Академический Документы

Профессиональный Документы

Культура Документы

Tds Declaration Us 194c 6 Transporters

Загружено:

Preethi VenkataramanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tds Declaration Us 194c 6 Transporters

Загружено:

Preethi VenkataramanАвторское право:

Доступные форматы

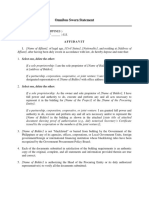

Declaration to be obtained on the letter head of the Transport Contractor in case of non-deduction of tax at

source u/s 194C (6) of the Income Tax Act, 1961

To

____________ (Name of the entity)

____________ (Address)

Sub: Declaration for Non- deduction of Tax at Source (TDS) under Section 194 C (6) of the Income tax

Act, 1961

I, __________, [Name of the person signing declaration] _________________ [Designation of the person

signing this declaration, like a Director, Partner, Sole Proprietor, Authorized Signatory, etc] of

___________________ [Name of the Transport Vendor entity] certify that:

I am authorized to make this declaration in the capacity as a _____________ [Designation of the

person signing this declaration, like a Director, Partner, Sole Proprietor, Authorized Signatory, etc]

_____________ [Name of the Transport Vendor entity] is engaged in the business of plying, hiring or

leasing of goods carriage for its business.

_____________ [Name of the Transport Vendor entity] does not own (whether Registered or as

Beneficial Owner) more than ten goods carriage as on date.

The Income Tax Permanent Account Number (PAN) of _____________ [Name of the Transport Vendor

entity] is ________________. [PAN of the Transport Vendor entity]. A self – attested photocopy of the

same is attached hereto with this Declaration.

If the number of goods carriages owned (whether registered or as beneficial owner) by _____________

[Name of the Transport Vendor entity] exceeds ten at any time during the Financial Year 2015-16, then

_____________ [Name of the Transport Vendor entity] shall forthwith, in writing intimate you of this fact.

In the event of any default, _____________ [Name of the Transport Vendor entity] undertakes to

indemnify you for any costs, taxes, expenses and any other liability that may arise upon you.

Place: (Signature)

Date: Name & Designation of Declarant

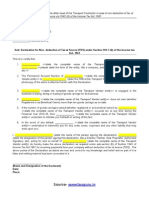

VERIFICATION

I, ___________________________ [Name of the person signing the declaration], _____________ [state the

designation of the person signing this declaration, like a Director, Partner, Sole Proprietor, Authorized Signatory,

etc], acting for and on behalf of _________________ [Name of the Transport Vendor entity], do hereby make

the above declaration as required under sub-section (6) of Section 194C of Income Tax Act 1961 for receiving

payments from your company without deduction of tax at source (TDS). The above points of the Declaration as

stated are true and correct to my knowledge and belief and no part of it is false and nothing material has been

concealed in it.

Place: (Signature)

Date: Name & Designation of Declarant

CArocked Team

Вам также может понравиться

- Name Position Company Name Address: AffidavitДокумент1 страницаName Position Company Name Address: AffidavitRobert TaylanОценок пока нет

- Application For Business Retirement: Taxpayer'S InformationДокумент2 страницыApplication For Business Retirement: Taxpayer'S InformationAvaОценок пока нет

- SofДокумент2 страницыSofAnonymous 370UoGcmkОценок пока нет

- Board Resolution FormatДокумент2 страницыBoard Resolution FormatAshok Sharma100% (3)

- Bond Application (Corporate)Документ2 страницыBond Application (Corporate)Ramon T. De Vera100% (1)

- Declaration Form: (Signature / Dual Name / Vernacular Declaration)Документ1 страницаDeclaration Form: (Signature / Dual Name / Vernacular Declaration)Bala KrishnaОценок пока нет

- VAT264Документ1 страницаVAT264Simbarashe MarisaОценок пока нет

- F.No.3815 B Life Insurance Corporation of IndiaДокумент4 страницыF.No.3815 B Life Insurance Corporation of Indiaharu sanОценок пока нет

- Purchase Agreement Deed of SaleДокумент2 страницыPurchase Agreement Deed of SaleHiddentribe Puregold kioskОценок пока нет

