Академический Документы

Профессиональный Документы

Культура Документы

Lecture 18 Relative Strength Index RSI PDF

Загружено:

braetto_1x10 оценок0% нашли этот документ полезным (0 голосов)

470 просмотров1 страницаThe Relative Strength Index (RSI) is a momentum oscillator that tracks the speed and change of price movements. It is calculated by taking the average return of positive periods and dividing it by the average return of negative periods, with the result ranging from 0 to 100. The RSI indicates whether a stock is overbought or oversold, with readings under 30 generally viewed as oversold and over 70 as overbought.

Исходное описание:

Оригинальное название

Lecture-18-Relative-Strength-Index-RSI.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe Relative Strength Index (RSI) is a momentum oscillator that tracks the speed and change of price movements. It is calculated by taking the average return of positive periods and dividing it by the average return of negative periods, with the result ranging from 0 to 100. The RSI indicates whether a stock is overbought or oversold, with readings under 30 generally viewed as oversold and over 70 as overbought.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

470 просмотров1 страницаLecture 18 Relative Strength Index RSI PDF

Загружено:

braetto_1x1The Relative Strength Index (RSI) is a momentum oscillator that tracks the speed and change of price movements. It is calculated by taking the average return of positive periods and dividing it by the average return of negative periods, with the result ranging from 0 to 100. The RSI indicates whether a stock is overbought or oversold, with readings under 30 generally viewed as oversold and over 70 as overbought.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

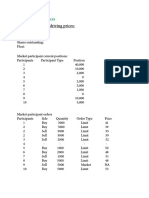

Lecture 18

Relative Strength Index (RSI)

This is a momentum oscillator that tracks the speed and change of price movements.

RSI = 100 - 100 / (1 + RS)

RS = average return of positive periods / average return of negative periods

The RSI gives an indication of recent price action performance and can range from

0 to 100. The default periods computed on is 14 days. The lower the RSI the more

oversold the stock is and the higher the RSI the more overbought the stock is. Usualy

an RSI under 30 is considered oversold and over 70 is overbought.

Вам также может понравиться

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Документ41 страницаAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Average True RangeДокумент2 страницыAverage True Rangesanny2005Оценок пока нет

- Five Key Factors That Move The Forex Markets - and How To Profit From ThemДокумент13 страницFive Key Factors That Move The Forex Markets - and How To Profit From ThemarifzakirОценок пока нет

- Reverse Engineering MACDДокумент1 страницаReverse Engineering MACDNiltonОценок пока нет

- 72s Adaptive Hull Moving Average PlusДокумент7 страниц72s Adaptive Hull Moving Average PlusSaravana GovindaswamyОценок пока нет

- Lecture 13 Candlesticks PDFДокумент5 страницLecture 13 Candlesticks PDFbraetto_1x1Оценок пока нет

- Cupping Therapy in InfertilityДокумент46 страницCupping Therapy in Infertilitymrcyber75% (8)

- Almonds - Feasibility Study For Processing PlanДокумент15 страницAlmonds - Feasibility Study For Processing Planbraetto_1x1Оценок пока нет

- Lecture 18 Relative Strength Index RSI PDFДокумент1 страницаLecture 18 Relative Strength Index RSI PDFbraetto_1x1Оценок пока нет

- Curso Larry WilliansДокумент226 страницCurso Larry WilliansJose Calachahuin100% (6)

- Understanding Basis PDFДокумент30 страницUnderstanding Basis PDFJaz MОценок пока нет

- Acetrades EbookДокумент20 страницAcetrades Ebookallegre50% (2)

- Argus Coalindo Indonesian Coal Index Report PDFДокумент2 страницыArgus Coalindo Indonesian Coal Index Report PDFSyadila RefiastoОценок пока нет

- Elliot WaveДокумент15 страницElliot WaveAbhishek Chopra100% (2)

- How To Use RSI (Relative Strength Index)Документ3 страницыHow To Use RSI (Relative Strength Index)paoloОценок пока нет

- Relative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystДокумент2 страницыRelative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystvvpvarunОценок пока нет

- Introducti: New C Cepts in Technical Trading SystemsДокумент4 страницыIntroducti: New C Cepts in Technical Trading Systemsapi-3831404100% (2)

- Prashant Shah - RSIДокумент5 страницPrashant Shah - RSIIMaths PowaiОценок пока нет

