Академический Документы

Профессиональный Документы

Культура Документы

SEC Registration Requirements for Securities

Загружено:

Gie Bernal Camacho0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров2 страницыThe document discusses securities registration requirements with the SEC in the Philippines. It notes that some securities are exempt from registration, such as those issued by governments or certain other regulated entities. Exempted securities still require SEC approval for exemption rather than full registration. Exempt transactions also do not require full registration, such as pre-incorporation stock subscriptions, stock dividends, or capital stock increases. Securities must generally be registered with the SEC before being made available to the public.

Исходное описание:

1

Оригинальное название

Before the Securities Made Available to the Public They Must Be Registered With SEC

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document discusses securities registration requirements with the SEC in the Philippines. It notes that some securities are exempt from registration, such as those issued by governments or certain other regulated entities. Exempted securities still require SEC approval for exemption rather than full registration. Exempt transactions also do not require full registration, such as pre-incorporation stock subscriptions, stock dividends, or capital stock increases. Securities must generally be registered with the SEC before being made available to the public.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров2 страницыSEC Registration Requirements for Securities

Загружено:

Gie Bernal CamachoThe document discusses securities registration requirements with the SEC in the Philippines. It notes that some securities are exempt from registration, such as those issued by governments or certain other regulated entities. Exempted securities still require SEC approval for exemption rather than full registration. Exempt transactions also do not require full registration, such as pre-incorporation stock subscriptions, stock dividends, or capital stock increases. Securities must generally be registered with the SEC before being made available to the public.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Before the securities made available to the public they must be registered with SEC

Registration with SEC

Exempt securities- those enumerated in the law that don’s require prior reg. w/sec

- No need to undergo registration with the SEC

Examples:

- securities issued by the government, state or it’s political subdivision (Reason: the

state will not defraud its own citizens/people)

- Securities issued by foreign government that has diplomatic relationship with the

Philippines

- Securities issued by corporations which are under the supervision of office of the

insurance commissioner, HLURB or BIR

- Securities issued by a bank except its own shares of stocks (Reason: banks receive

money from its depositors, and for the money that banks received from its

depositors, it pays interest. As Civil code provides, the relationship between the

bank and its depositor is debtor and creditor. Banks from time to time come out

with so called products, that if you have 100,000 it will issue to you certificates for

which represent your investment and with a guarantee rate of return. These

certificates would qualify as securities because they are instruments evidencing an

investment in a commercial enterprise. A banks certainly is a commercial enterprise.

Banks are licensed to receive investments from the public. When a bank makes an

offer of certain so called investment plans, they don’t have to undergo registration

with the SEC. But if it would issue its own share for subscription by the public, then

those shares shall have to undergo registration with the SEC.

Exempted secuties- ought to be registered w/ SEC, but instead of applying for registration, the

application could be for exemption, and if the application Is granted, they are called exempted

securities.

Ex. When the amount involve is not substantial, you could apply for exemption because of the cost of

registration.

Exempt Transactions- the law enumerates the exempt transactions:

1. Pre-incorporation Subscription Contracts (Logic:

2. stock dividends

3. increase its authorized capital stocks

Вам также может понравиться

- SEC Registration Requirements for SecuritiesДокумент2 страницыSEC Registration Requirements for SecuritiesAttorneyAngieОценок пока нет

- Law PortionДокумент30 страницLaw PortionSudarshan TakОценок пока нет

- Y N - Securities Law: Asay OtesДокумент10 страницY N - Securities Law: Asay OtesBrandon BeachОценок пока нет

- Review Notes On Securities Regulation Code A. State Policy, PurposeДокумент9 страницReview Notes On Securities Regulation Code A. State Policy, PurposeReagan Sabate Peñaflor JD100% (1)

- SC rules against Citibank in LTCP investment caseДокумент3 страницыSC rules against Citibank in LTCP investment caseLorie Jean UdarbeОценок пока нет

