Академический Документы

Профессиональный Документы

Культура Документы

How To Read Financial Statement PDF

Загружено:

Mazen AlbsharaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

How To Read Financial Statement PDF

Загружено:

Mazen AlbsharaАвторское право:

Доступные форматы

How to Read Financial Statements

This page is designed for the sole purpose of teaching someone how to read fnancial statements. While intended for

those with little or now knowledge of fnacial statements, it can be a handy reminder even for the seasoned professional.

This page is very long so an outline is provided to help you get the information you desire. (SEE OUTLINE)

HOW TO READ A FINANCIAL STATEMENT

If you are a certifed public accountant it is most unlikely that you can learn anything from reading this book. You

don't need to be told the basics of understanding what's presented in corporate annual reports. If you aren't a certifed

public accountant, and you fnd that annual reports are "over your head," this booklet can help you to grasp the facts

contained in such reports and possibly become a better informed investor. That is our principal aim in publishing this

booklet, but we also hope that it will be useful to other readers who want to understand how business works and to learn

more about the companies that provide them with goods and services or that offer them employment.

Most annual reports can be broken down into three sections: the Executive Letter, the business Review, and the

Financial Review. The Executive Letter gives a broad overview of the company's business and fnancial performance.

The Business Review summarizes recent developments, trends, and objectives of the company. The Financial Review

is where business performance is quantifed in dollars. This is the section we intend to clarify.

The Financial Review has two major parts: Discussion and Analysis, and Audited Financial Statements. A third part

might include information supplemental to the Financial Statements. In the Discussion and Analysis, management

explains changes in operating results from year to year. This explanation is presented mainly in a narrative format, with

charts and graphs highlighting the comparisons. The Operating results are numerically captured and presented in the

Financial Statements.

The principal components of the Financial Statements are the balance sheet; income statement; statement of changes

in shareholders' equity; statement of cash fows; and footnotes. The balance sheet portrays the fnancial strength of the

company by showing what the company owns and what it owes on a certain date. The balance sheet can be thought of

as a snapshot photograph since it reports on fnancial position as of the end of the year. The income statement, on the

other hand, is like a motion picture since it reports on how the company performed during the year and shows whether

operations have resulted in a proft or loss. The statement of changes in shareholders' equity reconciles the activity in

the equity section of the balance sheet from year to year. Common changes in equity result from company profts or

losses, dividends, or stock issuances. The statement of cash fows reports on the movement of cash by the company for

the year. The footnotes provide more detailed information on the balance sheet and income statement.

This booklet will focus on illustrating the basic fnancial statements and footnotes presented in annual reports in

accordance with current practice. It will also include examples of fnancial methods used by investors to better analyze

fnancial statements. In order to provide a framework for illustration, we will invent a company. It will be a public

company (one whose shares are freely traded on the open market). The reason for choosing a public company is that it

is required to provide the most extensive amount of information in its annual reports in accordance with guidelines

issued by the Securities and Exchange Commission (SEC). Our company will represent a typical corporation with the

most commonly used accounting and reporting practices. We'll call our company Typical Manufacturing Company, Inc.

A Few Words Before We Begin

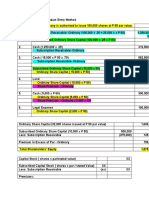

Below are four samples of a Balance Sheet, Income Statement, Statement of Changes in Shareholders' Equity, and a

Statement of Cash Flows. These are the statements we will discuss in the frst section. To simplify matters, we did not

illustrate the Discussion and Analysis nor did we present examples of the Executive Letter or Business Review. In our

sample statements, we've presented two years of fnancial results on the balance sheet and income statement and one

year of activity on the statement of changes in shareholders' equity and statement of cash fows. This was also done for

ease of illustration. Were we to comply with SEC requirements, we would have had to report the last three years of

activity in the Income Statement, Statement of Changes in Shareholders' Equity, and Statement of Cash Flows. Further

SEC requirements that we did not illustrate include: presentation of selected quarterly fnancial data for the past two

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

years, business segment information for the last three years, a listing of company directors and executive offcers, and

the market price of the company's common stock for each quarterly period within the two most recent fscal years.

Typical

Manufacturing

Company Inc.

Consolidated Balance Sheet

December 31,19X9 and 19X8 (dollars in thousands)

Assets 19X9 19X8

Current Assets

Cash $20,000 $15,000

Marketable securities at cost which

approximates market value 40,000 32,000

Accounts Receivable

Less allowance for doubtful accounts:

19X9: $2,375, 19X8: $3,000 156,000 145,000

Inventories 180,000 185,000

Prepaid Expenses and other current assets 4,000 3,000

Total current assets 400,000 380,000

Property, plant and equipment

Land $30,000 $30,000

Buildings 125,000 118,500

Machinery 200,000 171,100

Leasehold improvements 15,000 15,000

Furniture, fxtures, etc. 15,000 12,000

Total property, plant, and equipment $385,000 $346,600

Less accumulated depreciation $125,000 $97,000

Net property, plant and equipment $260,000 $249,600

Intagibles(goodwill, Patents) - less amortization $2,000 $2,000

Total assets $662,000 631,600

Liabilities

Current liabilities

Accounts payable $60,000 $57,000

Notes payable 51,000 61,000

Accrued expenses 30,000 36,000

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Income taxes payable 17,000 15,000

Other liabilities 12,000 12,000

Total current liabilities $170,000 $181,000

Long-term liabilities

Deferred income taxes $16,000 $9,000

12.5% Debentures payable 2010 130,000 130,000

Other long-term debt 0 6,000

Total libilities $316,000 $326,000

Shareholders Equity

Preferred staock $5.83 cumulative,

$100 par value authorized, issued and outstanding

60,000 shares $6,000 $6,000

Common stock $5.00 par value,

authorized 20,000,000 shares,

19x9 issued 15,000,000 shares,

19x8 14,500,000 shares 75,000 72,500

Additional paid-in capital 20,000 13,500

Retained earnings 249,000 219,600

Foreign currency translation adjustments 1,000 (1,000)

Less: Treasury stock at cost

(19x9-1,000; 19x8-1,000 shares) 5,000 5,000

Total shareholders' equity $346,000 $305,600

Total liabilities and shareholders' equity $662,000 $631,600

Typical

Manufacturing

Company Inc.

Consolidated Income Statement

December 31,19X9 and 19X8 (dollars in thousands)

19X9 19X8

Net sales $765,000 $725,000

Cost of sales 535,000 517,000

Gross margin $230,000 $208,000

Operating expenses

Depreciation and amortization 28,000 25,000

Selling, general and administrative expenses 96,804 109,500

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Operating income $105,196 $73,500

Other income (expense)

Dividends and interest income 5,250 9,500

Interest expense (16,250) (16,250)

Income before income taxes and extraordinary loss $94,196 $66,750

Income taxes 41,446 26,250

Income before extraordinary loss $52,750 $40,500

Extraordinary item: Loss on early extinguishment

of debt (net of income tax beneft of $750) (5,000) ---

Net income $47,750 $40,500

Common shares outstanding $14,999,000 $14,499,000

Earnings per common share before

extraordinary loss $3.19 $2.77

Earnings per share--extraordinary loss (.33) ---

Net income (per common share) $3.16

Typical

Manufacturing

Company Inc.

