Академический Документы

Профессиональный Документы

Культура Документы

CCN Xa0617nse2018 01 012018 02 28

Загружено:

Ashwin SevariaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CCN Xa0617nse2018 01 012018 02 28

Загружено:

Ashwin SevariaАвторское право:

Доступные форматы

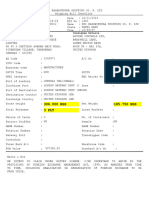

CONTRACT NOTE CUM BILL

#153/154 , 4TH CROSS,JP NAGAR 4TH PHASE, DOLLARS COLONY, BANGALORE, KARNATAKA, 560078

Phone:080 4040 2020, Fax :,Website :www.zerodha.com

SEBI REGISTRATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627 , BSE-EQ : INB011390623 , BSE-

F&O: INF011390623ATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627

NAME OF COMPLIANCE OFFICER : Venu Madhav K.S , PHONE NO : 080-40402020 , EMAIL ID : compliance@zerodha.com

DEALING OFFICE ADDRESS : #153/154 , 4th Cross JP Nagar 4th Phase, Dollars Colony Bangalore Karnataka - 560078

Phone No: +91 80 4040 2020

CONTRACT NOTE NO.: CNT-17/18-14538350 NSE-EQ BSE-EQ

TRADE DATE 15/02/2018 SETTLEMENT NO 2018032

SETTLEMENT DATE 15/02/2018

Name of the Client TAJINDERPALSINGH

Address of the Client Q NO 332 GUJARATREFINERY TOWNSHIP,VADODARA,GUJARAT,None,India,

PAN of Client AUGPS6616N

UCC of Client XA0617

Trading Back office code* XA0617

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O

*Trading/ Back Office Code (If Different from UCC) XA0617

Sir/Madam,

I / We have this day done by your order and on your account the following transactions:

Order No Order Trade No Trade Security/ Buy(B)/ Quantity Gross Brokerage Net Rate Closing Net Total Remarks

Time Time Contract Sell(S) Rate/Trade per Unit per unit Rate per (Before

description Price Per (Rs) (Rs) Unit(only Levies)

unit (Rs) for (Rs)

Derivatives)

(Rs)

NSE-EQ

1100000003449973 12:21:11 26527552 12:21:11 IOC B 10 375.65 375.6500 (3756.50)

1100000002565441 11:08:36 26139967 11:18:59 IOC B 1 375.00 375.0000 (375.00)

Sub Total: 11 (4131.50)

Net Total: (4131.50)

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O NET TOTAL

PAY IN/ PAY OUT OBLIGATION (4131.50) (4131.50)

Taxable value of Supply (Brokerage) (0.01) (0.01)

Exchange Transaction Charges (0.13) (0.13)

CGST (@9% of Brok & Trans Charges) (0.00)

SGST (@9% of Brok & Trans Charges) (0.00)

IGST (@18% of Brok & Trans Charges) (0.03) (0.03)

Securities Transaction Tax (4.00) (4.0)

SEBI Turnover Fees (0.01) (0.01)

Stamp Duty (0.41) (0.41)

Net amount receivable by Client / (payable by Client) (4136.09) (4136.09)

Details of trade-wise levies shall be provided on request.

Transactions mentioned in this contract note cum bill shall be governed and subject to the Rules, Bye-laws and Regulations and Circulars of the

respective Exchanges on which trades have been executed and Securities and Exchange Board of India from time to time. The Exchanges provide

Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). The client may approach its nearest

centre, details of which are available on respective Exchange’s website. Please visit www.bseindia.com for BSE, www.mcx-sx.com for MCX-SX,

www.nseindia.com for NSE and www.useindia.com for USE.

Propreitary trading disclosure: Pursuant to SEBI Circular Number SEBI/MRD/SEC/Cir-42/2003 dated November 19, 2003 &

SEBI/HO/CDMRD/DMP/CIR/P/2016/49 dated April 25, 2016 Zerodha & Zerodha Commodities Pvt. Ltd. discloses to its clients about its policies on

proprietary trades. Zerodha & Zerodha Commodities Pvt. Ltd. does proprietary trading in the cash and derivatives segment at NSE, BSE, and

MCX,NCDEX respectively.

