Академический Документы

Профессиональный Документы

Культура Документы

BPI vs. Posadas 56 Phil 215

Загружено:

Gela Bea BarriosАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BPI vs. Posadas 56 Phil 215

Загружено:

Gela Bea BarriosАвторское право:

Доступные форматы

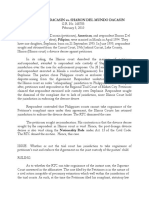

BPI vs.

Posadas

56 Phil 215

Facts: The estate of Adolphe Oscar Schuetze is the sole beneficiary named in the life-

insurance policy for $10,000, issued by the Sun Life Assurance Company of Canada.

During the following five years the insured paid the premiums at the Manila branch of the

company. The deceased Adolphe Oscar Schuetze married the plaintiff-appellant Rosario

Gelano.

The plaintiff-appellant, the Bank of the Philippine Islands, was appointed administrator of

the late Adolphe Oscar Schuetze's testamentary estate by an order, entered by the Court

of First Instance of Manila. The Sun Life Assurance Company of Canada, whose main

office is in Montreal, Canada, paid Rosario Gelano Vda. de Schuetze upon her arrival at

Manila, the sum of P20,150, which was the amount of the insurance policy on the life of

said deceased, payable to the latter's estate. On the same date Rosario Gelano Vda. de

Schuetze delivered the money to said Bank of the Philippine Islands, as administrator of

the deceased's estate, which entered it in the inventory of the testamentary estate, and

then returned the money to said widow. The appellee alleges that it is a fundamental

principle that a life-insurance policy belongs exclusively to the beneficiary upon the death

of the person insured.

Issue: Whether or not the life insurance policy belongs to the conjugal partnership.

Ruling: SC holds, (1) that the proceeds of a life-insurance policy payable to the insured's

estate, on which the premiums were paid by the conjugal partnership, constitute

community property, and belong one-half to the husband and the other half to the wife,

exclusively; and (2) that if the premiums were paid partly with paraphernal and partly

conjugal funds, the proceeds are likewise in like proportion paraphernal in part and

conjugal in part.

That the proceeds of a life-insurance policy payable to the insured's estate as the

beneficiary, if delivered to the testamentary administrator of the former as part of the

assets of said estate under probate administration, are subject to the inheritance tax

according to the law on the matter, if they belong to the assured exclusively, and it is

immaterial that the insured was domiciled in these Islands or outside.

Вам также может понравиться

- BPI Vs PosadasДокумент1 страницаBPI Vs PosadasRap PatajoОценок пока нет

- Finman VS CaДокумент2 страницыFinman VS Camario navalezОценок пока нет

- Zenith Insurance loses appeal on damagesДокумент1 страницаZenith Insurance loses appeal on damagesLoucille Abing LacsonОценок пока нет

- Insurance CasesДокумент55 страницInsurance CasesRyan RapaconОценок пока нет

- Philamcare Health System vs. Court of AppealsДокумент1 страницаPhilamcare Health System vs. Court of AppealsperlitainocencioОценок пока нет

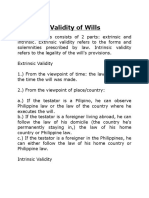

- Rules On Validity of WillsДокумент2 страницыRules On Validity of WillsManu SalaОценок пока нет

- SATURNINO v. PHILAM LIFEДокумент2 страницыSATURNINO v. PHILAM LIFETricia CornelioОценок пока нет

- Teal Motor Vs Orient InsuranceДокумент2 страницыTeal Motor Vs Orient InsuranceShiena Lou B. Amodia-RabacalОценок пока нет

- Philips Export Vs CAДокумент2 страницыPhilips Export Vs CAAnneОценок пока нет

- #4 Fieldsman Vs Vda de SongcoДокумент2 страницы#4 Fieldsman Vs Vda de SongcoDon SumiogОценок пока нет

- Del Val V Del ValДокумент2 страницыDel Val V Del ValGabe RuaroОценок пока нет

- Digest InsДокумент22 страницыDigest InsAndrea Klein LechugaОценок пока нет

- Sveriges Angfartygs Assurans Forening, Plaintiff-Appellant, vs. Qua Chee Gan, Defendant-Appellee. FactsДокумент17 страницSveriges Angfartygs Assurans Forening, Plaintiff-Appellant, vs. Qua Chee Gan, Defendant-Appellee. Factsyannie isananОценок пока нет