- Peter Aan - RSIДокумент4 страницыPeter Aan - RSIanalyst_anil14100% (1)

- G5-T6 How To Use RSIДокумент4 страницыG5-T6 How To Use RSIThe ShitОценок пока нет

- Secrets of Trading With RSIДокумент9 страницSecrets of Trading With RSIHarryОценок пока нет

- 20-Relative Strenght Index-1611440002-Muh Awal Tasir (Makalah)Документ19 страниц20-Relative Strenght Index-1611440002-Muh Awal Tasir (Makalah)nanda awaliaОценок пока нет

- ADXДокумент4 страницыADXdharmeshtrОценок пока нет

- RSI BasicДокумент93 страницыRSI BasicDinesh C0% (1)

- Moving Average: 10 Days Total 10-MAДокумент8 страницMoving Average: 10 Days Total 10-MAGhouse PashaОценок пока нет

- MACD Moving Average Convergence DivergenceДокумент2 страницыMACD Moving Average Convergence DivergencestashastashaОценок пока нет

- Types of Trading Indicators - Wealth SecretДокумент4 страницыTypes of Trading Indicators - Wealth Secretqgy7nyvv62Оценок пока нет

- Moving Average Indicator Checklist: Tradingwithrayner PresentsДокумент8 страницMoving Average Indicator Checklist: Tradingwithrayner PresentsHimanshu Singh RajputОценок пока нет

- The Basis of Technical AnalysisДокумент7 страницThe Basis of Technical AnalysisFranklin Aleyamma JoseОценок пока нет

- Metastock Breakout FormulasДокумент5 страницMetastock Breakout FormulasEd MartiОценок пока нет

- Stochastic RSI - StochRSI DefinitionДокумент9 страницStochastic RSI - StochRSI Definitionselozok1Оценок пока нет

- Technical AnalyyysisДокумент95 страницTechnical AnalyyysisSoumya Ranjan PandaОценок пока нет

- Relative Strength IndexДокумент12 страницRelative Strength IndexMonica Pangemanan0% (1)

- Average Directional Movement Index (ADX) : DescriptionДокумент9 страницAverage Directional Movement Index (ADX) : DescriptionvvpvarunОценок пока нет

- The Magic Momentum Method of Trading The Forex MarketДокумент16 страницThe Magic Momentum Method of Trading The Forex MarketBhavya ShahОценок пока нет

- ADX - The Trend Strength IndicatorДокумент5 страницADX - The Trend Strength IndicatorAditya Vikram Jha100% (1)

- Volatility StopsДокумент5 страницVolatility Stopspderby1Оценок пока нет

- MACD RulesДокумент1 страницаMACD RulesJafrid NassifОценок пока нет

- (Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)Документ6 страниц(Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)sivakumar_appasamyОценок пока нет

- The Blue HopperДокумент3 страницыThe Blue HopperRob Booker100% (1)

- 4X Pip Snager Trading Systems-PAGE 28Документ69 страниц4X Pip Snager Trading Systems-PAGE 28orangeray21Оценок пока нет

- Moving Average Convergence DivergenceДокумент3 страницыMoving Average Convergence DivergenceNikita DubeyОценок пока нет

- Mastering The MacdДокумент4 страницыMastering The Macdsaran21Оценок пока нет

- Poa FyersДокумент4 страницыPoa Fyerspradeep.jaganathanОценок пока нет

- Moving Average Trading Rules For NASDAQ Composite PDFДокумент13 страницMoving Average Trading Rules For NASDAQ Composite PDFKatlego MalulekaОценок пока нет

- Moving Average ConvergenceДокумент8 страницMoving Average ConvergenceGhouse PashaОценок пока нет

- Combining RSI With RSIДокумент39 страницCombining RSI With RSIwayansiagaОценок пока нет

- Trend FollowerДокумент62 страницыTrend Followergreenpark05100% (1)

- The 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeДокумент3 страницыThe 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeSweety DasОценок пока нет

- MetaStock Codes For DPTSДокумент1 страницаMetaStock Codes For DPTSTerence ChanОценок пока нет

- Mim RsiДокумент21 страницаMim RsiYev ChenkovОценок пока нет

- Average Directional Index - PPT 2Документ10 страницAverage Directional Index - PPT 2anon_212028Оценок пока нет