Date: Yours faithfully,

Place: For ZERODHA

(PAN No.: AAAFZ6602R and GSTIN of trading Member:

29AAAFZ6602R1ZG

MR.NITHIN KAMATH ( Authorized Signatory)

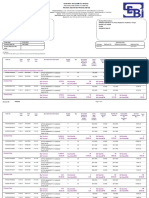

CONTRACT NOTE CUM BILL

#153/154 , 4TH CROSS,JP NAGAR 4TH PHASE, DOLLARS COLONY, BANGALORE, KARNATAKA, 560078

Phone:080 4040 2020, Fax :,Website :www.zerodha.com

SEBI REGISTRATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627 , BSE-EQ : INB011390623 , BSE-

F&O: INF011390623ATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627

NAME OF COMPLIANCE OFFICER : Venu Madhav K.S , PHONE NO : 080-40402020 , EMAIL ID : compliance@zerodha.com

DEALING OFFICE ADDRESS : #153/154 , 4th Cross JP Nagar 4th Phase, Dollars Colony Bangalore Karnataka - 560078

Phone No: +91 80 4040 2020

CONTRACT NOTE NO.: CNT-17/18-14668974 NSE-EQ BSE-EQ

TRADE DATE 16/02/2018 SETTLEMENT NO 2018033

SETTLEMENT DATE 16/02/2018

Name of the Client TAJINDERPALSINGH

Address of the Client Q NO 332 GUJARATREFINERY TOWNSHIP,VADODARA,GUJARAT,None,India,

PAN of Client AUGPS6616N

UCC of Client XA0617

Trading Back office code* XA0617

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O

*Trading/ Back Office Code (If Different from UCC) XA0617

Sir/Madam,

I / We have this day done by your order and on your account the following transactions:

Order No Order Trade No Trade Security/ Buy(B)/ Quantity Gross Brokerage Net Rate Closing Net Total Remarks

Time Time Contract Sell(S) Rate/Trade per Unit per unit Rate per (Before

description Price Per (Rs) (Rs) Unit(only Levies)

unit (Rs) for (Rs)

Derivatives)

(Rs)

NSE-EQ

1100000001094822 09:42:10 25388425 09:42:10 GANESHHOUC B 10 155.90 155.9000 (1559.00)

Sub Total: 10 (1559.00)

1100000001046446 09:39:55 27478858 14:51:26 IOC B 13 375.00 375.0000 (4875.00)

1100000001046446 09:39:55 27478939 14:51:27 IOC B 37 375.00 375.0000 (13875.00)

Sub Total: 50 (18750.00)

Net Total: (20309.00)

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O NET TOTAL

PAY IN/ PAY OUT OBLIGATION (20309.00) (20309.00)

Taxable value of Supply (Brokerage) (0.01) (0.01)

Exchange Transaction Charges (0.66) (0.66)

CGST (@9% of Brok & Trans Charges) (0.00)

SGST (@9% of Brok & Trans Charges) (0.00)

IGST (@18% of Brok & Trans Charges) (0.12) (0.12)

Securities Transaction Tax (20.00) (20.0)

SEBI Turnover Fees (0.03) (0.03)

Stamp Duty (2.03) (2.03)

Net amount receivable by Client / (payable by Client) (20331.85) (20331.85)

Details of trade-wise levies shall be provided on request.

Transactions mentioned in this contract note cum bill shall be governed and subject to the Rules, Bye-laws and Regulations and Circulars of the

respective Exchanges on which trades have been executed and Securities and Exchange Board of India from time to time. The Exchanges provide

Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). The client may approach its nearest

centre, details of which are available on respective Exchange’s website. Please visit www.bseindia.com for BSE, www.mcx-sx.com for MCX-SX,

www.nseindia.com for NSE and www.useindia.com for USE.

Propreitary trading disclosure: Pursuant to SEBI Circular Number SEBI/MRD/SEC/Cir-42/2003 dated November 19, 2003 &

SEBI/HO/CDMRD/DMP/CIR/P/2016/49 dated April 25, 2016 Zerodha & Zerodha Commodities Pvt. Ltd. discloses to its clients about its policies on

proprietary trades. Zerodha & Zerodha Commodities Pvt. Ltd. does proprietary trading in the cash and derivatives segment at NSE, BSE, and

MCX,NCDEX respectively.