Consolidated Statement of Changes

In Shareholders' Equity

December 31,19X9 and 19X8 (dollars in thousands)

Foreign

Additional Currency

Preferred Common Paid-In Retained Translation Treasury

Stock Stock Capital Earnings Adjustment Stock Total

Balance, Jan. 1, 19X9 $6,000 $72,500 $13,500 $219,600 ($1,000) ($5,000) $305,600

Net income 47,750 47,750

Dividends paid on:

preferred stock (350) (350)

common stock (18,000) (18,000)

Common stock issued $2,500 $6,500 $9,000

Translation gain $2,000 $2,000

Balance, Dec.31, 19X9 $6,000 $75,000 $20,000 $249,000 $1,000 ($5,000) $346,000

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Typical

Manufacturing

Company Inc.

Consolidated Statement of Cash Flows

December 31,19X9 and 19X8 (dollars in thousands)

Cash fows from operating activities:

Net income $47,750

Adjustment to reconcile net income to

net cash from operating activities:

Depreciation and amortization $28,000

Increase in marketable securities (8,000)

Increase in accounts receivable (11,000)

Decrease in inventory 5,000

Increase in prepaid expenses and other current

assets (1,000)

Increase in deferred taxes 7,000

Increase in accounts payable 3,000

Decrease in accrued expenses (6,000)

Increase in income taxes payable 2,000

Total Adjustments $19,000

Net Cash Provided by Operating Activities $66,750

Cash Flows from Investing Activities:

Purchase of fxed Assets ($38,400)

Net Cash Used in Investing Activities ($38,400)

Cash Flows from Financing Activities:

Decrease in notes payable ($10,000)

Decrease in other long-term debt (6,000)

Proceeds from issuance of common stock

Payment of dividends (18,350)

Net Cash Used in Financing Activities ($25,350)

Effect of Exchange Rate Changes on Cash $2,000

Increase in Cash $5,000

Cash at beginning of year 15,000

Cash at end of year $20,000

Income tax payments totaled $3,000 in 19X9.

Interest payments totaled $16,250 in, 19X9.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

See accompanying notes to consolidated fnancial statements.

The Balance Sheet

The balance sheet represents the fnancial picture as it stood on one particular day, December 31, 19X9, as though the

wheels of the company were momentarily at a standstill. Typical Manufacturing's balance sheet not only includes the

most recent year, but also the previous year. This lets you compare how the company fared in its most recent years.

The balance sheet is divided into two sides: on the left are shown assets; on the right are shown liabilities and

shareholders' equity. Both sides are always in balance. Each asset, liability, and component of shareholders' equity

reported in the balance sheet represents an "account" having a dollar amount or "balance." In the assets column, we list

all the goods and property owned, as well as claims against others yet to be collected. Under liabilities we list all debts

due. Under shareholders' equity we list the amount shareholders would split up it Typical were liquidated at its balance

sheet value.

Assume that the corporation goes out of business on the date of the balance sheet. If that occurs, the illustration

which follows shows you what typical Manufacturing

shareholders might expect to receive as their portion of the business.

Total assets (Less: intangibles) $660,000

Amount required to pay liabilities 316,000

Amount remaining for the shareholders $344,000

Now, we are going to give you a guided tour of the balance sheet's accounts. We'll. defne each item, one by one, and

explain how they work.

Assets

Current Assets

In general, current assets include cash and those assets which in the normal course of business will be turned into cash

in the reasonably near future, i.e., generally within a year from the date of the balance sheet.

Cash

This is just what you would expect-bills and coins in the till (petty cash fund) and money on deposit in the bank.

1 Cash $20,000

Marketable securities

This asset represents investment of excess or idle cash that is not needed immediately. In Typical's case it is invested

in preferred stock. Because these funds may be needed on short notice, it is essential that the securities be readily

marketable and subject to a minimum of price fuctuation. The general practice is to show marketable securities at cost

or market, whichever is lower.

2 Marketable securities at cost which approximates mkt.value $40,000

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Accounts receivable

Here we fnd the amount due from customers but not yet collected. When goods due are shipped prior to collection, a

receivable is recorded. Customers are usually given 30,60, or 90 days in which to pay. The amount due from customers

is $158,375. However, experience shows that some customers fail to pay their bills, because of fnancial diffculties or

some catastrophic event (a tornado, a hurricane, or a food) befalling their business. Therefore, in order to show the

accounts receivable item at a fgure representing expected receipts, the total is after a provision for doubtful accounts.

This year that debt reserve was $2,375.

3

Accounts receivable-less allowance for doubtful accounts of $2,375

$156,000

Inventories

The inventory of a manufacturer is composed of three groups. raw materials to be used in the product, partially

fnished goods in process of manufacture, and fnished goods ready for shipment to customers. The generally accepted

method of valuation of the inventory is cost or market, whichever is lower. This gives a conservative fgure. Where this

method is used, the value for balance sheet purposes will be cost, or perhaps less than cost if, as a result of deterioration,

obsolescence, decline in prices, or other factors, less than cost can be realized on the inventory. Inventory valuation

includes an allocation of production and other expenses, as well as the cost of materials

4 Inventories $180,000

Consolidated Balance Sheet

December 31,19X9 and 19X8 (dollars in thousands)

Assets 19X9 19X8

Current Assets

1 Cash $20,000 $15,000

2 Marketable securities at cost which

approximates market value 40,000 32,000

3 Accounts Receivable

Less allowance for doubtful accounts:

19X9: $2,375, 19X8: $3,000 156,000 145,000

4 Inventories 180,000 185,000

5 Prepaid Expenses and other current assets 4,000 3,000

6 Total current assets 400,000 380,000

Property, plant and equipment

Land $30,000 $30,000

Buildings 125,000 118,500

Machinery 200,000 171,100

Leasehold improvements 15,000 15,000

Furniture, fxtures, etc. 15,000 12,000

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

7 Total property, plant, and equipment $385,000 $346,600

8 Less accumulated depreciation $125,000 $97,00

9 Net property, plant and equipment $260,000 $249,600

10 Intagibles(goodwill, Patents) - less amortization $2,000 $2,000

11 Total assets $662,000 $631,600

Prepaid expenses

Prepaid expenses may arise for a situation such as this: During the year, Typical prepaid fre insurance Property, plant

and equipment premiums and advertising charges for the next year. Those insurance premiums and advertising services

are as yet unused at the balance sheet date, so there exists an unexpended item, which will be used up over the next 12

months. If the advance payments had not been made, the company would have more cash in the bank. So payments

made in advance from which the company has not yet received benefts, but for which it will receive benefts next year,

are listed among current assets as prepaid expenses.

5 Prepaid expenses and other current assets $4,000

Deferred charges for such items as the "introduction" of a new product to the market, or for moving a plant to a new

location, represent a type of asset similar to pre-paid expenses. However, deferred charges are not included in current

assets because the beneft from such expenditure will be reaped over several years to come. So the expenditure incurred

will be gradually written off over the next several years, rather than fully charged off in the year payment is made. Our

balance sheet shows no deferred charges because Typical has none. If it had, they would normally be included 'us'

before intangibles on the asset side of the ledger.

To summarize, the total current assets item includes primarily: cash,marketable securities, accounts receivable,

inventories, and prepaid expenses.

6 Total current assets $400,000

You will observe that these assets are mostly working assets in the sense that they are in a constant cycle of being

converted into cash. Inventories, when sold become accounts receivable; receivables, upon collection, become cash;

cash is used to pay debts and running expenses. We will discover later in the booklet how to make current assets tell a

story.

