Академический Документы

Профессиональный Документы

Культура Документы

Managerial Accounting Essay

Загружено:

Patrick PetitАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Managerial Accounting Essay

Загружено:

Patrick PetitАвторское право:

Доступные форматы

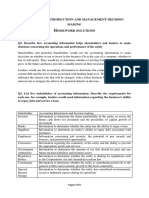

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

Managerial Accounting Essay

Patrick Petit

March 2008

The purpose of this essay is to develop an understanding of both the Balanced Scorecard and

Performance Prism frameworks and develop a critical analysis of how these two frameworks

differentiate both in terms of implementation and expected benefits.

Both the Balanced Scorecard and Performance Prism performance management frameworks are about

designing and implementing performance measurement capabilities in organizations, whether these

be public, private or non-profit enterprises, in an attempt to improve performances and achieve

strategic goals.

A comparative analysis will strive to emphasize the relative importance of using a particular

framework over another in light of what Andy Neel calls the “enduring challenges of measurement”

to effectively deploy any performance measurement capabilities in the enterprise, as it appears that no

single management control system is inherently superior to another.

Introduction

Effective performance measurement requires multiple financial and non-financial performance

measures. Effective performance measures should:

1. reflect key actions and activities that relate to the goals of the organization.

2. be affected by actions of managers and employees.

3. be readily understood by employees.

4. balance long- and short-term concerns.

5. be reasonably objective and easily measurable.

6. be used consistently and regularly to evaluate and reward managers and employees.

Well-designed management control systems develop and report both financial and non-financial

measures of performance since “You can't manage something you can't measure”[is this a citation ?].

Financial measures alone often arrive too late to help prevent problems. A deficient financial outlook

often results from poor non-financial performance in the first place. For instance, the effects of poor

non-financial performance such as lack of organizational learning or low customer satisfaction, may

not show up in the financial measures until the company has lost considerable ground. Conversely, a

superior financial outlook is the logical result of superior non-financial performance (Horngren &

All., 2008 (a)). Therefore,, for many years, organizations have increasingly monitored non-financial

performance as a key element of success. In recent years, most organizations have developed a new

awareness of the importance of controlling non-financial performance areas. This essay focuses on a

popular, broad approach to performance measurement, the Balanced Scorecard, which explicitly

balances financial and non-financial measures. It also describes a second-generation performance

03/16/08 1 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

measurement system, know as Performance Prism, which takes an even broader approach and

emphasis on non-financial measurement, from the perspective that the starting point of any

performance measurement system has to be driven by the stakeholders' requirements as opposed to

the organization's strategy.

The Balanced Scorecard Framework

Originally developed by Robert S. Kaplan and David Norton, the Balanced Scorecard framework has

been around for over a decade. It is the most commonly-applied framework in organizations around

the world. This the framework encompasses a set of performance measures intended to help

organizations implement their strategies more rapidly and effectively. It measures and reports

performance and strives to balance financial and non-financial measurements, link performance to

rewards, and gives explicit recognition to the diversity of organizational goals. Its performance

measurements address the four compartments of the performance pyramid as organizational learning,

business processes improvement, customer satisfaction, and financial strength from increased

profitability. Increased profitability is then re-injected at the organizational learning layer (the bottom

of the pyramid) and goes up again in a virtuous cycle. The chief virtue of the balanced scorecard,

when first presented in Harvard Business Review in 1992 and 1993, was that it advocated the

application of non-financial measures in a world that was then dominated by accounting measure

principals. Long-term financial performance is a primary focus of the framework, but it also

measures indirect causes (that is, non-financial measures) for ultimate operations performance such as

employee motivation, training and customer satisfaction. Another benefit of the balanced scoreboard

approach is that line managers can see the relationships between their own actions on the front-line,

and the financial metrics that relate to the organization's global goals.

The classic balanced scorecard developed by Kaplan and Norton includes key performance

indicators1 grouped into four inter-related categories known as the Balanced Scorecard Quadrants,

each containing objectives and measures from a distinct perspective. These perspectives are termed:

➔ Financial – Kaplan and Norton see the Financial quadrant as being the focal point of all the

objectives and measures of the other quadrants. Those objectives and performance measures

are associated with the shareholders' perception and expectation of the organization's financial

health. In commercial enterprises, the quadrant can include appropriate financial objectives

and measures such as:

➔ achieving a higher return on investment through higher return on investment (ROI)

and return on capital employed (ROCE).

