Академический Документы

Профессиональный Документы

Культура Документы

Republic Vs Patanao

Загружено:

Anonymous XsaqDYD0 оценок0% нашли этот документ полезным (0 голосов)

511 просмотров1 страницаtax

Оригинальное название

Republic vs Patanao

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документtax

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

511 просмотров1 страницаRepublic Vs Patanao

Загружено:

Anonymous XsaqDYDtax

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

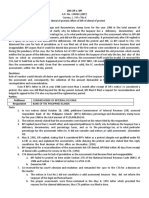

REPUBLIC VS PATANAO (1967)

12 Nov 2017

[L-22356, July 21, 1967] Civil Law| Taxation

FACTS:

Pedro B. Patanao, an Agusan timber concessionaire, was prosecuted for failure to file income tax

returns and for non-payment of income tax. He was ACQUITTED. Later, the government sued

him civilly for the collection of the tax due. Patanao alleges that the civil claim cannot prosper

anymore because:

1. He was already acquitted in the criminal case;

2. The collection of the tax was not reserved in the criminal action.

HELD:

1. The acquittal in the criminal case is not important. Under the Revised Penal Code, civil

liability is the result of a crime; in the Internal Revenue Code, civil liability arises first, i.e.,

civil liability to pay taxes arises from the fact that one has earned income or has engaged in

business, and not because of any criminal act committed by him. In other words, criminal

liability comes only after failure of the debtor to satisfy his civil obligation.

2. The collection of the tax could not have been reserved in the criminal case – because criminal

prosecution is not one of the remedies stated in the law for the collection of the tax. (Pp vs

Arnault, L-4288, Nov 20, 1952; Pp vs Tierra, L-17177-17180, Dec 28, 1964). Indeed civil

liability is not deemed included in the criminal proceeding. The tax certainly is not a mere

civil liability arising from a crime, that could be wiped out by the judicial declaration of non-

existence of the criminal acts charged. (Castro vs Internal Revenue, L-12174, April 20, 1962).

Вам также может понравиться

- CITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestДокумент1 страницаCITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestKate GaroОценок пока нет

- Serafica v. City Treasurer of OrmocДокумент1 страницаSerafica v. City Treasurer of OrmocEarl LarroderОценок пока нет

- Diaz Vs Secretary of FinanceДокумент3 страницыDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Cir Vs Central Luzon Drug CorporationДокумент2 страницыCir Vs Central Luzon Drug CorporationVincent Quiña Piga71% (7)

- People of The Philippines, Petitioners, SANDIGANBAYAN (Fourth Division) and BIENVENIDO A. TAN JR., RespondentДокумент2 страницыPeople of The Philippines, Petitioners, SANDIGANBAYAN (Fourth Division) and BIENVENIDO A. TAN JR., RespondentJoshua Erik Madria100% (1)

- COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Документ1 страницаCOMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Charles Roger Raya100% (1)

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEДокумент2 страницыDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusОценок пока нет

- City of Baguio v. Fortunato de Leon GR L-24756Документ1 страницаCity of Baguio v. Fortunato de Leon GR L-24756Charles Roger RayaОценок пока нет

- 3 Heng Tong Textiles V CIRДокумент1 страница3 Heng Tong Textiles V CIRJezreel Y. ChanОценок пока нет

- People v. Sandiganbayan DIGESTДокумент4 страницыPeople v. Sandiganbayan DIGESTkathrynmaydeveza100% (1)

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesДокумент7 страницJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesОценок пока нет

- Case 4 CIR Vs Fortune TobaccoДокумент1 страницаCase 4 CIR Vs Fortune TobaccolenvfОценок пока нет

- Javier v. AnchetaДокумент1 страницаJavier v. AnchetaGSSОценок пока нет

- Raytheon-Production-vs-COMMISSIONER OF INTERNAL REVENUEДокумент2 страницыRaytheon-Production-vs-COMMISSIONER OF INTERNAL REVENUECharles Roger RayaОценок пока нет