Property, Plant, and Equipment

Property, plant and equipment represents those assets not intended for sale that are used over and over again in order

to manufacture, display, warehouse, and transport the product. This category includes land, buildings, machinery,

equipment, furniture, automobiles, and trucks. The generally accepted and approved method for valuation is cost minus

the depreciation accumulated by the date of the balance sheet. Depreciation is discussed in the next section.

Property, plant, and equipment

Land $ 30,000

Buildings 125,000

Machinery 200,000

Leasehold Improvements 15,000

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Furniture, fxtures, etc 15,000

7 Total property, plant & equipment $385,000

The fgure displayed is not intended to refect market value at present or replacement cost in the future. While it is

recognized that the cost to replace plant and equipment at some future date might be higher, that possible cost is

obviously variable. For this reason, up to now, most companies have followed a general rule: acquisition cost less

accumulated depreciation based on that cost.

Depreciation

Depreciation is the practice of allocating the cost of a fxed asset over its useful life. This has been defned for

accounting purposes as the decline in useful value of a fxed asset due to wear and tear from use and passage of time.

The cost incurred to acquire the property, plant and equipment must be spread over the expected useful life, taking

into consideration the factors discussed above. For example: Suppose a delivery truck costs $10,000 and is expected to

last fve years. Using a straight-line" method of depreciation, $2,000 of the truck's cost is allocated to each year's income

statement. The balance sheet at the end of one year would show:

Truck (cost) $10,000

Less accumulated depreciation 2,000

Net depreciated value $ 8,000

At the end of the second year it would show:

Truck (cost) $10,000

Less accumulated depreciation 4,000

Net depreciated value $ 6,000

In our sample balance sheet, a fgure is shown for accumulated depreciation. This amount is the total of accumulated

depreciation for buildings, machinery, leasehold improvements, and furniture and fxtures. Land is not subject to

depreciation, and its listed value remains unchanged from year to year.

Less accumulated depreciation $125,000

Thus, net property, plant and equipment is the valuation for balance sheet purposes of the investment in property,

plant and equipment. As explained before, it consists of the cost of the various assets in this classifcation, less the

depreciation accumulated to the date of the fnancial statement.

9 Net property, plant, and equipment $260,000

Depletion is a term used primarily by mining and oil companies or any of the so-called extractive industries. Since

Typical Manufacturing is not in the mining business, we do not show depletion on the balance sheet. To deplete means

to exhaust or use up. As the oil or other natural resource is used up or sold, a depletion reserve is set up to compensate

for the natural wealth the company no longer owns.

Intangibles

These may be defned as assets having no physical existence, yet having substantial value to the company.

Examples? A franchise to a cable TV company allowing exclusive service in certain areas, or a patent for exclusive

manufacture of a specifc article. It should be noted, however, that only intangibles purchased from other companies are

shown on the balance sheet.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Another intangible asset sometimes found in corporate balance sheets is goodwill,

which represents the amount by which the price of acquired companies exceeds the related values of net assets

acquired. Company practices vary considerably in assigning value to this asset. Accounting rules now require one frm

that buys another to write off the goodwill over a period not exceeding 40 years.

10

Intangibles (goodwill, patents)less amortization

$2,000

All of these items added together produce the fgure listed on the balance sheet as

total assets.

11 Total assets $662,000

Liabilities

Consolidated Balance Sheet

December 31,19X9 and 19X8 (dollars in thousands)

Liabilities

Current liabilities

12 Accounts payable $60,000 $57,000

13 Notes payable 51,000 61,000

14 Accrued expenses 30,000 36,000

15 Income taxes payable 17,000 15,000

16 Other liabilities 12,000 12,000

17 Total current liabilities $170,000 $181,000

Long-term liabilities

18 Deferred income taxes $16,000 $9,000

19 12.5% Debentures payable 2010 130,000 130,000

20 Other long-term debt 0 6,000

21 Total libilities $316,000 $326,000

Shareholders Equity

22 Preferred staock $5.83 cumulative,

$100 par value authorized, issued and outstanding

60,000 shares $6,000 $6,000

23 Common stock $5.00 par value,

authorized 20,000,000 shares,

19x9 issued 15,000,000 shares,

19x8 14,500,000 shares 75,000 72,500

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

24 Additional paid-in capital 20,000 13,500

25 Retained earnings 249,000 219,600

26 Foreign currency translation adjustments 1,000 (1,000)

27 Less: Treasury stock at cost

(19x9-1,000; 19x8-1,000 shares) 5,000 5,000

28 Total shareholders' equity $346,000 $305,600

29 Total liabilities and shareholders' Equity $662,000 $631,600

Current Liabilities

This item generally includes all debts that fall due within 12 months. The current assets item is a companion to

current liabilities because current assets are the source from which payments are made on current debts. The

relationship between the two is one of the most revealing things to be learned from the balance sheet, and we will go

into that later. For now, we need to defne the subgroups within current liabilities.

Accounts payable

The accounts payable item represents amounts the company owes to its regular business creditors from whom it has

bought goods or services on open account.

12 Accounts payable $ 60,000

Notes payable

If money is owed to a bank, individual, corporation, or other lender, it appears on the balance sheet under notes

payable as evidence that a promissory note has been given by the borrower.

13 Notes payable $ 51,000

Accrued expenses

Now we have defned accounts payable as the amounts owed by the company to its regular business creditors. The

company also owes, on any given day, salaries and wages to its employees, interest on funds borrowed from banks and

from bondholders, fees to attorneys, insurance premiums, pensions, and similar items. To the extent that the amounts

owed and not recorded on the books are unpaid at the date of the balance sheet, these expenses are grouped as a total

under accrued expenses.

14 Accrued expenses $ 30,000

Income tax payable

The debt due to the various taxing authorities such as the Internal Revenue Service is the same as any other liability

under accrued expenses. But because of the amount and the importance of the tax factor, it is generally stated separately

as Income taxes payable.

15 Income taxes payable $17,000

Other Liabilities

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Simply stated, other liabilities includes all liabilities captured in the specifc categories presented.

16 Other liabilities $12,000

Total current liabilities

Finally, the total current liabilities item sums up all of the items listed under this classifcation.

17 Total current liabilities $170,000

Long-term Liabilities

In the matter of current liabilities, you will recall that we included debts due within one year from the balance sheet

date. Here, under the heading of long-term liabilities are listed debts due after one year from the date of the fnancial

report.

Deferred income taxes

One of the long-term liabilities on our sample balance sheet is deferred income taxes. The government provides

businesses with tax incentives to make certain kinds of investments that will beneft the economy as a whole. Current

and long-term debt are summed together to produce the fgure listed on the balance sheet as liabilities. For instance, a

company can take accelerated depreciation deductions for investments in plant and equipment. These rapid write-offs in

the early years of investment reduce what the company would otherwise owe in current taxes, but at some point in the

future the taxes must be paid. Companies include a charge for deferred taxes in their tax calculations on the income

statement and show what taxes would be without the accelerated write-offs. That charge then accumulates as a long-

term liability on the balance sheet.

18 Deferred income taxes $16,000

Debentures

The other long-term liability on our balance sheet is 12.5% debentures due in 2010. The money was received by the

company as a loan from the bond-holders, who in turn were given a certifcate called a bond, as evidence of the loan.

