Академический Документы

Профессиональный Документы

Культура Документы

Ratios Explained in Under 40

Загружено:

VaibhavladОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ratios Explained in Under 40

Загружено:

VaibhavladАвторское право:

Доступные форматы

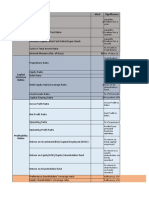

Ratios

Ratios Formula Expressed Remarks

Expressed as Indicates the efficiency in

Total Assets Turnover Ratio Net Sales / Avergae Total Assets No. of Times utilisation of Total Assets

Total Assets = Fixed Assets + Long Term Investments + Current Assets

Net Sales = Gross Sales - Sales Return - Excise Duty

Expressed as Indicates the efficiency in

Fixed Assets Turnover Ratio Net Sales / Average Net Fixed Assets No. of Times utilisation of Fixed Assets

Indicates the number of

times earnings are

Profit before Interest and Tax (EBIT) / Interest Expressed as sufficient to pay interest

Interest Coverage Ratio Expenses No. of Times on borrowingss

Indicates the number of

(NPAT (Net Profit after Tax) + Depreciation + times earnings are

Interest) / (Interest + Loan Principal Expressed as sufficient to repay the

Debt Service Coverage Ratio Repayment) No. of Times Loan Installments

Amount Available to Equity Shareholders :

(NPAT - Preference Dividend if any) / Indicates the Earnings

Earnings per Share (EPS) Outstanding No.of Equity Shares Rs. per Share available per equity share

Indicates the Dividend per

Amount Available as Equity Dividend: (Equity Rs. per Share equity share

Dividend per Share (DPS) Dividend) / Outstanding No.of Equity Shares

OR

EPS * Payout Ratio

Equity Dividend * 100 / Profit available to

Dividend Payout Ratio Equity Shareholders Indicates the percentage

OR of earnings actually

Pure Ratio or distributed as Equity

DPS * 100/ EPS Percentage Dividend

Profit before Interest and Tax *100 / Capital Indicates the Returns on

Return on Capital Employed Employed or Average Total Assets Percentage Total Capital Employed

Dividend yield measures

how much cash flow one

Percentage is getting for every rupee

invested in an equity

Dividend Yield DPS * 100 / MPS position

Dividend yield measures

how much cash flow one

Percentage is getting for every rupee

invested in an equity

position

(where MPS = Market Price per Share)

Indicates the number of

times the EPS is covered

Price Earnings Ratio (P/E Ratio) Market price per Share / Earnings Per Share No. of times by its market price.

Financial leverage is the

leverage effect on

Pure Ratio or account of the financial

Financial Leverage PBIT/PBT Percentage cost, interest

Operating leverage is

the leverage effect on

Pure Ratio or account of all fixed

Operating Leverage Contribution / PBIT Percentage costs other than interest

Pure Ratio or

Combined leverage Contribution / PBT Percentage

Вам также может понравиться

- 1.1 Financial Analytics Toolkit (8 Pages) PDFДокумент8 страниц1.1 Financial Analytics Toolkit (8 Pages) PDFPartha Protim SahaОценок пока нет

- Steel Structural Calculation ReportДокумент79 страницSteel Structural Calculation ReportSandeep Patil100% (4)

- LIQUIDITY AND SOLVENCY RATIOSДокумент26 страницLIQUIDITY AND SOLVENCY RATIOSDeep KrishnaОценок пока нет

- Marketing Quarter 4 (Week 1-9)Документ65 страницMarketing Quarter 4 (Week 1-9)NhojLaupОценок пока нет

- Financial Analysis Cheat Sheet: by ViaДокумент2 страницыFinancial Analysis Cheat Sheet: by Viaheehan6Оценок пока нет

- Imc PlanДокумент39 страницImc Planapi-485317347100% (2)

- Deliver To: Invoice To:: Sudan Invoice No: DateДокумент1 страницаDeliver To: Invoice To:: Sudan Invoice No: DateSimon NyuliahОценок пока нет

- Accounting KpisДокумент6 страницAccounting KpisHOCINIОценок пока нет

- Analysis of Self Supported Steel ChimneysДокумент81 страницаAnalysis of Self Supported Steel ChimneysrodrigoperezsimoneОценок пока нет

- Commodity OptionsДокумент122 страницыCommodity Optionskunalgupta89Оценок пока нет

- Ndubueze 09 PH DДокумент450 страницNdubueze 09 PH DJoy MainaОценок пока нет

- Finance Formula BankДокумент2 страницыFinance Formula BankMELISSA ANN COLOMAОценок пока нет

