Академический Документы

Профессиональный Документы

Культура Документы

Enron

Загружено:

Monica Nones0 оценок0% нашли этот документ полезным (0 голосов)

4 просмотров3 страницыtake time to read

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документtake time to read

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

4 просмотров3 страницыEnron

Загружено:

Monica Nonestake time to read

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

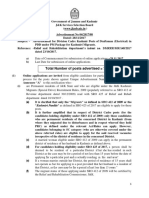

Background

Before its collapse, Enron marketed electricity and natural gas,

delivered energy and other physical commodities, and provided financial

and risk management services to customers around the world. Enron is

formed by the merger of Houston Natural Gas and Omaha – based InterNorth

on July 1985. Enron was once ranked the sixth-largest energy company in

the world. However, cracks began to appear in 2001. In August of that

year, Jeffrey Skilling, a driving force in Enron's revamp and the

company's CEO of six months, announced his departure, and Lay resumed

the post of CEO. In October 2001, Enron reported a loss of $618 million—

its first quarterly loss in four years. On Dec. 2, 2001, Enron filed for

bankruptcy protection in the biggest case of bankruptcy in the United

States up to that point. (WorldCom's collapse would later steal that

dubious honour.) Roughly 5,600 Enron employees subsequently lost their

jobs. And the findings was that the company falsified its financial

information to hide its bankruptcy and entice stockholder into still

investing them.

1. Why did Enron falsify its financial information?

- There are three factors that led Enron Company to its downfall

despite of being the largest energy company in the world. First

is being arrogant, then being unethical and lastly is being

aggressive. The firm only want to gain profit and they did not

think about their employees. They only want what is best for

them and push the employees to do it without compensating them

equal to their performance which pushes them to the edge. And

another is they are spinning off their asset without declaring

it to hide the real status of their company. So what is the

reason of falsifying their financial statement? Simply because,

they aimed to show that Enron was steadily growing and attract

investors to trust them. But in reality, Enron was making bad

investments and recognizing non-existent revenue. The schemes

hid the fact that the company’s cash flow was terrible and did

not deserve an investment-grade credit rating. Ultimately, the

manipulation of the financial statements helped Enron’s stock

price to grow from $30 per share in early 1998 to more than $80

per share in early 2001. Even when the stock price started to

fall, executives slowed the fall by continuing to manipulate the

financials. That led to its bankruptcy, because they can’t

justify their financial position during that time. And made them

decide to let the people know the truth about their status.

2. What is the impact of their action to the stockholder and the

general public?

- The Enron Scandal made a great impact that shook the world. And

the name Enron equals the term “fraud” up to these days. One of

the effects of this scandal is that, thousands lost their jobs

and their retirement funds. Investors lost millions. The effects

went beyond money. The trust of the investment community and the

public at large was violated. And also some companies were

affected by this scandal, because new accounting regulation was

created which is the Sarbanes – Oxeley that cost the public

millions of dollars. And external auditors were doubted, because

many people think that these auditors were neglecting their

responsibilities and duties.

3. What lesson could be learned from the downfall of Enron?

- The Enron Scandal would remain in the history forever and would

serve as a lesson to every company who are tempted to do

unethical things. It’s hard to believe there is a good thing

that can be gained from its downfall. But there is a saying that

tells that mistakes are part of learning and this became a

valuable by-product of the company’s downfall. People now

learned to check first the business status or background if the

business is legally operated and under the provision which

subject to the provision and registered with the appropriate

agency. With the implementation of the Sarbanes – Oxeley of

2002, companies have had an opportunity to re-evaluate their

processes and their controls over financial reporting. Companies

have been forced to improve the controls surrounding their

accounting systems, and certainly this helps make financial

information more reliable. Most importantly, the collapse of

Enron brought attention to the closely related issues of

financial statement fraud and fraud by executives. Good

corporate governance has become a priority for many companies,

and the focus on ethics and integrity in financial reporting has

helped increase investor confidence in some companies.