- SISON V ANCHETAДокумент4 страницыSISON V ANCHETAMayflor BalinuyusОценок пока нет

- Collector v. LaraДокумент2 страницыCollector v. LaraJaypoll DiazОценок пока нет

- Herrera vs. Quezon City Board of Assessment AppealsДокумент1 страницаHerrera vs. Quezon City Board of Assessment AppealsGeoanne Battad Beringuela100% (3)

- CIR Vs CA & CastanedaДокумент1 страницаCIR Vs CA & CastanedaArmstrong BosantogОценок пока нет

- CIR Vs Toledo DigestДокумент2 страницыCIR Vs Toledo DigestClar Napa100% (2)

- Collector Vs Batangas Transportation Co.Документ2 страницыCollector Vs Batangas Transportation Co.Lisa GarciaОценок пока нет

- Hilado vs. CIRДокумент2 страницыHilado vs. CIRAlan Gultia100% (2)

- 28 Municipality of Cainta Vs City of PasigДокумент2 страницы28 Municipality of Cainta Vs City of Pasighigoremso giensdks100% (3)

- Vera v. FernandezДокумент1 страницаVera v. FernandezIshОценок пока нет

- CIR Vs YMCAДокумент2 страницыCIR Vs YMCAGianna de JesusОценок пока нет

- CIR vs. San Miguel Corp Tax DigestДокумент2 страницыCIR vs. San Miguel Corp Tax DigestCJ100% (3)

- Misamis Oriental Association vs. Dept. of Finance SecretaryДокумент5 страницMisamis Oriental Association vs. Dept. of Finance SecretaryMadelle PinedaОценок пока нет

- CIR Vs BPI TAXДокумент2 страницыCIR Vs BPI TAXClaire Culminas100% (1)

- Eastern Theatrical Vs AlfonsoДокумент2 страницыEastern Theatrical Vs AlfonsoKirsten Denise B. Habawel-Vega67% (3)

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Документ4 страницыCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- Case Digest On Taxation 1Документ32 страницыCase Digest On Taxation 1Carl Vincent QuitorianoОценок пока нет

- Creba v. Romulo Case DigestДокумент2 страницыCreba v. Romulo Case DigestApril Rose Villamor67% (6)

- CIR Vs PLDTДокумент1 страницаCIR Vs PLDTArmstrong BosantogОценок пока нет

- Nursery Care Corp Vs City of ManilaДокумент2 страницыNursery Care Corp Vs City of ManilaCarlu YooОценок пока нет

- Cui vs. PiccioДокумент1 страницаCui vs. PiccioMagna AsisОценок пока нет

- CIR v. CA and Castaneda GR 96016 October 17, 1991Документ1 страницаCIR v. CA and Castaneda GR 96016 October 17, 1991Vel JuneОценок пока нет

- Group 1 - Sec. 23 24 NIRC Matrix PDFДокумент4 страницыGroup 1 - Sec. 23 24 NIRC Matrix PDFDenise DuriasОценок пока нет

- Caltex v. COA - DigestДокумент2 страницыCaltex v. COA - DigestChie Z. Villasanta71% (7)

- 19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestДокумент1 страница19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestHarleneОценок пока нет

- Compania General, CTA 4451 August 23, 1993Документ10 страницCompania General, CTA 4451 August 23, 1993codearcher27Оценок пока нет

- Gutierrez v. CTAДокумент3 страницыGutierrez v. CTAHoney BiОценок пока нет

- 13 Vegetable Oil Corp V TrinidadДокумент2 страницы13 Vegetable Oil Corp V TrinidadRocky GuzmanОценок пока нет

- Cir v. GoodrichДокумент7 страницCir v. GoodrichClaudine Ann ManaloОценок пока нет

- CIR Vs Fortune Tobacco DigestДокумент2 страницыCIR Vs Fortune Tobacco DigestCJ67% (6)