- Metropolitan vs. DMДокумент7 страницMetropolitan vs. DMAngel AlmazarОценок пока нет

- Nogales V Capitol Medical CenterДокумент2 страницыNogales V Capitol Medical CenterGraceОценок пока нет

- Bonifacio Bros Vs MoraДокумент2 страницыBonifacio Bros Vs MoraOmar Nasseef BakongОценок пока нет

- American Home Lns. V Chua, GR 130421 DigestДокумент2 страницыAmerican Home Lns. V Chua, GR 130421 DigestJade Marlu DelaTorreОценок пока нет

- BC - Sharruf & Co VS BaloiseДокумент2 страницыBC - Sharruf & Co VS BaloiseZsazsaОценок пока нет

- Digest of Vda de Gabriel V Ca GR No 103883 PDFДокумент2 страницыDigest of Vda de Gabriel V Ca GR No 103883 PDFXtian HernandezОценок пока нет

- Harding Vs Commercial Union Assurance CompanyДокумент2 страницыHarding Vs Commercial Union Assurance CompanyCarlota Nicolas VillaromanОценок пока нет

- Case Digest - Non Forum and ResДокумент36 страницCase Digest - Non Forum and ResAnalyn Grace Basay100% (1)

- Esso Standard Eastern, Inc., Vs CAДокумент3 страницыEsso Standard Eastern, Inc., Vs CAJohnRouenTorresMarzoОценок пока нет

- People vs Campos Partnership Dispute Case SummaryДокумент3 страницыPeople vs Campos Partnership Dispute Case SummaryRhena SaranzaОценок пока нет

- 130 La O v. Yek Tong LinДокумент1 страница130 La O v. Yek Tong LinJovelan V. EscañoОценок пока нет

- Dacasin Vs DacasinДокумент2 страницыDacasin Vs DacasinPam Otic-ReyesОценок пока нет

- Envi Law Cases and Special Laws Part 2Документ42 страницыEnvi Law Cases and Special Laws Part 2mccm92Оценок пока нет

- Dela Cruz V Northern Theatrical DigestДокумент2 страницыDela Cruz V Northern Theatrical DigestChristian Sorra75% (4)

- Vda. de Consuegra vs. GSIS Case DigestДокумент3 страницыVda. de Consuegra vs. GSIS Case DigestMaria Lopez100% (2)

- Dojillo v. COMELEC: Supreme Court rules on validity of ballots, status quo ante orderДокумент4 страницыDojillo v. COMELEC: Supreme Court rules on validity of ballots, status quo ante orderJechel TBОценок пока нет

- D1 Harding V Commercial Union Ass. Co. 38 Phil 464Документ7 страницD1 Harding V Commercial Union Ass. Co. 38 Phil 464ABCОценок пока нет

- Insurance DigestsДокумент4 страницыInsurance DigestsLesly BriesОценок пока нет

- Domicile Requirement for CandidatesДокумент11 страницDomicile Requirement for CandidatesPaulo VillarinОценок пока нет

- Fieldmen'S Insurance Co., Inc. vs. Mercedes Vargas Vda. de Songco, Et Al. and Court of AppealsДокумент2 страницыFieldmen'S Insurance Co., Inc. vs. Mercedes Vargas Vda. de Songco, Et Al. and Court of AppealsTiff DizonОценок пока нет

- Supreme Court Rules Judgment Against Deceased Person NullДокумент2 страницыSupreme Court Rules Judgment Against Deceased Person NullAngelo LopezОценок пока нет

- Lim V Phil Fishing Gear G.R. No. 136448Документ1 страницаLim V Phil Fishing Gear G.R. No. 136448Anonymous zIDJz7Оценок пока нет

- Harding V Commercial Union Assurance CompanyДокумент2 страницыHarding V Commercial Union Assurance CompanyAdrian Miraflor100% (2)

- Case Digest On SuccessionДокумент35 страницCase Digest On SuccessionJanlucifer Rahl100% (2)

- Isabelita Lahom vs Jose Melvin Sibulo adoption caseДокумент17 страницIsabelita Lahom vs Jose Melvin Sibulo adoption casemrspotterОценок пока нет