Date: Yours faithfully,

Place: For ZERODHA

(PAN No.: AAAFZ6602R and GSTIN of trading Member:

29AAAFZ6602R1ZG

MR.NITHIN KAMATH ( Authorized Signatory)

CONTRACT NOTE CUM BILL

#153/154 , 4TH CROSS,JP NAGAR 4TH PHASE, DOLLARS COLONY, BANGALORE, KARNATAKA, 560078

Phone:080 4040 2020, Fax :,Website :www.zerodha.com

SEBI REGISTRATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627 , BSE-EQ : INB011390623 , BSE-

F&O: INF011390623ATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627

NAME OF COMPLIANCE OFFICER : Venu Madhav K.S , PHONE NO : 080-40402020 , EMAIL ID : compliance@zerodha.com

DEALING OFFICE ADDRESS : #153/154 , 4th Cross JP Nagar 4th Phase, Dollars Colony Bangalore Karnataka - 560078

Phone No: +91 80 4040 2020

CONTRACT NOTE NO.: CNT-17/18-14790463 NSE-EQ BSE-EQ

TRADE DATE 19/02/2018 SETTLEMENT NO 2018034

SETTLEMENT DATE 19/02/2018

Name of the Client TAJINDERPALSINGH

Address of the Client Q NO 332 GUJARATREFINERY TOWNSHIP,VADODARA,GUJARAT,None,India,

PAN of Client AUGPS6616N

UCC of Client XA0617

Trading Back office code* XA0617

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O

*Trading/ Back Office Code (If Different from UCC) XA0617

Sir/Madam,

I / We have this day done by your order and on your account the following transactions:

Order No Order Trade No Trade Security/ Buy(B)/ Quantity Gross Brokerage Net Rate Closing Net Total Remarks

Time Time Contract Sell(S) Rate/Trade per Unit per unit Rate per (Before

description Price Per (Rs) (Rs) Unit(only Levies)

unit (Rs) for (Rs)

Derivatives)

(Rs)

NSE-EQ

1100000004925043 13:30:33 26785428 13:30:33 IOC B 100 368.60 368.6000 (36860.00)

1100000004360528 12:54:38 26573810 12:54:38 IOC B 10 367.70 367.7000 (3677.00)

1100000004094880 12:41:40 26474667 12:41:40 IOC S 11 369.00 369.0000 4059.00

Sub Total: 99 (36478.00)

1100000004073237 12:40:34 26465490 12:40:34 GANESHHOUC B 5 147.65 147.6500 (738.25)

Sub Total: 5 (738.25)

1100000004058415 12:39:47 26459767 12:39:47 IOC B 14 369.65 369.6500 (5175.10)

1100000004058415 12:39:47 26459768 12:39:47 IOC B 11 369.70 369.7000 (4066.70)

Sub Total: 25 (9241.80)

1000000004897446 14:00:54 1599441 14:00:54 DHAMPURSUG B 5 206.20 206.2000 (1031.00)

Sub Total: 5 (1031.00)

Net Total: (47489.05)

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O NET TOTAL

PAY IN/ PAY OUT OBLIGATION (47489.05) (47489.05)

Taxable value of Supply (Brokerage) (1.33) (1.33)

Exchange Transaction Charges (1.81) (1.81)

CGST (@9% of Brok & Trans Charges) (0.00)

SGST (@9% of Brok & Trans Charges) (0.00)

IGST (@18% of Brok & Trans Charges) (0.57) (0.57)

Securities Transaction Tax (49.00) (49.0)

SEBI Turnover Fees (0.08) (0.08)

Stamp Duty (5.56) (5.56)

Net amount receivable by Client / (payable by Client) (47547.4) (47547.40)

Details of trade-wise levies shall be provided on request.

Transactions mentioned in this contract note cum bill shall be governed and subject to the Rules, Bye-laws and Regulations and Circulars of the

respective Exchanges on which trades have been executed and Securities and Exchange Board of India from time to time. The Exchanges provide

Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). The client may approach its nearest

centre, details of which are available on respective Exchange’s website. Please visit www.bseindia.com for BSE, www.mcx-sx.com for MCX-SX,

www.nseindia.com for NSE and www.useindia.com for USE.

Propreitary trading disclosure: Pursuant to SEBI Circular Number SEBI/MRD/SEC/Cir-42/2003 dated November 19, 2003 &

SEBI/HO/CDMRD/DMP/CIR/P/2016/49 dated April 25, 2016 Zerodha & Zerodha Commodities Pvt. Ltd. discloses to its clients about its policies on

proprietary trades. Zerodha & Zerodha Commodities Pvt. Ltd. does proprietary trading in the cash and derivatives segment at NSE, BSE, and

MCX,NCDEX respectively.