➔ observing a significant revenue from new product launches through revenue growth

on selected product lines.

➔ rewarding shareholders through an increase of earnings per share, P/E ratio, or

dividend yield.

➔ Customers – the key emphasis for most executives is the customer. Many organizations

focus on customer satisfaction as the most important non-financial set of measurements. The

objectives recorded within the customer quadrant may be both contemporary and future

oriented. Examples of customer objectives and measures may include:

➔ dominating the major market through an increase of market shares

➔ Retain customer loyalty through customer satisfaction surveys

1 Measures that drive the organization to meet its goals

03/16/08 2 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

➔ building customer recognition through corporate image or brand awareness polls

➔ Internal Processes – the internal business process quadrant is about execution. Objectives

and measures in this quadrant focus on the operational aspects of an organization's activity.

They may include objectives and measures of the following type:

➔ competing on product reliability through monitoring of production defect rates.

➔ continuously challenging competitor' products on the market by reducing the time to

market for next-generation products.

➔ Learning and Growth – the learning and growth quadrant looks at enabling the organization

through strategic investment in people, business processes, information systems and the

organization's culture. Some examples of objectives and measures within the learning and

growth quadrant may include:

➔ valuing staff through an employee retention index.

➔ maximizing productivity through output per head.

➔ developing a skilled workforce through a number of training hours completed per

head.

The balanced scorecard framework can be flexible and should be regarded as a sort of template that

can be adapted to better reflect each organization's specific business segments.

Performance Prism Framework

The Performance Prism, coming from the Cranfield University), is presented as an innovative second-

generation, three-dimensional performance measurement and performance management framework .

Its positioning, compared to previous frameworks, such as the Balanced Scorecard, is that

performance measurement effectiveness should recognize values from a broad spectrum of partners.

The vision underpinning the Performance Prism is that performance measurements should not derive

uniquely from strategy but from considering relationships with all stakeholders. The Performance

Prism establishes this imperative by linking an organization's strategies, processes and capabilities

with the stakeholders wants and needs and, reciprocally, the expectations an enterprise has toward its

stakeholders. Thus, the objective of the Performance Prism is to provide a flexible framework for

organizations to design, build, operate and refresh a comprehensive performance measurement system

that looks at measurements from the perspective of the stakeholders.

When deciding what to measure, managers have to first identify who their stakeholders are and what

they want and need. Only then can they begin to decide what they should measure. The defenders of

the Performance Prism claim that existing works on performance measurement fail to recognize this,

with in particular the Balanced Scorecard which mandates that measures should be derived from

strategy. Therefore,the Performance Prism states that measures should be consistent with strategy, but

they should not be derived from strategy.

The framework works in a way that is comparable to an optical prism, hence the name Performance

Prism. The operating environment context is decomposed (through the prism) into measurements for

managing stakeholder categories. These categories include the usual investor and customer categories,

and have been extended(this is new in that framework) to intermediary, employee, supplier, regulator

and community categories. The framework does this in two ways:

➔ By considering and identifying the wants and needs of the stakeholders.

➔ By identifying what the organization's expects from its stakeholders.

03/16/08 3 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

Therefore, the Performance Prism establishes a two-way relationship channel between the

stakeholders and the organization. It consists of five interrelated outlooks on performance

measurement that poses the the following critical questions:

➔ Who are the key stakeholders and what are their wants and needs?

➔ What does the organization want and need from its stakeholders on a reciprocal basis?

➔ What strategies need to be put in place to satisfy these reciprocal wants and needs?

➔ What critical processes need to be put in place to enable the organization to execute its

strategies?

➔ What capabilities are required to operate and improve theses processes?

By answering these questions, organizations are supposed to be able to build a structured business

performance model. Together, these five perspectives provide a comprehensive and integrated

framework for managing organizational performance. The framework forces organizations to think

properly by exploring what strategies, processes2 and capabilities3 they will need to put in place in

order to deliver value to each of their stakeholders. Once the various groups of stakeholders based on

their specific needs are identified, the framework allows to define the strategies, processes and

capabilities relevant to each group, giving rise to what is called the success map.

The following section describes some of the framework's key points and explains why it consists of

these components.

Why is it critical to listen to the key stakeholders?

Executive opinion increasingly believes that the only sustainable way for an enterprise to survive and

thrive in the 21st century is to successfully manage its relationships with each of its principal

stakeholders. In a recent respondent program on risk management by the Economist Intelligence Unit

(EIU), reputation risk emerged as the highest ranking priority (62 per cent) above regulatory (41 per

cent) and human capital (41 per cent) risks (McKenna J., 2005). It is also the most difficult to manage

according to a recent study of the top 2000 private and public organizations in the UK (Unsworth, E.

