Академический Документы

Профессиональный Документы

Культура Документы

Answers To Installment Accounting Previously Uploaded in This Profile

Загружено:

Kate AlvarezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Answers To Installment Accounting Previously Uploaded in This Profile

Загружено:

Kate AlvarezАвторское право:

Доступные форматы

Easy

1. B (8;392 G)

2. B (7;392 D)

3. D (92;230 D)

4. B (1;197 D)

Realized gross profit on instalment sales in 2016: Collections x Gross profit rate %

2015 sales: P500,000 x 30% ……………………………………………………P150,000

2016 sales: P600,000 x 40% …………………………………………………… 240,000

P390,000

5. B (4;394 G)

Sales P1,000,000

Cost of installment sales 700,000

Deferred gross profit P 300,000

Less: Deferred gross profit, end

Installment accounts receivables, 12/31

(1,000,000-400,000) P 600,000

Gross profit rate (300,000 1,000,000) X 30% 180,000

Realized gross profit P 120,000

Operating expenses 80,000

Operating income P 40,000

Interest and financing charges 100,000

Net income P 140,000

6. C (2;4 link)

Installment account receivable, 12/31/13 P200,000

Gross profit rate 40%

Deferred gross profit, December 31,2013 P 80,000

Average

1. D (17;203 D)

Instalment accounts receivable, December 31, 2016:

Deferred gross profit, December 31, 2016/Gross profit rate

2015 sales: P120,000 / 30%............................................................. P 400,000

2016 sales: P440,000 / 40%............................................................ 1,100,000

Instalment accounts receivable, December 31, 2016……………………………… P1,500,000

2. C (27;208 D)

Trade-in allowance…………………………………………………………………….. P 43,200

Less: market value of trade-in merchandise

Estimated resale price after reconditioning………. P36,000

Less: Reconditioning costs………………………………... 1,800

Normal profit (15% x P36,000)…………………. 5,400 28,800

Over allowance P 14,400

Instalment sales............................................................ P 122,000

Less: over allowance…………………………………………………. 14,400

Adjusted instalment sales…………………………………………. P 108,000

Less” cost of instalment sales…………………………………… 86,400

Gross profit………………………………………………………………… P 21,600

Gross profit rate (P21,600 / P108,000)………………………………………………….. 20%

Realized Gross profit:

Down payment…………………………………………………………………………. P 7,200

Trade-in (at market value)………………………………………………………… 28,800

Instalment Collections:

(P108,000 – P28,800 – P7,200) / 10 x 3 months………… 21,600*

Total collections in 2016……………………………………………………………………….. P 57,600

Multiply by: Gross profit ratio……………………………………………………………….. 20%

P 11,520

* or (P122,400 – P7,200 – P43,200) / 10 x 3 months

3. B (14;8 link)

(1) Total realized gross profit

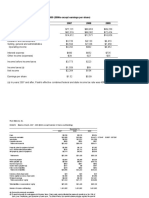

2011 2012 2013

Deferred gross profit before adjustment P10,500 P28,900 P96,000

Deferred gross profit, end:

2011 sales (P12,000 x 35%) 4,200

2012 sales (P40,000 x 34%) 13,600

2011 sales (P130,000 x 32%) 41,600

Realized gross profit, 12/31/13 P 6,300 P15,300 P54,400

Total (P76,000)

(2) Total collections in 2013

2011 2012 2013

Installment accounts receivable, beg

2011 sales (P10,500/35%) P30,000

2012 sales (P28,900/34%) 85,000

2011 sales (P96,000/32%) P300,000

Installment accounts receivable, end 12,000 40,000 130,000

Collections during 2013 P18,000 P45,000 P170,000

Total (P233,000)

4. B (29;14 link)

Fair value of repossessed merchandise P6,800

Unrecovered Cost:

Unpaid balance:

Sales 16,000

Collections:

