Академический Документы

Профессиональный Документы

Культура Документы

Format of Consolidated Balance Sheet of A Bank and Its Subsidiaries Consolidated Balance Sheet of - (Here Enter Name of The Parent Bank)

Загружено:

Ankita_Banka_7426Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Format of Consolidated Balance Sheet of A Bank and Its Subsidiaries Consolidated Balance Sheet of - (Here Enter Name of The Parent Bank)

Загружено:

Ankita_Banka_7426Авторское право:

Доступные форматы

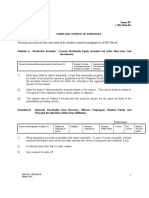

Appendix A

FORMAT OF CONSOLIDATED BALANCE SHEET OF A BANK AND ITS

SUBSIDIARIES

Consolidated Balance Sheet of ________________________ (here enter name of

the parent bank)

(Rs.in crore)

Balance Sheet as on March 31 (Year)

Particulars Schedule As on 31.3.__As on 31.3.

(current year) (previous year)

CAPITAL & LIABILITIES

Capital 1

Reserves & Surplus 2

Minorities Interest 2A

Deposits 3

Borrowings 4

Other Liabilities and Provisions 5

Total

ASSETS

Cash and Balances with Reserve Bank 6

of India

Balances with banks and money at call 7

and short notice

Investments 8

Loans & Advances 9

Fixed Assets 10

Other Assets 11

Goodwill on Consolidation1

Debit Balance of Profit and Loss A/C

Total

Contingent liabilities 12

Bills for collection

1

Where there is more than one subsidiary and the aggregation results in Goodwill in some

cases and Capital Reserves in other cases, net effect to be shown in Schedule 2 and Assets

side after giving separates notes.

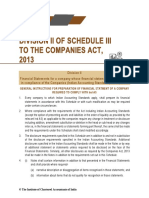

Consolidated Financial Statements

2

FORM OF CONSOLIDATED PROFIT AND LOSS ACCOUNT OF A BANK AND ITS

SUBSIDIARIES

Consolidated Profit and Loss Account of ________________________ (here enter name of

the parent bank)

(Rs. in crore)

Profit & Loss Account for the year ended March 31 ___

Particulars Schedule Year ended Year ended

31.3.__ 31.3.__

(current year) (previous year)

I. Income

Interest earned 13

Other income 14

Total

II. Expenditure

Interest expended 15

Operating expenses 16

Provisions and contingencies

Total

Share of earnings/loss in Associates 17

Consolidated Net profit/(loss) for the

year before deducting Minorities'

Interest

Less: Minorities' Interest

Consolidated profit/(loss) for the year

attributable to the group

Add: Brought forward consolidated

profit/(loss) attributable to the group

III. Appropriations

Transfer to statutory reserves

Transfer to other reserves

Transfer to Government/Proposed

dividend

Balance carried over to consolidated

balance sheet

Total

Earnings per Share1

1

Earning per share should be for both basic and diluted.

Consolidated Financial Statements

3

SCHEDULE 1 – CAPITAL

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

Authorised Capital

(.... Shares of Rs ... each)

Issued Capital

(.... Shares of Rs ... each)

Subscribed Capital

(.... Shares of Rs ... each)

Called-up Capital

(.... Shares of Rs ... each)

Less: Calls unpaid

Add: Forfeited shares

Total

SCHEDULE 2 – RESERVES & SURPLUS1

As on 31.3.__ As on 31.3.__

(current year) (previous year)

Statutory Reserves

Capital Reserves

Capital Reserve on Consolidation2

Share Premium

Other Reserves (specify nature)

Revenue and other Reserves

Balance in Profit and Loss Account

Total

SCHEDULE 2A-MINORITIES INTEREST

Minority interest at the date on which the

parent-subsidiary relationship came into

existence

Subsequent increase/ decrease

Minority interest on the date of balance sheet

1

Opening balances, additions and deductions since the last consolidated balance sheet shall be shown under

each of the specified heads.

