Академический Документы

Профессиональный Документы

Культура Документы

Financial Ratio Calculation

Загружено:

Abank Fahri0 оценок0% нашли этот документ полезным (0 голосов)

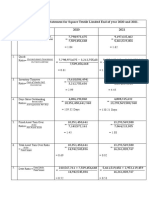

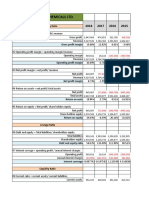

10 просмотров2 страницыThis document contains 26 financial ratios calculated for 2016 and 2015. The ratios measure performance metrics such as profitability, liquidity, leverage, and efficiency. Key ratios include Return on Assets of 1.86% in 2016 and 1.73% in 2015, Return on Equity of 3.55% in 2016 and 3.40% in 2015, and Current Ratio of 1.09 times in 2016 and 1.17 times in 2015.

Исходное описание:

Cal

Оригинальное название

Calculation

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document contains 26 financial ratios calculated for 2016 and 2015. The ratios measure performance metrics such as profitability, liquidity, leverage, and efficiency. Key ratios include Return on Assets of 1.86% in 2016 and 1.73% in 2015, Return on Equity of 3.55% in 2016 and 3.40% in 2015, and Current Ratio of 1.09 times in 2016 and 1.17 times in 2015.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

10 просмотров2 страницыFinancial Ratio Calculation

Загружено:

Abank FahriThis document contains 26 financial ratios calculated for 2016 and 2015. The ratios measure performance metrics such as profitability, liquidity, leverage, and efficiency. Key ratios include Return on Assets of 1.86% in 2016 and 1.73% in 2015, Return on Equity of 3.55% in 2016 and 3.40% in 2015, and Current Ratio of 1.09 times in 2016 and 1.17 times in 2015.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