- Law On Secrecy of Bank DepositsДокумент4 страницыLaw On Secrecy of Bank DepositsKrizza TerradoОценок пока нет

- Republic Act No. 9182Документ1 страницаRepublic Act No. 9182Leogen TomultoОценок пока нет

- What Is The Philippine Deposit Insurance CorporationДокумент25 страницWhat Is The Philippine Deposit Insurance CorporationKIM RODAОценок пока нет

- Deposit Substitute Operations (Quasi-Banking Functions)Документ6 страницDeposit Substitute Operations (Quasi-Banking Functions)Alyssa Mae BonaОценок пока нет

- PDICДокумент3 страницыPDICalaine daphneОценок пока нет

- SRC Protects Investors from Impossible PromisesДокумент13 страницSRC Protects Investors from Impossible PromisesJude ChicanoОценок пока нет

- 702P Group7 EquitymanagementДокумент38 страниц702P Group7 EquitymanagementJewelyn CioconОценок пока нет

- What Is A Lending Company?Документ5 страницWhat Is A Lending Company?Lourdes EPОценок пока нет

- Corporation and Securities NotesДокумент7 страницCorporation and Securities NotesJorge BandolaОценок пока нет

- Notes On SECURITIES REGULATION CODEДокумент18 страницNotes On SECURITIES REGULATION CODEcharmagne cuevasОценок пока нет

- International Business TerminologyДокумент10 страницInternational Business Terminology42092% (37)

- Banking LawsДокумент26 страницBanking LawsAnonymous X5ud3UОценок пока нет

- Exceptions To Doctrince of Indoor MGT, Prospectus, Etc.Документ3 страницыExceptions To Doctrince of Indoor MGT, Prospectus, Etc.Maduka CollinsОценок пока нет

- Lesson 3 - Lending IndustryДокумент15 страницLesson 3 - Lending Industryqrrzyz7whgОценок пока нет

- Financial MarketsДокумент13 страницFinancial MarketsJhonrey BragaisОценок пока нет

- Reviewer in Accounting 2Документ5 страницReviewer in Accounting 2kim natividadОценок пока нет

- Revenues and Other ReceiptsДокумент39 страницRevenues and Other ReceiptsMARIBEL SANTOSОценок пока нет

- PDIC insures deposits in Philippine banks, covers up to P500k per depositorДокумент8 страницPDIC insures deposits in Philippine banks, covers up to P500k per depositordemosreaОценок пока нет

- Reminders in Commercial LawДокумент23 страницыReminders in Commercial Lawjaenaanne100% (1)

- Banking Laws Governing Philippine Financial InstitutionsДокумент26 страницBanking Laws Governing Philippine Financial InstitutionsangelomoragaОценок пока нет

- Ms. XXX Ms. Yyy: Suspected-Financial-Scams-In-The-Philippines-According-SecДокумент4 страницыMs. XXX Ms. Yyy: Suspected-Financial-Scams-In-The-Philippines-According-SecJFAОценок пока нет

- The Use of Trusts and Corporations in Money LaunderingДокумент15 страницThe Use of Trusts and Corporations in Money LaunderingCHITENGI SIPHO JUSTINE, PhD Candidate- Law & PolicyОценок пока нет

- I. Definition and ClassificationДокумент97 страницI. Definition and ClassificationJeannОценок пока нет

- Requirements For Sole Proprietorship: Provision of The Civil Code On Partnership Formation States ThatДокумент7 страницRequirements For Sole Proprietorship: Provision of The Civil Code On Partnership Formation States ThatJudi CruzОценок пока нет

- Securities Regulation Code ReviewerДокумент12 страницSecurities Regulation Code ReviewerJose LacasОценок пока нет

- Zerodha Rights and Obligations of BO and DPДокумент8 страницZerodha Rights and Obligations of BO and DPAditya VermaОценок пока нет