2

Where there is more than one subsidiary aggregation results in goodwill in some cases and Capital Reserves in

other cases, net effect to be shown in Schedule 2 or Assets side after giving separate notes.

Consolidated Financial Statements

4

SCHEDULE 3 – DEPOSITS

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

A. I. Demand Deposits

(i) From banks

(ii) From others

II. Savings Bank Deposits

III. Term Deposits

(i) From banks

(ii) From others

Total (I, II and III)

B. (i) Deposits of branches in India1

(ii) Deposits of branches outside India2

Total (I and ii)

SCHEDULE 4 – BORROWINGS

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Borrowings in India

(i) Reserve Bank of India

(ii) Other banks

(iii) Other institutions and agencies

II. Borrowings outside India

Total (I and II)

Secured borrowings included in I & II above

SCHEDULE 5 – OTHER LIABILITIES AND PROVISIONS

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Bills payable

II. Inter-office adjustments (net)

III. Interest accrued

IV. Deferred Tax Liabilities

V. Others (including provisions)

Total

SCHEDULE 6 – CASH AND BALANCES WITH RESERVE BANK OF INDIA

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Cash in hand (including foreign currency

notes)

II. Balances with Reserve Bank of India

(i) In Current Account

(ii) In Other Accounts

Total (I & II)

1

Includes deposits of Indian branches of subsidiaries

2

Includes deposits of foreign branches of subsidiaries

Consolidated Financial Statements

5

SCHEDULE 7 – BALANCES WITH BANKS AND MONEY AT

CALL & SHORT NOTICE

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. In India

(i) Balances with banks

(a) In Current accounts

(b) In Other Deposit accounts

(ii) Money at call and short notice

(a) With banks

(b) With other institutions

Total ( i & ii)

II. Outside India

(i) In Current Account

(ii) In Other Deposit Accounts

(iii) Money at call and short notice

Total

Grand Total (I & II)

SCHEDULE 8 – INVESTMENTS

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Investments in India in

(i) Government securities

(ii) Other approved securities

(iii) Shares

(iv) Debentures and Bonds

(v) Investment in Associates

(vi) Others (to be specified)

Total

II. Investments outside India in

(i) Government securities (including local

authorities)

(ii) Investment in Associates

(iii) Other investments (to be specified)

Total

Grand Total (I & II)

III. Investments in India

(i) Gross value of Investments

(ii) Aggregate of Provisions for Depreciation

(iii) Net Investment

IV. Investments outside India

(i) Gross value of investments

(ii) Aggregate of Provisions for Depreciation

(iii) Other investments (to be specified)

Consolidated Financial Statements

6

SCHEDULE 9 – ADVANCES

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

A. (i) Bills purchased and discounted

(ii) Cash credits, overdrafts and loans

repayable on demand

(iii)Term loans

Total

B. (i) Secured by tangible assets (includes

advances against book debts)

(ii) Covered by Bank/Government

Guarantees

(iii) Unsecured

Total

C. I.Advances in India

(i) Priority sector

(ii) Public sector

(iii) Banks

(iv) Others

C.II. Advances outside India

(i) Due from banks

(ii) Due from others

(a) Bills purchased & discounted

(b) Syndicated Loans

(c) Others

Total

Consolidated Financial Statements

7

SCHEDULE 10 – FIXED ASSETS

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Premises

At cost as on 31st March of the preceding year

Additions during the year

Deductions during the year

Depreciation to date

IA. Premises under construction

II. Other Fixed Assets (including furniture

and fixtures)

At cost (as on 31 March of the preceding year

Additions during the year

Deductions during the year

Depreciation to date

IIA. Leased Assets

At cost as on 31st March of the preceding

year

Additions during the year including adjustments

Deductions during the year including provisions

Depreciation to date

Total (I, IA,II &IIA)

III. Capital-Work-in progress (Leased Assets) net of

Provisions

Total (I, IA, II, IIA & III)