Date: Yours faithfully,

Place: For ZERODHA

(PAN No.: AAAFZ6602R and GSTIN of trading Member:

29AAAFZ6602R1ZG

MR.NITHIN KAMATH ( Authorized Signatory)

CONTRACT NOTE CUM BILL

#153/154 , 4TH CROSS,JP NAGAR 4TH PHASE, DOLLARS COLONY, BANGALORE, KARNATAKA, 560078

Phone:080 4040 2020, Fax :,Website :www.zerodha.com

SEBI REGISTRATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627 , BSE-EQ : INB011390623 , BSE-

F&O: INF011390623ATION NO: NSE-EQ : INB231390627 , NSE-F&O : INF231390627 , NSE-CDS: INE231390627

NAME OF COMPLIANCE OFFICER : Venu Madhav K.S , PHONE NO : 080-40402020 , EMAIL ID : compliance@zerodha.com

DEALING OFFICE ADDRESS : #153/154 , 4th Cross JP Nagar 4th Phase, Dollars Colony Bangalore Karnataka - 560078

Phone No: +91 80 4040 2020

CONTRACT NOTE NO.: CNT-17/18-15263862 NSE-EQ BSE-EQ

TRADE DATE 23/02/2018 SETTLEMENT NO 2018038 1718226

SETTLEMENT DATE 23/02/2018 23/02/2018

Name of the Client TAJINDERPALSINGH

Address of the Client Q NO 332 GUJARATREFINERY TOWNSHIP,VADODARA,GUJARAT,None,India,

PAN of Client AUGPS6616N

UCC of Client XA0617

Trading Back office code* XA0617

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O

*Trading/ Back Office Code (If Different from UCC) XA0617 XA0617

Sir/Madam,

I / We have this day done by your order and on your account the following transactions:

Order No Order Trade No Trade Security/ Buy(B)/ Quantity Gross Brokerage Net Rate Closing Net Total Remarks

Time Time Contract Sell(S) Rate/Trade per Unit per unit Rate per (Before

description Price Per (Rs) (Rs) Unit(only Levies)

unit (Rs) for (Rs)

Derivatives)

(Rs)

BSE-EQ

1519356600028032747 10:54:39 1508900 10:54:39 IMFA B 5 593.55 593.5500 (2967.75)

Sub Total: 5 (2967.75)

Net Total: (2967.75)

NSE-EQ

1100000001604327 10:08:49 25706637 10:08:49 IOC B 100 367.00 367.0000 (36700.00)

Sub Total: 100 (36700.00)

Net Total: (36700.00)

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O NET TOTAL

PAY IN/ PAY OUT OBLIGATION (36700.00) (2967.75) (39667.75)

Taxable value of Supply (Brokerage) (0.01) (0.01) (0.02)

Exchange Transaction Charges (1.19) (1.50) (2.69)

CGST (@9% of Brok & Trans Charges) (0.00) (0.00)

SGST (@9% of Brok & Trans Charges) (0.00) (0.00)

IGST (@18% of Brok & Trans Charges) (0.22) (0.27) (0.49)

Securities Transaction Tax (37.00) (3.00) (40.0)

SEBI Turnover Fees (0.06) (0.00) (0.06)

Stamp Duty (3.67) (0.30) (3.97)

Net amount receivable by Client / (payable by Client) (36742.15) (2972.83) (39714.98)

Details of trade-wise levies shall be provided on request.

Transactions mentioned in this contract note cum bill shall be governed and subject to the Rules, Bye-laws and Regulations and Circulars of the

respective Exchanges on which trades have been executed and Securities and Exchange Board of India from time to time. The Exchanges provide

Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). The client may approach its nearest

centre, details of which are available on respective Exchange’s website. Please visit www.bseindia.com for BSE, www.mcx-sx.com for MCX-SX,

www.nseindia.com for NSE and www.useindia.com for USE.

Propreitary trading disclosure: Pursuant to SEBI Circular Number SEBI/MRD/SEC/Cir-42/2003 dated November 19, 2003 &

SEBI/HO/CDMRD/DMP/CIR/P/2016/49 dated April 25, 2016 Zerodha & Zerodha Commodities Pvt. Ltd. discloses to its clients about its policies on

proprietary trades. Zerodha & Zerodha Commodities Pvt. Ltd. does proprietary trading in the cash and derivatives segment at NSE, BSE, and

MCX,NCDEX respectively.

