Академический Документы

Профессиональный Документы

Культура Документы

Cameron Fisher Excel Budget Project

Загружено:

api-340519862Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cameron Fisher Excel Budget Project

Загружено:

api-340519862Авторское право:

Доступные форматы

Introduction to Management Accounting Solutions Manual

Problems: Set A

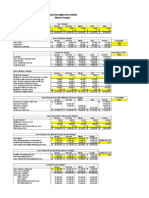

P9-54A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Solution:

Given

Sales Budget

December January February March April May

Unit sales* 5,067 5,340 5,940 5,520 5,700 5,160

Unit selling price $ 15 $ 15 $ 15 $ 15 $ 15 $ 15

Total sales Revenue $ 76,000 $ 80,100 $ 89,100 $ 82,800 $ 85,500 $ 77,400

*Hint: Unit sales = Sales in dollars ÷ Selling price per unit

Req. 1

Cash Collections Budget

January February March Quarter

Cash Sales (30%) $24,030 $ 26,730 $24,840 $75,600

Credit sales (70%) $ 53,200 $ 56,070 $ 62,370 $ 171,640

Total collections $ 77,230 $ 82,800 $87,210 $247,240

Req. 2

Production Budget

January February March Quarter

Unit sales 5,340 5,940 5,520 $16,800

Plus: Desired ending inventory (10%) 594 552 570 570

Total needed 5,934 6,492 6,090 17,370

Lesss: Beginning inventory 534 594 552 534

Units to produce 5,400 5,898 5,538 16,836

Req. 3

Direct Materials Budget

January February March Quarter

Units to be produced 5,400 5,898 5,538 16,836

Multiply by: Quantity of DM needed per unit 2 2 2 2

Quantity of DM needed for production 10,800 11,796 11,076 33,672

Plus: Desired ending inventory of DM (20%) 2,359 2,215 2,258 2,258

Total quantity of DM needed 13,159 14,011 13,334 35,930

Less: Beginning inventory of DM 2,160 2,359 2,215 2,160

Quantity of DM to purchase 10,999 11,652 11,119 33,770

Multiply by: Cost per pound $ 1.50 $ 1.50 $ 1.50 $ 1.50

Total cost of DM purchases $16,499 $17,478 $16,679 $50,656

April May

Unit Sales 5,700 5,160

Plus: Desired End Inventory (25%) 516

Total Needed 6,216

Less: Beginning Inventory 570

Units to produce 5,646

DM needed per unit 2

Quantity of DM needed for production 11,292

Req. 4

Cash Payments for Direct Material Purchases Budget

January February March Quarter

December purchases (From AP) $43,000 $43,000

January purchases $3,300 $13,199 $16,499

February purchases $3,496 $13,982 $59,499

March purchases $3,336 $3,336

Total disbursements $46,300 $16,695 $17,318 $80,313

a

33,630 x 20%

e

39,220 x 20%

Req. 5

Cash Payments for Direct Labor Costs

January February March Quarter

Direct Labor $2,106 $2,301 $2,160 $6,566

Chapter 9: The Master Budget and Responsibility Accounting 1

Introduction to Management Accounting Solutions Manual

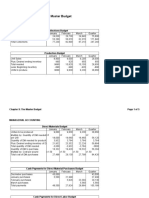

Req. 6

Cash Payments for Manufacturing Overhead Budget

January February March Quarter

Rent (fixed) $6,500 $6,500 $6,500 $19,500

Other MOH (fixed) $2,900 $2,900 $2,900 $8,700

Variable manufacturing overhead $ 7,560 $ 8,257 $ 7,753 $ 23,570

Total disbursements $16,960 $17,657 $17,153 $51,770

Req. 7

Cash Payments for Operating Expenses Budget

January February March Quarter

Variable operating expenses $ 6,408 $ 7,128 $ 6,624 $ 20,160

Fixed operating expenses $ 1,400 $ 1,400 $ 1,400 $ 4,200

Total disbursements $ 7,808 $ 8,528 $ 8,024 $ 24,360

* Hint: Units sold x Variable operating expenses per unit sold ($1.25)

Req. 8

Combined Cash Budget

January February March Quarter

Cash balance, beginning $4,460 $4,716 $19,935 $4,460

Plus: cash collections (req. 1) 77,230 82,800 87,210 247,240

Total cash available 81,690 87,516 107,145 251,700

Less cash payments:

