Академический Документы

Профессиональный Документы

Культура Документы

pd24 09e

Загружено:

Tommy DuИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

pd24 09e

Загружено:

Tommy DuАвторское право:

Доступные форматы

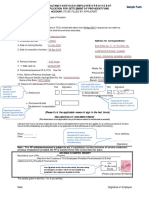

APPLICATION FOR A REFUND OF OVERDEDUCTED CPP

CONTRIBUTIONS OR EI PREMIUMS

For the year ending December 31

If you are an employer who overdeducted Canada Pension Plan Do not complete this form if you have deducted and reported CPP

(CPP) contributions or Employment Insurance (EI) premiums for contributions or EI premiums in excess of the maximum for the year

an employee for any of the reasons listed in Part A, complete on only one T4 slip for the employee. We will reduce your share to the

and mail this form to your tax centre to apply for a refund. maximum allowable and notify you of any credit balances when we

A separate form is required for each employee. process your T4 information return. However, if you reported these

overdeductions on more than one T4 slip for the employee, complete

If you are making an adjustment due to non-pensionable or Part B so we can calculate the amount of your overpayment.

non-insurable employment and you received a ruling from us,

attach a copy of the ruling, or a copy of the related decision by Do not complete this form if you have overdeducted CPP

the Minister of National Revenue or by the court. After we contributions or EI premiums within a current calendar year.

receive your completed form and a copy of the ruling or the Instead, reduce your current year remittances by the overdeduction.

decision, we will issue the refund.

You can send us this application with your T4 information return, or

To get a ruling about whether a person is engaged in send it later within the following time limits:

pensionable or insurable employment, complete

Form CPT1, Request for a Ruling as to the Status of a 앫 or CPP contributions, no later than four years from the end of the

Worker Under the Canada Pension Plan and/or Employment year in which the overpayment occurred;

Insurance Act. To get this form, visit www.cra.gc.ca or

call 1-800-959-2221. 앫 for EI premiums, no later than three years from the end

of the year in which the overpayment occurred; or

Do not adjust the CPP contribution or EI premium amounts you

report on your employee's T4 slips. We will credit an employee 앫 if an overdeduction results from a decision by the Minister

for excess CPP contributions or EI premiums when the or by the court, no later than 30 days after the decision is

employee files his or her income tax return. communicated to you or the employee.

Tick to show how you want this refund applied

Refund Transfer to current-year remittance account Transfer to another CRA account No.:

(en lettres

Identification (please moulées)

print)

Employer's name (as shown on Form PD7A) Payroll Account Number

R P

Address

Adresse

Postal code

Employee's name (last name first) Employee's social insurance number

— —

Address

Postal code

Part A – Tick the reason(s) for this application

Canada Pension Plan (CPP) Employment Insurance (EI)

Year Month Day Premiums in excess of the maximum amount

Employee under 18 or over 70 years of age Date of birth required on earnings paid yearly

Year Month Day

Employee of a corporation controls _______% of the

Employee receiving retirement pension from CPP or QPP since ...

voting shares of that corporation (see top of next page)

Employee receiving disability benefit from CPP or QPP

Year Month Day Employee was not engaged in insurable employment

Date employee was determined to be disabled (for example, the person was self-employed or related

to the owner). Note: A ruling may be required.

Year Month Day Please explain:

Employee died during the year Date of death

Employee was not engaged in pensionable employment (for Error in reading premium tables

Please explain:

example, the person was self-employed).

Note: A ruling may be required.

Error in reading contribution tables

PD24 E (09) Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou au 1-800-959-3376

Part A (continued) – If you ticked the "Employee of a corporation..." box, attach an updated copy of your share register or

complete the following corporate share arrangement.

Corporation identification Date of incorporation

Incorporated under the law of Information for

the period to

List the officers of the corporation (For recent shareholder changes, please provide a copy of the Shareholder's Register.)

President Vice-President Treasurer

Secretary Directors Directors

How many voting shares has the corporation issued? Common shares Preferred shares

How many votes do each type of share have? Common shares Preferred shares

List the distribution of the voting shares (Attach a separate sheet if necessary.)

Name Number of shares owned Date of issue

If yes, when and to whom were the shares transferred?

Have there been any transfers of the voting shares? Yes No (Attach a separate sheet if necessary.)

