Академический Документы

Профессиональный Документы

Культура Документы

Taxation Trends in The European Union - 2012 162

Загружено:

d05registerОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Taxation Trends in The European Union - 2012 162

Загружено:

d05registerАвторское право:

Доступные форматы

Developments in the Member States

Part II

United Kingdom U

n

Overall trends in taxation i

t

Structure and development of tax revenues

e

In 2010, the United Kingdom tax-to-GDP ratio (including social security contributions) stood at 35.6 %, an

increase by 0.8 % compared to 2009 but below its record 37.9 % of 2008 (which was marked by a sharp increase in

d

revenue from capital levies resulting from the national accounting treatment of certain financial sector

interventions, booked under "other direct taxes" (64)). The bulk of the recovery is due to a rebound in corporate K

income tax and VAT collection.

i

The tax structure shows a comparatively high weight of direct taxes (at 15.8 % of GDP, the fifth highest ratio n

amongst Member States). Direct taxes represent the primary source of revenues (44.4 % of the total taxes, the g

second level after Denmark), markedly larger than indirect taxes (36.9 %), and far outweighing social contributions

(18.7 %), the fourth lowest share of taxes in the EU after Denmark, Sweden and Malta. Revenue from personal

d

income taxes at 10.1 % was at the lower end of a range of just under 10 % to 11 % over the last decade. Corporate o

income taxes, which increased from 2.8 % of GDP to 4.0 % of GDP between 2002 and 2006, went back to 3.4 % m

and 3.6 % of GDP in 2007 and 2008 respectively but dropped to 2.8 % in 2009. The 2010 value of 3.1 % is above

the EU-27 average (2.7 %). Direct taxes other than corporate and personal income taxes were brought back to 2.8

% of GDP in 2009 and 2.6 % in 2010, a result in line with their historical levels (compared to an EU-27 average of

0.8 %). This category includes in particular council taxes on land and buildings and motor vehicle duties, but also

financial sector interventions by public sector authorities between 2007 and August 2009 referred to above.

Property taxation in the United Kingdom is high in proportion of GDP (4.2 % in 2010, of which 3.4 % is

recurrent).(65)

The United Kingdom is a highly centralised country in terms of tax collection with 94.1 % of revenues accruing to

the central government.

Finally, the overall tax burden increased by 2 percentage points from 1995 to 2000 but tended to decline between

2000 and 2003 (– 2 percentage points), and increased again between 2003 and 2006 (+ 2 percentage points). It

eased in 2007 to 36.3 % of GDP, but rose – for reasons explained above – to 37.9 % of GDP in 2008, before

decreasing to 34.8% in 2009.

Taxation of consumption, labour and capital; environmental taxation

The ITR on consumption increased to 18.4 % in 2010 (partly reflecting the increase in VAT from a temporary

15 % back to 17.5 % in January 2010). This however still sets the United Kingdom well below the EU-27 average

(21.3 %). As a result of relatively low social security contributions (6.7 % GDP compared to EU-27 at 10.9 %),

labour taxes revenue (14.3 % of GDP) is lower than in most other European countries (EU-27 17.1 %). The ITR on

labour employed is, at 25.7 %, the fourth lowest in the EU-27 and lies well below the EU-27 average (33.4 %).

This index has decreased by more than one percentage point compared to 2008.

Revenues from taxes on capital (10.1 % of GDP) dropped back to their 2004 levels but in 2010 the United

Kingdom remained the third highest in the EU-27 after Luxembourg and Italy (EU-27 average at 6.6 %). The high

contribution of taxes on capital to total tax revenue (9.9 percentage points over the 18.4 % EU-27 average) is

reflected in the relatively high implicit tax rate on capital (66) (36.9 % in 2009). Taxes on the capital stock (mainly

(64) In a number of financial sector interventions during 2008 the Financial Services Compensation Scheme (FSCS) was assigned rights over the assets of financial

institutions. The realisation of these assets of failed institutions to finance the compensation of depositors has been classified as a capital tax for national accounting

purposes (see: http://www.statistics.gov.uk/articles/nojournal/Financial-crisis.pdf page 33 and followings.). The United Kingdom is the main example of this type of

intervention. The increase in capital levies revenue in 2008 was equivalent to approx. 1.3% of GDP.

