Академический Документы

Профессиональный Документы

Культура Документы

File

Загружено:

Ortiz MansАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

File

Загружено:

Ortiz MansАвторское право:

Доступные форматы

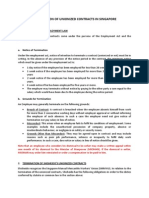

2017 NOTICE OF PROPOSED PROPERTY TAXES AND PROPOSED OR ADOPTED NON-AD VALOREM ASSESSMENTS

Full Parcel ID: 08-43-45-08-10-012-0040 The taxing authorities which levy taxes against your property will soon hold PUBLIC

Legal Description: DO NOT PAY HEARINGS to adopt budgets and tax rates for the next year. The purpose of these

BOYNTON LAKES PL 6 LT 4 BLK 12 PUBLIC HEARINGS is to receive opinions from the general public and to answer

THIS IS NOT questions on the proposed tax change and budget PRIOR TO TAKING FINAL ACTION.

A BILL Each taxing authority may AMEND or ALTER its proposals at the hearing.

COLUMN 1 COLUMN 2 COLUMN 3

Taxing Authority Your Property Taxes Last Year Your Taxes This Year Your Taxes This Year A public hearing on the proposed

*Dependent Special Districts If proposed budget change is made if no budget change is made taxes and budget will be held at

Taxable Value Millage Rate Tax Amount Taxable Value Millage Rate Tax Amount Taxable Value Millage Rate Tax Amount

the locations and dates below

COUNTY

County Operating 46,976 4.7815 224.62 49,012 4.7815 234.35 49,012 4.5421 222.62 9/05 6:00 PM (561) 355-3996

County Debt 46,976 .1327 6.23 49,012 .1208 5.92 49,012 .1208 5.92 301 N Olive Ave 6th Fl WPB 33401

PUBLIC SCHOOLS

By State Law 71,976 4.5720 329.07 74,012 4.2710 316.11 74,012 4.3485 321.84 9/06 5:05 PM (561) 434-8837

By Local Board 71,976 2.4980 179.80 74,012 2.4980 184.88 74,012 2.3759 175.85 3300 Forest Hill Blvd WPB 33406

MUNICIPALITY

Boynton Beach Operating 46,976 7.9000 371.11 49,012 7.9000 387.19 49,012 7.4224 363.79 9/07 6:30 PM (561)742-6310

100 E Boyntn Bch Blv BoyntnBch33435

INDEPENDENT SPECIAL DISTRICTS

So. Fla. Water Mgmt. Basin 46,976 .1477 6.94 49,012 .1384 6.78 49,012 .1384 6.78 9/14 5:15 PM (561) 686-8800

So. Fla. Water Mgmt. Dist. 46,976 .1359 6.38 49,012 .1275 6.25 49,012 .1275 6.25 3301 Gun Club Rd WPB 33406

Everglades Construction 46,976 .0471 2.21 49,012 .0441 2.16 49,012 .0441 2.16

Fl. Inland Navigation District 46,976 .0320 1.50 49,012 .0320 1.57 49,012 .0300 1.47 9/07 5:30 PM (561) 627-3386

190 E 13th St Riviera Bch FL 33404

Children's Services Council 46,976 .6833 32.10 49,012 .6590 32.30 49,012 .6464 31.68 9/14 5:01 PM (561) 740-7000

2300 High Ridge Rd ByntnBch 33426

Health Care District 46,976 .8993 42.25 49,012 .8508 41.70 49,012 .8508 41.70 9/13 5:15 PM (561) 659-1270

2601 10th Ave N Palm Springs 33461

Total Millage Rate & Tax Amount 21.8295 1,202.21 21.4231 1,219.21 20.6469 1,180.06 SEE REVERSE SIDE FOR EXPLANATION

NON-AD VALOREM ASSESSMENT

LEVYING AUTHORITY PURPOSE OF ASSESSMENT UNITS RATE ASSESSMENT CONTACT INFO.