2001). Changes in business practices arising from increasing governance, legal and regulatory

influences have made companies more vulnerable to reputation damages. Equally, the power and

intrusiveness of the media and communication industries has intensified focus on corporate reputation

with respect to unscrupulous business practices. Business reputation is hard to win but quickly lost.

Loss of confidence by any group of stakeholders can quickly lead to the decline of a company, most

strikingly in service businesses such as finance or professional services. For the majority of

enterprises it is seen as the most critical risk, as reputation is becoming a key source of competitive

advantage as products and services become less differentiated. A consensus among executives is to

state that a key element for managing reputation risk is to prompt for effective communications with

2 Processes enable an organization to perform its operations. Organizations broadly classify

business processes according to four categories: develop products and services, generate demand,

fulfill demand, and plan and manage the enterprise Processes run horizontally across and

enterprise's functional organization and are the blueprints for how work is completed. The order-to-

cash fulfillment process is an example of a business process to capture customer orders, make the

good, deliver it, and receive payment.

3 Capabilities can be defined as the combination of an organization's people, practices, technology

and infrastructure which collectively represent an organization's ability to create value through its

business processes. Customer order handling, procurement, manufacturing, distribution, credit

management are examples of capabilities.

03/16/08 4 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

all categories of stakeholder including shareholders, employees, customers and suppliers.

Failure to change was rated the second larger risk. If firms fail to listen to their stakeholders, they

cannot respond to their concerns. In effect, today's consumers are different from those of the 20 th

century. They are more demanding, smarter, better informed, and more in control of their purchasing

decisions. The numerous online services available, such as online reviews, consumer forums, price

comparators and online rebates, have collectively rendered old marketing recipes based on the 1950's

advertising techniques, obsolete. The development of Internet, online communities and pressure

groups are gaining in power and influence. The decline of the music record industry is an example

that illustrates well the most destructive effects of not listening to the structural changes of the market

such as de-intermediation that is desired by customers as well as the artists stakeholders (Hiatt, H. and

Serpick, E., 2007)

Similarly, in the global economy, suppliers and alliance partners are becoming increasingly important

components of an organization as manufacturing and service outsourcing needs continue to grow.

Also, the advent of the Corporate Social Responsibility movement and stewardship for non-financial

impacts over the environment and social responsibilities, for example, are other elements of proof of

the way corporations are expected to behave and listen to regulator and community stakeholder types.

Satisfied stakeholders should not be confused with profitable stakeholders

Take for example customer stakeholders. Research data first gathered by Xerox showed that very

satisfied customers are six times more likely to repeat their purchase in the next 18 months compared

to those who are just satisfied (Thomas O. Jones, W. Earl Sasser Jr., 1995). However, other studies

showed that many customers are not profitable and even possibly loss-makers to the surprise of an

organization. In retail banking, for instance, 20 percent of customers generate 130 percent of profits.

Basically, customers don't care about being loyal or profitable. They just want great products for the

right price. The important point is that performance metrics accounting for customer satisfaction alone

can be misleading as the organization's expectations for loyal and profitable customers may be

orthogonal to the notion of satisfied customer. Of course, the same principal applies to other

stakeholders such as employees or partners.

The key message here is that for every organization-to-stakeholder relation, the performance

measurement system should support irreflexive performance metrics for the reciprocal relation.

What strategies should the organization adopt to ensure the satisfaction of the stakeholders while

ensuring that the reciprocal requirements are also satisfied ?

Serving potentially conflicting requirements can lead to inconsistent strategies. It was apparent to the

designers of Performance Prism that organizations actually do not have the choice to address

antagonist viewpoints as a blunt manifestation of a more complex business environment that are

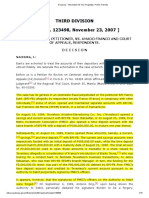

inherent to an increasingly inter-related and global economy. The role of measurement is four-fold

and can be applied at different levels of the organization as shown in the figure below:

03/16/08 5 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

Corporate Strategy

What business do we want Roles of Measurement

to be in and how shall

we build them successfuly?

