Академический Документы

Профессиональный Документы

Культура Документы

53131BIR Form No. 0901-C (Capital Gain)

Загружено:

jamesАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

53131BIR Form No. 0901-C (Capital Gain)

Загружено:

jamesАвторское право:

Доступные форматы

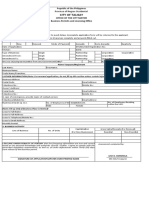

DLN:

BIR Form No.

Republika ng Pilipinas Application For Relief

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas From Double Taxation on 0901-C

Version 1.0 February 2010

Capital Gains

Date of Application

Part I TAX TREATY INFORMATION

1.

2. Fill in all applicable spaces. Mark all appropriate boxes with "NOT APPLICABLE" if no appropriate response.

2A Philippines Tax Convention with _______________________________ .

2B Article Invoked

Part II PAYMENT OF FEES

Processing and certification fees - AAB/BIR Official Receipt No. Date:

Part III PARTIES

1 Seller: (Attach separate sheet with the required information if there are two or more sellers)

Name: TIN:

Type of Entity: Corporation Partnership Individual Other:

(specify)

Is seller the Head

Office or a branch? Head Office Branch (if Branch, state country where Branch is registered) ________________

Address:

Business Phone No.: Fax No.: e-mail Address:

Date of Issuance of SEC Certification of Non-Registration of Corporation/Partnership:

(attach original copy)

Country of Incorporation / Residence:

2 Buyer:

Name: TIN:

Address:

B i

Business Phone

Ph No.:

N Fax No.: e-mail Address:

3 Agent in the Philippines of: Seller Buyer Both

Name: TIN:

Address:

Business Phone No.: Fax No.: e-mail Address:

Part IV DETAILS OF TRANSACTION

Philippine Corporation whose shares of stock are subject of sale/transfer:

S.E.C. Certificate No. Date Issued:

Date of sale/transfer

Total number of unit of participation/shares sold/transferred

Shares of stock Traded in the Stock Exchange Par Value Per Share (for Par shares)

Shares of stock Not Traded in the Stock Exchange Issue Value per Share (for No-Par shares)

Unit in Partnership

Real Property Interest (RPI), if applicable, of the Philippine Corporation as appearing in its audited financial statement

as of the date of sale/transfer of shares of stock/unit of participation (Use formula below)

Interest on properties enumerated in Sec. 3 of RR 4-86 (as

Real Property Interest (RPI) = reflected in Part V) %

Entire assets in terms of value

*Sale or transfer of shares of stock in Philippine Corporation includes sale or transfer of unit of participation in a Philippine Partnership.

Part V PERJURY DECLARATION

I/We declare, under the penalties of perjury, that this application has been made in good faith, and

that the representations incuding the accompanying documents have been verified by me/us and to the Stamp of BIR Receiving Office

best of my/our knowledge, belief, and information are correct, complete and true account of the and Date of Receipt

transaction/s subject of this application.

Seller/Agent of Seller and/or Buyer SIGNATURE

ITAD Filing Reference No.:

Part VI DOCUMENTARY REQUIREMENTS REMARKS

GENERAL DOCUMENTS

1. Proof of Residency

Original copy of consularized certification issued by the tax authority of the country of the income earner to the effect that such income earner is a

resident of such country for purposes of the tax treaty being invoked in the tax year concerned.

2. Articles of Incorporation (For income earner other than an individual)

Photocopy of the Articles of Incorporation (AOI) (or equivalent Fact of Establishment/Creation /Organization) of the income earner with the

original copy of consularized certification from the issuing agency, office or authority that the copy of Articles of Incorporation (AOI) (or

equivalent Fact of Establishment/Creation /Organization) is a faithful reproduction or photocopy.

3. Special Power of Attorney

A. If applicant/filer is the withholding agent of the income earner or the local representative in the Philippines of the income earner -

i. Original copy of a consularized Special Power of Attorney (SPA) or a consularized written authorization duly executed by the income earner

authorizing its withholding agent or local representative in the Philippines to file tax treaty relief application.