DM purchases (req. 4) 46,300 16,695 17,318 80,313

Direct labor (req. 5) 2,106 2,301 2,160 6,567

MOH costs (req 6) 16,960 17,657 17,153 51,770

Operating expenses (req 7) 7,808 8,528 8,024 24,360

Tax payment 10,800 10,800

Equipment purchases 5800 11,600 15800 33,200

Total cash payments 78,974 67,581 60,455 207,010

Ending cash before financing 2,716 19,935 46,690 44,690

Financing:

Borrowings 2,000 2,000

Repayments -2000 -2,000

Interest -75 -75

Total financing 2,000 2,075 -75

Cash balance, ending $4,716 $19,935 $44,616 $44,616

Req. 9

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit $3.00

Direct labor cost per unit $0.39

Variable MOH cost per unit $1.40

Fixed MOH per unit (given in problem) $0.80

Cost of manufacturing each unit $5.59

Req. 10

Damon Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales $ 252,000

Cost of goods sold 93,912

Gross profit 158,088

Operating expenses 24,360

Depreciation expense 4,400

Operating income 129,328

Less: interest expense 75

Less: provision for income tax @ 30% 38,723

Net income $90,530

Chapter 9: The Master Budget and Responsibility Accounting 2

Вам также может понравиться

- P9-57a 5th Ed Blank Worksheet OnlyДокумент7 страницP9-57a 5th Ed Blank Worksheet Onlyapi-2483356370% (1)

- Masterbudget Acct2020Документ4 страницыMasterbudget Acct2020api-249190933Оценок пока нет

- Excel Budget ProblemДокумент5 страницExcel Budget Problemapi-313254091Оценок пока нет

- Ivan Madrigals Comprehensive Master Budget Project Version AДокумент5 страницIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301Оценок пока нет

- Excel Budget ProjectДокумент6 страницExcel Budget Projectapi-314303195Оценок пока нет

- Numbers Sheet Name Numbers Table NameДокумент8 страницNumbers Sheet Name Numbers Table NameAhmed MahmoudОценок пока нет

- Comprehensive BudgetДокумент5 страницComprehensive Budgetapi-317125310Оценок пока нет

- Budget Assignment Norma GДокумент5 страницBudget Assignment Norma Gapi-242614310Оценок пока нет

- Master Budget ProjectДокумент7 страницMaster Budget Projectapi-404361400Оценок пока нет

- Excel Budget Problem TemplateДокумент2 страницыExcel Budget Problem Templateapi-324651338Оценок пока нет

- Acct 2020 Excel Budget Problem Student Template 1Документ5 страницAcct 2020 Excel Budget Problem Student Template 1api-316764247Оценок пока нет

- Acct 2020 Excel Master BudgetДокумент6 страницAcct 2020 Excel Master Budgetapi-302665852Оценок пока нет

- Chapter 9 HomeworkДокумент2 страницыChapter 9 Homeworkapi-311464761Оценок пока нет

- Excel Budget ProjectДокумент7 страницExcel Budget Projectapi-341205347Оценок пока нет

- Managerial Accounting Final ProjectДокумент5 страницManagerial Accounting Final Projectapi-382641983Оценок пока нет

- BigbudhunterkaarlsenДокумент25 страницBigbudhunterkaarlsenapi-356428418Оценок пока нет

- Acct 2020 Excel Budget ProblemДокумент6 страницAcct 2020 Excel Budget Problemapi-307661249Оценок пока нет

- BT Ke Toan Quan TriДокумент39 страницBT Ke Toan Quan TriTram NguyenОценок пока нет

- Budgeting ProblemДокумент7 страницBudgeting ProblemBest Girl RobinОценок пока нет

- Bigbud 4th Ed Womack BaileyДокумент26 страницBigbud 4th Ed Womack Baileyapi-356759536Оценок пока нет

- ASYNCHRONOUS ACTIVITY 4 WorksheetsДокумент12 страницASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.Оценок пока нет

- Ponderosa-IncДокумент6 страницPonderosa-IncpompomОценок пока нет

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент28 страницPresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualMarc Jim Gregorio100% (1)

- SaaS Sales Force Economics: Excel ModelДокумент86 страницSaaS Sales Force Economics: Excel ModelCazoomi100% (3)