1. Managers must track whether

or not the strategies they have

Business Unit Strategy chosen are actually being

What market do we want to implemented

be in and how shall we

serving them successfuly? 2. Measures should communicate

these strategies across the

organization's boundaries

Products & Services Strategy

What brands, products, and 3. Measure should encourage

services shall we offer to these incentives for implementation of

markets and how providing strategies

them successfuly?

4. Once available, data should be

analyzed and used to challenge

Operating Strategy whether strategic assumptions

Which process and capabilities are working as planned and if not

must we develop in order to why

serve these markets and provide

these products or services

effectively and efficiently?

Figure 1: Role of measurement in applied strategies at different levels of the organization

Comparative analysis

Both are frameworks used to design and build performance measurement systems. The Balanced

Scorecard framework has for principal that performance measurement should be derived from

strategy. On the opposite side, Performance Prism's main viewpoint is that strategies are in reality

reactions to opportunities and threats from an organization's operating environment standpoint.

Knowledge of stakeholders' changing requirements and how well the organization addresses them is

both the output of prior strategies and the basis of new strategies. Therefore, the starting point for

deciding what to measure should not be the organization's strategy but instead, who are the

organization's stakeholders, and what are their requirements. Therefore, the initial viewpoint on

performance measurement handled in Performance Prism is that of the stakeholder satisfaction as

opposed to the “drive your measures from your strategy” viewpoint of the Balanced Scorecard.

Performance Prism is positioned as a second-generation framework. It advertises a more holistic view

of the enterprise's stakeholders requirements. It also claims design superiority since the starting point

of design is directly geared toward the wants and needs of broader categories of stakeholders, as well

as, the reciprocity of an organization's expectations from its stakeholders. It places strategy as the

natural processing output of what seem to be the most stringent issues enterprises have to solve. That

is, gain satisfaction of key stakeholders, while maintaining their contribution at a sustainable and

profitable level for the organization.

However, while on the surface this seems sound and logical, a reality check of how performance

measurement systems are actually being implemented in the field may call for more cautious

conclusions. The point might not be about the theoretical superiority of one model versus another, but

03/16/08 6 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

instead the blunt reality of why managers are seemingly struggling with implementing frameworks in

all kinds of organization, including non-profit, private and public companies. Surprisingly, academic

studies show that the wide spread of the scorecard framework receives among the lowest rating for

effectiveness and that some 90 percent of managers fail to implement and deliver their organization's

strategies. Despite the increasing popularity of scorecard, managers and employees alike do not

necessarily perceive an added value from the framework. According to other surveys on management

tools , conducted by MBA students of the Michigan-Flint university and the Illinois State University,

the scorecard is perceived as having the least impressive effectiveness ratings, especially for private

companies (Clement and All, 2007). After all, it may come as no surprise that, as David Norton said

himself ,“We are experts in what to measure, not in how to measure” (Kaplan Interview, p13)

Is it the relative comprehensiveness and granularity level of a particular model that makes

organizations successful in the implementation of their operational performance measurement model?

Chris Adams and Andy Nelly, the evangelists of Performance Prism, advocate in a Business

Performance Management article that “When measures are consistent with an organization's

strategies, they encourage behaviors that are consistent with strategies. The right measures not only

offer means of tracking whether strategies are being implemented, but also means of communicating

strategies and encouraging implementations (Adams & Neely, 2003). While there is certainly truth in

this, does it mean that an organization abiding to the prism framework would get, for sure, a more

reliable outcome than with the scorecard framework? I could not find evidence of this, nor consensual

answers about this question in the examined documents. It remains though, that other experts of the

performance management field have different perspectives on this issue. For instance, Michael

Hammer (Hammer, 2007) points that operational performance measurement remains an unsolved

problem even in 2007, and that there are a number of reasons for this failure independently of the

framework being used. These reasons are developed in what he calls the seven deadly sins of

performance measurement . In substance, he says that “there is a widespread consensus that they (the

organizations) measure too much or too little, or the wrong things and that in any event they don't use

their metrics effectively” (Hammer, 2007). The article “The 7 Deadly Sins of Performance

Measurement and How to Avoid Them” is articulated around the following ideas:

➔ Biased results or what Michael Hammer calls “vanity” which inevitably leads organizations to

present metrics and people to look good in the face of stakeholders, whether they are part the

management hierarchy or external such as investors (i.e. business analysts, Wall Street). This

is particularly the case when bonuses and other rewards are attached to results measured in

terms of performance measurements.

