Академический Документы

Профессиональный Документы

Культура Документы

Preference Shares

Загружено:

Tiso Blackstar Group0 оценок0% нашли этот документ полезным (0 голосов)

29 просмотров1 страницаPreferenceShares

Оригинальное название

PreferenceShares

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPreferenceShares

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

29 просмотров1 страницаPreference Shares

Загружено:

Tiso Blackstar GroupPreferenceShares

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

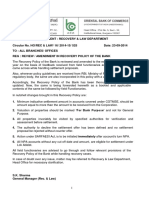

Markets and Commodity figures

08 March 2018

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 1719000 0 0 0 0 0 1.7 1940000 1605000 0 0 0 0

KRHALF 825000 0 0 0 0 0 -2.4 890000 800000 0 0 0 0

KRQRTR 419000 0 0 0 0 0 -16.2 510000 400000 0 0 0 0

KRTENTH 150000 0 0 0 0 0 -13.3 180000 150000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 117170 365 0.3 117170 117170 0 -17.8 142510 1 18.7 0 0 0

AFRICAGOLD 15536 -38 -0.2 15536 15536 0 -0.9 18346 15172 93.4 0 0 0

AFRICAPALLAD 11467 133 1.2 11467 11467 0 14.8 14392 7266 3043.2 0 0 0

AFRICAPLATIN 11190 -17 -0.2 11190 11190 0 -9.4 13451 11190 1669.8 0 0 0

AFRICARHODIU 21579 -27 -0.1 22339 21579 0 86.4 29900 11500 743.4 0 0 0

AGLSBY 13 1 8.3 13 13 0 -59.4 32 10 12 0 0 0

AGLSBZ 34 1 3 34 34 0 3 43 29 33 0 0 0

AMIBIG50EX-S 1283 13 1 1300 1275 1 7.5 7315 986 15.5 0 0 1.9

AMSSBP 35 1 2.9 35 35 0 6.1 48 33 34 0 0 0

ANGSBQ 25 0 0 0 0 0 -24.2 41 11 25 0 0 0

ANGSBR 31 1 3.3 31 31 0 -11.4 37 20 30 0 0 0

ASHBURTONGBL 3752 31 0.8 3777 3722 7 -7.7 4460 3621 160 0 0 0.5

ASHBURTONINF 2016 0 0 2016 1993 124 -4.3 2414 1812 1012 0 0 2.8

ASHBURTONMID 799 -4 -0.5 850 794 763 2.2 892 695 305.1 0 0 3

ASHBURTONTOP 5234 23 0.4 5530 5208 54 17.7 5886 4222 645.6 0 0 1.5

BATSBP 70 2 2.9 70 70 0 112.1 89 28 68 0 0 0

BILSBQ 6 0 0 0 0 0 -81.3 35 4 6 0 0 0

BILSBR 40 2 5.3 40 40 0 29 43 23 38 0 0 0

CORE DIVTRAX 3168 -20 -0.6 3200 3151 350 8.7 3275 2700 283.4 0 0 1.7

CORE EWTOP40 5128 23 0.5 5185 5075 4 5.8 5450 4680 170.7 0 0 2

CORE GLPROP 2925 39 1.4 2940 2888 37 -11 3855 2790 278.2 0 0 5.2