Date Transferred to Transferred from

Part B – List the details for all pay periods in the year.

You MUST complete this part so we can correctly calculate the amount of your overpayment.

Pay Period Canada Pension Plan (CPP) Employment Insurance (EI)

Employee CPP

Pensionable Required CPP CPP Insurable Employee EI Required EI EI

From To earnings contribution contribution overpayment earnings premium deducted premium overpayment

deducted

... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

Total Total

Employer CPP overpayment = employee CPP overpayment Employer EI overpayment 쏁 * 쎹 employee EI overpayment

Employer CPP overpayment

씰 Employer EI overpayment

씰

...

...

* Use 1.4 unless you are using a reduced rate. In that case,

enter the reduced rate.

...

Total overdeduction

Certification

I, , certify that the information given on this form is, to the best of my knowledge, correct and complete.

Name in capital letters

Date Signature of employer or authorized officer Position or office Telephone number (include area code)

Вам также может понравиться

- SAF Form - Updated 2019Документ2 страницыSAF Form - Updated 2019Tenson BeldenОценок пока нет

- Offerletter PHFL ApplicationidДокумент4 страницыOfferletter PHFL Applicationidharsh sahuОценок пока нет

- Staten of EarningsДокумент7 страницStaten of EarningsEcaterina DavidovОценок пока нет

- Jobkeeper Employee Nomination Notice: Section AДокумент2 страницыJobkeeper Employee Nomination Notice: Section AAnonymous H8viqHlM3wОценок пока нет

- Declaration For InvestmentsДокумент6 страницDeclaration For InvestmentsAnonymous EkFiHy0QoОценок пока нет

- MEB001 FundsAtWork Umbrella Funds Withdrawal FormДокумент5 страницMEB001 FundsAtWork Umbrella Funds Withdrawal FormdlndlaminiОценок пока нет

- PFF053 Member'SContributionRemittanceForm V03Документ12 страницPFF053 Member'SContributionRemittanceForm V03CA RosarioОценок пока нет

- Employment Law (HRM 657)Документ18 страницEmployment Law (HRM 657)Lia AliaaОценок пока нет

- Employer Specail Wage Report Social-Security-Form-SSA-131Документ2 страницыEmployer Specail Wage Report Social-Security-Form-SSA-131DellComputer99Оценок пока нет

- Declaration Form (22-23)Документ4 страницыDeclaration Form (22-23)vasavi kОценок пока нет

- US Internal Revenue Service: f2350 - 1996Документ2 страницыUS Internal Revenue Service: f2350 - 1996IRSОценок пока нет

- Full Service Payroll Set Up Checklist 2018Документ1 страницаFull Service Payroll Set Up Checklist 2018Anne EtrerozОценок пока нет

- Georgia Separation Notice Form DOL-800Документ3 страницыGeorgia Separation Notice Form DOL-800kelsey.frostОценок пока нет

- Payroll ChecklistДокумент1 страницаPayroll ChecklistDummy accountОценок пока нет

- Pension Papers SuperanuationДокумент19 страницPension Papers SuperanuationNaeem RaoОценок пока нет

- AttachmentДокумент15 страницAttachmentAjinkya kasarОценок пока нет

- Form P12 18 - 19Документ2 страницыForm P12 18 - 19Iniobong SaturdayОценок пока нет

- Notice 1Документ15 страницNotice 1Udta PanchhiОценок пока нет

- C6575 OMC ISASA Retirement Benefit Claim Form WR 1Документ4 страницыC6575 OMC ISASA Retirement Benefit Claim Form WR 1Lungisani MtshaliОценок пока нет

- Election To Stop Contributing To The Canada Pension Plan, or Revocation of A Prior ElectionДокумент2 страницыElection To Stop Contributing To The Canada Pension Plan, or Revocation of A Prior ElectionbatmanbittuОценок пока нет

- 2023 DD and Tax FormsДокумент5 страниц2023 DD and Tax FormselantobbyОценок пока нет

- US Internal Revenue Service: f8861 AccessibleДокумент2 страницыUS Internal Revenue Service: f8861 AccessibleIRSОценок пока нет

- PPP Loan Forgiveness Application (Revised 6.16.2020)Документ5 страницPPP Loan Forgiveness Application (Revised 6.16.2020)LaurenОценок пока нет

- Exit Process and FAQ'sДокумент8 страницExit Process and FAQ'snaimishamaniОценок пока нет

