Академический Документы

Профессиональный Документы

Культура Документы

Financial Management September 2010 Marks Plan ICAEW

Загружено:

Muhammad Ziaul HaqueАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Management September 2010 Marks Plan ICAEW

Загружено:

Muhammad Ziaul HaqueАвторское право:

Доступные форматы

Financial Management - Professional Stage - September 2010

PROFESSIONAL STAGE - FINANCIAL MANAGEMENT OT EXAMINER’S COMMENTS

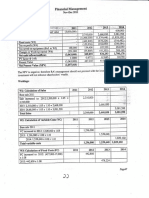

The following table summarises how well candidates answered each syllabus content area.

How well candidates answered each syllabus area

Syllabus area Number of questions Well answered Poorly answered*

1 8 8 0

2 3 2 1

3 4 4 0

Total 15 14 1

* If 40% or more of the candidates gave the correct answer, then the question was classified as “well answered”.

There was one question with a facility of less than 40%:

A company had to pay in euros for a delivery from an overseas supplier. The company expected the exchange rate

prevailing on the future payment date to be such as to make it indifferent between taking out a forward contract and

being exposed to the exchange rate risk. Candidates were given the forward exchange rate and the forward

exchange transaction cost. They were asked to calculate the expected spot rate on payment day. Most candidates

who answered the question incorrectly failed to take account of the transaction cost correctly.

© The Institute of Chartered Accountants in England and Wales 2010 Page 1 of 10

Financial Management - Professional Stage - September 2010

MARK PLAN AND EXAMINER’S COMMENTARY

The marking plan set out below was that used to mark this question. Markers were encouraged to use discretion

and to award partial marks where a point was either not explained fully or made by implication. In many cases,

more marks were available than could be awarded for each requirement. This allowed credit to be given for a

variety of valid points which were made by candidates.

QUESTION 1 Total marks: 29

General comments

This question had the second highest average mark on the paper and was mostly done well.

It tested the investment decisions element of the syllabus and was based on a manufacturing company’s

proposal to expand one product line whilst closing another.

In part (a) for 20 marks candidates were presented with a lot of information and from this they had to calculate

the NPV of the proposal. To do well they would have needed to demonstrate, inter alia, a good understanding

of relevant cash flows with regard to revenues, costs and the purchase and sale of machinery. Part (b) for

four marks required a calculation (with advice) of the impact on the NPV of a change in the estimated scrap

value of a machine. Part (c) was worth five marks and tested candidates’ understanding of Shareholder Value

Analysis (SVA) and how it could be applied to the company in the scenario.

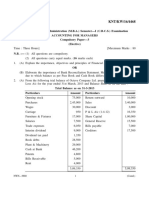

1(a)

Cease Domestic Tool (DT) production now

t0 t1 t2 t3

£ £ £ £

New machine (m/c) (4,200,000) 0

Tax on new m/c (W1) 235,200 188,160 150,528 602,112

Old m/c scrap 250,000

Old m/c tax saved (W2) 165,200

Old m/c foregone scrap (50,000)

Old m/c foregone tax (W3) (47,040) (37,632) (30,106) (106,422)

DT contribution foregone (W4) (1,566,000) (1,566,000) (1,566,000)

Boiler contribution gain (W5) 3,900,000 3,510,000 3,000,000

Fixed costs increase (W6) (200,000) (200,000) (200,000)

Tax on profit (597,520) (488,320) (345,520)

Working capital (W7) (1,600,000) 800,000 700,000 100,000

Total cash flows (5,196,640) 2,487,008 2,076,102 1,434,170

Discount 1.000 0.935 0.873 0.816

PV (5,196,640) 2,325,352 1,812,437 1,170,283

NPV 111,432

Marks were awarded for ignoring sales growth of bought-in tools

Positive NPV. Shareholder wealth increased. Therefore proceed with expansion.

© The Institute of Chartered Accountants in England and Wales 2010 Page 2 of 10

Financial Management - Professional Stage - September 2010

Alternative answer as two separate NPVs

Expand boilers

t0 t1 t2 t3

£ £ £ £

New machine (m/c) (4,200,000) 0

Tax on new m/c (W1) 235,200 188,160 150,528 602,112

Old m/c scrap 250,000

Old m/c tax saved (W2) 165,200

Boiler contribution (W5) 8,520,000 8,130,000 7,620,000

Fixed costs (W6) (2,100,000) (2,100,000) (2,100,000)

Tax on profit (1,797,600) (1,688,400) (1,545,600)

