Академический Документы

Профессиональный Документы

Культура Документы

BIR Form No. 1700 (Nov. 2011) Guide

Загружено:

Ellen Grace Madriaga0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров1 страницаBIR Form No. 1700 (Nov. 2011) Guide

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBIR Form No. 1700 (Nov. 2011) Guide

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров1 страницаBIR Form No. 1700 (Nov. 2011) Guide

Загружено:

Ellen Grace MadriagaBIR Form No. 1700 (Nov. 2011) Guide

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

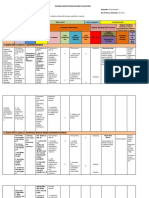

BIR Form No.

1700 – page 4

GUIDELINES AND INSTRUCTIONS

Who Shall File Income Tax Return (ITR) The return shall be filed and the tax shall be paid on or before the 15th day of April Change of Status

This return shall be filed by every resident citizen deriving compensation income of each year covering income for the preceding taxable year with any Authorized Agent If the taxpayer marries or should have additional dependent(s) during the taxable

from all sources, or resident alien and non-resident citizen with respect to Bank (AAB) located within the territorial jurisdiction of the Revenue District Office year, the taxpayer may claim the corresponding personal or additional exemption, as

compensation income from within the Philippines, except the following: (RDO) where the taxpayer is registered. In places where there are no AABs, the the case may be, in full for such year.

1. An individual whose gross compensation income does not exceed his total return shall be filed and the tax shall be paid with the concerned Revenue Collection

personal and additional exemptions. Officer (RCO) under the jurisdiction of the RDO. If the taxpayer dies during the taxable year, his estate may still claim the

2. An individual with respect to pure compensation income, as defined in personal and additional exemptions for himself and his dependent(s) as if he died at

Section 32(A)(1) derived from sources within the Philippines, the income tax on In case of “NO PAYMENT RETURNS”, the same shall be filed with the RDO where the close of such year.

which has been correctly withheld (tax due equals tax withheld) under the the taxpayer is registered or with the concerned RCO under the same RDO.

provisions of Section 79 of the Code: Provided, That an individual deriving If the spouse or any of the dependents dies or if any of such dependents

compensation concurrently from two or more employers at any time during the 3. For Installment Payment marries, becomes twenty-one (21) years old or becomes gainfully employed during the

taxable year shall file an income tax return. When the tax due exceeds P 2,000, the taxpayer may elect to pay in two equal taxable year, the taxpayer may still claim the same exemptions as if the spouse or any

3. An individual whose income has been subjected to final withholding tax (alien installments, the first installment to be paid at the time the return is filed and the of the dependents died, or as if such dependents married, became twenty-one (21)

employee as well as Filipino employee occupying the same position as that of second, on or before July 15 of the same year. years old or became employed at the close of such year.

the alien employee of regional or area headquarters and regional operating

Penalties

headquarters of multinational companies, petroleum service contractors and 4. For Non-Resident Taxpayer

sub-contractors, and offshore banking units; non-resident alien not engaged in In case taxpayer has no legal residence or place of business in the Philippines, the There shall be imposed and collected as part of the tax:

1. A surcharge of twenty five percent (25%) for each of the following violations:

trade or business). return shall be filed with the Office of the Commissioner thru Revenue District Office

4. A minimum wage earner or an individual who is exempt from income tax. No. 39, South Quezon City. a) Failure to file any return and pay the amount of tax or installment

due on or before the due date;

In case of married individuals who are still required to file returns or in those Gross Taxable Compensation Income b) Unless otherwise authorized by the Commissioner, filing a return with

a person or office other than those with whom it is required to be filed;

instances not covered by the substituted filing of returns, only one return for the The gross taxable compensation income of the taxpayer does not include

taxable year shall be filed by either spouse to cover the income of the spouses, which employees’ contributions to SSS, GSIS, HDMF, PHIC and Union Dues. c) Failure to pay the full or part of the amount of tax shown on the

return, or the full amount of tax due for which no return is required to be

return shall be signed by the husband and wife, unless it is physically impossible to do

so, in which case signature of one of the spouses would suffice. The non-business/non-profession related income reported under "other taxable filed on or before the due date;

d) Failure to pay the deficiency tax within the time prescribed for its

income" should reflect only the net taxable amount.