- Assignment Cost Final Edition1Документ5 страницAssignment Cost Final Edition1Bekama Abdii Koo TesfayeОценок пока нет

- Master Budget Assignment SollutionДокумент7 страницMaster Budget Assignment Sollutionatinafu assefaОценок пока нет

- Key To Corrections - LEVEL 2 MODULE 7Документ9 страницKey To Corrections - LEVEL 2 MODULE 7UFO CatcherОценок пока нет

- Financial Plan GM 2Документ9 страницFinancial Plan GM 2Ailene Nace GapoyОценок пока нет

- Sales Budget January-May 2018Документ10 страницSales Budget January-May 2018Patricia Camille AustriaОценок пока нет

- 08 Activity 1Документ4 страницы08 Activity 1Althea ObinaОценок пока нет

- Final TemplateДокумент14 страницFinal TemplateAyesha BatoolОценок пока нет

- Sales Budget in Units and in PesosДокумент4 страницыSales Budget in Units and in PesosJeson MalinaoОценок пока нет

- Acct 2020 EportfolioДокумент5 страницAcct 2020 Eportfolioapi-311375616Оценок пока нет

- Cash Is King HWДокумент16 страницCash Is King HWkuanishalua24Оценок пока нет

- Tanner McqueenДокумент4 страницыTanner Mcqueenapi-242859321Оценок пока нет

- Acc 223a CH 5 AnswersДокумент13 страницAcc 223a CH 5 Answersjr centenoОценок пока нет

- Master Budget Assignment Solution VAДокумент17 страницMaster Budget Assignment Solution VANour SawaftaОценок пока нет

- SCM 10 Activity1Документ2 страницыSCM 10 Activity1Katelyn SungcangОценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323Оценок пока нет

- Problems: Set A: SolutionДокумент8 страницProblems: Set A: Solutionapi-395519937Оценок пока нет

- Jacobh Excel3Документ8 страницJacobh Excel3api-664413574Оценок пока нет

- Actividad 2.3 - Irving Jonathan Burgos Morales - ContaДокумент10 страницActividad 2.3 - Irving Jonathan Burgos Morales - Contairvingbumi37Оценок пока нет

- Business Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Документ35 страницBusiness Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Raschelle MayugbaОценок пока нет

- P23-1A 1. Sale Budget Quarter 1 2 TotalДокумент7 страницP23-1A 1. Sale Budget Quarter 1 2 TotalVõ Huỳnh BăngОценок пока нет

- Financial Accounting - Final Case StudyДокумент13 страницFinancial Accounting - Final Case StudyAhmad ZakariaОценок пока нет

- Cupcake Exports LTD.: Pre Cost Sheet-StarntalerДокумент23 страницыCupcake Exports LTD.: Pre Cost Sheet-StarntalerromanОценок пока нет

- Sales Budget Jan Feb Mar April May TotalДокумент2 страницыSales Budget Jan Feb Mar April May Totalwhat everОценок пока нет

- WOODДокумент12 страницWOODJayson ReyesОценок пока нет

- Hansell Income Statement Group 1Документ5 страницHansell Income Statement Group 1Ashish RanjanОценок пока нет

- SolutionДокумент8 страницSolutionSajakul SornОценок пока нет

- Chapter 8Документ5 страницChapter 8Yến Hoàng HảiОценок пока нет

- Chapt.6 Budgeting For Profit Planning-DikonversiДокумент9 страницChapt.6 Budgeting For Profit Planning-DikonversiRahma NiaОценок пока нет

- HPP Harga JualДокумент9 страницHPP Harga JualMince 0607qqОценок пока нет

- Yarra Kira Adalia 2101646672 GSLC 30 April 2020 Excercise 10-12Документ3 страницыYarra Kira Adalia 2101646672 GSLC 30 April 2020 Excercise 10-12Yarra AdaliaОценок пока нет

- Apple Q3 FY19 Consolidated Financial StatementsДокумент3 страницыApple Q3 FY19 Consolidated Financial StatementsJack PurcherОценок пока нет

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionОт EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionРейтинг: 5 из 5 звезд5/5 (1)

- Cameron Fisher Amazon Financial PaperДокумент6 страницCameron Fisher Amazon Financial Paperapi-340519862Оценок пока нет

