Академический Документы

Профессиональный Документы

Культура Документы

Annexure VI - Form 12B - Prior Employment

Загружено:

Pruthvi Prakasha0 оценок0% нашли этот документ полезным (0 голосов)

65 просмотров1 страницаIncome tax Annexure

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документIncome tax Annexure

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

65 просмотров1 страницаAnnexure VI - Form 12B - Prior Employment

Загружено:

Pruthvi PrakashaIncome tax Annexure

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

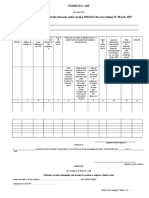

FORM NO.

12B

[See rule 26A]

Form for furnishing details of income under section 192(2) for the year ending 31st March,_______

Name and address of the employee

Permanent Account No.____________________________

Residential status_________________________________

Particulars of salary as defined in section 17,

paid or due to be paid to the employee during

the year

Amount

deducted in

respect of

Total amount of life Total

house rent insurance amount of

allowance, Value of premium, tax

Total conveyance perquities provident deducted

amount of allowance and and fund during the

salary other allowances amount of contribution, year

TAN of Permanent excluding to the extent accretion etc., to (enclose

the Account amounts chargeable to tax to which certificate

employer Number of required to [See Sec 10(13A) employee's Sec.80C issued

Name and (s) as the be shown read with Rule 2A provident Total of applies under

address of alloted employer Period of in column and Section fund Columns, (Give Section

Sno employer (s) by ITO (s) employment 7&8 10(14)] account 6, 7 & 8 details) 203 Remarks

1 2 3 4 5 6 7 8 9 10 11 12

Signature of the employee

Verification

I,____________________________________ do hereby declare that what is stated above is true to the best of my knowledge and belief.

Verified today, the_____________________day of______________________

Signature of the employee

Вам также может понравиться

- Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Документ4 страницыForm For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Dilip KumarОценок пока нет

- Furnishing Income Details - FORM 12BДокумент4 страницыFurnishing Income Details - FORM 12BMahi MahajanОценок пока нет

- Form No. 12B: (See Rule 26A)Документ3 страницыForm No. 12B: (See Rule 26A)sumit vermaОценок пока нет

- Form 12B detailsДокумент3 страницыForm 12B detailskawoОценок пока нет

- FORM 12B DETAILSДокумент4 страницыFORM 12B DETAILSRanga.SathyaОценок пока нет

- ISGEC Form 12B DetailsДокумент3 страницыISGEC Form 12B DetailsSantosh Kumar JaiswalОценок пока нет

- Annex 6 - Form 12B PDFДокумент3 страницыAnnex 6 - Form 12B PDFAnonymous Q1Y71rОценок пока нет

- Income Tax Form 12BДокумент3 страницыIncome Tax Form 12BlktyagiОценок пока нет

- Form No. 12B: Prabhakarappa ShashidharДокумент1 страницаForm No. 12B: Prabhakarappa ShashidharAmbika BpОценок пока нет

- 10 Previous Employer 12BДокумент3 страницы10 Previous Employer 12BvenkyОценок пока нет

- Form 12-B Updt23Документ4 страницыForm 12-B Updt23Durga prasad DashОценок пока нет

- FORM 12B - Previous Employment Income DeclarationДокумент3 страницыFORM 12B - Previous Employment Income DeclarationsudhakarОценок пока нет

- Form 12B - Previous Employment Income DetailsДокумент2 страницыForm 12B - Previous Employment Income DetailsSachin5586Оценок пока нет

- Payment of Bonus Act FormsДокумент5 страницPayment of Bonus Act Formspratik06Оценок пока нет

- EMP ID FORM 12B DETAILSДокумент2 страницыEMP ID FORM 12B DETAILSsrinivasОценок пока нет

- Statement For Financial Year: Name of The Employer: Tin: AddressДокумент2 страницыStatement For Financial Year: Name of The Employer: Tin: AddressMd. Abu NaserОценок пока нет

- Sample Filled Form 12BДокумент3 страницыSample Filled Form 12BSanjay sharma50% (2)

- Payment of Bonus Form A, B, C & DДокумент4 страницыPayment of Bonus Form A, B, C & Darun gupta0% (1)

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceДокумент4 страницыForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxОценок пока нет

- Form 16Документ4 страницыForm 16harit sharmaОценок пока нет

- Form-6 Register of EmployeesДокумент3 страницыForm-6 Register of EmployeessandilyavikasОценок пока нет

- Form No. 16A (See Rule31 (L) (B) )Документ4 страницыForm No. 16A (See Rule31 (L) (B) )Nirmal MalooОценок пока нет

- FORM 5 RETURN OF CONTRIBUTIONSДокумент4 страницыFORM 5 RETURN OF CONTRIBUTIONSsavita17julyОценок пока нет

- TDS Certificate SummaryДокумент14 страницTDS Certificate SummaryVaibhav NagoriОценок пока нет

- 0002 Payment Certificate 2010Документ3 страницы0002 Payment Certificate 2010SreedharanPNОценок пока нет

- Form 16 FormatДокумент2 страницыForm 16 FormatParthVanjaraОценок пока нет

- PFF12Документ2 страницыPFF12humanresources.qualimarkОценок пока нет

- WEEK 6 - AccДокумент2 страницыWEEK 6 - AccYusef ShaqeelОценок пока нет

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeДокумент3 страницыForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdОценок пока нет

- US Internal Revenue Service: f5500sb - 1993Документ3 страницыUS Internal Revenue Service: f5500sb - 1993IRSОценок пока нет

- ESIC From 5A Return of ContributionДокумент4 страницыESIC From 5A Return of ContributionCA.Nahush SahasrabuddheОценок пока нет

- Payment of Bonus Rules (Pt.-4)Документ9 страницPayment of Bonus Rules (Pt.-4)Anonymous QyYvWj1Оценок пока нет

- Form 16Документ3 страницыForm 16ganesh_korgaonkarОценок пока нет

- Exxon Employment AgreementДокумент12 страницExxon Employment AgreementOlusegun RunseweОценок пока нет

- Form C Bonus Paid to EmployeesДокумент2 страницыForm C Bonus Paid to Employeesnatrajbaskaran natrajОценок пока нет

- Form 16 WORD FORMATEДокумент2 страницыForm 16 WORD FORMATEJay83% (46)

- Form No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchДокумент3 страницыForm No. 12B Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31st MarchRakesh PawarОценок пока нет

- Form 16 TDS CertificateДокумент3 страницыForm 16 TDS CertificateBijay TiwariОценок пока нет

- Payment of Bonus RulesДокумент7 страницPayment of Bonus RulesvkpamulapatiОценок пока нет

- Federal Pension Contribution Declaration FormДокумент1 страницаFederal Pension Contribution Declaration Formashe100% (1)

- Itr 62 Form 67Документ2 страницыItr 62 Form 67busuuuОценок пока нет

- Form 16 TDS certificateДокумент8 страницForm 16 TDS certificateVikas PattnaikОценок пока нет

- Form 16 Part A: WWW - Taxguru.inДокумент10 страницForm 16 Part A: WWW - Taxguru.inAjit KhurdiaОценок пока нет

- Form 16a - TDS - Blank 16aДокумент1 страницаForm 16a - TDS - Blank 16aJayОценок пока нет

- Form 12A FormatДокумент1 страницаForm 12A FormatjaipalmeОценок пока нет

- Form No 16Документ2 страницыForm No 16saran2rasuОценок пока нет

- Tds N Adv TaxДокумент133 страницыTds N Adv TaxanuОценок пока нет

- US Internal Revenue Service: f5500sb - 1994Документ3 страницыUS Internal Revenue Service: f5500sb - 1994IRSОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToRajesh AntonyОценок пока нет

- Appendix 32 - PayrollДокумент2 страницыAppendix 32 - Payrollhehehedontmind meОценок пока нет

- Income Tax Return 480.20 (U)Документ3 страницыIncome Tax Return 480.20 (U)Alan EscobarОценок пока нет

- 4.2. Corporate Income Tax - Part 2Документ58 страниц4.2. Corporate Income Tax - Part 2Amina SultangaliyevaОценок пока нет

- US Internal Revenue Service: f8860 - 2002Документ2 страницыUS Internal Revenue Service: f8860 - 2002IRSОценок пока нет

- Form 64C Statement Income Distribution Investment FundДокумент1 страницаForm 64C Statement Income Distribution Investment Funddizzi dagerОценок пока нет

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeОт EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeОценок пока нет

- Pruthvi: Thanks For Choosing Swiggy, Pruthvi! Here Are Your Order Details: Delivery ToДокумент1 страницаPruthvi: Thanks For Choosing Swiggy, Pruthvi! Here Are Your Order Details: Delivery ToPruthvi PrakashaОценок пока нет

- Pruthvi: Thanks For Choosing Swiggy, Pruthvi! Here Are Your Order Details: Delivery ToДокумент1 страницаPruthvi: Thanks For Choosing Swiggy, Pruthvi! Here Are Your Order Details: Delivery ToPruthvi PrakashaОценок пока нет

- InternshipДокумент12 страницInternshipPruthvi PrakashaОценок пока нет

- Class 26 - Depreciation and Income TaxesДокумент19 страницClass 26 - Depreciation and Income TaxesPruthvi PrakashaОценок пока нет

- Https WWW - Irctc.co - in Eticketing PrintTicketДокумент2 страницыHttps WWW - Irctc.co - in Eticketing PrintTicketPruthvi PrakashaОценок пока нет

- Recruitment and SelectionДокумент23 страницыRecruitment and SelectionPruthvi PrakashaОценок пока нет

- Pki - Final PDFДокумент7 страницPki - Final PDFPruthvi PrakashaОценок пока нет

- Finance BillДокумент123 страницыFinance BillRoshanDaveОценок пока нет

- ST RP AssignmentsДокумент4 страницыST RP AssignmentsPruthvi PrakashaОценок пока нет

- 3 4advanced TechniquesДокумент10 страниц3 4advanced TechniquesPruthvi PrakashaОценок пока нет

- Class 25 - Breakeven AnalysisДокумент22 страницыClass 25 - Breakeven AnalysisPruthvi PrakashaОценок пока нет

- Class 5 - Theory of Consumer ChoiceДокумент33 страницыClass 5 - Theory of Consumer ChoicePruthvi PrakashaОценок пока нет

- Faster Transimission of DataДокумент7 страницFaster Transimission of DataPruthvi PrakashaОценок пока нет

- Income TaxДокумент1 страницаIncome TaxPruthvi PrakashaОценок пока нет

- SEO_TITLEДокумент5 страницSEO_TITLEPruthvi PrakashaОценок пока нет

- TicketДокумент1 страницаTicketPruthvi PrakashaОценок пока нет

- An Introduction To Websim A Briefing GuideДокумент26 страницAn Introduction To Websim A Briefing Guidei_khandelwalОценок пока нет

- Understanding OrganizationsДокумент19 страницUnderstanding OrganizationsPruthvi PrakashaОценок пока нет

- Understanding OrganizationsДокумент19 страницUnderstanding OrganizationsPruthvi PrakashaОценок пока нет

- Revised Master Plan Mysore NanjangudДокумент213 страницRevised Master Plan Mysore NanjangudPruthvi Prakasha0% (1)

- Access Point Configuration Group 2 Feb 7 2014Документ9 страницAccess Point Configuration Group 2 Feb 7 2014Pruthvi PrakashaОценок пока нет

- Scientific Paper On Software ReuseДокумент4 страницыScientific Paper On Software ReusePruthvi PrakashaОценок пока нет

- Emz SRSДокумент46 страницEmz SRSKhanak AkkaneeОценок пока нет

- SDLC Report On A Call Tracker ApplicationДокумент23 страницыSDLC Report On A Call Tracker ApplicationPruthvi PrakashaОценок пока нет

- Computer Networks WIreshark WIndows TCP/CTCP Practical ReportДокумент7 страницComputer Networks WIreshark WIndows TCP/CTCP Practical ReportPruthvi PrakashaОценок пока нет

- Software Requirement Specification Report For Call Tracking ApplicationДокумент12 страницSoftware Requirement Specification Report For Call Tracking ApplicationPruthvi PrakashaОценок пока нет

- Bayesian Model Recognizes Human SpeechДокумент38 страницBayesian Model Recognizes Human SpeechPruthvi PrakashaОценок пока нет