- Common financial ratios and their formulaeДокумент1 страницаCommon financial ratios and their formulaeNeedhi NagwekarОценок пока нет

- Traditional Models of Financial Statements AnalysisДокумент4 страницыTraditional Models of Financial Statements AnalysisMary LeeОценок пока нет

- Corrugated BoxДокумент68 страницCorrugated BoxPrabodh Rajavat100% (1)

- Accounting Test Bank 2Документ73 страницыAccounting Test Bank 2likesОценок пока нет

- Financial statement analysis techniques and ratios for evaluating business performanceДокумент7 страницFinancial statement analysis techniques and ratios for evaluating business performanceJhovet Christian M. CariÑoОценок пока нет

- Nature Purpose and Scope of Financial ManagementДокумент18 страницNature Purpose and Scope of Financial ManagementmhikeedelantarОценок пока нет

- Notes On Financial-RatiosДокумент2 страницыNotes On Financial-Ratioser.architguptaОценок пока нет

- Level 1 Assessment Financial Analysis ProdegreeДокумент4 страницыLevel 1 Assessment Financial Analysis ProdegreePrá ChîОценок пока нет

- Ratio Analysis FormulasДокумент3 страницыRatio Analysis FormulasVinayaniv YanivОценок пока нет

- Ratios PDFДокумент1 страницаRatios PDFSayan AcharyaОценок пока нет

- Handout Fin Man 2304Документ9 страницHandout Fin Man 2304Sheena Gallentes LeysonОценок пока нет

- Days Sales in AR 360/ Sales/ AR End Days Seberapa Lama AR Ke Collect, Ga Boleh Lewat Credit Term (LBH CPT LBH Bagus)Документ2 страницыDays Sales in AR 360/ Sales/ AR End Days Seberapa Lama AR Ke Collect, Ga Boleh Lewat Credit Term (LBH CPT LBH Bagus)Natasha WijayaОценок пока нет

- ACT. 1 FINANCIAL RATIOS - EllorimoДокумент3 страницыACT. 1 FINANCIAL RATIOS - EllorimoEra EllorimoОценок пока нет

- ACCCДокумент6 страницACCCAynalem KasaОценок пока нет

- Formulas and interpretations of key financial ratiosДокумент6 страницFormulas and interpretations of key financial ratiosjohngay1987Оценок пока нет

- HO 4 - Telecoms - Industry - and - Operator - Benchmarks - by - Key - Financial - Metrics - 4Q13Документ28 страницHO 4 - Telecoms - Industry - and - Operator - Benchmarks - by - Key - Financial - Metrics - 4Q13Saud HidayatullahОценок пока нет

- Dupont Decomposition: Operating ProfitabilityДокумент2 страницыDupont Decomposition: Operating ProfitabilitySatrujit MohapatraОценок пока нет

- FM ExamДокумент5 страницFM ExamSarlota KratochvilovaОценок пока нет

- Market RatiosДокумент5 страницMarket RatiosAmirul AmriОценок пока нет

- Financial AnalysisДокумент2 страницыFinancial AnalysisdavewagОценок пока нет

- Stracos Notes 1Документ1 страницаStracos Notes 1bangtan sonyeondanОценок пока нет

- TIFA CheatSheet MM X MLДокумент10 страницTIFA CheatSheet MM X MLCorina Ioana BurceaОценок пока нет

- Financial English 5.12Документ2 страницыFinancial English 5.12thuminh07112003Оценок пока нет

- MMS-2 Semester Batch 2010 - 2011 VesimsrДокумент11 страницMMS-2 Semester Batch 2010 - 2011 VesimsrVishal ShanbhagОценок пока нет

- Financial_Analysis_Cheat_Sheet_1709070577Документ2 страницыFinancial_Analysis_Cheat_Sheet_1709070577herrerofrutosОценок пока нет

- CA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamДокумент48 страницCA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamKapil MeenaОценок пока нет

- Topic 4. Stock MarketДокумент7 страницTopic 4. Stock MarketЕкатерина КидяшеваОценок пока нет

- 002 MAS FS Analysis Rev00 PDFДокумент5 страниц002 MAS FS Analysis Rev00 PDFCyvee Joy Hongayo OcheaОценок пока нет

- Ratio Analysis - Easy To RememberДокумент3 страницыRatio Analysis - Easy To RememberKhushbuJ100% (5)

- Ratio Analysis NepalДокумент10 страницRatio Analysis NepalDeep KrishnaОценок пока нет

- Ratio Analysis DuPont AnalysisДокумент7 страницRatio Analysis DuPont Analysisshiv0308Оценок пока нет