(65) The highest for the OECD countries (source: OECD Revenue Statistics, http://stats.oecd.org/Index.aspx?DataSetCode=REV )

(66) It should also be kept in mind that both the ITR on capital and capital income are biased upwards (compared to other EU countries) because the ITR base does not

capture the full extent of taxable profits of financial companies, particularly capital gains. A further reason is that the UK figures allocate all tax on occupational (second

pillar) and private pension benefits (third pillar) to capital income whilst for most other Member States the second pillar is allocated to transfer income and income of the

non-employed.

Taxation trends in the European Union 161

Вам также может понравиться

- UK Tax SystemДокумент13 страницUK Tax SystemMuhammad Sajid Saeed100% (1)

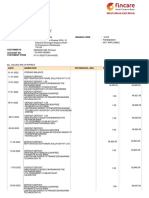

- Account Summary - 7382041247: ChecksДокумент4 страницыAccount Summary - 7382041247: ChecksJack SheldenОценок пока нет

- FinQuiz Level2Mock2016Version2JunePMSolutionsДокумент60 страницFinQuiz Level2Mock2016Version2JunePMSolutionsAjoy RamananОценок пока нет

- Tax Burden UKДокумент13 страницTax Burden UKArturas GumuliauskasОценок пока нет

- Pro Forma Invoice: Chemxo Trading FZEДокумент1 страницаPro Forma Invoice: Chemxo Trading FZErmautomobiles.dhkОценок пока нет

- Addressing Tax Evasion and AvoidanceДокумент43 страницыAddressing Tax Evasion and Avoidancek2a2m2Оценок пока нет

- Nego Chap2 MelaiДокумент4 страницыNego Chap2 Melaimelaniem_1Оценок пока нет

- Statementofaccount: Primary Holder Name: Chetan Sharma Address Branch CodeДокумент4 страницыStatementofaccount: Primary Holder Name: Chetan Sharma Address Branch CodeRohit raagОценок пока нет

- Inclusive Fintech - Blockchain, Cryptocurrency and IcoДокумент548 страницInclusive Fintech - Blockchain, Cryptocurrency and IcoAnonymous b4uZyiОценок пока нет

- Ch20 Guan CM Aise TBДокумент35 страницCh20 Guan CM Aise TBHero CourseОценок пока нет

- Taxation Trends in The European Union - 2012 122Документ1 страницаTaxation Trends in The European Union - 2012 122d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 174Документ1 страницаTaxation Trends in The European Union - 2012 174d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 118Документ1 страницаTaxation Trends in The European Union - 2012 118d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 70Документ1 страницаTaxation Trends in The European Union - 2012 70d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 20Документ1 страницаTaxation Trends in The European Union - 2012 20d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 39Документ1 страницаTaxation Trends in The European Union - 2012 39Dimitris ArgyriouОценок пока нет

- Taxation Trends in The European Union - 2012 74Документ1 страницаTaxation Trends in The European Union - 2012 74d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 28Документ1 страницаTaxation Trends in The European Union - 2012 28Dimitris ArgyriouОценок пока нет

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyДокумент8 страницEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanОценок пока нет

- Taxation Trends in The European Union - 2012 41Документ1 страницаTaxation Trends in The European Union - 2012 41Dimitris ArgyriouОценок пока нет

- Taxation Trends in The European Union - 2012 86Документ1 страницаTaxation Trends in The European Union - 2012 86d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 82Документ1 страницаTaxation Trends in The European Union - 2012 82d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 90Документ1 страницаTaxation Trends in The European Union - 2012 90d05registerОценок пока нет

