Академический Документы

Профессиональный Документы

Культура Документы

Financial Modeling Assignment

Загружено:

Afsheen AbbasiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Modeling Assignment

Загружено:

Afsheen AbbasiАвторское право:

Доступные форматы

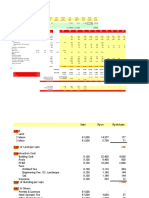

Q.

1

Years FV Q.2

i 20% 1 500

2 1050

3 1150 calculate PV by using i

4 1250 PV

5 1350 1. PV bu using formula

6 1450 2. PV by using NPV function

7 1550

8 1700

9 1850

10 1900

SOLUTION: Q1 SOLUTION:Q2

1. assuming PMT at the end of the ye

PV BY USING FORMULA

Years FV PV FV

1 500 416.6667

2 1050 729.1667

3 1150 665.5093 2. At the beginning of the year

4 1250 602.8164

5 1350 542.5347 FV

6 1450 485.6021

7 1550 432.5766

8 1700 395.3657

9 1850 358.5424

10 1900 306.8606

PV BY USING FORMULA IS 4935.641

PV BY USING NPV £4,935.64

SUBMITTED BY: HAMEEDUL

MBA

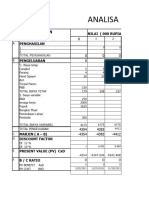

i 10%

Q.3

Years PMT Years

1 200 0 -10000

6% 2 200 1 2000

500 3 200 2 3000

4 200 3 6000

5 200 4 5000

6 200 5 4000

6 7000

Calculate FV 7 4500

8 9500

1. assuming PMT at the end of the year 9 8500

2. At the beginning of the year 10 1500

SOLUTION:Q2 SOLUTION:3

ng PMT at the end of the year Net present value of the project

Years FV

£685.80 0 -10000 -10000

1 2000 1818.182

2 3000 2479.339

beginning of the year 3 6000 4507.889

4 5000 3415.067

£769.51 5 4000 2483.685

6 7000 3951.318

7 4500 2309.212

8 9500 4431.82

9 8500 3604.83

10 1500 578.3149

NPV 19579.66

BY: HAMEEDULLAH ABBASI (01-120142-014)

MBA 2N

Calculate Net present value of the project

f the project

Вам также может понравиться

- Session - 10 - ClassДокумент8 страницSession - 10 - ClassTestОценок пока нет

- TVM ClassДокумент19 страницTVM ClassPurvi VijayОценок пока нет

- Practice Problems 2Документ9 страницPractice Problems 2Divyam GargОценок пока нет

- 0497427936124Документ18 страниц0497427936124Saleh AlgdaryОценок пока нет

- Project ManagemantДокумент2 страницыProject ManagemantTanu SinghОценок пока нет

- Allied Sugar Company!!: Financial SummaryДокумент2 страницыAllied Sugar Company!!: Financial SummaryFawad Ejaz BhattíОценок пока нет

- Inr Cr. Q Revenue Contribution To PE Contribution To Group Fixed Cost TVCДокумент12 страницInr Cr. Q Revenue Contribution To PE Contribution To Group Fixed Cost TVCSaagar ChitkaraОценок пока нет

- Capital Budgeting Assignment - G Venket Ramana - Roll No-14Документ5 страницCapital Budgeting Assignment - G Venket Ramana - Roll No-14Venket RamanaОценок пока нет

- Hire PurchaseДокумент6 страницHire PurchaseMehneelParulekarОценок пока нет

- Master Template v1Документ79 страницMaster Template v1KiranОценок пока нет

- Free Cash FlowДокумент11 страницFree Cash FlowAbdul Hameed LoundОценок пока нет

- Free Cash FlowДокумент11 страницFree Cash FlowAbdul Hameed LoundОценок пока нет

- Ekonomi Hans DadiДокумент279 страницEkonomi Hans DadiHans DadiОценок пока нет

- UntitledДокумент89 страницUntitledGYAN BHUSHAN PatelОценок пока нет

- Cash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. MДокумент26 страницCash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. Mangg4interОценок пока нет