Downpayment 3,200

Installment 3,200 6,400 9,600

Deferred gross profit (9,600 x 40%) 3,840 5,760

Gain on repossession P1,040

5. A (22;402 G)

Regular sales P1,575,000

Cost of regular sales 1,050,000

Gross profit on regular sales 525,000

Realized gross profit on installment sales:

Installment sales (1,093,750 x 240%) 2,625,000

Installment accounts receivable-12/31/08 1,575,000

Collections 1,050,000

Gross profit on rate on sales 140/240 612,500

Total realized gross profit 1,137,500

Operating expenses (1,137,500 x 70%) 796,250

Net income P 341,250

Hard

1. C (49;24 link)

Total realized gross profit (Sch.1) P157,156

Loss on repossession (Sch.2) (1,000)

Total realized gross profit loss on repossession 156,156

Operating expenses 96,000

Net income, Dec. 31,2013 P60,156

Schedule 1 – realized gross profit

2011 2012 2013

Sales Sales Sales

Inst. Contract receivable, 1/1/13 P110,000 P250,000 P420,000

Inst. Contract receivable, 21/31/13 (28,000) (92,000) (238,000)

Accounts written off (9,000) (2,800) –

Defaulted accounts (5,000) - -

Collections 68,000 155,200 182,000

Gross profit rate (GP/IS) 40% 38% 39%

Realized gross profit (P157,156) P27,200 P58,976 P70,980

Schedule 2 - loss o repossession:

Appraised value of repossessed merchandise P2,400

Less: reconditioning cots 400

Actual value at time of repossession 2,000

Less: unrecovered cost

Unpaid balance 5,000

Deferred gross profit (P5,000 x 40%) 2,000 3,000

Loss on repossession P(1,000)

2. B (38;213 D)

Dates (1) (2) (3) (4)

Collection 1% x (4) (1)-(2) (4)-(3)

Interest Principal Unpaid Balance

9/30/15 P3,600,000

9/30/15 P1,600,000 P-0- P1,600,000 2,000,000

10/31/15 220,000 20,000 *200,000 1,800,000

11/30/15 218,000 18,000 200,000 1,600,000

12/31/15 216,000 16,000 200,000 1,400,000

1/31/16 214,000 14,000 200,000 1,200,000

*monthly collections as to principal

3. C (39;213 D)

Dates (1) (2) (3) (4)

Collection 1% x (4) (1)-(2) (4)-(3)

Interest Principal Unpaid Balance

9/30/15 P3,600,000

9/30/15 P1,600,000 P-0- P1,600,000 2,000,000

10/31/15 211,164.15 20,000 191,164.15 1,808,835.85

11/30/15 211,164.15 18,088.36 193,075.79 1,615,760.06

12/31/15 211,164.15 16,157.60 195,006.65 1,420,753.51

1/31/16 211,164.15 14,207.54 196,956.61 1,223,796.90

4. D (40;213 D)

Average amount owed, (P2,000,000 + P200,0000 / 2 = P1,100,000

Interest paid: P3,600,000 x 12% x 10/12 = P360,000

Interest cost for 10-month period = P360,000 / P1,100,000 = 32.73%

Interest rate per year = 32.75% / (10/12) = 39.28%

5. (46;23 link)

Deferred gross profit, before adjustment P38,000

Less: deferred gross profit applicable to

Uncollected installment accounts:

2012: P16,250 x 30%/130% P3,750

2013:P90,000 x 25% 22,500 26,250

Realized gross profit P11,750

Less: Expenses 1,500

Net income on installment sales P10,250

Link:

https://drive.google.com/file/d/0B-oKl0zBZhKbWVhvVDV5d1dLRzg/view

D:

Practical accounting 2 by Dayag

G:

Advanced Accounting v1 by Guerrero

Вам также может понравиться

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestДокумент14 страницMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieОценок пока нет

- Solution Booklet 2 Installment LTCC, FranchiseДокумент7 страницSolution Booklet 2 Installment LTCC, Franchisemarcus yapОценок пока нет