- BFI REPORTING-Commercial BanksДокумент8 страницBFI REPORTING-Commercial BanksFire burnОценок пока нет

- Securities Regulation CodeДокумент13 страницSecurities Regulation CodeJude ChicanoОценок пока нет

- PDIC LAW AND GENERAL BANKING REGULATIONSДокумент5 страницPDIC LAW AND GENERAL BANKING REGULATIONSMarian's PreloveОценок пока нет

- Special Laws For RFBTДокумент22 страницыSpecial Laws For RFBTJinky LongasaОценок пока нет

- Mbfs Two MarksДокумент14 страницMbfs Two MarkssaravmbaОценок пока нет

- SRC protects investors interestsДокумент5 страницSRC protects investors interestsMarion JossetteОценок пока нет

- Philippine Deposit Insurance Corporation Act summarizedДокумент5 страницPhilippine Deposit Insurance Corporation Act summarizedPiolo Serrano100% (1)

- Co. law internal exam questionsДокумент9 страницCo. law internal exam questionsMahek RathodОценок пока нет

- SPV ChapterДокумент13 страницSPV Chaptersimple_aniОценок пока нет

- COMMERCIAL LAW TOPICSДокумент29 страницCOMMERCIAL LAW TOPICSAisha Mie Faith FernandezОценок пока нет

- Commercial BanksДокумент37 страницCommercial Banksshanpearl100% (2)

- Reviewer Civil Procedure San Carlos CollegeДокумент15 страницReviewer Civil Procedure San Carlos CollegeSheena ValenzuelaОценок пока нет

- Nature of SRC Kinds of Securities: State PolicyДокумент14 страницNature of SRC Kinds of Securities: State PolicyWayne Nathaneal E. ParulanОценок пока нет

- CHAPTER 4_GOVERNMENT_REVENUES AND OTHER RECEIPTSДокумент3 страницыCHAPTER 4_GOVERNMENT_REVENUES AND OTHER RECEIPTSMary Ann ArenasОценок пока нет

- Key TermsДокумент2 страницыKey Termsqbo.bestarionОценок пока нет

- Banking LawsДокумент26 страницBanking LawsAgnes Anne GarridoОценок пока нет

- Laws on banking and finance intermediariesДокумент4 страницыLaws on banking and finance intermediariesMary.Rose RosalesОценок пока нет

- Company Law - Topic 4Документ33 страницыCompany Law - Topic 4Mauricio AndradeОценок пока нет

- Asset Backed SecuritizationДокумент12 страницAsset Backed SecuritizationYousuf AminОценок пока нет

- Ph Gam - Revenues and Other ReceiptsДокумент7 страницPh Gam - Revenues and Other ReceiptsNabelah OdalОценок пока нет

- What Are The Elements of The Crime Punished Under The Bouncing Checks Law?Документ18 страницWhat Are The Elements of The Crime Punished Under The Bouncing Checks Law?Bill Breis100% (1)

- Special LawsДокумент18 страницSpecial LawsLeomar CastilloОценок пока нет

- Securities and Exchange Commission LawДокумент25 страницSecurities and Exchange Commission LawDyrene Rosario Ungsod67% (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- 04-Exercise 1 - Barangay Financial Statement and ReportsДокумент2 страницы04-Exercise 1 - Barangay Financial Statement and ReportsGie Bernal CamachoОценок пока нет

- Verb Tense: Nothing A Little Prozac Wouldn't CureДокумент7 страницVerb Tense: Nothing A Little Prozac Wouldn't CureGie Bernal CamachoОценок пока нет

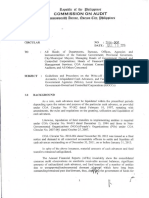

- Coa C2016-005Документ11 страницCoa C2016-005aliahОценок пока нет

- List of Expired Bondable Officials - As of 06.18.21 (LGU)Документ1 страницаList of Expired Bondable Officials - As of 06.18.21 (LGU)Gie Bernal CamachoОценок пока нет