- Activity Weeks 1 2 3 4 5 6 7 A B C D E F G H I J Total CummulativeДокумент5 страницActivity Weeks 1 2 3 4 5 6 7 A B C D E F G H I J Total CummulativeMohammad NaumanОценок пока нет

- Game BalancingДокумент5 страницGame Balancingiphone itiwОценок пока нет

- Terjadi Pada Titik Singgung Antara Kurva Isocost Dan Isoquan TДокумент9 страницTerjadi Pada Titik Singgung Antara Kurva Isocost Dan Isoquan TYudhi SutanaОценок пока нет

- BudgetДокумент2 страницыBudgetvijayОценок пока нет

- Bajaj Finserv ReportДокумент6 страницBajaj Finserv ReportAdarsh ChavelОценок пока нет

- Quiz 3032Документ4 страницыQuiz 3032PG93Оценок пока нет

- Cost AccountingДокумент24 страницыCost AccountingJalo NacionОценок пока нет

- Process Costing ExcelДокумент6 страницProcess Costing ExcelClaire BarbaОценок пока нет

- DR Reddy LabsДокумент6 страницDR Reddy LabsAdarsh ChavelОценок пока нет

- YTM at Time of Issuance (At Par)Документ8 страницYTM at Time of Issuance (At Par)tech& GamingОценок пока нет

- Project X: Wacc Years Units Sold Sale Price V.C SalesДокумент1 страницаProject X: Wacc Years Units Sold Sale Price V.C SalesJjjjjjjjjjОценок пока нет

- MDKA SucorДокумент6 страницMDKA SucorFathan MujibОценок пока нет

- Migsun Wynn: Total Grand Total With S.TДокумент6 страницMigsun Wynn: Total Grand Total With S.TThe investors fortuneОценок пока нет

- Solution Workshop #2Документ12 страницSolution Workshop #2ScribdTranslationsОценок пока нет

- Solution For Internal TestДокумент3 страницыSolution For Internal Testsumera dervishОценок пока нет

- Calpine SolutionДокумент5 страницCalpine SolutionDarshan GosaliaОценок пока нет

- CF Assignment 6Документ4 страницыCF Assignment 6Kush SinglaОценок пока нет

- Midterm Income-Tax SolutionДокумент4 страницыMidterm Income-Tax SolutionJennylyn MacatiagОценок пока нет

- EMI Calculator - Prepayment OptionДокумент15 страницEMI Calculator - Prepayment OptionKiran MulyaОценок пока нет

- EMI Calculator - Prepayment OptionДокумент15 страницEMI Calculator - Prepayment OptionKiran MulyaОценок пока нет

- Calculaiton of PI Index AT 10%Документ4 страницыCalculaiton of PI Index AT 10%shivaniОценок пока нет

- Blanko UTДокумент5 страницBlanko UTnovi antiОценок пока нет

- MGT 115 Removal Exam 1S AY 2017 2018 25 Sept 2018Документ6 страницMGT 115 Removal Exam 1S AY 2017 2018 25 Sept 2018Kadita MageОценок пока нет

- A SheetДокумент24 страницыA SheetBilal AliОценок пока нет

- Minicase Management KeuanganДокумент5 страницMinicase Management Keuangansiti nurjannahОценок пока нет

- Exam 2 ReviewДокумент53 страницыExam 2 ReviewNkeih FidelisОценок пока нет

- Data TablesДокумент12 страницData TablesmayankОценок пока нет

- Lab Simulation Assignment 7 NIKHILДокумент10 страницLab Simulation Assignment 7 NIKHILNikhil ReddyОценок пока нет

- Estimation of Initial Investment: A) Preliminary and Preoperating ExpДокумент14 страницEstimation of Initial Investment: A) Preliminary and Preoperating ExpShiv Pratap SinghОценок пока нет

