценок пока нет

- FRM Exam Questions Financial Markets and ProductsДокумент4 страницыFRM Exam Questions Financial Markets and ProductsEmmanuelDasiОценок пока нет

- FRM Part 1 FormulaSheetДокумент45 страницFRM Part 1 FormulaSheetEmmanuelDasi100% (2)

- Important Topics For FRM I ExamДокумент2 страницыImportant Topics For FRM I ExamEmmanuelDasiОценок пока нет

- UUbillДокумент1 страницаUUbillGaby PlayGame0% (1)

- Bank Reconciliation StatementДокумент33 страницыBank Reconciliation StatementMd TahirОценок пока нет

- Asset Protection-Untouchable WealthДокумент14 страницAsset Protection-Untouchable WealthMubanga100% (1)

- Red ONEДокумент6 страницRed ONEHakimEngineerEmasОценок пока нет

- By Changing Nothing, Nothing Changes.Документ2 страницыBy Changing Nothing, Nothing Changes.Kritika KapoorОценок пока нет

- Project Finance ValuationДокумент141 страницаProject Finance ValuationRohit KatariaОценок пока нет

- Vivas Vs Monetary Board of BSPДокумент5 страницVivas Vs Monetary Board of BSPmimisabayton100% (1)

- KL07CN9034 PDFДокумент9 страницKL07CN9034 PDFGimson JoseОценок пока нет

- Assignment 1 - Individual Assignment Fin430Документ7 страницAssignment 1 - Individual Assignment Fin430NURMISHA AQMA SOFIA SELAMATОценок пока нет

- What Is Commercial PaperДокумент3 страницыWhat Is Commercial PaperSj Rao100% (1)

- Principles and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Документ19 страницPrinciples and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Dr. Julius B. BertilloОценок пока нет

- EC-Manual (Updated Upto 31 Dec 2019)Документ126 страницEC-Manual (Updated Upto 31 Dec 2019)Syed Zahid ShahОценок пока нет

- Cbse Class 12Документ26 страницCbse Class 12Viditya ChauhanОценок пока нет

- Bank StatementДокумент30 страницBank StatementFerhan IskandarОценок пока нет

- Lecture NotesДокумент32 страницыLecture NotessamgoshОценок пока нет

- Bop PDFДокумент95 страницBop PDFNabeel Safdar100% (1)

- Activity Based Consent FaqsДокумент1 страницаActivity Based Consent FaqsSai GollaОценок пока нет

- F214741 Berat Zeka Cafe Le Marche Cafe Le Marche EUДокумент2 страницыF214741 Berat Zeka Cafe Le Marche Cafe Le Marche EUCristian CoffeelingОценок пока нет

- TopaДокумент16 страницTopaGaurav Pandey100% (1)

- EDP by Gowtham Kumar C.K PDFДокумент84 страницыEDP by Gowtham Kumar C.K PDFDeepthi Gowda100% (3)

- Unit 6-Money (Practice)Документ6 страницUnit 6-Money (Practice)Quân đoànОценок пока нет

- Michael Gavin and Ricardo Hausmann Office of The Chief Economist Inter-American Development Bank January 27, 1998Документ20 страницMichael Gavin and Ricardo Hausmann Office of The Chief Economist Inter-American Development Bank January 27, 1998Nathaniel MccallОценок пока нет

- Relevant Jurisprudence On MuttumДокумент3 страницыRelevant Jurisprudence On MuttumUlyana Ledang FortunatoОценок пока нет

- Transaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoДокумент2 страницыTransaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoIntan BinalandОценок пока нет

- Barclays BankДокумент4 страницыBarclays BanktsundereadamsОценок пока нет

- Fintech Report 2019Документ28 страницFintech Report 2019Nadeem KhanОценок пока нет

- Ref: File No: Proposal No:: M/S Ramraj Cold StorageДокумент4 страницыRef: File No: Proposal No:: M/S Ramraj Cold StoragePATLAОценок пока нет

- Inside Job - The Documentary That Cost $20,000,000,000,000 To ProduceДокумент30 страницInside Job - The Documentary That Cost $20,000,000,000,000 To ProduceForeclosure Fraud100% (6)

- The International Comparative Legal Guide To - Real Estate 2015Документ13 страницThe International Comparative Legal Guide To - Real Estate 2015Panos KolОценок пока нет

- Emotional Intelligence ProjectДокумент67 страницEmotional Intelligence ProjectVijay AnandОценок пока нет