Working capital (W7) (4,700,000) 800,000 700,000 3,200,000

Total cash flows (8,249,600) 5,610,560 5,192,128 7,776,512

Discount 1.000 0.935 0.873 0.816

PV (8,249,600) 5,245,874 4,532,728 6,345,633

NPV 7,874,635

Don’t expand boilers

t0 t1 t2 t3

£ £ £ £

Old m/c scrap 50,000

Old m/c tax (W3) 47,040 37,632 30,106 106,422

DT contribution (W4) 1,566,000 1,566,000 1,566,000

Boiler contribution (W5) 4,620,000 4,620,000 4,620,000

Fixed costs (W6) (1,900,000) (1,900,000) (1,900,000)

Tax on profit (1,200,080) (1,200,080) (1,200,080)

Working capital (W7) (3,100,000) 3,100,000

Total cash flows (3,052,960) 3,123,552 3,116,026 6,342,342

Discount 1.000 0.935 0.873 0.816

PV (3,052,960) 2,920,521 2,720,291 5,175,351

NPV 7,763,203

Marks were awarded for ignoring sales growth of bought-in tools OR putting it into both NPVs

Positive NPV difference of £111,432. Shareholder wealth increased. Therefore proceed with expansion.

Workings

W1 t0 t1 t2 t3

£ £ £ £

WDV 4,200,000 3,360,000 2,688,000 2,150,400

WDA (840,000) (672,000) (537,600) (2,150,400)

WDV 3,360,000 2,688,000 2,150,400 0,000

Tax 235,200 188,160 150,528 602,112

W2 Sell now

WDV b/f 840,000

Current scrap value (250,000)

Balancing allowance (BA) 590,000

Tax saving on BA @28% 165,200

© The Institute of Chartered Accountants in England and Wales 2010 Page 3 of 10

Financial Management - Professional Stage - September 2010

t0 t1 t2 t3

£ £ £ £

W3 Sell Y3

WDV 840,000 672,000 537,600 430,080

WDA (168,000) (134,400) (107,520) (380,080)

WDV 672,000 537,600 430,080 50,000

Tax saving on WDA @ 28% 47,040 37,632 30,106 106,422

W4 DT sales 8,700,000

Contribution @ 18% 1,566,000

W5 Boiler sales now 16,500,000

Boiler contribution @ 28% 4,620,000

Boiler sales new 28,400,000 27,100,000 25,400,000

Boiler contribution @ 30% 8,520,000 8,130,000 7,620,000

Boiler increased contribution 3,900,000 3,510,000 3,000,000

W6 Fixed costs (700,000) (2,100,000) (2,100,000) (2,100,000)

(1,200,000)

Increase (200,000) (200,000) (200,000)

W7 Working Capital 900,000 4,700,000 3,900,000 3,200,000

2,200,000

Increase (1,600,000) 800,000 700,000

Part (a) was hard work with a lot of information to work through. However a well organised candidate (n.b.

poor layout let a lot of candidates down) with a good understanding of the basic investment appraisal

techniques will have scored high marks. Capital allowances were generally done well, but many candidates

failed to correctly calculate the balancing allowances available. Too many candidates included figures for

Industrial Bought-in Tools – there was no need to do so. A good number of candidates were unable to deal

correctly with the fixed costs and/or the working capital elements within the question.

Total possible marks 20

Maximum full marks 20

1(b)

Impact of scrap value of £500,000 £

Scrap value 500,000

Reduction in BA (500,000 x 28%) (140,000)

Net increase in cash flow (Y3) 360,000

PV of Y3 additional cash (£360,000 x 0.816) 293,760

Thus the NPV of the proposed scheme would increase by £293,760 and makes it more attractive.

This was generally done well and most candidates were able to deal correctly with the reduction in the

balancing allowance and the need to then discount the net increase in cash flow.

Total possible marks 4

Maximum full marks 4

© The Institute of Chartered Accountants in England and Wales 2010 Page 4 of 10

Financial Management - Professional Stage - September 2010

1(c)

Shareholder value analysis (SVA) concentrates on a company’s ability to generate value and thereby

increase shareholder wealth. SVA is based on the premise that the value of a business is equal to the sum of

the present values of all of its activities. SVA posits that a business has seven value drivers:

1. Life of projected cash flows

2. Sales growth rate

3. Operating profit margin

4. Corporate tax rate

5. Investment in non-current assets

6. Investment in working capital

7. Cost of capital

The value of the business is calculated from the cash flows generated by drivers 1-6 which are then

discounted at the company’s cost of capital (driver 7).

In the case of Britton, all of the seven SVA value drivers are relevant and are used in the calculation. Britton’s

(three year) strategy of expanding its boiler market will increase the value of the firm.

The theoretical aspects of SVA were generally well done, but too few candidates applied the concept of SVA

to the Britton scenario.

Total possible marks 6.5

Maximum full marks 5

© The Institute of Chartered Accountants in England and Wales 2010 Page 5 of 10

Financial Management - Professional Stage - September 2010

QUESTION 2 Total marks: 25

General comments

This question had the lowest average mark on the paper.

It tested candidates’ understanding of financing decisions and was divided into five sections, based around

extracts from fictional newspaper articles.

Part (a) was numerical (nine marks) and required candidates to calculate the impact of a rights issue on a

company’s earnings figure and a shareholder’s wealth. The proceeds of the rights issue were to be used to

reduce the company’s level of gearing (debentures). Part (b) for five marks required candidates to explain the

implications of financial gearing on the value of the company’s shares. Parts (c) and (d) were worth three

marks and four marks respectively and tested candidates’ understanding the rights of debenture holders in a

company in financial distress. Finally, in part (e) for four marks candidates were given the current after-tax cost

of redeemable debenture stock and asked to calculate its current cum-interest market price.

2(a)

(i) Shares (m) Market value (£) £m

Current situation 600 1.25 750

Rights issue 300 0.95 285

Ex rights 900 1.15 1,035

£m

Current total earnings £750m/9.6 78,125

plus: Interest saved on redeemed debenture stock 285m x 8% x 72% 16,416

New total earnings 94,541

New Earnings per Share (EPS) £94,541m/900m £0.105

Current Earnings per Share £1.25/9.6 £0.130

Decrease in EPS 19.2%

(ii) £

Current value of shareholding 7,000 x £1.25 8,750

Value of new shareholding 7,000 1.5 x £1.15 12,075

less: Cost of taking up the rights 3,500 x £0.95 (3,325)

8,750

Current share of earnings 7,000 x £0.13 £910

New share of earnings 10,500 x £0.105 £1,103

In this part most candidates were able to calculate the theoretical ex-rights price correctly (and its impact on

the shareholder’s wealth), but far too few adjusted the earnings figure to take account of the interest savings

made from the debenture redemption.

Total possible marks 9

Maximum full marks 9

© The Institute of Chartered Accountants in England and Wales 2010 Page 6 of 10

Financial Management - Professional Stage - September 2010

2(b)

(i) Reduced gearing will cut the financial risk. The impact of gearing is that there will be (a) regular interest

payments and (b) the need at some future date to repay the capital sum that has been borrowed. The

implication of the cut in gearing is that it is regarded as too high at the moment by Bettalot and beyond its

optimal level.

(ii) As gearing increases/decreases then financial risk does the same.

The traditional view and M&M 1963 allowing for market imperfections is that the cost of equity moves in

the same direction as the level of gearing. Thus by repaying some of its outstanding debt, Bettalot will cut

its cost of equity (reduced financial risk/financial distress) and as a result, all else being equal, its share

price would increase.

The M&M 1963 view suggests two opposing effects on the share price from a reduction in gearing – a fall

from a reduction in the tax shield on debt and a rise from a reduction in the cost of equity through lower

financial risk.

The answers to part (b) were reasonable, but too many candidates included a lot of theory without application

to the scenario, i.e. they considered the impact of an increase in gearing and not a reduction as per the

question.

Total possible marks 5

Maximum full marks 5

2(c)

With the companies in financial distress there is a real chance that they will default on interest payments

and/or the repayment of sums due on redemption. If they do default then if the debentures are secured then

assets could be sold which would put the companies’ future in doubt. Thus debenture holders would have far

greater influence/control over company policy than is the norm.

The answers to this part were in general disappointing and too few candidates were able to apply their

knowledge in a practical setting.

Total possible marks 3

Maximum full marks 3

2(d)

In a debt for equity swap lenders are given shares in the company in exchange for the cancellation of some

(or all) of their debt.

The alternative outcome for lenders (i.e. if no swap takes place) could be that they lose their money

altogether, as the company concerned in a swap will be suffering liquidity problems.

If the debt equity swap went ahead there would now be more shares in issue. The gearing level would fall and

any tax advantages of gearing would be lost. These two combined are likely to cause a fall in the share price.

More candidates did well in this part and were able to demonstrate an understanding of the workings of a

debt for equity swap.

Total possible marks 4

Maximum full marks 4

© The Institute of Chartered Accountants in England and Wales 2010 Page 7 of 10

Financial Management - Professional Stage - September 2010

2(e)

Year Cash Flow (£) 5% factor PV (£)

1-3 4.32 2.723 11.763

3 100 0.864 86.400

Total Present Value 98.163

The PV of the future cash flows is £98.163, which would be the ex interest price in Year 0.

Thus the cum interest price would be (£98.163 + £6) £104.163

Factors: market interest rates, tax rate, risk (linked to any security, amount of other debt).