- US Internal Revenue Service: f2350 - 1992Документ2 страницыUS Internal Revenue Service: f2350 - 1992IRSОценок пока нет

- Conne QTДокумент4 страницыConne QThariomsingh.karnisenaОценок пока нет

- Key Points For Investment Proof Submission 2016-2017 Deadline and Mode of SubmissionДокумент13 страницKey Points For Investment Proof Submission 2016-2017 Deadline and Mode of SubmissionAjay TiwariОценок пока нет

- PdataДокумент6 страницPdataRazor11111Оценок пока нет

- MO W-4 Employee's Withholding Certificate: Reset Form Print FormДокумент1 страницаMO W-4 Employee's Withholding Certificate: Reset Form Print FormAmina chahalОценок пока нет

- RoeguideДокумент8 страницRoeguideLynn RileyОценок пока нет

- P46: Employee Without A Form P45: Section OneДокумент2 страницыP46: Employee Without A Form P45: Section Onedeepika505Оценок пока нет

- ESI Form 5Документ4 страницыESI Form 5savita17julyОценок пока нет

- Bir60 EguideДокумент15 страницBir60 Eguidekumar.arasu8717Оценок пока нет

- Declaration of Exemption - Employment at A Special Work SiteДокумент2 страницыDeclaration of Exemption - Employment at A Special Work SiteMatt WoodОценок пока нет

- UI-28 - Illinios Refund Form - 2016Документ2 страницыUI-28 - Illinios Refund Form - 2016MuhammadOwaisKhanОценок пока нет

- Basic NHP 2017Документ12 страницBasic NHP 2017khallushaik424Оценок пока нет

- Notification of OverpaymentДокумент1 страницаNotification of Overpaymentaanchal singhОценок пока нет

- SSSForm Member Loan Payment ReturnДокумент1 страницаSSSForm Member Loan Payment ReturnDream CunananОценок пока нет

- SC Ins3166Документ2 страницыSC Ins3166Luca GreikoОценок пока нет

- 3003568.australia Super Standard Choice 2.p7Документ3 страницы3003568.australia Super Standard Choice 2.p7gogin565Оценок пока нет

- PRAKRUTHIДокумент4 страницыPRAKRUTHIprakruthiry03Оценок пока нет

- Fowlis, Jesse - T183Документ2 страницыFowlis, Jesse - T183End UserОценок пока нет

- Critical Skills Employment Permits ChecklistДокумент6 страницCritical Skills Employment Permits ChecklistHassan RazaОценок пока нет

- 18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Документ3 страницы18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Mohamad FadzliОценок пока нет

- Certified Payroll Report RequirementsДокумент10 страницCertified Payroll Report RequirementsRASHID SIKDERОценок пока нет

- FPF060 Member'sContributionRemittance V01Документ3 страницыFPF060 Member'sContributionRemittance V01christine_balanagОценок пока нет

- Pag IbigДокумент3 страницыPag IbigSharon Rillo Ofalda100% (1)

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Документ4 страницыOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BОценок пока нет

- Tax Proof Guidelines FAQДокумент19 страницTax Proof Guidelines FAQRoshan LewisОценок пока нет

- US Internal Revenue Service: f2350 - 2001Документ3 страницыUS Internal Revenue Service: f2350 - 2001IRSОценок пока нет

- Payroll FAQ For Santa EmployeesДокумент1 страницаPayroll FAQ For Santa EmployeesLeigh ScottОценок пока нет

- P60single 2Документ1 страницаP60single 2Claira JervisОценок пока нет

- Work Opportunity Credit: General InstructionsДокумент3 страницыWork Opportunity Credit: General InstructionsLeigh MarieОценок пока нет

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeДокумент4 страницыDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirОценок пока нет

- NHS Pensions - Retirement Benefits Claim Form (AW8) : To The MemberДокумент16 страницNHS Pensions - Retirement Benefits Claim Form (AW8) : To The Memberbustyeva77Оценок пока нет

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSДокумент3 страницыArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- C Ujeniuc 2Документ17 страницC Ujeniuc 2cujeniucYAHOO.COMОценок пока нет

- U.S. Partnership Declaration and Signature For Electronic FilingДокумент2 страницыU.S. Partnership Declaration and Signature For Electronic FilingIRSОценок пока нет