FINANCIAL RATIO CALCULATION

No Ratio Formula 2016 2015

Market Price Per Share 5.625 5.050

1 PER = = 6,18 Times = 7,77 Times

Net Income Per Share 910 650

Income + Interest (1-Tax Rate) 10.634.943 9.939.236

2 ROA = = 1,86 % = 1,73 %

Total Assets 571.897.296 573.176.194

Income + Interest (1-Tax Rate) 10.634.943 9.939.236

3 ROI = = 2,60 % = 2,38 %

LL + SH'S Equity 408.632.389 417.172.005

Net Income 10.634.943 9.939.236

4 ROE = = 3,55 % = 3,40 %

Shareholder's Equity 299.748.943 292.661.551

Gross Margin 62.566.997 67.383.684

5 GPM = = 15,39 % = 14,94 %

Net Sales Revenue 406.437.733 451.126.030

Net Income 10.634.943 9.939.236

6 NPM = = 2,62 % = 2,20 %

Net Sales Revenue 406.437.733 451.126.030

Earnings Per Net Income 10.634.943 9.939.236

7 = = 0,06 US$ = 0,06 US$

Share No. Shares Outstanding 163.756.000 163.756.000

Cash Cash Generated by Operation 45.893.085 41.526.450

8 = = 4,32 Times = 4,18 Times

Realization Net Income 10.634.943 9.939.236

Assets Sales Revenue 406.437.733 451.126.030

9 = = 0,71 Times = 0,79 Times

Turnover Total Assets 571.897.296 573.176.194

Invested Sales revenue 406.437.733 451.126.030

10 Capital = = 0,99 Times = 1,08 Times

LL +SH'S Equity 408.632.389 417.172.005

Turnover

Sales Revenues 406.437.733 451.126.030

11 Equity Turnover = = 1,36 Times = 1,54 Times

Shareholders' Equity 299.748.943 292.661.551

Sales Revenues 406.437.733 451.126.030

12 Capital Intensity = = 1,12 Times = 1,23 Times

PPE 361.506.208 367.939.789

Cash 70.175.484 60.767.464

13 Day's Cash = = 74 Days = 58 Days

Cash Expenses ÷ 365 942.112 1.051.349

Day's Account Receivables 82.182.055 85.802.677

14 = = 74 Days = 69 Days

Receivables Sales ÷ 365 1.113.528 1.235.962

Inventory 3.477.956 4.276.557

15 Day's Inventory = = 4 Days = 4 Days

Cost of Sales ÷ 365 942.112 1.051.349

Inventory Cost of Sales 343.870.736 383.742.346

16 = = 98,87 Times = 89,73 Times

Turnover Inventory 3.477.956 4.276.557

Working Capital Sales Revenue 406.437.733 451.126.030

17 = = 2,29 Times = 2,48 Times

Turnover Working Capital 177.349.629 182.100.133

Current Assets 177.349.629 182.100.133

18 Current Ratio = = 1,09 Times = 1,17 Times

Current Liabilities 163.264.907 156.004.189

Monetary Current Assets 173.871.673 177.823.576

19 Quick Ratio = = 1,06 Times = 1,14 Times

Current Liabilities 163.264.907 156.004.189

Financial Assets 571.897.296 573.176.194

20 = = 1,91 Times = 1,96 Times

Leverage Ratio Shareholders' Equity 299.748.943 292.661.551

Debt/Equity Long-term Liabilities 272.148.353 280.514.643

21 = = 90,79 % = 95,85 %

Ratio Shareholders' Equity 299.748.943 292.661.551

Debt/Capitalizat Long-term Liabilities 272.148.353 280.514.643

22 = = 66,60 % = 67,24 %

ion LL +SH'S Equity 408.632.389 417.172.005

Time Interest (EBIT + Interest) 11.078.236 16.559.586

23 = = 11,65 Times = 16,09 Times

Earned Interest 951.033 1.028.955

Cash Flow / Cash Generated Operation 45.893.085 41.526.450

24 = = 16,86 % = 14,80 %

Debt Total Debt 272.148.353 280.514.643

Dividends Per Share 1,068 3,497

25 Dividend Yield = = 0,02 % = 0,07 %

Market Price Per Share 5.625 5.050

Dividend Dividends 4.680.150 4.391.972

26 = = 44,01 % = 44,19 %

Payout Net income 10.634.943 9.939.236

Вам также может понравиться

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineОценок пока нет

- Analisis Laporan KeuanganДокумент4 страницыAnalisis Laporan KeuanganStone BreakerОценок пока нет

- KellerFI504ProjectSolutionДокумент5 страницKellerFI504ProjectSolutionkfree76Оценок пока нет

- Company / Ratio Malaysia Resources Corporation Berhad IJM Corporation Berhad Gamuda Berhad Average Three Top Industries WTC BerhadДокумент3 страницыCompany / Ratio Malaysia Resources Corporation Berhad IJM Corporation Berhad Gamuda Berhad Average Three Top Industries WTC BerhadGraceYeeОценок пока нет

- Ratio AnalysisДокумент4 страницыRatio AnalysisKana jillaОценок пока нет

- Appendix BДокумент5 страницAppendix Bowenish9903Оценок пока нет

- Category of Financial Ratios No. YearДокумент3 страницыCategory of Financial Ratios No. YearIkaОценок пока нет

- Ratio AnalysisДокумент2 страницыRatio AnalysisShalehОценок пока нет

- Couche-Tards Ratio Analysis 2019Документ2 страницыCouche-Tards Ratio Analysis 2019/jncjdncjdnОценок пока нет

- MaxisДокумент4 страницыMaxisCalonneFrОценок пока нет

- Rumus Pasar ModalДокумент2 страницыRumus Pasar ModalGerardОценок пока нет

- FIN Individual AssignmentДокумент8 страницFIN Individual AssignmentMuhammad Muzammel100% (1)

- AlfredДокумент14 страницAlfredQuequ AppiahОценок пока нет

- ANALISIS RASIO PT Prima Cakrawala AbadiДокумент15 страницANALISIS RASIO PT Prima Cakrawala AbadiotovitasariОценок пока нет

- A. Profitability Ratio: Financial RatiosДокумент3 страницыA. Profitability Ratio: Financial RatiosshazОценок пока нет

- Week 4Документ9 страницWeek 4kishorbombe.unofficialОценок пока нет

- Account Appendix I & IIДокумент10 страницAccount Appendix I & IIAung phyoe Thar OoОценок пока нет

- Tugas Personal 1 FINC6193Документ9 страницTugas Personal 1 FINC6193alif syahputra11Оценок пока нет