Date: Yours faithfully,

Place: For ZERODHA

(PAN No.: AAAFZ6602R and GSTIN of trading Member:

29AAAFZ6602R1ZG

MR.NITHIN KAMATH ( Authorized Signatory)

Вам также может понравиться

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryОт EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryОт EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Contract note cum tax invoice for equity trades on 31/03/2023Документ4 страницыContract note cum tax invoice for equity trades on 31/03/2023Deebak SОценок пока нет

- CCN Qb5769nse Bse2020 03 042020 04 03Документ47 страницCCN Qb5769nse Bse2020 03 042020 04 03HEMANT PARMARОценок пока нет

- BajajДокумент4 страницыBajajoreo19q9Оценок пока нет

- CW 131007 20161026 Bse 27232 CommonДокумент2 страницыCW 131007 20161026 Bse 27232 CommonDebapriyo SinhaОценок пока нет

- Karvy Stock Broking LTDДокумент2 страницыKarvy Stock Broking LTDMayank KumarОценок пока нет

- Digitally Signed by DS ZERODHA 1 Date: 2017.03.31 04:16:52 IST Reason: "Regulatory" Location: "Zerodha, Bangalore"Документ2 страницыDigitally Signed by DS ZERODHA 1 Date: 2017.03.31 04:16:52 IST Reason: "Regulatory" Location: "Zerodha, Bangalore"Love you SravaniОценок пока нет

- Lexus Con NT 24 ThuДокумент136 страницLexus Con NT 24 ThuPranat BajajОценок пока нет

- MH9575 - 2021 10 12 - 2021 10 12Документ4 страницыMH9575 - 2021 10 12 - 2021 10 12Abhi JainОценок пока нет

- ZerodhaДокумент46 страницZerodhaanicket kabeerОценок пока нет

- RKSV Securities India Pvt. LTD.: Nse-EqДокумент2 страницыRKSV Securities India Pvt. LTD.: Nse-EqSachin MalviОценок пока нет

- 5paisa Capital Limited: Contract Note No. 0004658086Документ2 страницы5paisa Capital Limited: Contract Note No. 0004658086Bs20mscph013Оценок пока нет

- Comm_P140408_21032024Документ2 страницыComm_P140408_21032024prabhakardhaddОценок пока нет

- Alice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeДокумент2 страницыAlice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeKulasekara PandianОценок пока нет

- Digitally Signed by DS ZERODHA 1 Date: 2016.11.10 13:51:55 IST Reason: "Regulatory" Location: "Zerodha, Bangalore"Документ2 страницыDigitally Signed by DS ZERODHA 1 Date: 2016.11.10 13:51:55 IST Reason: "Regulatory" Location: "Zerodha, Bangalore"jamesОценок пока нет

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacДокумент1 страницаTax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacAashima sharmaОценок пока нет

- CHHANDAMAДокумент1 страницаCHHANDAMAMr. SOOTHSAYERОценок пока нет

- Krishiv Infotech: Tax InvoiceДокумент3 страницыKrishiv Infotech: Tax InvoiceRiviera SarkhejОценок пока нет

- Om Engineering Works: B-186 (A), B-187, RIICO Industrial Area Bhiwadi-3010119Документ1 страницаOm Engineering Works: B-186 (A), B-187, RIICO Industrial Area Bhiwadi-3010119Srishti GaurОценок пока нет

- Asg 4262 PDFДокумент3 страницыAsg 4262 PDFrishiОценок пока нет

- Kaynes 6607& 6608 ClistДокумент5 страницKaynes 6607& 6608 ClistSudhakaran SudhakaranОценок пока нет

- Digital ContractДокумент3 страницыDigital Contractgwc.avinash1012Оценок пока нет

- As 46037 0 01102017 31102017 11794-2Документ1 страницаAs 46037 0 01102017 31102017 11794-2Omar TahirОценок пока нет

- Tax Invoice GST Details Housing Cavity ManufacturingДокумент1 страницаTax Invoice GST Details Housing Cavity ManufacturingSrishti GaurОценок пока нет

- Ventura Securities Daily Activity StatementДокумент1 страницаVentura Securities Daily Activity StatementGauhar Abbas100% (1)

- Adobe Scan 15-Apr-2023Документ1 страницаAdobe Scan 15-Apr-2023VISHAL JANGRAОценок пока нет

