Академический Документы

Профессиональный Документы

Культура Документы

CIR v. TEAM SUAL

Загружено:

Dawn BernabeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CIR v. TEAM SUAL

Загружено:

Dawn BernabeАвторское право:

Доступные форматы

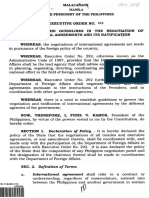

CIR v. Team Sual Corporation, [G.R. No. 205055. July 18, 2014] 8.

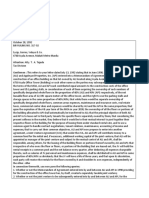

CIR’S ARGUMENTS ON MR w/ CTA:

a. CIR further claims that TSC's petition for review was

SUMMARY prematurely filed, alleging that under Section 112( C)

Team Sual filed for a claim for refund of unutilized input VAT but without of the NIRC, the CIR is given 120 days from the

waiting for the 120 period within which the BIR can decide the case, TSC submission of complete documents within which to

filed a petition with review with the CTA seeking for refund. CTA granted either grant or deny TSC's application for refund/tax

TSC’s petition. CIR opposed saying that the CTA petition was prematurely credit.

filed because before filing a petition with the CTA, there must first be a b. The CIR pointed out that TSC filed its petition for review

decision by the BIR or the 120 period must have lapsed. SC agreed with the with the CTA sans any decision on its claim and without

CIR saying that the requirement for decision by the BIR/Lapse of the 120 - waiting for the 120-day period to lapse.

day period is mandatory and jurisdictional.

9. CTA denied MR:

DOCTRINE: . TSC's petition for review was not prematurely filed

An administrative claim for refund of unutilized input VAT must first be filed notwithstanding that the 120-day period had not yet lapsed.

with the BIR within the prescriptive period of 2 years from the close of the a. pursuant to Section 112(A) of the NIRC, claims for refund/tax

taxable quarter when the sales were made. Before a petition for review may credit of unutilized input VAT should be filed within two years after

be filed before the CTA, there must first be decision by the BIR OR the lapse the close of the taxable quarter when the sales were made;

of a 120 period from filing of complete documents in support of the b. that the 120-day period is also covered by the two-year

application. This requirement in mandatory and jurisdictional, any decision prescriptive period within which to claim the refund/tax credit.

rendered by the CTA without this is deemed void. c. Allison J. Gibbs, et al. vs. CIR: the suit or proceeding must be

started in this Court before the end of the two-year period without

FACTS awaiting the decision of the Collector (now Commissioner).

1. TSC is in the business of power generation and the sale to d. Unlike assessments, no decision of respondent is required before

National Power Corporation (NPC); it is registered as a VAT one can go to this Court for a claim of refund.

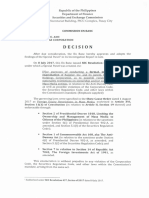

taxpayer. 10. CTA En Banc AFFIRMED

2. the CIR granted TSC's application for zero-rating arising from its . claimant may seek judicial redress for refund with the CTA either

sale of power generation services to NPC for the taxable year within 30 days from receipt of the denial of its claim for refund/tax credit,

2000 OR after the lapse of 120-day period in the event of inaction by the

3. As a VAT-registered entity, TSC filed its VAT returns for the Commissioner;

taxable year 2000. a. provided that both administrative and judicial remedies must be

4. On March 11, 2002, TSC filed with the BIR an administrative undertaken within the two (2)-year period from the close of the taxable

claim for refund of its unutilized input VAT in the amount of quarter when the relevant sales were made.

₱179,314,926.56 arising from its zero-rated sales to NPC for the b. If the two-year period is about to lapse, but the BIR has not

taxable year 2000. yet acted on the application for refund, the taxpayer should file a

5. On April 1, 2002, without awaitng the CIR's resolution of its Petition for Review with this Court within the two[-]year period.

administrative claim for refund/tax credit, TSC filed a petition for Otherwise, the claim is time-barred.

review with the CT A seeking the refund or the issuance of a ISSUES/HELD

tax credit certificate in the amount of ₱179,314,926.56 WN CTA en banc erred in holding that TSC's petition for review with the