SCHEDULE 11 – OTHER ASSETS

As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Inter-office adjustments (net)

II. Interest accrued

III. Tax paid in advance/tax deducted at source

IV. Stationery and stamps

V. Non-banking assets acquired in satisfaction of

claims

VII. Deferred Tax assets

VIII. Others

Total

Consolidated Financial Statements

8

SCHEDULE 12 – CONTINGENT LIABILITIES

Particulars As on 31.3.__ As on 31.3.__

(current year) (previous year)

I. Claims against the bank not acknowledged

as debts

II. Liability for partly paid investments

III. Liability on account of outstanding

forward exchange contracts

IV. Guarantees given on behalf of constituents

(a) In India

(b) Outside India

V. Acceptances, endorsements and other

obligations

VI. Other items for which the bank is

contingently liable

Total

SCHEDULE 13 – INTEREST AND DIVIDENDS EARNED

Particulars Year ended 31.3.__ Year ended

(current year) 31.3.__

(previous year)

I. Interest/discount on advances/bills

II. Income on investments

III. Interest on balances with Reserve Bank of India

and other inter-bank funds

IV. Others

Total

SCHEDULE 14 – OTHER INCOME

Particulars Year ended Year ended

31.3.__ 31.3.__

(current year) (previous year)

I. Commission, exchange and brokerage

II. Profit on sale of land, buildings and

other assets

Less: Loss on sale of land, buildings and

other assets

III Profit on exchange transactions

Less: Loss on exchange transactions

IV. Profit on sale of investments(net)

Less: Loss on sale of investments

V. Profit on revaluation of investments

Less: Loss on revaluation of investments

VI. a) Lease finance income

b) Lease management fee

a) Overdue charges

d) Interest on lease rent receivables

VII Miscellaneous income

Total

Consolidated Financial Statements

9

SCHEDULE 15 – INTEREST EXPENDED

Particulars Year ended Year ended

31.3.__ 31.3.__

(current year) (previous year)

I. Interest on deposits

II. Interest on Reserve Bank of India/

inter-bank borrowings

III. Others

Total

SCHEDULE 16 – OPERATING EXPENSES

Particulars Year ended 31.3.__ Year ended

(current year) 31.3.__

(previous year)

I. Payments to and provisions for employees

II. Rent, taxes and lighting

III. Printing and stationery

IV. Advertisement and publicity

V. (a) Depreciation on bank’s property other than

Leased Assets

(b) Depreciation on Leased Assets

VI. Directors’ fees, allowances and expenses

VII. Auditors’ fees and expenses (including branch

auditors’ fees and expenses)

VIII. Law charges

IX. Postage, telegrams, telephones, etc.

X. Repairs and maintenance

XI. Insurance

XII Amortisation of Goodwill, if any

XIII Other expenditure

Total

Notes:

1. The format prescribed above is primarily for banking subsidiaries. In case of

non-banking subsidiaries if any item of income/ expenditure or assets/

liabilities is not similar to those of the bank, these items should be separately

disclosed.

2. Additional line items, headings and sub-headings should be presented in the

consolidated balance sheet and consolidated profit and loss account and

schedules thereto when required by a statute, Accounting Standards or when

such a presentation is necessary to present the true and fair view of the

group’s financial position and operating results. In the preparation and

presentation of consolidated financial statements Accounting Standards

issued by the ICAI, to the extent applicable to banks, and the guidelines

issued by RBI should be followed.