- Installment Sales Consignment Sales Construction ContractsДокумент4 страницыInstallment Sales Consignment Sales Construction ContractsShaene GalloraОценок пока нет

- YowДокумент35 страницYowJane Michelle Eman100% (1)

- Intermediate Accounting Volume III 2012 Edition Suggested AnswersДокумент3 страницыIntermediate Accounting Volume III 2012 Edition Suggested AnswersEuphoriaОценок пока нет

- Accounting Assignments Financial StatementsДокумент5 страницAccounting Assignments Financial StatementsTendai MakosaОценок пока нет

- Dinner Co. Profit Loss StatementДокумент3 страницыDinner Co. Profit Loss StatementnovyОценок пока нет

- AFA Chapter 5 Consolidated Worksheet AdjustmentsДокумент6 страницAFA Chapter 5 Consolidated Worksheet AdjustmentsNguyễn Phương ThảoОценок пока нет

- Chapter18 - Answer PDFДокумент25 страницChapter18 - Answer PDFAvon Jade RamosОценок пока нет

- Chapter18 - Answer PDFДокумент25 страницChapter18 - Answer PDFJONAS VINCENT SamsonОценок пока нет

- Group 3: Quizzer On Installment SalesДокумент33 страницыGroup 3: Quizzer On Installment SalesKate Alvarez100% (2)

- Ma - Bep01 - LucioДокумент4 страницыMa - Bep01 - LucioGrace SimonОценок пока нет

- Managerial Analysis: CVP 01 Break-EvenДокумент4 страницыManagerial Analysis: CVP 01 Break-EvenGrace SimonОценок пока нет

- Profitability Ratio 2Документ18 страницProfitability Ratio 2Wynphap podiotanОценок пока нет

- Answer Key Quiz On Graduated Income Tax 1 PDFДокумент3 страницыAnswer Key Quiz On Graduated Income Tax 1 PDFMeg CruzОценок пока нет

- DAIBB MA Math Solutions 290315Документ11 страницDAIBB MA Math Solutions 290315joyОценок пока нет

- Tax ProblemsДокумент14 страницTax Problemsrav dano100% (1)

- Best Friends Co. Statement of Profit or Loss and Other Comprehensive Income For The Year Ended December 31, 20x1Документ3 страницыBest Friends Co. Statement of Profit or Loss and Other Comprehensive Income For The Year Ended December 31, 20x1Luis AlcalaОценок пока нет

- AFAR ANSWER KeyДокумент6 страницAFAR ANSWER KeyCheska JaplosОценок пока нет

- Franchise Accounting Problems SolutionsДокумент3 страницыFranchise Accounting Problems SolutionsJason BautistaОценок пока нет

- Chapter 15 Akun Keuangan TugasДокумент3 страницыChapter 15 Akun Keuangan Tugassegeri kecОценок пока нет

- Answers - Installment Sales - DayagДокумент11 страницAnswers - Installment Sales - DayagAye Buenaventura75% (16)

- Chapter 7Документ9 страницChapter 7Coursehero PremiumОценок пока нет

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000Документ26 страницMultiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000ALEXANDRANICOLE OCTAVIANOОценок пока нет

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeДокумент15 страницSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFДокумент3 страницыQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasОценок пока нет

- Recording Sales and Costs for Installment and Regular SalesДокумент2 страницыRecording Sales and Costs for Installment and Regular Salesjohn carlos doringoОценок пока нет

- FinAcc3 Chap9 PDFДокумент3 страницыFinAcc3 Chap9 PDFRenren FranciscoОценок пока нет

- FinAcc3 Chap9 PDFДокумент3 страницыFinAcc3 Chap9 PDFCindy BartolayОценок пока нет

- Angel Company interim report and operating segmentsДокумент3 страницыAngel Company interim report and operating segmentsJoana MagtuboОценок пока нет

- FinAcc3 Chap9 PDFДокумент3 страницыFinAcc3 Chap9 PDFReilpeterОценок пока нет

- Problem 17-1, ContinuedДокумент6 страницProblem 17-1, ContinuedJohn Carlo D MedallaОценок пока нет

- 3. BT IAS1 (SV)Документ3 страницы3. BT IAS1 (SV)HÀ THỚI NGUYỄN NGÂNОценок пока нет

- Acc 142 - ReviewerДокумент6 страницAcc 142 - ReviewerRiezel PepitoОценок пока нет

- Chap 5 Prob 1 3Документ10 страницChap 5 Prob 1 3Nyster Ann RebenitoОценок пока нет

- Appendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessДокумент14 страницAppendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessLan Hương Trần ThịОценок пока нет

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Документ5 страницComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellОценок пока нет

- Sol. Man. - Chapter 9 - Interim Financial ReportingДокумент6 страницSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHOОценок пока нет

- Consolidation of Foreign Subsidiaries UpdatedДокумент9 страницConsolidation of Foreign Subsidiaries UpdateddemolaojaomoОценок пока нет

- Consolidated Total Comprehensive Income Attributable To Parent P106,000Документ2 страницыConsolidated Total Comprehensive Income Attributable To Parent P106,000Wawex DavisОценок пока нет

- Batch 19 1st Preboard (P1)Документ12 страницBatch 19 1st Preboard (P1)Mike Oliver Nual100% (1)

- Intermediate Accounting 3 - SolutionsДокумент3 страницыIntermediate Accounting 3 - Solutionssammie helsonОценок пока нет

- Consolidation Workpaper Year AcquisitionДокумент78 страницConsolidation Workpaper Year AcquisitionJames Erick LermaОценок пока нет

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Документ3 страницыHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiОценок пока нет

- Financial Statement Analysis - Illustrative Problem - FOR STUDENTSДокумент6 страницFinancial Statement Analysis - Illustrative Problem - FOR STUDENTShobi stanОценок пока нет

- Finman P1 Compilation PDFДокумент33 страницыFinman P1 Compilation PDFJev CastroverdeОценок пока нет

- Acctg-5 Problem 15-12Документ7 страницAcctg-5 Problem 15-12Maria Fe Joanna AbonitaОценок пока нет

- 2017 Vol 3 CH 9 AnsДокумент3 страницы2017 Vol 3 CH 9 AnsDiola QuilingОценок пока нет

- Cash Flow Statement AnalysisДокумент14 страницCash Flow Statement AnalysisklairvaughnОценок пока нет

- Cases 3 - Berlin Novanolo G (29123112)Документ4 страницыCases 3 - Berlin Novanolo G (29123112)catatankotakkuningОценок пока нет

- Practice Exam Chapters 1-5 (1) Solutions: Problem IДокумент5 страницPractice Exam Chapters 1-5 (1) Solutions: Problem IAtif RehmanОценок пока нет

- Joint Operation Revenue and ExpensesДокумент2 страницыJoint Operation Revenue and ExpensesMitch Tokong MinglanaОценок пока нет

- Ap Solutions 2016Документ15 страницAp Solutions 2016Shariefia MagondacanОценок пока нет

- Chapter 10Документ5 страницChapter 10Xynith Nicole RamosОценок пока нет

- Name: Grade and Section:: S A L G L O S R E VДокумент5 страницName: Grade and Section:: S A L G L O S R E VPaul Robert DonacaoОценок пока нет

- Last Assign.Документ5 страницLast Assign.Ahmed Youssri TeleebaОценок пока нет

- Chapter 5 Tutorial ExerciseДокумент5 страницChapter 5 Tutorial ExerciseFarheen AkramОценок пока нет

- Notes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1Документ2 страницыNotes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1JonellОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- Read Gap Case - 2007 Case of Fred David's Strategic ManagementДокумент10 страницRead Gap Case - 2007 Case of Fred David's Strategic ManagementKate AlvarezОценок пока нет

- Document Incorporated by Reference 2010 03 16 PDFДокумент152 страницыDocument Incorporated by Reference 2010 03 16 PDFKate AlvarezОценок пока нет