CORE LVOLTRX 2754 13 0.5 2754 2754 0 -0.6 2896 2530 18.8 0 0 2.6

CORE PREF 797 -10 -1.2 810 792 465 -15.9 975 765 275 0 0 8.6

CORE S&P500 3267 33 1 3295 3240 15 3.8 3998 2810 491.1 0 0 2.2

CORE SAPY 6020 115 1.9 6020 5900 6 -9.5 7345 5585 148.9 0 0 6.1

CORE TOP50 2395 -5 -0.2 2415 2390 21 17.9 2632 2008 825.7 0 0 1.3

CORESHARESGL 976 6 0.6 980 935 65 0 1033 935 66.3 0 0 0

CORESHARESPR 1897 31 1.7 1900 1860 17 -10.7 2319 1790 265.2 0 0 6.2

DOLLARCSTDL 110720 480 0.4 110720 110720 0 -10.1 140850 10900 93.7 0 0 1.9

DSYSBQ 21 -1 -4.5 21 21 0 -34.4 48 21 22 0 0 0

ESPIBI 1102670 21255 2 1102670 1102670 0 20.3 1180103 914450 148.9 0 0 0

ESPIBK 1488425 2950 0.2 1488425 1488425 0 15.2 1497989 1283390 82.6 0 0 0

ESPIBO 1184493 -2383 -0.2 1184493 1184493 0 2.8 1469937 1148660 136.4 0 0 0

EXXSBP 23 2 9.5 23 23 0 -28.1 32 14 21 0 0 0

EXXSBQ 50 4 8.7 50 50 0 47.1 50 34 46 0 0 0

FSRSBR 8 1 14.3 8 8 0 -52.9 22 6 7 0 0 0

GFISBR 18 0 0 0 0 0 -50 39 15 18 0 0 0

GFISBS 40 1 2.6 40 40 0 21.2 43 31 39 0 0 0

HARSBR 21 2 10.5 21 21 0 -32.3 33 19 19 0 0 0

KIOSBP 6 1 20 6 6 0 -80.6 31 5 5 0 0 0

KIOSBQ 16 0 0 16 16 0 -51.5 33 11 16 0 0 0

KIOSBR 34 0 0 34 34 0 0 41 25 34 0 0 0

KRCSTDLCRTFC 1657600 -1900 -0.1 1657600 1657600 0 -0.7 1954950 17255 1415 0 0 0

MRPSBR 1 0 0 0 0 0 -96.7 155 1 1 0 0 0

MTNSBT 25 -11 -30.6 25 24 16 -26.5 37 24 36 0 0 0

NEWFUNDSEQUI 3136 -24 -0.8 3164 3136 42 6.5 3800 2700 75.8 0 0 0.3

NEWFUNDSGOVI 6113 1 0 6124 6077 19 13.1 6500 5280 359.1 0 0 6.8

NEWFUNDSILBI 6616 11 0.2 6616 6576 5 -0.3 6800 6302 59.4 0 0 2.6

NEWFUNDSMAPP 2264 8 0.4 2264 2263 0 18.7 10000 1001 40.8 0 0 1.5

NEWFUNDSNEWS 5490 30 0.5 5490 5490 0 15.3 5636 2001 42.2 0 0 1.2

NEWFUNDSS&P 3995 14 0.4 3995 3976 1 1 4095 3699 52.6 0 0 1.7

NEWFUNDSSHAR 301 4 1.3 301 299 0 2.7 420 255 46.3 0 0 1.4

NEWFUNDSSWIX 1858 7 0.4 1858 1853 0 22.7 1941 1416 18.5 0 0 0.6

NEWFUNDSTRAC 2322 0 0 2325 2318 51 6.9 2327 1664 118.8 0 0 5.8

NEWGOLD 11120 -16 -0.1 11120 11021 7 -9.5 13327 11021 9164.9 0 0 0

NEWGOLDISSUE 14918 -17 -0.1 14988 14884 9 -0.9 17677 14547 14916.8 0 0 0

