Академический Документы

Профессиональный Документы

Культура Документы

FX101 - Introduction To Forex

Загружено:

HASSAN MRADИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FX101 - Introduction To Forex

Загружено:

HASSAN MRADАвторское право:

Доступные форматы

1 Research Department

FX101: Introduction to Forex

Contents

Chapter 1: Forex for Beginners................................................................................................................................. 4

What is forex?....................................................................................................................................................... 4

What is trading? ................................................................................................................................................... 4

Currency Pairs....................................................................................................................................................... 5

FX vs Stocks........................................................................................................................................................... 6

Who are the market players? ............................................................................................................................... 7

Retail Traders and Speculators ......................................................................................................................... 7

Large Commercial Companies .......................................................................................................................... 7

Banks ................................................................................................................................................................ 7

Trading Sessions ................................................................................................................................................... 7

Best and worst days and time to trade ................................................................................................................ 8

Chapter 2: Basic Terms and Definitions ................................................................................................................. 10

Key Definitions.................................................................................................................................................... 10

Pip ................................................................................................................................................................... 10

Lot ................................................................................................................................................................... 10

Leverage ......................................................................................................................................................... 10

Margin ............................................................................................................................................................ 11

Bid vs Ask ........................................................................................................................................................ 11

Spread ............................................................................................................................................................. 11

Long vs Short .................................................................................................................................................. 11

Transaction Cost ............................................................................................................................................. 11

Types of Orders .................................................................................................................................................. 12

Market Order .................................................................................................................................................. 12

Limit Entry Order ............................................................................................................................................ 12

Stop-Entry Order ............................................................................................................................................ 12

Stop Loss ......................................................................................................................................................... 12

Take Profit Order ............................................................................................................................................ 12

Trailing Stop .................................................................................................................................................... 12

Good till Cancelled.......................................................................................................................................... 13

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

2 Research Department

Good for the day............................................................................................................................................. 13

Types of market analysis .................................................................................................................................... 13

Technical Analysis ........................................................................................................................................... 13

Fundamental Analysis..................................................................................................................................... 14

Sentiment ....................................................................................................................................................... 15

Which type of analysis is the best? .................................................................................................................... 15

Types of Charts ................................................................................................................................................... 16

Line Charts ...................................................................................................................................................... 16

Bar Charts ....................................................................................................................................................... 16

Japanese Candlesticks .................................................................................................................................... 17

Chapter 3: Trading and Planning ............................................................................................................................ 19

What is a trading plan?....................................................................................................................................... 19

How to decide which trading plan to use ........................................................................................................... 19

Traders’ Phycology ............................................................................................................................................. 20

Types of Traders ................................................................................................................................................. 20

Scalpers........................................................................................................................................................... 20

Intraday .......................................................................................................................................................... 20

Swing .............................................................................................................................................................. 21

Position Traders .............................................................................................................................................. 21

Risk management ............................................................................................................................................... 21

Risk vs Return ..................................................................................................................................................... 22

Chapter 4: Technical Analysis ................................................................................................................................. 23

Charting Techniques ........................................................................................................................................... 23

Technical indicators ............................................................................................................................................ 25

Leading vs Lagging Indicators ............................................................................................................................. 25

Moving Averages ................................................................................................................................................ 26

Exponential Moving Average.............................................................................................................................. 27

SMA vs EMA........................................................................................................................................................ 27

MAs Interpretation ............................................................................................................................................. 27

Single Moving Average ................................................................................................................................... 27

Double Moving Average ................................................................................................................................. 28

Triple Moving Average.................................................................................................................................... 29

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

3 Research Department

Stochastic Indicator ............................................................................................................................................ 30

Interpretation ................................................................................................................................................. 31

Relative Strength Index ...................................................................................................................................... 32

Interpretation ................................................................................................................................................. 33

Moving Average Convergence Divergence......................................................................................................... 33

Interpretation ................................................................................................................................................. 33

Candlesticks Patterns ......................................................................................................................................... 34

Three white soldiers ....................................................................................................................................... 34

Three Black Crows .......................................................................................................................................... 34

Bullish Marubozu ............................................................................................................................................ 34

Bearish Marubozu .......................................................................................................................................... 34

Falling Window ............................................................................................................................................... 34

Rising Window ................................................................................................................................................ 34

Hammer .......................................................................................................................................................... 35

Inverted Hammer ........................................................................................................................................... 35

Hanging Man .................................................................................................................................................. 35

Shooting Star .................................................................................................................................................. 35

Bullish Engulfing ............................................................................................................................................. 35

Bearish Engulfing ............................................................................................................................................ 35

Chapter 5: Fundamental Analysis ........................................................................................................................... 36

What are fundamentals? .................................................................................................................................... 36

News and Trading ............................................................................................................................................... 36

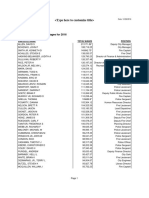

Persons to follow up: World Leaders ................................................................................................................. 36

Inflation .............................................................................................................................................................. 38

Interest Rates ..................................................................................................................................................... 39

Central Banks ...................................................................................................................................................... 40

Monetary Policy.................................................................................................................................................. 40

Fiscal Policy ......................................................................................................................................................... 41

Hawkish Vs Dovish .............................................................................................................................................. 41

Gross Domestic Product ..................................................................................................................................... 42

Unemployment................................................................................................................................................... 42

Economic Calendars ........................................................................................................................................... 43

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

4 Research Department

Chapter 1: Forex for Beginners

What is forex?

“Forex” also referred to as “FX” stands for Foreign Exchange, and it is the market where currencies are traded.

It is actually the largest and most liquid market in the world, with a traded volume of USD 5 trillion per day! If

you compare it with New York stock exchange that reaches up to USD 22.4 billion per day, you would probably

understand what we are talking about! Tokyo Stock exchange measures around USD 18.9 billion of trading

volume per day and London Stock exchange around USD 7.2 billion per day. If we illustrate the markets by

towers of dollars, below is the proper illustration!

What is trading?

