Академический Документы

Профессиональный Документы

Культура Документы

Unearned Premium Calculation - Rulebook PDF

Загружено:

subashОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Unearned Premium Calculation - Rulebook PDF

Загружено:

subashАвторское право:

Доступные форматы

Official Gazette of the Republic of Montenegro, No 70/08 [unofficial translation]

Pursuant to Article 83 paragraph 5 and Article 177 paragraph 4 of the Law on Insurance

(Official Gazette of the Republic of Montenegro 78/06 and 19/07), at the session held on 14

November 2008, the Council of the Insurance Supervision Agency adopted the

RULEBOOK ON DETAILED CRITERIA AND MANNER OF CALCULATING UNEARNED

PREMIUMS

General Provisions

Article 1

This Rulebook governs the detailed criteria and the manner of calculating unearned

premiums by insurance classes.

Unearned premium, for the purpose of this Rulebook, shall be a portion of the premium used

for covering insurance obligations that are to arise in the subsequent accounting period.

Article 2

An insurance company (hereinafter referred to as the company) shall establish and calculate

the unearned premium for such insurance where the coverage extends even after the expiry

of the accounting period.

Article 3

The basis for calculation of the unearned premium shall be the total insurance premium

established under the insurance contract (hereinafter referred to as the total premium).

Special Provisions

Article 4

The unearned premium shall be calculated on the last day of the current accounting period

as follows:

- on 31 December of the current year (annual calculation),

- on 31 March, 30 June, and 30 September of the current year (calculations during the

year),

- on the day of portfolio transfer.

Article 5

The unearned premium shall be calculated according to the individual calculation method for

each insurance contract with accurate proportion to the length of time involved (pro rata

temporis).

Article 6

In case of the insurance contracts where the amount of insurance coverage does not change

during the duration of insurance, the calculation of the unearned premium by the method

referred to in Article 5 of this Rulebook shall be applied in accordance with the following

formula:

Rulebook on Detailed Criteria of and Manner of Calculating Unearned Premiums 1

Official Gazette of the Republic of Montenegro, No 70/08 [unofficial translation]

, where

PP = unearned premium of individual insurance,

P = total premium of individual insurance,

d = number of days of insurance duration after the expiry of the accounting period,

D = total number of days of duration of the individual insurance.

In case of insurance contracts where the amount of coverage changes during the duration of

the insurance (builder’s risks insurance, contractual liability insurance of work contractors,

erection insurance, contractual liability insurance of erection contractors, film companies

insurance, credit insurance, commercial guarantee, and the like), the method referred to in

Article 5 of this Rulebook shall be applied in accordance with the change in the amount of

the coverage during the insurance period.

In case of insurance contracts where it may be assumed that the amount of insurance

coverage is to be changed linearly during the insurance period, the unearned premium shall

be calculated by the method referred to in Article 5 of this Rulebook in accordance with the

following formula:

, where

PP = unearned premium of individual insurance,

P = total premium of individual insurance,

d = number of days of insurance duration after the expiry of the accounting period,

D = total number of days of duration of individual insurance,

Op = insurance coverage (risk) at the beginning of the insurance period,

Ok = insurance coverage (risk) at the end of the insurance period.

In case of insurance contracts where the amount of insurance coverage changes during the

duration of the insurance, but it cannot be assumed that it will be changed linearly, the

formula other than the formula referred to in paragraph 3 of this Article may also be applied

for the calculation of the unearned premium, supported by the explanation of the authorized

actuary and the approval of the Insurance Supervision Agency.

Article 7

Total unearned premium of a specific class of insurance shall represent the sum of the

unearned premiums of individual insurances of such class of insurance.

Article 8

Unearned premium for life insurance where the mathematical reserve is calculated shall be

an integral part of the mathematical reserve.

Article 9

Unearned premium in the retention of a company shall be calculated by reducing the sum of

unearned premium of insurance of own portfolio and unearned premium of obtained co-

insurance by the sum of unearned premium transferred to co-insurance and re-insurance.