NEWGOLDPLLDM 11489 182 1.6 11489 11304 0 15 14305 9607 1592.6 0 0 0

NPNSBQ 1 0 0 0 0 0 -96.4 30 1 1 0 0 0

NPNSBR 11 0 0 11 11 0 -64.5 31 9 11 0 0 0

NPNSBS 23 -1 -4.2 23 23 0 -20.7 47 17 24 0 0 0

SATRIX40PRTF 5244 27 0.5 5265 5230 436 17.9 5592 4391 8002.5 0 0 1

SATRIXDIVIPL 264 -2 -0.8 270 264 770 23.4 274 196 1724.7 0 0 1.8

SATRIXFINI 1861 -6 -0.3 1892 1857 158 21.3 1905 1341 883.8 0 0 3

SATRIXILBI 554 1 0.2 557 551 31 -1.6 644 394 22.2 0 0 2.9

SATRIXINDI 7873 56 0.7 7918 7852 34 18.6 8850 6551 2340.3 0 0 1

SATRIXMSCI 3265 40 1.2 3280 3250 27 -0.2 3974 3145 266.7 0 0 0

SATRIXMSCIEM 3685 7 0.2 3740 3685 54 2.5 4400 3336 377.8 0 0 0

SATRIXPRTFL 1963 19 1 1968 1938 13 -9.9 2593 1820 65.5 0 0 5.7

SATRIXQLTY 972 -11 -1.1 993 972 126 26.6 1086 763 94.7 0 0 0.1

SATRIXRAFI40 1452 16 1.1 1463 1446 94 18.7 1502 1171 991.9 0 0 1.1

SATRIXRESI 3630 -11 -0.3 3650 3609 35 13.6 4072 2985 309 0 0 2.6

SATRIXS&P500 3130 20 0.6 3164 3111 28 1.5 3850 3001 192 0 0 0

SATRIXSWIXTO 1204 6 0.5 1214 1201 924 20 1344 990 514.2 0 0 1.1

SBKSBS 9 0 0 9 9 0 -60.9 28 9 9 0 0 0

SGLSBQ 40 2 5.3 40 40 0 14.3 49 16 38 0 0 0

SOLSBW 7 0 0 7 7 0 -76.7 32 6 7 0 0 0

SOLSBX 14 -1 -6.7 14 14 0 -56.3 33 11 15 0 0 0

SOLSBY 28 -1 -3.4 28 28 0 -3.4 39 21 29 0 0 0

STANLIB 5860 113 2 5866 5799 15 -9.5 7748 5536 101.5 0 0 7.7

STANLIBS&P50 15700 185 1.2 15700 15700 0 0 15977 15300 0 0 0 0

STANLIBSWIX4 1206 9 0.8 1217 1202 61 20.5 1410 958 2143.7 0 0 1.2

STANLIBTOP40 5229 26 0.5 5252 5229 0 17.6 5895 4311 718.4 0 0 1.3

SYGNIAITRIX 2039 31 1.5 2047 2001 16 -8.6 2320 1917 209.5 0 0 0

SYGNIAITRIXG 2997 37 1.3 3001 2997 1 -18.2 3898 2775 276.3 0 0 0.4

SYGNIAITRIXS 3330 40 1.2 3339 3323 2 -6.2 3838 3203 810.7 0 0 0.2

SYGNIAITRIXT 5241 25 0.5 5241 5241 0 -1.9 5527 4882 208.7 0 0 0

TOPSBW 4 0 0 0 0 0 -88.6 39 1 4 0 0 0

TOPSBX 20 -2 -9.1 20 20 0 -44.4 52 12 22 0 0 0

TOPSBY 45 -2 -4.3 45 43 1972 7.1 90 26 47 0 0 0

TOPSKQ 748 -37 -4.7 748 720 2 80.2 1419 160 785 0 0 0

TOPSKR 930 -37 -3.8 930 930 0 58.2 1520 333 967 0 0 0

TOPSKS 578 -37 -6 578 551 12 0 919 551 615 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