- Math Finance Project ResponseДокумент2 страницыMath Finance Project Responseapi-340519862Оценок пока нет

- Math Finance ProjectДокумент4 страницыMath Finance Projectapi-340519862Оценок пока нет

- Dance Culture - DhaantoДокумент14 страницDance Culture - Dhaantoapi-340519862Оценок пока нет

- New Income Tax Provisions On TDS and TCS On GoodsДокумент31 страницаNew Income Tax Provisions On TDS and TCS On Goodsऋषिपाल सिंहОценок пока нет

- Short Term Financial Management 3rd Edition Maness Test BankДокумент5 страницShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (16)

- Cdi 4 Organized Crime 2020 Covid AДокумент66 страницCdi 4 Organized Crime 2020 Covid AVj Lentejas IIIОценок пока нет

- 18.2 Gargallo vs. DOHLE Seafront Crewing August 2016Документ10 страниц18.2 Gargallo vs. DOHLE Seafront Crewing August 2016French Vivienne TemplonuevoОценок пока нет

- Ultra 3000 Drive (2098-In003 - En-P)Документ180 страницUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteОценок пока нет

- Henry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Документ7 страницHenry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Scribd Government DocsОценок пока нет

- Financial System in PakistanДокумент13 страницFinancial System in PakistanMuhammad IrfanОценок пока нет

- CHESS TECHNICAL GUIDELINES FOR PALARO 2023 FinalДокумент14 страницCHESS TECHNICAL GUIDELINES FOR PALARO 2023 FinalKaren Joy Dela Torre100% (1)

- Upload 1Документ15 страницUpload 1Saurabh KumarОценок пока нет

- 16) Tayug Vs Rural BankДокумент3 страницы16) Tayug Vs Rural BankJohn Ayson100% (2)

- MHRC Internal MemoДокумент1 страницаMHRC Internal MemoJacob RodriguezОценок пока нет

- ACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideДокумент3 страницыACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideMatthew Jalem PanaguitonОценок пока нет

- Peshawar PresentationДокумент21 страницаPeshawar PresentationsamОценок пока нет

- Finance Guidelines Manual For Local Departments of Social Services - VA DSS - Oct 2009Документ426 страницFinance Guidelines Manual For Local Departments of Social Services - VA DSS - Oct 2009Rick ThomaОценок пока нет

- Loss or CRДокумент4 страницыLoss or CRJRMSU Finance OfficeОценок пока нет

- Grande V AntonioДокумент17 страницGrande V Antoniochristopher1julian1aОценок пока нет

- (Ebook - Health) Guide To Health InsuranceДокумент28 страниц(Ebook - Health) Guide To Health InsuranceAndrei CarlanОценок пока нет

- Business Studies Form 2Документ46 страницBusiness Studies Form 2Gadaphy OdhiamboОценок пока нет

- Sum09 Siena NewsДокумент8 страницSum09 Siena NewsSiena CollegeОценок пока нет

- Η Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνДокумент25 страницΗ Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνKonstantinos MantasОценок пока нет

- LabRel MT Long QuizДокумент4 страницыLabRel MT Long QuizDerek EgallaОценок пока нет

- Midnights Children LitChartДокумент104 страницыMidnights Children LitChartnimishaОценок пока нет

- Cruz v. IAC DigestДокумент1 страницаCruz v. IAC DigestFrancis GuinooОценок пока нет

- Gun Control and Genocide - Mercyseat - Net-16Документ16 страницGun Control and Genocide - Mercyseat - Net-16Keith Knight100% (2)

- Duas of Some Messengers and Other MuslimsДокумент9 страницDuas of Some Messengers and Other Muslimsyakubu I saidОценок пока нет

- Protect Kids Using Parental Control For Internet AccessДокумент2 страницыProtect Kids Using Parental Control For Internet AccessVishal SunilОценок пока нет

- PAS 36 Impairment of AssetsДокумент10 страницPAS 36 Impairment of AssetsFhrince Carl CalaquianОценок пока нет

- International Finance - Questions Exercises 2023Документ5 страницInternational Finance - Questions Exercises 2023quynhnannieОценок пока нет

- Affidavit of SupportДокумент3 страницыAffidavit of Supportprozoam21Оценок пока нет

- Cypherpunk's ManifestoДокумент3 страницыCypherpunk's ManifestoevanLeОценок пока нет