Академический Документы

Профессиональный Документы

Культура Документы

Crop Loan

Загружено:

Ramana G0 оценок0% нашли этот документ полезным (0 голосов)

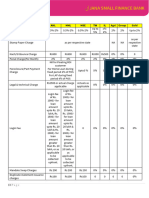

56 просмотров3 страницы1) The document discusses interest rates on various loans provided by Andhra Pradesh Grameena Vikas Bank, such as housing loans, personal loans, education loans, car loans, agriculture loans, and more.

2) Interest rates are revised for different loan segments, with most rates decreasing slightly.

3) Rates on loans like crop loans (up to Rs. 3 lacs), education loans (up to Rs. 2 lacs), and loans covered under CGTMSE (up to Rs. 1 lakh) see the largest decreases in interest.

Исходное описание:

Crop Loan

Оригинальное название

Crop loan

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1) The document discusses interest rates on various loans provided by Andhra Pradesh Grameena Vikas Bank, such as housing loans, personal loans, education loans, car loans, agriculture loans, and more.

2) Interest rates are revised for different loan segments, with most rates decreasing slightly.

3) Rates on loans like crop loans (up to Rs. 3 lacs), education loans (up to Rs. 2 lacs), and loans covered under CGTMSE (up to Rs. 1 lakh) see the largest decreases in interest.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

56 просмотров3 страницыCrop Loan

Загружено:

Ramana G1) The document discusses interest rates on various loans provided by Andhra Pradesh Grameena Vikas Bank, such as housing loans, personal loans, education loans, car loans, agriculture loans, and more.

2) Interest rates are revised for different loan segments, with most rates decreasing slightly.

3) Rates on loans like crop loans (up to Rs. 3 lacs), education loans (up to Rs. 2 lacs), and loans covered under CGTMSE (up to Rs. 1 lakh) see the largest decreases in interest.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

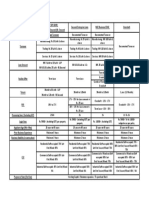

Agriculture Cash Credits (Crop loans)

Purpose Raising of various crops

All categories of farmers - Small/Marginal (SF/MF) and others including Tenant

Eligibility

farmers and Share Croppers who actually cultivate the lands

As per Scales of finance stipulated by the District Level Technical Committee,

Loan amount

depending on the crop.

ROI See Interest on loans and advances

Processing fee See Service charges

Security:

a) Upto Rs 50,000

Hypothecation of crops

b) Above Rs. 50,000 and upto

Rs. 1,00,000 i. Hypothecation of crops

ii. Mortgage of lands or Third party guarantee

c) Above Rs.1,00,000

i. Hypothecation of crops

ii. Mortgage of lands

d) For tobacco, Sugarcane and

other crops under ti-up

arrangement with boards/ i. Hypothecation of crops

factories/ companies ii. a. Hypothecation of crops

i. Upto Rs. 1 Lac b. Mortgage of lands

ii. Above one lac

a) Land records to ascertain cultivation rights.

Papers / Documents required b) Acreage under different crops

c) Sources of other borrowings e.g. Co-operative Societies and Banks.

LOANS & ADVANCES

Interest Rates on Loans & Advances

ANDHRA PRADESH GRAMEENA VIKAS BANK

HEAD OFFICE: :WARANGAL

REVISION OF INTEREST RATES ON ADVANCES

Segment Existing Revised

Rate rate

Bullet Payment 13.85% 13.85%

PGL

Over Draft (VikasSwarna) 14.25% 14.25%

Term Loan (Vikas Jewel) 13.75% 13.75%

Women 10.10% 9.80%

Housing Loans

Men 10.10% 9.85%

For Repairs and Upgradation (Maximum Rs 5 Lacs) 14.00% 12.00%

General Purpose Asset Backed Term Loans 14.00% 14.00%

Mortgage Loans

Overdraft Facility 14.25% 14.25%

Personal Loans to Employees With Check–off facility. 17.00% 14.50%

Without Check off facility. 17.00% 16.00%

Education Loans UptoRs 2 Lacs 12.00% 12.00%

Rs 2 Lacs to Rs 8 Lacs 13.00% 13.00%

Above Rs 8 lacs 14.00% 14.00%

Car Loans To Public 12.50% 12.00%

Cash Credit / Over Draft FacilityUptoRs 5 Lacs. 15.00% 13.50%

Cash Credit / Over Draft Facility Above Rs 5 Lacs. 15.00% 14.00%

ISB/SME Loans

Loans covered under CGTMSE up-to Rs 1 Lakh. 14.00% 12.00%

Term Loans UptoRs 5 lacs 14.00% 13.75%

Term Loans Above Rs 5 Lacs 15.00% 14.25%

General 14.00% 14.00%

NRLM O/s UptoRs. 3 lakh 7.00% 7.00%

SHGs

NRLM Above Rs.3 lakh 14.00% 14.00%

Through MACS/VOs 14.00% 14.00%

Crop Loans (Including KCC,RMGs, UptoRs 3 Lacs 7.00% 7.00%

JLGs, KouluRuthulu, ) (Disbursed

during the Subvention period)

Above Rs 3 Lacs 14.00% 14.00%

UptoRs 50000/- 13.00% 13.00%

Agrl. Term Loans and Allied Above Rs 50000/- 14.00% 14.00%

Agrl.Term Loans (including JLGs,

RMGs)

Clean Overdraft - 18.50% 18.50%

General Purpose credit cards (GCC) Maximum Limit Rs 25000/- 14.00% 14.00%

Solar Off-Grid - 11.00% 11.00%

Overdraft Facility to Land Lord Owners of our branch premises 13.50% 13.50%

Demand Loans. Loans against NSC/ KVP/LIC Policies etc., 15.00% 15.00%

Savings Bank cum OD account 14.00% 14.00%

Вам также может понравиться

- Marquez Vs Desierto DigestДокумент2 страницыMarquez Vs Desierto DigestKathleen CruzОценок пока нет

- Interest Rate: Head OfficeДокумент19 страницInterest Rate: Head Officeapi-19792705Оценок пока нет

- TD Bank StatementДокумент3 страницыTD Bank StatementdeepdokОценок пока нет

- TRAIN Vs CREATEДокумент6 страницTRAIN Vs CREATEleejongsukОценок пока нет

- Bard NoteДокумент20 страницBard NoteAmulya Kumar SahuОценок пока нет

- Credit Process Manual For Lending Against GoldДокумент28 страницCredit Process Manual For Lending Against GoldAmit SinghОценок пока нет

- Important Direct Debit Information - Action Required PDFДокумент2 страницыImportant Direct Debit Information - Action Required PDFAnnoОценок пока нет

- 02 Varun Nagar - Case HandoutДокумент2 страницы02 Varun Nagar - Case Handoutravi007kant100% (1)

- Principles of Accountancy MCQДокумент10 страницPrinciples of Accountancy MCQlindakutty50% (2)

- Bank Statement 1 Fusionn 1 PDFДокумент6 страницBank Statement 1 Fusionn 1 PDFBenny BerniceОценок пока нет

- Sanction Letter V2Документ3 страницыSanction Letter V2SRINIVASREDDY PIRAMALОценок пока нет

- Dumaguete Cathedral Credit Coop VS CirДокумент2 страницыDumaguete Cathedral Credit Coop VS CirJuris Formaran100% (2)

- House LoanДокумент4 страницыHouse LoanRamana GОценок пока нет

- SOC AssetsДокумент2 страницыSOC AssetsptsmithrafoundationОценок пока нет

- 6 Loan Products 2015: Co-Op. Societies Individuals Agriculture Agriculture Non Farm Sector Non FarmДокумент7 страниц6 Loan Products 2015: Co-Op. Societies Individuals Agriculture Agriculture Non Farm Sector Non FarmAbhishek ChoudharyОценок пока нет

- Afcott: Nigeria Limited Will Be Distributed To Deserving Farmers atДокумент6 страницAfcott: Nigeria Limited Will Be Distributed To Deserving Farmers atPolaganirajesh RajeshОценок пока нет

- TejbirДокумент1 страницаTejbirTejbir SinghОценок пока нет

- Projected Rates Dec 2022Документ6 страницProjected Rates Dec 2022Abeer KhanОценок пока нет

- Details of Rooftop Solar - Dec'20Документ3 страницыDetails of Rooftop Solar - Dec'20shahnawaz1709Оценок пока нет

- Retail Segment LoansДокумент2 страницыRetail Segment LoansKevin DsouzaОценок пока нет

- LoansДокумент5 страницLoansshamsherbaОценок пока нет

- SME LoanДокумент17 страницSME LoanrajОценок пока нет

- MSE Product One PagerДокумент1 страницаMSE Product One PagerVinod MОценок пока нет

- SBI Sanction Letter 2019-20-1Документ14 страницSBI Sanction Letter 2019-20-1s2amirthaОценок пока нет

- Applicable For Pcc/Ipcc May-2010/Nov-2010Документ17 страницApplicable For Pcc/Ipcc May-2010/Nov-2010Anshul AgarwalОценок пока нет

- Service Charges - Loans and Advances 14 NovДокумент21 страницаService Charges - Loans and Advances 14 Novsamuelbihari2012Оценок пока нет

- Information On Interest Rates and Sercice Charges As Per Rbi FormatДокумент1 страницаInformation On Interest Rates and Sercice Charges As Per Rbi Formatthiyagu_advОценок пока нет

- Banking OadsdДокумент85 страницBanking Oadsdkalis vijayОценок пока нет

- Interest Rates On Loans and AdvancesДокумент3 страницыInterest Rates On Loans and AdvancesBala RathnamОценок пока нет

- Fees and Charges W.E.F. 13th Dec, 2021Документ4 страницыFees and Charges W.E.F. 13th Dec, 2021Chandrashekar ReddyОценок пока нет

- Individual Car Loan Agreement SampleДокумент32 страницыIndividual Car Loan Agreement Sampleey019.aaОценок пока нет

- Housing Loan DetailsДокумент9 страницHousing Loan DetailsPandurangbaligaОценок пока нет

- Undergrad Review in Income TaxationДокумент17 страницUndergrad Review in Income TaxationJamesОценок пока нет

- Manorma Project ReportДокумент17 страницManorma Project Reportnaman rajОценок пока нет

- BAF Group-6Документ21 страницаBAF Group-6Amit Halder 2020-22Оценок пока нет

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFДокумент11 страницAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataОценок пока нет

- Charges 20131130Документ3 страницыCharges 20131130SssОценок пока нет

- Submitted By:-: (GROUP-5)Документ18 страницSubmitted By:-: (GROUP-5)Debendra Kumar NayakОценок пока нет

- Fees and Charges To DPДокумент2 страницыFees and Charges To DPMohd FarhanОценок пока нет

- Baroda Loan To DOCTORS PDFДокумент1 страницаBaroda Loan To DOCTORS PDFArun Ravindra Bharat BodankiОценок пока нет

- Chapter-4 RETAIL LENDING SCHEMES PDFДокумент64 страницыChapter-4 RETAIL LENDING SCHEMES PDFNanda KishoreОценок пока нет

- Zarai Taraqiati Bank Limited VisionДокумент4 страницыZarai Taraqiati Bank Limited VisionAhmad MalikОценок пока нет

- Indicative Profit Rates On Deposits Effective 1 April 2023: Savings AccountsДокумент5 страницIndicative Profit Rates On Deposits Effective 1 April 2023: Savings AccountsAtif QureshiОценок пока нет

- RBI Format ROI PCДокумент6 страницRBI Format ROI PCSandesh ManeОценок пока нет

- RetailServiceCharges Adv EnglishДокумент4 страницыRetailServiceCharges Adv EnglishYogesh PangareОценок пока нет

- Tax Rates 2009-10Документ2 страницыTax Rates 2009-10Mansoor AhmadОценок пока нет

- Govt. IncentivesДокумент19 страницGovt. IncentivesMANTRA COLLEGEОценок пока нет

- Fees and Charges CompensiveДокумент1 страницаFees and Charges CompensiveGSAINTSSAОценок пока нет

- Loan Guideline and DetailДокумент1 страницаLoan Guideline and DetailIbu SiddiqОценок пока нет

- MyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankДокумент1 страницаMyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankNikita GandotraОценок пока нет

- Commission Structure - May 2019Документ16 страницCommission Structure - May 2019Sabuj MollaОценок пока нет

- Stamp Duty Changes From 10.7.2023Документ2 страницыStamp Duty Changes From 10.7.2023Preetha ChelladuraiОценок пока нет

- Fees and Charges W.E.F. 17th Mar, 2021Документ3 страницыFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSEОценок пока нет

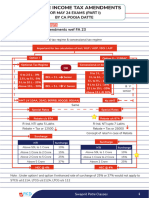

- IT Amendments For May 24 (Part 1) - 1Документ22 страницыIT Amendments For May 24 (Part 1) - 1Siddhi ShahОценок пока нет

- AdvancesДокумент174 страницыAdvancests pavanОценок пока нет

- Agriculture Nov 2021Документ49 страницAgriculture Nov 2021asingh2390Оценок пока нет

- Sources of Finance For New VentureДокумент8 страницSources of Finance For New VentureKiran KumarОценок пока нет

- KCC (PNB Kisan Credit Card Scheme) 261218Документ2 страницыKCC (PNB Kisan Credit Card Scheme) 261218Ramanpreet SinghОценок пока нет

- Bank AGRICULTUREДокумент23 страницыBank AGRICULTUREdecenttsunanditОценок пока нет

- Revsecuritisation SummitДокумент15 страницRevsecuritisation SummitaishwaryasamantaОценок пока нет

- Soc CFDДокумент6 страницSoc CFDindbatch2022Оценок пока нет

- Loanagainstproperty PDFДокумент4 страницыLoanagainstproperty PDFsameer ahmadОценок пока нет

- Revision of Interest Rate On Domestic, NRO and NRE Term DepositsДокумент2 страницыRevision of Interest Rate On Domestic, NRO and NRE Term DepositsTnaharОценок пока нет

- BOP Credit Card Sales Training Tool KitДокумент14 страницBOP Credit Card Sales Training Tool KitShivam KumarОценок пока нет

- BOP Credit Card Sales Training Tool Kit (7 Files Merged)Документ115 страницBOP Credit Card Sales Training Tool Kit (7 Files Merged)Shivam KumarОценок пока нет

- Annuity - Future Value (FV Function)Документ42 страницыAnnuity - Future Value (FV Function)Chirag GugnaniОценок пока нет

- BCom General Computer Applications Semester IIIДокумент10 страницBCom General Computer Applications Semester IIIRamana GОценок пока нет

- BCom Computer Applications I SemДокумент7 страницBCom Computer Applications I SemRamana GОценок пока нет

- BCom Computer Applications II SemДокумент8 страницBCom Computer Applications II SemRamana GОценок пока нет

- UG AttendДокумент1 страницаUG AttendRamana GОценок пока нет

- Singareni Collieries Company Ltd. Master of Business AdministrationДокумент11 страницSingareni Collieries Company Ltd. Master of Business AdministrationRamana GОценок пока нет

- Work Life BalanceДокумент69 страницWork Life BalanceRamana GОценок пока нет

- Chapter - IДокумент68 страницChapter - IRamana GОценок пока нет

- Dabur India Limited: Monthly Claim Summary - (MCS)Документ2 страницыDabur India Limited: Monthly Claim Summary - (MCS)Ramana GОценок пока нет

- Personal Loan: Why Avail A Personal Loan From HDFC Bank?Документ6 страницPersonal Loan: Why Avail A Personal Loan From HDFC Bank?Ramana GОценок пока нет

- Padmakshi IntroductionДокумент13 страницPadmakshi IntroductionRamana GОценок пока нет

- New Delhi - Updated: August 16, 2014 9:54 Am: Narendra ModiДокумент10 страницNew Delhi - Updated: August 16, 2014 9:54 Am: Narendra ModiRamana GОценок пока нет

- New Stockiest Appointment Check ListДокумент18 страницNew Stockiest Appointment Check ListRamana GОценок пока нет

- QPS SlabsДокумент16 страницQPS SlabsRamana GОценок пока нет

- Department of Commerce & Business Management: CertificateДокумент1 страницаDepartment of Commerce & Business Management: CertificateRamana GОценок пока нет

- Chapter - IДокумент5 страницChapter - IRamana GОценок пока нет

- Working Capital Kesoram FinanceДокумент56 страницWorking Capital Kesoram FinanceRamana GОценок пока нет

- Working Capital Management: AT NTPC Ltd. RamagundamДокумент4 страницыWorking Capital Management: AT NTPC Ltd. RamagundamRamana GОценок пока нет

- Tayota Company ProfileДокумент8 страницTayota Company ProfileRamana GОценок пока нет

- Rahul Ankushkar: Career ObjectiveДокумент2 страницыRahul Ankushkar: Career ObjectiveRamana GОценок пока нет

- Global Capital MarketДокумент42 страницыGlobal Capital MarketSunny MahirchandaniОценок пока нет

- Uan B.inggeris 1990-20088dДокумент211 страницUan B.inggeris 1990-20088dPhyan HyunОценок пока нет

- Front Office Cashier - PPTX QWДокумент16 страницFront Office Cashier - PPTX QWJen PequitОценок пока нет

- G.R. No. 159709Документ6 страницG.R. No. 159709Delsie FalculanОценок пока нет

- Module - 2: The Agricultural SectorДокумент47 страницModule - 2: The Agricultural SectormunmuntybbiОценок пока нет

- Digital CurrenciesДокумент4 страницыDigital CurrenciesMoksshОценок пока нет

- Lic Nir QuestionaireДокумент3 страницыLic Nir Questionaireneville79Оценок пока нет

- Basel 4Документ7 страницBasel 4Raj shekhar PandeyОценок пока нет

- Banking Careers Guide 09 2022Документ117 страницBanking Careers Guide 09 2022李深淼Оценок пока нет

- GRC RulesetДокумент6 страницGRC RulesetDAVIDОценок пока нет

- Statement 20190105044590Документ3 страницыStatement 20190105044590DanielОценок пока нет

- Fundamentals of Partnership FirmДокумент24 страницыFundamentals of Partnership FirmJyoti Sankar BairagiОценок пока нет

- Genbukan Canadian Tai Kai 2009Документ7 страницGenbukan Canadian Tai Kai 2009CESARОценок пока нет

- General Terms and ConditionsДокумент47 страницGeneral Terms and ConditionsCharmaine CorpuzОценок пока нет

- Assignm Ent No. 01: Management of Project Resources PRMG 020Документ8 страницAssignm Ent No. 01: Management of Project Resources PRMG 020tmnabilОценок пока нет

- Hindu Marriage Registration-User Manual For Online Citizen - Ver 1.0Документ10 страницHindu Marriage Registration-User Manual For Online Citizen - Ver 1.0Pudeti RaghusreenivasОценок пока нет

- Fema Add CHДокумент54 страницыFema Add CHMukesh DholakiaОценок пока нет

- Texas Senate Subcommitte Report - LendingДокумент53 страницыTexas Senate Subcommitte Report - LendingCalvin Glenn M.Оценок пока нет

- MIT43RMNHДокумент180 страницMIT43RMNHexecutive engineerОценок пока нет

- Detailed ICICI Bank Salary Accounts Offer - 4BДокумент4 страницыDetailed ICICI Bank Salary Accounts Offer - 4BsharmarahulhemantОценок пока нет

- Share MicrofinДокумент68 страницShare MicrofinMubeenОценок пока нет

- Analyze The Roles of International Payment in An Open EconomyДокумент22 страницыAnalyze The Roles of International Payment in An Open EconomyNgô Giang Anh ThưОценок пока нет