- Ireland: Developments in The Member StatesДокумент4 страницыIreland: Developments in The Member StatesBogdan PetreОценок пока нет

- Taxation Trends in EU in 2010Документ42 страницыTaxation Trends in EU in 2010Tatiana TurcanОценок пока нет

- Taxation Trends in The European Union - 2012 66Документ1 страницаTaxation Trends in The European Union - 2012 66d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 102Документ1 страницаTaxation Trends in The European Union - 2012 102d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 40Документ1 страницаTaxation Trends in The European Union - 2012 40Dimitris ArgyriouОценок пока нет

- GE 3 May 2012 - Andrea ManzittiДокумент23 страницыGE 3 May 2012 - Andrea ManzittiMeadsieОценок пока нет

- Taxation Trends in The European Union - 2012 107Документ1 страницаTaxation Trends in The European Union - 2012 107d05registerОценок пока нет

- Goverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαДокумент4 страницыGoverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαconstantinosОценок пока нет

- Taxation Trends in The European Union - 2012 59Документ1 страницаTaxation Trends in The European Union - 2012 59d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 21Документ1 страницаTaxation Trends in The European Union - 2012 21d05registerОценок пока нет

- Ates (2020)Документ23 страницыAtes (2020)nita_andriyani030413Оценок пока нет

- Two Pillars OECDДокумент10 страницTwo Pillars OECDmalejandrabv87Оценок пока нет

- Tax Systems and Tax Reforms in South and East Asia: ThailandДокумент27 страницTax Systems and Tax Reforms in South and East Asia: ThailandMarco CorvoОценок пока нет

- Public Finance: Restructuring ExpenditureДокумент2 страницыPublic Finance: Restructuring ExpenditurenaramgaribaluprakashОценок пока нет

- Faculty - Economic and ManagementДокумент5 страницFaculty - Economic and ManagementBaraawo BaraawoОценок пока нет

- Taxation Trends in The European Union - 2012 155Документ1 страницаTaxation Trends in The European Union - 2012 155d05registerОценок пока нет

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsДокумент44 страницыTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousОценок пока нет

- Why Do Developing Countries Tax So LittleДокумент27 страницWhy Do Developing Countries Tax So Littlekmgk03Оценок пока нет

- Taxation Trends in The European Union - 2012 159Документ1 страницаTaxation Trends in The European Union - 2012 159d05registerОценок пока нет

- Knowledge Horizons - Economics: Daniela PENU, Diana Mihaela APOSTOL, Cristina BĂLĂCEANUДокумент5 страницKnowledge Horizons - Economics: Daniela PENU, Diana Mihaela APOSTOL, Cristina BĂLĂCEANUDenis DenisОценок пока нет

- Salvador Barrios 2020Документ18 страницSalvador Barrios 2020Arnoldus ApriyanoОценок пока нет

- Public FinnceДокумент57 страницPublic FinnceJim MathilakathuОценок пока нет

- Acquis MaltaДокумент60 страницAcquis MaltacikkuОценок пока нет

- Ahorro en UEДокумент7 страницAhorro en UEelenaОценок пока нет

- The Determinants of Tax Revenue in Sub Saharan Africa - Tony & JorgenДокумент19 страницThe Determinants of Tax Revenue in Sub Saharan Africa - Tony & Jorgenpriyanthikadilrukshi05Оценок пока нет

- The Assessment of Taxation Impact On Economic Development. A Case Study of Romania (1995-2014)Документ14 страницThe Assessment of Taxation Impact On Economic Development. A Case Study of Romania (1995-2014)RashidAliОценок пока нет

- Taxation Trends in The European Union - 2012 33Документ1 страницаTaxation Trends in The European Union - 2012 33Dimitris ArgyriouОценок пока нет

- Inceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionДокумент9 страницInceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionAlex MariusОценок пока нет

- Monthly AprilMay v8ΙΙДокумент19 страницMonthly AprilMay v8ΙΙfotiskОценок пока нет