Business Policy

and Strategy

Enron Company

(TASK PERFORMANCE)

SUBMITTED BY:

ABAGAT, WINDRIEL M.

NONES, MONICA CHRISTIANNE M.

SUBMITTED TO:

MRS. TERESITA BASIÑO

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Security Agreement - Secured PartyДокумент7 страницSecurity Agreement - Secured PartyCo100% (33)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Internship Report On "Human Resource Managemet Practices of NCC Bank Ltd.Документ57 страницInternship Report On "Human Resource Managemet Practices of NCC Bank Ltd.Arefin RidwanОценок пока нет

- Chap 011 SolutionsДокумент8 страницChap 011 Solutionsarie_spp100% (1)

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Документ2 страницыQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelОценок пока нет

- Course Outline S1 2022Документ5 страницCourse Outline S1 2022Woon TNОценок пока нет

- 5.5 Manufacturing AccountsДокумент6 страниц5.5 Manufacturing AccountsZaynab ChowdhuryОценок пока нет

- Hyundai Pricelist CSDДокумент2 страницыHyundai Pricelist CSDNandish KumarОценок пока нет

- I.F.M.mba Que PaperДокумент3 страницыI.F.M.mba Que PaperbabadhirubabaОценок пока нет

- CH 1 FAcc I @2015Документ21 страницаCH 1 FAcc I @2015Gedion FeredeОценок пока нет

- Instant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF ScribdДокумент23 страницыInstant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF Scribdmarian.hillis984100% (38)

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Документ7 страницChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarОценок пока нет

- BUSINESS MATHEMATICS2nd QuarterДокумент1 страницаBUSINESS MATHEMATICS2nd QuarterLuz Gracia Oyao100% (1)

- Account Titles and Its ElementsДокумент3 страницыAccount Titles and Its ElementsJeb PampliegaОценок пока нет

- Container Market PDFДокумент3 страницыContainer Market PDFDhruv AgarwalОценок пока нет

- Comparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexДокумент21 страницаComparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexPlato KhisaОценок пока нет

- Cash Flow statement-AFMДокумент27 страницCash Flow statement-AFMRishad kОценок пока нет

- PRE TEST - Gen MathДокумент4 страницыPRE TEST - Gen MathJe CelОценок пока нет

- Draftsman (Electrical)Документ7 страницDraftsman (Electrical)suhail ahmadОценок пока нет

- Jurnal Tentang RibaДокумент15 страницJurnal Tentang RibaMuhammad AlfarabiОценок пока нет

- Employee Details Payment & Leave Details: Arrears Current AmountДокумент1 страницаEmployee Details Payment & Leave Details: Arrears Current AmountswapnilОценок пока нет

- Money MarketДокумент20 страницMoney Marketmanisha guptaОценок пока нет

- Value Based Questions in Economics Class XIIДокумент8 страницValue Based Questions in Economics Class XIIkkumar009Оценок пока нет

- Lesson 1 Definition of Finance Goals of The Financial ManagerДокумент14 страницLesson 1 Definition of Finance Goals of The Financial ManagerJames Deo CruzОценок пока нет

- 7th NFC Award 2010Документ4 страницы7th NFC Award 2010humayun313Оценок пока нет

- Module 2 HWДокумент5 страницModule 2 HWdrgОценок пока нет

- (C501) (Team Nexus) Assignment 1Документ14 страниц(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimОценок пока нет

- Lab 4Документ32 страницыLab 4M Aiman Syafiq0% (1)

- Research Report Pidilite Industries LTDДокумент7 страницResearch Report Pidilite Industries LTDAnirudh PatilОценок пока нет

- Problems - Share-Based PaymentsДокумент3 страницыProblems - Share-Based PaymentshukaОценок пока нет

- Ias 38 - TSVHДокумент37 страницIas 38 - TSVHHồ Đan ThụcОценок пока нет