Академический Документы

Профессиональный Документы

Культура Документы

Resume of Vonners2008

Загружено:

api-32573385Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Resume of Vonners2008

Загружено:

api-32573385Авторское право:

Доступные форматы

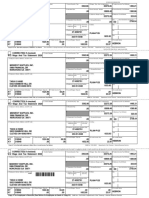

a Employee's SSN 571-04-1983 b Employer identification number (EIN) 93-1257467 OMB No.

1545-0008

3

C Employer's name, address, and ZIP code TA L LY- H O

ENTERPRISES, I N C JACK'S

1 Wgs, tips, other compn

85 24 . 4 0

2 Fed inc tax withheld

110.00

Social security wages

8156.40 Form W-2

TALLY-HO P. O . BOX 567 4 S3 tax withheld 5 2 8 . 5 Medicare wages & tips 6 Medicare tax withheld Wage and Tax

TALENT OR 97540 51 8524.40

8 Allocated tips 91

123 . 6 0

Advance EIC payment

Statement

7 Social security tips

d Control number

368.00

1 0 Depdnt care benefits 11 Nonqualified plans

2009

r Copy B To Be Filed with

Employee's FEDERAL Tax

Return

6 Employee's name, address, and ZIP code Suff. 13 14 Other 12 D This information is being

furnished to the Internal

LAVONNE D MAITLAND 5411 1 Revenue Service.

HIGHGATE #11 MEDFORD OR Statutory employee [ 12

97501 c

Retirement plan . . |_ 12

c

Third-party sick pay | 18 Local wages, tips, etc 1 9 Local income tax 20 Locality name

15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax OR

11035779-4 8524. 4o|_ 302.00

I T T "

QBMW2B2C 08/19/09 Department of the Treasury — IRS

a Employee's SSN 571-04-1983 b Employer identification number (EIN) 93-1257467 OMB No. 1545-0008

C Employer's name, address, and ZIP code TA L LY- H O 1 Wgs, tips, other compn 2 Fed inc tax withheld 1 1 0 3 Social security wages For.W-2

ENTERPRISES, INC 8524.40 . 00 8156.40 Wage and Tax

97540 4 SS tax withheld

JACK'S TALLY-HO P. O .

528.51

5 Medicare wages & tips 6 Medicare tax withheld Statement

BOX 567 8524 .40 123.60

TALENT OR 7 Social security tips 8 Allocated tips 9 Advance EIC payment 2009

368 . 00 Copy 2 To Be Filed

d Control number 1 0 Depdnt care benefits 11 Nonqualified plans 12a With Employee's

State, City, or Local

Income Tax Return.

e Employee's name, address, and ZIP code Suff. 13 14 Other 12b

LAVONNE D MAITLAND 5411 HIGHGATE

#11 MEDFORD OR 97501 Statutory employee [ 12c

Retirement plan . . [_ 12d

15 State Employer's state ID No. OR 16 State wages, tips, etc 17 StateThird-party

income taxsick pay |

8524.40 18 Local wages, tips, etc 19 Local income tax 20 Locality name

11035779-4 302.00

1

QBMW2B2C 08/19/09

QBMW2B2C 08/19/09

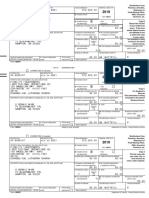

3 Employee's SSN 571-04-1983 b Employer identification number (EIN) 93-1257467 OMB No. 1545-0008

This information is being furnished to the IRS. If you are required to file a tax return, a negligence penalty or other sanction

C Employer's name, address, and ZIP cc de , may be imposed on you if this income is taxable and you fail to report i .

TALLY-HO ENTERPRISES INC 1 Wgs, tips, other compn 2 Fed inc tax withheld 3 Social security wages For.W-2

JACK'S TALLY-HO P.O. 97540

8524.40 110.00 8156.40 Wage and

6 Medicare tax withheld

BOX 567 4 SS tax withheld 5 Medicare wages & tips

123.60 Tax

TALENT OR 528.51 8524.40

7 Social security tips 8 Allocated tips 9 Advance EIC payment Statement

d Control No. 368 . 00

1 0 Depdnt care benefits 11 Nonqualified plans 12a 2009

Copy C For

EMPLOYEE'S

6 Employee's name, address, and ZIP code Suff. 13 14 Other 12b RECORDS. (See

LAVONNE D MAITLAND 5411 Notice to

HIGHGATE #11 MEDFORD OR 97501 Statutory employee [ Employee.)