- SLF017 ShortTermLoanRemittanceForm V01Документ2 страницыSLF017 ShortTermLoanRemittanceForm V01Ray Nan100% (8)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideОценок пока нет

- Lakshmi Vilas BankДокумент16 страницLakshmi Vilas Bankvinss420Оценок пока нет

- Act No 1120 FRIAR LANDS ACTДокумент6 страницAct No 1120 FRIAR LANDS ACThannahОценок пока нет

- FIRS's Circular On The Tax Implications of The Adoption of The IFRSДокумент19 страницFIRS's Circular On The Tax Implications of The Adoption of The IFRSOnaderu Oluwagbenga EnochОценок пока нет

- InsuranceДокумент7 страницInsurancesarvesh.bhartiОценок пока нет

- Harnden v. State Farm Mut. Auto. Ins. Co., CUMcv-09-289 (Cumberland Super. CT., 2010)Документ9 страницHarnden v. State Farm Mut. Auto. Ins. Co., CUMcv-09-289 (Cumberland Super. CT., 2010)Chris BuckОценок пока нет

- Casa Statement 201028130002457 PDFДокумент2 страницыCasa Statement 201028130002457 PDFSiti MariamОценок пока нет

- Engagement Letter ExampleДокумент3 страницыEngagement Letter ExamplemerrillvanОценок пока нет

- 110 Test Bank For Auditing and Assurance Services 5th Edition LouwersДокумент28 страниц110 Test Bank For Auditing and Assurance Services 5th Edition LouwersEbook freeОценок пока нет

- State Police Travel - Forfeiture FundsДокумент6 страницState Police Travel - Forfeiture FundsMark BrackenburyОценок пока нет

- Life Insurance Questionnaire: Design ConsiderationsДокумент7 страницLife Insurance Questionnaire: Design ConsiderationsRaju SharmaОценок пока нет

- Avishekh Idbi ProjectДокумент43 страницыAvishekh Idbi ProjectzishanmallickОценок пока нет

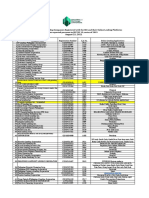

- List of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Документ2 страницыList of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Clark Adrian De Asis. Distor0% (1)

- Report On Recruitment of Life Advisors Bharti AXAДокумент84 страницыReport On Recruitment of Life Advisors Bharti AXAmegha140190Оценок пока нет

- Merchant Banking and Financial ServicesДокумент42 страницыMerchant Banking and Financial Servicesanita singhalОценок пока нет

- Rental ApplicationДокумент2 страницыRental ApplicationTracy Dunton0% (1)

- Cross Rates - August 23 2018Документ1 страницаCross Rates - August 23 2018Tiso Blackstar GroupОценок пока нет

- Tips WaccДокумент4 страницыTips WaccAfran KhalidОценок пока нет

- How To Fill The Foreign Inward Remittance FormДокумент3 страницыHow To Fill The Foreign Inward Remittance FormSubrata DasОценок пока нет

- Accounting For LeasesДокумент9 страницAccounting For LeasesNelson Musili100% (3)

- Ketan Parekh ScamДокумент10 страницKetan Parekh ScamTusharОценок пока нет

- ReportДокумент1 страницаReportumaganОценок пока нет

- GPR 410 Dissertation Ombaka 2012Документ60 страницGPR 410 Dissertation Ombaka 2012Kclf- Kenya Christian LawyersОценок пока нет

- December 2023 1Документ41 страницаDecember 2023 1rs5002595Оценок пока нет

- Bcom ProjectДокумент76 страницBcom ProjectVictor Muto100% (1)

- AccountsДокумент24 страницыAccountsManavОценок пока нет

- Owner Operator ContractДокумент3 страницыOwner Operator ContractNiel Dela CruzОценок пока нет

- Master Sub-Fee Protection Agreement With Participants' Full DetailsДокумент8 страницMaster Sub-Fee Protection Agreement With Participants' Full DetailsAlexandre Poignant-spalikowski100% (7)

- Regional Rural Banks in IndiaДокумент6 страницRegional Rural Banks in IndiaSadhana MishraОценок пока нет

- Balance Sheet of Bata India LTDДокумент1 страницаBalance Sheet of Bata India LTDSanket BhondageОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент3 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGirithar M SundaramОценок пока нет