Many candidates didn’t answer part (e) and of those that did most struggled to work backwards from a given

market rate of return to a current market price.

Total possible marks 4

Maximum full marks 4

© The Institute of Chartered Accountants in England and Wales 2010 Page 8 of 10

Financial Management - Professional Stage - September 2010

QUESTION 3 Total marks: 26

General comments

Most candidates scored well on this question and it had the highest average mark in the paper.

The question tested candidates’ understanding of managing financial risk and was divided into two main

sections – foreign exchange and an interest rate swap.

Part (a) was worth 15 marks and required candidates to calculate and discuss the potential benefits of

hedging (via a forward contract or a money market hedge) a large receipt of euros from a customer. In part

(b) for 11 marks candidates were given details of two companies’ loans – one at fixed rate, the other at

variable – and were asked to construct and comment on an interest rate swap that would benefit both parties.

3(a)(i)

Strengthening of sterling = 1.1084 x 1.01 = €1.1195/£

€3,500,000/1.1195 = £3,126,396

Weakening of sterling = 1.1084 x 0.99 = €1.0973/£

€3,500,000/1 0973 = £3,189,647

This was straightforward, but a disappointing number of candidates were unable to calculate a 1% increase

and then a 1% decrease in the value of sterling.

Total possible marks 3

Maximum full marks 3

3(a)(ii)

Forward contract Spot rate 1.1084

less: Premium (0.0040)

1.1044

Sterling receivable €3,500,000/1.1044 £3,169,142

Money market hedge Euro borrowing rate (3 months) 3.4%/4 = 0.85%

€3,500,000 x 1/1.0085 €3,470,501

At spot rate (€3,470,501/1.1084) £3,131,091

plus: Interest earned (sterling rate – 3.9%/4) £30,528

Total sterling receivable £3,161,619

This part was well answered and most candidates scored good marks.

Total possible marks 6

Maximum full marks 6

© The Institute of Chartered Accountants in England and Wales 2010 Page 9 of 10

Financial Management - Professional Stage - September 2010

3(a)(iii)

Spot rate gives a sterling value of £3,157,705 (€3,500,000/1.1084). Strengthening of sterling would reduce

receipt to £3,126,396, whilst weakening of sterling increases sterling receipt to £3,189,647. So it would be

preferable if sterling depreciated. Interest rates (and thus forward rate premium) suggest a weakening of

sterling in the three months ahead. The forward contract is preferable to the money market hedge (£7,523

higher). Management’s attitude to risk is important here. If sterling is expected to weaken then perhaps ignore

hedge and go with the spot rate. Alternatively as margins are low, the forward gives more security as the rate

of depreciation is not guaranteed.

Although many candidates produced good answers here, a lot scored poorly because their discussions of the

hedging possibilities were far too general and not sufficiently applied to the scenario.

Total possible marks 6

Maximum full marks 6

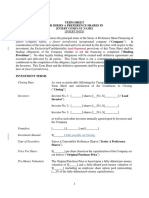

3(b)(i)

SWI HD Difference

Fixed 9.2% 10.8% 1.6%

Variable LIBOR + 1.0 LIBOR + 1.4 0.4%

Difference between differences 1.2%

This potential gain can be split evenly, i.e. 0.6% to each party, which means that SWI would pay LIBOR +

0.4% (LIBOR + [1.0% - 0.6%] and HD would pay fixed 10.2% (10.8% - 0.6%).

The interest rate swap would look like this:

SWI HD

Currently pays (9.2%) (LIBOR + 1.4)

HD pays SWI (bal fig) 8.8% (8.8)

SWI pays HD (LIBOR ) LIBOR

New net payment (LIBOR + 0.4) (10.2%)

SWI and HD would both pay at less (0.6% in each case) than their available fixed and variable rates.

New net interest rate (LIBOR + 0.4) 8.8% pa 10.2% pa

Interest on £24m pa £2,112k £2,448k

Alternatively

£’000 Rate £’000 £’000 Rate £’000

Interest paid now 24,000 (9.2%) (2,208) 24,000 (9.8%) (2,352)

HD pays SWI 8.8% 2,112 (8.8%) (2,112)

SWI pays HD (8.4%) (2,016) 8.4% 2,016

New interest payment (2,112) (2,448)

This was answered well. The main problem area for candidates was that many of them did not make the

variable leg of the swap at LIBOR as required in the question.

Total possible marks 8

Maximum full marks 8

3(b)(ii)

Counterparty risk – counterparty defaults before completion

Position or market risk – unfavourable market movements once swap established

Transparency risk – accounts become misleading

Again this was answered well.