- Final Cheat Sheet FA ML X MM UpdatedДокумент8 страницFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaОценок пока нет

- Ratio Analysis:: Liquidity Measurement RatiosДокумент8 страницRatio Analysis:: Liquidity Measurement RatiossammitОценок пока нет

- 2financial Statement AnalysisДокумент24 страницы2financial Statement AnalysisSachin YadavОценок пока нет

- Common ratios and their formulae explained in one placeДокумент1 страницаCommon ratios and their formulae explained in one placeNikhil TodiОценок пока нет

- Reviewer - CM, FR, ValДокумент3 страницыReviewer - CM, FR, ValbabeeandreaaОценок пока нет

- Ratios Formula SheetДокумент3 страницыRatios Formula SheetkaitlynjagooОценок пока нет

- Du Pont Chart: Multiplied byДокумент9 страницDu Pont Chart: Multiplied bymedhaОценок пока нет

- Fa Cheat Sheet MM MLДокумент8 страницFa Cheat Sheet MM MLIrina StrizhkovaОценок пока нет

- Impact of Dividend Policy On A Firm PerformanceДокумент5 страницImpact of Dividend Policy On A Firm PerformanceMuhammad AnasОценок пока нет

- Earnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesДокумент6 страницEarnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesHassleBustОценок пока нет

- Financial Mix RatiosДокумент7 страницFinancial Mix RatiosansanandresОценок пока нет

- Profitability InfographicДокумент1 страницаProfitability InfographicTaufik HussinОценок пока нет

- Financial+Statement+Analysis+Week+5bДокумент34 страницыFinancial+Statement+Analysis+Week+5bhezilgonzaga25Оценок пока нет

- ACCOUNTING RATIOS FOR THE ASSESSMENT OF MSBsДокумент1 страницаACCOUNTING RATIOS FOR THE ASSESSMENT OF MSBsErrol ThompsonОценок пока нет

- 8 Financial RatiosДокумент3 страницы8 Financial Ratios- fridaОценок пока нет

- Comprehensive Ratio AnalysisДокумент8 страницComprehensive Ratio Analysis9694878Оценок пока нет

- bài 10 - đo lường marketingДокумент13 страницbài 10 - đo lường marketingNgọc TrâmОценок пока нет

- 9960 FinancialratiosДокумент2 страницы9960 FinancialratiosGhelyn GimenezОценок пока нет

- Investment RatiosДокумент2 страницыInvestment RatiosMisbah ZiyaОценок пока нет

- Ca Final SFM ChalisaДокумент44 страницыCa Final SFM ChalisaSarabjeet SinghОценок пока нет

- Updated FSA Ratio SheetДокумент4 страницыUpdated FSA Ratio Sheetmoussa toureОценок пока нет

- ) PV (Fvif I) PV (1 FV N I I I IP: Inv. Turnover Sales/Inventories DSO Receivables/Avg. Sales Per DayДокумент1 страница) PV (Fvif I) PV (1 FV N I I I IP: Inv. Turnover Sales/Inventories DSO Receivables/Avg. Sales Per DayRicky ImandaОценок пока нет

- A level business formula (copy)Документ1 страницаA level business formula (copy)ducnguyentri.vinuniОценок пока нет

- Fundamental Analysis WorkbookДокумент4 страницыFundamental Analysis WorkbookMuaz saleemОценок пока нет

- Ratio FormulaeДокумент3 страницыRatio FormulaeNandhaОценок пока нет

- Finance Buzzwords Course 2 Cohort 2Документ5 страницFinance Buzzwords Course 2 Cohort 2Pramod KulkarniОценок пока нет

- Mudra Application EngДокумент6 страницMudra Application EngVaibhavladОценок пока нет

- Paper Napkins PDFДокумент6 страницPaper Napkins PDFsunitha kadaОценок пока нет

- Disclosure To Promote The Right To InformationДокумент32 страницыDisclosure To Promote The Right To InformationVaibhavladОценок пока нет

- Kshore Tarun Loan Application With Rev Checklist UARNДокумент4 страницыKshore Tarun Loan Application With Rev Checklist UARNVaibhavladОценок пока нет

- Lat Corr DOE RPT Dec16 FCM Final DraftДокумент14 страницLat Corr DOE RPT Dec16 FCM Final DraftNishant KakhaniОценок пока нет

- 25 Creative Ideas Packaging Design Companies Need To SeeДокумент42 страницы25 Creative Ideas Packaging Design Companies Need To SeeVaibhavladОценок пока нет