ABSA 69001 1 0 70000 69001 1 -13.1 82500 64001 3411.9 34.9 0 10.5

AECI5,5% 1400 0 0 0 0 0 -21.3 1775 1300 42 0 0 7.1

AFRICANOVER 1052 0 0 0 0 0 -24.9 1500 1050 2.9 0 0 1.1

AFRICANPHNX 2500 0 0 0 0 0 -28.9 3710 2200 338.1 0 0 0

BARWORLD6%PR 121 0 0 0 0 0 -7.6 137 121 0.5 0 0 9.9

CAPITEC-P 8360 0 0 0 0 0 -11.1 9750 7700 104.5 0 0 10.3

CAXTON-P 19000 0 0 0 0 0 0 19000 19000 9.5 0 0 3

CULLINAN 107 0 0 0 0 0 -0.9 112 107 0.5 0 0 10.3

DISC-B-P 8000 -378 -4.5 8000 8000 2 -19.2 10200 7690 670.2 0 0 13

FIRSTRANDB-P 7100 39 0.6 7100 7055 38 -13.9 8300 6750 3177.5 0 0 11

FOSCHINI 124 0 0 0 0 0 -27.1 170 124 0.2 0 0 10.5

GRINDRODPREF 7375 135 1.9 7375 7375 4 -4.8 7821 6499 535.8 0 0 12.4

IBRDMBLPRF1 101179 117 0.1 101179 101179 0 1 101960 100094 345.3 0 0 4.5

ILRDMBLPRF2 100655 0 0 0 0 0 -0.4 102054 100326 214.3 0 0 5.8

IMPERIALPREF 7250 -25 -0.3 7250 7200 8 -7.1 7905 6800 330.3 0 0 11.8

INVESTEC 7210 -90 -1.2 7300 7210 4 -16.2 8950 6900 1127.7 0 0 12.1

INVESTECPREF 8700 0 0 0 0 0 -5.8 11100 7900 239.6 0 0 2.6

INVICTA-P 8400 100 1.2 8400 8400 1 -12 9925 8020 622.5 0 0 13.7

LIBERTY11C 108 0 0 0 0 0 -1.8 150 101 16.2 0 0 10.2

NAMPAK6%PREF 125 0 0 0 0 0 -28.2 174 125 0.5 0 0 9.6

NAMPAK6,5%PR 111 0 0 0 0 0 -26 150 111 0.1 0 0 11.7

NEDBANKPREF 860 -10 -1.1 866 860 98 -7.5 960 810 3117 0 0 10.1

NETCAREPREF 6800 0 0 6800 6800 4 -23.6 9050 6500 442 0 0 12.7

PSGSERV 7200 50 0.7 7200 7100 30 -9.8 8230 6400 1245.2 0 0 12

RECMANDCLBR 1951 0 0 0 0 2 -24.1 2570 1900 924.8 0 0 0

REXTRFRM 200 0 0 0 0 0 31.6 200 100 0.3 0 0 6

SASFIN-P 7120 0 0 0 0 0 -11 8200 7112 128 0 0 12.2

STANDARD-P 7751 31 0.4 7760 7700 21 -9.9 8700 7202 4090.2 0 0 10.4

STD 74 0 0 0 0 0 -9.8 86 70 5.9 0 0 8.8

STEINHOFF-P 4401 0 0 0 0 0 -44.5 8100 1750 660.2 0 0 19.7

ZAMBEZIRF 5867 0 0 5900 5867 13 11.8 6425 5165 9381.7 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

DBRMIH 1821 -34 -1.8 1821 1821 0 -8.5 2221 1735 371 0 0 0

DBSTBNPM 58237 -5029 -7.9 58237 58237 0 0 63266 34620 6326.6 0 0 0

DBSTBNPN 108911 -6678 -5.8 108911 108911 0 0 115589 1 11558.9 0 0 0

DBSTBNPR 59527 0 0 59527 59527 0 0 60967 32600 6096.7 0 0 0

INVLTD 1110745 291 0 1110745 1110745 0 18.2 1131404 9962 12.2 0 0 0

UBNPNO 109939 2564 2.4 109939 109939 3 0 109939 10179 1073.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 5663 263 4.9 5663 5400 0 21.1 5900 3700 1395.5 0 0 0