- Tax Invoice Wire GIДокумент1 страницаTax Invoice Wire GIDJ SethОценок пока нет

- Trade DateДокумент16 страницTrade Datecps2502Оценок пока нет

- WB12BC3117 Tax AДокумент1 страницаWB12BC3117 Tax Azaid AhmedОценок пока нет

- Check List 4Документ2 страницыCheck List 4rababОценок пока нет

- Vivek SimlaДокумент1 страницаVivek Simlaredevil4lifeОценок пока нет

- Visha LДокумент2 страницыVisha LUbed QureshiОценок пока нет

- Creatio Hyd - 1764Документ1 страницаCreatio Hyd - 1764emamoddin ahemadОценок пока нет

- CN Fa45966 05122023 05122023Документ2 страницыCN Fa45966 05122023 05122023hemanth1234Оценок пока нет

- Sales 1048Документ1 страницаSales 1048Nil RoyОценок пока нет

- Caparo Engg I PVT Ltd. - Gidc HalolДокумент1 страницаCaparo Engg I PVT Ltd. - Gidc Halolrcvbrd06Оценок пока нет

- CCN Uy5236nse Bse2020 05 222020 05 22 PDFДокумент3 страницыCCN Uy5236nse Bse2020 05 222020 05 22 PDFRajesh MullapudiОценок пока нет

- CN Fa63928 25052023 25052023Документ5 страницCN Fa63928 25052023 25052023thealkpОценок пока нет

- Biswana TH Guha: I. R. Technology Services Pvt. LTDДокумент1 страницаBiswana TH Guha: I. R. Technology Services Pvt. LTDRoma BeheraОценок пока нет

- Assemble 6-8Документ1 страницаAssemble 6-8ok okОценок пока нет

- QuotationДокумент1 страницаQuotationManish DassОценок пока нет

- Mi TV WarrentyДокумент1 страницаMi TV Warrentyankit vermaОценок пока нет

- Accounting Voucher DisplayДокумент1 страницаAccounting Voucher DisplayAmit KumarОценок пока нет

- Comm G198327 03012022Документ2 страницыComm G198327 03012022MUTHYALA NEERAJAОценок пока нет

- Tax InvoiceДокумент1 страницаTax InvoiceAnkur RatheeОценок пока нет

- Tax InvoiceДокумент1 страницаTax InvoiceAnkur RatheeОценок пока нет

- Invoice: Vechoochira, Chempanoli Pathanamthitta GSTIN/UIN: 32AAIFK3878Q1ZMДокумент1 страницаInvoice: Vechoochira, Chempanoli Pathanamthitta GSTIN/UIN: 32AAIFK3878Q1ZMRAVEENDRA OFFICEОценок пока нет

- Sanket SafetyДокумент1 страницаSanket SafetyManoj GaikwadОценок пока нет

- wb12bh4409 DДокумент1 страницаwb12bh4409 Dmdneyaz9831Оценок пока нет

- Tax Invoice DetailsДокумент1 страницаTax Invoice Detailsraio interionfashionОценок пока нет

- Tax Invoice/Bill of Supply/Cash MemoДокумент1 страницаTax Invoice/Bill of Supply/Cash MemoIkka SinghОценок пока нет

- WB90E7632 Tax AДокумент1 страницаWB90E7632 Tax Azaid AhmedОценок пока нет

- Tax Invoice/Bill of Supply/Cash MemoДокумент1 страницаTax Invoice/Bill of Supply/Cash MemoVivek SamratОценок пока нет

- Financial Ledger (Nse/Bse/Fo)Документ5 страницFinancial Ledger (Nse/Bse/Fo)pooja sharmaОценок пока нет

- Easy GSTДокумент1 страницаEasy GSTAshish PathakОценок пока нет

- Tax Invoice DetailsДокумент1 страницаTax Invoice DetailsSANJAY PRAKASHОценок пока нет

- PI - Ravindra SinghДокумент1 страницаPI - Ravindra Singharyansingh4517Оценок пока нет

- Invoice No: 409/23-24 Date: 18 Oct 2023: 1,50,000.00 1,50,000.00 13,500.00 13,500.00 Grand Total 1,77,000.00Документ1 страницаInvoice No: 409/23-24 Date: 18 Oct 2023: 1,50,000.00 1,50,000.00 13,500.00 13,500.00 Grand Total 1,77,000.00prasadriri45Оценок пока нет

- Api 125Документ1 страницаApi 125Abhishek IndraleОценок пока нет

- Earthing Calculation, Rev-5, (As BUILT)Документ7 страницEarthing Calculation, Rev-5, (As BUILT)Ashwin SevariaОценок пока нет