Rulebook on Detailed Criteria of and Manner of Calculating Unearned Premiums 2

Official Gazette of the Republic of Montenegro, No 70/08 [unofficial translation]

Article 10

Unearned premium in retention of a reinsurance company shall be calculated as the

difference of the unearned premium under inwards reinsurance (based on risks assumed

from insurers or other reinsurers) and unearned premium under outwards reinsurance

(based on risks transferred to other reinsurers).

Final Provisions

Article 11

A company shall be obliged to, for the purpose of undisturbed supervision activities,

calculate the unearned premium in such a manner to enable the insight in all data necessary

for its calculation, such as: insurance premium, inception date and expiry date of insurance,

periodical calculation date, number of days of insurance duration, number of days of

insurance duration after the periodical calculation, amount of coverage (risk) at the inception

of insurance, amount of coverage (risk) at the expiry of insurance, data obtained from the

cedent, and other.

Article 12

Notwithstanding Article 5 of this Rulebook, a company that does not have appropriate IT

support may calculate the unearned premium by 31 March 2009 using the pro rata method

according to the following formula:

, where

UPP = total unearned premium,

KM = ratio for month M (according to the Table 1, which is attached to this Rulebook

and makes its integral part),

UPM = total premium invoiced in month M for insurance that lasts after the expiry of

the accounting period.

Article 13

This Rulebook shall enter into force on the eighth day after its publication in the Official

Gazette of Montenegro.

Number: SS-49/08

Podgorica, 14 November 2008

President of the Council of the Agency

Vladimir Kavarić, MSc.

Rulebook on Detailed Criteria of and Manner of Calculating Unearned Premiums 3

Official Gazette of the Republic of Montenegro, No 70/08 [unofficial translation]

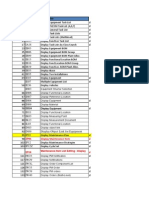

Table 1

Ratios KM based on dates of quarterly calculation

Date of quarterly calculation

31 March 30 June 30 September 31 December

Mont

Month Ratio Month Ratio Ratio Month Ratio

Year

Year

Year

Year

h

(M) (KM) (M) (KM) (KM) (M) (KM)

(M)

April 1/24 Jul 1/24 Oct 1/24 Jan 1/24

Previ

ous

May 3/24 Aug 3/24 Nov 3/24 Feb 3/24

Previous

Jun 5/24 Sept 5/24 Dec 5/24 Mart 5/24

Previous

Jul 7/24 Oct 7/24 Jan 7/24 April 7/24

August 9/24 Nov 9/24 Feb 9/24 May 9/24

Sept 11/24 Dec 11/24 Mart 11/24 Jun 11/24

Current

Oct 13/24 Jan 13/24 April 13/24 Jul 13/24

Current

Nov 15/24 Feb 15/24 May 15/24 August 15/24

Dec 17/24 March 17/24 Jun 17/24 Sept 17/24

Current

Jan 19/24 April 19/24 Jul 19/24 Oct 19/24

Current

Feb Augu

21/24 May 21/24 21/24 Nov 21/24

st

March 23/24 Jun 23/24 Sept 23/24 Dec 23/24

Rulebook on Detailed Criteria of and Manner of Calculating Unearned Premiums 4

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Personal Car Loan AgreementДокумент136 страницPersonal Car Loan AgreementCaxe1Оценок пока нет

- T Codes Sap PM CompleteДокумент44 страницыT Codes Sap PM CompletehimeshdarshanОценок пока нет

- Lic'S Bima Account - I (Plan No. 805) (UIN: 512N263V01)Документ8 страницLic'S Bima Account - I (Plan No. 805) (UIN: 512N263V01)Niten GuptaОценок пока нет

- Policy Fund Withdrawal Form v2Документ2 страницыPolicy Fund Withdrawal Form v2Julius Harvey Prieto BalbasОценок пока нет