Consolidated Financial Statements

Вам также может понравиться

- Annexure A Form of Consolidated Balance Sheet of A Bank and Its Subsidiaries Engaged in Financial ActivitiesДокумент10 страницAnnexure A Form of Consolidated Balance Sheet of A Bank and Its Subsidiaries Engaged in Financial ActivitiesHARDIK1001Оценок пока нет

- Format of Bank Final AccountsДокумент11 страницFormat of Bank Final Accountscs LakshmiОценок пока нет

- CA FormatДокумент7 страницCA FormatSwadil GhoshinoОценок пока нет

- We're in Beta! .: Send Us Your Feedback Feeds About Contact Our Network SitesДокумент6 страницWe're in Beta! .: Send Us Your Feedback Feeds About Contact Our Network SitesAshish Kumar SharmaОценок пока нет

- Annex UreДокумент97 страницAnnex UreRobert HookeОценок пока нет

- Bank Final AccountsДокумент11 страницBank Final AccountsSoumendra RoyОценок пока нет

- AnnexuresДокумент41 страницаAnnexuresShashank RajОценок пока нет

- Final Accounts of Banking CompaniesДокумент38 страницFinal Accounts of Banking CompaniesMadhu dollyОценок пока нет

- Banking Companies Financial Statements in IndiaДокумент7 страницBanking Companies Financial Statements in IndiaVinay GoyalОценок пока нет

- Accounting Solutions: Accounts of Banking Companies BankingДокумент20 страницAccounting Solutions: Accounts of Banking Companies BankingKr Ish NaОценок пока нет

- Statement of Accounts FormatДокумент2 страницыStatement of Accounts FormatdinuindiaОценок пока нет

- Appendex BДокумент83 страницыAppendex BCA Shiva LikhdhariОценок пока нет

- Financial of The Balance Sheet: BOOK - II (20 Marks)Документ13 страницFinancial of The Balance Sheet: BOOK - II (20 Marks)sanskriti kathpaliaОценок пока нет

- Financial Statements and Disclosure of InformationДокумент7 страницFinancial Statements and Disclosure of InformationAjit PatilОценок пока нет

- 01b-Preparation of Financial Statement-Class Work (New)Документ10 страниц01b-Preparation of Financial Statement-Class Work (New)Deepika SonuОценок пока нет

- Published AccountsДокумент31 страницаPublished AccountsGraceii Mecayer CuizonОценок пока нет

- Advanced AccountingДокумент372 страницыAdvanced AccountingNidhi ShahОценок пока нет

- R.Kanchanamala: Faculty Member IibfДокумент74 страницыR.Kanchanamala: Faculty Member Iibfmithilesh tabhaneОценок пока нет

- TYBAF Unit-1 Banking CO.Документ17 страницTYBAF Unit-1 Banking CO.sofiya syedОценок пока нет

- C A UnitДокумент6 страницC A UnitshakuttiОценок пока нет

- Com203 - Final Accounts of Banking CompaniesДокумент8 страницCom203 - Final Accounts of Banking Companiesvedant kedarОценок пока нет

- Laporan Keuangan PT Star Pacific TBK Dan Entitas AnakДокумент87 страницLaporan Keuangan PT Star Pacific TBK Dan Entitas AnakkaisОценок пока нет

- Balance Sheet of BankДокумент14 страницBalance Sheet of BankRobinhydОценок пока нет

- Financial Anaylsis 1Документ27 страницFinancial Anaylsis 1Nitika DhatwaliaОценок пока нет

- Annex MДокумент5 страницAnnex MJeruel San GabrielОценок пока нет

- Chapter 21 IAS 1Документ4 страницыChapter 21 IAS 1Chandan SamalОценок пока нет

- Listing Exchange BSE FloorДокумент41 страницаListing Exchange BSE FloorSAROJОценок пока нет

- 2019 AmericanRedCross Financial StatementsДокумент37 страниц2019 AmericanRedCross Financial StatementsEbno MaruhomОценок пока нет

- Afa CompilationДокумент36 страницAfa CompilationAnkur ChowdharyОценок пока нет

- 1 Financial Statement of CompaniesДокумент27 страниц1 Financial Statement of CompaniesGAMING ROADОценок пока нет

- 1 Financial Statement of CompaniesДокумент27 страниц1 Financial Statement of CompaniessmartshivenduОценок пока нет

- Rev SCH III - Sent PDFДокумент18 страницRev SCH III - Sent PDFAjay DesaleОценок пока нет