- Is 5572 Classification of Haz. AreaДокумент21 страницаIs 5572 Classification of Haz. AreaAshwin SevariaОценок пока нет

- 183177000e010052 11a30Документ1 страница183177000e010052 11a30Ashwin SevariaОценок пока нет

- Induction Motor Protection and StartingДокумент6 страницInduction Motor Protection and StartingHasith LiyanageОценок пока нет

- CRS - Hazardous Area LayoutДокумент9 страницCRS - Hazardous Area LayoutAshwin SevariaОценок пока нет

- Low Cost Motor Protection RelayДокумент4 страницыLow Cost Motor Protection RelayAshwin SevariaОценок пока нет

- 0309131-R3-Hazardous Area Boundaries PDFДокумент1 страница0309131-R3-Hazardous Area Boundaries PDFAshwin SevariaОценок пока нет

- DS59 - IEC 60079 0 2011 The Differences and The Consequences PDFДокумент3 страницыDS59 - IEC 60079 0 2011 The Differences and The Consequences PDFAshwin SevariaОценок пока нет

- 242109-02 - 0 - Iec60079-15 Ex Na Risk Assesment TablesДокумент1 страница242109-02 - 0 - Iec60079-15 Ex Na Risk Assesment TablesAshwin SevariaОценок пока нет

- R3 Hazardous Area BoundariesДокумент1 страницаR3 Hazardous Area BoundariesAshwin SevariaОценок пока нет

- Cable SizingДокумент25 страницCable Sizing54045114100% (1)

- Table of ContentsДокумент76 страницTable of ContentsMushahidОценок пока нет

- Tabla Awg A mm2Документ1 страницаTabla Awg A mm2Francisco HernandezОценок пока нет

- 8942V 00 CN 16 12 007 1 SДокумент23 страницы8942V 00 CN 16 12 007 1 SAshwin SevariaОценок пока нет

- HRC FusesДокумент16 страницHRC FusesAshwin SevariaОценок пока нет

- The Motor GuideДокумент135 страницThe Motor Guidegraduadoesime100% (2)

- HRC Fuse LinkДокумент4 страницыHRC Fuse LinkAshwin SevariaОценок пока нет

- Smart Brains Institute of Engineering Design & Research: Cabling SystemДокумент11 страницSmart Brains Institute of Engineering Design & Research: Cabling SystemAshwin SevariaОценок пока нет

- Early Coinage: Punch-Marked Coins and Roman CoinsДокумент64 страницыEarly Coinage: Punch-Marked Coins and Roman CoinsAshwin SevariaОценок пока нет

- Coins of Ancient India - Cunning Ham - 1891Документ161 страницаCoins of Ancient India - Cunning Ham - 1891changu250100Оценок пока нет

- PersianДокумент92 страницыPersianMujeeb Ur Rahman100% (3)

- Coins of India Through The AgesДокумент35 страницCoins of India Through The AgesAshwin Sevaria100% (1)

- The Coins of Purugupta: Pankaj TandonДокумент18 страницThe Coins of Purugupta: Pankaj TandonAshwin Sevaria100% (1)

- Indian Numismatics D.D. Kosambi Statistical AnalysisДокумент109 страницIndian Numismatics D.D. Kosambi Statistical AnalysisKishore PatnaikОценок пока нет

- Yashoda Singh Indian Coins Lots 1001-1242Документ29 страницYashoda Singh Indian Coins Lots 1001-1242Ashwin SevariaОценок пока нет

- Coins of India Through The AgesДокумент35 страницCoins of India Through The AgesAshwin Sevaria100% (1)

- History of Punch-Marked Coin in Indian Subcontinent MR - Dipayan DasДокумент11 страницHistory of Punch-Marked Coin in Indian Subcontinent MR - Dipayan DasAshwin SevariaОценок пока нет

- Indian Coins Lots 1243-1488 PDFДокумент33 страницыIndian Coins Lots 1243-1488 PDFAshwin SevariaОценок пока нет

- Gallery Sheet CoinsДокумент14 страницGallery Sheet CoinsTejas SanghaviОценок пока нет

- Porter's Five Force Analysis of Industry: Rivalry Among Competitors - Attractiveness: HighДокумент5 страницPorter's Five Force Analysis of Industry: Rivalry Among Competitors - Attractiveness: HighPrasanta MondalОценок пока нет

- Zerodha Brokerage Charges and CalculatorsДокумент9 страницZerodha Brokerage Charges and CalculatorsMrugen ShahОценок пока нет