Total possible marks 3

Maximum full marks 3

© The Institute of Chartered Accountants in England and Wales 2010 Page 10 of 10

Вам также может понравиться

- Book-Keeping and Accounts Level 2/series 2-2009Документ13 страницBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- Working Capital ManagementДокумент14 страницWorking Capital ManagementRujuta ShahОценок пока нет

- Case Study - Boeing 777Документ5 страницCase Study - Boeing 777Ratish Mayank0% (1)

- ICAEW Past Questions Answers March 2008 To March 2015 Summary of Financial Accounting-Application Level PDFДокумент274 страницыICAEW Past Questions Answers March 2008 To March 2015 Summary of Financial Accounting-Application Level PDFmizan81953% (15)

- SSC Mathematics English VesionДокумент309 страницSSC Mathematics English Vesionলাজ মাহমুদ0% (1)

- Cash Flow Question Paper1Документ10 страницCash Flow Question Paper1CA Sanjeev Jarath100% (3)

- India's Pharmaceutical TradeДокумент21 страницаIndia's Pharmaceutical Tradeprat1401Оценок пока нет

- FR Knowledge Check MCQДокумент145 страницFR Knowledge Check MCQMuhammad Khurshid100% (2)

- Jukka Lintusaari IRU Ertico MaaS WorkhopДокумент17 страницJukka Lintusaari IRU Ertico MaaS WorkhopanirudhasОценок пока нет

- Planet Retail 2018 ReportДокумент18 страницPlanet Retail 2018 ReportalanОценок пока нет

- Cargill // Steel SwapsДокумент14 страницCargill // Steel Swapsinfo8493Оценок пока нет

- Ifrs Vs Sme - ComparisonДокумент18 страницIfrs Vs Sme - ComparisonJean StephanyОценок пока нет

- Test Bank For Purchasing and Supply Chain Management 5th EditionДокумент16 страницTest Bank For Purchasing and Supply Chain Management 5th EditionLiam Perry100% (28)

- Facilitiesplanningdesign 160319150608 PDFДокумент314 страницFacilitiesplanningdesign 160319150608 PDFAdil HamidОценок пока нет

- Subway Drive-Thru: Build Sales Build Profits Build StoresДокумент10 страницSubway Drive-Thru: Build Sales Build Profits Build StoresCostas BogdanОценок пока нет

- 1 - 2 - SESSION - 1 - 2 - LP - LP - Optimization - DHAKA - 2018 PDFДокумент9 страниц1 - 2 - SESSION - 1 - 2 - LP - LP - Optimization - DHAKA - 2018 PDFMohsena MunnaОценок пока нет

- 000Документ192 страницы000andre1983Оценок пока нет

- Ydle Investor Presentation 5-8-2015 FinalДокумент28 страницYdle Investor Presentation 5-8-2015 FinalmeetpcОценок пока нет

- CTX HireДокумент8 страницCTX HireselleriverketОценок пока нет

- LCA BI - Financial Report UsageДокумент13 страницLCA BI - Financial Report UsageJackОценок пока нет

- Singapore Online Food Delivery Market Size-Compiled by OCM-2nd Dec 2021Документ34 страницыSingapore Online Food Delivery Market Size-Compiled by OCM-2nd Dec 2021Ebenezer HengОценок пока нет

- Solid Waste ManagementДокумент4 страницыSolid Waste ManagementAnimesh BhattОценок пока нет

- House Hearing, 113TH Congress - Rise of Innovative Business Models: Content Delivery Methods in The Digital AgeДокумент108 страницHouse Hearing, 113TH Congress - Rise of Innovative Business Models: Content Delivery Methods in The Digital AgeScribd Government DocsОценок пока нет

- CMD Tire Building Industry - CleanedДокумент53 страницыCMD Tire Building Industry - Cleanedvodka_taste2882Оценок пока нет

- AR BA1 - Unlocking Malaysia's Digital Future Opportunities, Challenges and Policy ResponsesДокумент16 страницAR BA1 - Unlocking Malaysia's Digital Future Opportunities, Challenges and Policy ResponsesMuhaizam MusaОценок пока нет

- Relating Operational and Financial FactorsДокумент17 страницRelating Operational and Financial FactorsNia M0% (2)

- Basic Financial Plan Template-FinalДокумент4 страницыBasic Financial Plan Template-FinalCelvin DiagustaОценок пока нет

- Steel+Statistical+Yearbook+2017 Updated+version090518Документ128 страницSteel+Statistical+Yearbook+2017 Updated+version090518radinasrОценок пока нет

- CBN Exchange Control ManualДокумент133 страницыCBN Exchange Control ManualAhmad Invaluable AdenijiОценок пока нет

- Metal SagaДокумент468 страницMetal SagaDaniel Rodrigues de SouzaОценок пока нет