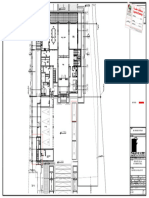

- A102 Ground Floor Plan (Proposed) 1367844246310Документ1 страницаA102 Ground Floor Plan (Proposed) 1367844246310Ramees MalikОценок пока нет

- 25 - Process ModelingДокумент9 страниц25 - Process ModelingArmel BrissyОценок пока нет

- Book1 3Документ45 страницBook1 3baohangaooiОценок пока нет

- Assignment 1 - Project Management - Fairuza Fasya RДокумент3 страницыAssignment 1 - Project Management - Fairuza Fasya RFairuza Fasya RahadistyОценок пока нет

- ABC Case StudyДокумент5 страницABC Case StudyAkanksha KОценок пока нет

- Base Case Analysis Best CaseДокумент6 страницBase Case Analysis Best CaseMaphee CastellОценок пока нет

- Denomination Petty Cash Total Denomination PCF Gasoline PCF - Regular PCF - RM CH - No. 1889647 CH - No.694942 CH - No. 1867776 CH - No.1867778Документ2 страницыDenomination Petty Cash Total Denomination PCF Gasoline PCF - Regular PCF - RM CH - No. 1889647 CH - No.694942 CH - No. 1867776 CH - No.1867778jaymark camachoОценок пока нет

- Teds Golf School - T - AccountsДокумент1 страницаTeds Golf School - T - AccountsSamuel KimОценок пока нет

- Año Capacidad de Lproduccion Demanda Ingreso /beneficio Costos Fijos Costos VariablesДокумент3 страницыAño Capacidad de Lproduccion Demanda Ingreso /beneficio Costos Fijos Costos VariablesErmelinda CcoyoОценок пока нет

- Financial AnalysisДокумент12 страницFinancial AnalysisAlaa AlsultanОценок пока нет

- KD. MN Kuwait Maldives PalestineДокумент13 страницKD. MN Kuwait Maldives PalestineSridhar DanduОценок пока нет

- Ipr Empirico: Duracion Horas PWF O Pws Psia QG MMPCD PWF Pi2-Pws2Документ4 страницыIpr Empirico: Duracion Horas PWF O Pws Psia QG MMPCD PWF Pi2-Pws2Cristhian SantanderОценок пока нет

- EstimationДокумент5 страницEstimationDivyam GargОценок пока нет

- Results For Quarter Ending June 30, 2009 Q G ,: July 17, 2009Документ27 страницResults For Quarter Ending June 30, 2009 Q G ,: July 17, 2009tilak26Оценок пока нет

- 5S Cheil Jedang TPM ActivityДокумент44 страницы5S Cheil Jedang TPM Activitynursaidah100% (1)

- Government Publications: Key PapersОт EverandGovernment Publications: Key PapersBernard M. FryОценок пока нет

- Samiullah Abbasi: House No 4, ST No 10, Abdullah Town, Bharakahu, IslamabadДокумент1 страницаSamiullah Abbasi: House No 4, ST No 10, Abdullah Town, Bharakahu, IslamabadAfsheen AbbasiОценок пока нет

- # RMT-Topic 7Документ26 страниц# RMT-Topic 7Afsheen AbbasiОценок пока нет

- Chap 020Документ30 страницChap 020Afsheen AbbasiОценок пока нет

- Proposal Development Fact SheetДокумент24 страницыProposal Development Fact SheetAfsheen AbbasiОценок пока нет

- HameedДокумент1 страницаHameedAfsheen AbbasiОценок пока нет

- HameedДокумент1 страницаHameedAfsheen AbbasiОценок пока нет

- CPECДокумент3 страницыCPECAfsheen AbbasiОценок пока нет

- 1Документ2 страницы1Afsheen AbbasiОценок пока нет

- PM Assignment - Sample Cover PageДокумент1 страницаPM Assignment - Sample Cover PageAfsheen AbbasiОценок пока нет

- Ak GrougДокумент18 страницAk GrougAfsheen AbbasiОценок пока нет

- 1.2 AppendixA Intro To Excel2Документ5 страниц1.2 AppendixA Intro To Excel2Rahmatullah MardanviОценок пока нет