Individuals not required to file an ITR or those qualified for substituted filing may payment in the notice of assessment.

voluntarily file this return for purposes of loans, foreign travel requirements and for Premium Payment on Health and/or Hospitalization Insurance 2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax shall be

other purposes they may deem proper. The amount of premiums not to exceed Two Thousand Four Hundred Pesos imposed in case of willful neglect to file the return within the period prescribed

(P 2,400) per family or Two Hundred Pesos (P 200) a month paid during the taxable by the Tax Code and/or by rules and regulations or in case a false or fraudulent

However, individuals other than those solely earning income as OFWs as return is filed.

defined in RR No. 1-2011 availing of the benefits of special law, such as, but not year for health and/or hospitalization insurance taken by the taxpayer for himself,

including his family, shall be allowed as a deduction from his gross income: Provided, 3. Interest at the rate of twenty percent (20%) per annum, or such higher rate as

limited to the PERA Law are required to file an ITR.

That said family has a gross income of not more than Two Hundred Fifty Thousand may be prescribed by rules and regulations, on any unpaid amount of tax, from

“Minimum Wage Earner” shall refer to a worker in the private sector paid the Pesos (P 250,000) for the taxable year: Provided, finally, That in the case of married the date prescribed for the payment until it is fully paid.

statutory minimum wage or to an employee in the public sector with compensation taxpayers, only the spouse claiming the additional exemption for dependents shall be 4. Compromise penalty, pursuant to existing/applicable revenue issuances.

income of not more than the statutory minimum wage in the non-agricultural sector entitled to this deduction.

where he/she is assigned. Excess Withholding Tax

Personal and Additional Exemptions Over withholding of income tax on compensation shall be refunded by the

“Fair Market Value” as determined in accordance with Section 6(E) of the Tax employer, except if the over withholding is due to the employee’s failure or refusal to

Individual taxpayer, whether single or married, shall be allowed a basic personal

Code, as amended, shall be used in reporting the non-cash income and receipts in the exemption of Fifty Thousand Pesos (P 50,000). file the withholding exemption certificate, or supplies false or inaccurate information,

Supplementary Information. the excess shall not be refunded but shall be forfeited in favor of the government.

In the case of married individuals where only one of the spouses is deriving

The term "individual whose compensation income has been subjected to final Attachments Required

gross income, only such spouse shall be allowed the personal exemption. 1. Certificate of Income Tax Withheld on Compensation (BIR Form No. 2316).

withholding tax” shall include aliens or Filipino citizens occupying the same positions

as the alien employees, as the case may be, who are employed by regional 2. Waiver of the husband’s right to claim additional exemption, if applicable.

An individual, whether single or married, shall be allowed an additional 3. Duly approved Tax Debit Memo, if applicable.

operating headquarters, regional or area headquarters, offshore banking units, exemption of P 25,000 for each qualified dependent child, not exceeding four (4). The

petroleum service contractors and sub-contractors, pursuant to pertinent provisions of 4. Proof of Foreign Tax Credits, if applicable.

additional exemption for dependents shall be claimed by the husband, who is deemed 5. For amended return, proof of tax payment and the return previously filed.

Sections 25 (C), (D), E) and 57(A), including those subject to Fringe Benefit Tax (FBT) the proper claimant unless he explicitly waives his right in favor of his wife.

under Section 33 of the Tax Code, as amended, Republic Act No. 8756, Presidential 6. Proof of other tax payment/credit, if applicable.

Decree No. 1354, and other pertinent laws. 7. Authorization letter, if filed by authorized representative,

“Dependent Child” means a legitimate, illegitimate or legally adopted child chiefly

dependent upon and living with the taxpayer if such dependent is not more than Note: All Background Information must be properly filled up.

“Registered Address” refers to the preferred address (i.e. residence or twenty-one (21) years of age, unmarried and not gainfully employed or if such

employer’s business address) provided by the taxpayer upon registration with the BIR All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the

dependent, regardless of age, is incapable of self-support because of mental or following information:

using BIR Form No. 1902 (Application for Registration-For Individuals Earning Purely physical defect.