- (Yunita Pangala-A031191177) UAS Analisis Informasi KeuanganДокумент8 страниц(Yunita Pangala-A031191177) UAS Analisis Informasi KeuanganChelsea Indri KurniaОценок пока нет

- Example Income Statements: Business Plan Financial ProjectionsДокумент3 страницыExample Income Statements: Business Plan Financial ProjectionsSUMANTO SHARANОценок пока нет

- Wilderness WordДокумент3 страницыWilderness Wordarsenali damuОценок пока нет

- Kelompok 5 - ALK Problem 9-3Документ4 страницыKelompok 5 - ALK Problem 9-3UmiUmiОценок пока нет

- Company Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesДокумент16 страницCompany Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaОценок пока нет

- Business Finance Quiz 3-SeratoДокумент4 страницыBusiness Finance Quiz 3-SeratoDaryl SeratoОценок пока нет

- Case Ratios and Financial Planning at EaДокумент6 страницCase Ratios and Financial Planning at EaAgus E. SetiyonoОценок пока нет

- CV Assignment - Agneesh DuttaДокумент14 страницCV Assignment - Agneesh DuttaAgneesh DuttaОценок пока нет

- Ratio Analyis of Sanofi AventisДокумент10 страницRatio Analyis of Sanofi AventissnawazhОценок пока нет

- ACC314 Revision Ratio Questions - SolutionsДокумент8 страницACC314 Revision Ratio Questions - SolutionsRukshani RefaiОценок пока нет

- SIM KAMIS 1230 TugasTM11 VionaBianca 21190000087Документ5 страницSIM KAMIS 1230 TugasTM11 VionaBianca 21190000087Viona BiancaОценок пока нет

- BritanniaДокумент4 страницыBritanniaHiral JoshiОценок пока нет

- CV Assignment - Agneesh DuttaДокумент9 страницCV Assignment - Agneesh DuttaAgneesh DuttaОценок пока нет

- Solution To Part 1 of The Project: Tootsie Roll Earning Per ShareДокумент5 страницSolution To Part 1 of The Project: Tootsie Roll Earning Per ShareChalondaWrightОценок пока нет

- Ratio AnalysisДокумент10 страницRatio Analysisbikash_kediaОценок пока нет

- Basic Financial Statement Analysis For Nestl Philippines, IncДокумент19 страницBasic Financial Statement Analysis For Nestl Philippines, IncDiane MiedesОценок пока нет

- Comprehensive IT Industry Analysis - ProjectДокумент52 страницыComprehensive IT Industry Analysis - ProjectdhruvОценок пока нет

- Investment Appraisal and Analysis Ide 2018Документ4 страницыInvestment Appraisal and Analysis Ide 2018vincentОценок пока нет

- Aditya nuVOДокумент12 страницAditya nuVOPriyanshi yadavОценок пока нет

- Valuation AssignmentДокумент20 страницValuation AssignmentHw SolutionОценок пока нет

- MoneyДокумент1 страницаMoneySashi TamizhaОценок пока нет

- Bemd RatiosДокумент12 страницBemd RatiosPRADEEP CHAVANОценок пока нет

- Earning After Tax+Depreciation ST Liab + LT Liab Earning After Tax+Depreciation ST Liab + LT LiabДокумент6 страницEarning After Tax+Depreciation ST Liab + LT Liab Earning After Tax+Depreciation ST Liab + LT LiabPutu AriefОценок пока нет

- Coca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Документ6 страницCoca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Sayan BiswasОценок пока нет

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDДокумент9 страницRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaОценок пока нет

- Blaine Kitchenware: Case Exhibit 1Документ15 страницBlaine Kitchenware: Case Exhibit 1Fahad AliОценок пока нет

- Financial Ratios of Keppel Corp 2008-1Документ3 страницыFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyОценок пока нет

- PNC Annual RPT 2020 LowresДокумент229 страницPNC Annual RPT 2020 LowresShehani ThilakshikaОценок пока нет

- Balance Sheet of State Bank of IndiaДокумент9 страницBalance Sheet of State Bank of IndiaSnehal TanksaleОценок пока нет

- Balance Sheet - in Rs. Cr.Документ72 страницыBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Smith and CPДокумент3 страницыSmith and CPFirdausОценок пока нет

