Академический Документы

Профессиональный Документы

Культура Документы

EAT 17,500 Retained Earnings 8,750

Загружено:

Leejat Kumar Pradhan0 оценок0% нашли этот документ полезным (0 голосов)

6 просмотров4 страницы3

Оригинальное название

Q3

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ3

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

6 просмотров4 страницыEAT 17,500 Retained Earnings 8,750

Загружено:

Leejat Kumar Pradhan3

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

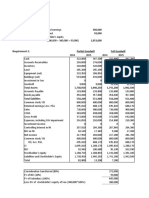

Revenue (PY) 7,200,000 Partciulars Amounts

Revenue growth 25% Revenues 9,000,000

GP margin 20% VC (7,200,000)

VC margin (1 - GP margin) 80% GP 1,800,000

Depreciation 20% OpEx (375,000)

Tax Rate 30% EBITDA 1,425,000

OpEx (PY) 300,000 Depreciation (1,000,000)

OpEx growth 25% EBIT 425,000

Debt Interest rate 12% Interest on Debt (300,000)

Notes interest rate 10% Interest on Notes (100,000)

Dividend payout ratio 50% EBT 25,000

Tax @30% (7,500)

EAT 17,500

Dividend @50% (8,750)

Retained Earnings 8,750

PY BS Investment in FA 1,000,000

Cash 100,000 AP 372,000 (year end)

AR 1,000,000 10% Notes 1,000,000 Loan Repayment (1/5th) 500,000

Inventory 558,000 12% Debt 2,500,000 WC Days

Fixed Assets (net) 5,000,000 Equity 2,786,000 AR 30

6,658,000 6,658,000 Inventory 20

AP 60

CY BS

Cash 100,000 AP 1,200,000

AR 750,000 10% Notes 255,250

Inventory 400,000 12% Debt 2,000,000

Fixed Assets (net) 5,000,000 Equity 2,786,000

RE 8,750

6,250,000 6,250,000

Opening 100,000

Retained Earnings + Depreciation 1,008,750

FA purchase (1,000,000)

Loan Repayment (500,000)

Change in AR (PY - CY) 250,000

Change in Inventory (PY - CY) 158,000

Change in AP (CY - PY) 828,000

Ending (before adjustment) 844,750

Repayment of Notes Payable (744,750)

Ending 100,000

Вам также может понравиться

- Soal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaДокумент13 страницSoal 1 (Kontribusi Asset Netto) : Uraian PT - Wayang PT - Gatot PT - KacaegiОценок пока нет

- AFAR Preboards SolutionsДокумент27 страницAFAR Preboards SolutionsIrra May GanotОценок пока нет

- FAR First Preboard Batch 89 SolutionДокумент6 страницFAR First Preboard Batch 89 SolutionZiee00Оценок пока нет

- Accounting AssignmentДокумент5 страницAccounting AssignmentVivek SinghОценок пока нет

- CH 9 ExamplesДокумент2 страницыCH 9 ExamplesAisha PatelОценок пока нет

- Extra Session 2 (30 Sept 2022) Spreadsheet (CH 3)Документ2 страницыExtra Session 2 (30 Sept 2022) Spreadsheet (CH 3)georgius gabrielОценок пока нет

- Financial Management Week 2 AssignmentДокумент2 страницыFinancial Management Week 2 AssignmentAndrea Monique AlejagaОценок пока нет

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Документ6 страницProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoОценок пока нет

- Exercises On DividendsДокумент16 страницExercises On DividendsGrace RoqueОценок пока нет

- FAC4864 Changes in Degree Workings TutorialДокумент24 страницыFAC4864 Changes in Degree Workings TutorialphosagontseОценок пока нет

- Tugas AKL1Документ4 страницыTugas AKL1Yandra Febriyanti0% (1)

- Advance AccountingДокумент6 страницAdvance AccountingRatna SariОценок пока нет

- Tugas 5 - InventoryДокумент11 страницTugas 5 - InventoryMuhammad RochimОценок пока нет

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceДокумент14 страницPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyОценок пока нет

- Paki Check BiДокумент5 страницPaki Check BiAusan AbdullahОценок пока нет

- Cash Flow Pr. 16-1AДокумент1 страницаCash Flow Pr. 16-1AKearrion BryantОценок пока нет

- Task Performance I. Horizontal AnalysisДокумент3 страницыTask Performance I. Horizontal AnalysisarisuОценок пока нет

- Pembahasan Kuiz Indirect HoldingsДокумент3 страницыPembahasan Kuiz Indirect HoldingsAdara KiranaОценок пока нет

- Lape - ACP312 - ULOa - Let's Analyze Week6Документ3 страницыLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeОценок пока нет

- Internal Test - 2 - FSA - QuestionДокумент3 страницыInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Tugas Adv2Документ13 страницTugas Adv2Widodo MohammadОценок пока нет

- Afar SolutionsДокумент8 страницAfar Solutionspopsie tulalianОценок пока нет

- Stock Acquisition Quiz 100% AnswerДокумент2 страницыStock Acquisition Quiz 100% AnswerJohn BalanquitОценок пока нет

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsДокумент36 страницMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (1)

- Ujian 1 AdvДокумент33 страницыUjian 1 AdvaraОценок пока нет

- Total Receipts 100,400 132,400 153,000Документ3 страницыTotal Receipts 100,400 132,400 153,000Marissa Jem ClaveriaОценок пока нет

- McPhee Distillers Statements v03 CPДокумент13 страницMcPhee Distillers Statements v03 CPcmag10Оценок пока нет

- BA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsДокумент23 страницыBA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsRed Ashley De LeonОценок пока нет