Compensation Income and Non-Resident Citizens/Resident Alien Employee). A. For CPAs and others (individual practitioners and members of

GPPs);

In the case of legally separated spouses, additional exemptions may be claimed a.1 Taxpayer Identification Number (TIN); and

When and Where to File and Pay only by the spouse who has custody of the child or children: Provided, That the total

1. For Electronic Filing and Payment System (eFPS) Taxpayer a.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry.

amount of additional exemptions that may be claimed by both shall not exceed the B. For members of the Philippine Bar (individual practitioners,

The return shall be e-filed and the tax shall be e-paid on or before the 15th day of maximum additional exemptions allowed by the Tax Code.

April of each year covering income for the preceding taxable year using the eFPS members of GPPs);

facilities thru the BIR website http://www.bir.gov.ph. b.1 Taxpayer Identification Number (TIN); and

Part IV – Items 53 to 68

b.2 Attorney’s Roll number or Accreditation Number, if any.

The filling-up of these fields is optional. The figures placed therein should be

2. For Non-Electronic Filing and Payment System (Non-eFPS) Taxpayer ENCS

properly documented and/or substantiated.

Вам также может понравиться

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- 1704 MqyДокумент1 страница1704 MqyRizza Mae RodriguezОценок пока нет

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsДокумент1 страницаGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloОценок пока нет

- For Taxable Year 2008, The Following Transitory Personal and Additional Exemptions Shall Be UsedДокумент2 страницыFor Taxable Year 2008, The Following Transitory Personal and Additional Exemptions Shall Be UsedCk Bongalos AdolfoОценок пока нет

- TAX-1401 (Income Tax Return & Payment of Tax)Документ5 страницTAX-1401 (Income Tax Return & Payment of Tax)Hilo MethodОценок пока нет

- Taxation 1 Lesson 1. Returns and Payment of TaxДокумент42 страницыTaxation 1 Lesson 1. Returns and Payment of TaxHarui Hani-31Оценок пока нет

- 1701 Guide Nov 2011Документ1 страница1701 Guide Nov 2011Cy YolipseОценок пока нет

- Guidelines 1701 June 2013 ENCS PDFДокумент4 страницыGuidelines 1701 June 2013 ENCS PDFGil PinoОценок пока нет

- 1700 Guide Nov 2011Документ1 страница1700 Guide Nov 2011Danilo Dela ReaОценок пока нет

- Returns and Payment of TaxДокумент12 страницReturns and Payment of TaxHelaena Bueno Delos SantosОценок пока нет

- 1601-EQ Guide January 2019 ENCS RevДокумент1 страница1601-EQ Guide January 2019 ENCS RevErika OrellanoОценок пока нет

- 1601C GuidelinesДокумент1 страница1601C GuidelinesAnonymous 1tTxK4Оценок пока нет

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Документ1 страницаGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoОценок пока нет

- Corporation Returns. - Requirements Final Adjustment ReturnДокумент3 страницыCorporation Returns. - Requirements Final Adjustment ReturnDevilleres Eliza DenОценок пока нет

- 1700 Guide June 2011Документ2 страницы1700 Guide June 2011fatmaaleahОценок пока нет

- Not Over P 10,000 5%: Tax Table If Taxable Income Is: Tax Due Is: If Taxable Income Is: Tax Due IsДокумент2 страницыNot Over P 10,000 5%: Tax Table If Taxable Income Is: Tax Due Is: If Taxable Income Is: Tax Due IsApple jean BucadОценок пока нет

- Unit 6 - Preparation of Annua ITR BIR Compliance RequirementsДокумент13 страницUnit 6 - Preparation of Annua ITR BIR Compliance RequirementsRomero Joseph AnthonyОценок пока нет

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsДокумент1 страницаBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaОценок пока нет

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsДокумент1 страницаBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaОценок пока нет

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsДокумент1 страницаBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaОценок пока нет

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnДокумент1 страницаGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezОценок пока нет

- TAX-CPAR Lecture Filing and Penalties Version 2Документ23 страницыTAX-CPAR Lecture Filing and Penalties Version 2YamateОценок пока нет

- CPAR Lecture Filing and Penalties (Batch 90) HandoutДокумент25 страницCPAR Lecture Filing and Penalties (Batch 90) HandoutAljur SalamedaОценок пока нет

- CPAR Filing, Penalties, and Remedies (Batch 89) HandoutДокумент25 страницCPAR Filing, Penalties, and Remedies (Batch 89) HandoutlllllОценок пока нет

- CPAR - Filing Penalties Remedies of TaxationДокумент25 страницCPAR - Filing Penalties Remedies of Taxationwendygilbuela2022Оценок пока нет