- ADR IndicatorДокумент8 страницADR IndicatorEnrique BlancoОценок пока нет

- Average Directional Movement ADXДокумент6 страницAverage Directional Movement ADXNiroj KhadkaОценок пока нет

- Savvy MACD IndicatorДокумент10 страницSavvy MACD IndicatorCapitanu IulianОценок пока нет

- Support Resistance Volume BasedДокумент12 страницSupport Resistance Volume BasedVinod KumarОценок пока нет

- Candlestick Charts - ExplanationДокумент15 страницCandlestick Charts - Explanationpangm100% (1)

- 02-Using Moving Averages On RSI To Trade Short Term (March 7, 2019)Документ12 страниц02-Using Moving Averages On RSI To Trade Short Term (March 7, 2019)Manoj Kumar MauryaОценок пока нет

- RSI Basic LiteДокумент41 страницаRSI Basic LiteDinesh CОценок пока нет

- Technical Analysis of Forex by MACD IndicatorДокумент8 страницTechnical Analysis of Forex by MACD IndicatorAbby MMОценок пока нет

- RSI Trade Settings Explained 4 Unique Trading Strategies - TradingSimДокумент25 страницRSI Trade Settings Explained 4 Unique Trading Strategies - TradingSimgiberamu790Оценок пока нет

- Refined MacdДокумент17 страницRefined Macdapolodoro7Оценок пока нет

- Trading+With+MACD+ +a+Lesson+on+DivergenceДокумент10 страницTrading+With+MACD+ +a+Lesson+on+DivergenceAndrea PedrottaОценок пока нет

- Trading Manual PDFДокумент23 страницыTrading Manual PDFTamás TóthОценок пока нет

- Mastering Forex Fundamentals: A Comprehensive Guide in 2 HoursОт EverandMastering Forex Fundamentals: A Comprehensive Guide in 2 HoursРейтинг: 5 из 5 звезд5/5 (1)

- Lecture 22 Batting Average Win Loss Ratio PDFДокумент1 страницаLecture 22 Batting Average Win Loss Ratio PDFbraetto_1x1Оценок пока нет

- Lecture 31 Confirmation Bias PDFДокумент1 страницаLecture 31 Confirmation Bias PDFbraetto_1x1Оценок пока нет

- Chart Patterns: Head and ShouldersДокумент6 страницChart Patterns: Head and Shouldersbraetto_1x1Оценок пока нет

- Lecture 24 Money Management PDFДокумент2 страницыLecture 24 Money Management PDFbraetto_1x1Оценок пока нет

- Loss Aversion: How Itaff Ects Our TradingДокумент1 страницаLoss Aversion: How Itaff Ects Our Tradingbraetto_1x1Оценок пока нет

- Lecture 30 Anchoring Effect PDFДокумент1 страницаLecture 30 Anchoring Effect PDFbraetto_1x1Оценок пока нет

- Lecture 19 Average True Range ATR PDFДокумент1 страницаLecture 19 Average True Range ATR PDFbraetto_1x1Оценок пока нет

- Lecture 26 The Importance of Psychology PDFДокумент1 страницаLecture 26 The Importance of Psychology PDFbraetto_1x1Оценок пока нет

- Lecture 14 Trends PDFДокумент4 страницыLecture 14 Trends PDFbraetto_1x1Оценок пока нет

- Lecture 20 Expectancy PDFДокумент2 страницыLecture 20 Expectancy PDFbraetto_1x1Оценок пока нет

- The Path of GuidanceДокумент78 страницThe Path of GuidanceksahunkОценок пока нет

- Lecture 23 Risk Management PDFДокумент2 страницыLecture 23 Risk Management PDFbraetto_1x1Оценок пока нет

- Lecture 17 Bollinger Bands PDFДокумент1 страницаLecture 17 Bollinger Bands PDFbraetto_1x1Оценок пока нет

- Lecture 3 What Is A Stock PDFДокумент1 страницаLecture 3 What Is A Stock PDFbraetto_1x1Оценок пока нет

- Lecture 12 Charts Candlesticks PDFДокумент1 страницаLecture 12 Charts Candlesticks PDFbraetto_1x1Оценок пока нет

- Lecture 16 Volume PDFДокумент1 страницаLecture 16 Volume PDFbraetto_1x1Оценок пока нет

- Lecture 9 Different Players PDFДокумент1 страницаLecture 9 Different Players PDFbraetto_1x1Оценок пока нет