B. If applicant/filer is the local representative of the withholding agent of the income earner -

i. Original copy of a consularized Special Power of Attorney (SPA) or a consularized written authorization duly executed by the income earner

authorizing its withholding agent or local representative in the Philippines to file tax treaty relief application; and

ii. Original copy of Letter of Authorization from the withholding agent authorizing local representative to file the tax treaty relief application

4. Certificate of Business Presence in the Philippines.

a. For Corporation or Partnership - Original copy of certification from the Philippines Securities and Exchange Commission that income

recipient is/is not registered to engage in business in the Philippines

b. For Individual - Original copy of a certification from the Department of Trade and Industry that the income earner is not registered to engage

in business in the Philippines

5. Certificate of No Pending Case

Original copy of a sworn statement providing information on whether the issue(s) or transaction involving directly or indirectly the same

taxpayer(s) which is/are the subject of the request for ruling is/are under investigation; covered by an on-going audit, administrative protest, claim

for refund or issuance of tax credit certificate, collection proceedings, or subject of a judicial appeal

ADDITIONAL DOCUMENTS SPECIFIC TO CAPITAL GAINS TAX FOR STRAIGHT SALE OR TRANSFER TRANSACTIONS

1. Contract

Original or certified copy of the notarized Deed of Absolute Sale or notarized Deed or Contract e.g. Deed of Assignment, which actually

transfers the ownership of the subject shares of stock

2. Stock Certificates

Certified copy of the Stock Certificate/s or Subscription Contract covering the subject shares of stock

3. General Information Sheet

Certified copy of the General Information Sheet (GIS) filed with the SEC, showing the name of the subscriber (when shares are not yet fully

paid and as a consequence, stock certificates have not been issued).

4. Corporate Secretary Certificates

Original copy of the duly notarized certificate executed by the Corporate Secretary of the domestic corporation showing the following information:

i. number and value off the subject

j shares off the seller as off the date off sale;;

ii. seller's percentage of ownership as of the date of sale;

iii. acquisition date(s) of the subject shares;

iv. mode of acquisition of the subject shares, including details of previous transfers and the actual Deed showing the parties involved in said

transfers; and

v. buyer's percentage of ownership after the transfer of the subject shares.

5. Comparative Schedule of Property, Plant and Equipment

Original copy of the comparative schedule duly certified by a responsible officer of the Philippine corporation, of the “real property or real

property interest/s” of the domestic corporation, reflecting the necessary adjustment for the period from the last audited financial statement to

the date of the interim unaudited financial statement submitted under no. 12, using the format and observing the guidelines set forth in Part VII

of the BIR Form No. 0901-C.

6. Financial Statement

a. Certified copy of the audited financial statements* for the year prior to the sale or transfer of the subject shares of stock; and

b. Original copy of the unaudited/or interim financial statements as of a specific date nearest to the date of sale, signed by a responsible officer

of the Philippine corporation.

7. BIR Form No. 0605- Payment Form

Certified copy of BIR Form No. 0605 and the official receipt reflecting the payment of the processing and certification fee with an authorized

agent bank under the jurisdiction of Revenue District Office No. 39, together with bank receipt or deposit slips.

8. BIR Form No. 2000 - Documentary Stamp Tax

Certified copy of BIR Form No. 2000 and the official receipt reflecting the payment of the documentary stamp tax on the subject sale or

transfer of the shares of stocks. If the documentary stamp tax shall be borne by the nonresident seller and/or nonresident buyer, the tax shall be

paid and the return shall be filed with an authorized agent bank under the jurisdiction of Revenue District Office No. 39. In case the buyer is a

resident of the Philippines, the return shall be filed and the tax shall be paid in accordance with Section 200(C) of the National Internal Revenue

Code of 1997.

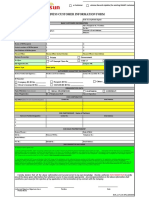

Part VII COMPARATIVE SCHEDULE OF PROPERTY, PLANT & EQUIPMENT (PPE)

Previous Year Current Year Transaction Date

Accumulated Depreciation Total Accumulated Total Accumulated

Particulars Acquisition Cost Book Value Book Value Depreciation Expense Book Value

Depreciation Expense Depreciation Depreciation

PPE1 xxx xxx xxx xxx xxx xxx xxx xxx xxx

PPE2 xxx xxx xxx xxx xxx xxx xxx xxx xxx

PPE3 xxx xxx xxx xxx xxx xxx xxx xxx xxx

Totals xxx xxx xxx xxx xxx xxx xxx xxx xxx

*Financial Statements refer to the balance sheet, income statement, cash flow statement, statement showing changes in equity, statement of retained earnings, and notes thereto

BIR FORM NO. 0901-C

Guidelines and Instructions

This form shall be duly accomplished in (3) three copies which must be signed by the applicant who may either be the income earner or the duly authorized representative of the income earner.