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldДокумент1 страницаGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaОценок пока нет

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsДокумент1 страницаBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaОценок пока нет

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsДокумент1 страницаBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaОценок пока нет

- Guidelines and Instructions For BIR Form No. 1601-FQ Quarterly Remittance Return of Final Income Taxes WithheldДокумент1 страницаGuidelines and Instructions For BIR Form No. 1601-FQ Quarterly Remittance Return of Final Income Taxes WithheldMark Joseph BajaОценок пока нет

- CPAR Filing, Penalties, Remedies (Batch 92) - HandoutДокумент25 страницCPAR Filing, Penalties, Remedies (Batch 92) - HandoutNikkoОценок пока нет

- BIR Form No. 1700Документ2 страницыBIR Form No. 1700mijareschabelita2Оценок пока нет

- Provided, That Taxes Allowed Under This Subsection, When Refunded or Credited, Shall Be Included As PartДокумент6 страницProvided, That Taxes Allowed Under This Subsection, When Refunded or Credited, Shall Be Included As Partchuga102Оценок пока нет

- Javier Assignment 28Документ9 страницJavier Assignment 28Shamraj E. SunderamurthyОценок пока нет

- 1701 GuidelinesДокумент4 страницы1701 GuidelinesJazz techОценок пока нет

- New ITRs 2014Документ72 страницыNew ITRs 2014miles1280Оценок пока нет

- How To File Your Income Tax Return in The Philippines-COMPENSATIONДокумент10 страницHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280Оценок пока нет

- PenaltiesДокумент2 страницыPenaltiesfatmaaleahОценок пока нет

- 0619-E Jan 2018 GuidelinesДокумент1 страница0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagОценок пока нет

- 2550Q Guidelines 2023 - FinalДокумент1 страница2550Q Guidelines 2023 - Finallorenzo ejeОценок пока нет

- 1601 C CompensationДокумент2 страницы1601 C Compensationjon_cpaОценок пока нет

- Chapter 12 Tds & TcsДокумент28 страницChapter 12 Tds & TcsRajОценок пока нет

- Taxation 2, Final Examination Student Name: Lagulao-Cabasan, Denise YДокумент3 страницыTaxation 2, Final Examination Student Name: Lagulao-Cabasan, Denise YDenise Lim-Yap Lagulao-CabasanОценок пока нет

- BIR Forms and Deadlines ReviewerДокумент8 страницBIR Forms and Deadlines ReviewerJuday MarquezОценок пока нет

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesДокумент1 страницаRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- 1702 RTsasaДокумент4 страницы1702 RTsasaEysOc11Оценок пока нет

- BIR 2019 Income Tax DescriptionДокумент20 страницBIR 2019 Income Tax DescriptionRiselle Ann SanchezОценок пока нет

- What Is An Itr?Документ12 страницWhat Is An Itr?جاثية عبدالرحمنОценок пока нет

- Tax Amnesty Act: February 2019Документ16 страницTax Amnesty Act: February 2019Carlin GreenОценок пока нет

- Tax Amnesty Act: February 2019Документ16 страницTax Amnesty Act: February 2019Joshel MaeОценок пока нет

- BIR FormsДокумент5 страницBIR FormsjoannalouisacgabawanОценок пока нет

- Income TaxДокумент14 страницIncome TaxArielle CabritoОценок пока нет

- Filing of Income TaxesДокумент57 страницFiling of Income TaxesThea MallariОценок пока нет

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsДокумент2 страницыBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodОценок пока нет

- Tax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentДокумент9 страницTax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentJeni ManobanОценок пока нет

- Tax Reviewer - Train LawДокумент8 страницTax Reviewer - Train LawCelestiaОценок пока нет

- Procedures For Filing of ESTATE TAXДокумент2 страницыProcedures For Filing of ESTATE TAXJennylyn Biltz AlbanoОценок пока нет

- 2016 42a740-Np (I)Документ21 страница2016 42a740-Np (I)CwsОценок пока нет

- Withholding Tax SystemДокумент8 страницWithholding Tax Systemjeric aquipelОценок пока нет

- 2550Q InstructionsДокумент1 страница2550Q InstructionsMay RamosОценок пока нет

- BIR Form 1601 c1Документ2 страницыBIR Form 1601 c1Ver ArocenaОценок пока нет

- Guide For Overseas Applicants IRELAND PDFДокумент29 страницGuide For Overseas Applicants IRELAND PDFJasonLeeОценок пока нет