6. CIR: TSC failed to comply with the conditions precedent for CT A was not prematurely filed - YES, FILING OF THE JUDICIAL CLAIM

claiming refund/tax credit of unutilized input VAT as it failed to IS PREMATURE

submit complete documents in support of its application for RATIO

refund/tax credit contrary to Section 112(C) of the NIRC

7. CTA: granted TSC's claim for refund/tax credit. but found that

that it was only able to substantiate the amount of 1. TSC filed its administrative claim within the two-year

₱173,265,261.30. prescriptive period. However, without waiting for the CIR decision or

the lapse of the 120-day period from the time it submitted its 3. The theory that the 30-day period must fall within the two-year

complete documents in support of its claim, TSC filed a petition for prescriptive results in truncating 120 days from the 730 days that the

review with the CTA on April 1,2002 - a mere 21 days after it filed its law grants the taxpayer for filing his administrative claim with the

administrative claim with the BIR. Commissioner.

Clearly, TSC's petition for review with the CTA was prematurely filed; 9. TSC submits that the requirement to exhaust the 120-day period

2. TS: non-observance of the 120-day period is not fatal to the filing of under Section 112(C) of the NIRC prior to filing the judicial claim with the

a judicial claim as long as both the administrative and the judicial CTA is a species of the doctrine of exhaustion of administrative remedies;

claims are filed within th 2 year period that the non-observance of the doctrine merely results in lack of cause of

3. SC: NO LEGAL BASIS! Sec.112 (A) states that "any VAT-registered action, which ground may be waived for failure to timely invoke the same.

person, whose sales are zero-rated or effectively zero-rated may, a. SC: NO- TSC's failure to comply with the 120-day mandatory period

within two years after the close of the taxable quarter when the sales renders its petition for review with the CTA void. It is a mere scrap of paper

were made, apply for the issuance of a tax credit certificate or refund from which TSC cannot derive or acquire any right notwithstanding the

of creditable input tax due or paid attributable to such sales." supposed failure on the part of the CIR to raise the issue of TSC' s non-

4. The phrase "within two (2) years x x x apply for the issuance of a tax compliance with the 120-day period in the proceedings before the CTA First

credit certificate or refund" refers to applications for refund/credit filed Division.

with the CIR and not to appeals made to the CTA. 10. TSC: under BIR Ruling No. DA-489-03 and RMC No. 49-03 had

5. Applying the two-year period to judicial claims would render nugatory already laid down the rule that the taxpayer-claimant need not wait for the

Section 112(C) of the NIRC, which already provides for a 30 day lapse of the 120-day period

period within which to appeal the decision or inaction of the CIR. ON RMC 49-03

6. CIR v San Roque: 120-day period that is given to the CIR within a. In San Roque, the Court had already clarified that nowhere in RMC

which to decide claims for refund/tax credit of unutilized input VAT is No. 49-03 was it stated that a taxpayer-claimant need not wait for the lapse

mandatory and jurisdictional. The taxpayer-claimant must wait for the of the 120-day mandatory period before it can file its judicial claim with the

120-day period to lapse otherwise, the petition would be rendered CTA. RMC No. 49-03 only authorized the BIR to continue the processing of a

premature and without a cause of action. IT would violate doctrine of claim for refund/tax credit notwithstanding that the same had been appealed

exhaustion of administrative remedies. to the CTA

a. CTA Charter: jurisdiction is to review on appeal "decisions of the b. Thus, if the taxpayer files its judicial claim before the expiration of the

Commissioner of Internal Revenue in cases involving x x x refunds of internal 120-day period, the BIR will nevertheless continue to act on the

revenue taxes." administrative claim because such premature filing cannot divest the

b. there is no "decision" of the Commissioner to review and CTA has no Commissioner of his statutory power and jurisdiction to decide the

jurisdiction over the appeal. administrative claim within the 120-day period.