There are several examples in life of currency trading, from something very simple to complex activities. For

example the exchange of a British tourist’s Pounds into US Dollar when traveling abroad, or the hedging of a

bank’s exposures to different countries. Trading is simply the process of buying one currency and

simultaneously selling another in order to gain a profit, where the profit (or loss if you do not estimate it well

enough) results from the changes in the exchange rates. The price of one currency compared to another

reflects what the currency is worth based on the country’s current and future economy. As the economy of a

country is affected by many factors, the country’s currency is affected by them as well.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

5 Research Department

Currency Pairs

Currencies’ symbols are always determined by three letters, where usually the first two letters declares the

name of the country that owns the currency and the third letter declares the name of the currency (with some

exceptions of course). There are standard abbreviations for all the currencies which have been determined by

the International Organization for Standardization (ISO).

The main currencies traded in the FX market are the below:

Symbol Country Name Nickname

USD United States US Dollar Buck

EUR Eurozone countries Euro Fiber

JPY Japan Yen Yen

GBP Great Britain Pound Cable

CHF Switzerland Franc Swissy

CAD Canada Canada Dollar Loonie

AUD Australia Australia Dollar Aussie

NZD New Zealand New Zealand Dollar Kiwi

A currency pair is a combination of two currencies’ symbols that indicates the related transaction. The first

currency in the pair is the base currency and the second currency in the pair is the counter or quote currency.

For example, if a trader buys EUR/USD, they are buying euros and selling US dollars.

The most traded currency in forex market is the US Dollar, included in the 85% of all reported transactions.

That is a physical consequence as the US economy is the largest economy in the world. The second most traded

currency is Euro with 39%, the third is JPY presenting 19% of the transactions and the fourth GBP covering 13%

of the transactions.

There are three types of currency pairs, the majors, the minors or major crosses and the exotics. Majors are the

most liquid currency pairs and therefore the most frequently traded. Majors consist of a combination of USD

and another liquid currency, as USD is the most important currency. The majors are the below:

EUR/USD

USD/JPY

USD/CHF

GBP/USD

USD/CAD

AUD/USD

NZD/USD

Major crosses are pairs that do not contain the USD, such as EUR/JPY, EUR/CHF, AUD/JPY, but they consist by

two major currencies.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

6 Research Department

Exotic pairs are made up of one major currency paired with the currency of an emerging economy, such as

Mexico, South Africa, Thailand etc. Below is a table with examples of exotic pairs.

Pair Name

USD/PLN US Dollar/Polish Zloty

EUR/RUB Euro/Russian Ruble

USD/HUF US Dollar/Hungarian Forint

USD/SEK US Dollar/Swedish Krona

USD/MXN US Dollar /Mexican Peso

USD/ZAR US Dollar/South African Rand

EUR/TRY Euro/Turkish Lira

USD/NOK US Dollar/Norwegian Krone

GBP/THB Great Britain Pound/Thai Baht

FX vs Stocks

Forex market has a lot of benefits and advantages; it certainly holds the most of the advantages between

traded markets. For example, there are no commissions on the transactions. In the forex market, margin

requirements are very low; this means if your deposit is not enough for a big trade, you can always control a

largest contract value using leverage! Leverage is the power of giving you the chance to trade larger amounts

than the amount of your balance (deposit). The table below reflects the major benefits of forex trading versus

stocks trading.

Characteristics Forex Stocks

Leverage Up to 1:500 No

24-Hour Trading Yes No

Middlemen No Yes

Minimal or no Commission Yes No

OTC market Yes No

Market Manipulation No Yes

Influence of brokerage firms Less Likely More Likely

Restriction on Short Selling No Yes

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

7 Research Department

Who are the market players?

Retail Traders and Speculators

Retail traders and Speculators make money through buying and selling of currencies and could include anyone

from hedge funds through to a retail trader at home with an account of USD50. Although in terms of size they

are the smaller traders, in terms of trading volume they hold the majority of 90%.

Retail traders are generally about 30% accurate at picking the trend, the rest just lose on average and they are

expecting to keep doing so.

Large Commercial Companies

Large commercial companies participate in the Forex market to do business. For example, electronics

manufacturers need to buy electronics’ parts from all over the world, exchanging their currencies to the

providers’ countries currencies. By using the FX market, they can get the best deal on currency fluctuations and

use the Forex market to protect themselves against adverse currency movements. This type of market players

achieves their transactions through commercial banks.

Banks

Banks are the largest players in the Forex market, mainly due to their influence on exchange rates. As Forex

market does not have a central exchange, the world’s largest banks determine the exchange rates by providing

the market with sell and buy prices based on the prices they are willing to buy and sell at. The prices they set

are based on supply and demand for currencies. These large banks, which are collectively known as the

interbank market, take on a large number of Forex transactions every day for both their customers and

themselves. Another big advantage of banks is that they are one of only few players that have access to a full

picture of order books. This information often allows banks to predict where moves will happen before they do.

Governments and Central Banks

Governments use the Forex markets for their operations, international trade payments, and handling their

foreign exchange reserves. Central banks, such as European Central Bank, affect the Forex markets by adjusting

interest rates to control inflation which can affect currency valuation. Central banks may also intervene in the

Forex market to realign exchange rates. If central banks feel that their currency is priced too high or too low,

they will start large sell/buy operations to alter exchange rate.

Trading Sessions

Although forex market is open 24 hours per day, it does not mean that it is always active the whole day. There

are four major trading sessions including New York, London (or European session), Tokyo (also refers as Asia

session) and Sydney.

Below is the table of the open and close times for each summer session in GMT:

1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

LONDON

New York

SYDNEY

TOKYO

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

8 Research Department

Time Zone GMT (OPEN-CLOSE)

London 07:00-16:00

New York 12:00-21:00

Sydney 22:00-07:00

Tokyo 23:00-08:00

Below is the table of the open and close times for each winter session in GMT:

1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

LONDON

New York

SYDNEY

TOKYO

Time Zone GMT (OPEN-CLOSE)

London 08:00-17:00

New York 13:00-22:00

Sydney 21:00-06:00

Tokyo 23:00-08:00

The summer session is approximately April to October while the winter session is approximately the period of

October to April.

As it’s illustrated from the chart above, there are hours where the two sessions overlap; those are the “prime

times” to trade forex!