- CANELA Learning Activity - NSPE Code of EthicsДокумент4 страницыCANELA Learning Activity - NSPE Code of EthicsChristian CanelaОценок пока нет

- Avalon LF GB CTP MachineДокумент2 страницыAvalon LF GB CTP Machinekojo0% (1)

- Engineering Management (Final Exam)Документ2 страницыEngineering Management (Final Exam)Efryl Ann de GuzmanОценок пока нет

- Tinplate CompanyДокумент32 страницыTinplate CompanysnbtccaОценок пока нет

- Linux For Beginners - Shane BlackДокумент165 страницLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Документ3 страницыAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraОценок пока нет

- MORIGINAДокумент7 страницMORIGINAatishОценок пока нет

- 23 Things You Should Know About Excel Pivot Tables - Exceljet PDFДокумент21 страница23 Things You Should Know About Excel Pivot Tables - Exceljet PDFRishavKrishna0% (1)

- Introduce Letter - CV IDS (Company Profile)Документ13 страницIntroduce Letter - CV IDS (Company Profile)katnissОценок пока нет

- TAS5431-Q1EVM User's GuideДокумент23 страницыTAS5431-Q1EVM User's GuideAlissonОценок пока нет

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingДокумент75 страницInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspОценок пока нет

- Familiarization With Apparatus and Equipment Used in Testing of MaterialsДокумент5 страницFamiliarization With Apparatus and Equipment Used in Testing of MaterialsEmanoAce33% (6)

- A320 Basic Edition Flight TutorialДокумент50 страницA320 Basic Edition Flight TutorialOrlando CuestaОценок пока нет

- Fidp ResearchДокумент3 страницыFidp ResearchIn SanityОценок пока нет

- P394 WindActions PDFДокумент32 страницыP394 WindActions PDFzhiyiseowОценок пока нет

- Assignment - 2: Fundamentals of Management Science For Built EnvironmentДокумент23 страницыAssignment - 2: Fundamentals of Management Science For Built EnvironmentVarma LakkamrajuОценок пока нет

- Catalog Celule Siemens 8DJHДокумент80 страницCatalog Celule Siemens 8DJHAlexandru HalauОценок пока нет

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsДокумент27 страницSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunОценок пока нет

- Unit Process 009Документ15 страницUnit Process 009Talha ImtiazОценок пока нет

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Документ2 страницыCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoОценок пока нет

- DC Servo MotorДокумент6 страницDC Servo MotortaindiОценок пока нет

- Accomplishment ReportДокумент1 страницаAccomplishment ReportMaria MiguelОценок пока нет

- Marine Lifting and Lashing HandbookДокумент96 страницMarine Lifting and Lashing HandbookAmrit Raja100% (1)

- Dialog Suntel MergerДокумент8 страницDialog Suntel MergerPrasad DilrukshanaОценок пока нет

- 2021S-EPM 1163 - Day-11-Unit-8 ProcMgmt-AODAДокумент13 страниц2021S-EPM 1163 - Day-11-Unit-8 ProcMgmt-AODAehsan ershadОценок пока нет

- Ss 7 Unit 2 and 3 French and British in North AmericaДокумент147 страницSs 7 Unit 2 and 3 French and British in North Americaapi-530453982Оценок пока нет

- Online EarningsДокумент3 страницыOnline EarningsafzalalibahttiОценок пока нет

- Efs151 Parts ManualДокумент78 страницEfs151 Parts ManualRafael VanegasОценок пока нет

- Reflections On Free MarketДокумент394 страницыReflections On Free MarketGRK MurtyОценок пока нет

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorОт EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorРейтинг: 4.5 из 5 звезд4.5/5 (132)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooОт EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooРейтинг: 5 из 5 звезд5/5 (2)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОт EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОценок пока нет

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsОт EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsРейтинг: 3 из 5 звезд3/5 (2)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersОт EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersОценок пока нет

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorОт EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorРейтинг: 4.5 из 5 звезд4.5/5 (63)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersОт EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersРейтинг: 5 из 5 звезд5/5 (4)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsОт EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsОценок пока нет

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОт EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОценок пока нет

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет