Академический Документы

Профессиональный Документы

Культура Документы

Annie

Загружено:

Sabreena ShahzadАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Annie

Загружено:

Sabreena ShahzadАвторское право:

Доступные форматы

Ahmad Shakeel Babar

Second Secretary (BTB)

FBR-HQ, Inland Revenue

FBR House

Constitution Avenue

G-5, Islamabad

Dated: 28.02.2018

SUBJECT: Your Office Letter No. 1 (64) S S (BTB-II) 2018 dated 15.02.2018

Dear Sir,

I act for Mrs Qurat-ul-Ain Zaheed r/o House No. 117, Block F/1, Wapda Town Lahore,

whom I shall hereinafter refer to as ‘the Client’. I have been instructed by the Client to

respond to the captioned communication issued from your office.

I state as below:

1. Firstly, I desire to comment upon a little misunderstanding emerging from your

letter above-referred. You state that the Client has expressed her ‘inability’ to

file the return as required. I may clarify that this statement misrepresents the

Client’s contention. The Client in her Reply dated 02.02.2018 did not anywhere

state that she was ‘unable’ to file the return. What she expressed was that she

was not liable to file a return under the provisions of section 114, Income Tax

Ordinance 2001.

2. You have written in the captioned letter in para 2 that “I am directed to say that

the subject-mentioned notice was issued under section 114 (4) of the Income Tax

Ordinance 2001. The said section empowers the Commissioners Inland Revenue to

require any person regardless of his/her sources of income or residential status’. I

submit that this does not bring out the legal position correctly as shown below.

3. Section 114 (4) of the ITO, 2001 is reproduced in full as below:

(4) Subject to sub-section (5), the Commissioner may, by notice in writing,

require any person who, in the Commissioner‘s opinion, is required to file a

return of income under this section for a tax year or assessment year but

who has failed to do so, to furnish a return of income for that year within

thirty days from the date of service of such notice or such longer or shorter

period as may be specified in such notice or as the Commissioner may

allow.

From the above, it is clearly manifest that the Commissioner is empowered to

require any person to file the return only if that person is required to file a return of

income under this section i.e. section 114. The requirements to file a return in

respect of a person are mentioned in clause (1) of section 114. The Client’s case

may fall only under sub-clause (ab) of section 114 of the ITO 2001.

4. In respect of clause (ab) of clause (1) of section 114 of the ITO 2001, the facts of

my Client are as under

i. My Client is a school teacher since 2003. She has no other source of income.

Her total income is not liable to taxation under the provisions of the ITO

2001. Certificate of her current salary with break-up is enclosed herewith.

ii. The motor vehicle purchased by her was not above 1000 CC and was

purchased by her savings from the income received in shape of salary since

2003.

I hope that above satisfies your concerns. I request therefore that the notice

against the Client may very kindly be discharged.

Shehzad Haider

Advocate High Court

C/o

ABS & Co

Advocates & Corporate Counselors

9-Fane Road, Lahore

Enclosed: as above

Вам также может понравиться

- Srinagar HC Judgment-1Документ59 страницSrinagar HC Judgment-1Sabreena ShahzadОценок пока нет

- PBA's Reply I WP 4353-14, IHC DT 15-10-2-14Документ13 страницPBA's Reply I WP 4353-14, IHC DT 15-10-2-14Sabreena ShahzadОценок пока нет

- 1999 S C M R 1379Документ79 страниц1999 S C M R 1379Shehzad Haider100% (1)

- Opinion Consumer CourtДокумент1 страницаOpinion Consumer CourtSabreena ShahzadОценок пока нет

- 2012 P L C (C.S.) 290Документ28 страниц2012 P L C (C.S.) 290Sabreena ShahzadОценок пока нет

- P L D 1982 Supreme Court 367Документ149 страницP L D 1982 Supreme Court 367Shehzad HaiderОценок пока нет

- 2013 P L C (C.S.) 864Документ10 страниц2013 P L C (C.S.) 864Sabreena ShahzadОценок пока нет

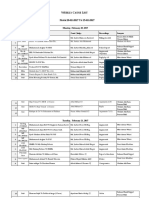

- Weekly Cause List 2016Документ6 страницWeekly Cause List 2016Sabreena ShahzadОценок пока нет

- LHC writ petition challenges Punjab SOEsДокумент7 страницLHC writ petition challenges Punjab SOEsSabreena ShahzadОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Judicial Review Compilation of Case DigestsДокумент8 страницJudicial Review Compilation of Case DigestsMiguel AlagОценок пока нет