Best and worst days and time to trade

During the overlap between London and New York there is the most movement in the market as New York and

London are the largest financial centers. Most trends begin during the London session, and they typically will

continue until the beginning of the New York session. Most economic reports are released near the start of the

New York session, as USD is involved in 85% of transactions and US economy is the largest of all the economies.

When those reports are released from US and Canada during the overlap of those two sessions, there is the

most movement in the market. Also, some late news coming from Europe can influence the market during the

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

9 Research Department

overlap. On the other hand, Tokyo-London overlap is the time with the thinnest liquidity as it is just the start for

European traders’ day.

Although European session is the busiest of them all, there are also specific days in the week with more

movement from all the markets. This is the middle of the week, where the most movement happens. It is also

important to notice that Fridays are usually busy until half day, after 16:00 GMT the market gets dried. Thus,

Friday after midday is considered one of the worst times to trade. Sundays and holidays are also a bad choice

since the liquidity is limited.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

10 Research Department

Chapter 2: Basic Terms and Definitions

So, now that you know what FX is about and the opportunities it offers you to make money, let’s start with the

basics! You would probably need to calculate your profit and learn how to trade. Let’s begin the training for a

step to richness direction!

Key Definitions

Pip

Pip is actually the measurement of the change in value and stands for “Percentage in Point”. A pip is usually

the last decimal point of a quotation, for example if EUR/USD changes from 1.1153 to 1.1154 the 0.0001 USD

rise in value is one pip. For the most of currency pairs, pip is the fourth digit. However there are exceptions, like

USD/JPY where the pip is the second decimal point. A change in USD/JPY from 120.97 to 120.98 is a change in

price of one pip. Generally, the currency pairs tend to be quoted to five decimal places and JPY pairs to 3

decimal places. The fifth (or 3rd for JPY pairs) decimal is called fractional pip. For example, if GBP/JPY moves

from 188.332 to 188.331 this is a 0.001 JPY move or one fractional pip.

Lot

A lot refers to a bundle of units in trade. It is basically the size of a trade. There are four commonly known lot

sizes:

Standard lot which is 100,000 units of the quote currency in a forex trade.

Mini lot which is 10,000 units of the quote currency

Micro lot that is 1,000 units of the quote currency

Nano lot is 100 units of the quote currency

Thus, if a trader sells 100,000 USD then he/she sells a standard lot with a trade size of 100,000 units.

One standard lot is also known as one contract size.

Leverage

In electronic forex trading, leverage enables traders to trade a bigger amount than their deposit. That’s

something similar to borrowing from a bank. You give a deposit to the bank, let’s say for example USD 1,000

and the bank lends you USD 10,000. The leverage amount depends on the trader choices and what a broker

offers. The leverage could be from 1:1 (no leverage basically) to 1:500. For example, a leverage of 1:100 means

that the trader has an account margin of USD 1,000 and is able to open a position up to USD 100,000! That’s

quite interesting eh? It is important to note that leverage may results to unlimited potential gains but the

potential losses do not exceed a trader’s invested capital.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

11 Research Department

Margin

As mentioned above, margin is the amount of money needed to open and maintain a position while free

margin is the amount of funds that is available to open additional positions.

Bid vs Ask

Forex traders have 2 prices for every pair on their trading platform. The bid and the ask price. Bid is the price

the broker is willing to buy the base currency in exchange for the quote currency, thus the price that the trader

would sell the currency pair.

Ask or offer is the price the broker asks to sell the base currency (and thus buy the quote currency). Thus, the

ask price is the best available price at which the trader will buy from the market

Spread

Spread is simply the difference between the bid and the ask price.

On the EUR/USD example above, the bid price is 1.10288 and the ask price is 1.10298. If a trader wants to buy

EUR/USD though this broker, he/she would click on the ask price, the price at which the broker is willing to sell.

Long vs Short

In forex, “going long” refers to buy a currency, which actually means to buy the base currency and sell the

quote currency. Thus if a trader wants to buy a currency, he wants the base currency to rise in value and then

sell it back at a higher price. That’s a “going long” or taking a “long position”.

If a trader wishes to sell, which actually means to sell the base currency and buy the quote currency, he/she

wants the base currency to fall in value and then buy it back at a lower price. This is called “going short” or

taking a “short position”.

Transaction Cost

The critical characteristic of the bid/ask spread is that it is also the transaction cost for a round-turn trade.

Round-turn means a buy (or sell) trade and an offsetting sell (or buy) trade of the same size in the same

currency pair. For example, in the case of the EUR/USD rate of 1.1433/36, the transaction cost is 3 pips. The

formula for calculating the transaction cost is:

Transaction cost (spread) = Ask Price – Bid Price

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

12 Research Department

Types of Orders

Market Order

A market order is an order to buy or sell at the best available price. It is one click order. You click on the price

you want to buy/sell and it’s done. It is the same like you are shopping on eBay! It’s kind of like using the one-

click ordering when you like the current price, you click once and the item is yours!

Limit Entry Order

A limit entry order is an order placed to either buy below the market or sell above the market, at a certain

price. These are used when traders want to enter the market in a value area. For example, if it looks like the

market is going to retrace lower from highs before moving higher again, a trader might use a limit entry order

to buy below the current price. That way, when the market retraces, he/she can get long for the push higher.

Stop-Entry Order

A stop-entry order is an order placed to buy above the market or sell below the market, at a certain price.

These are typically used in breakout plays. Traders will wait for a currency to break through a level before

entering in the direction of the breakout, and place a stop-entry order at the breakout level to get into the

trade as soon as it breaks out.

Stop Loss

Stop loss orders are useful for traders who are not willing to sit in front of their monitor all day in order to stop

the trade if it goes against them. A stop loss order is a type of order linked to a trade for the purpose of

preventing additional losses if price goes against expectations. A stop loss order remains in effect until the

position is liquidated or it can be cancelled by the trader. For example, you went long on EUR/USD at 1.1220.

To limit your maximum loss, you set a stop-loss order at 1.1200. This means if you were wrong and EUR/USD

drops to 1.1200 instead of moving up, your trading platform would automatically execute a sell order at 1.1200

the best available price and close out your position for a 20-pip loss.

