Академический Документы

Профессиональный Документы

Культура Документы

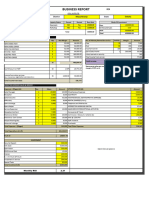

SEZ Non Sez: Transaction Chart

Загружено:

yuva_86Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SEZ Non Sez: Transaction Chart

Загружено:

yuva_86Авторское право:

Доступные форматы

SEZ NON SEZ

TRANSACTION

TRANSACTION GST PAYABLE TRANSACTION GST PAYABLE

CHART

Output GST Input GST Net Payable Output GST Input GST Net Payable

A Final Bill Value 66 55 000 - - - Final Bill Value 78 52 900 - 11 97 900 -

CLIENT ITC Reversal (-) 11 97 900

Note -1

B Sale Bill (to A) Sale Bill (to A)

CONTRACTOR Invoice Cost 60 50 000 - 10 89 000 (-) 10 89 000 Invoice Cost 60 50 000 11 97 900 10 89 000 1 08 900

Proft @10% 6 05 000 Proft @10% 6 05 000

66 55 000 [Refundable or 66 55 000

Add : GST 18% - It will be adj. Add : GST 18% 11 97 900

66 55 000 in other proj. 78 52 900

Liabilies]

C Sale Bill (to B) 10 89 000 9 90 000 99 000 Sale Bill (to B) 10 89 000 9 90 000 99 000

SUB-COTRACTOR Invoice Cost 55 00 000 Invoice Cost 55 00 000

Proft @10% 5 50 000 Proft @10% 5 50 000

60 50 000 60 50 000

Add : GST 18% 10 89 000 Add : GST 18% 10 89 000

71 39 000 71 39 000

D Sale Bill (to C) 9 90 000 - 9 90 000 Sale Bill (to C) 9 90 000 - 9 90 000

SUPPLIER Invoice Cost 50 00 000 Invoice Cost 50 00 000

(TO SUBCONTRACTOR) Proft @10% 5 00 000 Proft @10% 5 00 000

55 00 000 55 00 000

Add : GST 18% 9 90 000 Add : GST 18% 9 90 000

64 90 000 64 90 000

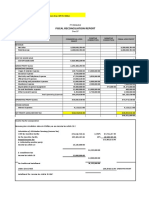

Note 1

If client -A is an end user…

then, this ITC amount of Rs.11,97,900/- is not eligible to take as Input Tax Credit by them. They have to reverse this amount as non eligible ITC in their GST Returns.

If client -A is further sell this property to others…

then, this ITC amount of Rs.11,97,900/- is eligible to take as Input Tax Credit by them. He can claim it as Input tax Credit and set off it with their Output GST Liability.

***

Вам также может понравиться

- A.Diesel Fuel Station Dealership Module: Investment Rs. 51,30,000Документ2 страницыA.Diesel Fuel Station Dealership Module: Investment Rs. 51,30,000Om ChavanОценок пока нет

- IT Assessment of Individuals IllustrationДокумент5 страницIT Assessment of Individuals Illustrationsyedfareed596Оценок пока нет

- BLT FINAL Assignment (Feb - June 2020) FINALДокумент16 страницBLT FINAL Assignment (Feb - June 2020) FINALSalman SajidОценок пока нет

- Cash Flow File No.1Документ8 страницCash Flow File No.1tomОценок пока нет

- Concept BillДокумент1 страницаConcept Billalmamunmolla96Оценок пока нет

- Solutionsof Chapter GSTДокумент14 страницSolutionsof Chapter GSTonstudy015Оценок пока нет

- Dashboard - SAI - PreviewReports - 2011Документ73 страницыDashboard - SAI - PreviewReports - 2011Oh Oh OhОценок пока нет

- ROI BaripadaДокумент1 страницаROI BaripadaTanmay AgarwalaОценок пока нет

- Tarafarma Worksheet Januari 2017Документ2 страницыTarafarma Worksheet Januari 2017Nazla HanifaОценок пока нет

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementДокумент5 страницPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewОценок пока нет

- Gmail - Free Chegg Answer From TechLaCarteДокумент4 страницыGmail - Free Chegg Answer From TechLaCarteShyam AgrawalОценок пока нет

- 1 BTAXREV Week 2 Income TaxationДокумент48 страниц1 BTAXREV Week 2 Income TaxationgatotkaОценок пока нет

- SBM Errata Sheet 2020 - 080920Документ11 страницSBM Errata Sheet 2020 - 080920Hamza AliОценок пока нет

- Ch. 1 - GST (Goods and Services Tax)Документ15 страницCh. 1 - GST (Goods and Services Tax)Natasha SinghОценок пока нет