- CLV Handout PDFДокумент21 страницаCLV Handout PDFKate AlvarezОценок пока нет

- 10 Year Life PlanДокумент2 страницы10 Year Life PlanKate AlvarezОценок пока нет

- Tesla PESTELДокумент3 страницыTesla PESTELJinal GanatraОценок пока нет

- Chapter 2: IT GovernanceДокумент33 страницыChapter 2: IT GovernanceKate AlvarezОценок пока нет

- Possible Solutions To Manila's IssuesДокумент2 страницыPossible Solutions To Manila's IssuesKate AlvarezОценок пока нет

- CLV Handout PDFДокумент21 страницаCLV Handout PDFKate AlvarezОценок пока нет

- CG Guidelines For Listed Companies Nov2010Документ13 страницCG Guidelines For Listed Companies Nov2010Raymond ChengОценок пока нет

- Financial Management For Non-ProfitsДокумент8 страницFinancial Management For Non-ProfitsErric19900% (1)

- History of LendingДокумент7 страницHistory of LendingKate AlvarezОценок пока нет

- Implementing Strategies: Management & Operations Issues: Strategic Management: Concepts & Cases 13 Edition Fred DavidДокумент32 страницыImplementing Strategies: Management & Operations Issues: Strategic Management: Concepts & Cases 13 Edition Fred DavidKate AlvarezОценок пока нет

- Option Contract - DayagДокумент5 страницOption Contract - DayagKate AlvarezОценок пока нет

- RevlonДокумент12 страницRevlonKate AlvarezОценок пока нет

- Case On GAP Inc.Документ21 страницаCase On GAP Inc.Kate AlvarezОценок пока нет

- Arbitrage Pricing TheoryДокумент6 страницArbitrage Pricing TheoryKate AlvarezОценок пока нет

- The Hershey Company: United States Securities and Exchange Commission FORM 10-KДокумент114 страницThe Hershey Company: United States Securities and Exchange Commission FORM 10-KndirangjОценок пока нет

- Accounting For SMEs Illustrative ProblemsДокумент5 страницAccounting For SMEs Illustrative ProblemsKate AlvarezОценок пока нет

- Financial Ratio AnalysisДокумент14 страницFinancial Ratio AnalysisPrasanga WdzОценок пока нет

- Twice BlessedДокумент4 страницыTwice BlessedKate AlvarezОценок пока нет

- THE REVISED OECD PRINCIPLES OF CORPORATE GOVERNANCE AND THEIR RELEVANCE TO NON-OECD COUNTRIES by Fianna Jesover and Grant Kirkpatrick1Документ31 страницаTHE REVISED OECD PRINCIPLES OF CORPORATE GOVERNANCE AND THEIR RELEVANCE TO NON-OECD COUNTRIES by Fianna Jesover and Grant Kirkpatrick1Kate AlvarezОценок пока нет

- Twice BlessedДокумент4 страницыTwice BlessedKate AlvarezОценок пока нет

- Chapter17 - AnswerДокумент5 страницChapter17 - AnswerGon FreecsОценок пока нет

- Quiz ReviewerДокумент1 страницаQuiz ReviewerKate AlvarezОценок пока нет

- Chapter20 - AnswerДокумент7 страницChapter20 - AnswerRicgie ManaladОценок пока нет

- The National EconomyДокумент17 страницThe National EconomyKate AlvarezОценок пока нет

- The Philippine Stock Exchange, IncДокумент21 страницаThe Philippine Stock Exchange, IncKate AlvarezОценок пока нет

- Quiz ReviewerДокумент1 страницаQuiz ReviewerKate AlvarezОценок пока нет

- Arbitrage Pricing TheoryДокумент6 страницArbitrage Pricing TheoryKate AlvarezОценок пока нет

- 33333331Документ219 страниц33333331Kate AlvarezОценок пока нет

- Acceptance Houses and Discount HousesДокумент16 страницAcceptance Houses and Discount HousesPrasant RoutОценок пока нет