- Acca p3 - Professional LevelДокумент31 страницаAcca p3 - Professional Levelmshahza89% (9)

- Standalone Financial Results For September 30, 2016 (Result)Документ10 страницStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- 4.aluminium Company of Malaysia Berhad 2013Документ120 страниц4.aluminium Company of Malaysia Berhad 2013LeeОценок пока нет

- 03 Taman Organis Content PlanДокумент22 страницы03 Taman Organis Content PlanJimmy SentosoОценок пока нет

- Iron and Steel Products Update 27mac2014Документ13 страницIron and Steel Products Update 27mac2014mfakhrudОценок пока нет

- Investment Evaluation: Professor Tim Thompson Kellogg School of ManagementДокумент36 страницInvestment Evaluation: Professor Tim Thompson Kellogg School of ManagementAmund BremerОценок пока нет

- Last Mile Connectivity VehicleДокумент51 страницаLast Mile Connectivity VehicleMuraliKrishnaОценок пока нет

- LSI Engenio Controller Firmware UpgradeДокумент3 страницыLSI Engenio Controller Firmware Upgradepcoffey2240Оценок пока нет

- April 2020 Summary: Type Category Budgeted Spent RemainingДокумент15 страницApril 2020 Summary: Type Category Budgeted Spent RemainingLillyОценок пока нет

- Material Specifications Data SheetДокумент3 страницыMaterial Specifications Data SheetDoug Seybert100% (2)

- Upstate Transit Landscape and The Need For RidesharingДокумент16 страницUpstate Transit Landscape and The Need For RidesharingUber NY MediaОценок пока нет

- Commodity Chartbook 09302011Документ9 страницCommodity Chartbook 09302011andrewbloggerОценок пока нет

- Argus Metal PricesДокумент22 страницыArgus Metal PricesGuntoro AliОценок пока нет

- Chart of Accounts Format - OdsДокумент5 страницChart of Accounts Format - OdsAnonymous PKLGaHnx100% (1)

- Broadband Infrastructure in The ASEAN Region - 0 PDFДокумент140 страницBroadband Infrastructure in The ASEAN Region - 0 PDFduyck100% (1)

- Structural Analysis of Scrap Baling Press For Cost ReductionДокумент9 страницStructural Analysis of Scrap Baling Press For Cost ReductionMUNIPRABAHARANОценок пока нет

- An Analysis of Yum Brands Asia Presented by Denise Odaro, Grace Ma, Monica Perez and Darius HubbardДокумент33 страницыAn Analysis of Yum Brands Asia Presented by Denise Odaro, Grace Ma, Monica Perez and Darius Hubbardedo7Оценок пока нет

- Estimated WACC of Commodity Trading CompaniesДокумент9 страницEstimated WACC of Commodity Trading CompaniesdxkarthikОценок пока нет

- Keywords Analysis - Top 20 Best-Sellers Based On SALES: Data Captured DateДокумент3 страницыKeywords Analysis - Top 20 Best-Sellers Based On SALES: Data Captured DateLi_Chen_LondonОценок пока нет

- Utx 20110330Документ2 страницыUtx 20110330andrewbloggerОценок пока нет

- Commercial Kitchen Equipment CalculatorДокумент17 страницCommercial Kitchen Equipment CalculatorNguyễn Thế PhongОценок пока нет

- Cost Estimation Using CocomoДокумент3 страницыCost Estimation Using Cocomotanmoy_249120195Оценок пока нет

- NEW eCMS Metal Industry DevДокумент344 страницыNEW eCMS Metal Industry DevendeshawОценок пока нет

- Steel Industry Update #252Документ8 страницSteel Industry Update #252Michael LockerОценок пока нет

- Value Added Products From RubberДокумент9 страницValue Added Products From RubberHarisanth100% (1)

- MA Team 4 Week 5 PresentationДокумент38 страницMA Team 4 Week 5 PresentationKwang Yi JuinОценок пока нет

- Business PlanДокумент224 страницыBusiness PlanTuan Pauzi Tuan Ismail100% (1)

- Report On New Business Plan: (Mr. Fast Food)Документ24 страницыReport On New Business Plan: (Mr. Fast Food)shahidul0Оценок пока нет

- Steel 2020Документ46 страницSteel 2020Bích NgọcОценок пока нет

- Scrap PricesIndexДокумент3 страницыScrap PricesIndexGabriel CaraveteanuОценок пока нет

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Документ4 страницыBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaОценок пока нет

- P1 Solution Dec 2018Документ6 страницP1 Solution Dec 2018Awal ShekОценок пока нет

- P1. PRO (O.L) Solution CMA June-2021 Exam.Документ5 страницP1. PRO (O.L) Solution CMA June-2021 Exam.Tameemmahmud rokibОценок пока нет