- Auto Repair Invoice TemplateДокумент2 страницыAuto Repair Invoice TemplateEscapayd EОценок пока нет

- Food Truck Lease AgreementДокумент2 страницыFood Truck Lease AgreementScribdTranslationsОценок пока нет

- Notification Form Foreign CorporationДокумент2 страницыNotification Form Foreign CorporationJenel ChuОценок пока нет

- SPECIAL POWER OF ATTORNEY - RequestДокумент2 страницыSPECIAL POWER OF ATTORNEY - Requestprince762Оценок пока нет

- Lic Form 3815 BДокумент2 страницыLic Form 3815 BKaushal Sharma100% (1)

- Membership Agreement: Epic Resources Multi-Purpose Cooperative, A CooperativeДокумент3 страницыMembership Agreement: Epic Resources Multi-Purpose Cooperative, A CooperativeMae Ann LacbayoОценок пока нет

- Pistol Authorization letter-C&FДокумент4 страницыPistol Authorization letter-C&FArea HQ GhtailОценок пока нет

- Bill of Lading - Terms and ConditionsДокумент13 страницBill of Lading - Terms and ConditionsDuDu SmileОценок пока нет

- OmnibusSwornStatement-NEW Bidding Format PDFДокумент2 страницыOmnibusSwornStatement-NEW Bidding Format PDFMichelle S. AlejandrinoОценок пока нет

- How To Fill The Guarantor FormДокумент22 страницыHow To Fill The Guarantor FormDavid magicianОценок пока нет

- CANCELLATION OF REAL ESTATE MORTGAGE Annex AДокумент3 страницыCANCELLATION OF REAL ESTATE MORTGAGE Annex ACybill Astrids Rey RectoОценок пока нет

- 2022 - Escrow Secretary's CertificateДокумент1 страница2022 - Escrow Secretary's CertificateAngela Pascual100% (1)

- Declaration Us 194CДокумент1 страницаDeclaration Us 194CSushant Ghadi0% (1)

- Independent Contractor AgreementДокумент6 страницIndependent Contractor AgreementShaqqaОценок пока нет

- Contract Termination Letter1Документ1 страницаContract Termination Letter1Marvellous YeezorОценок пока нет

- Sole Proprietorship Letter - BGДокумент1 страницаSole Proprietorship Letter - BGKaran AgrawalОценок пока нет

- Introduction (2) Accountingtheory ANZДокумент6 страницIntroduction (2) Accountingtheory ANZAakash SharmaОценок пока нет

- F No - 135Документ3 страницыF No - 135Treena Majumder SarkarОценок пока нет

- Contract Termination Letter2Документ1 страницаContract Termination Letter2Marvellous YeezorОценок пока нет

- Lease Takeover Notification FormДокумент1 страницаLease Takeover Notification FormNithish SajiОценок пока нет

- Report of Transfer of Ownership of A Motor VehicleДокумент2 страницыReport of Transfer of Ownership of A Motor VehicleTARANJIT SINGHОценок пока нет

- Share Affidavit If Origial Share Certificate MissedДокумент2 страницыShare Affidavit If Origial Share Certificate MissedSrinivasan Seenu100% (1)

- PowerДокумент1 страницаPoweramliiОценок пока нет

- Wks SBD NCB Section 9Документ6 страницWks SBD NCB Section 9Zeleke TaimuОценок пока нет

- Customs Power of AttorneyДокумент1 страницаCustoms Power of Attorneybennett1957Оценок пока нет

- Form MДокумент2 страницыForm Msalmanitrat0% (1)

- Pea Applicationform PDFДокумент1 страницаPea Applicationform PDFChipОценок пока нет

- Section 9 Contract FormsДокумент6 страницSection 9 Contract FormstofikkemalОценок пока нет

- Maklumat Pinjaman Kereta - IslamicДокумент6 страницMaklumat Pinjaman Kereta - IslamicIsham119Оценок пока нет

- Annex F RR 11-2018Документ1 страницаAnnex F RR 11-2018Renz Lorenz100% (1)

- Variation Deed (To Amend An Initial Agreement) - Template SampleДокумент5 страницVariation Deed (To Amend An Initial Agreement) - Template SampleLegal ZebraОценок пока нет

- Special Power of Attorney Sell Real Property SampleДокумент1 страницаSpecial Power of Attorney Sell Real Property Sampleblueclouds veraОценок пока нет

- Reg 1000 IbДокумент2 страницыReg 1000 Ibhowardnguyen714Оценок пока нет

- Declaration For Joint OwnershipДокумент1 страницаDeclaration For Joint OwnershipKelly HoffmanОценок пока нет

- Form 1 AДокумент2 страницыForm 1 Alicarvind100% (1)

- Title Seven (Termination of Employment Contract and End of Service Gratuity)Документ12 страницTitle Seven (Termination of Employment Contract and End of Service Gratuity)DrMohamed RifasОценок пока нет

- Encashment of Earned LeaveДокумент1 страницаEncashment of Earned LeaveRawinderОценок пока нет

- 01 339 PDFДокумент2 страницы01 339 PDFvanderbrley100% (1)

- Claim ReleaseДокумент2 страницыClaim ReleasekkОценок пока нет

- Unit 14 Provisions On The PartiesДокумент33 страницыUnit 14 Provisions On The PartiesThanh Lê Thị HoàiОценок пока нет

- Ownership of CopyrightДокумент3 страницыOwnership of CopyrightMeghan Kaye LiwenОценок пока нет

- Letters of AppointmentДокумент15 страницLetters of Appointmentsndipan_chakrabortyОценок пока нет

- Subscriber Sheet For MOA and AOAДокумент2 страницыSubscriber Sheet For MOA and AOAraajverma1000mОценок пока нет

- Redemption and Termination AgreementДокумент4 страницыRedemption and Termination Agreementpeaser0712Оценок пока нет

- LIFE 2020 NGO4GD - Model Declaration On Accounts ValidityДокумент1 страницаLIFE 2020 NGO4GD - Model Declaration On Accounts ValidityCatalin MihailescuОценок пока нет

- Contract of LeaseДокумент3 страницыContract of LeaseNetfinity SpringvilleОценок пока нет

- (DOLE) Checklist For Issuance of Certificate of Registration Pursuant To DO 174-17 (For Job Contractor or Sub-Contractor)Документ1 страница(DOLE) Checklist For Issuance of Certificate of Registration Pursuant To DO 174-17 (For Job Contractor or Sub-Contractor)Carmela CalangiОценок пока нет

- 194C - Non Deduction of TDS For TransporterДокумент1 страница194C - Non Deduction of TDS For TransporterDINESH MEHTAОценок пока нет

- TDS Declaration From Transporter For 194CДокумент1 страницаTDS Declaration From Transporter For 194Ckksinghp1987Оценок пока нет

- TDS Declaration From Transporter For 194CДокумент1 страницаTDS Declaration From Transporter For 194CASHISH KUMARОценок пока нет

- Template-Of-TDS-Declaration For Transporter Wef 1.6.15Документ1 страницаTemplate-Of-TDS-Declaration For Transporter Wef 1.6.15Dhananjay KulkarniОценок пока нет

- ITC Annual Report IndiaДокумент240 страницITC Annual Report IndiaPreethi Venkataraman100% (1)

- Nestlé Refrigerated Foods CompanyДокумент27 страницNestlé Refrigerated Foods CompanyPreethi Venkataraman100% (2)

- Nestlé Refrigerated Foods CompanyДокумент27 страницNestlé Refrigerated Foods CompanyPreethi Venkataraman100% (2)

- MRFДокумент3 страницыMRFPreethi Venkataraman100% (1)

- Financial Analysis of Telecommunication IndustryДокумент7 страницFinancial Analysis of Telecommunication IndustryPreethi VenkataramanОценок пока нет

- Week 1Документ29 страницWeek 1Preethi VenkataramanОценок пока нет

- Costco Canada TV Extended Warranty - Excellence Plus+ 3 Year TV WarrantyДокумент2 страницыCostco Canada TV Extended Warranty - Excellence Plus+ 3 Year TV WarrantyAnonymous SamTjzvОценок пока нет

- 2 Agreement To Sale Ajit Nanekar Flat NoДокумент46 страниц2 Agreement To Sale Ajit Nanekar Flat NoAjay ShindeОценок пока нет

- Present Scenario of Holding Tax Management of Local Government in Bangladesh - A Study On Union Parishad of Bogura DistrictДокумент9 страницPresent Scenario of Holding Tax Management of Local Government in Bangladesh - A Study On Union Parishad of Bogura DistrictMohiuddin Khan AL AminОценок пока нет

- MBA MCQsДокумент42 страницыMBA MCQsSyed Muazzam Ali Naqvi100% (2)

- Amity University: - Uttar PradeshДокумент2 страницыAmity University: - Uttar PradeshIshan MehraОценок пока нет

- Sop Torrens UpdatedДокумент13 страницSop Torrens Updatedahmed saeedОценок пока нет

- VERELL LERIAN - 008201800048 - SUMMARY CH 10 Ethics Applied To The AccountingДокумент3 страницыVERELL LERIAN - 008201800048 - SUMMARY CH 10 Ethics Applied To The AccountingVerell LerianОценок пока нет

- Brake Valve, Relay Valve 27.12.19 PDFДокумент1 страницаBrake Valve, Relay Valve 27.12.19 PDFnithinОценок пока нет

- RSA Environmental Legal and Compliance ReportДокумент25 страницRSA Environmental Legal and Compliance ReportrozadinoОценок пока нет

- Robert Dahl: The Concept of PowerДокумент15 страницRobert Dahl: The Concept of PowerIvica BocevskiОценок пока нет

- Part III PDFДокумент53 страницыPart III PDFRandolph QuilingОценок пока нет

- Statements Guidance Notes Issued by IcaiДокумент9 страницStatements Guidance Notes Issued by IcaiSatish MehtaОценок пока нет

- Helvering V HorstДокумент3 страницыHelvering V HorstKaren PascalОценок пока нет

- GE 104 Lecture 1 Person Authorized To Conduct Land Survey - PPSXДокумент58 страницGE 104 Lecture 1 Person Authorized To Conduct Land Survey - PPSXBroddett Bello AbatayoОценок пока нет

- Start Ups and Legal Compliance in IndiaДокумент43 страницыStart Ups and Legal Compliance in Indianishetha HemaОценок пока нет

- How Can You Describe The Global Marketplace of A Multinational CompanyДокумент16 страницHow Can You Describe The Global Marketplace of A Multinational CompanytseguОценок пока нет

- Group Assignment - April 23Документ16 страницGroup Assignment - April 23DIVA RTHINIОценок пока нет

- A Rothschild Plan For World GovernmentДокумент31 страницаA Rothschild Plan For World GovernmentZsi GaОценок пока нет

- Qualified Dividends and Capital Gains WorksheetДокумент1 страницаQualified Dividends and Capital Gains WorksheetBetty Ann LegerОценок пока нет

- General Ledger TablesДокумент3 страницыGeneral Ledger TablesSiji SurendranОценок пока нет

- WeBOC Registration RequirementДокумент3 страницыWeBOC Registration RequirementbehindthelinkОценок пока нет

- Valuation of GoodwillДокумент15 страницValuation of Goodwillbtsa1262013Оценок пока нет

- Tax Movie Research Paper - AAДокумент6 страницTax Movie Research Paper - AAAndrea Galeazzi RosilloОценок пока нет

- Notice of Cash Allocation PDFДокумент17 страницNotice of Cash Allocation PDFNah HamzaОценок пока нет

- Principles of Taxation Study Guide 2018 PDFДокумент42 страницыPrinciples of Taxation Study Guide 2018 PDFIssa BoyОценок пока нет

- Non Resident Alien PositionДокумент537 страницNon Resident Alien PositionJesse Faulkner100% (3)

- Ashok Jain FinalДокумент8 страницAshok Jain FinalSonu KumarОценок пока нет

- Senate Hearing, 106TH Congress - Treasury and General Government Appropriations For Fiscal Year 2000Документ317 страницSenate Hearing, 106TH Congress - Treasury and General Government Appropriations For Fiscal Year 2000Scribd Government DocsОценок пока нет

- Bilet La Ordin InternationalДокумент2 страницыBilet La Ordin InternationalGabriela ZsokОценок пока нет

- RR No. 6-2015 PDFДокумент5 страницRR No. 6-2015 PDFErlene CompraОценок пока нет