- CCN Xa0617nse2018 01 012018 02 28Документ8 страницCCN Xa0617nse2018 01 012018 02 28Ashwin SevariaОценок пока нет

- Emergence of Discount Broker in India "Zerodha": Sumit VermaДокумент16 страницEmergence of Discount Broker in India "Zerodha": Sumit VermasumitОценок пока нет

- KYC checklist for filling formДокумент16 страницKYC checklist for filling formLakshmi KiranОценок пока нет

- Nithin boy-Kamath-Outliers-PodcastДокумент29 страницNithin boy-Kamath-Outliers-PodcastChristifer ChristyОценок пока нет

- KYC checklist for filling formДокумент28 страницKYC checklist for filling formPralay RautОценок пока нет

- Zerodha Broking Ltd...Документ6 страницZerodha Broking Ltd...parth saboo100% (1)

- A Summer Internship Project Report "A Study On Investors Perception Towards The Derivative Markets" AT ZerodhaДокумент79 страницA Summer Internship Project Report "A Study On Investors Perception Towards The Derivative Markets" AT Zerodhajimit0% (1)

- Instructions / Checklist For Filling KYC FormДокумент22 страницыInstructions / Checklist For Filling KYC FormAiyazz ShaikhОценок пока нет

- Instructions / Checklist For Filling KYC FormДокумент22 страницыInstructions / Checklist For Filling KYC FormSAURABH SONIОценок пока нет

- Instructions / Checklist For Filling KYC FormДокумент23 страницыInstructions / Checklist For Filling KYC FormGV ManikantaОценок пока нет

- Zerodha 7Ps: Purvashree Gawde PGDM Marketing Roll No 17Документ4 страницыZerodha 7Ps: Purvashree Gawde PGDM Marketing Roll No 17Purvashree GawdeОценок пока нет

- Instructions / Checklist For Filling KYC FormДокумент19 страницInstructions / Checklist For Filling KYC FormRajОценок пока нет

- A Project Report ON: "Investment Pattern On The Basis of Risk Profile of Investers "Документ79 страницA Project Report ON: "Investment Pattern On The Basis of Risk Profile of Investers "aanchal bansal bОценок пока нет

- 27 Pratap Waghmare Zerodha Case StudyДокумент20 страниц27 Pratap Waghmare Zerodha Case Studypratap waghmare0% (1)

- Hybrid Fund Beats Index by 32Документ15 страницHybrid Fund Beats Index by 32ShnyderОценок пока нет

- 01 Zerodha Sustaining A Leadership Position in IndiaДокумент15 страниц01 Zerodha Sustaining A Leadership Position in IndiaMariya Thomas100% (1)

- KYC checklist for filling formДокумент19 страницKYC checklist for filling formPatu DhamalОценок пока нет

- 19bce0696 VL2021220701671 Ast02Документ7 страниц19bce0696 VL2021220701671 Ast02Parijat NiyogyОценок пока нет

- Digitally Signed by DS ZERODHA 1 Date: 2017.03.31 04:16:52 IST Reason: "Regulatory" Location: "Zerodha, Bangalore"Документ2 страницыDigitally Signed by DS ZERODHA 1 Date: 2017.03.31 04:16:52 IST Reason: "Regulatory" Location: "Zerodha, Bangalore"Love you SravaniОценок пока нет

- Zerodha TDДокумент22 страницыZerodha TDNitinОценок пока нет

- Zerodha Form PDFДокумент19 страницZerodha Form PDFsujeet kumarОценок пока нет

- Instructions / Checklist For Filling KYC FormДокумент22 страницыInstructions / Checklist For Filling KYC FormRohit JadhavОценок пока нет

- Project Report: "Research Analysis On Various Discount Brokerage and Full Time Brokerage Online Trading Firms"Документ58 страницProject Report: "Research Analysis On Various Discount Brokerage and Full Time Brokerage Online Trading Firms"JdeeОценок пока нет

- Instructions / Checklist For Filling KYC FormДокумент38 страницInstructions / Checklist For Filling KYC FormJeyakumar AОценок пока нет

- Lo LoДокумент77 страницLo LoK V BALARAMAKRISHNAОценок пока нет

- Instructions / Checklist For Filling KYC FormДокумент29 страницInstructions / Checklist For Filling KYC FormSuraj MehtaОценок пока нет

- Ntrepreneur: Nithin KamathДокумент16 страницNtrepreneur: Nithin KamathINDIAN ARMYОценок пока нет