- 74931bos60524 m1 AnnexureДокумент38 страниц74931bos60524 m1 AnnexureBala Guru Prasad TadikamallaОценок пока нет

- Pengungkapan Permodalan BMRI - Q IV 2017Документ6 страницPengungkapan Permodalan BMRI - Q IV 2017RS Delicious FoodsОценок пока нет

- App PDFДокумент3 страницыApp PDFSanjiv KubalОценок пока нет

- BASIC FEATURE OF Financial StatementДокумент6 страницBASIC FEATURE OF Financial StatementmahendrabpatelОценок пока нет

- Guidance Note On Audit of BanksДокумент449 страницGuidance Note On Audit of BanksManmohan SinghОценок пока нет

- Final Account Theory Students' GroupДокумент4 страницыFinal Account Theory Students' GroupI-51 GAURAV RANALKARОценок пока нет

- Ias 1Документ23 страницыIas 1Kundayi Elvis MutambirwaОценок пока нет

- PT SGH TBK Consol 31des 2020Документ134 страницыPT SGH TBK Consol 31des 2020marrifa angelicaОценок пока нет

- Companies Act, 2013 PDFДокумент25 страницCompanies Act, 2013 PDFshivam vermaОценок пока нет

- Guidance NoteДокумент151 страницаGuidance Noteshyamsunder bajajОценок пока нет

- Mau Bao Cao Tai Chinh Bang Tieng Anh 131104211352 Phpapp02Документ4 страницыMau Bao Cao Tai Chinh Bang Tieng Anh 131104211352 Phpapp02Vy Nguyen0% (1)

- CMA Data in ExcelДокумент7 страницCMA Data in ExcelVaishali MkОценок пока нет

- 06 Handout 1Документ19 страниц06 Handout 1Johnlloyd CahuloganОценок пока нет

- Form GFR 12AДокумент2 страницыForm GFR 12AMandalpu Rajasekhar Reddy100% (1)

- Balance Sheet FormatДокумент58 страницBalance Sheet FormatPrudhvi Bade100% (1)

- Unit 4 Understanding Financial Statements: StructureДокумент32 страницыUnit 4 Understanding Financial Statements: StructureTushar SharmaОценок пока нет

- 30 Credit Management AnalysisДокумент13 страниц30 Credit Management AnalysisYogesh R LahotiОценок пока нет

- IAS 33 Earnings Per Share - v2Документ35 страницIAS 33 Earnings Per Share - v2AdityaОценок пока нет

- Revised SCH VI For BS and ISДокумент4 страницыRevised SCH VI For BS and ISRavi BhattОценок пока нет

- 004 - Final SCH III - Indicative Template FinalДокумент54 страницы004 - Final SCH III - Indicative Template FinalAbhishek YadavОценок пока нет

- Adoption of Schedule VI To The Companies Act 1956 Class 12Документ52 страницыAdoption of Schedule VI To The Companies Act 1956 Class 12CrismonОценок пока нет

- Budi LK TW I 2020Документ72 страницыBudi LK TW I 2020Haliza NathaniaОценок пока нет

- Format & ProblemsДокумент13 страницFormat & ProblemsRohit BhagatОценок пока нет

- Financial Statement Analysis: The Information MazeДокумент43 страницыFinancial Statement Analysis: The Information MazeJay DaveОценок пока нет

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersОт EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersОценок пока нет

- Asset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectОт EverandAsset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectОценок пока нет

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersОт EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersОценок пока нет

- Financial Accounting III SyllabusДокумент11 страницFinancial Accounting III SyllabusMJ BotorОценок пока нет

- MOB Shantel Thomas-Final 1Документ32 страницыMOB Shantel Thomas-Final 1javeljamaica80% (5)

- ACCT 221 Report InstructionsДокумент4 страницыACCT 221 Report InstructionsAijaz AslamОценок пока нет

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsДокумент11 страницPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaОценок пока нет