LAKE WORTH DRAINAGE DISTRICT FLOOD PROTECTION/WATER SUPPLY 1 48.00 48.00 (561) 819-5479

BOYNTON BEACH FIRE RESCUE ASSESSMENT FIRE OPERATIONS 1 120.00 120.00 (561) 742-6312

SOLID WASTE AUTHORITY OF PBC GARBAGE SERVICES 1 174.00 174.00 (561) 697-2700

Total Non-Ad Valorem Assessment 342.00

Your final tax bill may contain non-ad valorem assessments which may not be reflected on this notice such as assessments for roads, fire, garbage,

lighting, drainage, water, sewer, or other governmental service and facilities which may be levied by your county, city, or any special district.

VALUE INFORMATION

Last Year ( 2016 ) This Year ( 2017 ) Market (also called "Just") value is the most probable

Market sale price for your property in a competitive, open

If you feel that the market value of your property is inaccurate

or does not reflect fair market value, or you are entitled to an Value 145,126 170,126 market on Jan. 1, 2017. It is based on a willing

buyer and a willing seller.

exemption or classification that is not reflected above, contact

your County Property Appraiser at the numbers listed on the Taxing Authority Assessed Value Exemptions Taxable Value

reverse side of this page. Last Year This Year Last Year This Year Last Year This Year

County Operating 96,976 99,012 50,000 50,000 46,976 49,012

If the Property Appraiser's office is unable to resolve the matter County Debt 96,976 99,012 50,000 50,000 46,976 49,012

as to market value, classification, or an exemption, you may file Public Schools 96,976 99,012 25,000 25,000 71,976 74,012

a petition for adjustment with the Value Adjustment Board. Municipality Operating 96,976 99,012 50,000 50,000 46,976 49,012

Petition forms are available from the County Property Appraiser's Independent Special Dists 96,976 99,012 50,000 50,000 46,976 49,012

office. Your petition must be filed with the Clerk of Value

Adjustment Board on or before: 5:00 PM September 15, 2017

at 301 N Olive Ave, West Palm Beach, FL 33401.

Assessed Value is the Exemptions are specific Taxable Value is the value

market value minus dollar or percentage used to calculate the tax

any assessment amounts that reduce due on your property

reductions. your assessed value. (Assessed Value minus

Exemptions).

Assessment Reductions Applies To Value

Save our Homes Assessment Cap- 2.1 percent in 2017 All Taxing Authorities 71,114

2017 NOTICE OF PROPOSED PROPERTY TAXES

NON-AD VALOREM ASSESSMENTS

Properties can receive an assessment reduction for a number of reasons including the Save our Homes Benefit and the 10%

AND PROPOSED OR ADOPTED

non-homestead property assessment limitation.

08-43-45-08-10-012-0040 08983 HOMESTEAD

Exemptions Applied Applies To Exempt Value

Homestead All Taxing Authorities 25,000

BOYNTON BEACH FL 33426-7631

Additional Homestead Non-School Taxing Authorities 25,000

CUADRA LEONOR C &

LOPEZ EMILIO

7 RIPLEY WAY

Any exemption that impacts your property is listed in this section along with its corresponding exempt value. Specific dollar or

percentage reductions in assessed value may be applicable to a property based upon certain qualifications of the property or

property owner. In some cases, an exemption's value may vary depending on the taxing authority. The tax impact of an exempt

value may also vary for the same taxing authority, depending on the levy (i.e., operating millage vs debt service millage).