- 4BSA2 GROUP2 GroupActivityNo.1Документ4 страницы4BSA2 GROUP2 GroupActivityNo.1Lizerie Joy Kristine CristobalОценок пока нет

- FAR05 - First Pre-Board SolutionsДокумент7 страницFAR05 - First Pre-Board SolutionsMellaniОценок пока нет

- Sharon PLC (Long Question)Документ4 страницыSharon PLC (Long Question)Jimmy LimОценок пока нет

- Single EntryДокумент2 страницыSingle EntryAnswer KeyОценок пока нет

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Документ5 страницThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerОценок пока нет

- Kertas Kerja Neraca Konsolidasi PT A: Keterangan PTA PTB Eliminasi Debit KreditДокумент3 страницыKertas Kerja Neraca Konsolidasi PT A: Keterangan PTA PTB Eliminasi Debit Kreditadelia ramadanОценок пока нет

- AF Ch. 4 - Analysis FS - ExcelДокумент9 страницAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinОценок пока нет

- Far410 - SS - Feb 2022Документ9 страницFar410 - SS - Feb 2022AFIZA JASMANОценок пока нет

- AFAR2 CH. 3 - Problem Quiz 1Документ19 страницAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaОценок пока нет

- Horizontal and Vertical AnalysisДокумент4 страницыHorizontal and Vertical AnalysisJasmine ActaОценок пока нет

- Final PB FAR Batch 7 Sept 2023Документ38 страницFinal PB FAR Batch 7 Sept 2023Leo M. SalibioОценок пока нет

- chp3 Practice Problem 1Документ1 страницаchp3 Practice Problem 1api-557861169Оценок пока нет

- Partnership Operation ExercisesДокумент3 страницыPartnership Operation ExercisesArlene Diane OrozcoОценок пока нет

- Partnership Operation ExercisesДокумент3 страницыPartnership Operation ExercisesArlene Diane OrozcoОценок пока нет

- CPAR B94 FAR Final PB Exam - Answers - SolutionsДокумент8 страницCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezОценок пока нет

- Soal KK QUIZ Versi EkuitasДокумент5 страницSoal KK QUIZ Versi EkuitasmraliyahОценок пока нет

- Spread Sheet ModelingДокумент9 страницSpread Sheet ModelingAbhay BaraОценок пока нет

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Документ31 страницаIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaОценок пока нет

- Qualifying Exam Review Financial Accounting & ReportingДокумент21 страницаQualifying Exam Review Financial Accounting & ReportingClene DoconteОценок пока нет

- Activities 11&12Документ6 страницActivities 11&12MPCIОценок пока нет

- Soal AKM 2015Документ24 страницыSoal AKM 2015Siti Armayani RayОценок пока нет

- Chapter 14Документ10 страницChapter 14Nikki GarciaОценок пока нет

- Horizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BДокумент10 страницHorizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BKarysse Arielle Noel JalaoОценок пока нет

- Solutions Consolidation-FormattedДокумент22 страницыSolutions Consolidation-FormattedShehrozSTОценок пока нет

- Bank A and B - Bank XДокумент4 страницыBank A and B - Bank XSoleil SierraОценок пока нет

- FAPC Handouts - SemIX-1Документ48 страницFAPC Handouts - SemIX-1moulisethi1020Оценок пока нет

- FS Analysis - Answer KeyДокумент1 страницаFS Analysis - Answer KeyMicah ErguizaОценок пока нет

- Answers To Reviewer in Acctg 2Документ3 страницыAnswers To Reviewer in Acctg 2Fatima AsprerОценок пока нет

- A104 - Answer To QuizДокумент7 страницA104 - Answer To QuizJanice Mae RabayaОценок пока нет

- Akuntansi Keuangan Lanjutan 2Документ6 страницAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiОценок пока нет

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDДокумент8 страницQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongОценок пока нет

- Setting Performance Standards Assessing Employee Performance Providing The FeedbackДокумент2 страницыSetting Performance Standards Assessing Employee Performance Providing The FeedbackLeejat Kumar PradhanОценок пока нет

- Education Infographic November 2017Документ1 страницаEducation Infographic November 2017Leejat Kumar PradhanОценок пока нет

- BYJU's The Learning App Exhibits 8a To 11Документ4 страницыBYJU's The Learning App Exhibits 8a To 11Leejat Kumar PradhanОценок пока нет

- Bringing "Class To Mass" With PlénitudeДокумент36 страницBringing "Class To Mass" With PlénitudeLeejat Kumar PradhanОценок пока нет

- Scheduling ProblemДокумент1 страницаScheduling ProblemLeejat Kumar PradhanОценок пока нет

- Dahm Bep ExamplesДокумент1 страницаDahm Bep ExamplesLeejat Kumar PradhanОценок пока нет

- Judicial Activism and RestraintДокумент13 страницJudicial Activism and RestraintLeejat Kumar PradhanОценок пока нет

- NASA Decision by ConsensusДокумент3 страницыNASA Decision by ConsensusLeejat Kumar PradhanОценок пока нет

- Additional Practice QuestionsДокумент4 страницыAdditional Practice QuestionsLeejat Kumar PradhanОценок пока нет

- CAG Additional Practice QuestionsДокумент3 страницыCAG Additional Practice QuestionsLeejat Kumar PradhanОценок пока нет

- Summary On Market Segmentation and PositioningДокумент2 страницыSummary On Market Segmentation and PositioningLeejat Kumar Pradhan0% (1)

- Millennials: Multi-Generational Leaders Staying Connected: The Bolser Group, LLCДокумент10 страницMillennials: Multi-Generational Leaders Staying Connected: The Bolser Group, LLCLeejat Kumar PradhanОценок пока нет