All fields must be mandatorily filled-up. If "NOT APPLICABLE" or "NONE" is/are the appropriate response, the same has/have to be clearly indicated in the corresponding field.

This form together with all the necesary documents mentioned in Part VI shall be submitted only to and received by the International Tax Affairs Division of the Bureau of Internal Revenue on

or before

b f fif

fifth

h (5) dday off the

h ffollowing

ll i monthh ffrom the

h ddate when

h the

h D

Deed

d off Ab

Absolute

l S Sale/Contract

l /C was executedd

Failure to properly file the TTRA with ITAD within the period prescribed herein shall have the effect of disqualifying the TTRA under this RMO.

Вам также может понравиться

- Application For Relief From Double Taxation: (Name of Contracting State)Документ2 страницыApplication For Relief From Double Taxation: (Name of Contracting State)Atty Rester John NonatoОценок пока нет

- Form 1945 - Application For Certificate of Tax Exemption For CooperativesДокумент4 страницыForm 1945 - Application For Certificate of Tax Exemption For CooperativesDarryl Jay Medina100% (1)

- Municipality of Carmona Business Permit Application Form: Republic of The Philippines Province of Cavite TAX YEARДокумент2 страницыMunicipality of Carmona Business Permit Application Form: Republic of The Philippines Province of Cavite TAX YEARJesavil Singhbal100% (1)

- Tarlac - San Antonio - Business Permit - NewДокумент2 страницыTarlac - San Antonio - Business Permit - Newarjhay llave100% (1)

- Application Form For Business PermitДокумент13 страницApplication Form For Business PermitKimBabОценок пока нет

- City of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersДокумент1 страницаCity of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDexter Q. JaducanaОценок пока нет

- Business Permit App FormДокумент1 страницаBusiness Permit App FormcheansiaОценок пока нет

- Application Form For Business Permit New Renewal and Retirement 1Документ4 страницыApplication Form For Business Permit New Renewal and Retirement 1Amiel GuintoОценок пока нет

- Unified Business Application FormДокумент2 страницыUnified Business Application FormKahlila-Keon Morabor-EstorninosОценок пока нет

- 3 - Irs 2849Документ2 страницы3 - Irs 2849Hï FrequencyОценок пока нет

- Power of Attorney and Declaration of RepresentativeДокумент2 страницыPower of Attorney and Declaration of RepresentativeJohn KammererОценок пока нет

- Customer Declaration Form Entity 1Документ3 страницыCustomer Declaration Form Entity 1KjОценок пока нет

- Power of Attorney and Declaration of RepresentativeДокумент2 страницыPower of Attorney and Declaration of Representativegordon scottОценок пока нет

- 1604CДокумент1 страница1604CNguyen LinhОценок пока нет

- MORONG Business Permit Form ARTAДокумент2 страницыMORONG Business Permit Form ARTAAz Khylle AlamonОценок пока нет

- Irs Form 2848Документ2 страницыIrs Form 2848john rossiОценок пока нет

- Type or Print Information Neatly. Please Refer To Instructions For More InformationДокумент3 страницыType or Print Information Neatly. Please Refer To Instructions For More InformationЛена КиселеваОценок пока нет

- Form - Application For Business PermitДокумент2 страницыForm - Application For Business Permitcamilo martalОценок пока нет

- Unified FormДокумент1 страницаUnified FormRobert V. AbrasaldoОценок пока нет

- Business Application FormДокумент2 страницыBusiness Application FormGe Na BieОценок пока нет

- BIR Form No. 0901-D DividendsДокумент2 страницыBIR Form No. 0901-D DividendsKoji ZerofourОценок пока нет

- BPLS Editable Form PDFДокумент3 страницыBPLS Editable Form PDFMr. Kitty CatОценок пока нет

- 1604-C Jan 2018 Final Annex A PDFДокумент1 страница1604-C Jan 2018 Final Annex A PDFAs Li NahОценок пока нет

- RMC No. 73-2019 - Annex AДокумент1 страницаRMC No. 73-2019 - Annex ALeo R.Оценок пока нет

- Bir FormsДокумент25 страницBir FormsAngel Mae ToreniadoОценок пока нет

- Power of Attorney and Declaration of RepresentativeДокумент2 страницыPower of Attorney and Declaration of RepresentativeEri TakataОценок пока нет