➔ The problem of organization silos that Michael Hammer calls “provincialism”. It creates an

environment where people, business units and departments can be successful individually, but

the enterprise as a whole may succeed only marginally or even fail. In my experience I have

seen this flow in many occasions at Sun Microsystems also known as the “Not Invent Here”

syndrome in engineering-based enterprise cultures, which leads entities within the

organization to compete against one another. A motto at Sun is to say that the worst

competitor of Sun is Sun itself.

➔ Paul Gaffney commenting the “The 7 Deadly Sins of Performance Measurement and How to

Avoid Them” article (in Hammer, 2007) pointed out that organizational silos can be defeated

by avoiding another flow Michael Hammer labels “narcissism”, which consists in measuring

performance from one's point of view, rather than from the customer's interest point of view.

For example, many companies measure the performance of order fulfillment in terms of

whether the shipment left the dock on the date scheduled. This is obviously of little interest

from the customer's perspective, who is interested in when the shipment will be received, not

03/16/08 7 Patrick Petit

Grenoble Graduate School of Business: MBA Managerial Accounting Assignment

when it left the dock.

The bottom line with respect to inefficiencies of performance measurement seems to reside essentially

in the fact that organizations “do not give operational measurement the attention it needs. They [the

organizations] follow the path of least resistance, using measures they have inherited from the past or

the first metrics that pop into their heads”. Regardless of the method or framework employed “a

serious commitment to performance improvement demands an equally serious commitment to

designing and using effective operational metrics” (Hammer, 2007).

Bibliography

Clement, C., Chen & Keith, T. Jones. (2007) 'Management Tools - The CPA Journal', August

2007;77,8;ABI/INFORM Global. pp. 50-54

Neely, A. (2007) 'The search of meaningful measures', Management Services Summer 2007Summer,

pp 14-17

Adams, C., Neely A. (2003) 'The New Spectrum: How the Performance Prism Framework Helps',

Business Performance Management, [Online], Available:

http://www.bpmmag.net/magazine/article.html?articleID=14101, [28 Feb. 2008]

Mackay, A. (2004) 'Research Report: A Practitioner's Guide to the Balanced Scorecard', The

Chartered Institute of Management Accountants, [Online], Available:

http://www.cimaglobal.com/cps/rde/xchg/SID-0AAAC564-1B1E8905/live/root.xsl/document_broker.

htm?filename=tech_ressum_a_practitioners_guide_to_the_balanced_scorecard_2005.pdf, [27 Feb.

2008], pp. 8-21

Hiatt, H. and Serpick, E.(2007), The Record Industry's Decline', June 19, p. 1, [Online], Available

http://www.rollingstone.com/news/story/15137581/the_record_industrys_decline, [24 Pct 2007]

Hammer, M. (2007) 'The 7 Deadly Sins of Performance Measurement and How to Avoid Them', MIT

Sloan Management Review, Spring 2007, Vol. 48 No. 3, pp 19-28

Charles T. Horngren & All., 2008 (a), Introduction to Management Accounting, Fourteenth Edition,

Person Prentice Hall, pp 385-401

McKenna J. (2005) 'Four out of five companies say threats to corporate reputation are rising', EIU

Press Release, 08 Dec. 2005, [Online], Available: http://www.eiuresources.com/mediadir/default.asp?

PR=850001885, [29 Feb. 2008]

Unsworth, E. (2001) 'What keeps U.K. execs awake at night', Business Insurance, issue May 14,

2001, [Online], Available: http://www.businessinsurance.com/cgi-bin/article.pl?

articleId=4160&a=a&bt=reputational, [25 Feb 2008]

Thomas O. Jones, W. Earl Sasser Jr. (1995) 'Why Satisfied Customers Defect', : Harvard Business

Review Article, Publication Date: Nov 1, 1995

03/16/08 8 Patrick Petit

Вам также может понравиться

- Productivity and Reliability-Based Maintenance Management, Second EditionОт EverandProductivity and Reliability-Based Maintenance Management, Second EditionОценок пока нет

- Chapter 16 Total Quality ManagementДокумент8 страницChapter 16 Total Quality ManagementKamble AbhijitОценок пока нет

- Rendalir Remembered Setting Guide, Edition 1Документ61 страницаRendalir Remembered Setting Guide, Edition 1Blair CrossmanОценок пока нет

- Final Internship ReportДокумент38 страницFinal Internship ReportNidhi Pious100% (3)

- SBL Exam KitДокумент24 страницыSBL Exam KitSIN NI TANОценок пока нет

- Strategic Management-Chapter 1 & 2Документ10 страницStrategic Management-Chapter 1 & 2rumelrashidОценок пока нет