- Travel Insurance PDFДокумент2 страницыTravel Insurance PDFΡομίρ ΓιάνκκιλОценок пока нет

- St. Paul Fire and Maritime Vs MacondrayДокумент2 страницыSt. Paul Fire and Maritime Vs MacondrayKirsten Denise B. Habawel-VegaОценок пока нет

- AIA Philam Life Policy Loan Request FormДокумент2 страницыAIA Philam Life Policy Loan Request Formmercedes bengadoОценок пока нет

- San Mateo Daily Journal 02-15-19 EditionДокумент32 страницыSan Mateo Daily Journal 02-15-19 EditionSan Mateo Daily JournalОценок пока нет

- Oup Personal Accident - UniversalSompoДокумент8 страницOup Personal Accident - UniversalSompoAkash JangidОценок пока нет

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFДокумент50 страницQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFTwsif Tanvir Tanoy92% (13)

- IA2 02 - Handout - 1 PDFДокумент10 страницIA2 02 - Handout - 1 PDFMelchie RepospoloОценок пока нет

- Income Decleration PDFДокумент2 страницыIncome Decleration PDFvijay dabhiОценок пока нет

- 5218 Admiralty HOA DocsДокумент262 страницы5218 Admiralty HOA DocsnerochualongОценок пока нет

- Circular No. 396 - Modified Guidelines On The Pag-IBIG Fund End-User Home Financing ProgramДокумент10 страницCircular No. 396 - Modified Guidelines On The Pag-IBIG Fund End-User Home Financing Programrutchie estorОценок пока нет

- Smart Health PDS BI 20181221 (Revised)Документ3 страницыSmart Health PDS BI 20181221 (Revised)Shanti GunaОценок пока нет

- Freelance Photographer Business PlanДокумент22 страницыFreelance Photographer Business PlanCincilei MОценок пока нет

- 126 - Philippine Home Assurance Corp. vs. Court of AppealsДокумент2 страницы126 - Philippine Home Assurance Corp. vs. Court of AppealsMarioneMaeThiamОценок пока нет

- IF1TB8 2018 (Online) - BookДокумент260 страницIF1TB8 2018 (Online) - BookYalchinОценок пока нет

- Burhani Contract - Rev 1-16.11.8Документ27 страницBurhani Contract - Rev 1-16.11.8musewejamesoumaОценок пока нет

- Income TaxДокумент57 страницIncome TaxDenis FernandesОценок пока нет

- Insurable InterestДокумент4 страницыInsurable InterestPragati RathoreОценок пока нет

- Ic 38Документ15 страницIc 38Rajkumar SharmaОценок пока нет

- LL.M. PART II (Semester III&IV)Документ25 страницLL.M. PART II (Semester III&IV)mehakОценок пока нет

- EchoStar 1998 Annual ReportДокумент81 страницаEchoStar 1998 Annual ReportDragon RopaОценок пока нет

- Nebosh Q and AДокумент279 страницNebosh Q and AHamid Raza0% (1)

- Certificate in TakafulДокумент6 страницCertificate in TakafulKhalid WaheedОценок пока нет

- Manulife Financial Corporation 2015 Annual ReportДокумент194 страницыManulife Financial Corporation 2015 Annual ReportGeorge SilvaОценок пока нет

- Financial Intermediaries and Players Philippines Financial Intermediaries and PlayersДокумент9 страницFinancial Intermediaries and Players Philippines Financial Intermediaries and PlayersLeo-Alyssa Gregorio-CorporalОценок пока нет

- Chapter 2. PITДокумент77 страницChapter 2. PITKhuất Thanh HuếОценок пока нет

- The Insular Life Assurance Co., LTD v. Feliciano (Sept. 1941)Документ2 страницыThe Insular Life Assurance Co., LTD v. Feliciano (Sept. 1941)lealdeosaОценок пока нет