- Project On SbiДокумент4 страницыProject On Sbijini03Оценок пока нет

- Andhra Petrochemicals LTD.: Profitability RatioДокумент13 страницAndhra Petrochemicals LTD.: Profitability RatioDäzzlîñg HärîshОценок пока нет

- Facebook IPO SlidesДокумент14 страницFacebook IPO SlidesLof Kyra Nayyara100% (1)

- Quiz RatiosДокумент4 страницыQuiz RatiosAmmar AsifОценок пока нет

- Balance Sheet RsДокумент5 страницBalance Sheet RsBinesh BashirОценок пока нет

- Balance Sheet of State Bank of India: - in Rs. Cr.Документ17 страницBalance Sheet of State Bank of India: - in Rs. Cr.Sunil KumarОценок пока нет

- Payback Period (In Months)Документ4 страницыPayback Period (In Months)Reyy ArbolerasОценок пока нет

- Ratio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Документ6 страницRatio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Thomas RajanОценок пока нет

- Financial Ratio PETRONДокумент6 страницFinancial Ratio PETRONsyahiir syauqiiОценок пока нет

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksОт EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksОценок пока нет

- Chapter 3Документ6 страницChapter 3Abank FahriОценок пока нет

- Pengumunan CPNS Kab. CirebonДокумент3 страницыPengumunan CPNS Kab. CirebonAbank FahriОценок пока нет

- The Role of Shared Services PDFДокумент5 страницThe Role of Shared Services PDFAbank FahriОценок пока нет

- WEB: Salvatore's Managerial Economics in A Global Economy, 8 Ed. Chapter 2: Changes in Supply and Demand Cause Large Swings in Copper PricesДокумент1 страницаWEB: Salvatore's Managerial Economics in A Global Economy, 8 Ed. Chapter 2: Changes in Supply and Demand Cause Large Swings in Copper PricesAbank FahriОценок пока нет

- Katie Wales, University of Leeds, UKДокумент20 страницKatie Wales, University of Leeds, UKAbank FahriОценок пока нет

- STTP Annual Report 2015Документ33 страницыSTTP Annual Report 2015Abank FahriОценок пока нет

- Current Ratio, Quick Ratio, Debt To Equity RatioДокумент20 страницCurrent Ratio, Quick Ratio, Debt To Equity RatioAbank FahriОценок пока нет

- Accounting Text and Cases 12 Ed.Документ14 страницAccounting Text and Cases 12 Ed.Abank FahriОценок пока нет

- B. Syllabus: NO Skills Competency Topic Source of Materials 1 at The AirportДокумент1 страницаB. Syllabus: NO Skills Competency Topic Source of Materials 1 at The AirportAbank FahriОценок пока нет

- No. Ratios 2016 2015 Diff.: Tests of Dividend PolicyДокумент1 страницаNo. Ratios 2016 2015 Diff.: Tests of Dividend PolicyAbank FahriОценок пока нет

- Accounting Text and Cases 12 Ed.Документ11 страницAccounting Text and Cases 12 Ed.Abank FahriОценок пока нет

- Calculation 8Документ2 страницыCalculation 8Abank FahriОценок пока нет

- Application Form Unilever General 2014v1Документ9 страницApplication Form Unilever General 2014v1Abank FahriОценок пока нет

- Accounting Text and Cases 12 Ed. Chapter 4 PDFДокумент22 страницыAccounting Text and Cases 12 Ed. Chapter 4 PDFAbank Fahri100% (2)

- MM5002 AccountingДокумент7 страницMM5002 AccountingAbank FahriОценок пока нет

- Accounting Text and Cases 12 Ed.Документ13 страницAccounting Text and Cases 12 Ed.Abank FahriОценок пока нет

- Accounting Text and Cases 12 Ed. Chapter 11 PDFДокумент13 страницAccounting Text and Cases 12 Ed. Chapter 11 PDFAbank FahriОценок пока нет

- Accounting Text and Cases 12 Ed.Документ19 страницAccounting Text and Cases 12 Ed.Abank Fahri100% (1)

- Theory of AccountsДокумент7 страницTheory of AccountsJeffrey CardonaОценок пока нет