12c

Retirement plan • • • 1

12d

15 State Employer's state ID No. OR Third-party sick pay | 18 Local wages, tips, etc 19 Local income tax 20 Locality name

16 State wages, tips, etc 17 State income tax 8524.40

J1035779-4 302.00

:r

Вам также может понравиться

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- W2 & Earnings: Kelly L WellsДокумент5 страницW2 & Earnings: Kelly L Wellshala100% (1)

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsДокумент2 страницы0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarОценок пока нет

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnДокумент1 страницаCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerОценок пока нет

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnДокумент5 страницCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- 2020 - PmaДокумент2 страницы2020 - Pmalaniya rossОценок пока нет

- W2 PreviewДокумент1 страницаW2 Previewmrs merle westonОценок пока нет

- W21225760934 0 PDFДокумент2 страницыW21225760934 0 PDFAnonymous czHLQeLPB4Оценок пока нет

- w2 hh83UtqU4WlQsBEvVnOTДокумент1 страницаw2 hh83UtqU4WlQsBEvVnOTDutchavelli5thОценок пока нет

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fДокумент3 страницы05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallОценок пока нет

- Jesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy StatementДокумент2 страницыJesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy Statementcg727841Оценок пока нет

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerДокумент9 страницAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerImran SadiqОценок пока нет

- W2 & Earnings: Emma MimsДокумент1 страницаW2 & Earnings: Emma MimsIsaiah MimsОценок пока нет

- Anil Gupta 2021 w2Документ2 страницыAnil Gupta 2021 w2Kawljeet Singh KohliОценок пока нет

- 2017W2 PDFДокумент2 страницы2017W2 PDFSeadevil0Оценок пока нет

- W2 & Earnings: Vanessa Sapien GonzalezДокумент4 страницыW2 & Earnings: Vanessa Sapien GonzalezVANESSA SAPIEN GONZALEZОценок пока нет

- W2 Taco BellДокумент3 страницыW2 Taco BellJuan Diego Velandia DuarteОценок пока нет

- Statement For 2021Документ2 страницыStatement For 2021seguins0% (1)

- W2 ExportДокумент1 страницаW2 ExportenderjosОценок пока нет

- Print PreviewДокумент4 страницыPrint PreviewDerrin Lee100% (1)

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atДокумент1 страницаWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekОценок пока нет

- Paredes Abreu - W2 2021Документ1 страницаParedes Abreu - W2 2021Sarah ParedesОценок пока нет

- 779 Ihh 403 H 6754020242226102101202Документ2 страницы779 Ihh 403 H 6754020242226102101202elena.69.mxОценок пока нет

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnДокумент7 страницWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartОценок пока нет

- 20212Документ2 страницы20212carriemccabeОценок пока нет

- Your 2021 Forms W-2 Are EnclosedДокумент7 страницYour 2021 Forms W-2 Are Enclosednethpas622Оценок пока нет

- MH0ihh081h6754910230616041100202 PDFДокумент2 страницыMH0ihh081h6754910230616041100202 PDFLogan GoadОценок пока нет

- Psav Encore Global W-2Документ5 страницPsav Encore Global W-2Vincent NewsonОценок пока нет

- 2316 (1) 2Документ2 страницы2316 (1) 2jeniffer pamplona100% (2)

- W-2 Form George PDFДокумент1 страницаW-2 Form George PDFGeorge LucasОценок пока нет

- Atla - Adn SplashДокумент1 страницаAtla - Adn Splashnatali jimenezОценок пока нет

- CORRECTED (If Checked)Документ2 страницыCORRECTED (If Checked)Dennis100% (1)

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptДокумент2 страницыKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1Оценок пока нет

- Omb No. 1545-0008 Omb No. 1545-0008Документ2 страницыOmb No. 1545-0008 Omb No. 1545-0008Luke NyeОценок пока нет

- Mona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementДокумент3 страницыMona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementManubhai PatelОценок пока нет

- Nolasco W2Документ2 страницыNolasco W2MARCOS NOLASCOОценок пока нет

- Wage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125Документ2 страницыWage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125rachel sanchezОценок пока нет

- College Accounting Chapters 1-15-22nd Edition Heintz Solutions ManualДокумент23 страницыCollege Accounting Chapters 1-15-22nd Edition Heintz Solutions Manualotisphoebeajn100% (29)

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Документ2 страницыProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenОценок пока нет

- Richard Feeney w2's 2018 2Документ3 страницыRichard Feeney w2's 2018 2Richy FeeneyОценок пока нет

- W2 FinalДокумент1 страницаW2 FinalWaqar Hussain100% (1)

- Wage and Tax StatementДокумент6 страницWage and Tax StatementNick RubleОценок пока нет

- Or Wcomp 0.72 or Wcomp 0.72Документ1 страницаOr Wcomp 0.72 or Wcomp 0.72aaronОценок пока нет

- TAXES w2 REGAL HospitalityДокумент2 страницыTAXES w2 REGAL Hospitalityoskar_herrera2012Оценок пока нет

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Документ2 страницыTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenОценок пока нет

- Your 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2Документ7 страницYour 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2bassomassi sanogoОценок пока нет

- NYSE - BX. Dear Unit Holder - PDFДокумент9 страницNYSE - BX. Dear Unit Holder - PDFEugene FrancoОценок пока нет

- W e ND A Statement 2020: Ag A T XДокумент2 страницыW e ND A Statement 2020: Ag A T Xadam burdОценок пока нет

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDupati K VeerappaОценок пока нет