- Nov-Dec 2011Документ9 страницNov-Dec 2011Usuf JabedОценок пока нет

- RUNNING HEAD: Accounting Questions 1Документ6 страницRUNNING HEAD: Accounting Questions 1Chirayu ThapaОценок пока нет

- Financial Accounting and Reporting: IFRS - 2015 December MSДокумент18 страницFinancial Accounting and Reporting: IFRS - 2015 December MSMarchella LukitoОценок пока нет

- Master of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Документ6 страницMaster of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Namrata RamgadeОценок пока нет

- ISA 700 eДокумент41 страницаISA 700 eAvinash BabykuttyОценок пока нет

- Deposit Slip (Bank's Part) : 1 50301103 Exam Fee (Paper GE 01, Paper GE 02, Paper GE 03, Paper GE 04, Paper GE 05,) 2,000.00Документ1 страницаDeposit Slip (Bank's Part) : 1 50301103 Exam Fee (Paper GE 01, Paper GE 02, Paper GE 03, Paper GE 04, Paper GE 05,) 2,000.00Muhammad Ziaul HaqueОценок пока нет

- Click HereДокумент1 страницаClick HereMuhammad Ziaul HaqueОценок пока нет

- Outsourcing It - It'S Good For Your Business: John Mccarthy Tells Us WhyДокумент2 страницыOutsourcing It - It'S Good For Your Business: John Mccarthy Tells Us WhyMuhammad Ziaul HaqueОценок пока нет

- Stage: Formation 1: Management in OrganisationsДокумент3 страницыStage: Formation 1: Management in OrganisationsMuhammad Ziaul HaqueОценок пока нет

- Ifrs 9Документ28 страницIfrs 9ahusain21Оценок пока нет

- AL Corporate Laws Practices May Jun 2013 1Документ2 страницыAL Corporate Laws Practices May Jun 2013 1Muhammad Ziaul HaqueОценок пока нет

- Stage: Formation 1: Management in OrganisationsДокумент3 страницыStage: Formation 1: Management in OrganisationsMuhammad Ziaul HaqueОценок пока нет

- 17419Документ1 страница17419Muhammad Ziaul HaqueОценок пока нет

- Class Routine of January-June 2016Документ11 страницClass Routine of January-June 2016Muhammad Ziaul HaqueОценок пока нет

- Making The Best Use of Limited Resources: A War Child Case StudyДокумент6 страницMaking The Best Use of Limited Resources: A War Child Case StudyMuhammad Ziaul HaqueОценок пока нет

- Factsheet IFRS7 Financial Instruments DisclosureДокумент23 страницыFactsheet IFRS7 Financial Instruments DisclosureMuhammad Ziaul HaqueОценок пока нет

- CIMA 2015 Professional Qualification SyllabusДокумент51 страницаCIMA 2015 Professional Qualification SyllabusMuhammad Ziaul HaqueОценок пока нет

- Cma Question - E1 - Enterprise OperationsДокумент14 страницCma Question - E1 - Enterprise OperationsMuhammad Ziaul HaqueОценок пока нет

- 6 Quiz Ifrs 7 and Ifrs 4Документ25 страниц6 Quiz Ifrs 7 and Ifrs 4Muhammad Ziaul HaqueОценок пока нет

- KL Business Comm Law May Jun 2016Документ1 страницаKL Business Comm Law May Jun 2016Muhammad Ziaul HaqueОценок пока нет

- Cma Question - r1 - Legal Environment of BusinessДокумент12 страницCma Question - r1 - Legal Environment of BusinessMuhammad Ziaul Haque100% (1)

- 6 Business LawДокумент1 страница6 Business LawMuhammad Ziaul HaqueОценок пока нет

- AL Corporate Laws Practices Nov Dec 2013Документ1 страницаAL Corporate Laws Practices Nov Dec 2013Muhammad Ziaul HaqueОценок пока нет

- ML SYLLABUS 13-Jul-2019 12-23-54Документ22 страницыML SYLLABUS 13-Jul-2019 12-23-54Muhammad Ziaul HaqueОценок пока нет

- Deposit Slip (Bank's Part) : 1 50301105 Management Level (Level 4) Correspondence Fee, 14,000.00Документ1 страницаDeposit Slip (Bank's Part) : 1 50301105 Management Level (Level 4) Correspondence Fee, 14,000.00Muhammad Ziaul HaqueОценок пока нет

- Class Routin Operation Level...Документ1 страницаClass Routin Operation Level...Muhammad Ziaul HaqueОценок пока нет

- E1 Enterprise OperationsДокумент3 страницыE1 Enterprise Operationsnayan83Оценок пока нет

