Академический Документы

Профессиональный Документы

Культура Документы

FMR (Arbitrage in The Foreign Exchange Market)

Загружено:

Vicknes ThevarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FMR (Arbitrage in The Foreign Exchange Market)

Загружено:

Vicknes ThevarАвторское право:

Доступные форматы

Arbitrage in the foreign exchange market: Turning on the microscope

This journal is about the real-time evidence on the frequency, size, duration and economic

significance of arbitrage opportunities s in the foreign exchange market. From this journal we

can learn that the move itself provides a motivation for a fresh analysis of arbitrage

opportunities because of changes in trading practices and market characteristics induced by

electronic platforms. The data set includes contemporaneous tick quotes of exchange rates and

interest rates that pertain to the most liquid segments of the FX and capital markets. It could

detect the existence and measure the duration of a number of short-lived arbitrage

opportunities only by using a unique data set at tick frequency for quotes of comparable

domestic and foreign interest rates and spot and forward exchange rates. Furthermore, one

must take into account all relevant aspects of the microstructure of the markets in order to

capture the opportunities and transaction costs that market participants face. This paper

investigates empirically the existence of arbitrage and the properties of potential departures

from no-arbitrage conditions using a microstructure perspective. The relevant literature

suggests that CIP arbitrage opportunities do not generally arise in the FX market and mispricing

is negligible when one accounts for estimated transaction costs.

The advantages of this study relative to all previous empirical analyses of arbitrage are our

data set, and a precise account of transaction costs as well as pricing and trading conventions.

Overall, the view of financial markets is, where efficiency is not interpreted as a statement

about prices being correct at each point in time but the notion that in efficiently-functioning

financial markets very short-term arbitrage opportunities can arise and invite traders to exploit

them, which makes it worthwhile to watch the relevant markets. These results, coupled with the

unpredictability of the arbitrage opportunities, imply that a typical researcher in international

macro-finance can safely assume arbitrage-free prices in the FX market when working with daily

or lower frequency data.

RECOMMENDATION

One of the recommendation given by the author is , in order to detect the existence and

measure the duration of a number of short-lived arbitrage opportunities it can be only done by

using a unique data set at tick frequency for quotes of comparable domestic and foreign interest

rates and spot and forward exchange rates.

Source: https://www.cass.city.ac.uk/__data/assets/pdf_file/0009/40689/JIE_2008.pdf

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Circular Business Models in The Medical Device Industry - Paths Towards Sustainable HealthcareДокумент15 страницCircular Business Models in The Medical Device Industry - Paths Towards Sustainable HealthcareNuriaОценок пока нет

- How Alcohol Brands Can Tap the eCommerce OpportunityДокумент16 страницHow Alcohol Brands Can Tap the eCommerce OpportunityFajri MekkaОценок пока нет

- Digital Marketing and Non - Line World: Business Intelligence The Intelligence PlatformsДокумент11 страницDigital Marketing and Non - Line World: Business Intelligence The Intelligence PlatformsPratiksha DeshmukhОценок пока нет

- Risk-Based AuditingДокумент16 страницRisk-Based AuditingMohammed JabbarОценок пока нет

- ANNEXURE ST-1 Assessee ProfileДокумент10 страницANNEXURE ST-1 Assessee ProfileKunalKumarОценок пока нет

- Shipsy Logistics Report SummaryДокумент4 страницыShipsy Logistics Report SummaryVaibhav BahetiОценок пока нет

- CS 803 (D) MIE Unit 1Документ9 страницCS 803 (D) MIE Unit 1Neha MishraОценок пока нет

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelДокумент20 страницUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelMERCY LAWОценок пока нет

- b5 Special Solving Set 5Документ6 страницb5 Special Solving Set 5MSHANA ALLYОценок пока нет

- Dissertation On Employee Engagement and RetentionДокумент4 страницыDissertation On Employee Engagement and RetentionOrderAPaperCanadaОценок пока нет

- (Group Project - Marketing Plan) Group 10Документ21 страница(Group Project - Marketing Plan) Group 10Tghusna FatmaОценок пока нет

- Withholding VAT Guideline (2017-18)Документ29 страницWithholding VAT Guideline (2017-18)banglauserОценок пока нет

- International Price List Marine b005 Ipl 2018 01Документ20 страницInternational Price List Marine b005 Ipl 2018 01RezaОценок пока нет

- CH 05Документ15 страницCH 05amir nabilОценок пока нет

- Role of the Sleeping PartnerДокумент15 страницRole of the Sleeping PartnerKhalid AsgherОценок пока нет

- CRM Project PlanДокумент12 страницCRM Project Planwww.GrowthPanel.com100% (5)

- WiproДокумент1 страницаWiproSugantha MohanОценок пока нет

- Flow ICM - STДокумент7 страницFlow ICM - STPatrícia Martins Gonçalves CunhaОценок пока нет

- Good Sales Candidate ResumesДокумент2 страницыGood Sales Candidate ResumesKapoor InfraОценок пока нет

- Proposal On Human Resource MagmtДокумент15 страницProposal On Human Resource MagmtKalayu KirosОценок пока нет

- Mock Test Paper - II for Intermediate (New) Group - II Paper 8A: Financial ManagementДокумент6 страницMock Test Paper - II for Intermediate (New) Group - II Paper 8A: Financial ManagementHarsh KumarОценок пока нет

- SAP T-Codes Module IS - DFPS Defense Forces and Public SecurityДокумент39 страницSAP T-Codes Module IS - DFPS Defense Forces and Public Securityharisomanath100% (1)

- NHIDCL Invoice Approval for Zojila Tunnel DPRДокумент8 страницNHIDCL Invoice Approval for Zojila Tunnel DPRMohd UmarОценок пока нет

- SAMPLE of Instructions To BiddersДокумент4 страницыSAMPLE of Instructions To BiddersAhmed FarajОценок пока нет

- CAMPOSOL Reports 121% Increase in EBITDA for 2016Документ24 страницыCAMPOSOL Reports 121% Increase in EBITDA for 2016Albert PizarroОценок пока нет

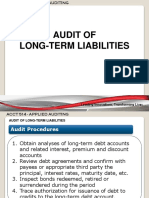

- Audit of Long-Term LiabilitiesДокумент43 страницыAudit of Long-Term LiabilitiesEva Dagus0% (1)

- The Customer JourneyДокумент1 страницаThe Customer JourneyIDG_World100% (3)

- Introduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan SoğancıДокумент27 страницIntroduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan Soğancırayhan555Оценок пока нет