- NPC Vs AlbayДокумент1 страницаNPC Vs AlbayIshОценок пока нет

- City of Baguio Vs de Leon GR No. L-24756Документ6 страницCity of Baguio Vs de Leon GR No. L-24756KidMonkey2299Оценок пока нет

- Villanueva V City of IloiloДокумент3 страницыVillanueva V City of IloiloPatricia Gonzaga100% (1)

- Philippine Airlines V CIRДокумент5 страницPhilippine Airlines V CIRBettina Rayos del SolОценок пока нет

- City of Baguio v. de LeonДокумент3 страницыCity of Baguio v. de LeonFox Briones Alfonso100% (1)

- 5 Chavez Vs Ongpin - DigestДокумент2 страницы5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- People vs. Kintanar, January 16, 2013Документ5 страницPeople vs. Kintanar, January 16, 2013Francis Leo TianeroОценок пока нет

- CIR Vs General FoodsДокумент4 страницыCIR Vs General FoodsMonaVargasОценок пока нет

- Bpi V Cir DigestДокумент3 страницыBpi V Cir DigestkathrynmaydevezaОценок пока нет

- Republic Vs Mambulao Lumber - CDДокумент1 страницаRepublic Vs Mambulao Lumber - CDmenforeverОценок пока нет

- Paseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Документ2 страницыPaseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Jo DevisОценок пока нет

- H DigestedCasesДокумент9 страницH DigestedCasesChocola Vi BriataniaОценок пока нет

- Cir Vs PinedaДокумент1 страницаCir Vs PinedadbaratbateladotОценок пока нет

- Taxation 1 Case DigestsДокумент26 страницTaxation 1 Case DigestsIrene QuimsonОценок пока нет

- Taxation LawДокумент40 страницTaxation Lawnelzahumiwat0Оценок пока нет

- Taxation Law Case Digests Hernando Bar 2023 - CompressДокумент43 страницыTaxation Law Case Digests Hernando Bar 2023 - Compressshaileen reyes-macalinoОценок пока нет

- 4 Republic V PatanaoДокумент4 страницы4 Republic V PatanaoPatricia Anne GonzalesОценок пока нет

- Migrant Workers and Overseas Filipinos ActДокумент29 страницMigrant Workers and Overseas Filipinos ActAnonymous XsaqDYDОценок пока нет

- Anti-Carnapping ActДокумент2 страницыAnti-Carnapping ActAnonymous XsaqDYDОценок пока нет

- Anti-Electricity and Electric Transmission LinesДокумент4 страницыAnti-Electricity and Electric Transmission LinesAnonymous XsaqDYDОценок пока нет

- Dizon CIVIL LAW Bar Notes PDFДокумент103 страницыDizon CIVIL LAW Bar Notes PDFAnonymous XsaqDYD100% (1)

- Atty. Ferrer vs. Spouses DiazДокумент1 страницаAtty. Ferrer vs. Spouses DiazAnonymous XsaqDYDОценок пока нет

- Metropolitan Bank vs. Junnel's MarketingДокумент2 страницыMetropolitan Bank vs. Junnel's MarketingAnonymous XsaqDYD100% (1)

- Letters of Credit and Trust ReceiptsДокумент6 страницLetters of Credit and Trust ReceiptsAnonymous XsaqDYDОценок пока нет

- People V HernandezДокумент1 страницаPeople V HernandezAnonymous XsaqDYDОценок пока нет

- In Terp LeaderДокумент66 страницIn Terp LeaderAnonymous XsaqDYDОценок пока нет

- Republic V SandiganbayanДокумент25 страницRepublic V SandiganbayanAnonymous XsaqDYDОценок пока нет

- G.R. No. 97957 March 5, 1993 People OF THE PHILIPPINES, Plaintiff-Appellee, ALBERTO LASE, Alias "BERT", Accused-AppellantДокумент19 страницG.R. No. 97957 March 5, 1993 People OF THE PHILIPPINES, Plaintiff-Appellee, ALBERTO LASE, Alias "BERT", Accused-AppellantAnonymous XsaqDYDОценок пока нет