The bond is really a formal promissory note issued by the company, which in this case agreed to repay the debt at

maturity in 2010 and also agreed to pay interest at the rate of 12.5% per year. Bond interest is usually payable semi-

annually. Typical's bond issue is called a debenture because the bonds are backed by the general credit of the

corporation rather than by the company's assets. Debentures are the most common type of bond issued by large, well-

established corporations today.

Companies can also issue frst mortgage bonds, which offer bondholder an added safeguard because they are secured

by a mortgage on all or some of the company's property. First mortgage bonds are considered one of the highest grade

investments because they give investors an undisputed claim on company earnings and the greatest safety. If the

company is unable to pay off the bonds in cash when they are due, holders of frst mortgage bonds have a claim or 1ien

before other creditors (such as debenture holders) on the mortgaged assets, which may be sold and the proceeds used to

satisfy the debt.

19 12.5% Debentures payable 2010 $130,000

Other long-term debt

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Other long-term debt includes all debt other than what is specifcally reported on in the balance sheet. In the case of

Typical, this debt was extinguished in 1989.

20 Other long-term debt 0

Total liabilities

Current and long-term debt are summer together to produce the fgure listed on the balance sheet as total liabilities.

21 Total liabilities $316,000

Shareholders' Equity

This item is the total equity interest that all shareholders have in this corporation. In other words, it is the

corporation's net worth after subtracting all liabilities. This is separated for legal and accounting reasons into the

categories discussed below.

Capital Stock

In the broadest sense this represents shares in the proprietary interest in the company. These shares are represented

by the stock certifcates issued by the corporation to its shareholders. A corporation may issue several different classes

of shares, each class having slightly different attributes.

Preferred Stock

These shares have some preference over other shares with respect to dividends and in distribution of assets in case of

liquidation. Specifc provisions can be obtained from a corporation's charter. In Typical, the preferred stock is a $5.83

cumulative $100 par value, which means that each share is entitled to $5.83 in dividends a year, before any dividends

are paid to the common shareholders. Cumulative means that if in any year the dividend is not paid, it accumulates in

favor of the preferred shareholders and must be paid to them when available and declared before any dividends are

distributed on the common stock. Sometimes preferred shareholders have no voice in company affairs unless the

company falls to pay them dividends at the promised rate.

22

Preferred stock $5.83 cumulative, $100 par value,

authorized issued and outstanding 60,000 shares

6,000

Common Stock

Each year before common shareholders receive any dividends, preferred holders are entitled to $5.83 per share, but no

more. Common stock has no such limit on dividends payable each year. In good times, when earnings are high,

dividends may also be high. And when earnings drop, so may dividends.

23

Common stock $5.00 par value authorized 20,000,000

$75,000

shares, issued 15,000,000 shares

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Additional Paid-in Capital

This is the amount paid in by shareholders over the par or legal value of each share. Typical's common stock has a

par value of $5.00 per share. In 1989, Typical sold 500,000 shares of stock for a total of $9,000. The $9,000 was

allocated on the balance sheet between capital stock and additional paid-in capital. 500,000 shares at a par value of

$5.00 for a total of $2,500 was allocated to common stock. The remaining $6,500 was allocated to additional paid-in

capital.

23

Common stock $5.00 par value authorized 20,000,000

shares issued 15,000,000 shares

$75,000

24 Additional paid-in capital $20,000

Total of capital stock (common) and additional paid-in

capital $95,000

Retained Earnings

When a company frst starts in business, it has no retained earnings. Retained earnings accumulate as the company

earns profts and reinvests or "retains" profts in the company. In other words, retained earnings increase by the amount

of profts earned, less dividends declared to shareholders. At the end of its frst year, if profts are $80,000 and dividends

of $30,000 are paid on the preferred stock but no dividends are declared on the common, the balance sheet will show

retained earnings of $50,000. In the second year, if profts are $140,000 and Typical pays $30,000 in dividends on the

preferred and $40,000 on the common, the accumulated retained earnings will be $120,000:

Balance at the end of the frst year $ 50,000

Net proft for second year 140,000

$190,000

Less: all dividends 70,000

Retained earnings at the end of the second year $120,000

The balance sheet for Typical shows the company has accumulated $249,000 in retained earnings.

25 Retained earnings $249,000

Foreign Currency Translation Adjustments

When a company has an ownership interest in a foreign entity and the entity's results are to be captured in the

company's consolidated fnancial statements, the fnancial statements of the foreign entity must be translated to U.S.

dollars. Generally, the translation gain or loss should be refected as a separate component of shareholders' equity called

foreign currency translation adjustment. This adjustment should be distinguished from adjustments relating to

transactions which are denominated in foreign currencies. The gain or loss in these cases should be included in a

company's net income.

26 Foreign currency translation adjustments $1,000

Treasury stock

When a company reacquires its own stock, it is reported as treasury stock and is deducted from shareholder's equity.

Of the cost and par methods of accounting, the former method is more commonly applied to treasury stock. Under the

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

cost method the cost of reacquired stock is deducted from share holders' equity. Any dividends on shares held in

thetreasury should never be included as income.

27 Treasury Stock $5,000

The sum total of stock (net of treasury stock), additional paid-in capital, retained earnings and foreign currency

translation adjustments, represents the total shareholder's equity.

28 Total shareholders' equity $346,000

Just what does the balance sheet show?

In order to analyze balance sheet fgures, investors look to certain fnancial statement ratios for guidance. One of

their concerns is whether the business will be able to pay its debts when they come due. They are also interested in the

company's inventory turnover and the amount of assets backing corporate securities (bonds, preferred and common

stock), along with the relative mix of these securities. In the following section, we discuss various ratios used for

balance sheet analysis

Net Working Capital

One very important thing to be learned from the balance sheet is net working capital or net current assets, sometimes

called working capital. This is the difference between total current assets and total current liabilities. You will recall

that current liabilities are debts generally due within one year from the date of the balance sheet. The source from

which to pay those debts is current assets. Thus, working capital represents the amount that is left free and clear after all

current debts are paid off. For Typical this is:

6 Current assets $400,000

17 Less: current liabilities 170,000

Working capital $230,000

If you consider yourself a conservative investor, you should invest only in companies that maintain a comfortable

amount of working capital. A company's ability meet obligations, expand volume, and take advantage of opportunities

is often determined by its working capital. Moreover, since you want your company to grow, this year's working capital

should be larger than last year's.

Current Ratio

What is a comfortable amount of working capital? Analysts use several methods to judge whether a company has a

sound working capital position. To help you interpret the current position of a company in which you are considering

investing, the current ratio is more helpful than the dollar total of working capital. The frst rough test for an industrial

company is to compare the current assets fgure with the total current liabilities. A current ratio of 2 to1is generally

considered adequate. This means that for each $1 of current liabilities, there should be $2 in current assets.

To fnd the current ratio, divide current assets by current liabilities. In Typical's balance sheet:

Current assets $400,000

6 = 2.35 or 2.35 to 1

Current liabilities $170,000

Thus, for each $1 of current liabilities, there is $2.35 in current assets to back it up.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

There are so many different kinds of companies, however, that this test requires a great deal of modifcation if it is to

be really helpful in analyzing companies in different industries. Generally, companies that have a small inventory and

easily collectible accounts receivable can operate safely with a lower current ratio than those companies having a greater

proportion of their current assets in inventory and selling their products on credit.

How Quick is Quick?