- Profit & Loss (Accrual) UD BUANA CANG IQRO PDFДокумент1 страницаProfit & Loss (Accrual) UD BUANA CANG IQRO PDForizaОценок пока нет

- Shri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 DocumentДокумент8 страницShri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 Documentbharath289Оценок пока нет

- Essentials of FA - Chapter 8aДокумент24 страницыEssentials of FA - Chapter 8amitpgandhiОценок пока нет

- 15 Company Law Notes From Kalpesh Classes For CA FinalДокумент259 страниц15 Company Law Notes From Kalpesh Classes For CA FinalKaustubh BasuОценок пока нет

- AFSДокумент107 страницAFSAwais Shahzad100% (1)

- Chapter 5 SummaryДокумент10 страницChapter 5 Summarymyhan20144Оценок пока нет

- Term Paper ON: "Financial Statement Analysis of Orion Pharmaceuticals LTD."Документ75 страницTerm Paper ON: "Financial Statement Analysis of Orion Pharmaceuticals LTD."Raihan WorldwideОценок пока нет

- Week 4 ALK Kelompok CДокумент82 страницыWeek 4 ALK Kelompok COldiano TitoОценок пока нет

- Activities Midterm PC1 - PROF1 Financial Management PDFДокумент5 страницActivities Midterm PC1 - PROF1 Financial Management PDFMarienell YuОценок пока нет

- Solutions - Chapter 2Документ29 страницSolutions - Chapter 2Dre ThathipОценок пока нет

- Local Media3172437425380563588Документ20 страницLocal Media3172437425380563588Candy SchrendiОценок пока нет

- Massage Therapy Business Plan ExampleДокумент22 страницыMassage Therapy Business Plan ExampleSergei Biriukov100% (2)

- Lecture Notes - Marketing Finance-JBIMS MumbaiДокумент60 страницLecture Notes - Marketing Finance-JBIMS MumbaiSusheel_85Оценок пока нет

- New-MATH 1033 Module 5 and 6Документ7 страницNew-MATH 1033 Module 5 and 6Gelo AgcaoiliОценок пока нет

- Understanding Financial StatementДокумент37 страницUnderstanding Financial StatementMagic of LifeОценок пока нет

- Financial Ratios Analysis Project at Nestle and Engro Foods PDFДокумент51 страницаFinancial Ratios Analysis Project at Nestle and Engro Foods PDFKanij FatemaОценок пока нет

- Tutorial (Merchandising With Answers)Документ16 страницTutorial (Merchandising With Answers)Luize Nathaniele Santos0% (1)

- Start-Up Expenses Year 1 (Starting Balance Sheet) : Station 1Документ38 страницStart-Up Expenses Year 1 (Starting Balance Sheet) : Station 1Angeilyn Segador Roda - TambuliОценок пока нет

- CH 07Документ56 страницCH 07Dr-Bahaaeddin AlareeniОценок пока нет

- Q4, Fabm1Документ9 страницQ4, Fabm1consuelomariasofiatОценок пока нет

- Business Plan Oyster Mushroom CultureДокумент13 страницBusiness Plan Oyster Mushroom Culturequeen6543216Оценок пока нет

- Ioana Burnei - Financial Decision MakingДокумент14 страницIoana Burnei - Financial Decision MakingIoana BalaucaОценок пока нет

- Accountancy and Business Statistics Second Paper: Management AccountingДокумент10 страницAccountancy and Business Statistics Second Paper: Management AccountingGuruKPOОценок пока нет

- Theory of Accounts - 1Документ9 страницTheory of Accounts - 1Joovs JoovhoОценок пока нет

- Starter Activity: Complete The Worksheet Provided by Your Teacher!Документ20 страницStarter Activity: Complete The Worksheet Provided by Your Teacher!Pammi KumariОценок пока нет

- 08 Costing by Products Joint ProductsДокумент15 страниц08 Costing by Products Joint ProductsMichael Brian TorresОценок пока нет