- Labrev Full Text 1Документ84 страницыLabrev Full Text 1Anonymous XsaqDYDОценок пока нет

- G.R. No. L-13109 March 6, 1918 THE UNITED STATES, Plaintiff-Appellee, DALMACEO ANTIPOLO, Defendant-AppellantДокумент33 страницыG.R. No. L-13109 March 6, 1918 THE UNITED STATES, Plaintiff-Appellee, DALMACEO ANTIPOLO, Defendant-AppellantAnonymous XsaqDYDОценок пока нет

- Tax 6 DigestsДокумент10 страницTax 6 DigestsAnonymous XsaqDYDОценок пока нет

- For Personal Services. - Among The Ordinary and Necessary Expenses Paid or Incurred inДокумент48 страницFor Personal Services. - Among The Ordinary and Necessary Expenses Paid or Incurred inAnonymous XsaqDYDОценок пока нет

- People of The Philippines V. Salomon Dioneda Y Dela Cruz A.K.A. SIMON DIONEDA DELA CRUZ 587 SCRA 312 (2009)Документ1 страницаPeople of The Philippines V. Salomon Dioneda Y Dela Cruz A.K.A. SIMON DIONEDA DELA CRUZ 587 SCRA 312 (2009)Anonymous XsaqDYDОценок пока нет

- Republic Vs PatanaoДокумент1 страницаRepublic Vs PatanaoAnonymous XsaqDYDОценок пока нет

- Double TaxationДокумент26 страницDouble TaxationAnonymous XsaqDYDОценок пока нет

- Philippine Airlines, Inc. V. Edu G.R. No. L-41383, August 15, 1988 FactsДокумент1 страницаPhilippine Airlines, Inc. V. Edu G.R. No. L-41383, August 15, 1988 FactsAnonymous XsaqDYDОценок пока нет

- 341349Документ199 страниц341349macaesva100% (1)

- Kopp - Oberst Indictment Press Release (Final)Документ2 страницыKopp - Oberst Indictment Press Release (Final)Nia TowneОценок пока нет

- Microsoft Enrile CasesДокумент13 страницMicrosoft Enrile CasesMarco MarianoОценок пока нет

- Digest (Morigo Vs People)Документ2 страницыDigest (Morigo Vs People)Anonymous db489e2vmzОценок пока нет

- Crespo Vs MogulДокумент5 страницCrespo Vs MogulDianeОценок пока нет

- Decided-Date-1: 3 June 2010Документ10 страницDecided-Date-1: 3 June 2010Mohd Ubaidi Abdullah ZabirОценок пока нет

- 01 Yu Vs Sandiganbayan, GR 128466Документ3 страницы01 Yu Vs Sandiganbayan, GR 128466Michelle CatadmanОценок пока нет

- Tim Valencia Motion To ReleaseДокумент3 страницыTim Valencia Motion To ReleaseJairus RubioОценок пока нет

- 78 80Документ15 страниц78 80Kabir JaiswalОценок пока нет

- ICAC Memorandum of UnderstandingДокумент5 страницICAC Memorandum of Understandingaladdin4dОценок пока нет

- PP v. Santiago Digest 1922 G.R. No. 17584 March 8, 1922 The People of The Philippines Islands, PlaintiffДокумент3 страницыPP v. Santiago Digest 1922 G.R. No. 17584 March 8, 1922 The People of The Philippines Islands, PlaintiffEPSON100% (1)

- Abanado Vs BayonaДокумент3 страницыAbanado Vs BayonaMichael LagundiОценок пока нет

- Mead v. ArgelДокумент2 страницыMead v. ArgelElle TalubanОценок пока нет

- David Vs MarquezДокумент5 страницDavid Vs MarquezM Azeneth JJОценок пока нет

- 16.22 US Vs TabianaДокумент10 страниц16.22 US Vs TabiananazhОценок пока нет

- Extradition CasesДокумент25 страницExtradition Casesmhilet_chiОценок пока нет

- People Vs HabanaДокумент2 страницыPeople Vs HabanaAnthony Tamayosa Del AyreОценок пока нет