- Syllabus-Operational Level ICMABДокумент27 страницSyllabus-Operational Level ICMABMuhammad Ziaul Haque50% (2)

- Print Receipt - AspxДокумент1 страницаPrint Receipt - AspxMuhammad Ziaul HaqueОценок пока нет

- Compilationofvatact1991theorymath 161130062840Документ58 страницCompilationofvatact1991theorymath 161130062840Muhammad Ziaul HaqueОценок пока нет

- 2018 ACA Syllabus and Technical Knowledge GridsДокумент156 страниц2018 ACA Syllabus and Technical Knowledge GridsMuhammad Ziaul HaqueОценок пока нет

- The FAF Trustees Are Responsible For Providing Oversight and Promoting AnДокумент3 страницыThe FAF Trustees Are Responsible For Providing Oversight and Promoting Annadia de mesaОценок пока нет

- Undiscovered ManagersДокумент2 страницыUndiscovered ManagersEric JacobsonОценок пока нет

- Assignment#2 ADRIANOCAÑADAДокумент3 страницыAssignment#2 ADRIANOCAÑADAADRIANO, Glecy C.Оценок пока нет

- Review Jurnal 9 10 11 Seminar Ak SyariahДокумент10 страницReview Jurnal 9 10 11 Seminar Ak SyariahShafira Husdini pertiwiОценок пока нет

- Components of A Balance Sheet AssetsДокумент3 страницыComponents of A Balance Sheet AssetsAhmed Nawaz KhanОценок пока нет

- Financial Management in The Sport Industry 2nd Brown Solution ManualДокумент10 страницFinancial Management in The Sport Industry 2nd Brown Solution ManualTravis Bogan100% (31)

- Series A Term Sheet MarkupДокумент16 страницSeries A Term Sheet MarkupSURAJ SINGHОценок пока нет

- Practice Week 3: The Capital Asset Pricing ModelДокумент1 страницаPractice Week 3: The Capital Asset Pricing ModelPuy NuyОценок пока нет

- Dwnload Full Fundamental Accounting Principles 23rd Edition Wild Solutions Manual PDFДокумент35 страницDwnload Full Fundamental Accounting Principles 23rd Edition Wild Solutions Manual PDFexiguity.siroc.r1zj100% (7)

- "Indirect Tax (GST) ": A Project OnДокумент56 страниц"Indirect Tax (GST) ": A Project OnTasmay EnterprisesОценок пока нет

- Deloitte Academy LTI SeminarДокумент85 страницDeloitte Academy LTI SeminarbokasodaОценок пока нет

- Minute Maid Case StudyДокумент2 страницыMinute Maid Case StudyEhab DanielОценок пока нет

- Ahmednagar Merchant'S Co - Op. Bank LTD.: MICR CodeДокумент8 страницAhmednagar Merchant'S Co - Op. Bank LTD.: MICR CodePiyu VaiОценок пока нет

- AFAR Partnership-ExercisesДокумент37 страницAFAR Partnership-ExercisesChelsy SantosОценок пока нет

- Week 7Документ16 страницWeek 7Hannah Rae ChingОценок пока нет

- AKR Corporindo (AKRA IJ/BUY/Rp3,600/Target: Rp4,730)Документ7 страницAKR Corporindo (AKRA IJ/BUY/Rp3,600/Target: Rp4,730)FREE FOR FREEDOMОценок пока нет

- Avendus Spark Initiating Coverage On KFIN Technologies LTD WithДокумент54 страницыAvendus Spark Initiating Coverage On KFIN Technologies LTD WithManthan PatelОценок пока нет

- Unit IДокумент40 страницUnit IVeronica SafrinaОценок пока нет

- Reimers Finacct03 sm09 PDFДокумент48 страницReimers Finacct03 sm09 PDFChandani DesaiОценок пока нет

- Business PPT TemplateДокумент18 страницBusiness PPT TemplateJAPSON, PRINCESS VОценок пока нет

- Mutual Fund Investment InternshipДокумент69 страницMutual Fund Investment InternshipSv KhanОценок пока нет

- Handout Appendix DCF Valuation 2023Документ21 страницаHandout Appendix DCF Valuation 2023Akshay SharmaОценок пока нет

- Part1 Topic 5 Accounting For Partnership Firms Admission of A PartnerДокумент54 страницыPart1 Topic 5 Accounting For Partnership Firms Admission of A PartnerShivani ChoudhariОценок пока нет

- Guidance Notes Dipam Valuation II To V - 1Документ35 страницGuidance Notes Dipam Valuation II To V - 1tomsraoОценок пока нет

- Deutsche BrauereiДокумент38 страницDeutsche BrauereiTazkia Munia0% (1)