- Indirect Tax 2013Документ120 страницIndirect Tax 2013Lavinia GauthierОценок пока нет

- 077NHSДокумент34 страницы077NHSSubhayan BoralОценок пока нет

- Dterminants of Tax Revenue Does Sectorial Composition Matter - Kadir KaragözДокумент15 страницDterminants of Tax Revenue Does Sectorial Composition Matter - Kadir Karagözpriyanthikadilrukshi05Оценок пока нет

- National Digital Taxes - Lessons From EuropeДокумент20 страницNational Digital Taxes - Lessons From EuropeJenny NatividadОценок пока нет

- Revenue Productivity of The Tax System in Lesotho Nthabiseng J. Koatsa and Mamello A. NchakeДокумент18 страницRevenue Productivity of The Tax System in Lesotho Nthabiseng J. Koatsa and Mamello A. NchakeTseneza RaselimoОценок пока нет

- What Changes Are Needed To Have A Serious Political Union in EuropeДокумент6 страницWhat Changes Are Needed To Have A Serious Political Union in EuropeFranco PerottoОценок пока нет

- Government Finance-Union and StatesДокумент33 страницыGovernment Finance-Union and StatesJitendra BeheraОценок пока нет

- Public FinanceДокумент6 страницPublic FinanceanjudeshОценок пока нет

- Taxation Trends in The European Union - 2012 30Документ1 страницаTaxation Trends in The European Union - 2012 30Dimitris ArgyriouОценок пока нет

- Adv Tax Assignment 1Документ8 страницAdv Tax Assignment 1Hussain ImranОценок пока нет

- 2 PBДокумент27 страниц2 PBkimseongyun123Оценок пока нет

- Taxation Trends in The European Union - 2012 84Документ1 страницаTaxation Trends in The European Union - 2012 84d05registerОценок пока нет

- EIB Investment Survey 2023 - European Union overviewОт EverandEIB Investment Survey 2023 - European Union overviewОценок пока нет

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeОт EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeОценок пока нет

- Taxation Trends in The European Union - 2012 224Документ1 страницаTaxation Trends in The European Union - 2012 224d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 223Документ1 страницаTaxation Trends in The European Union - 2012 223d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 220Документ1 страницаTaxation Trends in The European Union - 2012 220d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 222Документ1 страницаTaxation Trends in The European Union - 2012 222d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 221Документ1 страницаTaxation Trends in The European Union - 2012 221d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 223 PDFДокумент1 страницаTaxation Trends in The European Union - 2012 223 PDFd05registerОценок пока нет

- Taxation Trends in The European Union - 2012 225Документ1 страницаTaxation Trends in The European Union - 2012 225d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 219Документ1 страницаTaxation Trends in The European Union - 2012 219d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 216Документ1 страницаTaxation Trends in The European Union - 2012 216d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 214Документ1 страницаTaxation Trends in The European Union - 2012 214d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 218Документ1 страницаTaxation Trends in The European Union - 2012 218d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 215Документ1 страницаTaxation Trends in The European Union - 2012 215d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 217Документ1 страницаTaxation Trends in The European Union - 2012 217d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 212Документ1 страницаTaxation Trends in The European Union - 2012 212d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 204Документ1 страницаTaxation Trends in The European Union - 2012 204d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 213Документ1 страницаTaxation Trends in The European Union - 2012 213d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 210Документ1 страницаTaxation Trends in The European Union - 2012 210d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 203Документ1 страницаTaxation Trends in The European Union - 2012 203d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 203Документ1 страницаTaxation Trends in The European Union - 2012 203d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 211Документ1 страницаTaxation Trends in The European Union - 2012 211d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 204Документ1 страницаTaxation Trends in The European Union - 2012 204d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 203Документ1 страницаTaxation Trends in The European Union - 2012 203d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 203Документ1 страницаTaxation Trends in The European Union - 2012 203d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 204Документ1 страницаTaxation Trends in The European Union - 2012 204d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 195Документ1 страницаTaxation Trends in The European Union - 2012 195d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 195Документ1 страницаTaxation Trends in The European Union - 2012 195d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 196Документ1 страницаTaxation Trends in The European Union - 2012 196d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 196Документ1 страницаTaxation Trends in The European Union - 2012 196d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 196Документ1 страницаTaxation Trends in The European Union - 2012 196d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 198Документ1 страницаTaxation Trends in The European Union - 2012 198d05registerОценок пока нет