- .Apr 2022Документ10 страниц.Apr 2022SWAPNIL JADHAVОценок пока нет

- Forest Tower Flat Sale DetailsДокумент1 страницаForest Tower Flat Sale DetailsNikhil JaiswalОценок пока нет

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyДокумент1 страницаChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalОценок пока нет

- CuppaMania NPV AnalysisДокумент2 страницыCuppaMania NPV AnalysisdeepaksikriОценок пока нет

- Self-Occupied: Com Putati On of I Ncom E and Tax Pai DДокумент5 страницSelf-Occupied: Com Putati On of I Ncom E and Tax Pai DAnshika GoelОценок пока нет

- Trial BalanceДокумент1 страницаTrial Balancebhoomika.shah0624Оценок пока нет

- Cost Calculation PAO Sampit - ShandongДокумент1 страницаCost Calculation PAO Sampit - ShandongAULIA ANNAОценок пока нет

- Diji Survey 1Документ1 страницаDiji Survey 1bala hariОценок пока нет

- Project Orderslip Mori Lt35 Ranggada Re02Документ5 страницProject Orderslip Mori Lt35 Ranggada Re02Arland AsraОценок пока нет

- 3 BHKДокумент2 страницы3 BHKX097Оценок пока нет

- Swinburne University ACC10007 Discussion QuestionsДокумент5 страницSwinburne University ACC10007 Discussion QuestionsRenee WongОценок пока нет

- Subek Trade DuesДокумент2 страницыSubek Trade DuesKAMAL SUBEDIОценок пока нет

- T2 Revised Ans. (PS & ITA)Документ8 страницT2 Revised Ans. (PS & ITA)alvinmono.718Оценок пока нет

- Chapter 12 QR SolutionsДокумент14 страницChapter 12 QR SolutionsNAITIK SHARMAОценок пока нет

- 2016 FR PDFДокумент6 страниц2016 FR PDFSomeone 4780Оценок пока нет

- Muhammad Aiman Bin Mohd Azri ID 20050142 Sec 4 (A)Документ10 страницMuhammad Aiman Bin Mohd Azri ID 20050142 Sec 4 (A)Aiman AzriОценок пока нет

- Tla-7 1Документ17 страницTla-7 1Trisha Monique VillaОценок пока нет

- R2. TAX (M.L) Solution CMA May-2023 ExamДокумент5 страницR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudОценок пока нет

- Profit and LossДокумент9 страницProfit and LossAlbiyara MannОценок пока нет

- Car Lease ComparisonДокумент16 страницCar Lease Comparisonrahul kumarОценок пока нет

- Chapter 4 CB Problems - IДокумент11 страницChapter 4 CB Problems - IRoy YadavОценок пока нет

- 07.2 UPDATED Capital Investment DecisionsДокумент6 страниц07.2 UPDATED Capital Investment DecisionsMilani Joy LazoОценок пока нет

- GST Receipt Voucher TemplateДокумент2 страницыGST Receipt Voucher TemplateUNEXPECTEDОценок пока нет

- Project cost breakup for Bollineni Astra residential unitsДокумент1 страницаProject cost breakup for Bollineni Astra residential unitsShlok GargОценок пока нет

- Ratio Analysis Numericals Including Reverse RatiosДокумент6 страницRatio Analysis Numericals Including Reverse RatiosFunny ManОценок пока нет

- CF Assignment 1 Group 4Документ41 страницаCF Assignment 1 Group 4Radha DasОценок пока нет

- DT - Consignment Sales and Revenue From Contracts - Answer KeyДокумент5 страницDT - Consignment Sales and Revenue From Contracts - Answer Keyjessicayabutpangilinan252Оценок пока нет

- Hasil Abnormal ReturnДокумент1 страницаHasil Abnormal ReturnSurya KeceОценок пока нет

- Construction Project Extra Item StatementДокумент3 страницыConstruction Project Extra Item StatementNarayan Kumar GoaОценок пока нет

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsДокумент5 страницInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiОценок пока нет

- Chapter-21 (Solved Past Papers of CA Mod CДокумент67 страницChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Formate of GST InvoiceДокумент2 страницыFormate of GST InvoiceVinay VermaОценок пока нет

- Quotation To FVG For Factory Set UpДокумент4 страницыQuotation To FVG For Factory Set UpAnik SahaОценок пока нет

- BA 205 AnswerДокумент5 страницBA 205 AnswerAnhar Polo CanacanОценок пока нет

- Only Fill Yellow Cells: WorkingsДокумент2 страницыOnly Fill Yellow Cells: WorkingsvikrammoolchandaniОценок пока нет

- Pembahasan Kuiz Indirect HoldingsДокумент3 страницыPembahasan Kuiz Indirect HoldingsAdara KiranaОценок пока нет

- Group 2-Fin 6000BДокумент7 страницGroup 2-Fin 6000BBellindah wОценок пока нет

- Profitability Ratios ExplainedДокумент17 страницProfitability Ratios ExplainedJenina Augusta EstanislaoОценок пока нет

- ProfitabilityДокумент17 страницProfitabilityJenina Augusta EstanislaoОценок пока нет

- Invoice: SR - No Items Q'ty Unit Materials Cost Labour CostДокумент1 страницаInvoice: SR - No Items Q'ty Unit Materials Cost Labour CostYe YintОценок пока нет

- New Tax Rates vs Existing Tax Rates for IndividualsДокумент2 страницыNew Tax Rates vs Existing Tax Rates for IndividualsCA Upendra Singh ThakurОценок пока нет

- Notes - Help For BPДокумент21 страницаNotes - Help For BPmitemkt9683Оценок пока нет

- Ia Forcadela Part IIIДокумент5 страницIa Forcadela Part IIIMary Joanne forcadelaОценок пока нет

- Taller FinalДокумент13 страницTaller FinalJennifer Ramos PerezОценок пока нет

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetДокумент1 страницаFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenОценок пока нет

- NIT Patna Bihta CampusДокумент16 страницNIT Patna Bihta Campusyuva_86Оценок пока нет

- General Academic Vacancy PositionДокумент287 страницGeneral Academic Vacancy Positionyuva_86Оценок пока нет

- 03-GRIHA V-2019 Design Guideline On ENERGY EFFICIENCY - For Electrical ConsultantДокумент16 страниц03-GRIHA V-2019 Design Guideline On ENERGY EFFICIENCY - For Electrical Consultantyuva_86Оценок пока нет

- 02-GRIHA V-2019 Design Guideline On SUSTAINABLE ARCHITECTURE - For ArchitectДокумент20 страниц02-GRIHA V-2019 Design Guideline On SUSTAINABLE ARCHITECTURE - For Architectyuva_86Оценок пока нет

- Matrix Multi Attributes BMTPCДокумент37 страницMatrix Multi Attributes BMTPCyuva_86Оценок пока нет

- Bond STRGДокумент8 страницBond STRGyuva_86Оценок пока нет

- Bond CFRPДокумент10 страницBond CFRPyuva_86Оценок пока нет

- General Academic Vacancy PositionДокумент289 страницGeneral Academic Vacancy Positionyuva_86Оценок пока нет

- 04-ANNEXURE-01-ECBC 2017 (Mandatory Requirements) - For Electrical ConsultantДокумент18 страниц04-ANNEXURE-01-ECBC 2017 (Mandatory Requirements) - For Electrical Consultantyuva_86Оценок пока нет

- 01-GRIHA V-2019 Design Guideline On SITE PLANNING - For URCДокумент11 страниц01-GRIHA V-2019 Design Guideline On SITE PLANNING - For URCyuva_86Оценок пока нет

- Guntur Case Study PDFДокумент2 страницыGuntur Case Study PDFyuva_86Оценок пока нет

- WallДокумент9 страницWallvparthibban37Оценок пока нет

- Cantilever SlabДокумент7 страницCantilever Slabyuva_86Оценок пока нет

- Bridge Retrofit CFRPДокумент9 страницBridge Retrofit CFRPyuva_86Оценок пока нет

- Code Model Cfrp-IДокумент1 страницаCode Model Cfrp-Iyuva_86Оценок пока нет

- Rapidwall For HousingДокумент11 страницRapidwall For HousingDees_24100% (1)

- Smart City, Amaravati: Detailed Report On The Scope of Smart City For ConstructionДокумент45 страницSmart City, Amaravati: Detailed Report On The Scope of Smart City For Constructionyuva_86Оценок пока нет

- 01 Tender Highlights DSIIDCДокумент3 страницы01 Tender Highlights DSIIDCyuva_86Оценок пока нет

- ECO CELL PresentationДокумент12 страницECO CELL Presentationyuva_86Оценок пока нет

- 01.10.2020 Central Minimum WageДокумент1 страница01.10.2020 Central Minimum Wageyuva_86Оценок пока нет

- Data Center Site Infrastructure PDFДокумент14 страницData Center Site Infrastructure PDFPanos CayafasОценок пока нет

- Annex-01 TECHNOLOGY PROFILE Monolithic Plastic AluДокумент5 страницAnnex-01 TECHNOLOGY PROFILE Monolithic Plastic AluTarun ChopraОценок пока нет