Take Profit Order

Take Profit order is exactly the opposite of a stop loss order. It automatically closes a trader’s position once a

pre-set profit has been made. Let’s assume that you are sure that EUR/USD will go up to 1.2000 and then start

dropping again, you want to place a close order at that price in order to make the maximum possible profit. But

suddenly your girlfriend calls and she want to take her out tonight. So you place a take profit order and you

leave with no worries of losing the pick!

Trailing Stop

A trailing stop is a type of stop loss order that moves as price fluctuates. For example, let’s assume going short

USD/JPY at 89.90, with a trailing stop of 30 pips. This means that the stop loss is at 90.20. If the price goes down

and hits 89.60, the trailing stop would move down to 90.90. The stop won’t widen if market goes higher against

the trade. Once the market price hits the trailing stop price, a market order to close the position at the best

available price will be sent.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

13 Research Department

Good till Cancelled

That’s indeed as simple as is heard; a GTC order remains active in the market until the trader decides to cancel

it.

Good for the day

A GFD order remains active until the end of the trading day. If you wonder “What end of trading date? Didn’t

you tell me before that there’s not an end until Friday?”, then you really got the point! As forex is a 24-hour

market, this usually means 5:00 pm EST (the time U.S. markets close) but some brokers may have another

“end” for their trading days so we advise you to check it out.

We will examine later on how some of those orders are implemented on Meta Trader 4, an electronic trading

platform widely used by online traders.

Types of market analysis

There are three ways to analyze the market:

1. Technical Analysis

2. Fundamental Analysis

3. Sentiment Analysis

You would hear forex experts to debate which type is the best. However it doesn’t really matter as a good

trader needs to know about all of them. In this chapter we will provide a briefed explanation of those three

types of analysis and later on we will analyze them in detail.

Technical Analysis

Technical analysis aims to the determination of the future trend of movement of a currency based on current

and previous price movements. Hence, it’s directly connected with charts, patterns, indicators etc. It’s a

popular type of analysis because it’s relatively quick and it has been proven to work. Technical analysis is based

on the theory that historical price movements can determine the current trading conditions and potential price

movements. It is proven again and again that history tends to repeat itself, that’s why technical analysis is so

popular.

Charts are the easiest way for visualizing historical data, in forex language to visualize currency’s history. As the

majority of forex traders look for certain price levels and chart patterns relying on technical analysis, it becomes

likely that these patterns will manifest themselves in the markets. However, this does not mean that different

traders would have the same view about how price would move in the near or far future. Technical Analysis is

by default a very objective method of analysis. There are so many technical indicators that someone could use

that is almost impossible for all of the traders to think of the same.

Many technical analysis techniques will only work in specific conditions. Technical analysis can also give traders

an insight into turning points and potential entry points, by showing what is likely to happen in a certain set of

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

14 Research Department

circumstances, or what may happen if you follow the opposite trade. The main evidence for using technical

analysis is that, theoretically, all current market information is reflected in price.

Technical analysts look for similar patterns that have formed in the past, and will form trade ideas believing

that price will act the same way that it did before. The important thing is that you understand the concepts

under technical analysis so you can use Fibonacci, Bollinger bands, trend indicators or pivot points. You can see

how a chart with several indicators would look like on the above picture. No, no do not panic, we will examine

them on a later stage and they would look at you like a piece of cake!

Fundamental Analysis

Fundamental analysis in forex involves analyzing the economic, social and political forces that affect the value

of a country’s currency. All of the news reports, economic data and political events that come out about a

country are similar to news that come out about a stock and are used by investors to obtain an idea of value. As

the economy of a country is changing over time, so does value.

As a general rule in economics, supply and demand determine price, the same stands in forex. A trader can

determine the demand and likely fluctuations in value for a particular currency by understanding the

relationship between an economy and its currency value; this is what fundamentals traders do. It may sounds

complex, but the most important premise is that if a country’s economy is good, then the value of its currency

should be high as well. As the economic profile of a country strengthens; the value of its currency is increasing.

Of course in order to have an outlook on a country’s economic outlook, you need to know which factors affect

its economy and how to analyze them. This is similar to the analysis of the factors that affect supply and

demand, which events and indicators could cause an increase or a drop of a currency’s economy and as a

consequence a currency’s value? The better profile a country’s economy has, the more foreign businesses and

investors will invest in that country. This results in the need to purchase that country’s currency to obtain those

assets.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

15 Research Department

Some important indicators to use are the figures and statements given in speeches by important economists,

CEOs or politicians. Those are known as economical announcements that have a big impact on currency moves,

especially those that are related with USA economy as USA has the biggest impact in the market. Later on, we

will examine in detail several fundamental indicators and the way to analyze them.

Sentiment

Sentiment analysis is a type of forex analysis that focuses on identifying and measuring the overall

psychological state of all participants in the market. Sentiment analysis attempts to identify what percentage of

market participants are bullish or bearish. The market basically represents what all traders feel about the

market.

Retail traders can’t move the forex markets in their favor. If the majority thinks it is a bearish market or a

bullish market and you don’t, you can’t actually do much about that. Sometimes you need to adapt rapidly to

this kind of change. If you get an idea of what market participants may be thinking, you can better predict the

market in your favor. If you choose to ignore forex sentiment analysis, then you simply increase your risk. Being

able to quantify market sentiment is an important tool.

Which type of analysis is the best?

Fundamental traders would argue with technical traders regarding which type of analysis is the best. Actually

one is not better than the other; all of them are different ways to look at the market. If you feel more

comfortable with one of them, if you prefer to watch the news for example, you can use mostly the one

preferred. However we would advise you to use all of them, even if you use the one more than the other. By

using all of them you would have a clear and most objective view of the market and how it will likely move.

Let’s illustrate this need with a real life example.