7. That the two-year prescriptive period is about to lapse is ON BIR Ruling DA-489-03

inconsequential. a. BIR Ruling No. DA-489-03 does provide a valid claim for equitable

. The 120-day mandatory period may extend beyond the two-year estoppel under Section 246 of the Tax Code. BIR Ruling No. DA-489-03

prescriptive period. Consequently, the 30-day period given to the taxpayer- expressly states that the "taxpayer-claimant need not wait for the lapse of the

claimant likewise need not fall under the two-year prescriptive period. What 120-day period before it could seek judicial relief with the CT A by way of

matters is that the administrative claim is filed with the BIR within the two- Petition for Review."

year prescriptive period. b. the CTA does not acquire jurisdiction over a judicial claim that is filed

8. Why 30-day period need not necessarily fall within the two-year before the expiration of the 120-day period.

prescriptive period, as long as the administrative claim is filed within c. There are, however, two exceptions to this rule.

the two-year prescriptive period: i.The first exception is if the Commissioner, through a specific ruling, misleads

1.The application for refund or credit may be filed by the taxpayer a particular taxpayer to prematurely file a judicial claim with the CT A. Such

with the Commissioner on the last day of the two-year prescriptive specific ruling is applicable only to such particular taxpayer.

period and it will still strictly comply with the law. ii.The second exception is where the Commissioner, through a general

2. the two-year prescriptive period does not refer to the filing of the interpretative rule issued under Section 4 of the Tax Code, misleads all

judicial claim with the CTA but to the filing of the administrative claim taxpayers into filing prematurely judicial claims with the CTA.

with the Commissioner

d. In these cases, the Commissioner cannot be allowed to later on

question the CT A's assumption of jurisdiction over such claim since

equitable estoppel has set in

e. BIR Ruling No. DA-489-03 is a general interpretative rule because it

was a response to a query made by a government agency ( the One Stop

Shop Inter-Agency Tax Credit and Drawback Center of the Department of

Finance)

f. Being a general interpretative rule, the CIR is barred from

questioning the CTA's assumption of jurisdiction since estoppel under

Section 246 of the NIRC had already set in

24

g. Nevertheless, the Court clarified that taxpayers can only rely on BIR

Ruling No. DA-489-03 from the time of its issuance on December 10, 2003

up to its reversal by this Court in Aichi on October 6, 2010

2. TSC: Court's ruling in Aichi should only be applied prospectively; that

prior to Aichi, the Court supposedly ruled that a taxpayer-claimant

need not await the lapse of the 120-day period. The Court does not

agree.

. There is no basis to TSC's claim that this Court. Cases cited by TSC

do not support its contention.

3. Even if TSC was able to substantiate that it is indeed entitled to a

refund/tax credit, its claim would still have to be denied.

. "Tax refunds are in the nature of tax exemptions, and are to be

construed strictissimi Juris against the entity claiming the same."

a. "The taxpayer is charged with the heavy burden of proving that he

hascomplied with and satisfied all the statutory and administrative

requirements to be entitled to the tax refund

b. TSC, in prematurely filing a petition for review with the CTA, failed to

comply with the 120-day mandatory period under Section 112(C) of the

NIRC. Thus, TSC's

claim for refund/tax credit of its unutilized input VAT should be denied.

DISPOSITIVE

WHEREFORE, the petition is GRANTED

Вам также может понравиться

- Zalamea Vs Court of Appeals and Transworld AirlinesДокумент2 страницыZalamea Vs Court of Appeals and Transworld AirlinesistefifayОценок пока нет

- Abelardo Lim and Esmadito GunnabanДокумент2 страницыAbelardo Lim and Esmadito GunnabanRainnie McBeeОценок пока нет

- Sps. Binarao v. Plus BuildersДокумент3 страницыSps. Binarao v. Plus BuildersJuvy Dimaano100% (1)

- Cir V Smart CommunicationДокумент2 страницыCir V Smart CommunicationAnonymous Ig5kBjDmwQОценок пока нет

- Bonifacio Water Corp V CIR (Digest)Документ3 страницыBonifacio Water Corp V CIR (Digest)Angelo CastilloОценок пока нет

- Court Rules No Tenancy in Land Dispute CaseДокумент2 страницыCourt Rules No Tenancy in Land Dispute CaseseentherellaaaОценок пока нет

- CIR Vs Baier-Nickel and NDC Vs CIRДокумент3 страницыCIR Vs Baier-Nickel and NDC Vs CIRKath LeenОценок пока нет

- G.R. No. 213394 - Spouses Pacquiao V PDFДокумент21 страницаG.R. No. 213394 - Spouses Pacquiao V PDFindie100% (1)