- FutureMetrics Pellet Plant Risk AnalysisДокумент19 страницFutureMetrics Pellet Plant Risk AnalysisSalli MarindhaОценок пока нет

- ADX The Trend Strength Ind..Документ4 страницыADX The Trend Strength Ind..pderby1Оценок пока нет

- Research in International Business and Finance: David Moreno, Marcos Antoli, David QuintanaДокумент14 страницResearch in International Business and Finance: David Moreno, Marcos Antoli, David QuintanaEnrica Des DoridesОценок пока нет

- Chapter 6 Homework - Motaman AlquraishДокумент9 страницChapter 6 Homework - Motaman AlquraishMaddah HussainОценок пока нет

- RWJ 08Документ38 страницRWJ 08Kunal PuriОценок пока нет

- BetterSystemTrader Session004 NickRadgeДокумент17 страницBetterSystemTrader Session004 NickRadgepderby1100% (1)

- 04 - 05 - Option Strategies & Payoff'sДокумент66 страниц04 - 05 - Option Strategies & Payoff'sMohammedAveshNagoriОценок пока нет

- Creating Job Opportunities For UnemployedДокумент4 страницыCreating Job Opportunities For UnemployedhadncsОценок пока нет

- AndraUnger WEBINAR Nov4-2015Документ43 страницыAndraUnger WEBINAR Nov4-2015Faisal MahboobОценок пока нет

- Exercise 9 Statement of Cash Flows - 054915Документ2 страницыExercise 9 Statement of Cash Flows - 054915Hoyo VerseОценок пока нет

- Bonds Valuation PowerpointДокумент39 страницBonds Valuation Powerpointttongoona3Оценок пока нет

- Project Aurelius Pt1 01bДокумент4 страницыProject Aurelius Pt1 01btestinoОценок пока нет

- ch06 SM RankinДокумент12 страницch06 SM Rankinhasan jabrОценок пока нет

- BSP Circular 1109Документ3 страницыBSP Circular 1109Maya Julieta Catacutan-EstabilloОценок пока нет

- Financial Institutions Instruments and Markets 8th Edition Viney Solutions ManualДокумент27 страницFinancial Institutions Instruments and Markets 8th Edition Viney Solutions Manualdonnamargareta2g5100% (23)

- Terry Smith (Businessman)Документ4 страницыTerry Smith (Businessman)Freddy YanceОценок пока нет

- Brigade Enterprises LimitedДокумент36 страницBrigade Enterprises LimitedAnkur MittalОценок пока нет

- Financial Statement Analysis of TataДокумент32 страницыFinancial Statement Analysis of TataVISHNU SATHEESHОценок пока нет

- Chap29 PremiumДокумент34 страницыChap29 PremiumNGOC HOANG BICHОценок пока нет

- To Valuation Concepts: by Sarah M. Balisacan, CPAДокумент12 страницTo Valuation Concepts: by Sarah M. Balisacan, CPAardee esjeОценок пока нет

- Long-Term Financial Planning and Growth: Mcgraw-Hill/IrwinДокумент25 страницLong-Term Financial Planning and Growth: Mcgraw-Hill/IrwinLeonardus WendyОценок пока нет

- Special Financial InstitutionsДокумент11 страницSpecial Financial InstitutionsSenelwa Anaya100% (3)

- CE A92 Final PlatesДокумент2 страницыCE A92 Final PlatesMikaОценок пока нет

- Chapter-08-Ideas On Operating SegmentsДокумент12 страницChapter-08-Ideas On Operating Segmentsmdrifathossain835Оценок пока нет

- Aan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodДокумент25 страницAan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodNamra SaeedОценок пока нет

- Walt Disney Company's Slepping Beauty Bond - Student SpreadsheetДокумент20 страницWalt Disney Company's Slepping Beauty Bond - Student SpreadsheetshrabaniОценок пока нет

- Porter's Five Forces Model ReferenceДокумент3 страницыPorter's Five Forces Model ReferenceKumardeep SinghaОценок пока нет

- Fortune Brands Inc: FORM 10-QДокумент49 страницFortune Brands Inc: FORM 10-Qtomking84Оценок пока нет

- Schilling 07Документ52 страницыSchilling 07Fahmida IkramОценок пока нет