- Disclosure To Promote The Right To InformationДокумент31 страницаDisclosure To Promote The Right To InformationVaibhavladОценок пока нет

- About - GST India-Goods and Services Tax in IndiaДокумент13 страницAbout - GST India-Goods and Services Tax in IndiaVaibhavladОценок пока нет

- Machine AddДокумент3 страницыMachine AddVaibhavladОценок пока нет

- Admin Office Handrails-ModelДокумент1 страницаAdmin Office Handrails-ModelVaibhavladОценок пока нет

- Drilling DataДокумент4 страницыDrilling DataVaibhavladОценок пока нет

- What Is GST and How It Will Affect YouДокумент6 страницWhat Is GST and How It Will Affect YouVaibhavladОценок пока нет

- Ringsizefinder3 PDFДокумент2 страницыRingsizefinder3 PDFVaibhavladОценок пока нет

- Tankfarm DesignДокумент15 страницTankfarm DesignVaibhavladОценок пока нет

- Tankfarm Drawing by ExplotechДокумент1 страницаTankfarm Drawing by ExplotechVaibhavladОценок пока нет

- Weight Per Metre Structurals PDFДокумент18 страницWeight Per Metre Structurals PDFVaibhavladОценок пока нет

- 3 CH 2Документ20 страниц3 CH 2Mary HarrisonОценок пока нет

- ETP Flow Diagram-ModelДокумент1 страницаETP Flow Diagram-ModelVaibhavladОценок пока нет

- Jankowiak Chinese Industrial Clusters 20121Документ15 страницJankowiak Chinese Industrial Clusters 20121Andres PerezОценок пока нет

- Petroleum DemandДокумент7 страницPetroleum DemandWon JangОценок пока нет

- Accounting For Special Transaction C8 Prob 5Документ2 страницыAccounting For Special Transaction C8 Prob 5skilled legilimenceОценок пока нет

- Merged Sample QuestionsДокумент55 страницMerged Sample QuestionsAlaye OgbeniОценок пока нет

- Dyer2013 PDFДокумент574 страницыDyer2013 PDFMiguel Alejandro Diaz CastilloОценок пока нет

- Sales Force, Internet and Direct MarketingДокумент30 страницSales Force, Internet and Direct MarketingDedeMuhammadLuthfi0% (1)

- IFM12e Ch12Документ12 страницIFM12e Ch12jjxxhh888Оценок пока нет

- Best ADX Strategy Built by Professional TradersДокумент6 страницBest ADX Strategy Built by Professional TradersSantosh ThakurОценок пока нет

- Unit IДокумент19 страницUnit IlakshmiОценок пока нет

- Exercises Part6Документ14 страницExercises Part6Inder Mohan0% (1)

- Resume Mohit J Han JeeДокумент3 страницыResume Mohit J Han JeeMohit JhanjeeОценок пока нет

- Literature ReviewДокумент28 страницLiterature ReviewIshaan Banerjee50% (2)

- Chap 005 (FIVE GENERIC COMPETITIVE STRATEGY)Документ15 страницChap 005 (FIVE GENERIC COMPETITIVE STRATEGY)AyAmmore Zainal AbidinОценок пока нет

- Exercise 3: Chapter 3Документ5 страницExercise 3: Chapter 3ying huiОценок пока нет

- Retail MarketДокумент44 страницыRetail Marketvipul5290Оценок пока нет

- GE Matrix guide - Industry attractiveness and business strength factorsДокумент12 страницGE Matrix guide - Industry attractiveness and business strength factorsArun ChidambaramОценок пока нет

- Sample QuestionsДокумент2 страницыSample QuestionsKajal JainОценок пока нет

- Rakesh Jhunjhunwala's views on wealth creation, stock investing and business evaluationДокумент8 страницRakesh Jhunjhunwala's views on wealth creation, stock investing and business evaluationtarachandmara100% (3)

- Pas 16 Property, Plant, and Equipment: I. NatureДокумент2 страницыPas 16 Property, Plant, and Equipment: I. NatureR.A.Оценок пока нет

- Task 1Документ16 страницTask 1lakishikaОценок пока нет

- June 9-Acquisition of PPEДокумент2 страницыJune 9-Acquisition of PPEJolo RomanОценок пока нет

- GTB FinTech Whitepaper (DB012) A4 DIGITALДокумент28 страницGTB FinTech Whitepaper (DB012) A4 DIGITALErinda MalajОценок пока нет

- Capital Market Instruments in PakistanДокумент10 страницCapital Market Instruments in PakistanMuhammad YamanОценок пока нет