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Arrests and The Miranda RightsДокумент12 страницArrests and The Miranda RightsJohn Mark ParacadОценок пока нет

- Class Struggle in PakistanДокумент12 страницClass Struggle in PakistanAdaner UsmaniОценок пока нет

- Nature of Public PolicyДокумент8 страницNature of Public Policykimringine100% (1)

- Sample Motion Re House Arrest ApprovalДокумент6 страницSample Motion Re House Arrest ApprovalBen Kanani100% (1)

- Termination of Unionized Contracts in Singapore Caa 08012014 Time 1413pmДокумент5 страницTermination of Unionized Contracts in Singapore Caa 08012014 Time 1413pmgeraldtanjiaminОценок пока нет

- Compassionate Appnt - Not Below Under J.A. - JudgementДокумент6 страницCompassionate Appnt - Not Below Under J.A. - JudgementThowheedh Mahamoodh0% (1)

- People Vs AgacerДокумент3 страницыPeople Vs Agacermorriss hadsam50% (2)

- MOA For OJTДокумент2 страницыMOA For OJTJp Isles MagcawasОценок пока нет

- Home Insurance v. American Steamship-A Bill of LadingДокумент2 страницыHome Insurance v. American Steamship-A Bill of LadingNikko Franchello SantosОценок пока нет

- Pakistan and Muslim WorldДокумент25 страницPakistan and Muslim WorldSyed Muhammad UkashaОценок пока нет

- Resolution No. 41-17 - Honorarium For Monitoring TeamДокумент1 страницаResolution No. 41-17 - Honorarium For Monitoring TeamBARANGAY MAMBALILIОценок пока нет

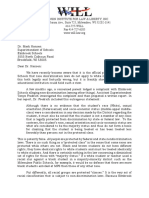

- WILL LetterДокумент3 страницыWILL LetterKendall TietzОценок пока нет

- Code of Conduct: Simple Living Encompasses A Number of Different Voluntary Practices ToДокумент3 страницыCode of Conduct: Simple Living Encompasses A Number of Different Voluntary Practices ToVai MercadoОценок пока нет

- Fujiki Vs Marinay 700 SCRA 69Документ20 страницFujiki Vs Marinay 700 SCRA 69RaymondОценок пока нет

- The Boston Tea Party Brewing Revolution in Colonial AmericaДокумент2 страницыThe Boston Tea Party Brewing Revolution in Colonial AmericaCsacsiОценок пока нет

- Ann TicknerДокумент280 страницAnn TicknerAgata SzymanskaОценок пока нет

- Aquino vs. MangaoangДокумент1 страницаAquino vs. MangaoangjerushabrainerdОценок пока нет

- The Independent 21 February 2016Документ60 страницThe Independent 21 February 2016artedlcОценок пока нет

- In The Court of District & Sessions Judge, Rajkot Bail Application No. 106 of 2019Документ4 страницыIn The Court of District & Sessions Judge, Rajkot Bail Application No. 106 of 2019Deep HiraniОценок пока нет

- Constitution of RomaniaДокумент8 страницConstitution of RomaniaFelixОценок пока нет

- Unctad and Wto: Two Multilateral Organisations Dealing With TradeДокумент9 страницUnctad and Wto: Two Multilateral Organisations Dealing With TradeSigy VargheseОценок пока нет

- 2020 Ok CR 5Документ13 страниц2020 Ok CR 5Dillon JamesОценок пока нет

- Social Welfare Project/Program Development and ManagementДокумент14 страницSocial Welfare Project/Program Development and ManagementJudy Andor0% (1)

- Anti Torture LawДокумент16 страницAnti Torture Lawiana_fajardo100% (1)

- Irving Kristol - On The Political Stupidity of The Jews (1999) - AzureДокумент4 страницыIrving Kristol - On The Political Stupidity of The Jews (1999) - Azureplouise37Оценок пока нет

- Justice For Children DetentionДокумент106 страницJustice For Children DetentionSalvador C. VilchesОценок пока нет

- Daily Nation 27.05.2014Документ80 страницDaily Nation 27.05.2014Zachary MonroeОценок пока нет

- Voluntary Retirement SchemeДокумент3 страницыVoluntary Retirement SchemeJinesh ThakkerОценок пока нет

- Notice: All Parties Were Duly Notified: Calendar of Cases 28 May 2019Документ3 страницыNotice: All Parties Were Duly Notified: Calendar of Cases 28 May 2019Ronald Caringal CusiОценок пока нет

- 26 JanДокумент2 страницы26 JanAndrea StavrouОценок пока нет