DBMSCIAFETN 11709 46 0.4 11709 11709 0 16.9 12250 8018 2332.6 0 0 0

DBMSCICHETN 7339 120 1.7 7400 7250 2 33.3 41275 5300 1443.8 0 0 0

DBMSCIEMETN 6203 72 1.2 6203 6203 0 19.3 47325 4237 1226.2 0 0 0

FRKBONDGOLD 1653000 -2100 -0.1 1653000 1653000 0 0.7 1942200 1611900 2310.9 0 0 0

FRSFRPT9JUN1 116150 -150 -0.1 116150 116150 0 -8.1 138800 116150 855.6 0 0 0

GOLDCMMDTY-L 17314 -22 -0.1 17314 17314 0 -1.5 20534 16911 173.4 0 0 0

IBLUSDZAROCT 119536 356 0.3 119536 119536 0 -8.9 145570 116000 417.1 0 0 1

IBSWX40TR2ET 19518 142 0.7 19518 19518 0 3.8 20256 1 968.8 0 0 0

IBTOP40CLIQU 127971 1255 1 127971 127971 0 9.9 130581 110223 1.3 0 0 0

IBTOP40TR2ET 7422 35 0.5 7422 7422 0 0.9 7819 1 941.8 0 0 0

IBVR1ETN 124820 248 0.2 124820 124820 1 6.9 124820 116700 2074.1 0 0 0

NEWWAVEETN 11202 -6 -0.1 11202 11202 0 -9.4 13515 10267 23.3 0 0 0

NEWWAVEEUROE 1473 1 0.1 1473 1473 0 6.6 1706 1336 47.9 0 0 0

NEWWAVEGBPET 1654 4 0.2 1654 1654 0 3.8 1911 1544 152.8 0 0 0.1

NEWWAVESLVET 194 1 0.5 194 194 0 -12.6 251 185 21.1 0 0 0

NEWWAVEUSDET 1190 4 0.3 1197 1187 74 -9.1 1460 1160 514 0 0 1

PALADIUMCOMM 31850 448 1.4 31850 31850 0 17.2 39554 26101 157 0 0 0

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Вам также может понравиться

- Shoprite Food Index 2023Документ19 страницShoprite Food Index 2023Tiso Blackstar GroupОценок пока нет

- Ramaphosa's Letter To MkhwebaneДокумент1 страницаRamaphosa's Letter To MkhwebaneTiso Blackstar GroupОценок пока нет

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Документ2 страницыArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupОценок пока нет

- Anti Corruption Working GuideДокумент44 страницыAnti Corruption Working GuideTiso Blackstar GroupОценок пока нет

- Ramaphosa's Letter To MkhwebaneДокумент1 страницаRamaphosa's Letter To MkhwebaneTiso Blackstar GroupОценок пока нет

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Документ2 страницыLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupОценок пока нет

- Collective InsightДокумент10 страницCollective InsightTiso Blackstar GroupОценок пока нет

- Open Letter To President Ramaphosa - FinalДокумент3 страницыOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupОценок пока нет

- Statement From The SA Tourism BoardДокумент1 страницаStatement From The SA Tourism BoardTiso Blackstar GroupОценок пока нет

- Ramaphosa's Letter To MkhwebaneДокумент1 страницаRamaphosa's Letter To MkhwebaneTiso Blackstar GroupОценок пока нет

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Документ2 страницыLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupОценок пока нет

- JP Verster's Letter To African PhoenixДокумент2 страницыJP Verster's Letter To African PhoenixTiso Blackstar GroupОценок пока нет

- Sanlam Stratus Funds - June 1 2021Документ2 страницыSanlam Stratus Funds - June 1 2021Lisle Daverin BlythОценок пока нет

- FairbairnДокумент2 страницыFairbairnTiso Blackstar GroupОценок пока нет

- BondsДокумент3 страницыBondsTiso Blackstar GroupОценок пока нет

- JudgmentДокумент30 страницJudgmentTiso Blackstar GroupОценок пока нет

- Tobacco Bill - Cabinet Approved VersionДокумент41 страницаTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupОценок пока нет

- LibertyДокумент1 страницаLibertyTiso Blackstar GroupОценок пока нет

- Collective Insight September 2022Документ14 страницCollective Insight September 2022Tiso Blackstar GroupОценок пока нет

- BondsДокумент3 страницыBondsTiso Blackstar GroupОценок пока нет

- The ANC's New InfluencersДокумент1 страницаThe ANC's New InfluencersTiso Blackstar GroupОценок пока нет

- Critical Skills List - Government GazetteДокумент24 страницыCritical Skills List - Government GazetteTiso Blackstar GroupОценок пока нет

- Forward Rates - June 30 2022Документ2 страницыForward Rates - June 30 2022Tiso Blackstar GroupОценок пока нет

- Forward Rates - June 28 2022Документ2 страницыForward Rates - June 28 2022Tiso Blackstar GroupОценок пока нет

- Fuel Prices - June 30 2022Документ1 страницаFuel Prices - June 30 2022Tiso Blackstar GroupОценок пока нет

- Forward Rates - June 29 2022Документ2 страницыForward Rates - June 29 2022Tiso Blackstar GroupОценок пока нет