- MFRS 108Документ22 страницыMFRS 108Yeo Chioujin0% (1)

- Cost and Cost Classifications PDFДокумент5 страницCost and Cost Classifications PDFnkznhrgОценок пока нет

- AON vs. AOAДокумент3 страницыAON vs. AOASubbaramaiahamu Venkataramaiah100% (1)

- Improving Work Methods and ProductivityДокумент8 страницImproving Work Methods and Productivitymann20Оценок пока нет

- Management AccountingДокумент112 страницManagement AccountingSugandha Sethia100% (1)

- Wages and Salary AdministrationДокумент47 страницWages and Salary Administrationsaha apurvaОценок пока нет

- Lecture 2 Quality ManagementДокумент22 страницыLecture 2 Quality ManagementWilliam DC RiveraОценок пока нет

- AGGREGATE PLANNING STRATEGIESДокумент6 страницAGGREGATE PLANNING STRATEGIESAjit ChoudhariОценок пока нет

- Quality BasicsДокумент17 страницQuality BasicsAnchal ChhabraОценок пока нет

- HRM Case and Solution On JAДокумент13 страницHRM Case and Solution On JAAshhab Zaman RafidОценок пока нет

- New Clause 49 Vs SOXДокумент13 страницNew Clause 49 Vs SOXprateek007soniОценок пока нет

- AnnovaДокумент26 страницAnnovaAry Daffaa Mayza NaibahoОценок пока нет

- Principle-Based vs. Rule-Based AccountingДокумент2 страницыPrinciple-Based vs. Rule-Based AccountingPeter MastersОценок пока нет

- Management Accounting ConceptsДокумент19 страницManagement Accounting ConceptsPlatonicОценок пока нет

- Takt Time Invalid Cycle TimesДокумент3 страницыTakt Time Invalid Cycle TimesMuhammad ZubairОценок пока нет

- ME - Business Objectives and Models of The Firm - 10Документ26 страницME - Business Objectives and Models of The Firm - 10semerederibe100% (1)

- Assignment 2 QMS 2019ht74101@wilp - Bits-Pilani - Ac.in PDFДокумент17 страницAssignment 2 QMS 2019ht74101@wilp - Bits-Pilani - Ac.in PDFAmit PaulОценок пока нет

- Cost Accounting IIДокумент62 страницыCost Accounting IIShakti S SarvadeОценок пока нет

- ABC Costing Helps Astro Boy Co. Decision MakingДокумент3 страницыABC Costing Helps Astro Boy Co. Decision MakingDaiannaОценок пока нет

- MBA - Strategic Management + AnswersДокумент24 страницыMBA - Strategic Management + AnswersOlusegun Olasunkanmi PatОценок пока нет

- MBA Managerial Economics Distance Mode Presessional Assignment 2016Документ2 страницыMBA Managerial Economics Distance Mode Presessional Assignment 2016Tawanda Zimbizi0% (1)

- Thus The Objectives of Production Management Are Reflected inДокумент4 страницыThus The Objectives of Production Management Are Reflected inCubeОценок пока нет

- Manufacturing and Operations ManagementДокумент52 страницыManufacturing and Operations ManagementRohit DhawareОценок пока нет

- Chapter - 6 Activity Based CostingДокумент41 страницаChapter - 6 Activity Based CostingAlyssa GalivoОценок пока нет

- Baumols TheoryДокумент35 страницBaumols TheoryAman Singh Rajput100% (1)

- TQMДокумент51 страницаTQMnoor106Оценок пока нет

- Financial StatementДокумент36 страницFinancial StatementKopal GargОценок пока нет

- Activity-Based Costing: A Guide to Calculating True Product CostsДокумент3 страницыActivity-Based Costing: A Guide to Calculating True Product CostsRoikhanatun Nafi'ahОценок пока нет

- MGT705 - Advanced Cost and Management Accounting Midterm 2013Документ1 страницаMGT705 - Advanced Cost and Management Accounting Midterm 2013sweet haniaОценок пока нет

- CHAPTER 1 - OUTLINE For QUALITY AND PERFORMANCE EXCELLENCEДокумент7 страницCHAPTER 1 - OUTLINE For QUALITY AND PERFORMANCE EXCELLENCEKenedy FloresОценок пока нет