- Conquilla vs. BernardoДокумент11 страницConquilla vs. BernardoCheer S100% (1)

- Roy C. Lewellen, Jr. v. Gene Raff, Individually and in His Official Capacity as Prosecuting Attorney for the First Judicial District of Arkansas David Cahoon, Individually and in His Official Capacity as Deputy Prosecuting Attorney for Lee County, Arkansas Henry Wilkinson, Individually and in His Official Capacity as Circuit Court Judge for the First Judicial District of Arkansas, Lafayette Patterson Jeanne Kennedy Doug Williams Lee County, Arkansas Robert May, Jr., Individually and in His Official Capacity as Sheriff of Lee County. Lafayette Patterson v. Robert Banks Margie Banks Reverend Almore Banks (Four Cases). Roy C. Lewellen, Jr. v. Gene Raff, Individually and in His Official Capacity as Prosecuting Attorney for the First Judicial District of Arkansas David Cahoon, Individually and in His Official Capacity as Deputy Prosecuting Attorney for Lee County, Arkansas Lafayette Patterson Jeanne Kennedy Doug Williams, Lee County, Arkansas Robert May, Jr., Individually and in His OfficiaДокумент5 страницRoy C. Lewellen, Jr. v. Gene Raff, Individually and in His Official Capacity as Prosecuting Attorney for the First Judicial District of Arkansas David Cahoon, Individually and in His Official Capacity as Deputy Prosecuting Attorney for Lee County, Arkansas Henry Wilkinson, Individually and in His Official Capacity as Circuit Court Judge for the First Judicial District of Arkansas, Lafayette Patterson Jeanne Kennedy Doug Williams Lee County, Arkansas Robert May, Jr., Individually and in His Official Capacity as Sheriff of Lee County. Lafayette Patterson v. Robert Banks Margie Banks Reverend Almore Banks (Four Cases). Roy C. Lewellen, Jr. v. Gene Raff, Individually and in His Official Capacity as Prosecuting Attorney for the First Judicial District of Arkansas David Cahoon, Individually and in His Official Capacity as Deputy Prosecuting Attorney for Lee County, Arkansas Lafayette Patterson Jeanne Kennedy Doug Williams, Lee County, Arkansas Robert May, Jr., Individually and in His OfficiaScribd Government DocsОценок пока нет

- Clint Young Sub WritДокумент58 страницClint Young Sub WritLaw&Crime100% (1)

- Female Criminality SupriyaДокумент17 страницFemale Criminality Supriyaratna supriyaОценок пока нет

- Police Reports and Their PurposeДокумент30 страницPolice Reports and Their PurposeIrene Enriquez Carandang100% (4)

- 830 - Preventing Systemic Corruption in BrazilДокумент4 страницы830 - Preventing Systemic Corruption in BrazilJoseph SaxОценок пока нет

- Petition For BailДокумент3 страницыPetition For BailAzrael CassielОценок пока нет

- People vs. Castaneda, JRДокумент2 страницыPeople vs. Castaneda, JRTiffany AnnОценок пока нет

- Inder Mohan Goswami v. State of Uttaranchal (2007) (Summon and Warrant)Документ13 страницInder Mohan Goswami v. State of Uttaranchal (2007) (Summon and Warrant)MD AATIF IQBALОценок пока нет

- Memorandum of Facts and Law Old Version No 2Документ105 страницMemorandum of Facts and Law Old Version No 2MichaelОценок пока нет

- Peraturan Permainan Dart 2023Документ76 страницPeraturan Permainan Dart 2023SunivaguОценок пока нет

- Information Sample Acts of Lasciviousness Mashing of Private PartsДокумент2 страницыInformation Sample Acts of Lasciviousness Mashing of Private PartsEric John Calagui0% (1)

- Impartial and Competent CourtДокумент13 страницImpartial and Competent CourtInnah Agito-RamosОценок пока нет