- Ibps Po Mains 2023 Current Affairs, Bank & Static Ga 7 Days 7 MocksДокумент57 страницIbps Po Mains 2023 Current Affairs, Bank & Static Ga 7 Days 7 Mockssatyam singhОценок пока нет

- Synopsis Icici FinancialДокумент10 страницSynopsis Icici FinancialbhatiaharryjassiОценок пока нет

- Literature Review Capital BudgetingДокумент4 страницыLiterature Review Capital Budgetingc5p9zbep100% (1)

- Letter From TCI To ABN AmroДокумент2 страницыLetter From TCI To ABN AmroF.N. HeinsiusОценок пока нет

- Coursework For International Finance (AutoRecovered)Документ24 страницыCoursework For International Finance (AutoRecovered)Noble NwabiaОценок пока нет

- Cash Management - Overview Slide For TTT - 15.0 - PTJ Ao (Cmsi v1.0)Документ63 страницыCash Management - Overview Slide For TTT - 15.0 - PTJ Ao (Cmsi v1.0)Siti Habsah Abdullah100% (1)

- Damo CH 12Документ65 страницDamo CH 12HP KawaleОценок пока нет

- Blackbook Topics TybbiДокумент2 страницыBlackbook Topics Tybbiankit chauhan100% (1)

- Ch3 - test bank: corporate finance (ةقراشلا ةعماج)Документ25 страницCh3 - test bank: corporate finance (ةقراشلا ةعماج)sameerОценок пока нет

- Budget SheetДокумент10 страницBudget Sheetshrestha.aryxnОценок пока нет

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasДокумент5 страницCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasBrianSantiagoОценок пока нет

- Forex Service Charges: Exports Bills Purchased /Discounted/NegotiatedДокумент9 страницForex Service Charges: Exports Bills Purchased /Discounted/NegotiatedSameer GhogaleОценок пока нет

- The Following Data Pertain To Lincoln Corporation On December 31Документ8 страницThe Following Data Pertain To Lincoln Corporation On December 31Jhianne Mae Albag100% (1)

- Cash DiscountsДокумент13 страницCash DiscountsDonquixote MingoОценок пока нет

- CV - Divya GoyalДокумент1 страницаCV - Divya GoyalGarima JainОценок пока нет

- Simple and Compound InterestДокумент3 страницыSimple and Compound InterestSanjay SОценок пока нет

- UPSC - Candidate's Application Details (Registration-Id: 117..Документ1 страницаUPSC - Candidate's Application Details (Registration-Id: 117..rajat singhОценок пока нет

- Ecodal - A.M. No. 05-11-04-SC - Rules of Procedure in Cases of Civil ForfeitureДокумент34 страницыEcodal - A.M. No. 05-11-04-SC - Rules of Procedure in Cases of Civil ForfeitureKyle LuОценок пока нет

- Discussion 4 FinanceДокумент5 страницDiscussion 4 Financepeter njovuОценок пока нет

- Working of Depositary System 110820104758 Phpapp02Документ76 страницWorking of Depositary System 110820104758 Phpapp02harsh royОценок пока нет

- CV Format For A BankerДокумент2 страницыCV Format For A BankerNurun Nobi100% (1)

- Assignment 5 - Sources and Uses of Funds - 323711041Документ3 страницыAssignment 5 - Sources and Uses of Funds - 323711041MA. ANGELA NISSI QUIROZОценок пока нет

- Master Input Sheet: InputsДокумент37 страницMaster Input Sheet: Inputsminhthuc203Оценок пока нет