- Page001to133 PDFДокумент133 страницыPage001to133 PDFyuva_86Оценок пока нет

- Nitcivilnew PDFДокумент257 страницNitcivilnew PDFyuva_86Оценок пока нет

- NormsДокумент11 страницNormsPrakash KannanОценок пока нет

- 4419 FS 04 Kwik-Deck 1Документ20 страниц4419 FS 04 Kwik-Deck 1ezzularabОценок пока нет

- Page001to133 PDFДокумент133 страницыPage001to133 PDFyuva_86Оценок пока нет

- Infrastructure Organization's Vision and ValuesДокумент143 страницыInfrastructure Organization's Vision and Valuesyuva_86100% (1)

- ICACMS 2017 Conference Advances Construction Materials Systems ChennaiДокумент2 страницыICACMS 2017 Conference Advances Construction Materials Systems Chennaiyuva_86Оценок пока нет

- Online Assignment Instant-36 PDFДокумент8 страницOnline Assignment Instant-36 PDFsolutionsОценок пока нет

- Difference Between Offer and Invitation To TreatДокумент5 страницDifference Between Offer and Invitation To TreatBrian Okuku Owinoh100% (2)

- Training MatrixДокумент4 страницыTraining MatrixJennyfer Banez Nipales100% (1)

- Relucio V Civil ServiceДокумент6 страницRelucio V Civil ServiceLASОценок пока нет

- Digital Signature Certificate Subscription FormДокумент7 страницDigital Signature Certificate Subscription FormAneesh VelluvalappilОценок пока нет

- Visual Design-Composition and Layout PrinciplesДокумент5 страницVisual Design-Composition and Layout PrinciplesRadyОценок пока нет

- Over 20 free and paid Pathfinder 2E character sheet optionsДокумент1 страницаOver 20 free and paid Pathfinder 2E character sheet optionsravardieresudОценок пока нет

- Display Kit GuideДокумент9 страницDisplay Kit GuidemfabianiОценок пока нет

- Contrafund 31-07-2020Документ12 страницContrafund 31-07-2020b1OSphereОценок пока нет

- What Digital Camera - May 2016Документ100 страницWhat Digital Camera - May 2016Alberto ChazarretaОценок пока нет

- Biju Patnaik University of Technology MCA SyllabusДокумент18 страницBiju Patnaik University of Technology MCA SyllabusAshutosh MahapatraОценок пока нет

- Pe-501003-009 STPДокумент9 страницPe-501003-009 STPJeyakumar ArumugamОценок пока нет

- CSCI369 Lab 2Документ3 страницыCSCI369 Lab 2Joe Ong ZuokaiОценок пока нет

- Secretary Leila De Lima vs Magtanggol GatdulaДокумент2 страницыSecretary Leila De Lima vs Magtanggol GatdulaShane Fulgueras100% (1)

- Seminar On Biodegradable PolymersДокумент19 страницSeminar On Biodegradable Polymerskeyur33% (3)

- QRHДокумент12 страницQRHNwe OoОценок пока нет

- DSKH Riviera Q2 101Документ10 страницDSKH Riviera Q2 101Viết HảiОценок пока нет

- Assessment Task 2Документ15 страницAssessment Task 2Hira Raza0% (2)

- Data Sheet Sylomer SR 28 ENДокумент4 страницыData Sheet Sylomer SR 28 ENlpczyfansОценок пока нет

- LGДокумент5 страницLGPreetham Kiran RodriguesОценок пока нет

- Internship Contract AppendixДокумент3 страницыInternship Contract AppendixSheОценок пока нет

- 102XM PartesДокумент109 страниц102XM PartesGuillermo García GarcíaОценок пока нет

- Playlist ArchacДокумент30 страницPlaylist ArchacMartin JánošíkОценок пока нет

- Apc Materials PropertiesДокумент15 страницApc Materials PropertiesnamyefОценок пока нет

- Erasmo WongДокумент3 страницыErasmo WongGabriel GutierrezОценок пока нет

- QSF HRM F03 Job Application FormДокумент2 страницыQSF HRM F03 Job Application Formjohn MОценок пока нет

- Ruskin Bond's Haunting Stories CollectionДокумент5 страницRuskin Bond's Haunting Stories CollectionGopal DeyОценок пока нет

- Disaster Risk Reduction and LivelihoodsДокумент178 страницDisaster Risk Reduction and LivelihoodsFeinstein International Center100% (1)

- Terms and conditions for FLAC 3D licensingДокумент2 страницыTerms and conditions for FLAC 3D licensingseif17Оценок пока нет

- MU - NACELLESURCAMION - ANG - E07.07 htb180Документ73 страницыMU - NACELLESURCAMION - ANG - E07.07 htb180Marcin RombalskiОценок пока нет