- CPCДокумент31 страницаCPCLavinaОценок пока нет

- Jar-GRLDINE V.Документ6 страницJar-GRLDINE V.Danpatz GarciaОценок пока нет

- Glossary 3Документ1 страницаGlossary 3rudra8pandey.8shivamОценок пока нет

- Coca Cola Vs GomezДокумент2 страницыCoca Cola Vs Gomezyannie11Оценок пока нет

- Administrative Law NotesДокумент19 страницAdministrative Law Notesbanerjeedebayan0% (1)

- Donzell Jackson A023e3bae3ef1e4 1 2Документ16 страницDonzell Jackson A023e3bae3ef1e4 1 2DeAndre Bridges100% (1)

- J. Bersamin - Legal Ethics PDFДокумент46 страницJ. Bersamin - Legal Ethics PDFLeslie Javier BurgosОценок пока нет

- Supreme Court upholds conviction of man for illegal recruitment and estafaДокумент4 страницыSupreme Court upholds conviction of man for illegal recruitment and estafaKaiОценок пока нет

- Christopher Loliscio v. Glenn Goord, As Warden, Clinton Correctional Facility, 263 F.3d 178, 2d Cir. (2001)Документ23 страницыChristopher Loliscio v. Glenn Goord, As Warden, Clinton Correctional Facility, 263 F.3d 178, 2d Cir. (2001)Scribd Government DocsОценок пока нет

- PNB vs Davao Sunrise dispute over interest rates in loan agreementsДокумент51 страницаPNB vs Davao Sunrise dispute over interest rates in loan agreementsJaysonОценок пока нет

- Maquilan vs. Maquilan PDFДокумент14 страницMaquilan vs. Maquilan PDFKrissaОценок пока нет

- Nasureco V NLRC DigestДокумент2 страницыNasureco V NLRC DigestFidelis Victorino QuinagoranОценок пока нет

- Conciliation: About The Conciliation ProcessДокумент2 страницыConciliation: About The Conciliation ProcessSuleimanRajabuОценок пока нет

- Manangement and Profit Sharing Agreement SampleДокумент2 страницыManangement and Profit Sharing Agreement Sampledouglas100% (3)

- Qcourt: L/Epublic of TbeДокумент5 страницQcourt: L/Epublic of TbeTashi MarieОценок пока нет

- 6-G.R. No. 164108Документ6 страниц6-G.R. No. 164108Sugar ReeОценок пока нет

- Summer of A.Y. 2019-2020 Business Laws and Regulations by Dr. Daryl F. Quinco, CPA, MBA, LLB NotesДокумент15 страницSummer of A.Y. 2019-2020 Business Laws and Regulations by Dr. Daryl F. Quinco, CPA, MBA, LLB NotesJody BarceloОценок пока нет

- Mann v. Hutchinson, 10th Cir. (1999)Документ9 страницMann v. Hutchinson, 10th Cir. (1999)Scribd Government DocsОценок пока нет

- Drimal's Motion To Suppress WiretapsДокумент16 страницDrimal's Motion To Suppress WiretapsDealBookОценок пока нет

- VAKALATNAMAДокумент1 страницаVAKALATNAMABagri NitishОценок пока нет

- Federal Investigation Agency - ActДокумент10 страницFederal Investigation Agency - ActHasan BilalОценок пока нет

- Group 4 Final Case DigestДокумент17 страницGroup 4 Final Case DigestRewsEnОценок пока нет

- Cases Seri ConnollyДокумент9 страницCases Seri ConnollyIqram MeonОценок пока нет

- Parol Evidence Rule The Plain Meaning Rule and The Principles o PDFДокумент46 страницParol Evidence Rule The Plain Meaning Rule and The Principles o PDFDebina MitraОценок пока нет

- CA upholds conviction of man for selling shabuДокумент6 страницCA upholds conviction of man for selling shabuJomai siomaiОценок пока нет

- Trust DeedДокумент18 страницTrust Deedsivaganesh_7100% (2)

- LAPD Review of Categorical Use of Force PolicyДокумент28 страницLAPD Review of Categorical Use of Force PolicySouthern California Public RadioОценок пока нет

- Introduction To LawДокумент66 страницIntroduction To LawJanetGraceDalisayFabrero83% (6)

- Engineering Contracts Presentation B J VasavadaДокумент73 страницыEngineering Contracts Presentation B J VasavadabnkadiaОценок пока нет