Let’s assume that you only use technical analysis and you are really good at it. You are so busy with watching all

those indicators and technical analysis charts that you do not have time to watch the news. Thus, you are fully

determined to ignore fundamentals and based your trading actions on technicals. With your high level skills

and technics you found out a great opportunity that would make EUR/CHF have an incredible uptrend, so you

decided to be aggressively long on EUR/CHF. You are so sure that you didn’t even place a stop loss order; you

are planning to stop it in few days after you receive a lot of pips. You put your order, feeling so good for having

a great opportunity and you leave home to go out with friends. All of a sudden, EUR/CHF moves 400 pips

against your order! You go home at night and you see that disaster. Feeling absolutely depressed and trying to

understand what happened, you sit on your sofa and switch on the TV. All channels are talking about the

unexpected decision of Swiss national bank to abandon attempts to cap CHF’s value. Today you just decided to

make space for fundamentals into your trading strategy.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

16 Research Department

Types of Charts

Line Charts

Line charts are the simplest form of forex charts that represent only the closing prices over a preset period of

time. It is the most basic of the three charts as there is a drawn line connecting the closing prices of the

selected timeframe.

Below is an example of a EUR/USD line chart:

The most popular version of line charts is the daily line chart that plots each day’s closing prices.

Bar Charts

A bar chart shows the opening and closing prices, as well as the highs and lows.

Those are:

High: The top of the vertical line that defines the highest price of the time period

Low: The bottom of the vertical line that defines the lowest price of the time period

Open: A small horizontal line on the left of the vertical bar that is the opening price

Close: A small horizontal line on the right of the vertical bar that is the closing price

If the close price is higher than the open price then the bar has the blue form, if the opposite occurs then the

bar takes the red form of the example below.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

17 Research Department

In contrast to the line chart, bar chart’s main advantages are its ability to display the price range over the given

period of time and its capacity to display price gaps. However it does not display the whole price fluctuation, as

line chart does.

Example of a bar chart for EUR/USD:

Japanese Candlesticks

The candlestick chart is quite similar to the bar chart as it consists highs, lows, open and close prices. In

candlesticks the body in the middle indicates the range between the opening and closing prices. Usually, if the

body is filled or colored in, then the currency pair closed lower than it opened. For those colors reasons, the

candlestick is considered easier to view as it immediately gives you the idea of a bearish or bullish market. In

the following example, the ‘filled color’ is black and the other white.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

18 Research Department

Candlesticks are the most widely used charts and the most technics in technical analysis are based on this type

of charts. They are easy to interpret, easy to use and they are the best identifiers of market turning points as to

whether the market is turning from a downtrend to an uptrend or vice versa.

For sure we will elaborate further on this great tool our Japanese friends discover hundred years ago, thanks to

them we can use our technical analysis on an easy manner!

Example of EUR/USD Candlestick Chart:

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

19 Research Department

Chapter 3: Trading and Planning

What is a trading plan?

A trading plan is a systematic trading method, a strategy, set by an individual trader in order to evaluate assets,

return and risk. Thus, a trading plan includes a trader’s strategy, risk management, money management and

trading rules.

It is basically a guideline that the trader himself has created in order to follow those rules by discipline so that

he can achieve his trading targets.

A trader must not be affected by emotions as this might cause him to deviate from the rules, raw trading and

strategy rules must be followed every single day in every single trade in order to have successful trading results.

The importance of a trading plan is that it lets you know if the trades are in the right direction or not. As

renowned fund managers state, “the trading plan you use is not as important as having a trading plan.”

How to decide which trading plan to use

In order to create a trading plan you have to identify your risk appetite. Are you a risky trader or do you prefer

to risk less and get less? Of course this depends on your capital on how much of it you can afford to lose. A

good trader shall not be driven by emotions and risk more than what he can afford to lose.

The risk appetite of a trader is also closely related to the return he would like to have. All of you would laugh

and think that the more profit you have the better, but think again. If you go for much, you have to risk much

as well. Maybe it all goes right and you win all those pips, but what if it goes wrong and you lose them instead?

See? That’s not so simple.

One important step in determining the trading plan that you are going to follow is to calculate your drawdown.

The drawdown is the percentage of your initial capital that you have lost. The larger your drawdown is, the

hardest it is to recap. Drawdown is the peak to bottom decline during a specific record period of an investment

or of a trade. It is simply the money you lose divided by the initial money of the investment. For money

management purposes, the maximum drawdown one shall have is 20%-25%. Let’s illustrate the reason with

simple examples. Let’s say that you decided to have 20% drawdown. So, if you lose 20% of your capital, how

much do you need to gain in order to recover? The answer is simple 20% divided by 80% (the remaining capital)

which equals to 25%. 25% to recover and then even more to have a gain again! Now, if your drawdown is 50%,

you would need 100% win ratio to recover! And so on and so forth.

Another factor in choosing a trading plan that fits your personal lifestyle is exactly the way of your lifestyle. You

must ask yourself and reply honestly to the question of how much time you can really spend on trading. There

are traders which keep long term trades and do not have to be in front of the monitor all the time and there

are other traders which have a lot of time to trade and they are in front of the screen the whole day scalping

around.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

20 Research Department

A trading plan is a list consisting of many points, which you should check and tick before you proceed with

every new trade. If only one condition of your list is not met, then you have to think twice before proceeding

with the trade. Remember, consistency and discipline is the key to success!

Traders’ Phycology

A trading plan should fit the trader’s personality. If the trader does not feel comfortable following his own plan

he would most likely fail. You do not have to challenge yourself, just make yourself comfortable and you would

see that you would trade with less stress and more confidence, which usually leads to profitable trading. If you

are driven by emotions you would probably diverge from your plan and at the end you would find yourself in a

panic situation with no plan B to follow. The trading plan is raw rules you need to follow, do not listen to other

traders, do not copy others that does not fit your style and most significantly stick to your trading plan!

Recently there is a new science called “Behavioral Finance”. Those scientists are trying to identify the behavior

of investors and traders and see behind the market efficiency theory. In economics, we assume that traders are

rational human being that do not act irrational and always control themselves. Behavioral finance study

traders’ psychology and identifies several syndromes that are far from “efficiency” and “rationality”. An

example is the tendency of humans to go with the flow and the insecurity they feel of standing alone against

the crowd. For example, imagine yourself going long on EUR/USD, you are really happy for your trade since it

qualifies all requirements of your trading plan and is profitable at the moment. Then suddenly you see that all

of your friends are short on EUR/USD and they all deride you because “you are so stupid for going long”. Would

you feel a bit uncomfortable? Or maybe you would even close your trade and follow theirs. That is an everyday

example of behavioral finance and the irrationality of human beings. Your psychology plays a huge role in your

trades, be careful so that you can choose a trading plan on which you would feel comfortable enough to stand

alone against the crowd!

