Академический Документы

Профессиональный Документы

Культура Документы

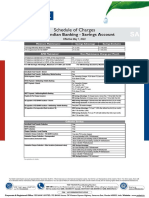

Schedule of Charges

Загружено:

Himesh ShahАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Schedule of Charges

Загружено:

Himesh ShahАвторское право:

Доступные форматы

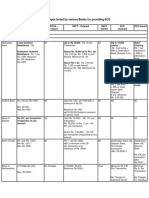

ROAMING CURRENT ACCOUNT SCHEDULE OF CHARGES w.e.

f Feb 1, 2017

Glossary of Terms

MAB Monthly Average Balance (MAB) calculated as average of daily closing positive balances of each day spread over a

period of the month

NMMAB Non-maintenance of Monthly Average Balances

Base Location Base Location refers to the all the Branches belonging to the same clearing zone in which the account is opened

Non-Cash Non Cash Transactions Collections include - Local Cheque collection Non base & Upcountry Cheque Collections. Non

Transactions Cash Transaction Payments include -Demand Drafts, Pay Order & Multicity Cheque payments,

All Cash transactions of Rs 10 Lacs & above on a single day would require prior intimation & approval of the Branch at least one

working day in advance

Variant Standard Classic Premium Gold Gold Plus Platinum Elite

MAB Requirement (Rs.) 10,000 25,000 50,000 100,000 300,000 500,000 1,000,000

2,500 if MAB

5,000 if MAB >=

>= 50% &

NMMAB Charges (Rs.) 750 1,000 1,500 2,000 3,000 50% & 10,000 if

5,000 if MAB

MAB <50%

<50%

Free Limits

Variant Standard Classic Premium Gold Gold Plus Platinum Elite

Cash Deposit Base

100,000 250,000 500,000 1,000,000 3,000,000 5,000,000 10,000,000

location (Rs.)

Cash Deposit Non base

NIL NIL NIL 100,000 300,000 500,000 1,000,000

location (Rs.)

No cash deposit free limit if MAB maintained is less than:

i) 50% of MAB required for Gold, Gold Plus, Platnium & Elite

ii)80% of MAB required for Standard, Classic & Premium

Non Cash Transaction-

Free Free Free Free Free Free Free

Collections (Rs.)

Non Cash Transaction-

1,000,000 2,500,000 Free Free Free Free Free

Payments (Rs.)

Cheque Leaves per

25 50 100 200 600 1,000 2,000

month (nos.)

Total Transactions

20 50 100 200 600 1,000 2,000

(nos.)

Cash Withdrawal Base Unlimited free on Value for self ;

Branch (Rs.) Maximum Rs 50,000 per transaction for 3rd party payment

Cash Withdrawal Non

Rs.50,000 Free per day. Allowed only for self-cheques

Base Branch (Rs.)

RTGS Payment (Rs.)

Transaction amount between Rs. 2 lakh to Rs. 5 lakh - Rs. 25 per transaction

(applicable only for

Transaction amount > Rs. 5 lakh - Rs. 50 per transaction

Standard,Classic and

No charges for RTGS payments done using Internet Banking / Mobile Banking

Premium)

NEFT payment (Rs.)

Transaction amount upto 10,000 - Rs. 2.50 per transaction; Rs10,001 to Rs.1 lakh - Rs. 5 per transaction; Rs 1

(applicable only for

lakh to Rs. 2 lakhs - Rs. 15 per transaction; Above Rs 2 lakhs - Rs. 25 per transaction

Standard,Classic and

No charges for NEFT payments done using Internet Banking / Mobile Banking

Premium)

Transaction up to 10,000: 3.50 per transaction; 10,001 to 1 lakh: 5 per transaction; 1 lakh to 2 lakh: 15 per

IMPS payment

transaction.

Charges Beyond Free Limits

Service Charges beyond Free Limits Minimum Charge

(Rs.)

Cash Deposit-Base location Rs 3 per Rs 1,000. 50

Rs 3 per Rs 1,000 plus anywhere cash deposit charge of Rs 5

Cash Deposit-Non-Base location per Rs 1,000. 100

Cash Withdrawal – Non-Base Rs.2 per 1000 50

Non Cash Transaction -Payments Rs.0.50 per 1000 ; Minimum Rs 50 per Transaction & 50

Maximum Rs 500 per Transaction

Cheque Leaves Rs.2 per leaf

Transaction Charges Rs. 50 per cash deposit transaction & Rs 25 for others

Other transaction includes all cash withdrawal & clearing transactions except 1.