- Wage and Tax Statement: Copy C-For Employee'S RecordsДокумент1 страницаWage and Tax Statement: Copy C-For Employee'S RecordslidiaОценок пока нет

- 5 MTihh 4271 H 1914120242901191102202Документ2 страницы5 MTihh 4271 H 1914120242901191102202elena.69.mxОценок пока нет

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Документ2 страницыMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcОценок пока нет

- Statement For 2022-1Документ2 страницыStatement For 2022-1Hengki Yono100% (1)

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeДокумент2 страницы5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezОценок пока нет

- Ajax PDFДокумент2 страницыAjax PDFGeorge AndoneОценок пока нет

- Bank Document - 1024889356736934991Документ7 страницBank Document - 1024889356736934991alexanderlucasnicolasОценок пока нет

- W-2 Wage and Tax Statement: I I I IДокумент1 страницаW-2 Wage and Tax Statement: I I I Imichelle analieОценок пока нет

- ICOIN, INC (Gov)Документ1 страницаICOIN, INC (Gov)je987164Оценок пока нет

- W2 A YanezДокумент1 страницаW2 A YanezLuis AngelesОценок пока нет

- Syllabus For Final Examination, Class 9Документ5 страницSyllabus For Final Examination, Class 9shubham guptaОценок пока нет

- Deep MethodДокумент13 страницDeep Methoddarkelfist7Оценок пока нет

- Saln 1994 FormДокумент3 страницыSaln 1994 FormJulius RarioОценок пока нет

- Bon JourДокумент15 страницBon JourNikolinaJamicic0% (1)

- Civil Engineering Interview QuestionsДокумент19 страницCivil Engineering Interview QuestionsSrivardhanSrbОценок пока нет

- FACT SHEET KidZaniaДокумент4 страницыFACT SHEET KidZaniaKiara MpОценок пока нет

- Review of Related LiteratureДокумент9 страницReview of Related LiteratureMarion Joy GanayoОценок пока нет

- Use Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)Документ7 страницUse Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)TASHKEELОценок пока нет

- EEN 203 Slide Notes Year 2018: PART I - Numbers and CodesДокумент78 страницEEN 203 Slide Notes Year 2018: PART I - Numbers and CodesSHIVAM CHOPRAОценок пока нет

- Robert FrostДокумент15 страницRobert FrostRishi JainОценок пока нет

- Narrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"Документ1 страницаNarrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"AdrianОценок пока нет

- WRAP HandbookДокумент63 страницыWRAP Handbookzoomerfins220% (1)

- LECTURE 1.COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICS - Ver 2Документ24 страницыLECTURE 1.COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICS - Ver 2Trixia Nicole De LeonОценок пока нет

- Compare Visual Studio 2013 EditionsДокумент3 страницыCompare Visual Studio 2013 EditionsankurbhatiaОценок пока нет

- Maratua Island Survey ReportДокумент8 страницMaratua Island Survey ReportJoko TrisyantoОценок пока нет

- Case 3 GROUP-6Документ3 страницыCase 3 GROUP-6Inieco RacheleОценок пока нет

- Cui Et Al. 2017Документ10 страницCui Et Al. 2017Manaswini VadlamaniОценок пока нет

- Project Report Devki Nandan Sharma AmulДокумент79 страницProject Report Devki Nandan Sharma AmulAvaneesh KaushikОценок пока нет

- Fireware EssentialsДокумент499 страницFireware EssentialsEmmanuel RodríguezОценок пока нет

- Index-Formal Spoken Arabic Dialogue - Al Kitaab Based - MSA - From Langmedia Five CollegesДокумент5 страницIndex-Formal Spoken Arabic Dialogue - Al Kitaab Based - MSA - From Langmedia Five CollegesD.ElderОценок пока нет

- HitchjikersGuide v1Документ126 страницHitchjikersGuide v1ArushiОценок пока нет

- Law - Midterm ExamДокумент2 страницыLaw - Midterm ExamJulian Mernando vlogsОценок пока нет

- Answer The Statements Below by Boxing The Past Perfect TenseДокумент1 страницаAnswer The Statements Below by Boxing The Past Perfect TenseMa. Myla PoliquitОценок пока нет

- Task Performance Valeros Roeul GДокумент6 страницTask Performance Valeros Roeul GAnthony Gili100% (3)

- A Comparison of Practitioner and Student WritingДокумент28 страницA Comparison of Practitioner and Student WritingMichael Sniper WuОценок пока нет

- Adobe Scan Sep 06, 2023Документ1 страницаAdobe Scan Sep 06, 2023ANkit Singh MaanОценок пока нет

- DB - Empirically Based TheoriesДокумент3 страницыDB - Empirically Based TheoriesKayliah BaskervilleОценок пока нет

- Army War College PDFДокумент282 страницыArmy War College PDFWill100% (1)

- Harlem Renaissance LiteratureДокумент2 страницыHarlem Renaissance LiteratureSylvia Danis100% (1)

- God Whose Will Is Health and Wholeness HymnДокумент1 страницаGod Whose Will Is Health and Wholeness HymnJonathanОценок пока нет