- Competative Programming by Nitkcccc TeamДокумент29 страницCompetative Programming by Nitkcccc TeamPruthvi PrakashaОценок пока нет

- UML Documentation of A Call Tracking SoftwareДокумент17 страницUML Documentation of A Call Tracking SoftwarePruthvi PrakashaОценок пока нет

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueДокумент3 страницыReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueVikas BishtОценок пока нет

- Understanding the basics of GSTДокумент8 страницUnderstanding the basics of GSTSandeep SinghОценок пока нет

- ACCT 328 - Assignment 2Документ7 страницACCT 328 - Assignment 2MalekОценок пока нет

- SalStmnt 2019julДокумент1 страницаSalStmnt 2019julNabendu KARMAKARОценок пока нет

- Txndetails 101878000509244982Документ1 страницаTxndetails 101878000509244982s5t5wffcnfОценок пока нет

- Full and Final StatementДокумент3 страницыFull and Final StatementMaheswari MedapatiОценок пока нет

- SSPCNADVДокумент1 страницаSSPCNADVZinhle MpofuОценок пока нет

- (D) Capital of The Surviving SpouseДокумент3 страницы(D) Capital of The Surviving SpouseAnthony Angel TejaresОценок пока нет

- Tax Invoice BillДокумент1 страницаTax Invoice BillSushma KumariОценок пока нет

- 457 Plan: What Is A 457 Plan?Документ3 страницы457 Plan: What Is A 457 Plan?Gna OngОценок пока нет

- OPSTAT - TemplateДокумент1 страницаOPSTAT - TemplateGokulОценок пока нет

- Manav's Salary SlipДокумент1 страницаManav's Salary SlipManav Unique WorldОценок пока нет

- Income Tax Basics - Federal Board of Revenue Government of PakistanДокумент8 страницIncome Tax Basics - Federal Board of Revenue Government of PakistanIkhtesham KhanОценок пока нет

- Medicard Philippines V Cir (Vat - Hmo)Документ1 страницаMedicard Philippines V Cir (Vat - Hmo)Jerome MagpantayОценок пока нет

- Payslip: HJC Design and ConstructionДокумент6 страницPayslip: HJC Design and ConstructionHazel Joy CastilloОценок пока нет

- Rajeev Ranjan SlipДокумент1 страницаRajeev Ranjan SlipRohit raagОценок пока нет

- Internal Revenue ServiceДокумент1 страницаInternal Revenue ServiceLUZ DOMINGOОценок пока нет

- D17 F6RUS-Section B Ans CleanДокумент6 страницD17 F6RUS-Section B Ans CleanZulaikha AbdulmuminОценок пока нет

- Rti FormДокумент2 страницыRti FormKumar GauravОценок пока нет

- Form 1099 IntДокумент1 страницаForm 1099 IntEdeke0% (1)

- Chatham County Commission Exemption PresentationДокумент37 страницChatham County Commission Exemption Presentationsavannahnow.comОценок пока нет

- Cir Vs CastanedaДокумент2 страницыCir Vs CastanedaAyra CadigalОценок пока нет

- Salary Certificate in ExcelДокумент2 страницыSalary Certificate in ExcelAnurag KumarОценок пока нет

- Classification of TaxesДокумент2 страницыClassification of TaxesJoliza Calingacion100% (1)

- Railtel Corporation of India Limited. Gstin: 27Aabcr7176C1Zd PanДокумент1 страницаRailtel Corporation of India Limited. Gstin: 27Aabcr7176C1Zd PanKhyati GuptaОценок пока нет

- Income Tax Calulator With Computation of IncomeДокумент18 страницIncome Tax Calulator With Computation of IncomeSurendra DevadigaОценок пока нет

- Gross Profit From SaleДокумент5 страницGross Profit From SaleRosemarie CruzОценок пока нет

- Sarah Paredes 21w2Документ2 страницыSarah Paredes 21w2Sarah ParedesОценок пока нет

- Tax Invoice for Online Ticket Booking ServiceДокумент1 страницаTax Invoice for Online Ticket Booking ServiceSri Jaya Surya MoviesОценок пока нет

- Accounting Research Memo - 2Документ2 страницыAccounting Research Memo - 2api-247273217Оценок пока нет