- Certificate of Creditable Tax Withheld at SourceДокумент36 страницCertificate of Creditable Tax Withheld at SourceProbinsyana KoОценок пока нет

- Power of Attorney: WWW - Ftb.ca - GovДокумент5 страницPower of Attorney: WWW - Ftb.ca - Govphamel2648Оценок пока нет

- Business Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameДокумент3 страницыBusiness Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameRodelLaborОценок пока нет

- Revised Customer Information Sheet July 2023 1Документ1 страницаRevised Customer Information Sheet July 2023 1emzthineОценок пока нет

- Pinamungajan Business PermitДокумент2 страницыPinamungajan Business PermitHannah PanaresОценок пока нет

- GP MAA Updated 2023 - 10Документ4 страницыGP MAA Updated 2023 - 10Ken Louie NarvaezОценок пока нет

- Application Form For Business PermitДокумент2 страницыApplication Form For Business PermitMalouz ZerdaОценок пока нет

- Business Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameДокумент2 страницыBusiness Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade Namelhuk banaag100% (2)

- BPLO Taguig Mayor's Permit ApplicationДокумент2 страницыBPLO Taguig Mayor's Permit Applicationgille abajar50% (4)

- New RRF June 2023Документ1 страницаNew RRF June 2023Jlj ChuaОценок пока нет

- Revised Application For Renewal FM-CDC-MD-02 As of 2017 Sept 15Документ4 страницыRevised Application For Renewal FM-CDC-MD-02 As of 2017 Sept 15Christy SanguyuОценок пока нет

- Form 1594777111Документ1 страницаForm 1594777111Evcillove Mangubat100% (1)

- Caffrey Trading Corp.: Units 2703 & 2705 Finance Centre 26 St. Cor 9 Ave., Fort Bonifacio Global City, TaguigДокумент2 страницыCaffrey Trading Corp.: Units 2703 & 2705 Finance Centre 26 St. Cor 9 Ave., Fort Bonifacio Global City, Taguigrowena balaguerОценок пока нет

- RMC No. 71-2023 Annex A.1Документ2 страницыRMC No. 71-2023 Annex A.1Ron Andi RamosОценок пока нет

- Form C3.1 Single Work Permit Change in Employer Application For Recruiting Temping AgentsДокумент5 страницForm C3.1 Single Work Permit Change in Employer Application For Recruiting Temping AgentsPG Venkatesh YadavОценок пока нет

- 2017 Credit ApplicationДокумент3 страницы2017 Credit Applicationsabelolucky44Оценок пока нет

- Form C1 KEI - Single Work Permit Renewal Application For Key Employment InitiativeДокумент5 страницForm C1 KEI - Single Work Permit Renewal Application For Key Employment Initiativeknop13Оценок пока нет

- Application Form Business Permit UnifiedДокумент2 страницыApplication Form Business Permit UnifiedNameless DevelopmentОценок пока нет

- Loan Agents Information Sheet - New BLANKДокумент1 страницаLoan Agents Information Sheet - New BLANKBernadette EusteОценок пока нет

- Peixoto, Angel - IRS Form 2848Документ2 страницыPeixoto, Angel - IRS Form 2848MariaОценок пока нет

- BIR Form No. 1709 Final PDFДокумент3 страницыBIR Form No. 1709 Final PDFErica Caliuag0% (1)

- FATCA Non IndividualДокумент6 страницFATCA Non IndividualMarneni Yallamanda RaoОценок пока нет

- IC Approved Application For Bond 9.11.2019Документ4 страницыIC Approved Application For Bond 9.11.2019Violiza Mae RequirosoОценок пока нет

- Application New Bus. Permit NewДокумент3 страницыApplication New Bus. Permit NewDadz CoraldeОценок пока нет

- Operator Application Form 2.0Документ6 страницOperator Application Form 2.0IanОценок пока нет

- Annexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor ResponseДокумент13 страницAnnexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor ResponseMirza FaisalОценок пока нет

- Bplo Unified Business Application Form Final20201216 - 05939Документ1 страницаBplo Unified Business Application Form Final20201216 - 05939Elmer ZabalaОценок пока нет

- Form EMLapplicationforexemptionДокумент2 страницыForm EMLapplicationforexemptionNaruto UzumakiОценок пока нет

- MAF - Domestic - FinalДокумент6 страницMAF - Domestic - FinalSumit BhamisaraОценок пока нет