- Fuel Prices - June 28 2022Документ1 страницаFuel Prices - June 28 2022Tiso Blackstar GroupОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- MAC2601-OCT NOV 2013eДокумент11 страницMAC2601-OCT NOV 2013eDINEO PRUDENCE NONGОценок пока нет

- Topic 10 - Practice ProblemsДокумент2 страницыTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanОценок пока нет

- Big WajibДокумент16 страницBig WajibYuliana FadhilОценок пока нет

- CARO 2020 PresentationДокумент47 страницCARO 2020 PresentationMuralidharan SОценок пока нет

- Module 4Документ3 страницыModule 4Robin Mar AcobОценок пока нет

- BP, Reliance in $7.2 BN Oil Deal: Market ResponseДокумент22 страницыBP, Reliance in $7.2 BN Oil Deal: Market ResponseAnkit PareekОценок пока нет

- Final Presentationon SharekhanДокумент15 страницFinal Presentationon SharekhanRajat SharmaОценок пока нет

- Topics Covered: Does Debt Policy Matter ?Документ11 страницTopics Covered: Does Debt Policy Matter ?Tam DoОценок пока нет

- Books of Prime Entry: The Cash BookДокумент11 страницBooks of Prime Entry: The Cash Bookأحمد عبد الحميدОценок пока нет

- Sworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioДокумент1 страницаSworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioBryan WilleyОценок пока нет

- Learnings From DJ SirДокумент94 страницыLearnings From DJ SirHare KrishnaОценок пока нет

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesДокумент16 страницFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweОценок пока нет

- Evidence of FundsДокумент3 страницыEvidence of FundsMIrfanFananiОценок пока нет

- Lilac Flour Mills - FinalДокумент9 страницLilac Flour Mills - Finalrahulchohan2108Оценок пока нет

- 150.events After The Reporting PeriodДокумент6 страниц150.events After The Reporting PeriodMelanie SamsonaОценок пока нет

- Arielle Martin - IRS LetterДокумент2 страницыArielle Martin - IRS LetterArielle MartinОценок пока нет

- Yaba, Brixzel's AssignmentДокумент4 страницыYaba, Brixzel's AssignmentYaba Brixzel F.Оценок пока нет

- SME Products: Baroda Vidyasthali LoanДокумент17 страницSME Products: Baroda Vidyasthali LoanRavi RanjanОценок пока нет

- 03 Understanding Income Statements 2Документ36 страниц03 Understanding Income Statements 2Roy GSОценок пока нет

- Group Assignment FIN533 - Group 4Документ22 страницыGroup Assignment FIN533 - Group 4Muhammad Atiq100% (1)

- Motion of Appeal by Aurelius CapitalДокумент329 страницMotion of Appeal by Aurelius CapitalDealBook100% (1)

- Senate Hearing, 109TH Congress - Unobligated Balances: Freeing Up Funds, Setting Priorities and Untying Agency HandsДокумент63 страницыSenate Hearing, 109TH Congress - Unobligated Balances: Freeing Up Funds, Setting Priorities and Untying Agency HandsScribd Government DocsОценок пока нет

- Axis Focused 25 FundДокумент1 страницаAxis Focused 25 FundYogi173Оценок пока нет

- MainMenuEnglishLevel-3 RLD2014016Документ291 страницаMainMenuEnglishLevel-3 RLD2014016Asif RafiОценок пока нет

- Profit Maximization Vs Value MaximizationДокумент2 страницыProfit Maximization Vs Value MaximizationNicklas Garștea100% (4)

- Stock Portfolio Tracker (Blueprint)Документ76 страницStock Portfolio Tracker (Blueprint)DansОценок пока нет

- City Laundry: Chart of Account Assets LiabilitiesДокумент6 страницCity Laundry: Chart of Account Assets LiabilitiesGina Calling DanaoОценок пока нет

- Globalizing The Cost of Capital and Capital Budgeting at AESДокумент33 страницыGlobalizing The Cost of Capital and Capital Budgeting at AESK Ramesh100% (1)

- Deed of Conditional Sale-1Документ3 страницыDeed of Conditional Sale-1Prince Rayner Robles100% (1)

- CH 16Документ28 страницCH 16Michelle LindsayОценок пока нет