- Financial Decision Making and The Law of One PriceДокумент39 страницFinancial Decision Making and The Law of One PriceKavi ShahОценок пока нет

- Guide Financial Plan VC4A Startup AcademyДокумент7 страницGuide Financial Plan VC4A Startup AcademyLadipo AilaraОценок пока нет

- Revision For Final Exam TvomДокумент9 страницRevision For Final Exam TvomAdrian TanОценок пока нет

- Chap 3 M4B TT 1Документ10 страницChap 3 M4B TT 1Mai Phương AnhОценок пока нет

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyДокумент1 страницаChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalОценок пока нет

- Capital Budgeting Notes (MBA FA - 2023)Документ10 страницCapital Budgeting Notes (MBA FA - 2023)kavyaОценок пока нет

- D&L Industries Still Growing StrongДокумент6 страницD&L Industries Still Growing Strongανατολή και πετύχετεОценок пока нет

- Q44 46 SolutionДокумент7 страницQ44 46 SolutiontaikhoanscribdОценок пока нет

- TB - Chapter21 Mergers and AcquisitionsДокумент12 страницTB - Chapter21 Mergers and AcquisitionsPrincess EspirituОценок пока нет

- DanforthДокумент6 страницDanforthZafar Khan100% (2)

- CASE 2-MIDTERM FMP - Denisa Naura - 29123145Документ9 страницCASE 2-MIDTERM FMP - Denisa Naura - 29123145Denisa NauraОценок пока нет

- Csit-20-S2-36 Fyp-21-S1-20p Project ProposalДокумент34 страницыCsit-20-S2-36 Fyp-21-S1-20p Project Proposalapi-544373827Оценок пока нет

- Feasibility Of: Foam Production ProjectДокумент36 страницFeasibility Of: Foam Production Projectdaniel nugusie89% (9)

- 2019 T1 FINS3616 Tutorial Slides 10a Ch17 v1 Apr 24 PDFДокумент116 страниц2019 T1 FINS3616 Tutorial Slides 10a Ch17 v1 Apr 24 PDFKelvin ChenОценок пока нет

- This Study Resource Was: (Question)Документ3 страницыThis Study Resource Was: (Question)Mir Salman AjabОценок пока нет

- MGAC 2 MidtermДокумент63 страницыMGAC 2 MidtermJoana TrinidadОценок пока нет

- IP Valuation FinalДокумент46 страницIP Valuation FinalNancy EkkaОценок пока нет

- UofAProjectManagement PDFДокумент520 страницUofAProjectManagement PDFcjОценок пока нет

- A Summer Project ReportДокумент57 страницA Summer Project Reportanshu276Оценок пока нет

- Stuti Mehta pgmb2149 FinanceДокумент12 страницStuti Mehta pgmb2149 FinanceStutiОценок пока нет

- Case 22 Victoria Chemicals PLC (A)Документ2 страницыCase 22 Victoria Chemicals PLC (A)tipo_de_incognito75% (4)

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 3 PDF ScribdДокумент41 страницаInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Richard A Brealey 3 PDF Scribdlauryn.corbett387100% (39)

- Humber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsДокумент5 страницHumber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsAnisaОценок пока нет

- Report Solar Energy Suriname TaisafelixДокумент25 страницReport Solar Energy Suriname TaisafelixTaísa FelixОценок пока нет

- Cost-Benefit Analysis Excel TemplateДокумент5 страницCost-Benefit Analysis Excel TemplatekimcoxperinОценок пока нет

- CFA Level1 2017 Mock ExamДокумент75 страницCFA Level1 2017 Mock ExamMauricio CabreraОценок пока нет

- CH 11Документ48 страницCH 11Pham Khanh Duy (K16HL)Оценок пока нет

- Finanical Management Ch5Документ43 страницыFinanical Management Ch5Chucky ChungОценок пока нет

- Layer Poultry Project ReportДокумент3 страницыLayer Poultry Project ReportakashgaudОценок пока нет