- Franchisee Application FormДокумент4 страницыFranchisee Application FormMuzammil HawaОценок пока нет

- WPGPipingIndex Form 167 PDFДокумент201 страницаWPGPipingIndex Form 167 PDFRaj AryanОценок пока нет

- Industrial Management: Teaching Scheme: Examination SchemeДокумент2 страницыIndustrial Management: Teaching Scheme: Examination SchemeJeet AmarsedaОценок пока нет

- SDM Case AssignmentДокумент15 страницSDM Case Assignmentcharith sai t 122013601002Оценок пока нет

- Contemp World Module 2 Topics 1 4Документ95 страницContemp World Module 2 Topics 1 4Miguel EderОценок пока нет

- How To Attain Success Through The Strength of The Vibration of NumbersДокумент95 страницHow To Attain Success Through The Strength of The Vibration of NumberszahkulОценок пока нет

- DevelopmentPermission Handbook T&CPДокумент43 страницыDevelopmentPermission Handbook T&CPShanmukha KattaОценок пока нет

- Sikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPДокумент15 страницSikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPHemant MeenaОценок пока нет

- Relay Interface ModulesДокумент2 страницыRelay Interface Modulesmahdi aghamohamadiОценок пока нет

- 1 Ton Per Hour Electrode Production LineДокумент7 страниц1 Ton Per Hour Electrode Production LineMohamed AdelОценок пока нет

- Media SchedulingДокумент4 страницыMedia SchedulingShreyansh PriyamОценок пока нет

- Faida WTP - Control PhilosophyДокумент19 страницFaida WTP - Control PhilosophyDelshad DuhokiОценок пока нет

- Karmex 80df Diuron MsdsДокумент9 страницKarmex 80df Diuron MsdsSouth Santee Aquaculture100% (1)

- Ahakuelo IndictmentДокумент24 страницыAhakuelo IndictmentHNNОценок пока нет

- Comparative Analysis of Mutual Fund SchemesДокумент29 страницComparative Analysis of Mutual Fund SchemesAvinash JamiОценок пока нет

- Andrews C145385 Shareholders DebriefДокумент9 страницAndrews C145385 Shareholders DebriefmrdlbishtОценок пока нет

- Step-7 Sample ProgramДокумент6 страницStep-7 Sample ProgramAmitabhaОценок пока нет

- R 18 Model B Installation of TC Auxiliary Lights and WingletsДокумент29 страницR 18 Model B Installation of TC Auxiliary Lights and WingletsAlejandro RodríguezОценок пока нет

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianДокумент3 страницыMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaОценок пока нет

- Province of Camarines Sur vs. CAДокумент8 страницProvince of Camarines Sur vs. CACrisDBОценок пока нет

- ESK-Balcony Air-AДокумент2 страницыESK-Balcony Air-AJUANKI PОценок пока нет

- ADS Chapter 303 Grants and Cooperative Agreements Non USДокумент81 страницаADS Chapter 303 Grants and Cooperative Agreements Non USMartin JcОценок пока нет

- Bharat Heavy Electricals LimitedДокумент483 страницыBharat Heavy Electricals LimitedRahul NagarОценок пока нет

- Eclipsecon MQTT Dashboard SessionДокумент82 страницыEclipsecon MQTT Dashboard Sessionoscar.diciomma8446Оценок пока нет

- VoIP Testing With TEMS InvestigationДокумент20 страницVoIP Testing With TEMS Investigationquantum3510Оценок пока нет

- Financial StatementДокумент8 страницFinancial StatementDarwin Dionisio ClementeОценок пока нет

- Process Synchronization: Silberschatz, Galvin and Gagne ©2013 Operating System Concepts - 9 EditionДокумент26 страницProcess Synchronization: Silberschatz, Galvin and Gagne ©2013 Operating System Concepts - 9 EditionKizifiОценок пока нет

- INTERNATIONAL BUSINESS DYNAMIC (Global Operation MGT)Документ7 страницINTERNATIONAL BUSINESS DYNAMIC (Global Operation MGT)Shashank DurgeОценок пока нет

- Annotated Portfolio - Wired EyeДокумент26 страницAnnotated Portfolio - Wired Eyeanu1905Оценок пока нет

- Common Base AmplifierДокумент6 страницCommon Base AmplifierMuhammad SohailОценок пока нет

- Central Banking and Monetary PolicyДокумент13 страницCentral Banking and Monetary PolicyLuisaОценок пока нет