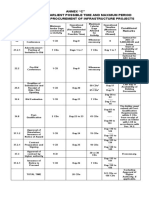

- PCAB License (PCAB Categories)Документ8 страницPCAB License (PCAB Categories)Gie Bernal CamachoОценок пока нет

- Sample Aom - Delayed Bidding Beyond TimelinesДокумент3 страницыSample Aom - Delayed Bidding Beyond TimelinesGie Bernal CamachoОценок пока нет

- 05-Suggested Solution - Exercise 1Документ1 страница05-Suggested Solution - Exercise 1Gie Bernal CamachoОценок пока нет

- Chart of Accts - Inventory, PPE, IP and BAДокумент5 страницChart of Accts - Inventory, PPE, IP and BAGie Bernal CamachoОценок пока нет

- Barangay Accounting Q&A: Financial Statements and JournalsДокумент10 страницBarangay Accounting Q&A: Financial Statements and JournalsGie Bernal CamachoОценок пока нет

- Itinerary MsbernalДокумент1 страницаItinerary MsbernalGie Bernal CamachoОценок пока нет

- Timelines InfrastructureДокумент1 страницаTimelines InfrastructureGie Bernal CamachoОценок пока нет

- PCAB License (PCAB Categories)Документ8 страницPCAB License (PCAB Categories)Gie Bernal CamachoОценок пока нет

- 06-Exercise 2 - Appropriation, Recording and ReportingДокумент10 страниц06-Exercise 2 - Appropriation, Recording and ReportingGie Bernal CamachoОценок пока нет

- Sample Aom - Delayed Bidding Beyond TimelinesДокумент3 страницыSample Aom - Delayed Bidding Beyond TimelinesGie Bernal CamachoОценок пока нет

- Retrace, Recast, Refill, Regain, and RewriteДокумент1 страницаRetrace, Recast, Refill, Regain, and RewriteGie Bernal CamachoОценок пока нет

- Graphite Is Harmful Because Swallowing It Could Cause Damage To The BodyДокумент1 страницаGraphite Is Harmful Because Swallowing It Could Cause Damage To The BodyGie Bernal CamachoОценок пока нет

- A. Taxation As An Inherent Power of The StateДокумент6 страницA. Taxation As An Inherent Power of The StateGie Bernal CamachoОценок пока нет

- Reimbursement Espense Receipt: Appendix 46Документ1 страницаReimbursement Espense Receipt: Appendix 46Gie Bernal CamachoОценок пока нет

- Brgy Calumpang Resolution Reallocating FundsДокумент4 страницыBrgy Calumpang Resolution Reallocating FundsGie Bernal CamachoОценок пока нет

- (Municipalities of Aroroy, Baleno, Milagros & Mobo) : Commission On AuditДокумент1 страница(Municipalities of Aroroy, Baleno, Milagros & Mobo) : Commission On AuditGie Bernal CamachoОценок пока нет

- Verb Tense: Nothing A Little Prozac Wouldn't CureДокумент7 страницVerb Tense: Nothing A Little Prozac Wouldn't CureGie Bernal CamachoОценок пока нет

- CebuДокумент1 страницаCebuGie Bernal CamachoОценок пока нет

- Office of The Municipal TreasurerДокумент2 страницыOffice of The Municipal TreasurerGie Bernal CamachoОценок пока нет

- Dream HouseДокумент1 страницаDream HouseGie Bernal CamachoОценок пока нет

- RERДокумент1 страницаRERGie Bernal CamachoОценок пока нет

- Dream HouseДокумент1 страницаDream HouseGie Bernal CamachoОценок пока нет

- Post QualificationДокумент4 страницыPost QualificationGie Bernal CamachoОценок пока нет

- NFCCДокумент1 страницаNFCCGie Bernal CamachoОценок пока нет

- PCAB CategoriesДокумент3 страницыPCAB CategoriesGie Bernal CamachoОценок пока нет