- Aug 2 CollatedДокумент24 страницыAug 2 CollatedAlexis Von TeОценок пока нет

- Digest Agapay Vs PalangДокумент2 страницыDigest Agapay Vs PalangLorryDelgadoОценок пока нет

- Castro VS Insurance CommissionerДокумент1 страницаCastro VS Insurance CommissionerLord AumarОценок пока нет

- 6 - 3. Dacasin Vs DacasinДокумент3 страницы6 - 3. Dacasin Vs DacasinMervin ManaloОценок пока нет

- Heirs of Maramag V de Guzman DigestДокумент2 страницыHeirs of Maramag V de Guzman DigestEmmanuel Ortega100% (1)

- Labor Union Officers Lose Status Due to Illegal StrikeДокумент1 страницаLabor Union Officers Lose Status Due to Illegal StrikeMikaela TriaОценок пока нет

- Gallego v. Sandiganbayan RulingДокумент2 страницыGallego v. Sandiganbayan RulingCamille Britanico100% (1)

- Insurance Law Notes Unit 2Документ10 страницInsurance Law Notes Unit 2Subham AgarwalОценок пока нет

- RCBC Wins Insurance Proceeds CaseДокумент13 страницRCBC Wins Insurance Proceeds CaseClaudine Christine A. VicenteОценок пока нет

- Partnerships, Agency, and TrustsДокумент3 страницыPartnerships, Agency, and TrustsGloriette Marie AbundoОценок пока нет

- CA ruling on psychological incapacity annulment caseДокумент2 страницыCA ruling on psychological incapacity annulment caseJohn Patrick NazarreaОценок пока нет

- BPI v. IAC - Credit TransactionsДокумент6 страницBPI v. IAC - Credit TransactionsCoby MirandaОценок пока нет

- DigestДокумент5 страницDigestAmer Lucman IIIОценок пока нет

- Estate of Ong Vs Joanne DiazДокумент1 страницаEstate of Ong Vs Joanne DiazCeedee Ragay100% (1)

- Philacor Credit Corporation V CIRДокумент6 страницPhilacor Credit Corporation V CIRBettina Rayos del SolОценок пока нет

- American Home Assurance Co. v. Chua, 1999Документ2 страницыAmerican Home Assurance Co. v. Chua, 1999Randy SiosonОценок пока нет

- Geagonia Vs CAДокумент1 страницаGeagonia Vs CAmackОценок пока нет

- Misamis Lumber Corp v. Capital Dev. Surety Co.Документ2 страницыMisamis Lumber Corp v. Capital Dev. Surety Co.Roland OliquinoОценок пока нет

- Bachrach v. British American InsuranceДокумент2 страницыBachrach v. British American InsuranceHency TanbengcoОценок пока нет

- Group 3Документ91 страницаGroup 3Anny YanongОценок пока нет

- Pablito Taneo Vs Court of Appeals (G.R. No. 108532)Документ3 страницыPablito Taneo Vs Court of Appeals (G.R. No. 108532)Yves Tristan MenesesОценок пока нет

- Case No. 7 BPI v. Posadas G. No. 34583. October 22, 1931 Topic: Life InsuranceДокумент3 страницыCase No. 7 BPI v. Posadas G. No. 34583. October 22, 1931 Topic: Life InsuranceLance LagmanОценок пока нет

- Labor Case DigestsДокумент18 страницLabor Case DigestsGela Bea BarriosОценок пока нет

- Police ReportДокумент2 страницыPolice ReportGela Bea BarriosОценок пока нет

- Republic of The Philippines/SSC/SSS vs. Asiapro Cooperative FactsДокумент2 страницыRepublic of The Philippines/SSC/SSS vs. Asiapro Cooperative FactsGela Bea BarriosОценок пока нет

- (G.r. No. 150155. September 1, 2004) Spouses Ramon and Felicisima Dioso, Petitioners, vs. Spouses Tomas and Leonora Cardeo, Respondents.Документ6 страниц(G.r. No. 150155. September 1, 2004) Spouses Ramon and Felicisima Dioso, Petitioners, vs. Spouses Tomas and Leonora Cardeo, Respondents.Gela Bea BarriosОценок пока нет

- Toshiba VAT Refund Case G.R. No. 157594Документ1 страницаToshiba VAT Refund Case G.R. No. 157594Gela Bea BarriosОценок пока нет