Types of Traders

Scalpers

The shortest interval trading award is definitely going to this type of traders! Scalpers are traders that enter and

exit a position in a very short period of time targeting a small amount of pips. If you are going to enter and exit

the market in a rapid timeframe you have to be able to watch market moves at all times. If you are prepared to

be a scalper then you need to have the ability to stare at your platform the whole day and make trades again

and again. If you are not willing to spend a lot of hours of your day in front of your computer screen then this

type of trading is not suitable for you. Make sure you know how many pips you are willing to lose in order to

gain around 10 pips and go on. You can also take a look at automated scalping techniques.

Intraday

If you prefer to hold trades for a short timeframe but think that scalping it too fast for you, then you may prefer

intraday trading. Intraday traders are those who hold a position within the day and close it before day ends.

Intraday traders usually use up to hourly charts to monitor their positions and their target is within 50-80 pips

per trade. This type of traders is up to date with fundamentals in order to be able to take the right decision at

the beginning of their trading day. They also like to use sentiment analysis and exit their positions when they

feel that the time has come.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

21 Research Department

An intraday trader may be looking for breakouts of the hourly trading range in either direction by placing

pending orders in both sides of the trading range waiting for one of them to be triggered. Another way to trade

within the day is to look at a longer time frame chart to determine the longer trend and then place your orders

based on a shorter timeframe in the direction of the longer trend.

The last method of intraday trading is again by looking at longer timeframe charts and determines your entry

point on shorter charts, but entering in the opposite direction of the overall trend in order to get some pips

from overall trend’s corrections.

Swing

This type of traders is looking to keep positions open for some days. The longer a trade remains open, the

wider the Stop loss and Take profit should be. Thus, this type of trading requires larger SL and TP than the two

types referred above. Swing traders usually use daily time-frame charts to evaluate the overall trend and 4-

hours timeframe charts for entry and exit purposes (timing purposes).

If you do not feel comfortable in keeping a trade open during the night and you can’t get enough sleep because

of that, then swing trading is probably not your style. Because swing traders are looking for larger moves, price

would move against the trade most frequent than intraday trading. If you cannot watch your trade losing

money, then you should not be a swing trader.

Position Traders

Last but not least, position trading which is the longest term in trading. This kind of traders holds their positions

open for several months or even years. In order for a trade to remain open for so long, you have to keep very

wide stop loses and take profit orders. Since you keep a position open for so long, you have to focus on

fundamentals which will move your trade accordingly. If you look for such a big move, you can’t ignore the

important news announced for your selected pairs of trading.

Thus, it is very important for position traders to understand how fundamentals work and how each

fundamental indicator affects their pairs.

Risk management

In trading, risk management is the art of minimizing your risk and maximizing your return. It is about mastering

the control of the probability and the impact of unfortunate events, so that we can maximize the opportunities

to make profit.

A very important lesson to learn in trading is to avoid gambling. Gambling is the worst enemy of risk

management in the world of trading. Remember that our goal is to make money and not to try our luck! Risk

management includes all the parameters of a trading plan referred to at the beginning of the chapter.

Risk management is the most important concept of a trading plan.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

22 Research Department

Risk vs Return

Under money and risk management purposes, a reward to risk of less than 1 is not acceptable. Reward to risk is

a simple ratio, the points you aim to gain divided by the points you risk. Thus, it is TP points divided by SL

points. 1 is the minimum risk to reward ratio that traders should accept. This means that you risk the same

amount of pips that you are aiming to gain. If you risk more than what you would win, then it is simply not

worth it.

In trading, it is generally accepted that a reward to risk ratio of 3:1 is the best one can follow. A simple example

is the below:

Trader A decided that the reward to risk ratio which fits his trading plan is 3:1. He wants to firstly apply that on

EUR/USD, going long on the pair. He would like to gain around 60 pips. In order to have a 3:1 ratio, you would

need to divide the TP pips by 3 to get his risk points. Thus, he would place a stop loss 20 pips below the current

market price of EUR/USD a take profit of 60 pips above current market price.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

23 Research Department

Chapter 4: Technical Analysis

Technical analysis is based on the analysis of historical data and its illustration on charts. The three principles

on which technical analysis and technical trading are based are the below:

History repeats itself

Market action discounts everything, all the known and unknown information that may affect prices.

There is no available information that affects prices and is not reflected in the price.

Prices move in trends

There are many indicators invented by mathematicians, statisticians, financial analysts, even journalists that are

trying to predict future price moves. Of course like every other science that is forecasting future moves (for

example weather prediction), it is all about probabilities. Nothing is certain but everything is probable.

Charting Techniques

There are several types of charts construction: line charts, candlesticks, candle volume, bar charts, point and

figure charts, market profile chart etc... Each chart is being used mainly by a specific group of persons.

Line chart consists of two factors, the closing price and the selected time-period. If for example the selected

time frame is one hour, then the closing price of each hour will be illustrated on the chart by a continuous line.

Below is an example of a line chart of USDSGD. The horizontal axis represents the time factor and the vertical

axis the price factor. The same happens for bar charts and candlestick charts.

Line charts are the easiest charts to be understood by the general public as they represent only the closing

price of each time-period. Thus, they are being used mainly when a currency is represented to the public.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

24 Research Department

Bar charts are being used mainly by futures traders as they show the difference between the close price of the

previous period and the close price of the current period.

Candlesticks are mainly being used by traders as they represent the difference between open and close price

for the predetermined period of time and also the difference between high and low price for the same period.

This range is very important for trading. They represent the range of prices clearly as they are usually drawn in

different colors for up periods vs down periods. The illustration of such charts can clearly identify the trend of a

pair by referring to its color.

Above is an hourly chart of EURUSD with white downwards candles and black upwards candles. If a candle is

white, it means that within this specific hour the close price was lower than the open price.