- CIR vs CA on VAT liability of non-profit service providerДокумент2 страницыCIR vs CA on VAT liability of non-profit service providerEllen Glae DaquipilОценок пока нет

- NPC Vs Mun. of NavotasДокумент2 страницыNPC Vs Mun. of NavotasClaudine Christine A. VicenteОценок пока нет

- NG V People DigestДокумент1 страницаNG V People DigestRobynne LopezОценок пока нет

- Tax Doctrine on Willful BlindnessДокумент4 страницыTax Doctrine on Willful BlindnessKatОценок пока нет

- Tax Refund Denied for Lack of Official ReceiptsДокумент2 страницыTax Refund Denied for Lack of Official ReceiptsDianne Bernadeth Cos-agon100% (1)

- CIR v. Benguet Corp Ruling on Retroactive Application of VAT RulingДокумент1 страницаCIR v. Benguet Corp Ruling on Retroactive Application of VAT RulingAgnes GamboaОценок пока нет

- RPT Case DigestsДокумент71 страницаRPT Case Digestscarlota ann lafuenteОценок пока нет

- 46 in The Matter of Estate of Telesforo de Dios - Case DIgestДокумент3 страницы46 in The Matter of Estate of Telesforo de Dios - Case DIgestGoodyОценок пока нет

- Sison Vs AnchetaДокумент2 страницыSison Vs AnchetaBenedick LedesmaОценок пока нет

- PCGG v. COJUANGCOДокумент3 страницыPCGG v. COJUANGCOKristine VillanuevaОценок пока нет

- Aranas V. Mercado Facts:: Special Proceedings - Case Digest 3 Year - John Wesley School of Law and GovernanceДокумент3 страницыAranas V. Mercado Facts:: Special Proceedings - Case Digest 3 Year - John Wesley School of Law and GovernanceJayson Paolo DiazОценок пока нет

- CIR vs. Embroidery & Garments Industries PhilsДокумент5 страницCIR vs. Embroidery & Garments Industries PhilsEmil BautistaОценок пока нет

- 5 - CIR vs. Hon. Raul M. GonzalezДокумент6 страниц5 - CIR vs. Hon. Raul M. GonzalezJaye Querubin-FernandezОценок пока нет

- Rodriguez Vs CA GR 121964, June 17, 1997Документ1 страницаRodriguez Vs CA GR 121964, June 17, 1997Sherryl GrimaldoОценок пока нет

- PNB v. VillaДокумент3 страницыPNB v. VillaYodh Jamin OngОценок пока нет

- PEZA VAT Refund for Export EnterprisesДокумент1 страницаPEZA VAT Refund for Export EnterprisesAbdulateef SahibuddinОценок пока нет

- Liquigaz Philippines Corporation v CIR Assessment ValidityДокумент3 страницыLiquigaz Philippines Corporation v CIR Assessment ValidityCrmnmarieОценок пока нет

- 1 Advent Capital v. Nicasio I. AlcantaraДокумент3 страницы1 Advent Capital v. Nicasio I. AlcantaraGene Michael MiguelОценок пока нет

- 48 People V UmanitoДокумент4 страницы48 People V UmanitoKeisha Yna V. RamirezОценок пока нет

- Case Digest (Eusebio - Garcia)Документ5 страницCase Digest (Eusebio - Garcia)burn_iceОценок пока нет

- Balais-Mabanag vs. Register of Deeds of Quezon CityДокумент20 страницBalais-Mabanag vs. Register of Deeds of Quezon CityDianne May CruzОценок пока нет

- Tax Evasion Case Against Spouses DismissedДокумент16 страницTax Evasion Case Against Spouses Dismissedred gynОценок пока нет

- Court rules petitioner failed to prove ownership of disputed lotsДокумент2 страницыCourt rules petitioner failed to prove ownership of disputed lotsSarah Victorio100% (1)

- Case Digest - Aquino Vs NLRCДокумент2 страницыCase Digest - Aquino Vs NLRCZh Rm100% (1)

- Supreme Court upholds prosecution of tax evasion caseДокумент2 страницыSupreme Court upholds prosecution of tax evasion caseJD BallosОценок пока нет