- The Project AuditДокумент17 страницThe Project AuditFann YinОценок пока нет

- Six Sigma Quality Strategy Originating From Motorola in 1981Документ5 страницSix Sigma Quality Strategy Originating From Motorola in 1981Pankaj ThakurОценок пока нет

- Performance AppraisalДокумент3 страницыPerformance AppraisalYashwant BishtОценок пока нет

- Qcfi Durgapur Chapter: Question & Answers BankДокумент13 страницQcfi Durgapur Chapter: Question & Answers Bankdeepakhishikar24Оценок пока нет

- Cost of Quality As A Driver For Continuous Improvement - Case Study - Company XДокумент8 страницCost of Quality As A Driver For Continuous Improvement - Case Study - Company XAbdur Rahman UsamaОценок пока нет

- Resources and CapabilitiesДокумент14 страницResources and CapabilitiesSaadОценок пока нет

- Functions of Performance AppraisalДокумент8 страницFunctions of Performance AppraisalRay VictorОценок пока нет

- JITДокумент11 страницJITghosh_001Оценок пока нет

- Unit2 Quality MGMT Leading ThinkerДокумент43 страницыUnit2 Quality MGMT Leading ThinkerDr-Mukesh S TomarОценок пока нет

- Project and Sourcing ManagementДокумент28 страницProject and Sourcing ManagementDEEPANSHI SONIОценок пока нет

- Budgeting and Budgetary Control PDFДокумент39 страницBudgeting and Budgetary Control PDFMr DamphaОценок пока нет

- Welding SPCДокумент3 страницыWelding SPCnineapril82Оценок пока нет

- Chapter1 - Statistics For Managerial DecisionsДокумент26 страницChapter1 - Statistics For Managerial DecisionsRanjan Raj UrsОценок пока нет

- Chitra de Silva PDFДокумент268 страницChitra de Silva PDFRamadona SimbolonОценок пока нет

- Training Needs AssessmentДокумент3 страницыTraining Needs AssessmentSusanna SamuelОценок пока нет

- Module 1 - Introduction and Management Decision Making - Homework SolutionsДокумент4 страницыModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelОценок пока нет

- Linear Programming ApplicationДокумент8 страницLinear Programming ApplicationMartin AndreanОценок пока нет

- Chapter 02 - Public Affairs ManagementДокумент7 страницChapter 02 - Public Affairs ManagementThao TrungОценок пока нет

- Quality CostДокумент21 страницаQuality Costankitd7777Оценок пока нет

- VCMAdvantageДокумент59 страницVCMAdvantagejehangir0000100% (1)

- Decision TreeДокумент8 страницDecision TreePham TinОценок пока нет

- Week 1a Business Strategy - Introduction To StrategyДокумент21 страницаWeek 1a Business Strategy - Introduction To StrategyOnur SerbestОценок пока нет

- Eliminate Non-Value Added ActivitiesДокумент8 страницEliminate Non-Value Added ActivitiesAdrian ChrissanjayaОценок пока нет

- A Study On VED Analysis Done at SRI IYYAN TEXTILE MILL PVT LTD, CoimbatoreДокумент25 страницA Study On VED Analysis Done at SRI IYYAN TEXTILE MILL PVT LTD, CoimbatoreKrishna Murthy AОценок пока нет

- Practicing Managerial Accounting at Bengal PacificДокумент36 страницPracticing Managerial Accounting at Bengal PacificAlamgir Mohammad TuhinОценок пока нет

- Management Control SystemsДокумент50 страницManagement Control SystemsMapuia Lal PachuauОценок пока нет

- A Cloud Computing Cost-Benefit Analysis Assessing Green IT BenefitsДокумент181 страницаA Cloud Computing Cost-Benefit Analysis Assessing Green IT BenefitsPatrick Petit100% (2)

- The Kioto ProtocolДокумент7 страницThe Kioto ProtocolPatrick PetitОценок пока нет

- Impact of Information Technologies On Leadership A Short Survey of E-LeadershipДокумент3 страницыImpact of Information Technologies On Leadership A Short Survey of E-LeadershipPatrick PetitОценок пока нет

- Sun Microsystems International Human Resource Management Case StudyДокумент7 страницSun Microsystems International Human Resource Management Case StudyPatrick Petit100% (1)

- International Market Entry For The Mobile Telecommunications Market in The Russian FederationДокумент8 страницInternational Market Entry For The Mobile Telecommunications Market in The Russian FederationPatrick PetitОценок пока нет