Candle volume have the same characteristics with candlestick charts with the difference that they have widths

for each candle, they incorporate the volume. The bigger the width, the more volume there was on this specific

period and the thinner a candle, the less volume there was. This type of charts is mainly useful for stocks and

bonds.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

25 Research Department

Point and Figure charts, or better known as P&F, are much different from the previous types of charts. The

main difference is that they do not take into consideration time. A new entry is being drawn on a P&F chart if a

predetermined amount has been exited. If not, there is no entry at all. On very volatile periods there are many

entries while on quiet periods there are no drawings at all. P&F charts are mainly used by technical analysts as

they are too complex to be understood by an amateur trader or the public and it fits each technical analyst

needs. The main advantage of P&F chart is that it filters the noise and the technical analyst decides which

amount is the critical one.

Market Profile is a chart that is being used mostly by intraday stock traders. It shows if the current price of an

instrument is overpriced or underpriced and thus it produces sell or buy signals respectively.

Technical indicators

Technical indicators predict the future price moves or the future direction of the price. Most of them are based

on simple or complex mathematical calculation of historic data like the price itself, volume, open interest etc...

Examples of those calculations could be means, standard deviations, variances, regressions etc... Some

indicators are drawn on the price charts, others below the chart and others can apply on both of them.

There are indicators for all timeframes and time periods. Some of them are recommended by their inventor to

better be used for a specific period. For example relative strength index, or better known as RSI, was

introduced by Willes Wilder’s which recommended to use RSI with 14 lagging periods. Also, there are indicators

that are recommended to be used for a specific time frame, for example bullish and bearish flags are mostly

short-term patterns.

Leading vs Lagging Indicators

It is important for every trader to realize that there are two types of indicators. Leading indicators are those

who lead the price, in other words they precede price movements thus they give signals before the new trend

or the reversal occurs. Leading indicators have a forecasting sense. On the other hand, lagging indicators are

those who are behind price move, they react to prices and do not lead them. Thus, a lagging indicator gives a

signal after the new trend or reversal occurs, they have a confirmation sense that the new trend has indeed

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

26 Research Department

began. Example of lagging indicators is moving averages while example of leading indicators is relative strength

index (RSI).

The indicators which are moving within a range are called oscillators. For example RSI is trending within the

range of 0 and 100 while moving average convergence divergence (MACD) does not have a certain bound

range. Most oscillators have overbought and oversold levels and all indicators have their equilibrium level.

Usually, the upwards penetration of the equilibrium level is a bullish signal while the downwards penetration of

it is a bearish signal. For RSI the equilibrium line is 50 since it ranges within 0 and 100, for MACD the

equilibrium line is 0 since it does not have certain bounds.

Between indicators and price a trader should always look for divergences. Positive divergences occur when the

price chart is making new lows but the oscillator chart does not confirm the downtrend and it is making higher

or equal lows. This means that a reversal to the upside is on its way, but we only trade that upon confirmation

by the price. Negative divergences occur when price is making higher highs but the oscillator is making lower or

equal highs and does not confirm the uptrend. That’s a sign that the uptrend is about to reverse, again we are

trading the signal upon confirmation by the price pattern which is the failure of higher highs.

Moving Averages

Moving averages are methods of calculation of the average value of an instrument’s price. There is the typical

statistical mean, which is called simple moving average, and other ways of calculation. They are being called

“moving” averages as they change or move respectively with price. A critical thinking is needed from the trader

about the time periods for which the MA will be calculated. Of course everything is being calculated on the

platform that each trader uses, the only thing needed by the trader is to select the type of moving average that

fits his/her style for each case and time period. However a good trader can decide the type of MA needed only

if he has an overview in mind of the calculation behind them. All the moving averages are illustrated on the

prices chart.

It is important to understand that MAs are trend-following indicators and not leaders, they are lagging

indicators. A moving average does not anticipate the trend; it only reacts to the prevailing trend. During a

trading range MAs produce a lot of whipsaws. Since they are trend-following indicators it is better to be used

during an uptrend or a downtrend. There are many types of MA, some of them are simple MA, Exponential MA,

weighted MA, triangular MA etc. The most used ones are EMA and SMA. Moving averages is the base of many

important and widely used indicators such as Bollinger bands, MACD, etc.

Simple Moving Average

SMA is the typical statistical mean of the prices. If the trader chooses a 14 day SMA then the calculation would

be the sum of the closing price for those 14 days and then the division of the sum by 14. For each period the

calculation would be for 14 periods before including the current one.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

27 Research Department

Below is an example of a 14-days SMA calculation

Day Price

1 95

2 88

3 98

4 99

95+88+98+⋯+100+110 1308

5 90 SMA = 14

= 14

= 93.428

6 94

7 89

8 87

9 85

10 88

11 90

12 95

13 100

14 110

Exponential Moving Average

EMA or exponentially weighted moving average gives more weight to the most recent price and less to the

previous data. Thus, EMA reacts faster to current price movements than SMA. Weighing factors decrease

exponentially that’s the reason why it is being called exponential. EMA takes into consideration all of the past

prices of the instrument and this is considered one of its biggest advantages.

SMA vs EMA

The main criticism of SMA is that it does not take into account all the historic periods while EMA does. Since

history is important in technical analysis that is considered the main disadvantage of SMA. On the other hand,

SMA puts equal weight to all the time periods while EMA put more weight on the most recent one. There is a

theory that stands that the most accurate forecast for the next day is today, so many believe that it is better to

put more weight on the last period than on the previous ones. It is up to each trader to choose the most

suitable MA according to its needs and strategy.

MAs Interpretation

Single Moving Average

During an existing uptrend a buy signal occurs when the closing price penetrates to the upwards the MA. On

the other side, a sell signal occurs upon a downwards penetration of the moving average by the price during an

existing downtrend. The selection of the lagging periods of the MA depends on the timeframe. Usually a

medium-term MA is being used for the single trading signals, like a simple moving average of 21 periods,

SMA21. Below is an example of a daily chart of NZDCAD during a downtrend, there are two sell signals on the

below chart marked in red cycles.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

28 Research Department

Downwards penetration of the SMA21

during an existing downtrend

Double Moving Average

Two moving averages are being used for this method, usually a short term and a medium term or a long term

MA. The general rule is that the longer MA is better to be a multiplier of two of the shorter MA, if for example a

trader chooses a 10-periods short term MA then the longest could be 20 periods or 40 periods. Both MA are

applied on the same chart and they execute buy and sell signals by their crosses.