- Samar-I Electric Cooperative v. CIRДокумент2 страницыSamar-I Electric Cooperative v. CIRTzarlene Cambaliza100% (1)

- SC upholds conviction of accused who pleaded guilty to kidnapping and murderДокумент3 страницыSC upholds conviction of accused who pleaded guilty to kidnapping and murderTelle MarieОценок пока нет

- 45 Hernandez vs. PascualДокумент2 страницы45 Hernandez vs. PascualGoodyОценок пока нет

- CIR v. Pascor RealtyДокумент1 страницаCIR v. Pascor RealtyDaLe AparejadoОценок пока нет

- CIR V Manila Mining DigestДокумент2 страницыCIR V Manila Mining DigestNikki ZaideОценок пока нет

- Uploads PDF 196 SP 159811 03012021Документ59 страницUploads PDF 196 SP 159811 03012021Manuel Joseph FrancoОценок пока нет

- 392 Malvar V Kraft FoodДокумент34 страницы392 Malvar V Kraft Foodmiles punzalanОценок пока нет

- La Rosa V Ambassador HotelДокумент2 страницыLa Rosa V Ambassador HotelAnonymous wbEpfdMОценок пока нет

- GSIS Land Sale Tax LiabilityДокумент4 страницыGSIS Land Sale Tax LiabilitycharmssatellОценок пока нет

- CIR v. NEXT MOBILE, INC. GR No. 212825. December 7, 2015Документ2 страницыCIR v. NEXT MOBILE, INC. GR No. 212825. December 7, 2015Jernel JanzОценок пока нет

- CIR v. Magsaysay LinesДокумент2 страницыCIR v. Magsaysay LinesDiwata de Leon100% (1)

- 05 CELAJE Johannes v. ImperialДокумент2 страницы05 CELAJE Johannes v. ImperialJosh CelajeОценок пока нет

- 091 - Fajardo V Hon. Alfredo S. LimДокумент2 страницы091 - Fajardo V Hon. Alfredo S. LimPatrick ManaloОценок пока нет

- Kepco Vs CIR Case DigestДокумент2 страницыKepco Vs CIR Case DigestFrancisca Paredes100% (1)

- Mendoza Vs Teh DIGESTДокумент2 страницыMendoza Vs Teh DIGESTClaudine SumalinogОценок пока нет

- Attorney Fees Case DigestДокумент2 страницыAttorney Fees Case DigestbaabolsОценок пока нет

- Succession Transcriptions (Pre Finals)Документ10 страницSuccession Transcriptions (Pre Finals)Maricon DumagatОценок пока нет

- (SPIT) (Contex Corp. v. CIR) (Francisco)Документ3 страницы(SPIT) (Contex Corp. v. CIR) (Francisco)gundam_rose_01100% (4)

- Corre Vs Tan CorreДокумент2 страницыCorre Vs Tan CorreLean Manuel ParagasОценок пока нет

- CIR vs. PNBДокумент2 страницыCIR vs. PNBEzi AngelesОценок пока нет

- Skippers United Pacific Vs NLRC Ponente: J. Austria-Martinez FactsДокумент1 страницаSkippers United Pacific Vs NLRC Ponente: J. Austria-Martinez FactsDaphnie Cuasay0% (1)

- ProvRem - Acuna vs. CaluagДокумент6 страницProvRem - Acuna vs. CaluagVernon Craig ColasitoОценок пока нет

- Wenphil v. AbingДокумент5 страницWenphil v. AbingDom UmandapОценок пока нет

- Nego Digest 2Документ1 страницаNego Digest 2David Tan100% (1)

- 3stanfilco V TequilloДокумент2 страницы3stanfilco V TequilloIanОценок пока нет

- CIR V Deutsche Knowledge ServicesДокумент3 страницыCIR V Deutsche Knowledge ServicesRobert Manto100% (1)

- CIR V Deutsche Knowledge ServicesДокумент3 страницыCIR V Deutsche Knowledge ServicesWilbert ChongОценок пока нет

- IASManualДокумент64 страницыIASManualMarlon YapОценок пока нет

- Administrative Order No 07Документ10 страницAdministrative Order No 07Anonymous zuizPMОценок пока нет

- UNSC Report Jan 2019 PDFДокумент66 страницUNSC Report Jan 2019 PDFDawn BernabeОценок пока нет

- LITD NotesДокумент2 страницыLITD NotesDawn BernabeОценок пока нет

- 2 People V VeridianoДокумент2 страницы2 People V VeridianoDawn BernabeОценок пока нет

- Eo 459 1997Документ5 страницEo 459 1997davidОценок пока нет

- UNSC Report On Situation in Middle East Including The Palestine QuestionДокумент24 страницыUNSC Report On Situation in Middle East Including The Palestine QuestionDawn BernabeОценок пока нет

- 16612-2000-Updated Handbook On Audit ProceduresДокумент66 страниц16612-2000-Updated Handbook On Audit ProceduresDawn BernabeОценок пока нет

- 1 Pesigan V AngelesДокумент2 страницы1 Pesigan V AngelesDawn BernabeОценок пока нет

- United Nations Security Council Resolution 2334Документ3 страницыUnited Nations Security Council Resolution 2334André RivenellОценок пока нет

- Legal Writing LectureДокумент2 страницыLegal Writing LectureDawn BernabeОценок пока нет

- Summary of The IJC's Judgment On Whaling in The AntarcticДокумент35 страницSummary of The IJC's Judgment On Whaling in The AntarcticABC News OnlineОценок пока нет

- Conflict of Laws - AznarДокумент6 страницConflict of Laws - AznarDawn BernabeОценок пока нет

- Conflict of Laws - Contract - Zalamea V CAДокумент5 страницConflict of Laws - Contract - Zalamea V CADawn BernabeОценок пока нет

- Anti Rape LawДокумент2 страницыAnti Rape LawDawn BernabeОценок пока нет

- Apiag V CanteroДокумент2 страницыApiag V CanteroDawn BernabeОценок пока нет

- Anti Rape LawДокумент2 страницыAnti Rape LawDawn BernabeОценок пока нет

- Chavez V GonzalesДокумент2 страницыChavez V GonzalesDawn BernabeОценок пока нет

- Pelayo V LauronДокумент5 страницPelayo V LauronDawn BernabeОценок пока нет

- Pelizloy Realty v. BenguetДокумент2 страницыPelizloy Realty v. BenguetDawn Bernabe100% (1)

- 2018decision RapplerIncandRapplerHoldingsCorp PDFДокумент29 страниц2018decision RapplerIncandRapplerHoldingsCorp PDFDawn BernabeОценок пока нет

- Anti-Sexual Harassment Act of 2016Документ3 страницыAnti-Sexual Harassment Act of 2016Dawn BernabeОценок пока нет

- Ordinance No. SP. 2501, S-2016Документ12 страницOrdinance No. SP. 2501, S-2016Dawn BernabeОценок пока нет

- Conflict of Laws - Bellis V BellisДокумент3 страницыConflict of Laws - Bellis V BellisDawn BernabeОценок пока нет

- Compiled RR - S Part IIДокумент181 страницаCompiled RR - S Part IIDawn BernabeОценок пока нет

- Boston Bank V ManaloДокумент3 страницыBoston Bank V ManaloDawn BernabeОценок пока нет

- Conflict of Laws - AznarДокумент6 страницConflict of Laws - AznarDawn BernabeОценок пока нет

- Estanislao V CA - AgencyДокумент2 страницыEstanislao V CA - AgencyDawn BernabeОценок пока нет

- Aznar V CitibankДокумент2 страницыAznar V CitibankDawn BernabeОценок пока нет

- Final Report: House of Assembly Select Committee On The House of Assembly Restoration BillДокумент137 страницFinal Report: House of Assembly Select Committee On The House of Assembly Restoration BillkaiОценок пока нет

- Chapter 2 Quiz - Business LawДокумент3 страницыChapter 2 Quiz - Business LawRayonneОценок пока нет

- HOUSE CONTRACT AGREEMENT SUMMARYДокумент6 страницHOUSE CONTRACT AGREEMENT SUMMARYRachmat FaizalОценок пока нет

- Williams v. Taylor Hardin Secure Medical Facility Et Al (Inmate 2) - Document No. 3Документ3 страницыWilliams v. Taylor Hardin Secure Medical Facility Et Al (Inmate 2) - Document No. 3Justia.comОценок пока нет