In addition to net working capital and current ratio, there are other ways of testing the adequacy of the current

position. What are quick assets? They're the assets you have to cover a sudden emergency, assets you could take right

away to the bank, if you had to. They are those current assets that are quickly convertible into cash. This leaves out

merchandise inventories, because such inventories have yet to be sold and are not convertible into cash. Accordingly,

quick assets are current assets minus inventories and prepaid expenses.

6 Current assets $400,000

4 Less: inventories 180,000

5 Less: prepaid expenses 4,000

Quick assets $216,000

Net quick assets are found by taking the quick assets and subtracting the total current liabilities. A well-fxed

industrial company should show a reasonable excess of quick assets over current liabilities. This provides a rigorous and

important test of a company's ability to meet its obligations.

Quick assets $216,000

17 Less: current liabilities 170,000

Net Quick Assets $46,000

The quick assets ratio is found by dividing quick assets by current liabilities.

$216,000 Quick assets

17 = 1.3 or 1.3 to 1

Current liabilities

As you see, for each $1 of current liabilities, there is the same industry. $1.30 in quick assets available.

Debt to Equity

A certain level of debt is acceptable, but too much presents a hazardous signal to investors. The debt-to-equity ratio

is an indicator of whether the company is excessively using debt for fnancing purposes. For Typical, the computed as

follows:

21 $316,000 Total liabilities

= .91

28 $346,000Total Shareholders Equity

A debt-to-equity ratio of .91 means the company is using 91 cents of liabilities for every dollar of shareholders'

equity in the business. Normally, industrial companies maintain a maximum of a 1 to 1 ratio, to keep debt at a level

which is less than the investment level of the owners of the business. Utilities and fnancial companies can operate

safely with much higher ratios.

Inventory Turnover

How big an inventory should a company have? That depends on a combination of many factors. An inventory is large

or small depending upon the type of business and the time of the year. An automobile dealer, for example, with a large

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

stock of autos at the height of the season is in a strong inventory position, yet that same inventory at the end of the

season is a weakness in the dealer's fnancial condition.

One way to measure adequacy and balance of inventory is to compare it with sales for the year to get inventory

turnover. Typical's sales for the year are $765,000, and inventory on the balance sheet date is $180,000. Thus turnover

is 4.25 times (765+180), meaning that goods are bought and sold out more than four times per year on average. (Strict

accounting requires computation of inventory turnover by comparing annual cost of goods sold with average inventory.

This information is not readily available in some published statements, so many analysts look instead for sales related to

inventory.)

Inventory as a percentage of current assets is another comparison that may be made. In Typical, the inventory of

$180,000 represents 45% of the total current assets, which amount to $400,000. But there is considerable variation

between different types of companies, and thus the relationship is signifcant only when comparisons are made between

companies in the same industry.

Book Value of Securities

The balance sheet will reveal net book value (the value on the company's books) or net asset value of the company's

securities. This value represents the amount of corporate assets backing a bond or a common or preferred share. Here's

how we calculate values for Typical's securities.

Net Asset Value Per Bond

To state this fgure conservatively, intangible assets are subtracted as if they have no value on liquidation. Current

liabilities of $170,000 are considered paid. This leaves $490,000 in assets to pay the bondholders. So, $3,769 in net asset

value protects each $1,000 bond.

11 Total assets $662,000

10 Less: intangibles 2,000

Total tangible assets $660,000

17 Less: current liabilities 170,000

$490,000

Net tangible assets available to meet bondholders' claims

$490,000 =$3,769 Net asset value per $1,000 bond

130

bonds oustanding

Net Asset Value Per Share of Preferred Stock

To calculate net asset value of a preferred share, we take total assets, conservatively stated at $660,000 (eliminating

$2,000 of intangible assets). Current liabilities of $170,000 and long-term liabilities are con-sidered paid. This leaves

$344,000 of assets protecting the preferred. So, $5,733 in net asset value backs each share of preferred.

11 Total assets $662,000

10 Less: intangibles 2,000

Total tangible assets $660,000

17 Less: current liabilities $170,000

18,19, & 20 Long-term liabilities 146,000

$344,000

Net assets backing the preferred stock

$344,000,000 = $5,733

Net asset value per share of prefered

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

60,000

Shares of preferred stock oustanding

Net Book Value per Share of Common Stock

The net book value per share of common stock can be looked upon as meaning the amount of money each share

would receive if the company were liquidated, based on balance-sheet values. Of course, the preferential shareholders

would have to be satisfed frst. The answer, $22.54 net book value per share of common stock, is arrived at as follows:

11 Total assets $662,000

10 Less: intangibles 2,000

Total tangible assets $660,000

17 Less: current liabilities $170,000

18,19, & 20 Long-term liabilities 146,000

22 Preferred stock 6,000

$322,000

$338,000

Net assets available for the common stock

$338,000,000 = $22.54

Net asset value per share of common stock

14,999,000

shares of common

stock outstanding

An alternative method of arriving at the common shareholders' equity-- conservatively stated at $338,000 - is:

23 Common stock $ 75,000

24 Additional paid-in capital 20,000

25 Retained earnings 249,000

26 1,000

Foreign currency translation adjustments

27 Treasury stock (5,000)

$340,000

10 Less: intangible assets (2,000)

Total common shareholders' equity $338,000

$338,000,000 = $22.54

Net book value per share of common stock

14,999,000

shares of preferred

stock oustanding

Do not be misled by book value fgures, particularly of common stocks. Proftable companies often show a very low

net book value and very sub- stantial earnings. Railroads, on the other hand, may show a high book value for their

common stock but have such low or irregular earnings that the stock's market price is much less than its book value.

Insurance companies, banks, and investment companies are exceptions. Because their assets are largely liquid (cash,

accounts receivable, and marketable securities), the book value of their common stock is sometimes a fair indication of

market value.

Capitalization Ratio

The proportion of each kind of security issued by a company is the capitalization ratio. A high propor-tion of bonds

sometimes reduces the attractiveness of both the preferred and common stock, and too much preferred can detract from

the common's value. That's because bond interest must be paid before preferred dividends, and preferred dividends

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

before common dividends.

To get Typical's bond ratio divide the face value of the bonds, $130,000, by the total value of bonds, preferred and

common stock, additional paid-in capital, retained earnings, foreign currency translation ad-justments and treasury

stock, less intangibles, which is $474,000. This shows that bonds amount to about 27% of Typical's total capitalization.

19 Debentures $130,000

22 Preferred stock 6,000

23 Common stock 75,000

24 Additional paid-in capital 20,000

25 Retained earnings 249,000

26 Foreign currency translation adjustments 1,000

27 Treasury stock (5,000)

10 Less: intangibles (2,000)

Total capitalization $474,000

The preferred stock ratio is found the same way-divide preferred stock of $6,000 by the entire capitali-zation of

$474,000. The result Is about 1 %. The common stock ratio will be the difference be-tween 1 00% and the total of the

bond and preferred stock ratio-or about 72%. The same result is reached by combining common stock, additional paid-

in capital, retained earnings, foreign currency translation adjustments, and treasury stock.

Amount

Ratio

19 Debentures 27%

$130,000

22 Preferred stock 6,000 1%

10 Common stock

&

23- (including additional paid-in capital, related earnings, and foreign

27 currency translation adjustments less: treasury stock and

intangibles) 338,000 72%

Total $474,000 100%

The Income Statement

(dollars in thousands except per-share amounts)

Now, we come to the payoff for many potential investors. the income statement. It shows how much the corporation

earned or lost during the year. It appears earlier in this page (Go there now). While the balance sheet shows the

fundamental soundness of a company by refecting its fnancial position at a given date, the income statement may be of

greater interest to investors because it shows the record of its operating activities for the whole year. It serves as a

valuable guide in anticipating how the company may do in the future. The fgure given for a single year is not nearly the

whole story. The historical record for a series of years is more important than the fgure of any single year. Typical

includes two years in its statement and gives a ten-year fnancial summary as well, which appears further down this page

(Go there now).