A buy signal during an uptrend occurs when the short term MA crosses upwards the longer MA, an existing

uptrend is a must. Respectively, a sell signal during a downtrend occurs when the short term MA crosses

downwards the longer MA, an existing downtrend is a must.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

29 Research Department

Bearish cross during a downtrend => Sell

Signal

20-Periods MA

10-Periods MA

Triple Moving Average

Three moving averages are being used for this method, a short term, a medium term and a long term MA. Just

like double moving average trading signals method, the medium term MA needs to be a multiple of 2 of the

short-term and the long-term MA has to be a multiple of 2 of the medium term MA. For example if we choose a

short term MA of 10 periods, the medium term could be 20 or 40 periods and the long term 40 or 80

accordingly.

A buy alert occurs upon a bullish upwards penetration of the long term MA by the short-term MA during an

existing uptrend. A buy signal (buy confirmation) occurs upon a bullish upwards penetration of the long-term

MA by the medium-term MA during an existing uptrend. A sell alert occurs upon a bearish downwards

penetration of the long term MA by the short-term MA during an existing downtrend. A buy signal (buy

confirmation) occurs upon a bearish downwards penetration of the long term MA by the medium term MA

during an existing downtrend.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

30 Research Department

Sell Alarm

Sell Signal

20-Periods MA

10-Periods MA

40-Periods MA

On the example above, there is an existing downtrend, and then a sell alarm by the cross of 40-period MA of

10-periods MA and then there is a sell signal by the cross of 40-periods MA by the 20-periods MA.

Of course there are exceptions that prove the triple MA rule. One of them is the famous and widely used triple

moving average of Robert C. Allen. He suggested the combination of 4, 9 and 18 periods MAs. Another famous

triple combination of MAs is Fibonacci sequence numbers, 8, 13, 21, 34 and so forth.

The main advantage of the triple MA method is that it generates less whipsaw than the double MA method

since it gives an alert and then a confirmation. The main criticism and disadvantage of the MA methods is that

an existing uptrend or downtrend is a must, which means that the trader losses the opportunity to open a

position on tops or bottoms.

Stochastic Indicator

Stochastic is an oscillator that compares where an instrument’s price closed relative to its price range over the

last selected time periods. There are two main indicators that stochastic consists of, %K and %D. %K is being

called the fast stochastic and %D the slow stochastic. This happens because %K is closest to prices since it’s a

first derivative of them while %D is a moving average of %K.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

31 Research Department

Stochastic always ranges between 0% and 100%. A reading of 0% means that instrument’s current price is at its

lowest reading for the selected period and a reading of 100% means that instrument’s current price is at its

highest reading for the selected period. Also, instrument’s current price is at the midpoint of the selected

period’s range when the value of stochastic is 50% and so forth.

The below formula is being used for %K calculation:

𝐶 − 𝐿𝐿

∗ 100

𝐻𝐻 − 𝐿𝐿

Where:

C = current period closing price

LL=Lowest price of the previous x-time periods selected

HH = Highest price of the previous x-time periods selected

If for example we want to calculate a 20-day %K and 0.6784 is today’s close price, 0.6018 is the lowest price of

the last 20 days and 0.7189 is the highest price of the last 20-days then %K price would be:

0.6784−0.6018

0.7189−0.6018

∗ 100 = 65.41%

65.41% level shows that today’s close is at the level of 65.41% relative to the security’s price range over the last

20 days. That means that today’s close is highest than the midpoint of security’s price range within the last 20

days.

Of course you don’t have to calculate stochastic prices for each period, they are being calculated automatically

and a chart of it is drawn below price chart. However is good to know the concept of calculation behind every

indicator to know where you can use it and what its amount reveals about the current market price.

Interpretation

In general, when a faster indicator crosses upwards the slower indicator, it is a bullish signal and when the

faster indicator crosses downwards the slower indicator, it is a bearish signal. For stochastic those signals are

stronger when %K rises above %D above 80% as a buy signal and when %K falls below %D below 20% as a sell

signal.

Another buy signal by stochastic is when both %K and %D fall below 20% and then rise above 20%.

Respectively, a sell signal occurs when %K and %D rise above 80% and then fall below 80%.

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

32 Research Department

Above is an example of EURUSD where stochastic has upwards penetrated the overbought level and then

downwards penetrated the same level, which is a sell signal. Price has indeed felt after stochastic’s bearish

signal.

Another interpretation of stochastic and all the oscillators is looking for convergences/divergences between

price and stochastic.

Relative Strength Index

RSI was introduced by Welles Wilder in Futures magazine in 1978, Wilder proposed to use a 14-period RSI but a

trader can adapt the periods to its own trading style and time frame. The general rule of thumb for all the

indicators is that the less periods we choose the more volatile they are. RSI measures the internal strength of

an instrument and it ranges between 0 and 100.

RSI is calculated based on up-days and down-days of bar charts. RSI formula is the below:

100

100 - 1+𝑈/𝐷

Harborx Limited is authorized and regulated by CySEC (License no. 230/14) S.P.

info@harborx.com Tel: +357 25 025522 Fax: +357 25 030258

33 Research Department

Where:

U = Number of up-days for the selected period

D = Number of down-days for the selected period

The neutral days are calculated as up-days.

The equilibrium line of RSI is 50, its oversold level is 30 and its overbought level is 70. If RSI is above 50 it means

that there are more up-days than down-days for the selected period. If it is below 50 it means that there are

more down-days than up-days.

Interpretation

When RSI crosses upwards the equilibrium line, it is a buy signal and when it crosses downwards the 50 line

that’s a sell signal. A strong buy signal occurs when RSI upwards penetrates 70. Strong Sell signal occurs upon

downwards penetration of 30 oversold level.

Divergences also apply on RSI. If market is making new highs but RSI is making new lows then the price is