- Simba Papers CaseДокумент21 страницаSimba Papers CaseZenaОценок пока нет

- Test Bank For Business Law Today Comprehensive Text and Cases Diverse Ethical Online and Global Environment 10th Edition MillerДокумент20 страницTest Bank For Business Law Today Comprehensive Text and Cases Diverse Ethical Online and Global Environment 10th Edition Millera629801354Оценок пока нет

- York County Court Schedule For April 25Документ5 страницYork County Court Schedule For April 25York Daily Record/Sunday NewsОценок пока нет

- Bernas Constitutional Structure PDFДокумент808 страницBernas Constitutional Structure PDFAngelic Recio100% (13)

- Del Carmen Vs BacoyДокумент14 страницDel Carmen Vs BacoyKiks JampasОценок пока нет

- ERC Procedure COC ApplyДокумент2 страницыERC Procedure COC Applygilgrg526Оценок пока нет

- Final PPT Motor TP Insurance & ClaimsДокумент57 страницFinal PPT Motor TP Insurance & ClaimsPRAKASH100% (1)

- Theory of Punishment in Ancient India PunishmentДокумент8 страницTheory of Punishment in Ancient India PunishmentTulsi TiwariОценок пока нет

- Charles A. Albrecht v. Baltimore & Ohio Railroad Company, 808 F.2d 329, 4th Cir. (1987)Документ6 страницCharles A. Albrecht v. Baltimore & Ohio Railroad Company, 808 F.2d 329, 4th Cir. (1987)Scribd Government DocsОценок пока нет

- Sale of Goods Act essentialsДокумент29 страницSale of Goods Act essentialsKrithikaVenkat100% (2)

- CAPULONG. Client Activism in Progressive Lawyering TheoryДокумент87 страницCAPULONG. Client Activism in Progressive Lawyering TheoryLarissa Castro ChryssafidisОценок пока нет

- Final MCS Book 10 01 2019Документ420 страницFinal MCS Book 10 01 2019Sahilkhan Pathan Advocate100% (1)

- 2019-6 Brady Giglio DirectiveДокумент10 страниц2019-6 Brady Giglio DirectiveAndrew FordОценок пока нет

- Rep v. JosonДокумент9 страницRep v. JosonGianne Claudette LegaspiОценок пока нет

- Limitation Notes N.L.SДокумент8 страницLimitation Notes N.L.SkingОценок пока нет

- CLJ - 2021 - 4 - 327 - Psb-Nurul Izzah Vs Dato SallehДокумент21 страницаCLJ - 2021 - 4 - 327 - Psb-Nurul Izzah Vs Dato SallehFadhilah Abdullah (KTN)Оценок пока нет

- English For Students in LawДокумент125 страницEnglish For Students in LawIancu Lavinia BertaОценок пока нет

- Campanilla Crim PreWeek 2018Документ42 страницыCampanilla Crim PreWeek 2018Beau Masiglat100% (2)

- Affidavit by Student on Refund PolicyДокумент2 страницыAffidavit by Student on Refund PolicyAbhishekОценок пока нет

- Analysis of 157th Law Commission Report on Doctrine of Lis PendensДокумент11 страницAnalysis of 157th Law Commission Report on Doctrine of Lis PendensShreya Ghosh DastidarОценок пока нет

- Barrido v. NonatoДокумент6 страницBarrido v. NonatoCherish Kim FerrerОценок пока нет

- Module 10 - Rights of A Person Under Custodial InvestigationДокумент6 страницModule 10 - Rights of A Person Under Custodial InvestigationJekz Bright100% (1)

- Family Law CourseworkДокумент6 страницFamily Law CourseworkPhillip MukuyeОценок пока нет

- BARBA Vs Liceo - PhilRadiant Vs Metrobank Case DigestsДокумент6 страницBARBA Vs Liceo - PhilRadiant Vs Metrobank Case DigestsKaren RefilОценок пока нет

- Mizoram Driver Group B and C Post Recruitment Rules 2018Документ5 страницMizoram Driver Group B and C Post Recruitment Rules 2018Ngcha PachuauОценок пока нет

- 9 PNB V SayoДокумент43 страницы9 PNB V SayoMaryland AlajasОценок пока нет