An income statement matches the amounts received from selling goods and services and other items of income

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

against all the costs and outlays incurred in order to operate the company. The result is a net income or a net loss for the

year. The costs incurred usually consist of cost of sales; overhead expenses such as wages and salaries, rent, supplies,

depreciation; interest on money borrowed; and taxes.

Net Sales

The most important source of revenue always makes up the frst item on the income statement. In Typical

Manufacturing, it is net sales. It represents the primary source of money received by the company from its customers

for goods sold or services rendered. The net sales item covers the amount received after taking into consideration

returned goods and allowances for reduction of prices. By comparing 19X9 and 19X8, we can see if Typical had a better

year in 19X9, or a worse one.

30 Net Sales $765,000 $725,000

Cost of Sales

In a manufacturing establishment, this represents all the costs incurred in the factory in order to convert raw materials

into fnished products. These costs are commonly known as product costs. Product costs are those costs which can be

identifed with the purchase or manufacture of goods made available for sale. There are three basic components of

product cost: direct materials; direct labor; and manufacturing overhead. Direct materials and direct labor costs can be

directly traced to the fnished product. For example, for a furniture manufacturer, lumber would be a direct material cost

and carpenter wages would be a direct labor cost. Manufacturing overhead costs, while associated with the

manufacturing process, cannot be traceable to the fnished p roduct. Examples of manufacturing overhead costs are costs

associated with operating the factory plant (plant depreciation, rent, electricity, supplies, maintenance and repairs, and

production foremen salaries).

31 Cost of sales $535,000

Gross Margin

Gross Margin is the excess of sales over cost of sales, It represents the residual proft from sales after consid-ering

product costs.

32 Gross margin $230,000

Depreciation and Amortization

Each year's decline in value of non-manufacturing facilities would be captured here. Amortization is the decline in

useful value of an intangible, such as a 17-year patent.

33 Depreciation and amortization $28,000

Selling, General, and Administrative Expenses

These expenses are generally grouped separately from cost of sales so that the reader of an income statement may see

the extent of selling and adminis-trative.co.sts. They include salesmen's salaries and commissions, advertising and

promotion, travel and entertainment, executives' salaries, offce payroll and offce expenses.

34 Selling, general and administrative expenses $96,804

Subtracting all operating expenses from the net sales fgure gives us the operating income.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

35 Operating income $105,196

An additional source of revenue comes from dividends and interest received by the company from its investment in

stocks and bonds. This is listed separately under an item called other income (expense).

36 Dividends and interest income $5,250

Interest Expense

The interest paid to bondholders for the use of their money is sometimes referred to as a fxed charge because the

interest must be paid year after year whether the company is making money or losing money. Interest differs from

dividends on stocks, which are payable only if the board of directors declares them.

Interest paid is another cost of doing business and is deductible from earnings in order to arrive at a base for the

payment of income taxes.

Typical Manufacturing's debentures, carried on the balance sheet as a long-term liability, bear 12.5% in-terest per

year on $130,000. Thus, the interest expense in the income statement Is equal to $16,250 per year. It shows up under

other income (expense).

37 Interest expense $16,250

Income Taxes

Each corporation has a bas' tax rate, which depends 'II 31c on the level and nature of its income. Large corporations

like Typical Manufacturing are subject to the top corpo-rate income tax rate, but tax credits tend to lower the overall tax

rate. Typical's income before taxes is $94,196; the tax comes to $41,446.

38 Income before provision for income taxes $94,196

39 Provision for income taxes 41,446

Income Before Extraordinary Loss

After we have taken into consideration all ordinary income (the plus factors) and deducted all ordinary costs (the

minus factors), we arrive at income before extraordinary loss for the year.

40 Income before extraordinary loss $52,750

Extraordinary Loss

Under ordinary conditions, the above income of $52,750 would be the end of the story. However, there are years in

which companies experience unusual and infrequent events called extraordinary items. Examples of extraordinary items

include debt extinguishments, tax loss carry forwards, pension plan terminations, and litigation settlements. In this case,

Typical extinguished a portion of its debt early. This event's isolated on a separate line, net of its tax effect. Its earnings-

per-share impact is also segregated from the earnings per share attribut-able to"normal" operations.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

41

Loss on early extinguishment of debt (net of tax

($5,000)

beneft of $750)

Net Income

Once all income and costs, including extraordinary items, are considered, we arrive at net income.

42 Net income $47,750

Condensed, the income statement looks like this:

Plus factors:

30 Net sales $765,000

36 Dividends and Interest 5,250

Total $770,250

Minus factors:

31 Cost of sales $535,000

33-34 Operating expenses 124,804

37 Interest expense 16,250

39 Provision for income taxes 41,446

Total $717,500

40 $ 52,750

Net income before extraordinary loss

41 Extraordinary loss (5,000)

42 Net income $ 47,750

Other Items

Two other items that do not apply to Typical could appear on an income statement. First, U.S. companies that do

business overseas may have transaction gains or losses related to fuctuations in foreign currency exchange rates.

Second, if a corporation owns more than 20% but less than 51 % of the stock of a subsidiary company, the

corporation must show its share of the subsidiary's earnings-minus any dividends received from the subsidiary on its

income statement. For example, if the corporation's share of the subsidiary's earnings is $1,200 and the corporation

received $700 in dividends from the company, the corporation must include $500 on its income statement under the

category equity in the eamings of unconsolidated subsidiaries. The corporation must also increase its investment in the

company to the extent of the earnings it picks up on its income statement.

Analyzing the Income Statement

The income statement will tell us a lot more if we make a few detailed comparisons. Before you invest in a company,

you want to know its operating margin of proft and how it has changed over the years. Typical had sales of

$765,000,000 in 19X9 and showed $105,196,000 as the operating income.

35 $105,196 operating income

= 13.8%

30 $765,000 sales

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

This means that for each dollar of sales $0.1380 remained as a gross proft from operations. This fgure is interesting

but is more signifcant if we compare it with the proft margin last year.

35 $ 73,500 operating income

= 10.1%

30 $725,000 sales

Typical's proft margin went from 10.1 % to 13.8%, so business didn't just grow, it became more proftable. Changes

in proft margin can refect changes in effciency, product line, or types of customers served.

We can also compare Typical with other companies in its feld. If our company's proft margin is very low compared

to others, it, is an unhealthy sign. If it is high, there are grounds for optimism.

Analysts also frequently use operating cost ratio for the same purpose. Operating cost ratio is the complement of the

margin of proft. Typical's proft margin is 13.8%. The operating cost ratio is 86.2%. -

Amount Ratio

30 Net Sales $765,000 100.0%

31,33,34 Operating Cost 659,804 86.2%

35 Operating Income $105,196 13.8%

Net proft ratio is still another guide to indicate how satisfactory the year's activities have been. In Typical

Manufacturing, the year's net income was $47,750. The net sales for the year amounted to $765,000. Therefore,

Typical's income was $47,750 on $765,000 of sales or:

42 $47,750 net income

= 6.2%

30 $765,000 sales

This means that this year for every $1 of goods sold, 6.20 in proft ultimately went to the company. By comparing the

net proft ratio from year to year for the same company and with other companies, we can best judge proft progress.

Last year, Typical's net income was $40,500 on $725,000 in sales:

42 $40,500 net income

= 5.6%

30 $725,000 sales

We can compare the U.S. Department of Commerce's latest available average proft margins for all U.S. manufacturers

to the proft margins calculated from Typical's 10-year summary further down the pag. (Go there now).

The margin of proft ratio, operating cost ratio, and net proft ratio, like all those we examined in connection with the

balance sheet, give us general information about the company and help us 'udge its prospects for the future. All these

comparisons have signifcance for

Proft Margins (After Tax)

19X3 19X4 19X5 19X6 19X7

Average of U.S. Manufacturers 4.1 4.6 3.8 3.8 4.9

Typical 6.1 5.3 5.0 5.1 5.5

the long term, because they tell us about the fundamental economic condition of the company. One question remains:

are the securities a good investment for you now? For an answer, we must look at some additional factors.

Interest Coverage

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

The bonds of Typical Manufacturing represent a very substantial debt, but they are due many years in the future. The

yearly interest, however, is a fxed charge, and we want to know how readily the company can pay the interest. More

specifcally, we would like to know whether the borrowed funds have been put to good use so that the earnings are

ample and thus available to meet interest costs.

The available income representing the source for payment of the bond interest is $110,446 (operating proft plus

dividends and interest). The annual bond interest amounts to $16,250. This means the annual interest expense is covered

6.8 times.

$110,446 available income

37 = 6.8%

$16,250 interest on bonds

Before an industrial bond can be considered a safe investment, most analysts say that the company should earn its

bond interest requirement three to four times over. By these standards, Typical Manufacturing has a fair margin of

safety.

What About Leverage?

A stock is said to have high leverage if the company that issued it has a large proportion of bonds and preferred stock

outstanding in relation to the amount of common stock. A simple illustration will show why. Let's take, for example, a

company with $10,000,000 of 4% bonds outstanding. If the company is earning $440,000 before bond interest, there

will only be $40,000 left for the common stock after payment of $400,000 bond interest ($10,000,000 at 4% equals

$400,000). However, an increase of only 10% in earnings (to $484,000) will leave $84,000 for common stock dividends,

or an increase of more than 100%. If there is only a small amount of common stock issued, the increase in earnings per

share will appear very impressive.

You have probably realized that a decline of 10% in earnings would not only wipe out everything available for the

common stock, but also result in the company's being unable to cover its full interest on its bonds without dipping into

accumulated earnings. This is the great danger of so-called high-leverage stocks and also illustrates the fundamental

weakness of companies that have a disproportionate amount of debt or preferred stock. Conservative investors usually

steer clear of them, although these stocks do appeal to people who are willing to assume the risk.

Typical Manufacturing, on the other hand, is not a highly leveraged company. Last year, Typical paid $16,250 in

bond interest and its net proft --before this payment -- came to $56,750. This left $40,500 for the common stock and

retained earnings. Now look what happened this year, Net proft before subtracting bond interest rose by $7,250, or

about 13%. Since the bond interest stayed the same, net income after paying this interest also rose $7,250, But that is

about 18% of $40,500. While this is certainly not a spectacular example of leverage, 18% is better than 13%.

Preferred Dividend Coverage

To calculate the preferred dividend coverage (the number of times preferred dividends were earned), we must use net

proft as our base, because federal, income taxes and all interest charges must be paid before anything is available for

shareholders. Because we have 60,000 shares of $100 par value preferred stock that pays a dividend of $5.83 1/3, the

total dividend requirement for the preferred stock is $350,000. Dividing the net income of $47,750,000 by this fgure we

arrive at approximately 136.4, which means that the dividend requirement of the preferred stock has been earned more

than 136 times over. This ratio is so high partly because Typical has only a small amount of preferred stock outstanding.

Earnings Per Common Share

The buyer of common stock is often more concerned with the earnings per share of a stock than with the dividend.

This is because earnings per share usually infuence stock market prices. Although our income statement separates

earnings per share before and after the effect of the extraordinary item, the remainder of our presentation will only

consider earnings per share after the extraordinary item. In Typical's case the income statement shows earnings available

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

for common stock.

46 Earnings per share $3.16

But if it didn't, we could calculate it ourselves:

42 Net proft for the year $47,750

Less: dividend requirements on preferred stock 350

Earnings available for the common stock $47,400

$47,400,000 earnings available after preferred dividends = $3.16 earnings per

14,999,000 number of outstanding common shares share of common

Typical's capital structure is a very simple one, comprised of common and preferred stock. It's earnings-per-share

computation will suffce under this scenario. However, if the capital structure is more complex and contains securities

which are convertible into common stock, options, warrants or contingently issuable shares, the calculation requires

modifcation. In fact, separate calculations must be performed. This is called dual presentation. The calculations are

primary and fully diluted earnings per common share.

Primary Earnings Per Common Share

This is determined by dividing the earnings for the year not only by the number of shares of common stock

outstanding but by the common stock plus common stock equivalents if dilutive.

Common stock equivalents are securities, such as convertible preferred stock, convertible bonds, stock options,

warrants and the like, that enable the holder to become a common shareholder by exchanging or converting the security.

These are deemed to be only one step short of common stock -- their value stems in large part from the value of the

common to which they relate.

Convertible preferred stock and convertible bonds offer the holder either a specifed dividend rate or interest return, or

the option of participating in increased earnings on the common stock, through conversion. They don't have to be

actually converted to common stock for these securities to be called a common stock equivalent. This is because they

are in substance equivalent to common shares, enabling the holder at his discretion to cause an increase in the number of

common shares by exchanging or converting. How do accountants determine a common stock equivalent? A convertible

security is considered a common stock equivalent if its effective yield at the date of its issuance is less than two-thirds

of the then-current average Aa corporate bond yield.

Now, let's put our new terms to work in an example, remembering that it has nothing to do with our own company,

Typical Manufacturing. We start with the facts we have available. We'll say we have 100,000 shares of common stock

outstanding plus another 100,000 shares of preferred stock, convertible into common on a share-for-share basis.

(Assume they qualify as common stock equivalents.) We add the two and get 200,000 shares altogether. Now let's say

our earnings fgure is $500,000 for the year. With these facts, our primary computation is easy:

$500,000 earnings for the year = $2.50 primary

200,000 adjusted shares outstanding earnings per share

However, as mentioned earlier, the common stock equivalent shares are only included in the computation if the

effect of conversion on earnings per share is dilutive. Dilution occurs when earnings per share decrease or loss per share

increases. For example, assume the preferred stock paid $3 a share in dividends. Without conversion, the earnings per

share would be $2, as opposed to $2.50 per share, because net income available for common after payment of dividends

would be $200,000 ($500,000 less $300,000) divided by the 100,000 common shares outstanding. In this case, the

common stock equivalent shares would be excluded from the computation because conversion results in a higher

earnings per share (anti-dilutive). Therefore, earnings per share of $2 will be refected on the income statement.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

Fully Diluted Earnings Per Common Share

The primary earnings per share item, as we have just seen in the preceding section, takes into consideration common

stock and common stock equivalents. The purpose of fully diluted earnings per share is to refect maximum potential

dilution in earnings that would result if all contingent issuances of common stock had taken place at the beginning of

the year.

This computation is the result of dividing the earnings for the year by: common stock and common stock equivalents

and all other securities that are convertible (even though they do not qualify as common stock equivalents).

How would it work? First, remember that we have 100,000 shares of convertible preferred outstanding, as well as our

100,000 in common. Now, let's say we also have convertible bonds with a par value of $10,000,000 outstanding. These

bonds pay 6% interest and have a conversion ratio of 20 shares of common for every $1,000 bond. Assume the current

average Aa corporate bond yield is 8%. These bonds are not common stock equivalents, because 6% is not less than

two-thirds of 8%. However, for fully diluted earnings per share we have to count them in. If the 10,000 bonds were

converted, we'd have another 200,000 shares of stock, so adding everything up gives us 400,000 shares. But by

converting the bonds, we could skip the 6% interest payment, which gains us another $600,000 gross earnings. So our

calculation looks like this:

Earnings for the year $500,000

Interest on the bonds $600,000

Less: the income tax 300,000

applicable to deduction

300,000

Adjusted earnings $800,000

$800,000 adjusted earnings = $2 fully diluted

400,000 adjusted shares outstanding earnings per share

The only remaining step is to test for dilution. Earnings per share without bond conversion would be $2.50 ($500,000

divided by 200,000 shares). Since earnings per share of $2 is less than $2.50 we would assume debt conversion in our

calculation of fully diluted earnings per share.

Price-Earnings Ratio

Both the price and the return on common stock vary with a multitude of factors, One such factor is the relationship

that exists between the earnings per share and the market price. It is called the price-eamings ratio, and this is how it is

calculated: If a stock is selling at 25 and earning $2 per share, its price-earnings ratio is 12 1/2 to 1, usually shortened to

12 1/2 and the stock is said to be selling at 12 1/2 times earnings. If the stock should rise to 40, the price-earnings ratio

would be 20. Or, if the stock drops to 12, the price-earnings ratio would be 6.

In Typical Manufacturing, which has no convertible common stock equivalents, the earnings per share were

calculated at $3.16. If the stock were selling at 33, the price-earnings ratio would be 10.4. This is the basic fgure that

you should use in viewing the record of this stock over a period of years and in comparing the common stock of this

company with other similar stocks.

$33 market price = 10.4 : 1 or

26

$3.16 earnings per share 10.4 times

This means that Typical Manufacturing common stock is selling at approximately 10.4 times earnings.

Last year, Typical earned $2.77 per share. Let's say that its stock sold at the same price-earnings ratio then. This

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

means that a share of Typical was selling for $28.80 or so, and anyone who bought Typical then would be satisfed now.

Just remember, in the real world, investors can never be certain that any stock will keep its same price-earnings ratio

from year to year. The historical P/E multiple is a guide, not a guarantee.

In general, a high P/E multiple, when compared with other companies in the same industry, means that investors have

confdence in the company's ability to produce higher profts in the future.

Statement of Changes in Shareholders' Equity

(dollars in thousands except per-share amounts)

This statement analyzes the changes from year to year in each shareholder's equity account. From this statement, we

can see that during the year additional common stock was issued at a price above par. We can also see that Typical

experienced a translation gain. The rest of the components of equity, with the exception of retained earnings which we

discuss below, remained the same.

Just as the income statement refects the payoff for shareholders, retained earnings refects the payoff for the

company itself . It shows how much money the company has plowed back into itself for new growth. The Statement of

Changes shows that retained earn-ings increase by net income less dividends on pre-ferred and common stock. Since we

have already analyzed net income, we will now analyze dividends.

Dividends

Dividends on common stock vary with the proftability of the company. Common shareholders were paid $18,000 in

dividends this year. Since we know from the balance sheet that Typical has 14,999,000 shares outstanding, the frst

thing we can learn here is what may be the most important point to some potential investors - dividends per share.

$18,000,000 common stock dividends = $1.20 per

14,999,000 shares share

Once we know the amount of dividends per share, we can easi ly discover the dividend payout ratio. This is Simply

the percentage of net earnings per share that is paid to shareholders.

$1.20 dividend per common share

46 = 38%

$3.16 earnings per common share

Of course, the dividends on the $5.83 preferred stock will not change from year to year, The word cumulative in the

balance statement description tells us that if Typical's management someday didn't pay a dividend on its preferred stock,

then the $5.83 payment for that year would accumulate. It would have to be paid to preferred shareholders before any

dividends could ever be declared again on the common stock.

That's why preferred stock is called preferred. It gets at any dividend money frst. We've already talked about

convertible bonds and convertible preferred stock. Right now, we're not interested in that aspect because Typical

Manufacturing doesn't have any convertible securities outstanding. Chances are its 60,000 shares of preferred stock,

with a par value of $100 each, were issued to family members of Mr. Isaiah Typical, who founded the company back in

1923. When he took Typical public, he didn't keep any of the common stock. In those days, the guaranteed $5.83

dividend was more important to Isaiah, He was not interested in taking any more chances on Typical.

During the year, Typical has added $29,400 to its retained earnings. Even if Typical has some lean years in the future,

it has plenty of retained earnings from which to keep on declaring those $5.83 dividends on the preferred stock and

$1.20 dividends on the com-mon stock.

fle:///C|/Users/meezon1/Desktop/mirrors.htm[ ﻡ03:19:23 01/04/2011]

How to Read Financial Statements

There is one danger in having a lot of retained earnings. It could attract another company -- Shark Fast Foods &

Electronics, for instance -- to buy up Typical's common stock to gain enough control to vote out the current

management. Then Shark might merge Typical into itself. Where would Shark get the money to buy Typical stock? By

issuing new shares of its own stock, perhaps. And where would Shark get the money to pay the dividends on all that

new stock of its own? From Typical's retained earnings. So Typical's management has the obligation to its shareholders

to make sure that its retained earnings are put to work to increase the total earnings per share of the shareholders. Or

else, the shareholders might cooperate with Shark if and when it makes a raid.

25 Retained earnings $249,000

Return on Equity

Seeing how hard money works, of course, is one of the most popular measures that investors use to come up with

individual judgments on how much they think a certain stock ought to be worth. The market itself-- the sum of all

buyers and sellers-- makes the real decision. But the investors often try to make their own, in order to decide whether

they want to invest at the market's price or wait. Most investors look for Typical's return on equity, which shows how

hard shareholders' equity in Typical is working. In order to fnd Typical's current return on equity, we look at the

balance sheet and take the common shareholders'equity for last year--not the current year--and then we see how much

Typical made this year on it. We use only the amount of net proft after the dividends have been paid on the preferred

stock. For Typical Manufacturing, that means $47,750 net proft minus $350. Here is what we get:

$47,750 net income - $350 preferred stock dividend $305,600 last

year's stockholders' equity- $6,000 preferred stock value

$47,000 = 15.8% Return on equity

$299,600

For every dollar of shareholders' equity, Typical made more than $0.15. Is that good? Well, $0.158 on the dollar is

better than Typical could have done by going out of business, taking its shareholders' equity and putting that $299,600 in

the bank. So Typical obviously is better off in its own line of work. When we consider putting our money to work in

Typical's stock, we should compare Typical's $0.158 not only to whatever Typical's business competitors make, but to

Typical's investment competitors for our money.For instance, the latest available average rate for all U.S. industry,

according to the U.S. Federal Trade Commission, was $0.16.