Payments / collections through RTGS & NEFT, 2. Upcountry Cheque Collection 3.

Transactions done through Internet / Phone / Mobile / ATM

Penal charges for accounts not maintaining Rs 25 per transaction from first transaction for Standard & Classic Variants and Rs 10

MAB (not applicable on cash deposit per transaction from first transaction for Premium, Gold, Gold Plus, Platinum & Elite

transaction) variants.

Transaction includes all cash withdrawal & clearing transactions except payments /

collections through RTGS & NEFT, Upcountry Cheque Collection and transactions done

through Internet / Phone / Mobile / ATM

Bulk Cash Volume Charges Rs 3 per 1000 beyond 5 times free limit on base cash deposit

Free Services

Service Charges

RTGS Collections and NEFT Collections

Local Cheque Collection at base branch, Local Cheque Payments, Fund Transfers

(Transaction charges applicable beyond free transaction limits)0

Product type change to any ICICI Bank Current Account product FREE

Transactions done through Internet / Phone / Mobile Banking / Email & ICICI Bank ATM (except NEFT and

RTGS transactions for Standard and Classic)

Other Charges

Debit Card Related

Free-Platinum &

Debit Card Charges Per annum Elite;Rs.250 for

other Variants

De hotlisting of Debit Card Free

ATM Transactions at other bank ATM (India) Balance Inquiry Rs 8.5

Withdrawal (per transaction) Rs.20

ATM Transactions at other bank ATM (Outside India ) Withdrawal (per transaction) Rs.125

Replacement of lost / stolen debit card, Replacement of PIN Per instance Rs. 200

Other Common Charges

Account Closure Charges: If closed within 14 days Nil

Standard, Classic & Premium If closed beyond 14 days but within 6 months Rs.500

If closed beyond 6 months Rs. 200

If closed within 14 days Nil

Account Closure Charges: If closed beyond 14 days but within 6 months Rs.1000

Gold, Gold Plus, Platinum & Elite If closed beyond 6 months Rs. 500

Mobile Alerts - Standard, Classic and Premium Per month Rs.25

Mobile Alerts - Gold, Gold Plus, Platinum & Elite Per month Free

Monthly Account Statement Per month Free

Account Statement through Fax: Per page Rs 5

(Daily / Weekly / Fortnightly / Monthly) Minimum per month Rs 200

Interest Certificate Per certificate Free

Cheque Return - Issued by customer For first 2 instruments of the month – Rs. 500 per instrument

(Including Fund Transfers) From 3rd instrument onwards of the month – Rs.750 per instrument

Cheque Return - Deposited by Customer Per instrument Rs 100

ECS Debit Return Per Instrument Rs. 350

Speed Clearing charges Per Instrument of value above Rs. 100,000/- Rs. 150

Branch Based transactions:

Including Stop Payment, Standing Instruction, DD Per instance Rs.100

Cancellation, DD Duplicate, DD revalidation, Duplicate

Statement, Bankers' Report, Certificate of Balance for

Previous Year, Old Record Retrieval, Signature Verification

Phone Banking transactions:

For transactions available on IVR, if done through Phone

Banking Officer Free

For any services or charges not covered under this brochure, please contact any of our branches or write to

corporatecare@icicibank.com

The service charges are subject to change without any prior intimation to customer. However, the prevailing charges would be hosted

on www.icicibank.com. Charge cycle period shall be from 1st to 31st of the month.

For Domestic General Banking Transactions the pricing for Trade RCA variants would be as per the following mapping:

TRCA USD 25K - RCA Premium, TRCA USD 75K - RCA Gold, TRCA USD 300K - RCA Platinum, TRCA USD 600K – RCA Elite, TRCA

1500K – RCA Elite.