- Lecture 5 What Is A Stock Exchange PDFДокумент1 страницаLecture 5 What Is A Stock Exchange PDFbraetto_1x1Оценок пока нет

- Lecture 4 What Is A Market PDFДокумент1 страницаLecture 4 What Is A Market PDFbraetto_1x1Оценок пока нет

- Lecture 2 Why Be Involved in The Markets PDFДокумент1 страницаLecture 2 Why Be Involved in The Markets PDFbraetto_1x1Оценок пока нет

- Lecture 6 What Is A Broker PDFДокумент1 страницаLecture 6 What Is A Broker PDFbraetto_1x1Оценок пока нет

- Lecture 1 Course Objectives Teaching ApproachДокумент1 страницаLecture 1 Course Objectives Teaching Approachbraetto_1x1Оценок пока нет

- Lecture 8 Orders Driving Prices Level1 Level2 Time and Sales PDFДокумент3 страницыLecture 8 Orders Driving Prices Level1 Level2 Time and Sales PDFbraetto_1x1Оценок пока нет

- OFDM2Документ17 страницOFDM2braetto_1x1Оценок пока нет

- S02 3G RPLS2 - v2-0 The Physical LayerДокумент74 страницыS02 3G RPLS2 - v2-0 The Physical LayerginnboonyauОценок пока нет

- Ran ParДокумент98 страницRan Parbraetto_1x1Оценок пока нет

- MerchandisingДокумент8 страницMerchandisingArnab RayОценок пока нет

- Margin Guide: Agriculture EquitiesДокумент3 страницыMargin Guide: Agriculture EquitiesGaro OhanogluОценок пока нет

- Commodity Market of Aluminium: Sourabh SrivastavaДокумент11 страницCommodity Market of Aluminium: Sourabh Srivastavachandoo.upadhyay0% (1)

- Monopolistic CompetitionДокумент36 страницMonopolistic CompetitionAmlan SenguptaОценок пока нет

- Topic 7 - Theory of D Firm - 2Документ17 страницTopic 7 - Theory of D Firm - 2az1anОценок пока нет

- Derivative QuestionsДокумент42 страницыDerivative QuestionsPravenGadi0% (1)

- Global Styrene Pricing Spikes On Supply TightnessДокумент6 страницGlobal Styrene Pricing Spikes On Supply Tightnessrdany3437100% (1)

- System Shark Attack PDFДокумент10 страницSystem Shark Attack PDFbjm778Оценок пока нет

- DarivativesДокумент75 страницDarivativesapi-316719777Оценок пока нет

- RevenueДокумент4 страницыRevenuenayan gujarkarОценок пока нет

- Motilal 9th WealthДокумент40 страницMotilal 9th WealthDhritimanDasОценок пока нет

- Hedging FuturesДокумент39 страницHedging Futuresapi-3833893100% (1)

- Liberty Trading - Disclosure Document 2010Документ16 страницLiberty Trading - Disclosure Document 2010Jose WalkerОценок пока нет

- CQG SymbolsДокумент33 страницыCQG Symbolsmoby_rahmanОценок пока нет

- Option GreeksДокумент2 страницыOption GreeksYarlagaddaОценок пока нет

- Blue Chip CompanyДокумент12 страницBlue Chip CompanyMuralis MuralisОценок пока нет

- PROJECT On Commodity Market From Nirmal Bang by PLABAN KUNDUДокумент68 страницPROJECT On Commodity Market From Nirmal Bang by PLABAN KUNDUPlaban Kundu67% (6)

- CCI - Technical AnalysisДокумент20 страницCCI - Technical AnalysisqzcОценок пока нет

- Elasticity of Demand PDFДокумент35 страницElasticity of Demand PDFSona Chalasani100% (2)

- ComoditiesДокумент61 страницаComoditiesShankar VarmaОценок пока нет

- Finman 10 DerivativesДокумент5 страницFinman 10 DerivativesStephanie Dulay SierraОценок пока нет

- The Wyckoff Method of Trading: Part 15: Market StrategyДокумент9 страницThe Wyckoff Method of Trading: Part 15: Market Strategysatish sОценок пока нет

- How To Trade A Forex Triangle Chart Pattern - Tips and Tricks PDFДокумент8 страницHow To Trade A Forex Triangle Chart Pattern - Tips and Tricks PDFctanghamОценок пока нет