- Information Technology and Open Source Marketing in The Participation AgeДокумент14 страницInformation Technology and Open Source Marketing in The Participation AgePatrick PetitОценок пока нет

- Useful Phrases For Writing EssaysДокумент4 страницыUseful Phrases For Writing EssaysAlexander Zeus100% (3)

- Travel Tours Advisers, Inc. v. Cruz, SR PDFДокумент33 страницыTravel Tours Advisers, Inc. v. Cruz, SR PDFAgent BlueОценок пока нет

- 5 BPI Family Bank Vs FrancoДокумент15 страниц5 BPI Family Bank Vs FrancoSDN HelplineОценок пока нет

- PHQ 9Документ2 страницыPHQ 9melbaylonОценок пока нет

- Legal Literacy Project: Amity Law School, NoidaДокумент14 страницLegal Literacy Project: Amity Law School, Noidaprithvi yadav100% (2)

- John Maynard KeynesДокумент3 страницыJohn Maynard KeynesNora Alfaro BalsakiОценок пока нет

- Appraisal: BY M Shafqat NawazДокумент28 страницAppraisal: BY M Shafqat NawazcallОценок пока нет

- How and When Heavens Gate (The Door To The Physical Kingdom Level Above Human) May Be Entered An Anthology of Our MaterialsДокумент240 страницHow and When Heavens Gate (The Door To The Physical Kingdom Level Above Human) May Be Entered An Anthology of Our Materialsjay sean100% (1)

- Crim 1 CasesДокумент228 страницCrim 1 CasesLeo Mark LongcopОценок пока нет

- A Guide For Case Managers and Those Who Commission ThemДокумент9 страницA Guide For Case Managers and Those Who Commission ThemAR GameCenterОценок пока нет

- NGAS Vol 1 CH 1Документ2 страницыNGAS Vol 1 CH 1niqdelrosario100% (1)

- April 2010 Philippine Supreme Court Rulings on Criminal LawДокумент34 страницыApril 2010 Philippine Supreme Court Rulings on Criminal LawRommel RositoОценок пока нет

- Dialogic OD Approach to TransformationДокумент12 страницDialogic OD Approach to Transformationevansdrude993Оценок пока нет

- CONSTI 2 Midterm PointersДокумент10 страницCONSTI 2 Midterm PointersRommel P. Abas100% (1)

- JONKER - EJC108675 - Addressing The Spatial Inequality of Economic Infrastructure Through Spatial Planning - Mkhize, Ntuthuko Brian 2022-10-22Документ169 страницJONKER - EJC108675 - Addressing The Spatial Inequality of Economic Infrastructure Through Spatial Planning - Mkhize, Ntuthuko Brian 2022-10-22Vincent PhillipsОценок пока нет

- Cases ContractДокумент3 страницыCases ContractDann JOCKERОценок пока нет

- Picpa Qar Committee 2015-2016Документ20 страницPicpa Qar Committee 2015-2016Henry MapaОценок пока нет

- 8 Goals for Global DevelopmentДокумент2 страницы8 Goals for Global DevelopmentchenlyОценок пока нет

- Moris Ravel - Igre Vode - AnalizaДокумент17 страницMoris Ravel - Igre Vode - AnalizaAleksa IlicОценок пока нет

- The Precious Garland of Ratnavali of NagarjunaДокумент64 страницыThe Precious Garland of Ratnavali of NagarjunaZacGo100% (1)

- Employee EmpowermentДокумент10 страницEmployee EmpowermentashdreamОценок пока нет

- University of Buea - CameroonДокумент17 страницUniversity of Buea - CameroonL'ange EtrangeОценок пока нет

- 10 National Power Corporation vs. Heirs of Macabangkit SangkayДокумент1 страница10 National Power Corporation vs. Heirs of Macabangkit Sangkaymayton30100% (1)

- Bullies vs Dictators: Comparing Methods of ControlДокумент3 страницыBullies vs Dictators: Comparing Methods of ControlFaizah Fiza100% (1)

- Williams Paper2Документ9 страницWilliams Paper2api-571976805Оценок пока нет

- Pre-Reading and CH 1Документ4 страницыPre-Reading and CH 1api-589105477Оценок пока нет

- 1 Rallos vs. Felix Go Chan - Sons Realty Corporation 81 SCRA 251, January 31, 1978 PDFДокумент20 страниц1 Rallos vs. Felix Go Chan - Sons Realty Corporation 81 SCRA 251, January 31, 1978 PDFMark Anthony Javellana SicadОценок пока нет