All charges are exclusive of GST as applicable from time to time

For details Terms and Conditions please refer to www.icicibank.com

Вам также может понравиться

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsОт EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsОценок пока нет

- Glossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteДокумент4 страницыGlossary of Terms: Variant Standard Classic Premium Gold Gold Plus Platinum EliteAlka RanjanОценок пока нет

- One Globe Trade AccountДокумент5 страницOne Globe Trade AccountKhushi VarshneyОценок пока нет

- Comparison of Standard Chartered Bank With Citibank and HSBCДокумент5 страницComparison of Standard Chartered Bank With Citibank and HSBCarpit_tОценок пока нет

- New Dgtca SocДокумент2 страницыNew Dgtca SocchintankantariaОценок пока нет

- Casil Soc 01 07 23Документ2 страницыCasil Soc 01 07 23rishisiliveri95Оценок пока нет

- Shubhaarambh SocДокумент2 страницыShubhaarambh SocCrAzY PuLkiTОценок пока нет

- New StartupДокумент2 страницыNew StartupAmey ChavanОценок пока нет

- New Start Up Account SocДокумент1 страницаNew Start Up Account SocMoorthi VОценок пока нет

- Rca SocДокумент3 страницыRca SocKrishna Kiran VyasОценок пока нет

- Sba 2 0 Ivy PDFДокумент2 страницыSba 2 0 Ivy PDFChandan SahОценок пока нет

- Service Charges and Fees-Federal BankДокумент10 страницService Charges and Fees-Federal Bankakhil kurianОценок пока нет

- Shubhaarambh Soc PDFДокумент1 страницаShubhaarambh Soc PDFSanjayОценок пока нет

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Документ4 страницыSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPОценок пока нет

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFДокумент2 страницыSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaОценок пока нет

- Service Charges and FeesДокумент12 страницService Charges and FeestirОценок пока нет

- Service Charges Wef 01-Oct-2023Документ11 страницService Charges Wef 01-Oct-2023Loona KKОценок пока нет

- Service Charges and Fees (With Effect From 01st April 2024)Документ12 страницService Charges and Fees (With Effect From 01st April 2024)kbrc0405Оценок пока нет

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Документ2 страницыMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedОценок пока нет

- ICICI Bank Current Account ChargesДокумент3 страницыICICI Bank Current Account Chargesashishtiwari92100% (1)

- 811 - Kotak Mahindra BankДокумент5 страниц811 - Kotak Mahindra BankVivek EadaraОценок пока нет

- Federal Bank Service ChargesДокумент11 страницFederal Bank Service ChargesAlbin GeorgeОценок пока нет

- Sbprime - Bde'sДокумент16 страницSbprime - Bde'sParteek JangraОценок пока нет

- Service Charges and FeeДокумент10 страницService Charges and FeeShanОценок пока нет

- Service Charges and Fees 01-10-2020Документ10 страницService Charges and Fees 01-10-2020mshafeeqksОценок пока нет

- Schedule of Charges Edge Business 1st Feb 20 PDFДокумент2 страницыSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaОценок пока нет

- CABCA - SOC - July 22Документ2 страницыCABCA - SOC - July 22anjumОценок пока нет

- Service Charges and FeesДокумент10 страницService Charges and FeesAkhil MohanОценок пока нет

- Nri Schedule of ChargesДокумент4 страницыNri Schedule of ChargesRishiОценок пока нет

- Service Charges 01st OCT 2022Документ11 страницService Charges 01st OCT 2022SpeakupОценок пока нет

- Broking Idirect Linked Savings AccountДокумент7 страницBroking Idirect Linked Savings Accounttrue chartОценок пока нет

- Service Charges and Fees Wef 01st Oct 2022Документ12 страницService Charges and Fees Wef 01st Oct 2022ranjith ananthОценок пока нет

- Business Essential AccountДокумент4 страницыBusiness Essential Accountshekharsap284Оценок пока нет

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Документ2 страницыService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03Оценок пока нет

- Digital Savings Account Effective July 2021Документ3 страницыDigital Savings Account Effective July 2021Nikhil KumarОценок пока нет

- Schedule of Service Charges and Fees: Name of The Bank Allahabad BankДокумент5 страницSchedule of Service Charges and Fees: Name of The Bank Allahabad BankmodijiОценок пока нет

- Gib Savings Account Wef 01may2022Документ3 страницыGib Savings Account Wef 01may2022Ankur VermaОценок пока нет

- Description of Charge/Feature: Param VisheshДокумент4 страницыDescription of Charge/Feature: Param Visheshgaurav_p_9Оценок пока нет

- GSFC MpowerДокумент2 страницыGSFC Mpowerneerajsibgh434Оценок пока нет

- HDFC Vs IciciДокумент10 страницHDFC Vs IciciRahulОценок пока нет

- SOC Savings AdityaДокумент2 страницыSOC Savings AdityaDenny PjОценок пока нет

- Chartered Accountant 2 0Документ3 страницыChartered Accountant 2 0RkОценок пока нет

- Product FeaturesДокумент1 страницаProduct FeaturesdrtejpalОценок пока нет

- Schedule of Charges Effective July 22, 2021Документ3 страницыSchedule of Charges Effective July 22, 2021Vivek DixitОценок пока нет

- Service Charges and Fees 01-10-2020Документ11 страницService Charges and Fees 01-10-2020ammu susanОценок пока нет

- Current Account VariantДокумент1 страницаCurrent Account VariantSandeep PundirОценок пока нет

- Regular Salary Account Service ChargesДокумент2 страницыRegular Salary Account Service ChargesGunde Hari BabuОценок пока нет

- Revised Schedule of ChargesДокумент2 страницыRevised Schedule of Chargesmayankmehta052Оценок пока нет

- DownloadДокумент2 страницыDownloadGazzu GazaliОценок пока нет

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthДокумент2 страницыSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurОценок пока нет

- Schedule of Charges - Retail (India)Документ2 страницыSchedule of Charges - Retail (India)John PeterОценок пока нет

- Axis Bank Service ChargesДокумент4 страницыAxis Bank Service ChargesRanjith MeelaОценок пока нет

- Service Charges and FeeДокумент10 страницService Charges and Feehgfh hgfОценок пока нет

- Privilege Banking AccountsДокумент5 страницPrivilege Banking AccountsVinod MohiteОценок пока нет

- ECS ChargesДокумент14 страницECS ChargesgnanaОценок пока нет

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Документ2 страницыNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741Оценок пока нет

- Account Tariff Structure Basic Savings AccountДокумент1 страницаAccount Tariff Structure Basic Savings Accountgaddipati_ramuОценок пока нет

- General Charges of Kotak BankДокумент2 страницыGeneral Charges of Kotak BankSarafraj BegОценок пока нет

- Credit Insurance CompanyДокумент4 страницыCredit Insurance CompanyHimesh ShahОценок пока нет

- Heading FilesДокумент1 страницаHeading FilesHimesh ShahОценок пока нет

- Mutual Fund CompaniesДокумент3 страницыMutual Fund CompaniesHimesh ShahОценок пока нет

- Nagpur - DetailДокумент2 страницыNagpur - DetailHimesh Shah0% (1)

- India Chartbook July 2019Документ63 страницыIndia Chartbook July 2019Himesh ShahОценок пока нет

- RBI To Cut Interest Rates FurtherДокумент1 страницаRBI To Cut Interest Rates FurtherHimesh ShahОценок пока нет

- What Would It Cost A Country To Leave The EuroДокумент2 страницыWhat Would It Cost A Country To Leave The EuroHimesh ShahОценок пока нет

- Daily Forex Focus: Indian RupeeДокумент4 страницыDaily Forex Focus: Indian RupeeHimesh ShahОценок пока нет

- Master Circular On Branch Licensing Regional Rural BanksДокумент48 страницMaster Circular On Branch Licensing Regional Rural BanksHimesh ShahОценок пока нет

- Geojit BNP Paribas Financial Services LTD.: Application Form For IntermediariesДокумент1 страницаGeojit BNP Paribas Financial Services LTD.: Application Form For IntermediariesHimesh ShahОценок пока нет

- Finrex Treasury Advisors Corporate ProfileДокумент8 страницFinrex Treasury Advisors Corporate ProfileHimesh ShahОценок пока нет

- Axis Service Charges of Foreign ExchangeДокумент9 страницAxis Service Charges of Foreign ExchangeHimesh ShahОценок пока нет

- Finrex Treasury Advisors Corporate ProfileДокумент8 страницFinrex Treasury Advisors Corporate ProfileHimesh ShahОценок пока нет

- Corporation Bank Bank ChargesДокумент15 страницCorporation Bank Bank ChargesHimesh ShahОценок пока нет

- BPR American BankДокумент18 страницBPR American BankGargy ShekharОценок пока нет

- Avi Thesis Final Credit Risk Management in Sonali Bank LTDДокумент20 страницAvi Thesis Final Credit Risk Management in Sonali Bank LTDHAFIZA AKTHER KHANAMОценок пока нет

- Liberia Guide For ImportersДокумент2 страницыLiberia Guide For ImportersMOCIdocs100% (2)

- Internal Assignment Applicable For June 2017 Examination: Course: Commercial Banking System and Role of RBIДокумент2 страницыInternal Assignment Applicable For June 2017 Examination: Course: Commercial Banking System and Role of RBInbala.iyerОценок пока нет

- Office of Executive Engineer Ty. Maintenance Division No.3 (Civil) U.P.P.W.D, LucknowДокумент4 страницыOffice of Executive Engineer Ty. Maintenance Division No.3 (Civil) U.P.P.W.D, LucknowDeepak Singh RanaОценок пока нет

- Muhammad Bilal SaeedДокумент24 страницыMuhammad Bilal SaeedKamran ArshafОценок пока нет

- ZHG Farm PDFДокумент13 страницZHG Farm PDFJohan PrinslooОценок пока нет

- An Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedДокумент32 страницыAn Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedNafiz FahimОценок пока нет

- Polytechnic University of The Philippines: Financing CompaniesДокумент48 страницPolytechnic University of The Philippines: Financing CompaniesMomo MontefalcoОценок пока нет

- Debitum White PaperДокумент88 страницDebitum White PaperICO ListОценок пока нет

- 4 Banking Business Models in Digital AgeДокумент11 страниц4 Banking Business Models in Digital AgeArie Wibowo SutiarsoОценок пока нет

- Inventory and Payable ManagementДокумент22 страницыInventory and Payable Managementparminder bajajОценок пока нет

- Revision 1 AFIFI AnswersДокумент7 страницRevision 1 AFIFI AnswersimieОценок пока нет

- Assignment Assumption and Recognition Agreement UBS IndymacДокумент10 страницAssignment Assumption and Recognition Agreement UBS IndymacTBОценок пока нет

- G.R. No. 182722Документ10 страницG.R. No. 182722Johari Valiao AliОценок пока нет

- Civil Services Magazine DEC'14Документ120 страницCivil Services Magazine DEC'14Er RameshОценок пока нет

- Financial Accounting 2022 NeHu Question PaperДокумент7 страницFinancial Accounting 2022 NeHu Question PaperSuraj BoseОценок пока нет

- Indian Institute of Banking & Finance: Certificate Course in Digital BankingДокумент6 страницIndian Institute of Banking & Finance: Certificate Course in Digital BankingKay Aar Vee RajaОценок пока нет

- Bank Reconciliation ActivitiesДокумент3 страницыBank Reconciliation ActivitiesRheu ReyesОценок пока нет

- Choose More Value For You and Your Family: Get The Help You NeedДокумент19 страницChoose More Value For You and Your Family: Get The Help You Needluthandozwane18Оценок пока нет

- To The Chief Executive Officer Bank of America N.A. (India Branches)Документ53 страницыTo The Chief Executive Officer Bank of America N.A. (India Branches)aditya tripathiОценок пока нет

- Mindanao Savings and Loans Inc Vs WillkomДокумент2 страницыMindanao Savings and Loans Inc Vs Willkomis_still_artОценок пока нет

- JSC Bank For Investment and Development of Vietnam (HOSE: BID)Документ7 страницJSC Bank For Investment and Development of Vietnam (HOSE: BID)Thu Huong PhamОценок пока нет

- National Law University, OdishaДокумент13 страницNational Law University, OdishaIshwar MeenaОценок пока нет

- Basel 3Документ10 страницBasel 3sampathfriendОценок пока нет

- Ledger Confirmation F.Y. 2019-20Документ1 страницаLedger Confirmation F.Y. 2019-20GaganDasPapaiОценок пока нет

- The Illuminati Exposed Part 1Документ72 страницыThe Illuminati Exposed Part 1lowe777100% (1)

- RFBT First Preboard B94 - QuestionnaireДокумент17 страницRFBT First Preboard B94 - QuestionnaireRevs AsjeiОценок пока нет

- AES CS Virtual Internship ProjectДокумент22 страницыAES CS Virtual Internship ProjectAjay0% (1)

- 130+ Last 6 Month: Current Affairs McqsДокумент14 страниц130+ Last 6 Month: Current Affairs McqsSharjil AlamОценок пока нет