- Answers To Midterm 3040AДокумент12 страницAnswers To Midterm 3040ApeaОценок пока нет

- ENBDДокумент1 страницаENBDpvr2k1Оценок пока нет

- Debt 31-05-2008Документ3 870 страницDebt 31-05-2008bipinpowerОценок пока нет

- Project Finance Risk Analysis TechniquesДокумент111 страницProject Finance Risk Analysis TechniquesDriton BinaОценок пока нет

- Summative Test For Genmath Quarter 2 Final PrintДокумент3 страницыSummative Test For Genmath Quarter 2 Final PrintClemente Ace Burce Macorol100% (2)

- Compilation of Cases in BankingДокумент179 страницCompilation of Cases in BankingMaria Guilka SenarloОценок пока нет

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesДокумент7 страницEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeОценок пока нет

- S STRATEGIES FOR EFFECTIVE NPA RECOVERIEStrategies For Effective Npa RecoveriesДокумент12 страницS STRATEGIES FOR EFFECTIVE NPA RECOVERIEStrategies For Effective Npa RecoveriesambujchinuОценок пока нет

- Rent To OwnДокумент3 страницыRent To OwnEfefiong Udo-NyaОценок пока нет

- The Tip of Indian Banking - Part 4Документ424 страницыThe Tip of Indian Banking - Part 4ambujchinuОценок пока нет

- E-BANKING FEATURES, BENEFITS AND IMPACT OF DIGITAL TRANSFORMATIONДокумент4 страницыE-BANKING FEATURES, BENEFITS AND IMPACT OF DIGITAL TRANSFORMATIONMir AqibОценок пока нет

- Lone Pine Cafe (A) : Harvard Business Case by Professor Robert N AnthonyДокумент2 страницыLone Pine Cafe (A) : Harvard Business Case by Professor Robert N AnthonyPranav ManianОценок пока нет

- Republic Act NoДокумент57 страницRepublic Act Noedwin castilloОценок пока нет

- Chapter 8 SMДокумент34 страницыChapter 8 SMYber LexОценок пока нет

- Asmt - Acc 501 PDFДокумент21 страницаAsmt - Acc 501 PDFChhorvy KhanОценок пока нет

- Sample Risk Rating ModelДокумент11 страницSample Risk Rating ModelFocus ManОценок пока нет

- Mar 102022 Smespd 02 eДокумент83 страницыMar 102022 Smespd 02 esalam ahmedОценок пока нет

- Mercantile Law Part-I AssignmentДокумент12 страницMercantile Law Part-I AssignmentMd Aríf Hussaín AlamínОценок пока нет

- Flash Memory Income Statements 2007-2009Документ10 страницFlash Memory Income Statements 2007-2009sahilkuОценок пока нет

- Merchant of Venice EssayДокумент3 страницыMerchant of Venice Essayapi-293642408Оценок пока нет

- Bonnevie v. CAДокумент1 страницаBonnevie v. CAArlando G. ArlandoОценок пока нет

- Amalgamation of FirmsДокумент3 страницыAmalgamation of Firmsmohanraokp2279Оценок пока нет

- Comparing Home Loans Across Top BanksДокумент55 страницComparing Home Loans Across Top BanksShikha Wadwa0% (1)

- SC rules no payment without delivery to creditorДокумент28 страницSC rules no payment without delivery to creditorMariaAyraCelinaBatacan100% (1)

- Saln Ammy 2017Документ4 страницыSaln Ammy 2017KarissaОценок пока нет

- Home LoanДокумент130 страницHome LoanAnkit ButtoliaОценок пока нет

- AIG Global Funds ProspectusДокумент257 страницAIG Global Funds ProspectusserebryakovОценок пока нет

- Sales AgreementДокумент1 страницаSales AgreementPhillip KingОценок пока нет

- Inscriptions 25Документ41 страницаInscriptions 25Gopinath Radhakrishnan100% (12)