- VAT refund filing periods under Philippine tax lawДокумент1 страницаVAT refund filing periods under Philippine tax lawGela Bea BarriosОценок пока нет

- Commissioner of Internal Revenue vs. Aichi Forging Company of Asia, Inc. - Tax RefundДокумент1 страницаCommissioner of Internal Revenue vs. Aichi Forging Company of Asia, Inc. - Tax RefundColeenОценок пока нет

- Evidence CaseДокумент42 страницыEvidence CaseGela Bea BarriosОценок пока нет

- Real Estate Mortgage Sample FormatДокумент3 страницыReal Estate Mortgage Sample FormatMarc Alquiza100% (9)

- Input Tax Credits for VAT InvoicesДокумент1 страницаInput Tax Credits for VAT InvoicesGela Bea BarriosОценок пока нет

- Fort Bonifacio Dev Corp v. CirДокумент1 страницаFort Bonifacio Dev Corp v. CirGela Bea BarriosОценок пока нет

- Mindanao II Geothermal Partnership vs. CIR G.R. 193301, 11 March 2013Документ1 страницаMindanao II Geothermal Partnership vs. CIR G.R. 193301, 11 March 2013Gela Bea BarriosОценок пока нет

- Example - Deed of Absolute Sale of SharesДокумент2 страницыExample - Deed of Absolute Sale of SharesGela Bea Barrios100% (1)

- Transitional Input VATДокумент1 страницаTransitional Input VATGela Bea BarriosОценок пока нет

- G.R. No. 207112, December 08, 2015 Pilipinas Total Gas, Inc., Petitioner, V. Commissioner of Internal Revenue, Respondent.Документ11 страницG.R. No. 207112, December 08, 2015 Pilipinas Total Gas, Inc., Petitioner, V. Commissioner of Internal Revenue, Respondent.Gela Bea BarriosОценок пока нет

- Diaz vs. Secretary of Finance - Value Added Tax (Vat)Документ1 страницаDiaz vs. Secretary of Finance - Value Added Tax (Vat)Gela Bea BarriosОценок пока нет

- Capitol Medical Center vs. Meris (470 Scra 125, September 16, 2005)Документ1 страницаCapitol Medical Center vs. Meris (470 Scra 125, September 16, 2005)Gela Bea BarriosОценок пока нет

- Hilton v. GuyotДокумент2 страницыHilton v. GuyotGela Bea BarriosОценок пока нет

- Management PrerogativeДокумент1 страницаManagement PrerogativeGela Bea BarriosОценок пока нет

- Ong Ching Po VS CaДокумент1 страницаOng Ching Po VS CaGela Bea BarriosОценок пока нет

- Heirs of Teodoro de La Cruz Vs CAДокумент1 страницаHeirs of Teodoro de La Cruz Vs CAGela Bea BarriosОценок пока нет

- Sample Deed of Absolute Sale of SharesДокумент3 страницыSample Deed of Absolute Sale of SharesGela Bea BarriosОценок пока нет

- Widows and Orphans Vs CAДокумент1 страницаWidows and Orphans Vs CAGela Bea BarriosОценок пока нет

- San Miguel Brewery Sales Force Union vs. Hon. Blas OpleДокумент1 страницаSan Miguel Brewery Sales Force Union vs. Hon. Blas OpleGela Bea BarriosОценок пока нет

- G.R. No. 130730 October 19, 2001: Gener vs. de LeonДокумент1 страницаG.R. No. 130730 October 19, 2001: Gener vs. de LeonGela Bea BarriosОценок пока нет

- Judicial Notice vs. Personal Knowledge of A JudgeДокумент1 страницаJudicial Notice vs. Personal Knowledge of A JudgeGela Bea BarriosОценок пока нет

- Sec. 4. Judicial Admissions.Документ1 страницаSec. 4. Judicial Admissions.Gela Bea BarriosОценок пока нет

- Requirements for a Judicial AdmissionДокумент1 страницаRequirements for a Judicial AdmissionGela Bea BarriosОценок пока нет

- Zalamea vs. Court of Appeals 288 SCRA 23 (1993)Документ2 страницыZalamea vs. Court of Appeals 288 SCRA 23 (1993)Gela Bea BarriosОценок пока нет

- R.A. No. 9337Документ1 страницаR.A. No. 9337Gela Bea BarriosОценок пока нет